Derrick is available for hire

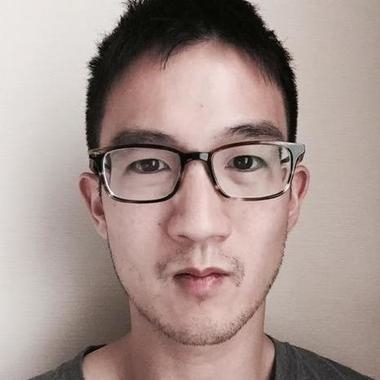

Hire DerrickDerrick Hsu

Verified Expert in Finance

Finance Expert

Location

San Francisco, CA, United States

Toptal Member Since

May 28, 2017

A Harvard MBA student, Derrick has advised on $10 billion in M&A acquisitions across entertainment, fintech, consumer internet, and biotech. While working closely with both startup founders and Fortune 100 executives, he has leveraged his expertise in financial modeling, product management, and growth marketing. He enjoys advising clients on complex capital raising, M&A, corporate finance, venture capital, and product strategy projects.

Career Highlights

M&A Analyst

Lazard

Education Highlights

Master of Business Administration (MBA)

Harvard University

Master's Degree

University of Pennsylvania

Case Studies

Industry Expertise

Other Expertise

Work Experience

Corporate Development Manager

2013 - 2015

eBay

- Executed the strategic capital allocation during a $30+ billion separation between eBay and PayPal.

- Analyzed the international acquisition and expansion strategy in markets such as Latin America, China, and Southeast Asia.

- Built nontraditional valuation models for high-growth startups in new markets and technologies.

- Identified business models and planned product roadmaps to integrate early-stage startup acquihires.

Focus areas: Tax Preparation, Taxation, Capital Markets, Negotiation, Growth Strategy, Integration, Mergers & Acquisitions (M&A)

Corporate Development Manager

2013 - 2015

PayPal

- Served as a lead manager on $800 million acquisition of Braintree/Venmo (the largest PayPal acquisition to date); executed entire due diligence process and transaction process within a four-week timeframe.

- Led a business projections analysis for Greater China region as the sole US representative on $2 billion worth of partnership and investment deals with leading Chinese eCommerce and fintech players.

- Prepared materials on the key strategy, integration plan, and success factors and presented my findings to the M&A committee (consisting of the CEO, CFO, and CTO) and board of directors.

- Managed a cross-functional deal team of 70+ internal and external members across product, tech, marketing, and legal.

- Developed an onboarding integration roadmap for key initiatives and organizational changes across business units (affecting over 150 people organizations).

Focus areas: Negotiation, Growth Equity, Finance Strategy, Integration, Mergers & Acquisitions (M&A)

M&A Analyst

2011 - 2013

Lazard

- Conducted multiple scenario analyses and robust business projections by department as the sole analyst on multiple acquisitions for Steris Medical (totaling over $500 million).

- Served as the sole analyst on Pinnacle's $3 billion acquisition of Ameristar (largest gaming transaction); modeled a complex 280G valuation for golden parachutes.

- Built financial models for mergers and strategic alternatives for entertainment and biotech clients, including the top talent agency CAA.

- Prepared and presented investment materials and acquisition memos to client CEOs and CFOs.

- Maintained strategic research database and comparable analyses for biotech and entertainment cohorts.

Focus areas: Finance Strategy, Mergers & Acquisitions (M&A)

Education

2015 - 2017

Master of Business Administration (MBA) in General Management

Harvard University - Boston, MA, USA

2009 - 2010

Master's Degree in Biomedical Engineering

University of Pennsylvania - Philadelphia, PA, USA

2005 - 2010

Bachelor's Degree in Biomedical Engineering

University of Pennsylvania - Philadelphia, PA, USA

Collaboration That Works

How to Work with Toptal

Toptal matches you directly with global industry experts from our network in hours—not weeks or months.

1

Share your needs

Discuss your requirements and refine your scope in a call with a Toptal domain expert.

2

Choose your talent

Get a short list of expertly matched talent within 24 hours to review, interview, and choose from.

3

Start your risk-free talent trial

Work with your chosen talent on a trial basis for up to two weeks. Pay only if you decide to hire them.

Top talent is in high demand.

Start hiring