What Is a Financial Model?

In this tutorial, we will show you how to structure and build a financial model. An accurate, in-depth and well thought out financial model will provide you with the tools with which to project and forecast the future performance of your business.

In this tutorial, we will show you how to structure and build a financial model. An accurate, in-depth and well thought out financial model will provide you with the tools with which to project and forecast the future performance of your business.

Toptal Research

In-depth analysis and industry-leading thought leadership from a panel of Toptal researchers and subject matter experts.

Expertise

What Is Financial Modeling?

A financial model is a mathematical representation of how a company works. It is used to forecast the business’ financial performance, provide direction, and give context to uncertainty, and creating one of these models is financial modeling. Imagine the model as a machine: We insert fuel in the form of assumptions, such as salaries and customer acquisition costs, which produces the output regarding projections of the company’s performance (e.g., future revenues and cash flows). Deciding which assumptions to use and understanding how to project accurately can be a difficult undertaking, although it’s well worth the cost, as sophisticated models end up serving as powerful decision-making and forecasting tools for management. Why else is modeling important? What are the different types of financial models, and how do we go about financial model building?

Why Is Financial Modeling so Important?

The possibility of a financial model’s outputs perfectly matching reality is very low. After all, financial models are based upon a narrow set of assumptions from a range of possible inputs. With so much uncertainty, why should business owners bother themselves with building a financial model? And why do investors care so much about it?

Improved finance skills can lead to significantly increased opportunities of success and thus founders should invest in improving these skills. There are several reasons why founders should devote significant resources to building their model, which can be perceived as a manifestation of finance skills. Two of these reasons include:

-

A financial model gives direction on where the company is going. In other words, it can reveal the main business drivers and, in the case of significant deviation, provides insight on where the company should focus in order to manage or hedge risks.

-

It is a strong indication to investors that the founders know what they are doing and that they understand the business. The various assumptions and reasoning behind the financial model demonstrate whether the founders are reasonable thinkers or not, meanwhile providing a necessary tool for the company’s valuation.

For these reasons, management should not just try to find a readily available financial model template to fill out. A template can provide an idea of how a model is built and indications of missing elements, but no more than this. After all, a financial model template represents a different business with different needs and characteristics. Instead, a proper financial model should be built from scratch. Custom models show that founders understand the nuances of their business and should demonstrate sharp business acumen. Given that the financial model is the analytical tool driving many of the projections and outputs in investor presentations, a well-built, sophisticated financial model increases investor confidence and the possibility of receiving funding. Thus, it can be a great investment to cooperate with a top financial modeling expert that can help you to create a robust model and help you manage and fully understand it.

Financial Modeling Basics

Prior to building your model, it is first important to select what type of model fits your needs most closely.

Main Financial Forecast Methods

There are two main methods to build a startup financial model: top down and bottom up.

Top Down

In a top-down approach, we start with the big picture and then work backwards; we define the milestones that we need to achieve in order to reach the target. For instance, if we have a mobile nutrition startup, we begin by saying that the market in 2017 is worth $27 billion and from starting at zero, by year 2, we will capture 7% of it. In this way, we just defined the revenue and then we calculated the costs associated with this target and so on.

Bottom Up

On the other hand, in a bottom-up approach, we start with basic assumptions (e.g., sales people needed and the cost thereof, attractiveness of our business, traffic) in order to build the financial model. Subsequently, we can create scenarios in order to check how the assumptions have to change (e.g., how many more salespeople we need) in order to achieve our goals.

Which Approach Should We Take?

A top-down approach, particularly in the case of a startup, can be rather opaque and based upon subjective, overly-optimistic predictions or even desires. This can put more value on a bottom-up approach towards leading to a better understanding of the model. On the other hand, the top-down approach can ignore today’s situation and provide useful inputs regarding milestones to be achieved. Thus, for financial modeling purposes, the bottom-up approach can give a more structured, realistic perspective, which can be complemented from a strategic perspective with some top-down analysis.

How to Build a Financial Model and What We Should Be Aware of

One you have decided upon the type of model to build, you should make sure that you develop an understanding of all the component parts that go into constructing a fully dynamic financial model.

