Forensic Accounting: Due Diligence’s Secret Weapon

More than just a way to investigate financial crimes, forensic accounting is the most in-depth form of due diligence and compliance. But smaller firms often overlook its value. Here’s why that’s risky.

Ryan Zanoni

Refining Your Middle-market Merger Strategy: From Acquisition to Integration

The M&A failure rate runs as high as 90%, and middle-market companies tend to fare worse than larger ones due to more limited resources. Here’s how to ensure that your next acquisition succeeds.

Michael J. McDonald

Distressed M&A: Assessing Opportunities for Bargain Purchases

Bankruptcy often presents an opportunity to purchase quality distressed assets at bargain prices. However, it also brings major challenges in terms of assessing the value of businesses with difficult realities, dwindling liquidity, limited resources, and uncertain prospects.

Jeff Anapolsky

Quality of Earnings: A Key Pillar of Financial Due Diligence

Financial due diligence is the process of making sure the price of an asset is in line with its operating performance “under the hood.” Assessing the quality of earnings is one of its key tests: How sustainable is the business’ reported financial performance?

Saveen Kumar

Healing Broken Supply Chains: Manufacturing Outside China

Given the outbreak of COVID-19 and its disruptive impact on supply chains, many are looking to diversify their manufacturing locations. We provide an analysis of the pros and cons, current state, and outlook for major markets outside of China.

Martin Schwarzburg

Seller’s Market: Financial Due Diligence Questions to Ask

How can you easily assess whether your business is ready for sale? Key questions need to be answered to make the sales process as smooth as possible. A checklist can help managers prepare.

Saveen Kumar

M&A Negotiation Tactics and Strategies: Tips From a Pro

Mergers and acquisitions are headline-grabbing events that are often the pinnacle of a CEO’s career. But they also often fail to generate value, as numerous studies over the years have shown.

With over 15 years of experience doing M&A deals, Toptal Finance Expert Javier Enrile shows that the main reason for disappointing results is simple: Most people think M&A is merely an exercise of agreeing on a price for the deal. What they fail to understand is that there is a science to doing M&A that often makes the difference between a deal being successful or not.

In this article, Enrile runs through three key tactics for ensuring your company can get the most value out of an M&A transaction.

