Commercial Drones Are Revolutionizing Business Operations

When most hear “drone,” they think expensive military aircrafts or small consumer toys. However, the future of drones will actually be shaped by practical commercial applications, due to their ability to drive efficiency and data analytics.

This article defines drones and their total addressable market and highlights how their capabilities can be leveraged in commercial business operations. It also includes investment trends and predictions for the future of the industry.

Francesco Castellano

Should We Rethink the Use of EBITDA?

EBITDA is one of the most common metrics in finance. However, while intended to provide a “cleaner” picture of operating performance than net income, in reality it often achieves the opposite effect. It is also in many cases a questionable proxy for cash flow, as well as a dubious valuation tool.

Puneet Gandhi

Why Investors Are Irrational, According to Behavioral Finance

Though traditional economic theory posits that individuals are rational, we all know this to be an oversimplification of the truth. The cyclical investment process is rife with psychological pitfalls. Only by becoming aware of and actively avoiding innate behavioral biases can investors reach impartial decisions. Herein lies the true value of the emerging field of behavioral finance, which sheds light on investor psychology and true financial behavior.

Melissa Lin

How Artificial Intelligence Is Disrupting Finance

As consumers, we’re familiar with AI: we benefit from cars that parallel park themselves, devices that respond when asked questions, and streaming platforms that suggest shows we may like. However, professionally, the larger question is how industries will harness the power of AI. In finance, AI offers opportunities for operational efficiencies in everything from risk management and trading to insurance underwriting.