A financial model has two main parts; the assumptions (input) and the three financial statements (output), namely income statement, balance sheet, and cash flow statement. Based on the individual company’s needs, more parts can be added, such as sources and allocation of capital, valuation, and sensitivity analysis (outputs based on different scenarios). Let’s have a look at the main characteristics of each of them, along with some examples of a financial model’s components:

No. 1: Assumptions and Drivers

This should be the first tab in a spreadsheet and contain variables that will be used in the other tabs. Ideally, the rest of the tabs should have no manual input and every single number will be sourced and calculated from the assumptions tab.

The assumptions are unique to each business and include relevant topics of the business such as revenues (e.g., growth rate), costs (e.g., salaries), and capital (e.g., interest rate). The assumptions should be serious and reasonable numbers and thus should be a product of proper research (e.g., industry averages, expert opinions) but also critical thinking. For instance, a new startup has increased needs in marketing and thus should not blindly use the average spending of a few big, mature companies in the sector. In order to keep the list tidy, it would be better to have assumptions based upon the actual needs of the model and not just an infinite, difficult-to-use list. When building financial models, finding evidence, defining benchmarks, and creating ranges regarding certain assumptions is also a recommended approach in order to reach robust conclusions.

Lastly, we can add some supporting schedules, as part of the assumptions or as separate tabs. For instance, if the business has debt, there should be an amortization schedule showing the repayments, interest payments, and the progress of the loan.

No. 2: The Income Statement

The income statement shows the revenues and the costs of a company and indicates if it has profits or losses. It is divided into two parts: operating and non-operating. If for instance a software company sells a property, the revenues for the transaction are non-operating, because real estate does not constitute its core business.

An income statement is quite straightforward, so why it is so useful? Well, an investor (as well as the entrepreneur) can check the forecast growth, the margin evolution, and the costs and their relative weight to the revenues.

