Analyzing the Effects of Negative Interest Rates Across Five Economies

What happens when interest rates drop below zero - are you really paid to borrow money? Japan, Sweden, Denmark, Switzerland, and the Eurozone have all experienced negative rates and their experiences give pointers towards the effectiveness of such strategies.

Toptal Talent Network Experts

Forecast for Success: A Guide to Cash Management

Running out of cash is one of the main reasons why startups fail. More established companies can also be affected. We outline the importance of managing cash, key metrics, and actions to improve performance.

Paul Ainsworth

Survival Metrics: Getting to Grips with the Startup Burn Rate

Burn rate is one of the simplest, yet most fundamental metrics that investors and startups focus on. It pertains to the total cash spend of the business per month, which demonstrates both growth progress and potential runway that the business has to survive. This article introduces the burn rate concept and the tactics that can be applied to optimize it.

Pierre Francois

Biotech Valuation Idiosyncrasies and Best Practices

Biotech companies with little to no revenue can still be worth billions. Consider the most prominent 2017 biotech M&A deal when Gilead bought Kite Pharma for almost $12 billion. At the time of the deal, Kite had over $600 million in accumulated deficit, but it also had a pipeline of CAR-T cell therapies, which treat cancer. This article examines how to value such pipelines. It also focuses on the risk-adjusted NPV valuation methodology, portfolios of multiple drug candidates, and how value is impacted by the characteristics of the investor or acquirer.

Raphael Rottgen, CFA FRM

Forecaster’s Toolbox: How to Perform Monte Carlo Simulations

One of the most important and challenging aspects of forecasting is handling the uncertainty inherent in examining the future. Every CEO, CFO, board member, investor, or investment committee member brings their own experience and approach to financial projections and uncertainty, influenced by different incentives. Oftentimes, comparing actual outcomes against projections underscores the need to explicitly recognize uncertainty.

Monte Carlo simulations are an extremely effective tool for handling risks and probabilities, used for everything from constructing DCF valuations, valuing call options in M&A, and discussing risks with lenders to seeking financing and guiding the allocation of VC funding for startups. This article provides a step-by-step tutorial on using Monte Carlo simulations in practice.

