Exploring the Bear Case of the Cryptocurrency Bubble

The arguments for a cryptocurrency revolution can tend to sway toward appearing more like get-rich-quick schemes than balanced debates. The regulatory risk overhang, constant scams, and technological immaturity of the movement mean that long-term success is far from certain.

In this article, Jonathan Sterling addresses the other side of the argument: the bear case for a crypto future. He shines a light on the problems blighting cryptocurrencies and some remedies for them, drawing upon comparisons with historic bubbles, some centuries old.

The arguments for a cryptocurrency revolution can tend to sway toward appearing more like get-rich-quick schemes than balanced debates. The regulatory risk overhang, constant scams, and technological immaturity of the movement mean that long-term success is far from certain.

In this article, Jonathan Sterling addresses the other side of the argument: the bear case for a crypto future. He shines a light on the problems blighting cryptocurrencies and some remedies for them, drawing upon comparisons with historic bubbles, some centuries old.

Jon is a software engineer that has built out a number of Fintech solutions relating to cryptocurrency and market-making for trading.

Expertise

PREVIOUSLY AT

This article was originally published November 7, 2017.

Executive Summary

Cryptocurrencies are in a bubble and regulators could burst this at a whim.

- Eight years after the introduction of Bitcoin, there are now over 900 cryptocurrencies and their prices are at all-time highs.

- Richard Schiller categorizes bubbles as an underlying story driving the market forward, as opposed to the fundamentals of the assets. Cryptocurrencies are riding on a narrative of economic empowerment and freedom.

- Despite the widespread attention that cryptocurrencies receive, many of the actors involved in the market are not fully informed. Debate tends to turn to hype and naive investors are buying crypto-assets without fully understanding what they are.

- Banks spend 73% of the market capitalization of Bitcoin each year on regulatory compliance. Crypto-assets are currently unregulated and free of these restrictions. As such, the market has thrived but also developed some bad habits.

