The Greek Debt Crisis Explained

After several months of relative quiet, Greece is back in the spotlight as the latest repayment deadline on its bailout debt comes due in July. We take the opportunity to review the root causes of the crisis, what has been happening since it kicked off, and what needs to be done to resolve the situation.

After several months of relative quiet, Greece is back in the spotlight as the latest repayment deadline on its bailout debt comes due in July. We take the opportunity to review the root causes of the crisis, what has been happening since it kicked off, and what needs to be done to resolve the situation.

Solon is a top rated sell-side equity analyst, with deep experience in financial analysis and valuation work.

Expertise

PREVIOUSLY AT

Key Takeaways

- The economy of Greece is back in the spotlight as an impending repayment deadline on its outstanding debt becomes due in July. Talks on refinancing these with further bailout funds are once again stalled. Seven years on, the Greek debt crisis continues to be unresolved.

- The root cause of Greece’s economic crisis can be found in the profound structural economic inefficiencies that were borne out of the 1980s depression the country suffered through. As the country came out of brutal fascist military rule, the country embarked on a public sector-led economic boom that sowed the seeds of the crisis the country faces today.

- Many argue that Eurozone membership is to blame for the current debt crisis. Nevertheless, we disagree: Euro membership in fact provided a means, by way of both funding and structures, to spur the Greek economy’s development. Unfortunately, the opportunity was not taken advantage of.

- Instead, Eurozone membership created a way of sweeping the problems under the carpet, and caused artificially low borrowing costs that allowed the various governments of past decades to continue the expansionary public sector policies of the previous periods.

- The straw that broke the camel’s back and precipitated the current crisis was the global financial meltdown of 2008. But in many ways, the economy of Greece was already insolvent before then.

- Despite the immediate future looking bleak, we believe the Greek Debt Crisis can still be resolved. If the underlying structural problems that have plagued the economy since the 1980s are finally tackled, the situation could turn around. These reforms must be centered around five key areas:

- Fixing investment and business scale disincentives

- Reducing the size of the public sector’s contribution to the economy

- Addressing labor market inefficiencies

- Improving the legal and judicial systems

- Curtailing the size and role of the “shadow” economy

- If something is not done soon to address the situation, it risks deteriorating from an economic crisis to a humanitarian one.

Here We Go Again: The Economy of Greece Is Back in the Spotlight

Those following the news will no doubt know that Greece has for several years now been battling through a severe financial and economic crisis that has had profound consequences for the Greek economy and population, and at times threatened the stability of the Eurozone (and consequently the global financial markets).

After months of being out of the spotlight, Greece has recently returned to the fore as an impending repayment deadline on its latest batch of rescue-package loans becomes due in July. In scenes all too familiar, talks on the next installment of bailout money are again stalled as the parties argue over ineffectiveness of the reform agenda, the need for debt relief, the IMF’s reluctance to participate in the bailout package, and several other issues. In other words, we’re back where we started.

As we continue to follow the latest twists and turns in this unfortunate story, we thought it made sense to take a step back and assess the situation from a higher vantage point. This aim of this article is to give readers a high-level overview of the Greek Debt Crisis, outline what has happened since the crisis officially began, and provide some thoughts on what is needed for Greece to get out of this mess.

Greece Crisis Explained: How Greece Got into Its Current Mess

Greece’s modern history is strongly connected to its membership and participation in the European Project. Greece has been part of the European Economic Community (the precursor to the European Union) since 1981, but struggled to join the Euro, the Eurozone’s common currency, as some of the conditions of entry were stringent. Nevertheless it succeeded in 2001, and in a televised New Year’s message, Costas Simitis, then prime minister, pronounced that “inclusion in EMU ensures for [Greece] greater stability and opens up new horizons.”

