Selling a Business for Maximum Value in a Challenging M&A Market

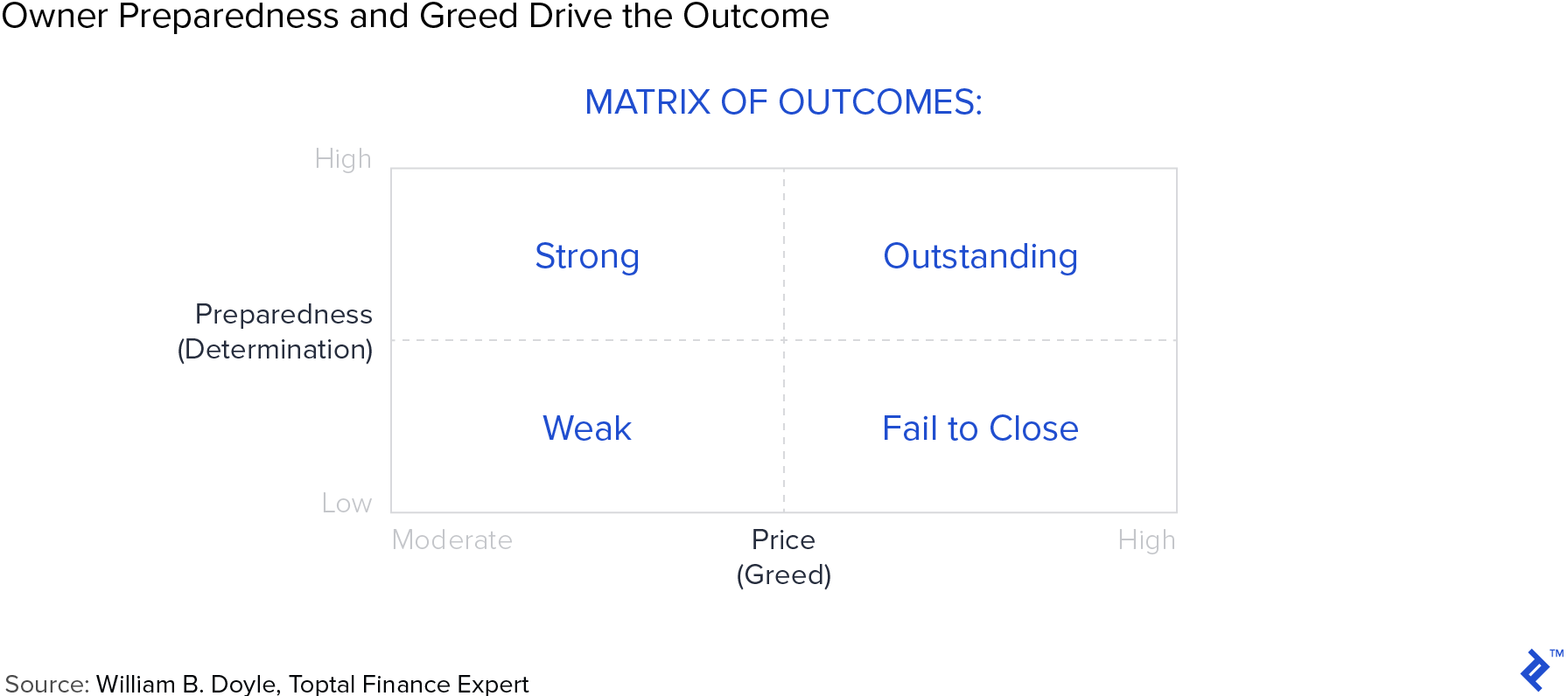

With $936 billion of uninvested private equity capital inching down market, why do 46% to 80% of lower middle market sell-side transactions fail to close? The usual answer is that companies are not ready for buyers’ examination and owners can be overly optimistic or even greedy.

Business owners can do much more to put themselves in the driver’s seat. Success boils down to the following: (1) take the time and do the work to prepare for an exit transaction and (2) apply “intelligent greed” to close your best deal.

With $936 billion of uninvested private equity capital inching down market, why do 46% to 80% of lower middle market sell-side transactions fail to close? The usual answer is that companies are not ready for buyers’ examination and owners can be overly optimistic or even greedy.

Business owners can do much more to put themselves in the driver’s seat. Success boils down to the following: (1) take the time and do the work to prepare for an exit transaction and (2) apply “intelligent greed” to close your best deal.

Bill is an expert at scaling growth businesses and turning around struggling companies. He has completed $1.3B of financing transactions.

