Chapter 11 Bankruptcy: What Is It and What Happens Next?

Bankruptcy is a high-stakes game for creditors and debtors. Understanding the process steps of a Chapter 11 reorganization is critical for related parties looking to protect their interests.

Bankruptcy is a high-stakes game for creditors and debtors. Understanding the process steps of a Chapter 11 reorganization is critical for related parties looking to protect their interests.

Jeff is a graduate of Harvard Business School and Harvard Law School with experience in multiple industries.

Expertise

PREVIOUSLY AT

Understanding bankruptcy becomes especially crucial during economically difficult times. Directors and officers of distressed companies may be hesitant to consider bankruptcy because of its negative connotations: damage to reputation, credit, and self-image. Therefore, they may be overly optimistic when communicating with suppliers, customers, lenders, and employees and avoid mentioning bankruptcy. However, dwindling liquidity, near-term maturities, and potential covenant breaches may mean a reorganization bankruptcy (Chapter 11) is far preferable to an even worse fate: liquidation in Chapter 7.

A Chapter 11 reorganization provides many benefits for troubled companies, including much-needed relief from unsustainable debt levels, the ability to unravel burdensome contracts, and breathing room to develop a plan. Once a debtor and its creditors reach agreement on a plan to reorganize, the business receives a fresh start with a new balance sheet that is aligned with current operational realities.

Understanding the hidden agendas and shifting motivations of both debtors and creditors is essential if you ever experience bankruptcy in the future, whether you are a part of the management team leading a distressed company, a vendor with unpaid invoices due from a company entering bankruptcy, or an investor seeking an opportunistic bargain.

What Is Chapter 11 Bankruptcy?

Chapter 11 bankruptcy’s definition is quite specific. In bankruptcy, there are two groups to consider: the debtor and its creditors. A company that files for bankruptcy is referred to as a “debtor,” and any entity—or person—who has claims against that debtor is referred to as a “creditor.” For companies with multiple subsidiaries, each legal entity must file a separate bankruptcy petition, thereby creating a group of debtors with bankruptcy cases that are typically jointly administered by a Bankruptcy Court. However, each debtor’s group of creditors is treated separately.

A debtor begins a bankruptcy case by filing a bankruptcy petition with a Bankruptcy Court, which is a specialized federal court that handles a large volume of both consumer and business bankruptcies each year. After following the formal procedures in its bylaws (e.g., board resolution or shareholder vote) to take this extraordinary step, a company can enter bankruptcy by filling out a short form and paying a relatively small fee. Insolvency, meaning total liabilities being greater than total assets (or generally not paying debts as they come due), is not required.

The petition date is important. Chapter 11 bankruptcy proceedings focus on prepetition creditors, meaning holders of debts, claims, and other liabilities arising before the date of the bankruptcy petition. With rare exceptions, debtors are prohibited from paying any prepetition creditors outside of the bankruptcy process. On the other hand, postpetition creditors receive special protections to encourage customers and suppliers to continue doing business with a debtor during bankruptcy.

Goals of Reorganization

In the US, debtors are treated more favorably than in countries with laws that prioritize liquidation over reorganization. Inherent in the structure of the Bankruptcy Code is the idea that reorganization is more advantageous than liquidation because it preserves businesses that create jobs, provide valuable goods and services, pay taxes, and benefit communities. By reorganizing under Chapter 11, debtors are given a second chance while creditors receive higher recoveries than in liquidation.

The overarching goals of a Chapter 11 reorganization are to:

- Provide a fresh start for debtors and discharge debtors from prepetition debts

- Give a fair and equitable distribution to all creditors

- Enable breathing room to create a plan of reorganization

- Consolidate all disputes involving the debtor into one forum

- Empower debtors to unravel uneconomic business arrangements

- Give creditors greater recoveries than they would have received in liquidation

Protecting the Debtor’s Estate

On the petition date, all of the assets of the debtor become part of that debtor’s estate. Possession is irrelevant and assets may be anywhere, including in the possession of creditors. The Bankruptcy Code contains multiple provisions to preserve value for the debtor’s estate.

