Why Music Royalties Are an Attractive Asset Class

In the current market environment of low yields and interest rates, music royalties are an increasingly attractive asset class. Their low correlation with macroeconomic performance and high income potential have resulted in more investors wanting to invest in music royalties.

In the current market environment of low yields and interest rates, music royalties are an increasingly attractive asset class. Their low correlation with macroeconomic performance and high income potential have resulted in more investors wanting to invest in music royalties.

Jimmy has executed and evaluated $1+ billion in debt, equity, and M&A transactions across a range of industries.

Expertise

PREVIOUSLY AT

In this article, we’ll take a closer look at the investment side of the music industry and explore why music royalties are considered an attractive asset class in the current market environment, how active investors can increase the value of their music IP, and what to watch for when you’re considering investing in music royalties.

Why Are Music Royalties Considered an Attractive Asset Class?

“I think everyone realized that publishing catalogs were assets you could finance, like a building. And the forecasts the investment banks are making for the number of streaming subscribers in the next 10 years are extraordinary. So investment bankers, hedge funds, private equity – they all look at this as an asset class.” — Martin Bandier, former CEO and chairman of Sony/ATV Music Publishing

Stability of Streaming

Streaming has brought greater stability to music royalty cash flows. As we discussed the State of the Music Industry, digital streaming has driven the growth in global recorded music revenues after 15 years of declines caused by piracy and the decline of the physical album. There is now greater confidence in owning music IP assets and the royalty income derived from them.