Expertise

PREVIOUSLY AT

Executive Summary

Master the Owner's Conflicts, Goals, and Expectations

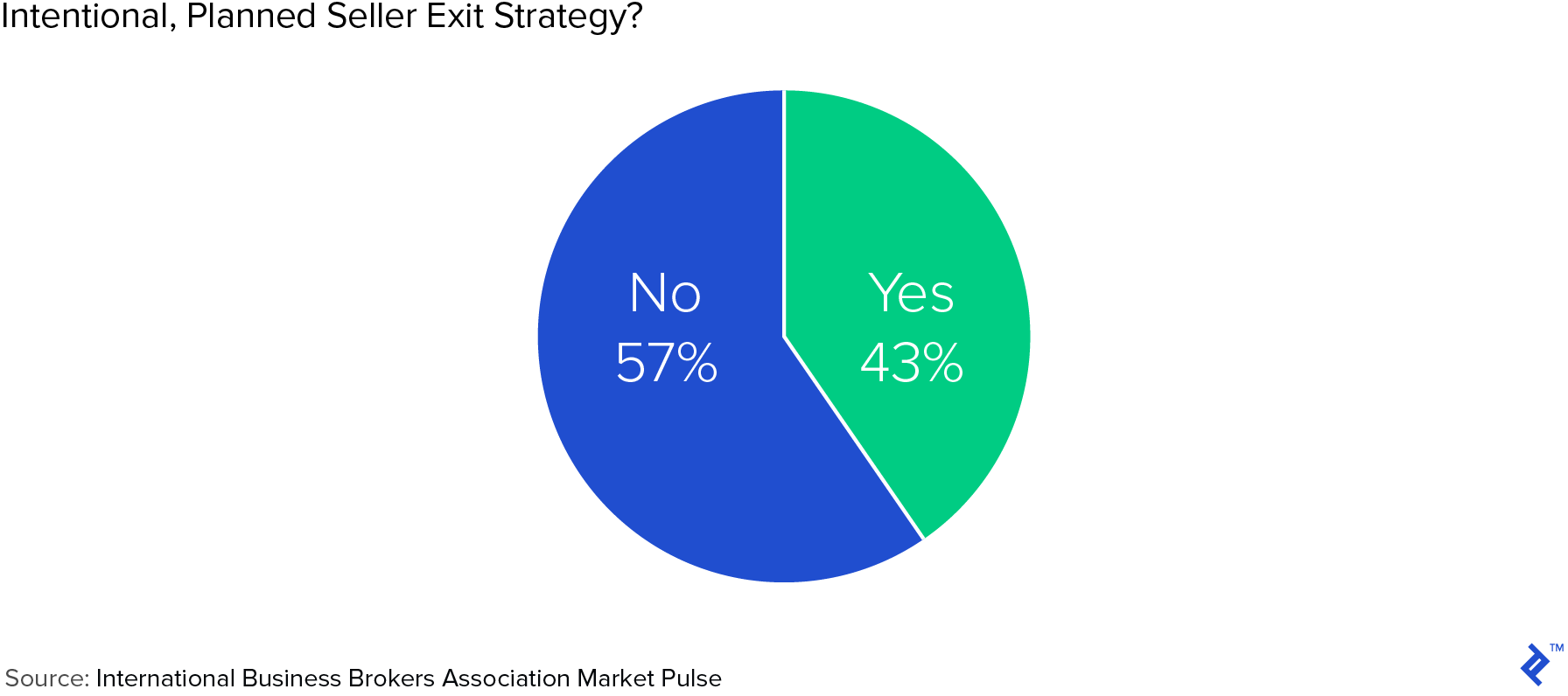

- According to a survey conducted by the International Business Brokers Association, fewer than half of sellers of companies up to $50 million follow a planned sale procedure.

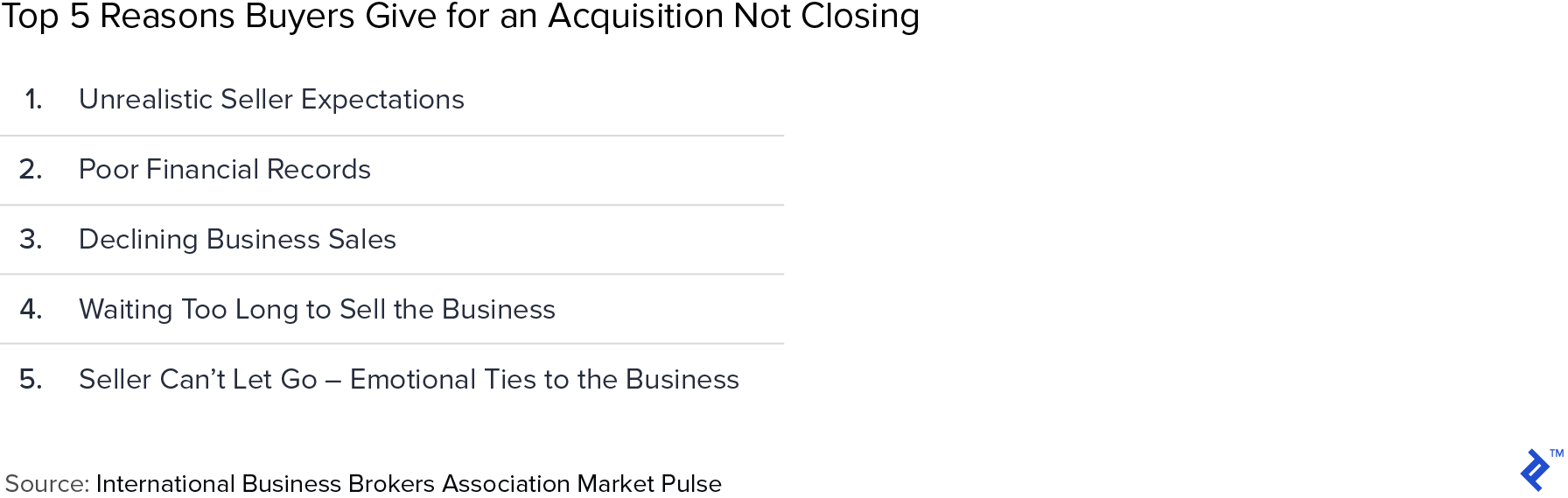

- Of the top five reasons buyers give for not closing, at least four are almost completely under the seller's control: unrealistic seller expectations, poor financial records, declining business sales, waiting too long to sell, and/or the seller can't let go (emotional ties to the business).

- Those owners who close deals manage to overcome these doubts. Don't waffle—decide. Commit early to a process and make it work.

Boost Company Performance

- Analyze the business. A set of core profit-focused analyses can surface ideas such as culling product lines or extending them, re-negotiating problem contracts, targeting higher value customers, and a range of other options to boost profits.

- Quick fixes. Selective price increases (particularly in areas that are well below market or haven't been adjusted for a significant period of time) are an oft-overlooked, quick, and powerful path to improving revenues and profitability. Most other quick fixes tend to be expense-oriented, such as sub-leasing unused real estate and plugging other profit leaks.

- Bigger, longer-term fixes. These may take a year or more to produce earnings, but they can yield big benefits.

- Growth plan. You have an opportunity to lay out the post-investment value of your company to the most skeptical buyer's acquisition committee members by backing up your projections and assumptions with customer acquisition data, trends, market information, and other defensible support.