In many ways, Eurozone membership has been beneficial for Greece. A look at GDP growth since membership (Chart 1) shows how the economy has grown nicely since acceding to the monetary union (only to radically revert its course after the Global Financial Crisis of 2008). More importantly, one can see how Eurozone entry was followed by a fairly healthy dose of “economic catch-up” relative to other Eurozone countries (GDP per capita relative to the EU average appreciated from the mid-80% mark in 1995 to the mid-90% mark right before the Global Financial Crisis), an encouraging sign regarding membership’s effect on the Greek economy.

With the benefit of hindsight though, membership has had some negative unintended consequences that can arguably be considered to have contributed to the current crisis—put simply, membership of the Euro plastered over the more deep-rooted and severe economic malaise that the country was experiencing.

Greece Leading Up to Eurozone Membership: An Economy in Crisis

After more than a decade of strong economic growth, Greece entered the 1980s in a period of economic depression. Despite joining the European Economic Community in 1981, the Greek economy essentially moved sideways, and by 1987, Greek GDP was roughly the same as in 1979, while other European economies had continued to grow.

To a large extent, the cause of the situation was a political reaction by a Greek population who, after enduring the effects of a horrifyingly brutal seven-year long military junta, elected a left-leaning, socially liberal government. This new political regime, among other things, resulted in a large increase in government spending. This stifled the private sector and saw an explosive expansion of the public sector as a percentage of total GDP. Government spending and borrowing soared, leading to sixteen years of double-digit fiscal deficit (Chart 2).

This period unfortunately gave rise to serious underlying structural economic problems including a bloated public sector, excessive bureaucracy, convoluted legislation, severe judicial delays, and increased power of labor unions. Unemployment grew (Chart 3), and inflation plagued the economy (Chart 4).

In an effort to fix the inflationary issues, Greece devalued the drachma in 1983, a move that only helped to provide brief respite before inflation resumed its course. Fundamentally, Greece was caught in an inflationary/devaluation spiral which would only continue in absence of measures tackling the underlying problems facing the Greek economy.

As a result, the economy of Greece continued on its path of fiscal expansion and debt-funded growth, leading to extremely high levels of indebtedness (Chart 5). By the time the Maastricht Treaty was signed in 1992 (which, in essence, gave birth to the concept of a monetary union and the Euro), Greek borrowing costs were more than twice as high as most of its European counterparts (Chart 6).

Greece Prepares to Join the Euro: The Situation Improves Slightly

With this backdrop, Greek entry into the single currency offered the means, by way of both funding and structures, to spur its development. But entry into the Euro required adherence to a set of strict monetary and fiscal policies. These helped generate a reversal of the previous decades of economic policies, and the Greek economy improved somewhat as a result. Debt-to-GDP levels stabilized (as opposed to prior years’ constant increases) (Chart 7), and inflation declined and fell into line with other Eurozone members (Chart 8).

Progress was made on structural reforms as well, including the abolition of most punitive protectionist tariffs, a curtailment of subsidies, and some privatizations.

Greece Joins the Euro: Issues Are Swept Under the Carpet

In January of 2001, Greece formally joined the Euro, leading finance minister Ioannis Papandoniou to describe it as “an historic day that would place Greece firmly at the heart of Europe.” And, as mentioned above, the short-term effects were largely positive, with encouraging increases in growth and per capita output.

However, membership in the Euro had been plastered over the underlying structural deficiencies in the economy that had still not been resolved. Normally, when a country borrows excessively, it will find that its exchange rate will start to slip and its interest rates will rise. As Greece adopted the Euro, it could no longer avail itself of such external warning signs. Borrowing costs plummeted (Chart 9) and as Matt Phillips points out, “yields on Greek government debt fell to levels on par with some of the most creditworthy countries in Europe, such as Germany […] Adoption of the stable currency, backed by the European Central Bank, installed confidence—and frankly overconfidence—in financial markets. Investors seemed to discard any concerns about the Greek economy, as well as the country’s shaky credit history.”