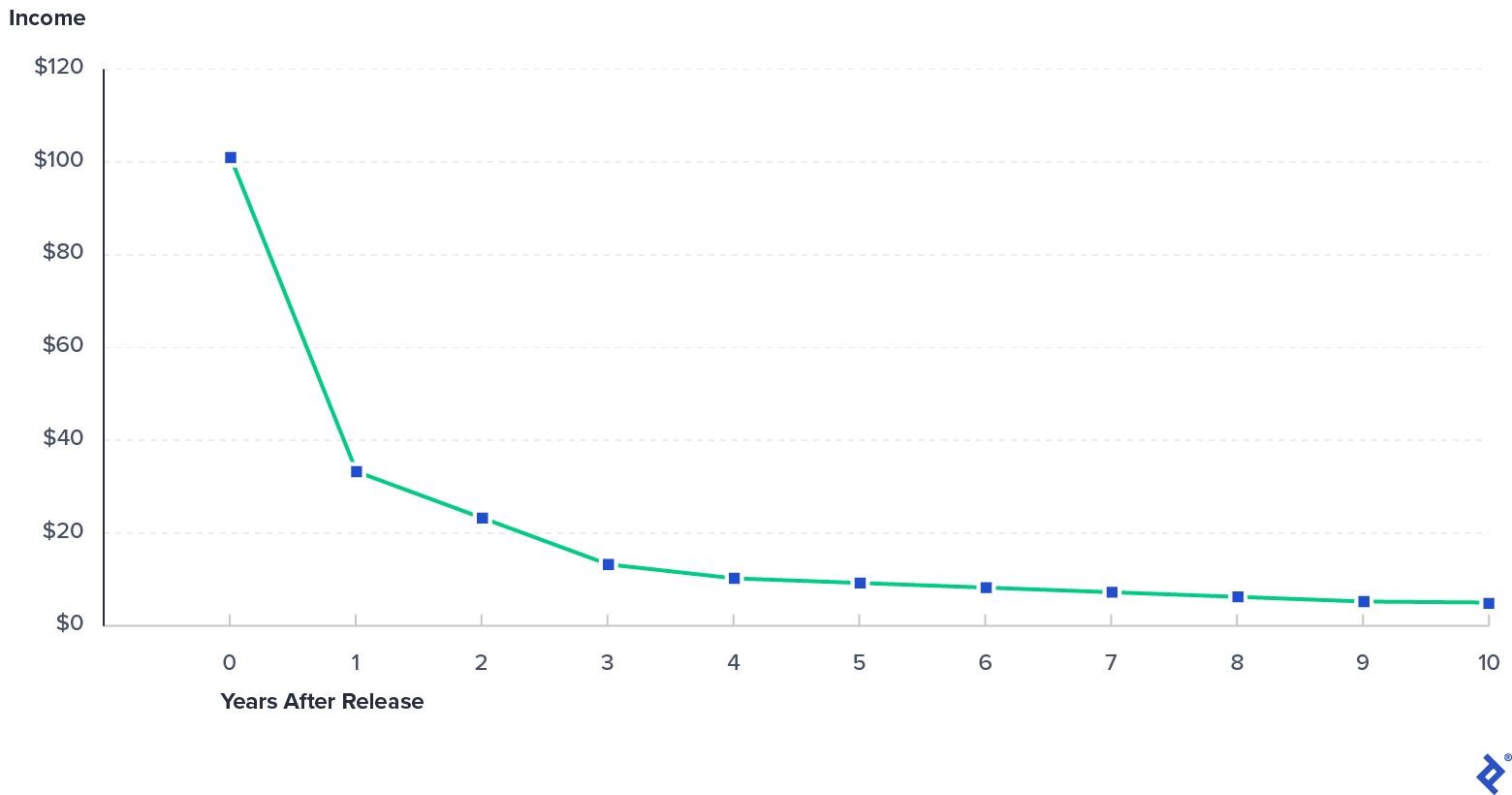

At a song level, new music royalty income generally sees its greatest income 3-12 months after release. Income then declines over the next 5-10 years. At this point, the remaining “tail” of income often bounces around but remains relatively stable thereafter.