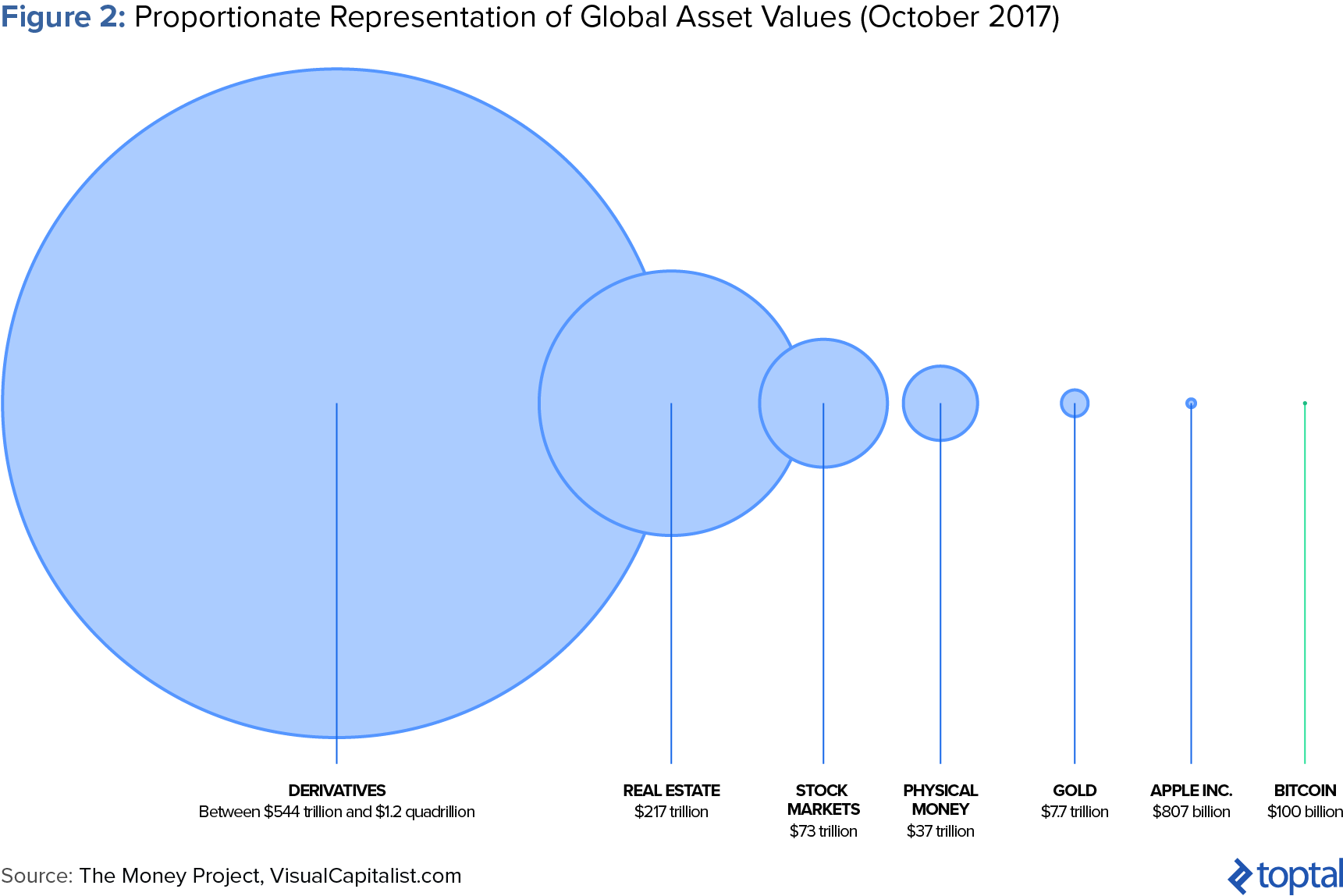

- Regulators cannot necessarily shut down cryptocurrencies, but they can restrict liquidity into them from fiat currencies and hamper their growth. The global derivatives market, for example, is worth $1.2 quadrillion, dwarfing Bitcoin’s $100 billion market cap.

Market manipulations in crypto markets are undermining their credibility.

- Due to low liquidity, no regulation, and a lack of clear understanding of the markets, pump and dumps are widespread in crypto markets. This is where a speculator can artificially sell while concurrently buying their own currency, wait for the market to rise, and then dump their holdings.

- Frontrunning is also a common occurrence in ICOs, where early investors—who are used to show initial faith in the enterprise—buy discounted tokens before immediately selling them on.

As with historic bubbles, scams are exploiting naive investors.

- ICOs can have the characteristics of vaporware. Entrepreneurs are raising hundred of millions of dollars purely on concepts. Money is being raised from investors who do not truly understand the technical concepts being proposed to them, let alone whether they are feasible.

- The actual asset structures of ICOs are not only complex but also new forms of assets in their own right. This further confuses investors, which is compounded by the "FOMO" mentality of rushing into investments and following the crowd.

- The use of celebrities to promote ICOs further demonstrates the use of manipulative marketing techniques used to cajole immature investors into participating in ICOs.