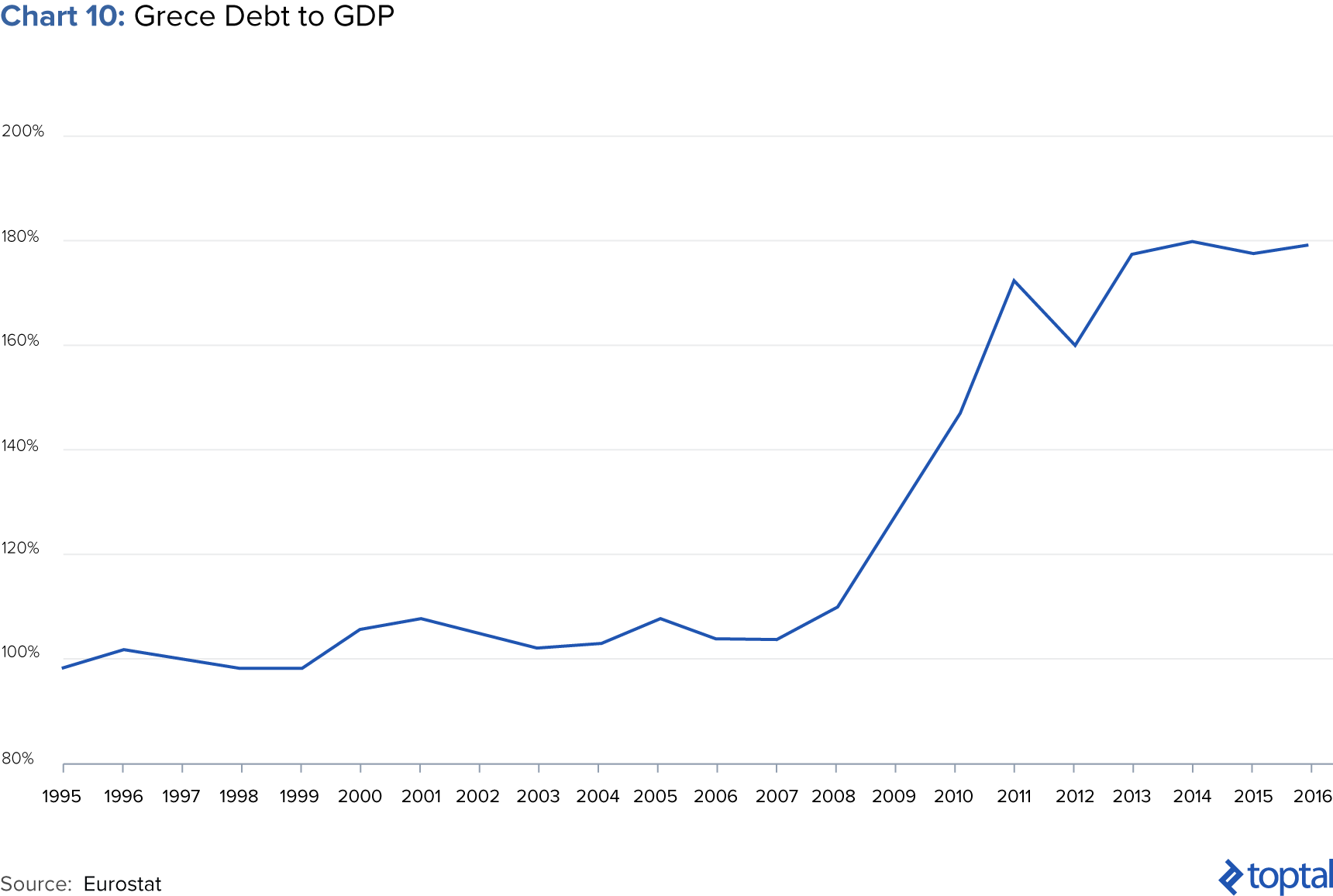

The result of the above was that Greece returned to its prior ways of excessive government borrowing and fiscal expansion (Chart 10). Despite the tepid attempts at structural reform prior to Euro entry, the economy continued to suffer from continuing underlying structural problems. As Valentina Romei of the Financial Times points out, “In this period growth was largely consumption-driven. The annual average growth rate of government consumption expenditures was 4.7 per cent compared to 1.9 per cent in the Eurozone. Exports growth rates were similar to the other countries, while imports grew much faster.”