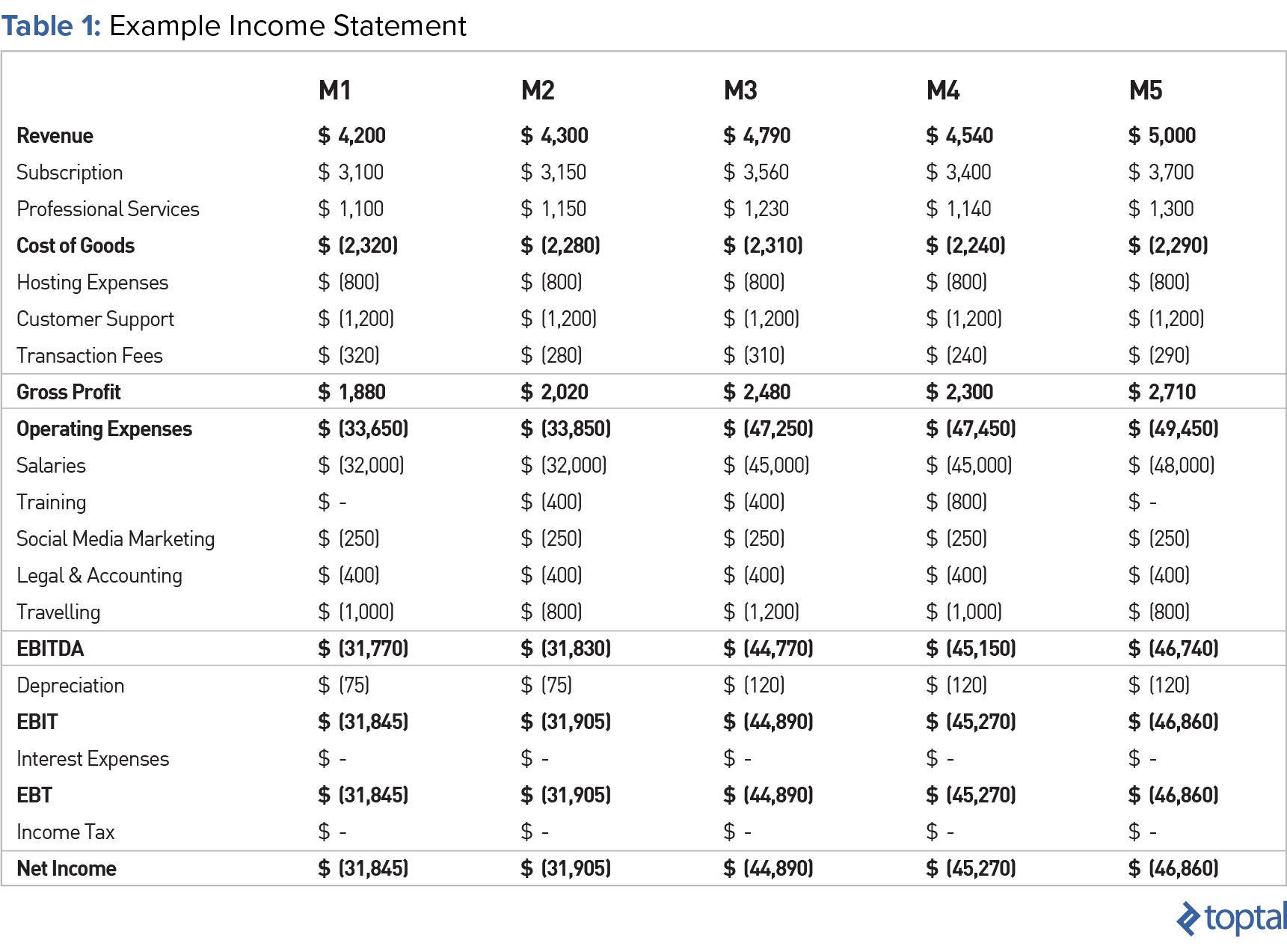

With the assumptions in place, the income statement can be completed: revenues, direct costs, gross profit, operating expenses, EBITDA, non-operating expenses, earning before tax, tax, and net income, and it is ready. Of course, depending upon the level of detail we want, we can create sub-categories relevant to our business. If for instance we have a startup with more than one revenue source, under the revenue line we can add each of them (e.g., revenue from subscription, revenue from advertisement). However, reading the numbers is one thing and interpreting them is another. One of the most used metrics, EBITDA, is a good indicator of operating capabilities, but still has its own perils. Below, there is a visual example of an income statement. It should be noted that for the first year, it is better to have a monthly breakdown:

No. 3: The Balance Sheet

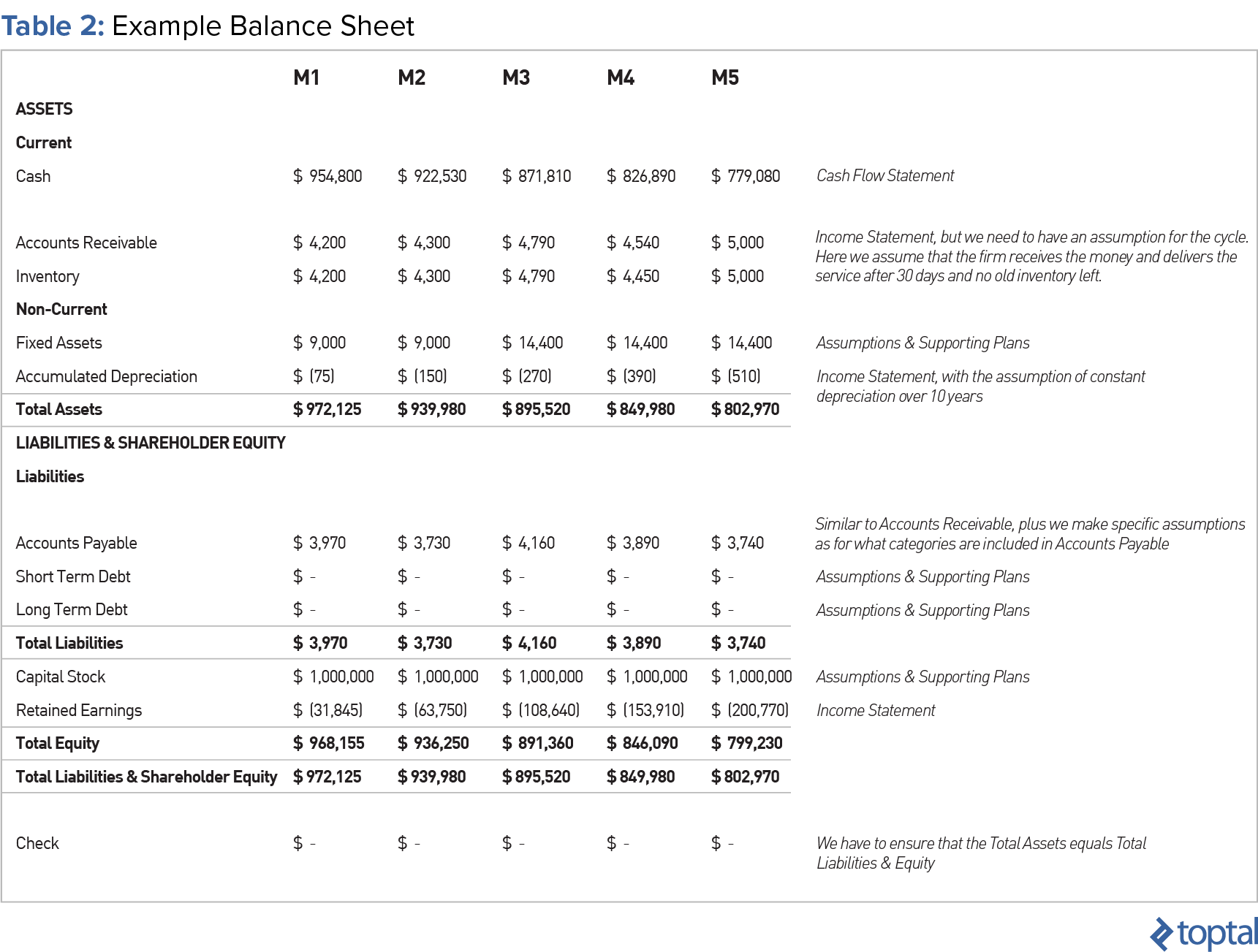

The balance sheet is a snapshot of the business’ assets, equity, and liabilities. It is an indicator of the financial health of the company, showing what it owns and owes. The major parts are the current and non-current assets, current and non-current liabilities, and equity. Balance sheets for startups are very important, because startups in their early days usually are loss-making and operate with no cash flows. So, it is crucial to track the net working capital balance, in order to plan in advance, even with the help of an expert. After building the income statement and putting the assumptions in place, we can easily translate them to the balance sheet. For instance, the sales/revenues will be reflected to the cash and accounts receivable (sales on credit) of the balance sheet, while the net income goes to the retained earnings. Below, there is an illustration of a simple balance sheet, connected to the previous income statement with supporting comments about how each entry is generated.

No. 4: The Cash Flow Statement

As the saying in finance goes: “profit is an opinion, but cash is the fact.” This phrase illustrates how significant the cash flow statement is. Moreover, investors want to see what a startup does with its money, but also that it can pay what it owes, invest, and grow. Thus, one of their favourite metrics is the free cash flows that equate to Net Income + Amortization/Depreciation - Changes in Working Capital - Capital Expenditures and shows that a firm can pay for its own operations.