Petition Timeline

As its name suggests, an automatic stay arises automatically on the petition date. The automatic stay protects a debtor from collection efforts by creditors in the postpetition period. It is one of the primary reasons why debtors file for bankruptcy. To avoid a free-for-all among creditors, prevent favoritism, and allow a fair resolution of disputes, the automatic stay forbids a debtor from paying any creditors for prepetition claims, debts, or liabilities. In many cases, such prepetition liabilities will not be paid until the debtor emerges from bankruptcy.

Willful violation of the automatic stay is treated very seriously by Bankruptcy Courts. Willful does not refer to whether the creditor knew that its action violated the automatic stay; rather, willful means that the creditor knowingly took the action, meaning that the action itself was not accidental. In particular, creditors should be careful not to implement setoffs—offsetting debts due from a customer with amounts (e.g., refunds) due to that customer—to avoid inadvertently violating the automatic stay. In general, it is better to ask permission from the Bankruptcy Court than to seek forgiveness later.

Under certain circumstances, a creditor can formally request that the Bankruptcy Court “lift” the automatic stay with respect to specific assets so that the creditor can take action. For example, the Bankruptcy Code allows the automatic stay to be lifted if the specific assets, such as unused equipment or surplus land, are not necessary to the debtor’s reorganization.

Another way that the Bankruptcy Code protects the debtor’s estate is through voidable preferences. While the automatic stay provides postpetition protection of the assets in the debtor’s estate, voidable preferences target prepetition transfers. A Bankruptcy Court may void a prepetition transfer of property to a creditor on account of an antecedent debt made while the debtor was insolvent that enables the creditor to receive more than it would in the bankruptcy case. There is a rebuttable presumption of insolvency during 90 days prior to the petition date (one year for insiders). Therefore, all transactions occurring within the 90 days prior to the petition date are typically scrutinized to ensure that certain creditors did not receive favorable or preferential treatment to the detriment of all other creditors.

The debtor must initiate preference litigation and bears the burden of proof for showing the prepetition transfer to the creditor meets the definition of a voidable preference. Then, the creditor bears the burden of proving elements of its defenses, if any. Key defenses include: contemporaneous exchange, new value exception, and ordinary course of business. In general, creditors should consult a qualified bankruptcy attorney when facing preference litigation.

The Reorganization Process

Throughout a Chapter 11 reorganization, a debtor continues to operate in the ordinary course of business. Any activities outside of the ordinary course of business, such as selling the entire company or raising postpetition financing, require Bankruptcy Court approval.

The debtor uses its breathing room as a time for turning around its operations, restructuring its balance sheet, and attempting a return to solvency. During the bankruptcy process, the debtor receives an exclusive period for proposing a plan of reorganization to its creditors, and the creditors then receive an opportunity to vote on the debtor’s plan. If the creditors vote to accept the plan, then the plan is presented to the Bankruptcy Court for confirmation. Plan confirmation allows the Bankruptcy Court to verify that the plan satisfies the requirements of the Bankruptcy Code and other applicable laws. While the Bankruptcy Court does not propose the plan or dictate its contents, the Bankruptcy Court can deny confirmation even if creditors vote overwhelmingly to approve the plan. If the creditors vote to reject the plan or the Bankruptcy Court denies confirmation, the debtor must begin again.

While the Bankruptcy Code allows the Bankruptcy Court to extend a debtor’s exclusive period for proposing a plan and soliciting votes, the 2005 amendments to the Bankruptcy Code created a maximum period of 18 months (20 months including soliciting votes). Once a debtor loses its exclusive period for proposing a plan and soliciting votes, then any creditor may propose a plan, which may lead to multiple plans being solicited for votes. Since multiple plans typically create confusion and prolong the bankruptcy process, there is a strong incentive for a debtor and its creditors to strike a deal before the debtor loses exclusivity.