The Lisbon council sums up this period nicely: “Greece in the 2000-2007 period offers a dramatic example of unsustainable, boom-based growth acceleration pursued under weakening systemic growth forces.”

Making matters worse, in 2004, Greece admitted that it had manipulated some of their economic data in order to be allowed into the union, and reports began to emerge of the extent and means of financial “fudging” that had taken place.

A Ticking Bomb: Greece Explodes into Crisis

As we’ve illustrated above, the roots of the current crisis had been sowed over 20-30 years, and the current situation is just the symptom of the underlying problems that have never been fixed. Nevertheless, the straw that broke the camel’s back came in the form of the Global Financial Crisis of 2008, an event that sent financial markets into turmoil. With debt markets reeling, Greece’s unsustainable debt piles began to be too tentative.

In 2009, after more statistical irregularities that had resulted in an underreporting of public debt were laid bare, Greek debt was downgraded. Suddenly, “Greece was shut out from borrowing in the financial markets. By the spring of 2010, it was veering toward bankruptcy, which threatened to set off a new financial crisis [and the existence of the Eurozone itself].”

To avert the crisis, the IMF, ECB, and the European Commission, a group which would go on to famously be called the Troika, agreed to extend emergency funding to Greece. In essence, Greece was bailed out.

The bailout marks the beginning of what has now become a long and drawn-out saga, that has seen twists and turns that make for a fascinating and at the same time highly frustrating following. While the exact unfolding of the story so far could take pages to detail, we’ve provided a handy timeline (courtesy of the Council on Foreign Relations) that highlights the most significant events. More importantly, we then go on to analyze the most important issues at stake.

Austerity vs. Debt Relief

At the heart of the seemingly never-ending saga lies the tension between the Eurozone members of the Troika on the one hand who insist on austerity, and the Greek authorities on the other who are pushing for debt relief. And interestingly, the IMF seems to have come down on the side of the Greeks in recent years. In fact, in a recent blog post, the IMF stated that:

The IMF is not demanding more austerity. On the contrary, when the Greek government agreed with its European partners […] to push the Greek economy to a primary fiscal surplus of 3.5 percent by 2018, we warned that this would generate a degree of austerity that could prevent the nascent recovery from taking hold […] We have not changed our view that Greece does not need more austerity at this time.

As a result of this impasse, successive Greek governments, reticent to reform (primarily due to political reasons), pinned the blame for the required fiscal contraction on the country’s creditors. This of course has stoked resentment amongst the Greek population for both lenders and the reforms.

Nevertheless, Eurozone members, captained by Germany, continue to insist that austerity is required. In a statement by Annika Breidthardt, European Commission spokesperson, the European Commission hit back, saying “The European institutions consider that the policies of the ESM program are sound and if fully implemented can return Greece to sustainable growth and can allow Greece to regain market access.”

Until now, austerity seems to have been winning the battle, perhaps due to Greece’s lack of options. But as the economy continues to get worse (See below), the debate is seeing growing voices in favor of debt relief.

Greece Votes for Change

As outlined in the timeline above, by 2014, Greece had started showing some growth and had been able to briefly return to financial markets. However, a faction of the Greek political class leveraged anger about the austerity the country had to endure, and on the procedural issue of electing the—largely ceremonial—president of the republic, precipitated an election which they won in January of 2015.

Promptly, they abandoned all attempts at reform and even regressed some that had previously been implemented. Once their position became untenable in June of 2015, they decreed a shut-down of the banks (to avoid a bank run), imposed capital controls, and agreed to the third Economic Adjustment Programme. This caused a split in the party and a new election, but not much changed.

The election of Syriza marks one of the most dramatic twists in the story so far. It has resulted in Greek political life being dominated by a fear/anger spectrum, where fear of Euro exit alternates with anger at the high unemployment rate and deep recession. A lot of extremist parties have come to the fore as a result of unsubstantiated populist claims. The last two governments were elected on the premise that they were better suited to resist the creditor’s demands for reforms.