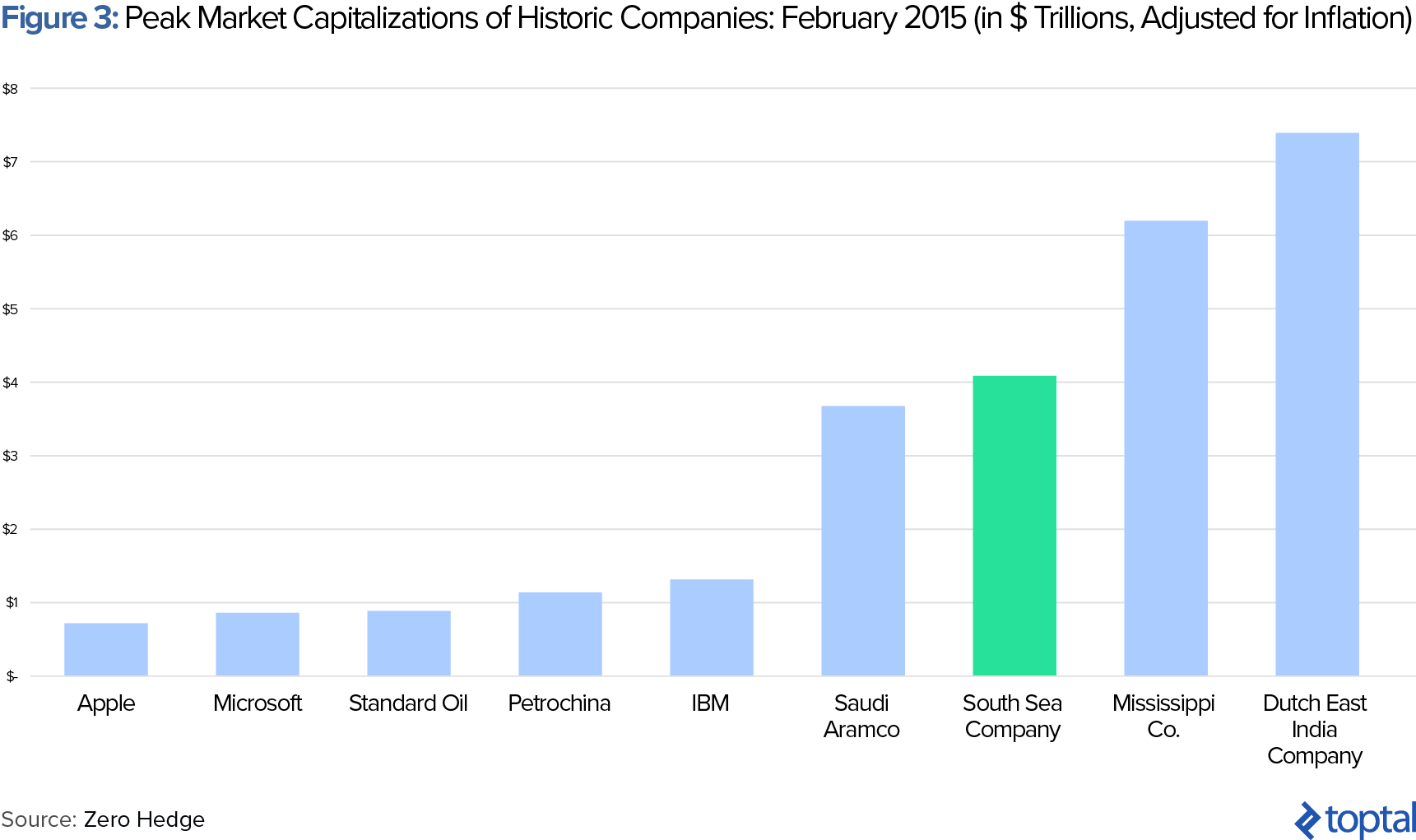

- The current ICO craze is reminiscent of the South Sea Bubble of the 18th century, a speculatory period that involved crazed investment into enterprises in the New World. Once one of the highest valued companies of all time, the South Sea Company’s bubble burst and the company disappeared almost as quickly as it appeared.

Blockchains are still not proven technology, and more work is required.

- Blockchains are still new concepts and their technology has not yet been proven on a consumer-wide scale. Attention should be focused on developing this, not speculating on short-termist projects.

- The security of blockchains is a concept that most investors in crypto-assets do not understand. The onus is on them to protect their assets, which, on the basis of the amount of thefts and frauds in the space, is not being done properly.

There are some solutions to these issues.

- A less polarized mentality of "us against the world" is needed; this could be enforced by the promotion of self-regulatory standards. These could also help to highlight the bad actors in the ecosystem.

- More development is required into the underlying technology of blockchains. In the long run, this would be far more valuable than ICO moon-shot projects.

- Awareness and discussion needs to be promoted. Conferences should present balanced debates from both sides of the crypto-view and more emphasis should be placed on educating investors instead of soliciting their investments.

Is This a Revolution, or Snake Oil?

Cryptoenthusiasts, myself included, have a tendency to start discussing cryptocurrencies at any given opportunity. Once our audience starts to concede that they have some viability, we then begin to explain elaborate theories about how the world may look in 50 years’ time after they change everything. To quote Chris DeRose, “You’ll see a lot of rampant idealism in the movement, which is a little bit dangerous.” Since that 2015 claim, calling the space’s rampant idealism “a little bit dangerous” has proven to be an understatement. In a podcast earlier this year, DeRose offered a solution to this danger:

I am striving to be a secular Bitcoiner. I wish to be not a pumper. I wish to be an independent evaluator of these technologies. I think that our greed is going to make us as willfully ignorant as it is pronounced, so you constantly have to fight it. I think that I am adding more value in skepticism and rationalism.

