Celebrity Investors Take Over Silicon Valley

Today, there are many celebrities that have become investors, and many investors that are borderline celebrities. One thing is clear: The division between Hollywood and Silicon Valley has become increasingly blurred. Though in the past it has been common for famous entertainers, musicians, or actors to grow their wealth through real estate, royalties, or restaurants, celebrities today are turning towards tech investments.

This article explores why celebrities are drawn to Silicon Valley, the types of companies they invest in, different models of their involvement, and commentary on how it impacts the tech industry.

Melissa Lin

How Is the International Money Transfer Market Evolving?

With the global workforce becoming increasingly mobile, international money transfers (“remittances”) have equally grown in prominence, passing the $530 billion a year mark in 2016.

Fees for transfers are at an all-time low, thanks to pressure from bodies such as the UN, which is providing consumers with more value. But how are transfer companies responding to this pressure and what steps are they taking to differentiate themselves from the rest of the pack?

Mauro F. Romaldini, ACMA CGMA

Commercial Drones Are Revolutionizing Business Operations

When most hear “drone,” they think expensive military aircrafts or small consumer toys. However, the future of drones will actually be shaped by practical commercial applications, due to their ability to drive efficiency and data analytics.

This article defines drones and their total addressable market and highlights how their capabilities can be leveraged in commercial business operations. It also includes investment trends and predictions for the future of the industry.

Francesco Castellano

Cybersecurity: What Every CEO and CFO Should Know

$7.35 million. That’s the average cost of a data breach is. Sure, cybersecurity isn’t sexy. However, in today’s digital age, it is undeniably critical for large corporations and small startups alike. This is compounded by the fact that hacks are becoming commonplace.

Read on to arm yourself with awareness to these invisible threats, and tangible steps you can take to protect yourself and your company.