Make Your Financials a Sound Foundation for a Transaction

- Get an outsider's diagnosis. Have an outside consultant conduct an early review of your financial statements, controls, and projections as if the consultant represents a prospective buyer. Some red flags for potential buyers include overdue accounts receivable and slow turning inventory, shifts in accounting classifications and changes in outside accountants, and weak basic controls.

- Get ready for prime time. Prepare your financials on a GAAP basis and anticipate extensive due diligence review. You can present your business in a way the buyer/investors can evaluate with confidence in your data.

Know What Your Company Is Worth and Consider All Potential Buyers

- Calculate your company's value. You (or a financial consultant) can value your company using the core three valuation methodologies: stock market, discounted cash flow, and M&A analysis. These provide a common starting point for a buyer/investor's analysis, but be aware that certain valuation methodologies are more relevant for particular companies, industries, and circumstances.

- Generate a comprehensive list of potential buyers. Your company is ultimately worth what the highest-paying willing buyer will pay. First, identify as many potential buyers (including international buyers) as you can, including competitors, providers of complementary products or services, suppliers, customers, and financial buyers. Evaluate which financial buyers have an interest or experience in related businesses, particularly focusing on their portfolio companies.

Add an Expert to Your Team

- With $936 billion of uninvested private equity capital inching down market, why do 46% to 80% of lower middle market sell-side transactions fail to close? It's usually because companies are not ready for buyers' examination and owners are too optimistic.

- Consider adding an interim CFO to your team to help you prepare for a sale and set your expectations to achieve your best outcome. An interim CFO can help you boost company performance, prepare financial statements and projections, calculate the target value of your business, and identify and analyze the potential buyers that may pay top dollar for your business.

- Choose the right intermediary, considering industry knowledge, international exposure, commitment to staff your assignment with senior personnel, and the individuals on the team. Conduct research on intermediaries and network to identify 5 to 10 candidates, and then run a process to select the best agent to represent your company.

Introduction

With $936 billion of uninvested private equity capital inching down market, why do 46% to 80% of lower middle market sell-side transactions fail to close? The usual answer is that companies are not ready for buyers’ examination and owners can be overly optimistic or even too greedy.

In my 30+ years of experience serving in the roles of president, CFO, principal investor, investment banker, consultant, and operating turnaround expert, I’ve improved the operating performance of ten businesses and completed 27 M&A, investment, and financing transactions totaling $1.3 billion. Based on this experience, in this article, I describe common reasons deals fail, and I outline what an owner can do to drive a better outcome.

I make the case that business owners can do much more to put themselves in the driver’s seat. My advice on how to sell your business boils down to (1) take the time and do the work to prepare for an exit transaction and (2) apply “intelligent greed” to close your best deal. An interim CFO can help you boost company performance, prepare for the sale process, understand your valuation range, and target and analyze potential buyers you might not have considered.

Selling a Business: Master the Owner’s Conflicts and Expectations

Monetizing your life’s work is your reward for years of building it. And of course, that motivates you to pursue a sale of the business. However, the large proportion of unsuccessful deals shows that the gap between price and seller expectations is a huge problem that sellers do not anticipate. This article provides a pragmatic approach to fix the imbalance many sellers experience where their expectations far exceed what a buyer will pay.

First, you, the owner, need to overcome your natural trepidation and apply the same determination to sell the business that you applied to build it. Every owner is plagued with thoughts like these:

- “It’s time to sell, but I’m not sure I’m ready to let go.”

- “I want top dollar now, but maybe I could get higher value with a two-step transaction.”

- “There seems to be an insurmountable problem with every prospective buyer and offer.”

Those owners who close deals manage to get over those doubts. Don’t waffle–decide. Commit early to a process and make it work. This article examines the steps an owner and the company can take to improve the odds of closing the transaction, and at a higher price. An owner’s willingness from the outset of the process to take those steps both confirms the owner’s determination and increases the company’s preparedness. According to a survey of 264 business brokers in 36 states conducted by the International Business Brokers Association, fewer than half of sellers of companies up to $50 million follow a planned sale procedure:

Overlay that with the top five reasons buyers give for not closing, and consider that at least four of these are under the seller’s control.

Selling a Business: Boost Company Performance

This may seem painfully obvious. However, you’d be surprised to find that most companies do not take the time and effort to make the quick fixes, consider the bigger fixes, or build a growth plan so the buyer/investor can see the potential value of the acquisition:

What You Can Do to Boost Company Performance

Here are some actions you can take to optimize company performance:

Analyze the business. The following analyses can surface ideas such as culling product lines or extending them, re-negotiating problem contracts, targeting higher value customers, and a range of other options to boost profits:

- Profitability by product line

- Profitability by channel

- Profitability by customer

- Prospect-to-customer conversion rates

- Competitive position and trends

- Market trends

- Processing flow/bottlenecks

- Supply chain

The most revealing analyses will vary by company and industry, but these almost always identify potential profitability improvements.

Quick fixes. Selective price increases are an oft-overlooked, quick, and powerful path to improving revenues and profitability. Most other quick fixes tend to be expense-oriented, such as sub-leasing unused real estate, refinancing expensive equipment leases, and plugging other profit leaks. Consider this example: A snack food manufacturer where I served as an investor and advisor had not bid the price of its second largest component of COGS materials in several years; bidding the item to four suppliers (including the incumbent) reduced its cost by 24%, lowering COGS by 7%.

Bigger, longer-term fixes. These may take a year or more to produce earnings, but they can yield big benefits. For example, when I was helping a payment processing company suffering from production bottlenecks, we added low-cost processing equipment at pinch points, which eliminated 25% of direct labor hours in a business where direct labor constitutes 45% of total revenues. Not only did this improve profitability, it also dramatically increased scheduling flexibility and shortened lead times.

