Refining Your Middle-market Merger Strategy: From Acquisition to Integration

The M&A failure rate runs as high as 90%, and middle-market companies tend to fare worse than larger ones due to more limited resources. Here’s how to ensure that your next acquisition succeeds.

The M&A failure rate runs as high as 90%, and middle-market companies tend to fare worse than larger ones due to more limited resources. Here’s how to ensure that your next acquisition succeeds.

Michael J. McDonald

Michael is an award-winning journalist who has worked at Bloomberg News and Thomson Financial. He is the Senior Writer for Toptal’s Finance Blog.

Expertise

Featured Experts

There’s no single framework to guide corporations that are pursuing merger and acquisition deals. If there were, then the failure rate for M&A probably wouldn’t be so persistently high—up to 90%.

Instead, each company must identify and understand the principles that produce successful deals and use them to fashion its own effective strategy and follow through. That approach, it turns out, is an easier proposition for larger firms. Studies show that bigger enterprises have more success with M&A, probably because they have the experience and resources to develop and implement their own playbooks.

Smaller firms are less likely to have M&A experience, so the probability is higher that their dealmaking comes up short. Acquisitions have become a more frequent focus in the lower-middle market, where enterprises with less than $100 million in annual revenue are aggressively looking to scale, particularly if they’re controlled by private equity firms. Under these circumstances, that lack of experience presents a challenge.

“In the middle market, you have to be more thoughtful, practical, and pragmatic,” says Rohit Srivastava, a founding partner at M&A and tech transformation consultancy Vertigo Advisors who joined Toptal’s network in 2021. “It’s not going to be the same scope or size as mega mergers, which have predefined integration teams. You won’t have time for 500 questions. You have to boil it down closer to 20 well-defined questions.”

Nonetheless, smaller companies can still learn from the tenets that guide enterprise-level M&A. M&A is complicated at every scale and rife with idiosyncrasies and surprises. In this article, we’ll examine the three principles that experts agree make up the foundation of every successful M&A deal: thoughtful strategy, thorough due diligence, and people-centered integration.

What Makes for a Successful M&A?

Whatever their size, companies are complex entities, reflecting their industries’ particular approaches to products, markets, technology, and customers as well as their own histories. Acquiring and integrating a company is complicated, and the process brings numerous opportunities for missteps. The challenge of every M&A is figuring out how to achieve the projected goals and benefits while avoiding errors that might undercut them.

If an acquisition doesn’t deliver the anticipated benefits, it’s considered a failure. But these expectations are often based on faulty assumptions formed in the deal’s negotiation and closing phases. These mistakes often don’t emerge until the acquirer is trying to integrate the staff, operations, or customer base that it wanted.

“M&A is the corporate equivalent of marriage,” says Anuar Heberlein, a former senior associate consultant at Bain & Co. who joined Toptal’s consulting network in 2016. “First you date, and then you decide to get married. There should be minimal surprises or misalignment if you really get to know the other company through due diligence.”

To improve an acquirer’s chances of success, experts like Heberlein and Srivastava focus on the three phases that are essential components in the process, both conceptually and practically.

M&A Strategy. This describes the reason for pursuing the deal. It could be very specific—for instance, the rationale for buying a company’s assets, like its customers or some patent it controls. Or it could be broader—why a company is looking to acquire as it expands geographically or seeks to diversify its business operations. Regardless, it’s critical to get the nuance right because this strategy drives the decision-making process. (Some buyers, such as private equity firms, may refer to the strategy as the investment thesis.)

Due Diligence. The M&A discovery process is multipronged. It shapes the assumptions that determine the potential investment return while also helping create a checklist for integration after the deal closes. At this point it’s crucial to analyze the alignment between the acquirer and the acquired business so that elements like technology, personnel, and culture can be meshed. The better the diligence, the easier the integration.

Post-merger Integration. In this final phase, known as PMI, operations or personnel are consolidated and any mistaken assumptions about revenue and growth synergies, cost savings from consolidation, and culture fit will become evident. Surprises tend to emerge at this point, and missteps and shortcuts from the pre-close process reveal themselves. A well-executed PMI mitigates the fallout from late-stage disappointments, but a poorly executed one can undermine an otherwise well-constructed deal.

Although each of these phases presents its own potential pitfalls, there are principles that can help guide you through an M&A.