Melissa Lin

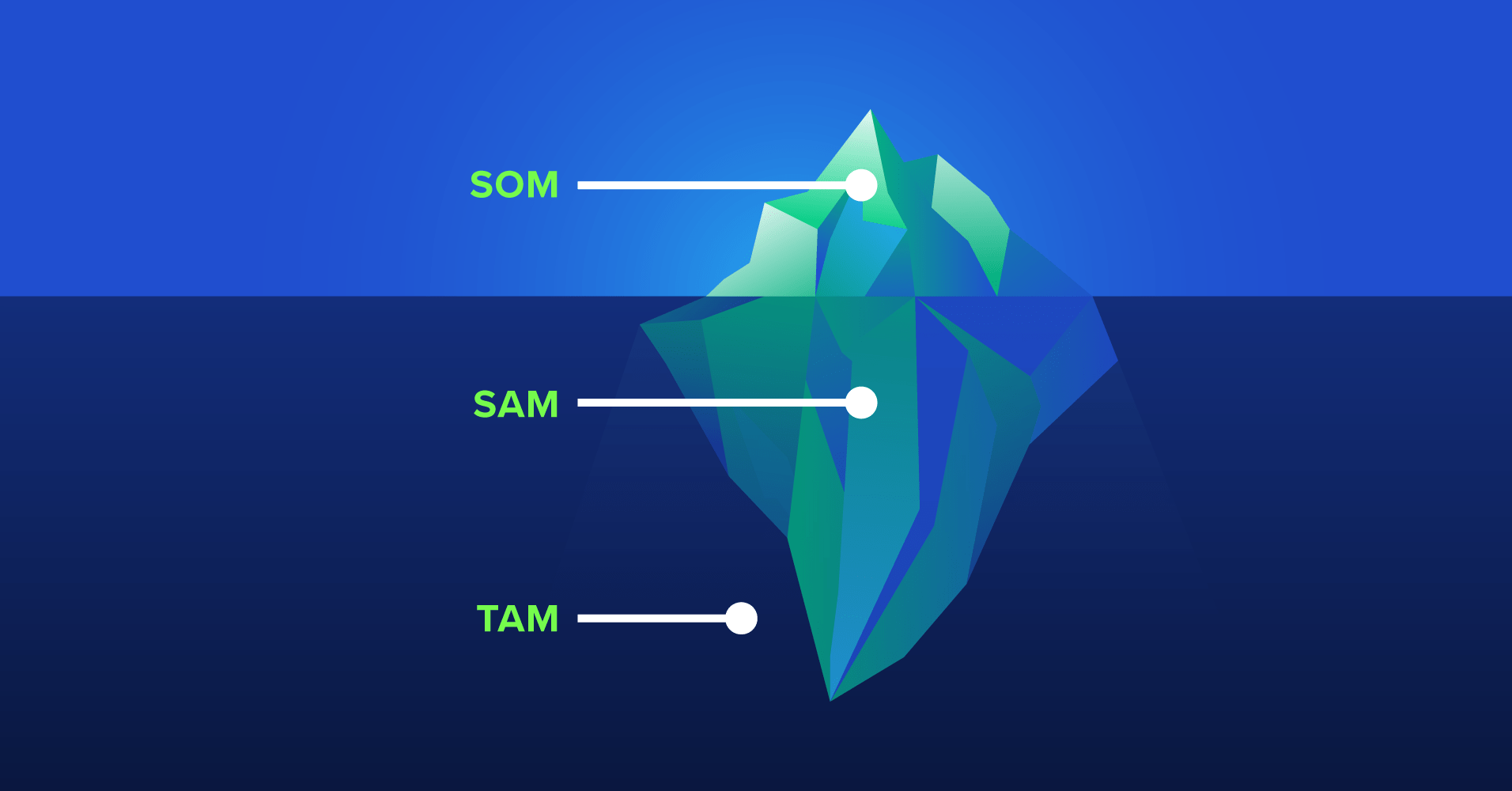

TAM Methodology: An Explanation and Example of Total Addressable Market Analysis

Total Addressable Market (TAM) sizing exercises have become very popular for assessing the potential of a business. TAM is, however, often miscalculated and misinterpreted. In this article, we will look at how to calculate it and its derivative subset waypoints of SAM and SOM. A working example will also be demonstrated for WeWork.

Toptal Talent Network Experts

Why Investors Are Irrational, According to Behavioral Finance

Though traditional economic theory posits that individuals are rational, we all know this to be an oversimplification of the truth. The cyclical investment process is rife with psychological pitfalls. Only by becoming aware of and actively avoiding innate behavioral biases can investors reach impartial decisions. Herein lies the true value of the emerging field of behavioral finance, which sheds light on investor psychology and true financial behavior.