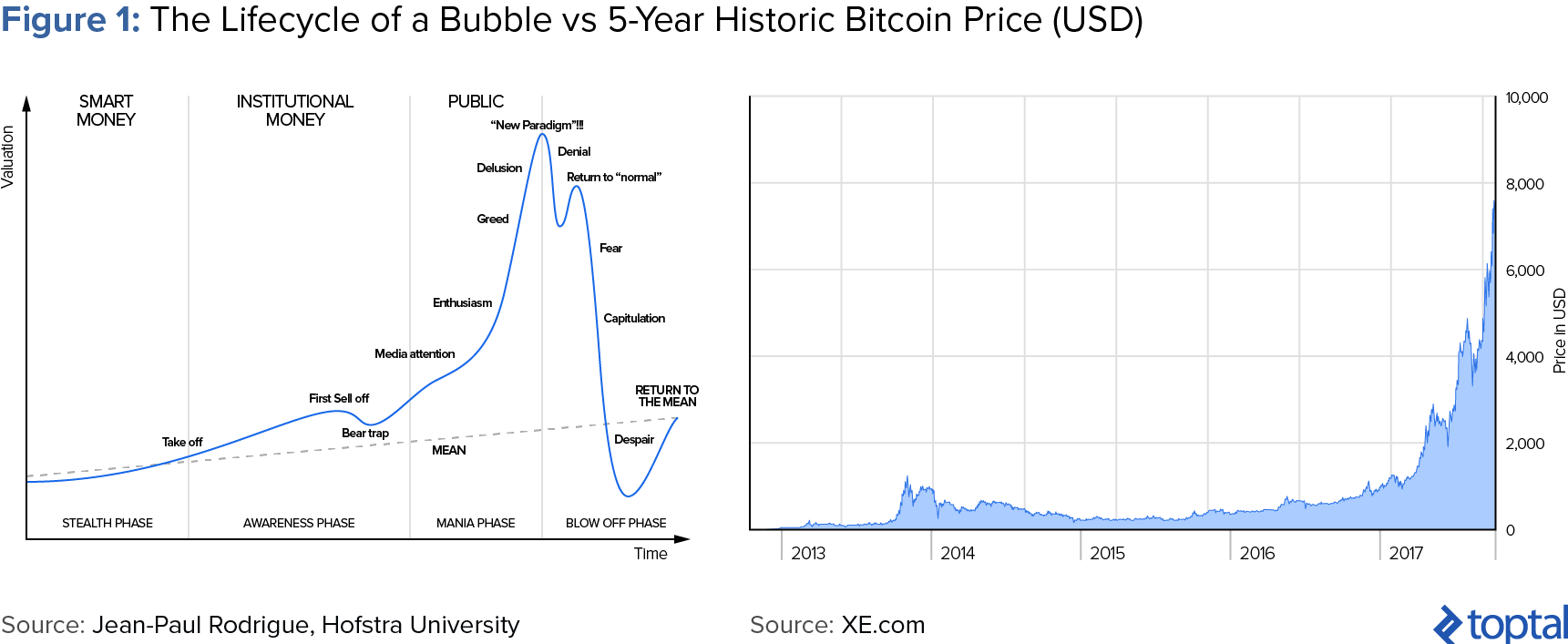

As someone with 50% of their net worth in cryptocurrencies, DeRose’s quote provided the genesis for my article: to provide some skepticism and rationalism to the current cryptocurrency craze. The big issue as far as I can see is that hyperbitcoinization (a “Bitcoin future”) is seen as an inevitability by many cryptoenthusiasts. This, I argue, is the catalyst for the current speculative bubble of cryptocurrencies—and make no mistake about it, we are in a Bitcoin bubble:

Nobel prize winner Richard Shiller, who predicted the Dotcom Bubble shortly before its crash in 2001 and then the mid-2000s Housing Bubble five years before it burst, says that what is driving Bitcoin at the moment, like other examples of bubbles, is a story:

And it’s the quality of the story that’s attracting all of this interest. And it’s not necessarily sustainable. What is the story? Satoshi Nakamoto had this brilliant paper, and then disappeared. Where is this guy? And then we have a new form of money that replaces [everything]. It sounds extremely revolutionary… And the story has inspired young people and active people, and that’s what’s driving the market.

I have come to this conclusion from my own observations and through interactions at cryptocurrency meetups all over the world. I listen to the newcomer pitch and cannot help but think, “This isn’t a balanced discussion about the technology and economics of blockchain technology—it’s a timeshare sales pitch.” I watch people with no technical or economic background talk about cryptocurrencies with little more than a surface-level understanding. This in turn leads to a confused audience, who are spun with an argument of “Smart people understand it. People who don’t understand it are not smart enough to get it.” People see others getting involved and they want to follow this “smart money.” But this is a fallacy; I ask very basic questions to these speakers regarding the technology and economics, and they’re at a total loss for answers.

Therefore, to better inform the community as a whole, over the course of this article I will attack the bull case of cryptocurrencies from multiple angles. First, let’s start with regulation.

The Regulatory Vacuum Cannot Last Forever

Cryptocurrencies in their current state are outperforming traditional financial assets primarily because of their regulatory arbitrage ability. The largest six banks in the US alone pay approximately $70 billion to meet regulatory compliance standards—at the time of writing, that’s around 73% of the entire market capitalization of the largest cryptocurrency, Bitcoin. Citigroup alone has 30,000 employees in its compliance department, a figure that vastly outnumbers the total number of blockchain developers in the world. Indeed as of mid-2016, William Mougayar claims that there are only 5,000 such developers globally. Simply put, blockchains are thriving in large part due to a lack of a regulatory sandbox, and that cannot last forever.