Yet in the last year a new kind of political persona, that of the reliable interlocutor, represented by the centre-right opposition, is gaining ground. With the government hanging on to power by a tenuous parliamentary majority of three, political change may be around the corner.

Have the Reforms Been Implemented?

Of course, an obvious question related to all this is whether Greece has in fact stuck to its commitments, as part of the bailout funds, to implement reforms. And the answer seems to be “somewhat.” In the most recent bailout review, the Greek authorities admitted that “almost two thirds of the actions creditors have demanded for the disbursement of the next tranche of emergency loans have yet to be completed.”

Of course, the required reforms are complex and take time to fully implement, and in fact, according to the same memo, 40% of the remaining reforms are in “implementation process.” However that also means that a large chunk continue to be lacking. And these are big obstacles. They include “major labor law reforms, pension cuts, taxation of low incomes, fiscal targets, and the liberalization of certain markets. They are the issues that Greece and lenders disagree [on] to the point that negotiations have stalled.”

The debate around pension reform is a case in point. A centerpiece of the original reform agenda laid out in the first bailout back in 2010, the Troika is pushing Greece to save 1.8 billion Euros, equivalent to 1% of GDP, from these measures. And as can be seen in the chart below, Greece has the highest pension costs in the European Union as a proportion of GDP.

And yet, reforms have only been halfhearted. As Sotiris Nikas of Bloomberg points out “The reform[s were] applied only to new entitlements, with successive cuts to existing pensions presented as temporary measures that might be reversed after the crisis […] Last year’s reform ended this duality by abolishing the old system for determining pension entitlements. Still, Tsipras’s government kept its promise not to further cut existing primary pensions by introducing a top-up. That top-up is now in the firing line. The IMF says the system places too high a burden on younger generations and that the link between contributions and benefits is too weak.” The example of pension reforms is illustrative of the general back-and-forth that has been occurring around the entire reform package over the years.

Bailout Measures So Far Fail to Fix the Economy

The other big issue underlying the bailout story so far is that it largely has not worked from an economic standpoint. Unfortunately, rather than improving, the Greek economy has worsened considerably, and it looks further away from being capable of repaying its debts than it did prior to the bailout funds. The most dramatic headline result is that the economy of Greece has contracted approximately 25% since the crisis began, proving to be one of the worst in Europe since the Great Depression (Chart 12).

Unemployment continues to be unsustainably high (Chart 13) and by 2015 had reached over 25%. And as mentioned above, rather than improve the government’s indebtedness, the debt-to-GDP ratio has continued to worsen, rendering the country only more insolvent (Chart 14)

Looking Ahead: How Can the Greek Economic Crisis Be Solved?

With all of the above in mind, the pertinent question looms large: Can the Greek debt crisis be solved’? Despite all the gloom and doom, there is of course still a path to recovery. Throughout this article, we have consistently mentioned underlying structural deficiencies in the Greek economy. And at the risk of sounding banal, this is where the answer lies. If Greece can finally make progress in fixing these deficiencies, the country and its economy may track a course back to prosperity.

So what are these underlying deficiencies? With so many issues at stake, it is difficult to provide a succinct and at the same time informative summary; however, a 2012 McKinsey report does a nice job boiling all the issues down into five major areas. We run through these in turn.

Investment and Business Scale Disincentives

The Greek economy continues to rely extremely heavily on small and medium-sized businesses, often family owned (Chart 15). By their very nature, these business are much less competitive than their larger counterparts, which in turn affects overall competitiveness of the Greek economy.

Further hampering competitiveness are over-regulation and bureaucracy in many different sectors (Chart 16). Moreover, certain tax laws and administrative processes also contribute to inefficiency and lower productivity, as do labor laws which create disincentives for larger enterprises to scale up and hire more employees.

All of the above has therefore created a situation in which Greece consistently lags behind its European counterparts in terms of productivity and competitiveness, even after years of growth and catch-up prior to the Financial Crisis of 2008 (Chart 17).