Hypothetical Income for a Song

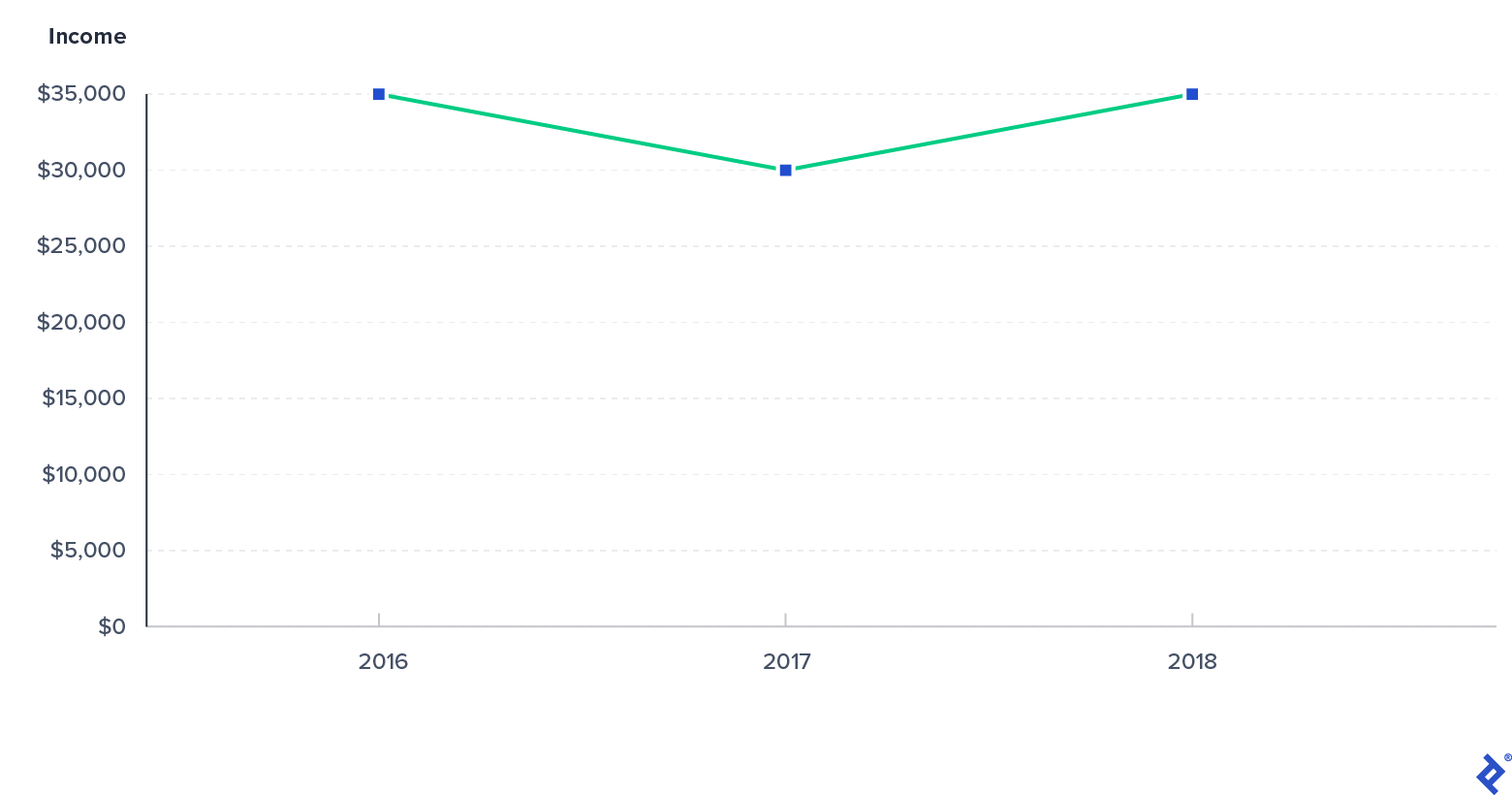

For a real example that highlights the impact of streaming growth, let’s take a look at a catalog of songwriter performance royalty income. This catalog includes interests in hip-hop songs including a partial interest in Jay-Z’s Grammy-winning “Empire State of Mind,” sold via Royalty Exchange, an online marketplace to buy and sell royalties.

Performance Royalties from a Sample Songwriter Catalog

The catalog contains songs released between 2001 and 2009, with an income-weighted average release year of 2009. Royalty Exchange provided three years of catalog income data starting in Q4 2015, hence we are analyzing years 7-9 after release (i.e., the typical “tail”). As you can see in the chart, the catalog’s annual cash flow fluctuates around $30,000 per year. Much like streaming is driving music industry growth, this catalog’s streaming income grew 33% during the 12-month period prior to sale, supporting the catalog’s cash flow stability. Again, each catalog will have different characteristics, but in general, streaming is helping to offset declining income in other formats such as downloads and physical (e.g., CDs and vinyl) sales. Greater income stability provides music IP investors with more confidence in the asset class.

Recurring Revenue Potential

Music royalties are a source of recurring income. Music royalty income is collected by several different distributors, with income paid periodically to music IP rights holders. Recurring payments are desirable to investors looking for a source of predictable income, typically found in asset classes such as real estate.

Yield in a World of Low Interest Rates and Dividends

Music royalties often have attractive yields. In the current market environment, investors are searching for opportunities to earn something on their cash without a high risk of losing their principal. For example, as of September 2020:

- US 10-year treasury yield was 0.7%.

- S&P 500 dividend yield was 1.8%.

- Vanguard High-yield Corporate Bond (VWEHX) yield was 3.9%.

In this context, music royalties investments can often look like a relatively appealing asset class. For a similar period of 2020 data, the following examples stand true:

- Royalty Exchange reports that the average annualized return on investment for catalogs sold on its platform was greater than 12%.

- Hipgnosis Songs Fund’s (SONG) dividend yield is 4.3%.

- Mills Music Trust’s (MMTRS) dividend yield is 9.6%.

At the same time, it is important to remember that music royalty income fluctuates and is not fixed. As we already discussed, music royalty cash flows for a song often decline over time. In other words, the last 12 months’ royalty income does not necessarily mean the next 12 months’ income will be equal or greater. We will cover this dynamic more later when we discuss potential pitfalls of investing in music IP.

