Toby Clarence-Smith

Verified Expert in Finance

Valuation Expert

With over a decade of experience across private equity, venture capital, and banking, Toby founded and successfully sold a venture-backed eCommerce company, giving him a unique skill set that combines the financial/investment perspective with tangible operational expertise. His consulting work focuses on helping clients with diligence investment opportunities, as well as companies looking to raise capital and grow their businesses.

Career Highlights

Education Highlights

Certification Highlights

Case Studies

Industry Expertise

Software Expertise

Other Expertise

Work Experience

Founder & Managing Partner

CS Investimenti

- Focused efforts on deal origination, assessment, and due diligence to find one single SME to acquire and then actively manage.

- Built detailed cashflow models for multiple investment opportunities to assess intrinsic cashflow generation through both up and down cycles.

- Negotiated with business owners regarding the structure of acquisitions including earn-out mechanisms, seller note issuance, and layered financing structures.

- Industry assessment and sector-focused macro predictions to choose specific verticals in which to focus the search.

Venture Capital Investor

Mountain Nazca

- Acted as an entrepreneur-in-residence, assisting portfolio companies with operational issues and growth-related challenges.

- Participated as a member of the investment team. I aided in the origination of new dealflow and assessment of investment opportunities.

- Helped develop thesis-based investment strategies around global macro trends and sectors. Areas of focus; cryptocurrency, fintech, and online commerce and marketplaces.

- Assisted with fundraising efforts for the new fund, helping put together the pitch and other fundraising-related documentation.

- Spearheaded the development of a new investment strategy akin to "company building" but where the original focus was on the entrepreneur rather than the idea itself.

Co-Founder | CEO

Petsy

- Launched one of the most respected and successful startups in the country, receiving multiple rounds of investment from the top venture capital funds in the country.

- Built an extremely loyal customer base with incredibly high net promoter scores.

- Oversaw an expansion from a three-person team to a 50+ person team.

- Managed the entire development of the technology platform across web, mobile web, and native mobile applications.

- Opened our first retail store to build out a full-service omni-channel retailer.

- Built all the operating and financial models underlying three rounds of capital raise with Venture Capital funds as well as business plan approval at the board level.

Founder Intern

Linio

- Led the opening of a warehouse from which we were processing over 1,000 orders a day.

- Led and managed a UX/UI review with clients and delivered several recommendations to the product team regarding improvements to the platform.

- Modeled and proposed an optimized customer service team structure.

- Managed an offline marketing strategy (below the line) for a project.

- Offered a full-time founder position by the end of my time at Linio, but decided to turn it down to launch my own company.

Investment Associate

Bridges Ventures

- Helped prepare the investment memorandum for an investment in a chain of gyms.

- Oversaw incoming business plan proposals and appraisals.

- Built a detailed store rollout financial and execution model for one of the portfolio companies.

- Helped develop the social impact assessment framework.

Investment Banking Assistant Vice President

Barclays Capital

- Prepared investment memorandums and credit memos for highly leveraged transactions.

- Managed portfolios and assessments of loan book portfolios.

- Created a pitch book for corporate finance and M&A deals.

- Did extensive valuation and merger analysis.

- Managed client responsibilities with some of the world's largest private equity funds.

- Promoted six months early (a highly unusual occurrence).

Other Experience

Has the US Equity Crowdfunding Market Lived up to Expectations?

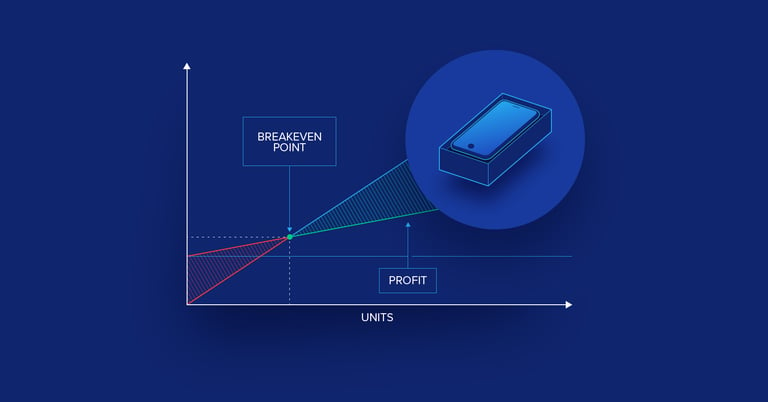

Don’t Scale an Unprofitable Business: Why Unit Economics (Still) Matter

Amazon vs. Walmart: Bezos Goes for the Jugular With Whole Foods Acquisition

The Party Isn’t Over: A Deep-Dive into Why Unicorns Will Bounce Back in 2017

The Impact of Brexit on the Financial Services Sector

Education

Master of Business Administration (MBA) in Finance

The Wharton School of the University of Pennsylvania - Philadelphia, PA, USA

Bachelor of Science in Economic History (Economics)

London School of Economics and Political Science - London, England

Certifications

Endeavor Entrepreneur

Endeavor

GMAT: 760

Graduate Management Admission Council

How to Work with Toptal

Toptal matches you directly with global industry experts from our network in hours—not weeks or months.

Share your needs

Choose your talent

Start your risk-free talent trial

Top talent is in high demand.

Start hiring