Javier Enrile

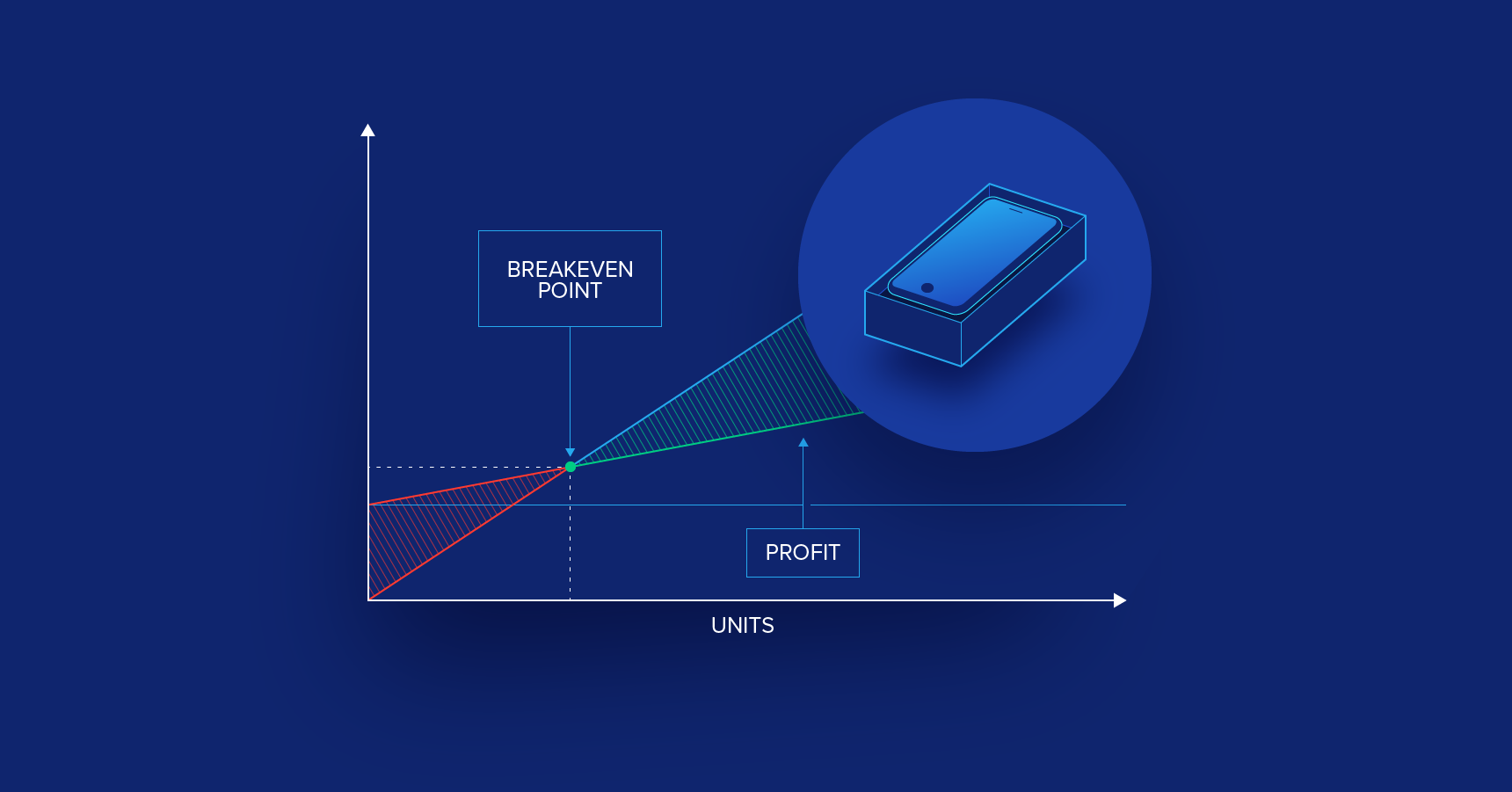

Don’t Scale an Unprofitable Business: Why Unit Economics (Still) Matter

With venture funding having grown more than 120% in the US in the last five years, startup founders and investors alike have grown increasingly comfortable with low margin business models. But the successes of the Amazons and Facebooks of this world often mask failure in a slew of other sectors, where the “build it and they will come” model doesn’t always work.

In this article, Toptal Finance Expert Toby Clarence-Smith brings attention back to the importance of studying a business’ long-term sustainability prospects, with a particular focus on unit economics, one of the building blocks of profitability and breakeven analysis for startups.

Toby Clarence-Smith

Selling a Business for Maximum Value in a Challenging M&A Market

With $936 billion of uninvested private equity capital inching down market, why do 46% to 80% of lower middle market sell-side transactions fail to close? The usual answer is that companies are not ready for buyers’ examination and owners can be overly optimistic or even greedy.

Business owners can do much more to put themselves in the driver’s seat. Success boils down to the following: (1) take the time and do the work to prepare for an exit transaction and (2) apply “intelligent greed” to close your best deal.

William B. Doyle, Jr.

World-class articles, delivered weekly.

Toptal Finance Experts

- Blockchain Consultants

- Business Management Consultants

- Business Plan Consultants

- Business Process Optimization Consultants

- Certified Public Accountants (CPA)

- Economic Development Consultants

- Equity Research Analysts

- Excel Experts

- Financial Benchmarking Consultants

- Financial Forecasting Experts

- Financial Modeling Consultants

- Financial Writers

- Fintech Consultants

- FP&A Consultants

- Fractional CFOs

- Fundraising Consultants

- FX Consultants

- Growth Strategy Consultants

- Integrated Business Planning Consultants

- Interim CFOs

- Investment Managers

- Investment Thesis Consultants

- Investor Relations Consultants

- M&A Consultants

- Market Sizing Experts

- Pitch Deck Consultants

- Private Equity Consultants

- Procurement Consultants

- Profitability Analysis Experts

- Real Estate Experts

- Restructuring Consultants

- Risk Management Consultants

- Small Business Consultants

- Supply Chain Management Consultants

- Valuation Specialists

- Venture Capital Consultants

- Virtual CFOs

- Xero Experts

- View More Freelance Finance Experts

Join the Toptal® community.