Growth plan. Any buyer or investor must make a case to its investment committee for the post-investment value of your company. You, who know the business best, have an opportunity to lay out the value in a way to appeal to the most skeptical committee members by backing up your projections and assumptions with customer acquisition data, trends, market information and other defensible support. Your audience will include operating people, marketers, accountants, and certainly some MBAs, and your roadmap for the future can make your company rise to the top of the list of opportunities they consider.

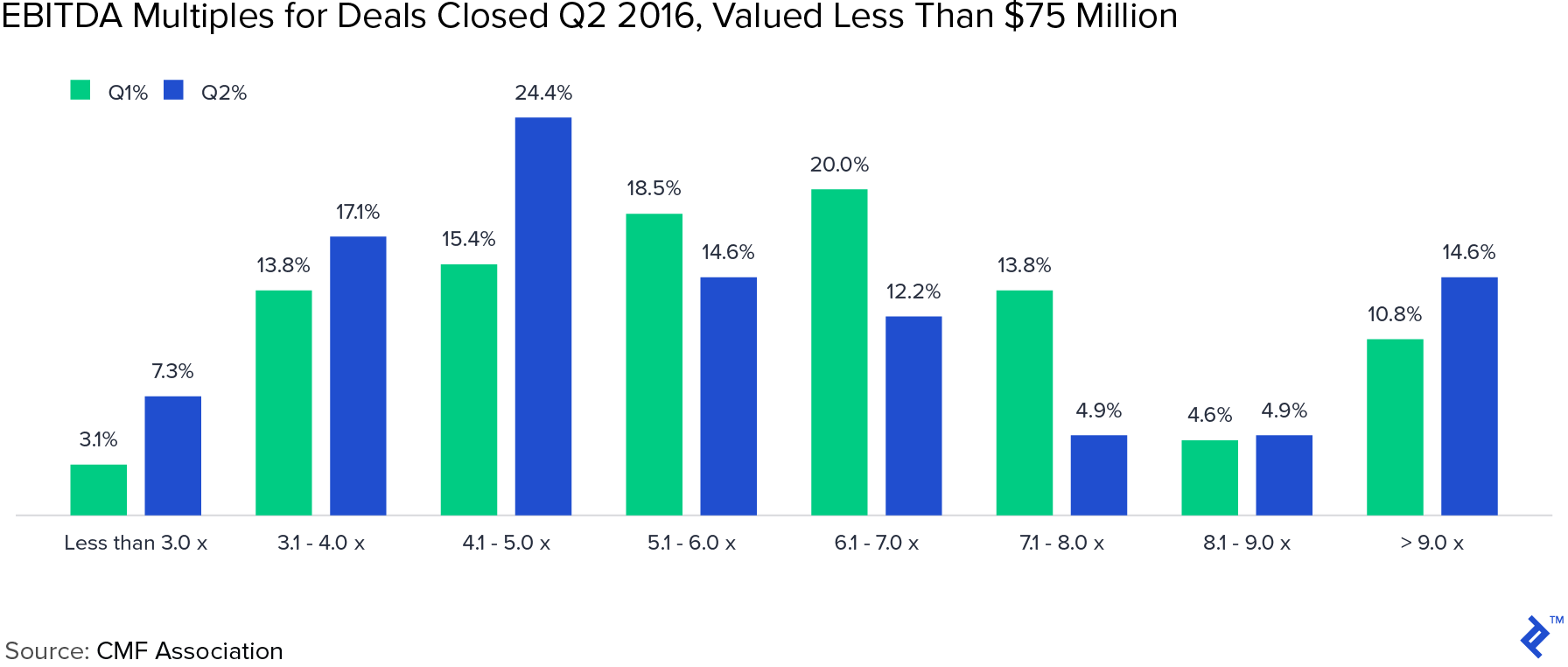

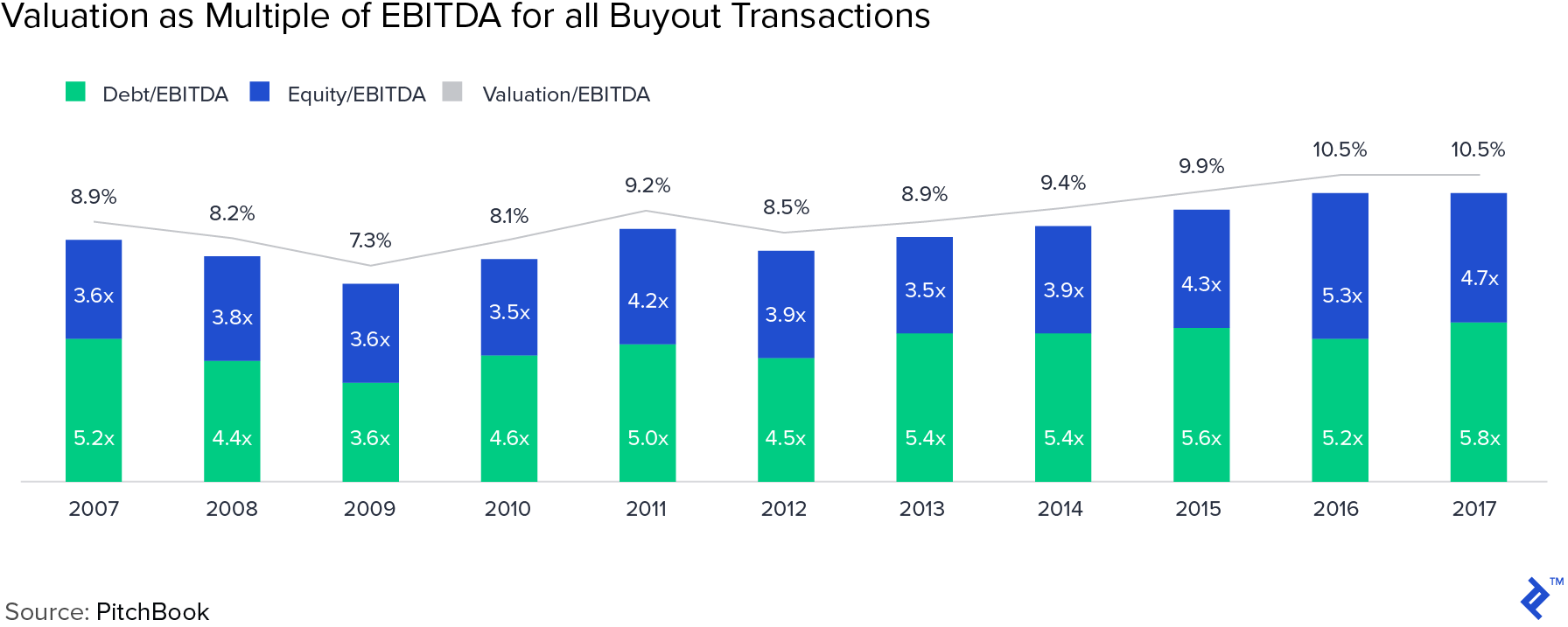

An interim CFO can help you apply these profit improvement and growth initiatives. I explain below why boosting profitability powerfully increases the value of your company. Your company value will be increased by a multiple of the improvement of your earnings. Your growth plan extends and expands these improvements. Boosting EBITDA may also increase your multiple—if a company with $2 million EBITDA is worth $10 million, that same company with $5 million EBITDA could be worth $50+ million.

The EBITDA Multiple

Every dollar you can add to profits increases the value of your company by a multiple of that dollar because buyers and their advisors value an acquisition as a multiple of its earnings. The following chart shows how most companies worth less than $75 million are valued at multiples of earnings before interest, taxes, depreciation, and amortization (EBITDA) ranging from 3.0x to 9.0x (see below). The EBITDA multiple for your company will be based on your industry, growth prospects, scale, and certain other factors. I discuss valuation calculations later in this article.

The Expanding EBITDA Multiple

Furthermore, if you can increase your earnings enough to raise the scale of your company, your earnings could be multiplied by a higher number because larger companies generally command higher earnings multiples than smaller companies (everything else equal: in the same industry and with the same growth rate, etc.). This is because (1) more capital is available for larger transactions—private equity funds, in particular, are constrained by minimum deal size limitations—because large corporations with high stock prices and excellent access to capital markets can afford larger deals and also need them to be large enough to make material contributions to the acquirers; and (2) companies with more than $3 – $5 million in EBITDA are generally operated by deeper management teams that can run the business after the owner pockets transaction proceeds and leaves. A company can increase its scale and multiple by increasing its own profitability, which this article describes, or by acquisition.

An example is an aerospace components manufacturer with lean manufacturing credentials and sole source Boeing contracts that was not able to attract private equity funding because of its small scale and lean management team. When that company entered into an acquisition agreement with a supplier of a complementary product (without lean manufacturing strengths), the combined company demonstrated $40 million in sales and a deeper management team, which attracted letters of interest from two private equity investors. I was a manager of the investment fund that acquired a controlling interest in the combined companies.

Selling a Business: Make Your Financials a Sound Foundation for a Transaction

Financial Statements and Controls