Reorganization Steps

While there is a wide variety of motions, objections, notices, applications, affidavits, orders, and other filings in a bankruptcy case, the broad outline of how Chapter 11 transforms a distressed company into a reorganized company is as follows:

- Retaining attorneys and advisors for the debtor

- Finalizing board resolution or shareholder vote to declare bankruptcy

- Filing the bankruptcy petition by the debtor

- Opening of the bankruptcy case by the Bankruptcy Court

- Filing of first-day motions by the debtor and holding a first-day hearing before the Bankruptcy Court

- Appointment of the Official Committee of Unsecured Creditors by the US Trustee

- Retaining attorneys and advisors for the Official Committee of Unsecured Creditors

- Assuming or rejecting executory contracts and unexpired leases by the debtor

- Submitting proofs of claim by creditors prior to the claims bar date

- Filing the disclosure statement

- Filing the plan of reorganization

- Voting on the plan of reorganization by creditors

a) Votes are tabulated in classes.

b) Creditors receiving full recoveries are deemed to accept while creditors receiving no recoveries are deemed to reject.

c) To pass, the plan needs 2/3 in amount and 1/2 in number of a class.

d) Voting is repeated until an agreement is reached.

- Confirmation of the plan of reorganization by the Bankruptcy Court

- Exiting from Chapter 11 by the business as a reorganized company

- Filing voidable preference claims by the debtor

- Resolving voidable preferences, fraudulent transfers, prepetition litigation, rejection damages, and other disputed claims

- Distributing bankruptcy estate assets to creditors according to the plan of reorganization

- Closing of the bankruptcy case by the Bankruptcy Court

Priority of Claim Correlates to Rate of Recovery

In order to pursue the goal of providing a fair and equitable distribution to creditors, the Bankruptcy Code determines a priority of payment for creditors by categorizing similarly situated creditors into classes and then prioritizing the classes. Even if a distressed company never enters bankruptcy, its creditors’ behavior outside of bankruptcy is often heavily influenced by their expectations of this priority of payment. As such, out-of-court workouts often occur in the shadow of bankruptcy.

Priority of Claims

The Bankruptcy Code provides for payment first of debtor-in-possession (DIP) loans, a special kind of postpetition financing that typically enjoys a super-priority status above other claims. Generally, the DIP loan is funded by the first lien secured lenders since they often want to maintain their position of control in the bankruptcy process, but sometimes, a new investor gets involved. On the hierarchy of debt, DIP lenders with super-priority status must be paid in full before first lien creditors receive any recoveries. Then, the prepetition secured claims are paid, then unsecured claims, and finally, equity interests. Absent consensus, creditors ranking lower in priority generally cannot be paid until those before them are paid in full. This is known as the absolute priority rule. There may be subdivisions among the various levels, such as first lien and second lien secured debt, tranches of unsecured debt, or preferred and common equity. This priority of payment is often referred to as a “waterfall,” where the distributable cash fills the highest-priority bucket first until the corresponding creditors receive 100% recoveries, then the next bucket, and so on until the distributable cash runs out.

Another important concept to understand is the fulcrum security. This is the class of claims that is most likely to be converted to equity ownership during a restructuring. When voting on a plan of reorganization, creditors receiving full recoveries are deemed to accept while creditors receiving no recoveries are deemed to reject. Therefore, the class of claims receiving partial recoveries—the fulcrum security—are often the real decision-makers regarding plan approval. Creditors holding the fulcrum security are partially in-the-money and partially out-of-the-money, so their recoveries are likely to involve equity in the reorganized company that emerges from bankruptcy. The fulcrum security may change over time, particularly in cyclical industries and businesses affected by volatile commodities.