Large and Inefficient Public Sector

This has been a common theme throughout this article, but the point remains important: Greece’s public sector is too large relative to its overall GDP. And while some economies (e.g., the Nordics) are able to derive value from a large public sector, Greece generally has not. In fact, as McKinsey’s report points out, “the World Economic Forum ranked Greece extremely low in public sector outcomes. Combined with high government expenditure, this demonstrates the underperformance of the Greek public sector” (Chart 18).

Aside from the above, a large number of enterprises in the private sector remain “semi-public” in that they are still very much tied to the state, and either directly or indirectly controlled by the public sector. This, along with poor transparency and accountability standards, creates important distortions that inhibit the private sector’s ability to improve.

Labor Market Inefficiency

The Greek labor market, despite recent reforms, continues to be relatively inefficient. Unions continue to heavily influence the economy, and generally inflexible labor requirements mean that companies are reticent to hire more workers. These inefficiencies make it extremely difficult to hire and fire, and as a result, Greece has the lowest employment turnover rate in Europe and the longest average tenure in employment across the Union.

The labor force is also hindered by an inadequate educational system. As the World Economic Forum points out, “The educational system does not deliver the quality education needed for a dynamic economy and is plagued by inequities: data in our upcoming report show very different performance outcomes among students depending on their income levels. As a consequence, Greece ranks 30th out of the 30 countries for the quality of education.”

Inadequate Legal and Judicial System

The McKinsey report sums up the issues surrounding the legal system nicely: “Business in Greece is impeded by a cumbersome legal system, which comprises a number of laws, sometimes ambiguous, obsolete, or contradictory, (e.g., in environmental legislation), with multiple overlaps and frequent revisions (e.g., in the case of tax legislation). The resulting complexity creates a rigid and inefficient administration, responsible for delays, confusion, and frequent friction with businesses and citizens.”

Regarding the judicial system in particular, the IMF’s most recent country report outlines how:

The limited capacity of the judicial system has been an issue since the beginning of the crisis. The delays in litigation are endemic, courts lack adequate technology and data systems, and the support bureaucracy is highly inefficient. The court system is also overburdened because of the high appeal rate: Reportedly, more than 50 percent of judicial decisions are appealed, which consumes additional judicial resources in the resolution of disputes.

The insolvency and creditor rights framework is supported by an inadequate institutional setting. The court system is fragmented, not centrally managed and operated, and lacks the necessary supportive data systems. Moreover, judges lack specialization and expertise. For instance, judges deal with all types of cases (civil and criminal cases) and need to rotate every two years in their position, not enabling specialization. Training of the judiciary is also lacking. There is a lack of competent auxiliary staff, proper systems for case management, and adequate infrastructure. Additional judicial resources have been allocated to address the backlog in personal insolvency cases

Widespread Informality

For many years, the “informal” sector in Greece has been an issue that has not been effectively dealt with. Tax evasion is rampant, and it is estimated that “two out of three Greek workers either understate their earnings or fail to disclose them to the taxman altogether.” In 2013, it was estimated that 24% of all economic activity was undeclared. This of course results in a very significant tax collection gap: In 2009 for instance, it was estimated that “between €15-20 billion of personal, corporate, and sales taxes were lost […] equivalent to 7-9% of the country’s GDP and 60-80% of 2010 fiscal budget.”

The issue of tax evasion is a multifaceted problem. As the Economist points out, “Greeks, even more than their counterparts elsewhere, feel that their taxes are wasted. One study, using data from the 1990s, put Greece’s “tax morale” fourth-lowest of 26 countries. Greece’s public sector is more corrupt than that of any other EU state, according to Transparency International, a pressure group. Satisfaction with public services is extremely low. No wonder, then, that many Greeks have few qualms about not paying their share.”