There can be an inherent disconnect between your and the buyer’s understanding of the role of financial statements. You need your financial statements to be accurate, but they may be constructed to tell you what you need to know and to avoid overpaying taxes; generally accepted accounting principles (GAAP) may not be important to you. However, it’s different for the buyer/investor. The lead executive loses his or her job if the financials turn out to be inaccurate. This happened to Hewlett Packard when it acquired Autonomy, and Caterpillar, which got bulldozed buying Siwei. The takeaway here is that financial presentation and controls are critical to buyers/investors’ comfort that your company will not damage their careers.

Get an outsider’s diagnosis. When I serve as CFO or when I’m preparing a client for sale, I conduct an early review of the client’s financial statements, controls, and projections as if I represent a prospective buyer. Here are some examples of indicators that may alarm potential buyers:

- Overdue accounts receivable and slow-turning inventory may reveal customer dissatisfaction, unforeseen shifts in demand, or less-than-diligent working capital management.

- Shifts in accounting classifications, change in outside accountants, or write-offs of inventory point to potential accounting irregularities.

- Weak basic controls such as the purchasing agent not overseeing inventory, rigor of inventory procedures, and cash management practices flag potential for fraud.

Get ready for prime time. Accordingly, prepare your financials on a GAAP basis and anticipate extensive due diligence review. You will almost certainly need your outside accountant to help prepare as well as provide support as buyers/investors pore over the financials. You can present your business in a way the buyer/investors can evaluate with confidence in your data and will not be as tempted to discount your value for downside risk.

Projections

The essence of an acquisition is: The buyer pays the seller in exchange for the future benefit to the buyer of owning the acquired business. Your projections describe those benefits, and the way you present them can provide the buyer confidence that the value will be realized. So, projections are the foundation of the proceeds you will receive as well a great opportunity for you to explain benefits (i.e., sell the deal) and boost buyer confidence (i.e., minimize risk discount).

So you need to do projections. While financial projections need to accurately portray expected future performance, they necessarily require important assumptions. They should be favorable enough to generate enthusiasm among buyers and still remain convincing. Add to that an acquirer, particularly a strategic one, probably tries to maximize quarterly earnings, which you risk diluting. That puts a cap on what the acquirer can pay (see the discussion below on analyzing and understanding your prospective buyers). It also sensitizes the buyer to risks that a post-closing earnings shortfall would reduce their per-share earnings and jeopardize the stock price of the acquirer, an acquisition Rubicon that may lead the buyer to put a risk discount on the price it will pay for your company. Accordingly, your projections should be anchored in current reality (your financial statements) and build into a believable future (your financial model).

Build your three-statement operating model. You need a financial model that describes the business, demonstrates that your accounting capabilities are sound, and allows you to present credible future value for your prospective investor. A three-statement operating model will include linked income statement, balance sheet, and statement of cash flows, “driven” by the most important business parameters you experience every day, such as prospect conversion rates, customer-by-customer sales, pricing, and headcount. Your three-statement operating model extends your three-statement historical financials to a credible projection of future business performance.