The common refrain you hear from cryptocurrency thought leaders when this argument is made is, “It’s censorship resistant because of its decentralization. You can’t regulate cryptocurrencies. You can’t force the protocols to change!” They send you down the thought path of, “How could regulators shut down the network?” but this is the wrong line of thought to take. The more important question is, “How can regulators make cryptocurrencies irrelevant even if the networks themselves stay up?” I argue that while regulatory bodies would have a hard time completely killing cryptocurrencies, they could regulate a blockchain future into insignificance. Here are some examples of how they could do this:

- Mandating that businesses cannot accept cryptocurrency as payment and enforcing this with spot-checks and severe penalties, including the closing of businesses.

- Controlling the on- and off-ramps to crypto. In order to obtain cryptocurrency, one must exchange fiat money for it, and for any significant amount of money, this will go via an online exchange. These exchanges need to be able to handle this fiat money, which necessitates that they operate bank accounts, mechanisms that be closed on a whim by an overzealous bank or its federal regulator. Even outside of electronic audit trails, local in-person bitcoin exchanges can be cracked down on with undercover agents. This may sound exaggerated, but it is plausible. A currency is the manifestation of the direct faith placed in a government (via its central bank); if it is seen that citizens are circumnavigating this, it can be in a government’s best interests to close the loophole.

- Banning the import of blockchain-related technology hardware, such as ASICs, to hinder the growth of the network.

- Banning large Virtual Private Server (VPS) providers from allowing blockchain technology to run in their datacenters.

- Continually enforcing that all taxes be paid in fiat, and then expanding that so that all heavily-regulated industries (such as healthcare) must transact solely in fiat.

- Increasing the sophistication of tax investigations into people who appear to have more money than they claim. If somebody is reporting minimum income on their tax return but living a jet-set lifestyle, they could be flagged to prove their source of funding.

- Restricting money tied up in the highly-regulated, quadrillion-dollar derivatives market from entering into the cryptocurrency space.

Will Derivatives Be the Bargaining Chip?

The last point of the previous section is particularly pertinent, regarding how the huge derivatives market interacts with the cryptoeconomy. A large argument for hyperbitcoinization is that Wall Street hasn’t entered the crypto space yet. It is cognitive dissonance to think that Wall Street will enter the market en masse while also thinking that regulation cannot prevent cryptocurrencies’ expansion. How could all of that regulated money supposedly move into the cryptoeconomy in the first place? To show the size of the stakes at play here, the visualization below shows the comparative size of the global derivatives market relative to the popular assets that we use to store money.

The retort from cryptoenthusiasts when I present this argument is, “Yes, but that’s just one country. Regulation would require the coordination of all the governments in the world, because if one allows it, all of the money will go there and that economy will flourish.” While it is true that the SEC cannot regulate the entire world, they can regulate a significant portion of the world’s liquidity. Cryptocurrencies’ values are directly related to the amount of liquidity that they have, and the SEC, the regulator of the world’s largest economy, has the power to turn the screws on this.

The next response I get is usually, “Why has this not happened yet?” The reason for that is twofold.

- Regulatory bodies responsible for trillions of dollars of wealth tend to move slowly and cautiously. They must consult with a range of stakeholders, both up and down their chains.

- Cryptocurrencies have not been a big enough target until recently. The risk of this ratchets up as prices climb; the higher the price, the sooner that regulation will occur.

When cryptoenthusiasts talk about regulators, they commonly have the idea that regulatory bodies only exist to make the barriers to entry high in order to keep banks rich. While there are certainly flaws to many regulatory agencies’ policies, they exist for good reasons and stamp out problems, some that are particularly rife in the cryptocurrency world: market manipulations and scams.

Market Manipulations and Scams Diminish the Credibility of Cryptocurrencies

Some of the schemes that exist for bad actors to both trade and solicit investments into cryptocurrencies are at best unethical and at worst outright illegal. The most blatant are summarized below.

Pump and Dumps

Due to low liquidity, lack of regulation, and the highly speculative nature of cryptocurrency markets, “pump and dumps” are a common occurrence. For as little as $50,000, a market manipulator can make the price of a chosen cryptocurrency more than double in value. The manipulator simply has to acquire a given coin over time, then when he’s ready to pump, he sells his coin at an inflated price while simultaneously buying from himself at the increased price. The market notices the price starting to increase and a snowball effect occurs. The initial pumper then sits back as the price continues to rise before dumping all of their coins at the height of the speculative period.

The fact that there are even organized groups that openly celebrate and coordinate these actions demonstrates the “Wild West” mentality of the crypto market.

Frontrunning

Hedge funds and other large investment entities in the cryptospace are given access to presales of ICOs, commonly at a 25% discount. They then sell their coins as soon as they can and quickly make a 25% return on their money. The reason for the presales is so that the company performing the ICO can have money to spend on marketing. There is a certain irony in the anti-establishment crowd getting so easily taken advantage of by, well, the establishment.