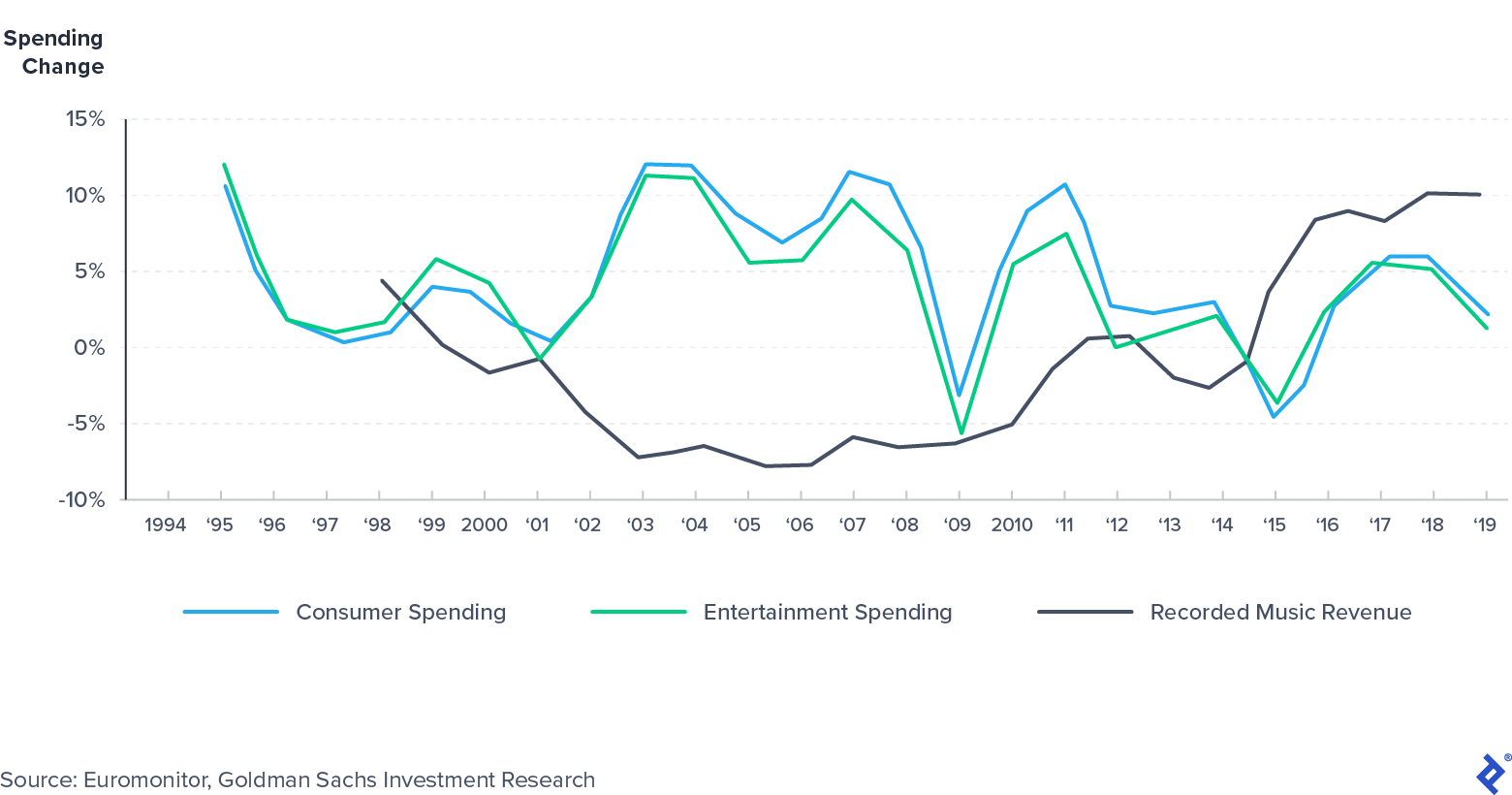

Low Correlation to Economic Activity

Music spending has historically shown little correlation to broader economic activity. As seen in State of the Music Industry, music spending and its associated royalties are holding up well relative to other industries during the COVID-19 pandemic. Historically, both recorded music and music publishing data have not seen a clear correlation with broader spending activity. In the following chart, Goldman Sachs highlights this lack of correlation by comparing the recorded music industry’s 15-year decline due to piracy and its subsequent streaming-driven rebound versus personal consumer expenditures (PCE.) Per Goldman’s “Music in the Air” report, recorded music spending has outgrown PCE growth by a factor of 2.4x since 2016.