Use the model. The buyer/investor’s financial team will need to sign off on any deal. A thoughtful, workable financial model makes the acquisition process much easier for them and will give you at least a shot at setting the basis for your negotiations. An example of the impact of a financial model: As investment bankers selling a bank data processor to a large private equity investor, we were able to support profit projections by line of business and demonstrate tax advantages of a provision that allowed the buyer to benefit from asset purchase tax advantages from a stock sale transaction (in this case a 338(h)(10) tax election), which substantially boosted the value to the buyer of this acquisition by the present value of future tax savings, which were 40% of pre-tax earnings. Ultimately, a strategic buyer swooped in before the close and paid a substantial premium over the private equity firm’s price, which illustrates potential benefits of running a complete process and casting a wide net for buyers/investors. As negotiations progress, you can discuss why you make key assumptions, which can keep discussions going and educate the buyer on the value of your business.

Selling a Business: Know What Your Company Is Worth and Consider All Potential Buyers

You may find yourself negotiating with (i) a strategic buyer larger than you are who knows the market well or (ii) a professional investor who negotiates transactions with companies like yours for a living or (iii) both. And you are conducting the single most important transaction of your career. While hope is not a business valuation methodology, your advantage is that nobody cares like you do. And you can prepare.

Calculate Your Company’s Value

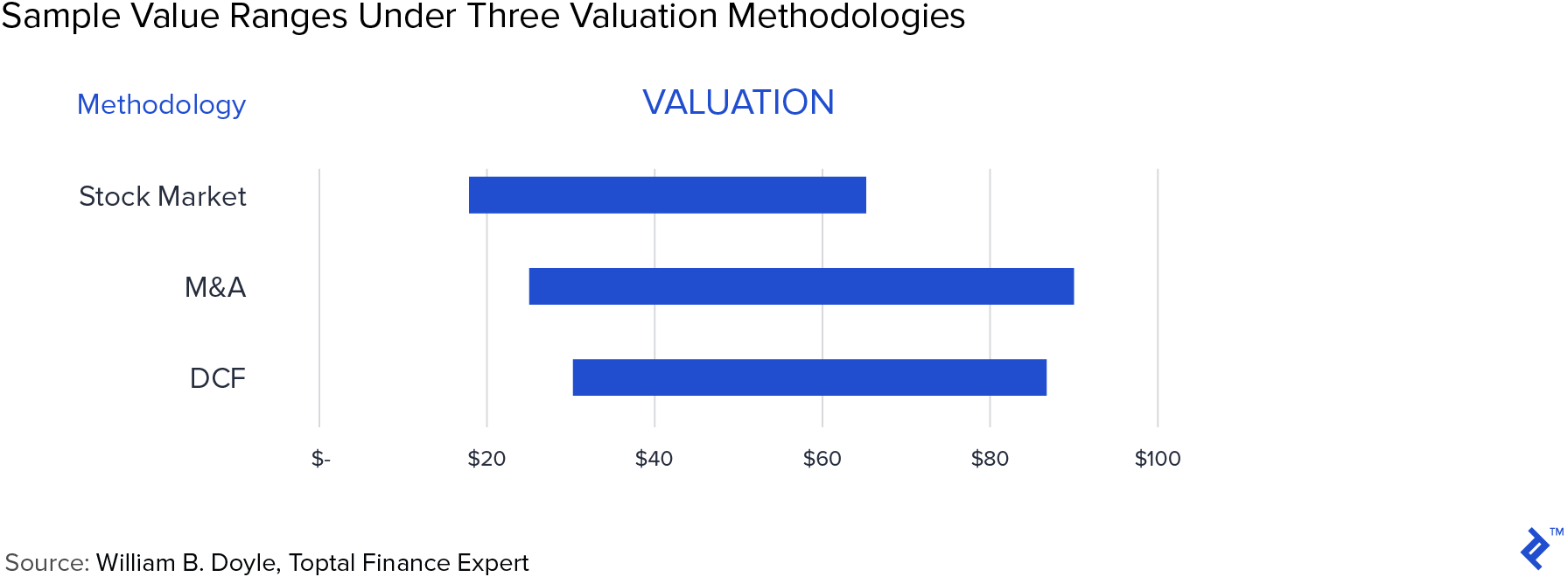

When selling a business, work with your advisor to conduct the core three business valuation analyses:

(i) Market values of comparable publicly-traded companies (stock market valuation)

This valuation methodology considers publicly traded companies in industries as similar to yours as possible and calculates the market value of those companies as a ratio of their key financial indicators—principally, revenues, earnings, and growth, historical and projected. It applies those ratios to your financial indicators and applies a private company discount to arrive at one range of value for your company.

(ii) Transaction values for comparable businesses acquired (M&A valuation)

This considers transaction valuation of companies in industries related to yours that have sold. Similar to the analysis above, it calculates the ratio of those transaction values to the companies’ key financial indicators and applies those ratios to your company’s metrics to estimate a second range of value for your company.

(iii) Discounted cash flow analysis (DCF valuation)

Based on the principle that the value of a business is the present value of its future cash flows, this method focuses on your projections and value as a stream of future earnings. It discounts them to the present at a rate that reflects your cost of capital to estimate the third value range for your business.

These standard three business valuation methodologies provide a common starting point for a buyer/investor’s analysis, and you should know how you come out. Certain business valuation methodologies are more relevant for particular companies, industries, and circumstances, but you should be familiar with each of them and understand which are more relevant, and why. To illustrate with an example, the following chart depicts the three value ranges for a sample company:

M&A is not a science. Buyers and sellers negotiate acquisitions, so a valuation analysis cannot predict a transaction price. Here, you are establishing a reasonable range for your own expectations, setting the stage for discussions, and bolstering your case for a higher value for your company.