Technological Naivety Is Being Exploited

It is immediately obvious to most people that raising hundreds of millions of dollars from simply writing a whitepaper and not actually developing a prototype from it has a certain disconnect. However, in some quarters, that appears to be the mantra to how the ICO space works. Somebody writes down a wild idea and then they go and raise far more money than they could ever need to build it. Also, I might add, with no legal requirement that they actually build said product.

ICOs generally do not provide equity or any of the protections that come with it. The claims in ICO whitepapers can be outlandish, but are difficult to decipher for nontechnical investors (which I would argue, most are). For example, a whitepaper I recently read promised to decentralize the livestreaming of video, along similar properties to the BitTorrent format. Sounds good, right? Well it does if you’ve never attempted to download a popular torrent as soon as it’s released. If there’s heavy demand for a torrent, then it is extremely slow to download for the first few hours. In the context of livestreaming, this means that the livestream would be delayed by hours for the majority of people, hence rendering the entire concept useless.

Investment Naivety Is Being Exploited

It’s not just the specification of the technology being promised that you have to be wary of; there are also increasingly elaborate token structures that are emerging from ICOs. Decoding these terms can be a challenge, even for financial experts, let alone retail investors hoping to make a quick buck. This brings us back to the point raised by Richard Schiller that these markets are being driven purely by a narrative.

When I call a certain cryptocurrency a scam, I am often rebutted with: “If it’s a scam, then why am I making so much money from it?” This just exposes the naivety surrounding it—scams are generally guaranteed to be profitable for a minority; that’s what encourages more money to flow in. Whistles were being blown about Bernie Madoff’s ponzi scheme for nearly a decade before it finally collapsed.

Further fuel is added to the fire by manipulative investment marketing techniques. Experienced investors are aware of their emotional biases and work to keep them out of their trading decisions as much as possible. However, most novice investors don’t have the level of meta awareness required to avoid falling for fear-of-missing-out (“FOMO”) marketing and other psychological tricks. Are Paris Hilton and Floyd Mayweather Jr. the second reincarnations of Geraldine Weiss and Warren Buffet, or just transient ICO hype-machines? The targeting of celebrity marketing appears to be aimed at the young, get-rich-quick crowd: a group of investors that largely don’t even have a 401k, let alone a mortgage.