Low Correlation of Record Music Spend with Personal Consumer Expenditures (PCE): 1994-2019

Music publishing income has been more resilient through economic cycles. As discussed in my prior article, CISAC collections data showed steady growth during the Great Recession.

Public equity markets provide a couple of examples of music IP asset relationship to the broader market. Mills Music Trust (ticker: MMTRS) has a -0.65 beta indicating MMTRS generally moves in the opposite direction of the market. Hipgnosis Songs Fund (ticker: SONG-GB) has a 0.21 beta suggesting much less volatility than the broader market.

The combination of stability, recurring income, attractive relative yields, and historically less correlation to broader economic fluctuations has made music royalties an attractive asset class for investors.

What Are the Main Levers Active Investors Use to Increase Value of Music IP?

In addition to the above reasons, investors in music IP can actually work to increase the value of their investment. Active investors use three main levers to increase value:

1) Developing performing artists and songwriters who create new music IP. Traditional record labels and music publishers spend significant time and capital identifying talented performing artists and songwriters and then helping them create and market new music IP.

2) Finding creative licensing opportunities for existing music IP. Labels, publishers, and royalty funds, which have the ability to license their music IP, will “work” their existing catalog of songs by finding new licensing opportunities in film, TV, advertising, cover songs, and video games.

3) Decreasing cost and payment timing of royalty collections. The flow of funds from end consumers to music IP rights owners is complex and often involves many “middlemen,” such as collection societies and agencies. Payment timings between these collectors and rights holders can take 6-12 months, or even longer. Labels, publishers, and royalty funds, which have the ability to administer their catalog of songs, will look to minimize these costs and the time lag between payments in order to maximize cash flow available to shareholders.

What Are the Potential Pitfalls to Consider When Investing in Music?

There are many potential pitfalls to consider when investing in music IP assets. We will narrow these risks to ones we see as most important when acquiring income producing music IP. Notably, we are not considering risks with finding and developing new artists and songwriters.

Valuation Risk

When purchasing a music IP asset, there is always potential that you could overpay. For example, as discussed earlier, music royalty income typically declines rapidly in the first several years after release before leveling off in year 10 and beyond. If you paid 8x last year’s cash flow for a song catalog that is on average one year old, that implied 12.5% yield will likely be much lower in year 2 if the cash flows follow a typical decay path. On the other hand, if you paid 8x for a catalog that is 15 years old with a history of consistent income, that 12.5% yield will likely, all else equal, be more stable in the future.

Music industry journalist Cherie Hu published an essay about Hipgnosis that covers the company’s average acquisition multiple in relation to its catalog age in which she states, “Multiple sources I spoke with were concerned that this maturity mix would struggle in the long term to generate the returns Hipgnosis is promising for investors, especially given the 13.9x multiple that the fund is paying for its acquisitions.” Catalog age is just one important factor to consider in music IP valuation. Some others include royalty type, genre, income diversification by song, and termination rights. In summary, paying a reasonable price is critical in order to generate compelling returns.

Counterparty Risk

It is important to do the necessary legal diligence to verify the chain of title and confirm the seller owns what they claim. Some special considerations that can add complexity to a transaction include liens on the seller’s asset, bankruptcies, divorces, and estates.

Technology Risk

Napster disrupted music in the 2000s leading to 15 years of recorded music industry declines. The proliferation of smartphones and streaming has reversed this trend and helped the industry return to growth. Technological innovation can have a material impact on music royalties, for better or worse.