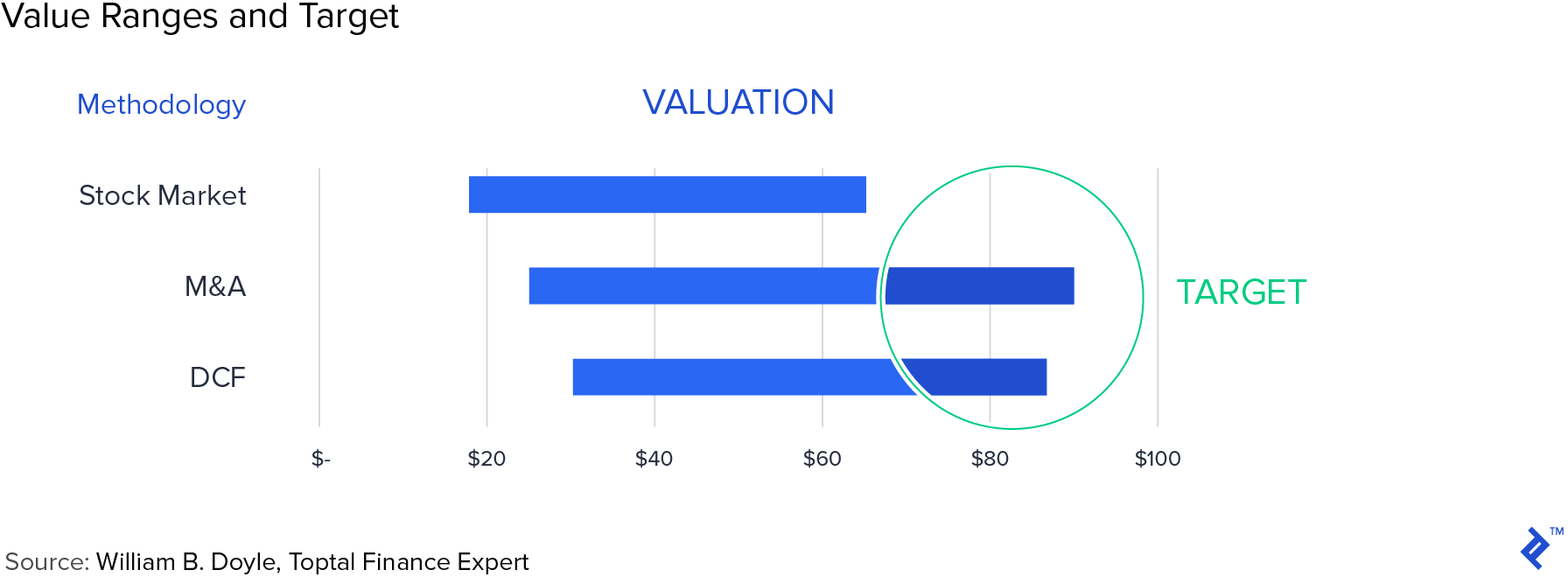

Generate a Comprehensive List of Potential Buyers

Creating a list of potential buyers is a good start, but remember that your company is really worth what the highest paying willing buyer will pay. To identify your most promising buyers and top price, you need to consider what you are worth to specific prospective buyers. The first step is to identify as many potential buyers as you can. They can include competitors and potential competitors, suppliers of complementary products or services, customers and potential customers, suppliers and potential suppliers, financial buyers such as buyout firms, and international buyers in each of these categories. In my experience, the most motivated buyers are often suppliers of complementary products or services, and potential foreign buyers are often overlooked.

So, conduct a thorough analysis of your industry, including international players. Evaluate which financial buyers have an interest or experience in related businesses, particularly focusing on their portfolio companies. Below is a sample profile of competitors of a client company whose business is tracking first responders’ readiness. The profile includes all of the domestic industry players and for each shows its presence and strength in the various lines of business (red = particularly strong/black = strong/gray = weak), any of which might represent reasons the client company could add value to the competitor if it were to purchase this company.

Sample Profile of Competitors

You will similarly profile suppliers, customers, relevant portfolio companies of target private equity investors, and international players. Consider what value you add to each potential acquirer by expanding their sales, giving them entry to your markets, allowing them to sell your products or services, transferring to them your customer contracts, and/or consolidating operations to reduce costs.

Next, consider how each potential acquirer is valued. A public company with a high stock price might boost its own earnings per share even if it pays a high price for your business. A private equity firm reaching the end of its investment window (the period they are allowed to invest) may be highly motivated to close a deal since it will lose access to its investment capital soon.

Evaluate acquirers’ appetite to spend cash or stock. This could make a substantial tax difference to you as well as importantly affect your risk from exposure to their overall business post-sale. Finally, special considerations such as declared interest in expanding into your geographic or product arena flag potentially highly motivated buyers.

By approaching the greatest number of potential buyers and understanding your value to each, you put yourself in the best position to sell your company at or above the high end of your estimated ranges of value:

You will reach this higher target valuation range by negotiating with the buyers to whom you’re worth the most because of some combination of (i) business fit, (ii) buyer stock price, and (iii) unforeseen/unforeseeable circumstances such as a financial buyer approaching the end of its contractual investment period. An example from my role as an investment banker, after meeting the corporate development group of a newly unregulated telecommunications company seeking acquisitions: Shortly afterward, selling a business in the marketing information industry, I worked with the seller to define a strategy for applying that prospective buyer’s resources to a national rollout for marketing data. The transaction price significantly exceeded other prospective buyers’ offers; conversely, the acquirer made a small (for that company), successful foray into applying its scale to selling market information.

Now that you are in a position to know your value to specific buyers and formulate intelligent greed to negotiate the best price from promising buyers, let’s discuss the sale process.