Historical Parallels

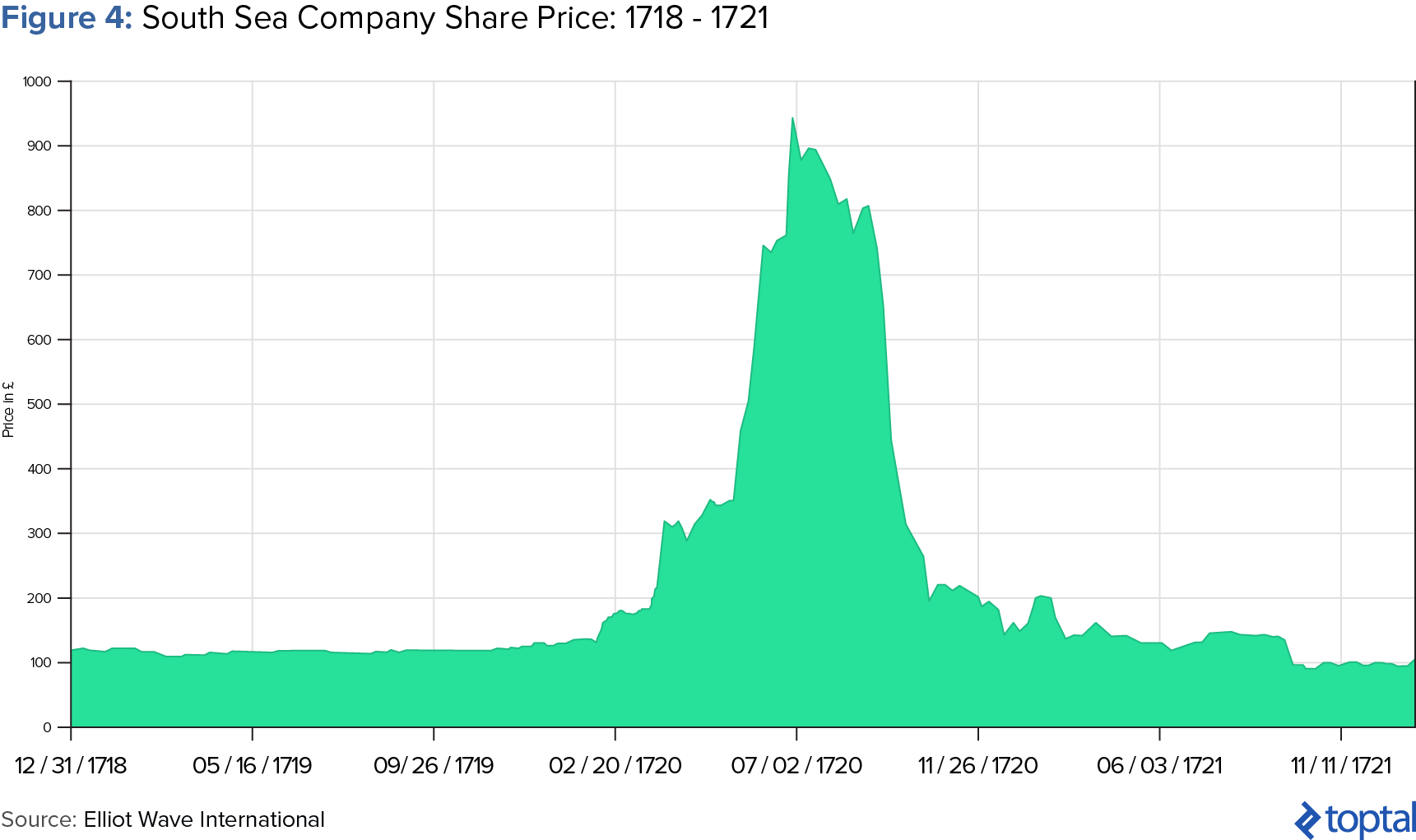

Coindesk notes that parallels to the current ICO craze have existed for centuries, going all the way back to the South Sea Bubble of the 1700s and beyond. The South Sea Company was formed after a war for Spain’s lands erupted in 1701 and the resultant debris of war debt and broken trade routes. Thus, the South Sea Company was created by royal British charter and given a monopoly over trade in the New World. The marketing for its fundraising was ambitious, and even “commoners” were, for the first time, allowed to invest in the company. The company at one point was one of the highest valued businesses of all time:

Marketers for the South Sea Company then realized that they could just apply the same techniques to raise money for their own companies. These companies that soon formed were known as “bubble companies.” Their initial intentions were innocent enough, with ideas such as “insurance, but in the New World;” however, as hype grew around these new companies and everyone was making money, the claims of the companies grew more and more outlandish, with one even promising to make “a wheel for perpetual motion.” Of course, this was unsustainable and eventually led to the Great Depression of the 1700s. The exponential rise and fall of the South Sea Company share price encapsulates how starkly this unraveled.

Similar paradigms exist in other bubbles, new and old, such as the Scottish colony in Panama in the 17th century and the Dotcom Bubble of the 21st century. There is a common theme in the marketing of bubbles, which has been satirized in the cryptocommunity as “Buttcoin.” The idea comes from marketing an existing concept, but with it:

- Marketed in a “new world”

- Offered over the internet

- Decentralized on a blockchain

The ideas start out genuine and viable, such as the aforementioned insurance example, but quickly spiral out of control until you are left with an amateur transcript for a science fiction novel.

Blockchain Technology Is Still Immature

To quote Vlad Zamfir, a lead researcher at the Ethereum Foundation:

Ethereum isn't safe or scalable. It is immature experimental tech. Don't rely on it for mission critical apps unless absolutely necessary!

— Vlad Zamfir (@VladZamfir) March 4, 2017

The base technology of cryptocurrencies just isn’t yet ready for so much money to be thrown at it. Don’t get me wrong, I’ve been programming for over a decade, have a B.Sc. in computer science, and believe that the technology has serious potential, but I don’t think that is driving prices to such outlandish levels. Blockchains are not secure, nor are they scalable, but these are problems that we hope to solve going forward. In June of 2017, Vlad went on to say on Bitcoin Uncensored, a popular Bitcoin podcast:

I feel like I haven’t done enough to tell people that this is an immature technology and that I have concerns due to the fact that commercial interest and adoption has far outpaced the tech research and development. I have a lot of concerns that the cart is leading the horse on this one.

Security Ramifications Are Misunderstood

When Andreas Antonoupolus was asked about the need for regulation to protect Bitcoin consumers, he replied:

Bitcoin is consumer protection because user control is consumer protection. Regulators are just helping banks avoid competition

I’ve already addressed the second statement, but the first deserves closer inspection. “User control is consumer protection.” In the crypto world, users are in full control and are solely responsible for their money. This means that they alone must secure it and have no recourse if it is lost or stolen. How to reliably store your cryptocurrencies is a relatively complex topic, especially for those that aren’t technologically savvy. Each has a myriad of ramifications, and no method is 100% secure or convenient.