What You Can Do If Your Customer Declares Bankruptcy

Diverse Types of Unsecured Creditors

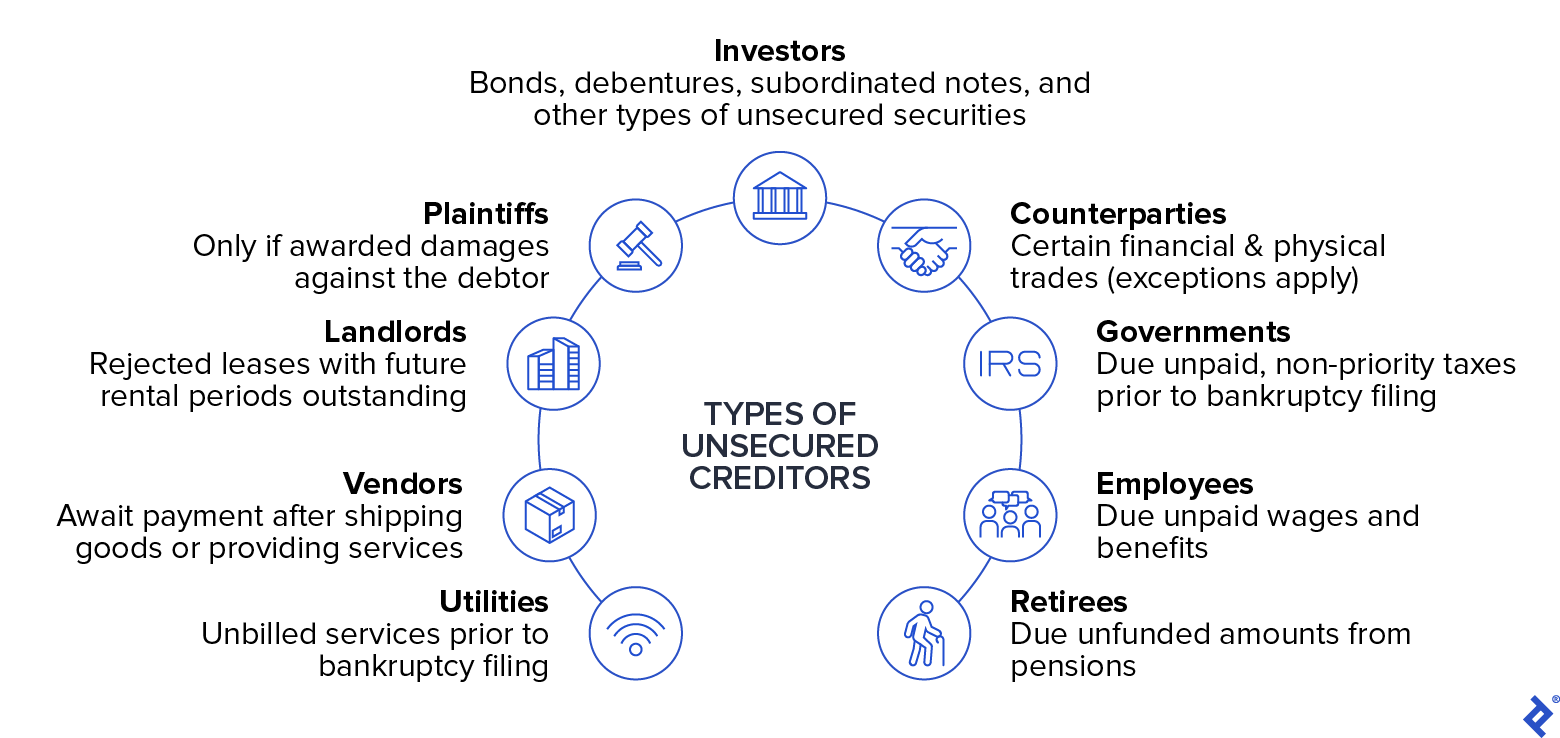

Vendors are only one type of unsecured creditor in the general unsecured class. In a large bankruptcy case, there can be thousands or tens of thousands of other unsecured creditors in the same bucket. Since, in general, all unsecured creditors must receive the same rate of recovery on their prepetition claims, it can be helpful for vendors to monitor developments affecting other unsecured creditors. For example, the trading price of an unsecured bond may indicate the recovery rate for all unsecured creditors, including vendors.