Selling a Business: Choose the Right Intermediary

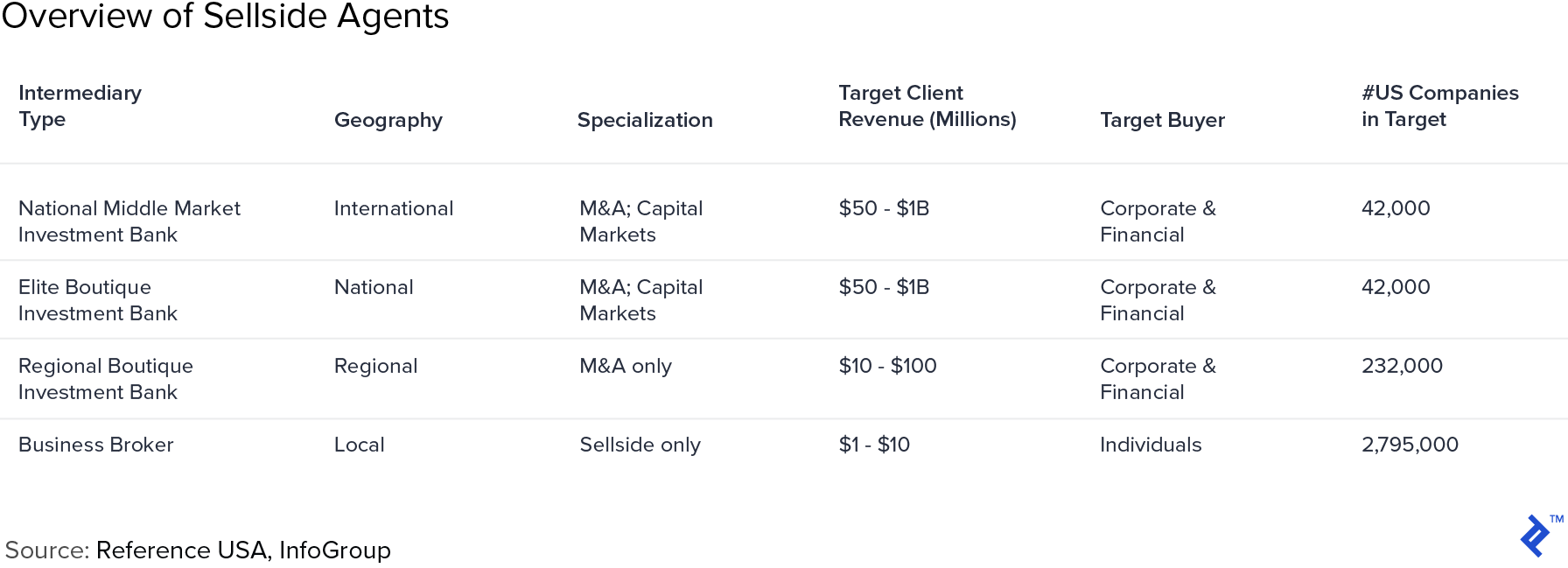

Choosing the right seller’s agent is a confusing morass:

- Business broker or investment banker?

- Industry specialist or generalist?

- Regional or national? International?

- Will I get the partner or a junior team?

- I’m too small for the top firms even to be interested.

- I’m a client once, but buyers repeat, so where does my agent’s loyalty lie?

- The firm I like best charges an enormous minimum fee!

If you think the market for your business is inefficient, the choice of a seller’s agent is worse. Perhaps the single most common seller’s mistake is not doing the legwork up front to select the best seller’s agent. The following chart shows general categories of intermediary, which broadly fit client revenue ranges:

National and specialty boutique investment banks bring particular expertise in complex or international transactions. National investment banks can access public and private capital markets to fund transactions for their clients. Of course, their fee expectations are substantial. Certain considerations such as industry-specific experience, international exposure, commitment to staff your assignment with senior personnel, and the individuals on the team vary widely. You should conduct research on intermediaries and network to identify 5 to 10 candidates and then run a process to select the best agent for your company.

Taking thoughtful control of the process makes all the difference:

- Market to the marketers. If you are taking the steps to prepare and present your business, prospective agents will see you as worth more, and as an easier client (the magic double for them!). If you can demonstrate your value to them as you would to a buyer, you can attract better agents.

- Bake them off. Invite prospective agents to present why they are the best firm for you. In the process, you will acquaint the losing participants with your business—they may hustle to bring in a buyer so they can get paid a buy-side fee!

- Oversee the process. Beware considering your selling agent to be your advisor or friend. Their value to you is to bring in prospects and assist negotiations. Your value to them is their fee. It is up to you to oversee the process without micro-managing it.

Recommended Action Steps for Selling a Business

- Start early and take charge.

- Identify and implement profit improvements.

- Diagnose and upgrade accounting controls and capabilities.

- Build your three-statement financial model.

- Construct projections based on support you can defend.

- Analyze your company’s value yourself.

- Conduct detailed industry profile (customers, competitors, complementary product/service providers, suppliers, potential entrants).

- Specify what you bring to specific buyers and refine your value to each.

- Conduct a disciplined process to select the right seller’s agent.

Conclusion

Selling your company is one of the most important events of your life, and you should approach it accordingly. The market for your business is inefficient and the range of possible outcomes is vast, so the potential value to you of doing it right is enormous. Fix both components of EXPECTATIONS » PRICE by setting realistic valuation expectations, increasing your company’s profits, identifying the most promising potential buyers/investors, and managing the entire process to maximize the price the most willing buyer will pay. In summary, combine preparedness with “intelligent greed” to achieve your best outcome, which an interim CFO on your team may help you achieve.

Further Reading on the Toptal Blog:

Understanding the basics

How do you estimate the value of a company?

Company valuation typically utilizes the core three valuation methodologies: stock market, discounted cash flow, and M&A analysis. These provide a common starting point for a buyer/investor’s analysis, but certain valuation methodologies are more relevant for particular companies, industries, and circumstances.

William B. Doyle, Jr.

Menlo Park, United States

Member since December 5, 2017

About the author

Bill is an expert at scaling growth businesses and turning around struggling companies. He has completed $1.3B of financing transactions.

Expertise

PREVIOUSLY AT