Further, does the average person understand 2FA/3FA, multisigs, timelocks, password managers, and more? Aside from that, do you think people actually analyze the smart contracts that they pay money into for ICOs to make sure they’re secure? Hundreds of millions of dollars worth of Ethereum has already been stolen due to flaws in smart contracts alone, alongside billions of dollars of Bitcoin. Cryptocurrencies give responsibility of the security of money to the people least qualified to secure it. This, like blockchains, doesn’t scale well, as we’ve repeatedly seen over the years.

How Can We Solve These Issues?

I am not claiming that all of the above issues are unsolvable and that the future of cryptocurrency is bleak, but rather that the case for cryptocurrencies isn’t being reasonably portrayed and hyperbitcoinizatoin is far from guaranteed. However, there are some steps that could be taken to further legitimize the movement.

Less Polarization, More Discussions

We need an attitude change on both sides of the cryptoeconomic debate; the best arguments occur when people are conciliatory towards reaching a common ground. Let’s aim for reasoned debates/discussions and get rid of the polarization crypto seems to have of “us against the world.” I’m currently creating a debate platform that crowdsources funds to pay experts to debate one another in a public format. Experts get compensated for their time and the public gets fair and balanced discussions.

Self Regulation

I think that regulation is coming very soon and that it will have a massive impact on the market. The shock can be softened by being proactive and setting up best practices that the majority of the community agrees on so that regulators can be engaged on the front foot.

Some examples of points that the community could discuss and attempt to reach consensus on include:

- ICO token structure

- Ethical ICO marketing practices

- Legally enforceable promises for ICOs

- Basic rights of token holders

- Best practices for blockchain security

It is time for the community to band together and say what they will and won’t accept. Right now, its fragmentation is being exploited upon, and with some organization, this can be curtailed. Efforts such as those of the Bitcoin Foundation, Interledger, and Coin Center are giving a great start to establishing fair and balanced regulatory standards for the cryptocommunity.

Less Talk, More Development

Cryptoenthusiasts should spend less time evangelizing and more time getting all of the technological and economic kinks worked out. The ethos of “move fast and break things,” which was popularized by the web application development community, does not transfer well to the cryptocurrency world where billions of dollars are on the line. There are already enough users, so now let’s work out the issues of scalability, fees, and speed. Let’s build prototypes and then raise reasonable amounts of money, rather than raise hundreds of millions based off a piece of paper and no working product. Most importantly of all, let’s shun companies that take the get-rich-quick, ICO route.

Awareness and Education

The cryptocommunity should learn about the marketing and propaganda techniques that are convincing them to buy into cryptocurrencies in the first place. Most of these techniques are no longer effective if you’re aware of them and recognize them in the wild. An elaboration of these techniques would require another entire article. Cryptocurrency speakers should educate people on what cryptocurrencies fundamentally are while presenting a fair case, including all of the risks involved, instead of being timeshare salesmen.

We Need Long-termist Pragmatism, Not Short-termist Opportunism

The case for cryptocurrency isn’t so clear-cut for either side; however, I think that it’s safe to say that we are currently in a speculative bubble rather than a solid emerging market. At present, the case for cryptocurrencies is largely exaggerated and exploited upon by their supporters. Investors should be weary. That said, the technology of the blockchain revolution does have fantastic potential and shouldn’t be completely ignored. If the market can successfully navigate regulatory waters and weed out the scamsters, it has a very good chance of succeeding, but if not, it is doomed.

Understanding the basics

What is Bitcoin and cryptocurrency?

Cryptocurrencies (Bitcoin being the largest) are decentralized technologies that let users make secure payments and store money without the need to use their name or go through a bank. They run on distributed public ledgers called blockchains, which record all transactions and holdings.

What is cryptocurrency trading?

Cryptocurrency trading is the practice of speculating on the price movements of a crypto-asset with an aim at making short-term financial profits. Traders view a cryptocurrency like any other financial asset (Equities, FX) and they buy, hold and sell holdings to capitalize upon price movements.

What is distributed ledger technology?

Distributed ledgers record and verify transactions or contracts in a decentralized electronic form across different locations and people, negating the need for a central authority to maintain the provenance of the network. Information on the ledger is stored using cryptography, providing security and anonymity.

What is an economic bubble?

Bubbles are market phenomena characterized by significant increases in asset prices to levels vastly above the fundamental value of that asset. They are often hard to detect while they are occurring because of disagreements over the true value of the asset.

Jonathan Sterling

Dubai, United Arab Emirates

Member since May 2, 2017

About the author

Jon is a software engineer that has built out a number of Fintech solutions relating to cryptocurrency and market-making for trading.

Expertise

PREVIOUSLY AT