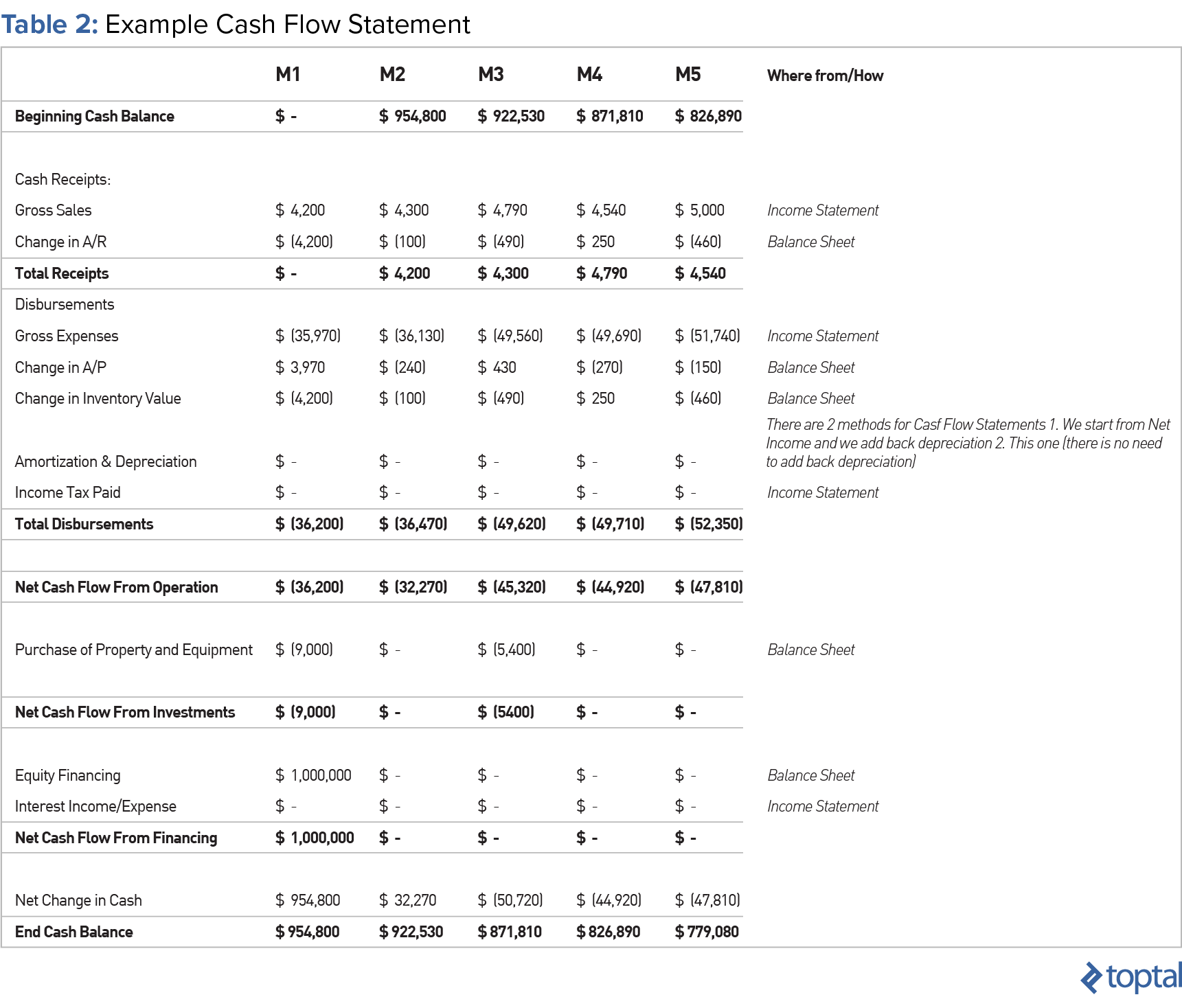

Having completed the income statement and the balance sheet, it is easy to build the cash flow statement. We start with the net income, then add back depreciation, adjust for changes in non-cash working capital, and then we have the cash from operations. Then, the cash used in investing is a function of capital expenditures, while the cash from financing can be found in the assumptions for raising debt and equity or in the balance sheet. Below, we can see a cash flow statement and how easy it is to build, after having built the two other statements:

No. 5: Business Valuation and Sensitivity Analysis

When all the three statements are ready, we can proceed with the discounted cash flow analysis. Here, we estimate the free cash flow, as we described before, and we bring it to today’s value by using the opportunity cost or even the required rate of return. In this way, we can get a first glimpse at the value of the company. Moreover, now we can perform sensitivity analyses by modifying assumptions and creating various operating scenarios. In this exercise, we can see how the value of the company changes in different case in order to better assess risk and plan ahead if, for example, sales decline or marketing conversion drop more than expected.

Conclusion

Financial models are tools used to inform decision-making and arrive at projections. Financial models come into play at many stages in a company’s lifecycle, such as when the company seeks to raise capital, make acquisitions, budget, or simply understand how changes to any of the business’ drivers will impact overall performance. Given the importance of models at these critical junctions, it is essential that an experienced professional who can accurately capture the specifics of your business is behind the financial model.