Melissa Lin

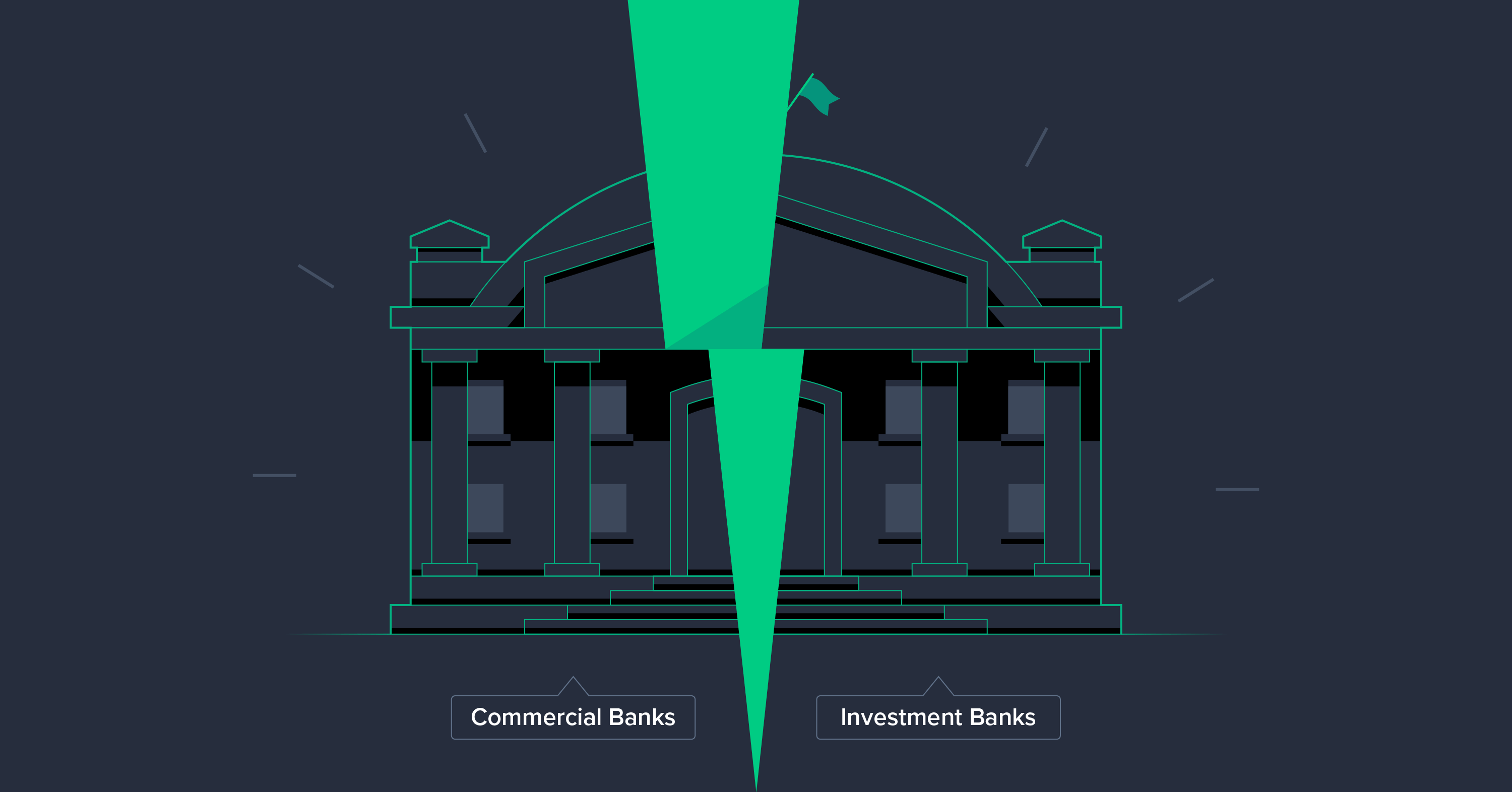

Glass-Steagall Act: Did Its Repeal Cause the Financial Crisis?

The Glass-Steagall Act, Depression-era legislation, has had a controversial, unconventional run. 80 years after its inception, it’s made its way back into public discourse. This article examines its historical context, its erosion, and the repeal of the Glass=Steagall Act, as well as its impact on the financial crisis.

Melissa Lin

The Greek Debt Crisis Explained

After several months of relative quiet, Greece is back in the spotlight as the latest repayment deadline on its bailout debt comes due in July. We take the opportunity to review the root causes of the crisis, what has been happening since it kicked off, and what needs to be done to resolve the situation.

Solon Molho

Is a Cashless Society the New Reality?

A cashless society is approaching, with progress particularly pronounced in certain parts of the world. This piece examines global payment trends, as well as benefits and drawbacks of a cashless economy. It also includes case studies on India and Sweden, two countries already transitioning to a cashless future.

Melissa Lin

What is the Border Adjustment Tax? Potential Benefits and Risks

With tax reform discussions likely to rise to the national forefront, this article provides analysis regarding border adjustment taxes and the recent House proposal. It assesses economic implications and historical comparisons to help you understand how you and your business might be impacted.

Melissa Lin

Hiring a Startup CFO: When to Hire a CFO and Why You Need One

For young companies, the value of a full-time CFO is hotly contested. At the debate’s core, is the trade-off between the sheer expense of an experienced CFO at such an early stage (not cheap), and the value said individual posits to confer where growth, strategy, fundraising, and operations are concerned.

Borrowing elements from Maslow’s Hierarchy of Needs and adapting them for this purpose, Toptal Finance Expert Scott Brown introduces a unique framework for how startups might go about thinking through and making this decision.

Scott Brown

World-class articles, delivered weekly.

Toptal Finance Experts

- Blockchain Consultants

- Business Management Consultants

- Business Plan Consultants

- Business Process Optimization Consultants

- Certified Public Accountants (CPA)

- Economic Development Consultants

- Equity Research Analysts

- Excel Experts

- Financial Benchmarking Consultants

- Financial Forecasting Experts

- Financial Modeling Consultants

- Financial Writers

- Fintech Consultants

- FP&A Consultants

- Fractional CFOs

- Fundraising Consultants

- FX Consultants

- Growth Strategy Consultants

- Integrated Business Planning Consultants

- Interim CFOs

- Investment Managers

- Investment Thesis Consultants

- Investor Relations Consultants

- M&A Consultants

- Market Sizing Experts

- Pitch Deck Consultants

- Private Equity Consultants

- Procurement Consultants

- Profitability Analysis Experts

- Real Estate Experts

- Restructuring Consultants

- Risk Management Consultants

- Small Business Consultants

- Supply Chain Management Consultants

- Valuation Specialists

- Venture Capital Consultants

- Virtual CFOs

- Xero Experts

- View More Freelance Finance Experts

Join the Toptal® community.