Melissa Lin

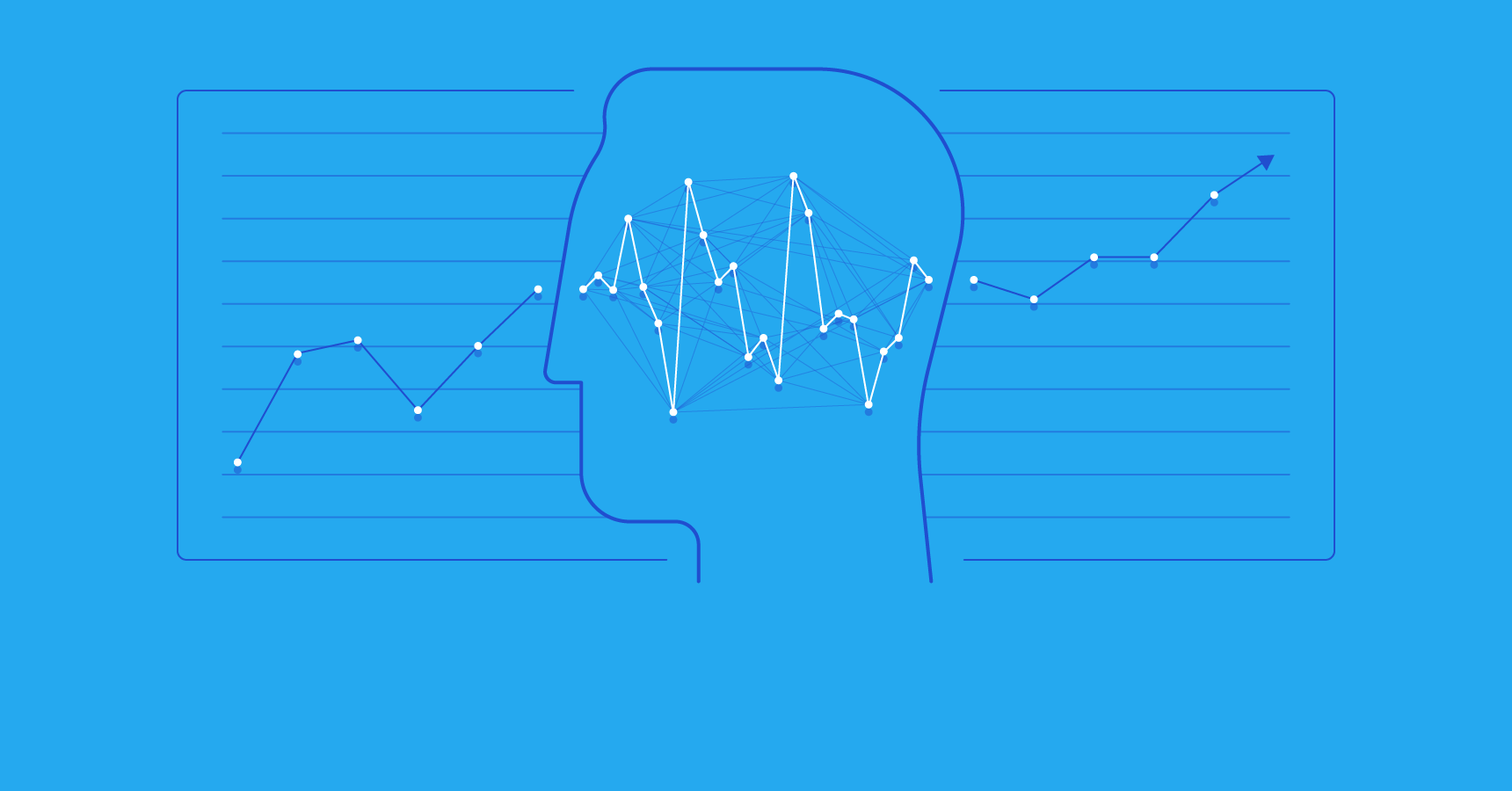

How Artificial Intelligence Is Disrupting Finance

As consumers, we’re familiar with AI: we benefit from cars that parallel park themselves, devices that respond when asked questions, and streaming platforms that suggest shows we may like. However, professionally, the larger question is how industries will harness the power of AI. In finance, AI offers opportunities for operational efficiencies in everything from risk management and trading to insurance underwriting.

Melissa Lin

Esports: A Guide to Competitive Video Gaming

While the complex esports industry may be daunting for investors, it is growing exponentially and has already amassed a large global audience. Here’s what to know about how to invest in esports.