Types of Unsecured Creditors

There are many types of unsecured creditors which may include:

- Utilities that have provided unbilled, prepetition services to the debtor

- Vendors who are awaiting payment after shipping goods or providing services to the debtor in the prepetition period

- Landlords who entered into prepetition leases that have been rejected by the debtor in the postpetition period and have damages resulting from such breach

- Plaintiffs with meritorious litigation claims against the debtor

- Investors who hold bonds, debentures, subordinated notes, and other types of unsecured securities

- Counterparties with swaps, futures, or other trades with the debtor that are unsettled and in-the-money as of the petition date

- Governments due unpaid, prepetition, nonpriority taxes

- Employees who are due unpaid, prepetition wages and benefits

- Retirees due unfunded amounts from pensions

Best Practices for Vendors

Creditors must beware harassing customers for payment of prepetition amounts during the postpetition period because they can become liable for violating the automatic stay. If the creditor engages in “self-help,” there could be severe consequences, which may include penalties imposed by the Bankruptcy Court for violating the automatic stay.

If a customer goes bankrupt, suppliers can consider monetizing their bankruptcy claims by selling them to a claims trader. While this will only ensure a partial recovery, it will allow suppliers to gain faster access to cash and avoid the time and expense of participating in the bankruptcy process.

Other best practices for vendors if their customer enters bankruptcy include:

- Verifying your contact information is correct on the debtor’s notice list

- Reading the First Day Declaration for relevant background about the bankruptcy case

- Monitoring public info for the bankruptcy case using PACER

- Filing a proof of claim before the claims bar date

- Reviewing the accuracy of the debtor’s schedules for your reported claim

Lastly and most importantly, vendors should review the debtor’s disclosure statement, which is meant to provide adequate information for all creditors to evaluate the treatment of their claims, understand the company’s situation prepetition and postpetition, and make an informed decision regarding how to vote on the plan of reorganization proposed by the debtor.

It is important to seek advice from qualified bankruptcy professionals when customers enter bankruptcy. Turnaround professionals can help you understand your position and the situation at large to help you best navigate the bankruptcy process, such as:

- Gathering evidence to defend against potential voidable preference litigation for payments from insolvent customers within 90 days of the petition date

- Assessing reclamation claims for certain goods sold on credit to customers within 20 days of the petition date

- Seeking approval of setoff of mutual debts and claims

- Advocating for critical vendor status

- Selling your claim to a claims trader

- Evaluating the treatment of your claim

- Deciding how to vote on a plan of reorganization

Jump Ahead in Line: Critical Vendor Status

A company often has certain suppliers who are essential to its operations. In the months leading up to a bankruptcy filing, a troubled company’s vendors may become aware of the company’s distress as traditional payment patterns change. Suspicious suppliers may begin restricting the supplies and services until the company makes catch-up payments. In dire circumstances, key suppliers will even cut off the company completely, exacerbating its distress. In such circumstances, the company may try switching to other vendors who are willing to allow more favorable payment terms. Sometimes, however, there is no substitute. In bankruptcy, an essential supplier with no substitute is known as a critical vendor.

A critical vendor has strong leverage in negotiating recovery of its prepetition claims because it can simply refuse to provide additional supplies and services that the company desperately needs to continue operating. However, there is a high burden of proof: The debtor must have an essential need for the vendor and there cannot be any acceptable substitute suppliers.

Seeking critical vendor status can be highly beneficial for an unsecured creditor because the Bankruptcy Court can approve payment of its prepetition claims outside of a plan of reorganization. Rather than wait for a partial recovery at the end of the bankruptcy case, a critical vendor can receive full recovery at the beginning of the case for its unpaid, prepetition invoices. Without Bankruptcy Court approval, the automatic stay would forbid the debtor from paying its critical vendors.

Official Committee of Unsecured Creditors

Vendors should also evaluate whether it is beneficial for them to serve on an Official Committee of Unsecured Creditors (UCC). The UCC, which is often called the “watchdog” of the bankruptcy process, can play an integral part in shaping the course of a particular case. The UCC represents a wide variety of unsecured creditors and is a key driving force in determining the direction and success of a debtor’s bankruptcy case. The US Trustee appoints a diverse mix of volunteers from among the debtor’s top 20 largest creditors to serve on the UCC.

The debtor pays for lawyers and advisors to advise the UCC. While individual unsecured creditors have rights to be heard in the Bankruptcy Court, they must pay for their own attorneys. The Bankruptcy Code authorizes the creation of a UCC to acknowledge that it would be unwieldy and costly for hundreds or thousands of unsecured creditors to file separate objections to the debtor’s motions, appear before the Bankruptcy Court during hearings, and negotiate a plan of reorganization.