Aside from obviously affecting government revenue, and in turn the government’s ability to repay its debts, a large shadow economy also hampers growth in other ways. Firms operating in the informal economy for instance tend not to borrow (as much, or at the same sort of market rates that legitimate firms can borrow at), thus limiting their ability to grow and invest in productivity enhancements. This in turn hampers wages at these firms, which creates a virtuous spiral.

Why Bother with the Eurozone at All?

Of course, another option could be to leave the Eurozone. This would allow Greece to devalue its currency and consequently ease the debt burden. More extreme, Greece could default on its debts altogether.

Interestingly though, even in the throes of a recession, public opinion has consistently supported Euro membership. This seems counterintuitive initially, but has deep historic roots. Greece had a currency peg to the US dollar between 1953 and 1973. During that period, when it held a steady exchange rate of thirty Drachmas to the US dollar, it enjoyed a growth rate that was the second highest in the OECD, surpassed only by Japan.

After the Bretton Woods agreement collapsed, the Greek Drachma devalued gradually, to reach 282 Drachmas to the US dollar when it was abolished in December 2000 as a result of joining the Euro. This is akin to an annual decline of 4.7%.

In this context, and given the relatively high reliance on imports (Greece imports almost 2/3 of its energy needs, including nearly all of its oil), Greeks likely view the loss of the stability of the Euro as a risk not worth taking. Even at the height of the government’s confrontation with creditors, between 74% and 79% of people supported Greece’s participation in the Euro, in multiple polls conducted at the time.

A Mentality Change Is Needed

Despite the slew of negative news, we continue to believe that the situation could turn and eventually improve. But for this to happen, a number of things need to come together. Most of the important reforms that the country needs to undertake have already been enacted, if not implemented. Some of these, like opening up closed professions (more than a hundred with stringent entry restrictions and administratively set pricing eroding overall competitiveness) are slow burners and will take time to seep through.

However, despite the various structural reforms that we’ve highlighted above, Greece’s uniqueness lies in that it never truly embraced the need for reform, which it undertook only grudgingly, partially, and with much delay. What is fundamentally needed is a government that will take ownership of the reform agenda and instill a modicum of stability and good execution.

Perhaps a bit odd—but in our view, informative—example of the deficiencies in the current political class relates to the prevalence of smoking in public, and even enclosed public spaces. One walk around Athens is very revealing—most visitors cannot believe that smoking in public places is actually illegal. TV footage of the health minister smoking while addressing parliament, for instance, did not raise any eyebrows amongst Greeks. Clearly, this is not of any economic consequence, but its value lies as an illustration of the disregard Greeks, including the country’s government, harbor for their own laws. It is thus no wonder that the first review of the third Adjustment Programme was completed more than a year behind schedule. Continued delays and uncertainty compound the cost.

In a recent event, Deputy Economy and Development Minister Stergios Pitsiorlas perhaps summed it up best, with, “I believe that the biggest structural change that must be made in our country is a change in culture and this concerns us all.”

Ultimately, putting politics or economic theory aside, most will agree that this crisis needs to come to an end. At the end of the day, recent years have taken a severe toll on the Greek population. Greece is now the third poorest country in the EU, behind Bulgaria and Romania, and recent Eurostat data shows that more than 22% of the population were “materially deprived” in 2015. And while poverty figures have been dropping sharply in the ex-communist Balkan states, Greece’s numbers have doubled since 2008.

So unless something is done soon, the Greek situation may evolve from an economic crisis to a humanitarian one.

Understanding the basics

How much is the Greek national debt?

As of December 2017, Greece has a national debt of approximately EUR 329 billion. Its debt to GDP ratio is 179 percent.

What is the rate of unemployment in Greece?

Since October 2011, the Greek unemployment rate has been between 20 and 30 percent.

When was the first bailout for Greece?

Greece, the IMF and other eurozone leaders agreed to the first Greek bailout package for EUR 110 billion on May 2nd, 2010.

Solon Molho

Athens, Central Athens, Greece

Member since February 21, 2017

About the author

Solon is a top rated sell-side equity analyst, with deep experience in financial analysis and valuation work.

Expertise

PREVIOUSLY AT