Josh Chapman

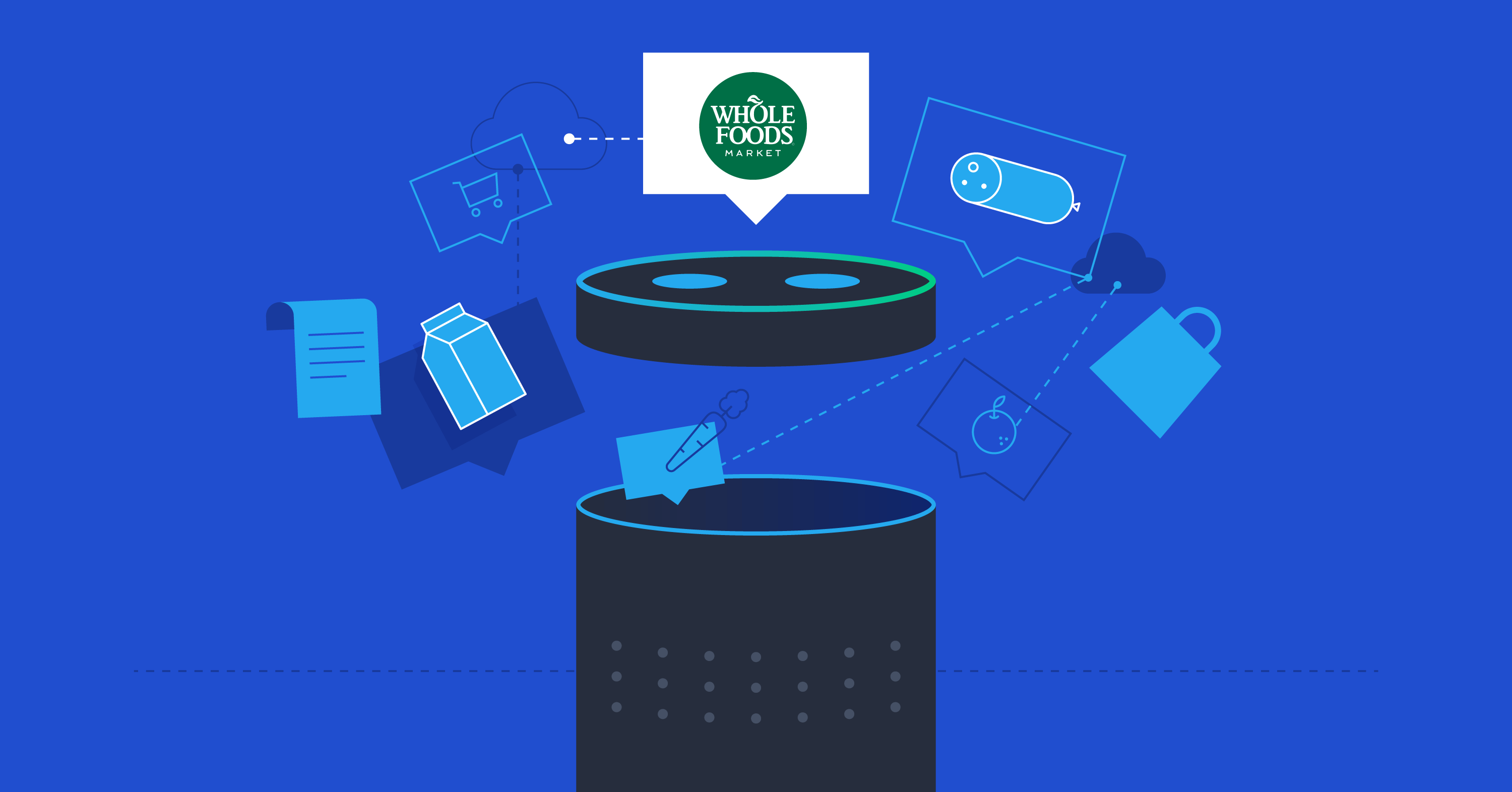

Amazon vs. Walmart: Bezos Goes for the Jugular With Whole Foods Acquisition

Through its acquisition of Whole Foods, Amazon is not only likely to disrupt the grocery shopping experience but is perhaps embarking on a grander push that could change the entire retail landscape, leaving Walmart on the back foot.

Toby Clarence-Smith

World-class articles, delivered weekly.

Toptal Finance Experts

- Blockchain Consultants

- Business Management Consultants

- Business Plan Consultants

- Business Process Optimization Consultants

- Certified Public Accountants (CPA)

- Economic Development Consultants

- Equity Research Analysts

- Excel Experts

- Financial Benchmarking Consultants

- Financial Forecasting Experts

- Financial Modeling Consultants

- Financial Writers

- Fintech Consultants

- FP&A Consultants

- Fractional CFOs

- Fundraising Consultants

- FX Consultants

- Growth Strategy Consultants

- Integrated Business Planning Consultants

- Interim CFOs

- Investment Managers

- Investment Thesis Consultants

- Investor Relations Consultants

- M&A Consultants

- Market Sizing Experts

- Pitch Deck Consultants

- Private Equity Consultants

- Procurement Consultants

- Profitability Analysis Experts

- Real Estate Experts

- Restructuring Consultants

- Risk Management Consultants

- Small Business Consultants

- Supply Chain Management Consultants

- Valuation Specialists

- Venture Capital Consultants

- Virtual CFOs

- Xero Experts

- View More Freelance Finance Experts

Join the Toptal® community.