Instead, on behalf of all unsecured creditors, the UCC negotiates with the debtor and its secured lenders to create a plan of reorganization to exit Chapter 11. Although the UCC may recommend that unsecured creditors vote to approve or reject the debtor’s proposed plan, each unsecured creditor makes its own independent decision about voting.

Advantages & Disadvantages of Voluntary UCC Service for Vendors

| Advantages | Disadvantages |

| Expressing opinions collectively is better than individually | Making a significant time commitment |

| Influencing decisions by the debtor and Bankruptcy Court | Acting as a fiduciary to the unsecured creditors as a whole |

| Having costs reimbursed by the debtor | Maintaining confidentiality of information |

| Accessing confidential information and staying abreast of case developments | Becoming restricted from claims trading |

| Networking with other creditors involved in the same industry | Being distracted from day-to-day operations |

| Potentially strengthening the relationship with the debtor after reorganization | Potentially harming the relationship with the debtor after reorganization |

Distressed M&A: Buying a Company Out of Bankruptcy

Bankruptcy often presents an opportunity for qualified bidders with access to cash to purchase quality assets at a bargain price. Before considering a distressed purchase, a savvy investor must diagnose whether the distress was primarily caused by the industry, company, or management. Best to understand the root problems before evaluating potential turnaround solutions. If a potential buyer believes the debtor’s troubled operations can be saved, then it is important to acknowledge the amount of time, liquidity, and risk involved in the turnaround effort. A cheap price may not be a bargain but rather may reflect the risk of “catching a falling knife.”

Selling some or all of a debtor’s assets may be an attractive alternative to emerging as a standalone company pursuant to a plan of reorganization, especially if the debtor and its creditors are deadlocked or the company is not viable enough to remain independent. Section 363 is the part of the Bankruptcy Code that provides a way for a debtor to sell some or all of the assets of its business. As per the Bankruptcy Code, only the debtor can propose a so-called “363 sale.” In a 363 sale, assets are generally sold free and clear of all liabilities, claims, and debts, and there are usually cash-only bids. All sales are final, with limited representations, warranties, and escrows. There are no refunds. The goal of a 363 sale is to obtain the highest and best offer for the assets being sold so that the creditors can receive fair and equitable recoveries.

Ultimately, distressed M&A is a complex topic that is worth exploring in greater detail in a future article.

Collaborative Process Drives Value

By working together, parties can enhance overall value in a reorganization so that the debtor gets a fresh start and creditors receive greater recoveries than in liquidation. Bankruptcy is supposed to be a collaborative process that is designed to build consensus. However, it can be challenging to rebuild trust and credibility in order to agree upon an exit strategy. Amid uncertainty and volatility, fatigued parties who view bankruptcy as a zero-sum game can frustrate the process and destroy value for everyone.

Restructuring experts provide clarity during times of disruption. By understanding the bankruptcy process from multiple perspectives, restructuring experts help navigate multi-party negotiations to reach a successful outcome. Restructuring experts serve as a reliable bridge between financial, legal, and operational issues to improve inefficiencies, strengthen financial reporting, fortify internal controls, address liquidity hurdles, and provide guidance throughout the turnaround process. Experiences from prior cases enable restructuring experts to anticipate issues, predict outcomes, and avoid common pitfalls. By developing creative strategies and resolving disputes, restructuring experts enhance value for both debtors and creditors.

Understanding the basics

Can a company survive Chapter 11?

Chapter 11 reorganization is not necessarily terminal for a business. It can provide relief from unsustainable debt levels, the ability to unravel burdensome contracts, and breathing room to develop a plan. Once a debtor and its creditors reach agreement, the business starts fresh with a new balance sheet.

Jeff Anapolsky

Houston, TX, United States

Member since December 11, 2017

About the author

Jeff is a graduate of Harvard Business School and Harvard Law School with experience in multiple industries.

Expertise

PREVIOUSLY AT