Stefan Thelin

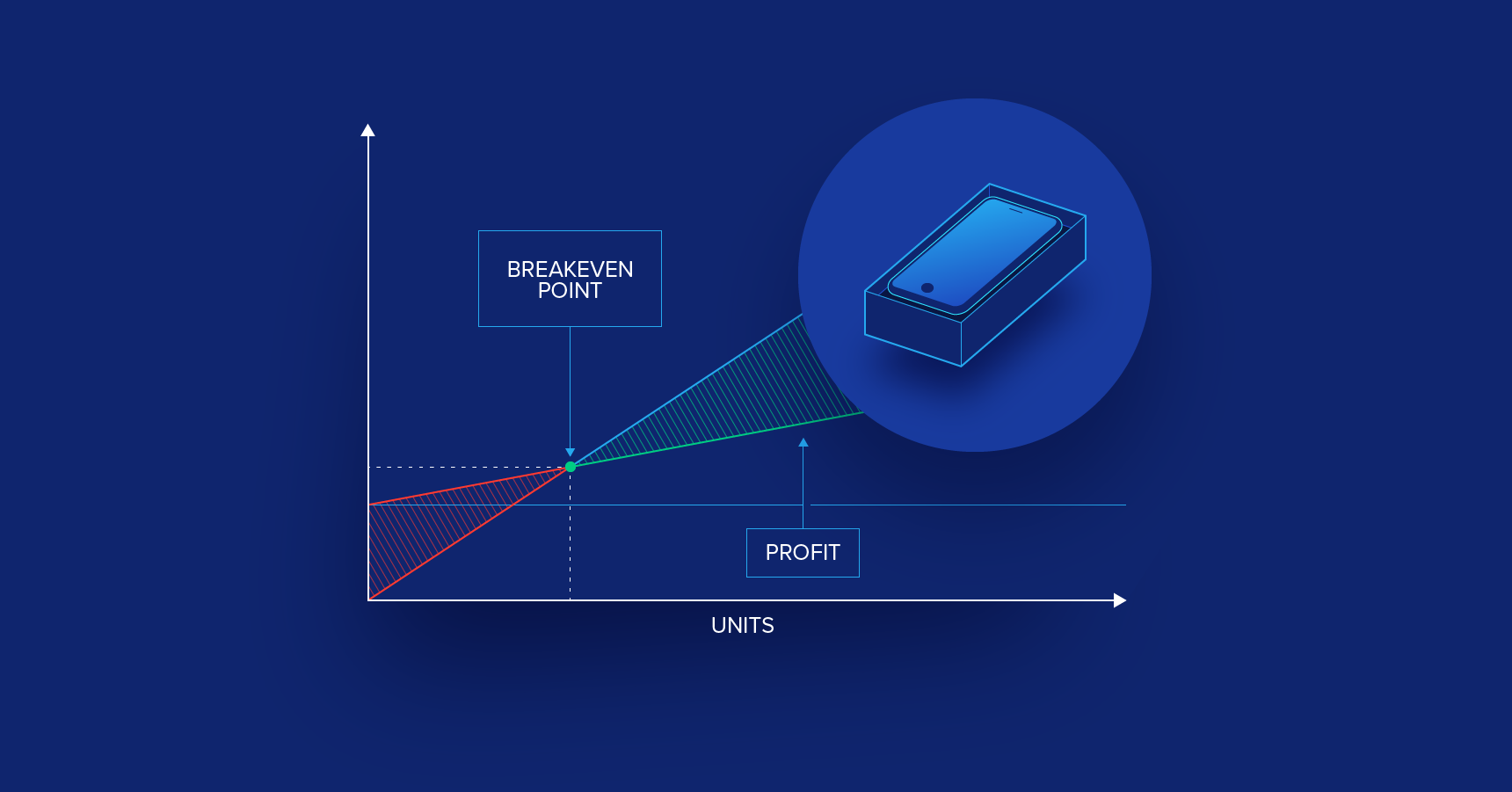

Don’t Scale an Unprofitable Business: Why Unit Economics (Still) Matter

With venture funding having grown more than 120% in the US in the last five years, startup founders and investors alike have grown increasingly comfortable with low margin business models. But the successes of the Amazons and Facebooks of this world often mask failure in a slew of other sectors, where the “build it and they will come” model doesn’t always work.

In this article, Toptal Finance Expert Toby Clarence-Smith brings attention back to the importance of studying a business’ long-term sustainability prospects, with a particular focus on unit economics, one of the building blocks of profitability and breakeven analysis for startups.

Toby Clarence-Smith

Advanced Financial Modeling Best Practices: Hacks for Intelligent, Error-free Modeling

From abstract spreadsheets to real-world application, financial models have become an inextricable part of business life and an indispensable part of every company’s toolkit. But irrespective of its ubiquitousness as a productivity and decision-making tool, many out there still have a love-hate relationship with it.

Finance expert Alberto Bazzana authors a comprehensive “how-to guide,” for both the novices and experts among us, detailing Wall Street’s best practices for intelligent, effective, and error-free financial modeling.

Alberto Bazzana

The Statistical Edge: Enhance Your Metrics with the Actuarial Valuation Method

Traditionally confined to the realms of insurance and pensions, actuaries are now branching out into the wider business world.

The long-termist and statistical approach of actuarial science makes it an invaluable tool for recurring income businesses. This article looks at how, showing examples of usage within customer lifetime value and human resources.

Dani Freidus

Why Every Business Should Build Weekly Cash Flow Forecasts

When most finance professionals hear the term “13 week cash Forecast,” they view it as a burden—one more task to appease an overbearing lender. It doesn’t help that it seems less exciting than analyzing an investment or acquisition. Therefore, people often only prioritize these forecasts in distressed situations, when it is too late to take corrective actions.

However, in this article, Toptal Finance Expert Marty Mooney argues that weekly cash forecasts are crucial for all businesses, irrespective of size, health, or sector. It also provides a simple tutorial for efficiently building such analyses.

Marty Mooney

World-class articles, delivered weekly.

Toptal Finance Experts

- Blockchain Consultants

- Business Management Consultants

- Business Plan Consultants

- Business Process Optimization Consultants

- Certified Public Accountants (CPA)

- Economic Development Consultants

- Equity Research Analysts

- Excel Experts

- Financial Benchmarking Consultants

- Financial Forecasting Experts

- Financial Modeling Consultants

- Financial Writers

- Fintech Consultants

- FP&A Consultants

- Fractional CFOs

- Fundraising Consultants

- FX Consultants

- Growth Strategy Consultants

- Integrated Business Planning Consultants

- Interim CFOs

- Investment Managers

- Investment Thesis Consultants

- Investor Relations Consultants

- M&A Consultants

- Market Sizing Experts

- Pitch Deck Consultants

- Private Equity Consultants

- Procurement Consultants

- Profitability Analysis Experts

- Real Estate Experts

- Restructuring Consultants

- Risk Management Consultants

- Small Business Consultants

- Supply Chain Management Consultants

- Valuation Specialists

- Venture Capital Consultants

- Virtual CFOs

- Xero Experts

- View More Freelance Finance Experts

Join the Toptal® community.