Regulatory Risk

Many music royalty rates, especially rates related to the musical composition copyright, are regulated. While most of the recent royalty rate decisions have been positive for music IP rights holders, future changes to rates could have a material impact on music IP cash flows.

Inflation Risk

Most types of music royalties do not immediately react to price inflation. As discussed, many royalty rates are regulated with a rate structure set for multi-year periods. In their 2011 research paper, Professors Peter Alhadeff and Caz McChrystal noted that regulated US physical mechanical royalty rates paid to songwriters and publishers in the US have been “devaluing steadily against inflation since 1976.” At the same time, unregulated royalty rates often have a duration of more than one year. Meanwhile, streaming services, such as Spotify, have not focused on increasing prices to the consumer, resulting in a decline in their average revenue per user and per-stream royalty rate over time. In short, a sudden increase in inflation is unlikely to be reflected, at least in the near term, in music royalty rates.

How to Invest in Music IP?

There are three vehicles to invest in music IP assets:

- Record labels and publishers

- Music royalty funds

- Direct purchases of music IP assets

Record Labels and Publishers

Traditional record labels and publishers are difficult to gain direct investment exposure to because most are parts of larger conglomerates (e.g., Sony, Universal, BMG) or are privately owned (e.g., Concord Music). However, more traditional labels and publishers are going public. Warner Music Group priced its IPO in June 2020, and Vivendi announced that an IPO of its subsidiary Universal Music Group is planned by 2023 or earlier.

Royalty Funds

Music royalty funds are mainly private, but a few are public. Hipgnosis Songs Fund and Mills Music Trust are two examples of publicly traded companies that own interests in music royalties and distribute the majority of available cash flow after expenses to shareholders. In the private market, Shamrock Capital recently closed a $400 million fund focused on music and other content IP. Round Hill Music has mentioned that it is currently fundraising for its third music IP fund. However, these private royalty funds typically have significant minimum investment amounts ($5+ million), meaning their target investors are institutions and ultra-high net worth investors.

Purchasing Music IP Directly

Direct purchases of music IP occur in the private market. Online marketplace platforms, such as Royalty Exchange, are making direct ownership of music IP assets more accessible for the average investor. Royalty Exchange offers smaller deal sizes that range from $5k to less than $1 million and also offers passive interests in a catalog of songs, so an investor is only collecting the ongoing distributions, much like “mailbox money” that you sit and wait to collect. However, there is some work required on the part of an investor to properly value the catalog, as opposed to relying on (and paying) the managers of a record label, publisher, or music royalty fund to do this.

Music IP: Stability, Recurring Income, Attractive Yields, and Correlation Benefits

In short, many find music IP investing attractive given greater stability, recurring income, attractive relative yields, and lack of correlation to the broader market. Interested investors have multiple ways of gaining exposure to this exciting asset class, but before doing so, should think hard about their preferences when it comes to investment size, liquidity, growth vs. dividend yield, and active or passive ownership.

Understanding the basics

Can you invest in music?

If they’re interested in how to invest in muusic royalties, retail investors can invest in the music industry in three ways: first, by purchasing equity in a listed music label, such as Warner Music; second, through investing in funds that purchase music royalties; and finally, by directly buying shares of royalty catalogs listed through specialist websites.

What are royalties in music?

Royalty payments are the method through which those who are involved in the creation and sale of a song (e.g., artist, songwriter, label, publisher, etc.) make money. Royalties are divided into three types: performance, mechanical, and synchronization. Music royalty investing treats these payment streams as an asset class.

How long do you get royalties for a song?

At a song level, new music royalty income typically sees its greatest income 3-12 months after release. Income then declines to lower levels over the next 5-10 years. At this point, the remaining “tail”’ of income often bounces around but remains relatively stable.

Jimmy Stone

New Orleans, LA, United States

Member since May 23, 2019

About the author

Jimmy has executed and evaluated $1+ billion in debt, equity, and M&A transactions across a range of industries.

Expertise

PREVIOUSLY AT