Principle 1: Let Your Strategy Guide Your Process

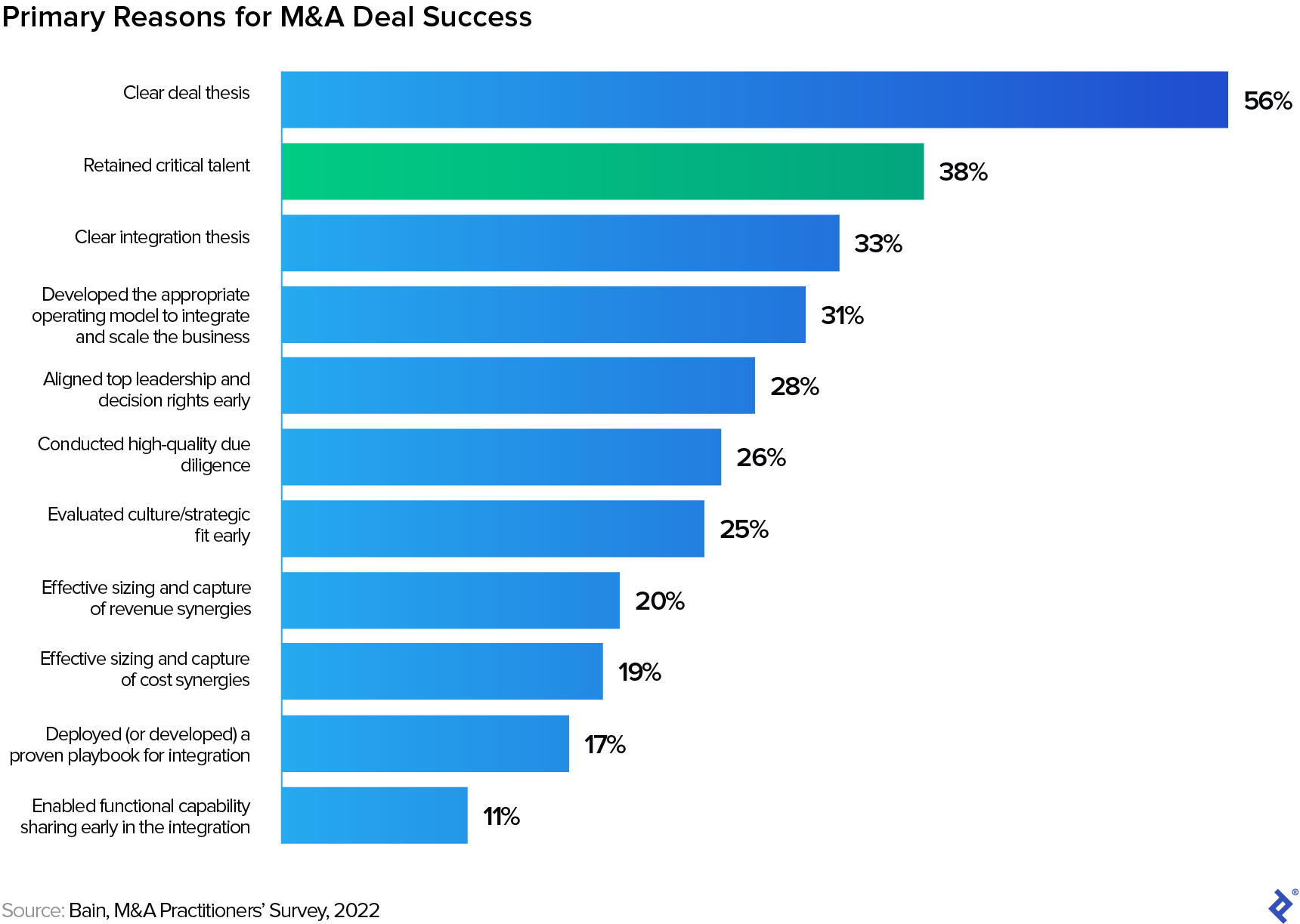

There are many motivations for deals, and the variety of M&A strategies reflects that diversity. The challenge for many companies is to understand that their strategy can express the aspirations of the acquiring company and provide a data-driven action plan that holds up under scrutiny. For instance, it’s not uncommon for a technology company to buy another business just to get its prized software developers. If the thesis is to amass talent through acquisitions, then one of the top priorities for diligence is ensuring that agreements are developed for retaining staff, with a focus on PMI.

But that’s not always what happens. “The bigger picture can often get lost as strategies are passed along from a team executing a deal to those implementing it,” says Neel Augusthy, who formerly oversaw acquisitions as a chief financial officer in Asia for Johnson & Johnson and joined Toptal’s consulting network in 2021.

Keeping the whole process in mind, the first step in developing a robust and practical strategy is to understand why a company is pursuing acquisitions. Corporate acquirers are typically grouped into one of two categories: a financial buyer that cares primarily about standalone cash-generating capability or a strategic buyer that focuses on synergies created through integration. But in reality there is significant overlap between these categories, especially as deals evolve from negotiation to implementation. The Corporate Finance Institute offers a list of common motivations for mergers:

- The deal creates value through revenue generation synergies created by the combined entity.

- The deal creates value through cost-saving synergies from reducing overlap in operations.

- The acquisition is an effort to diversify business operations by entering into new markets or offering new products or services.

- The acquisition will expand a company’s financial capacity to advance business development, or it will reduce tax liabilities by creating losses.

It’s key to identify what’s most important about the acquired company—customers, intellectual property, etc.—and let that drive the M&A process.

Of course, even a well-articulated thesis can go awry. Heberlein once worked with a payroll company that expanded globally by acquiring other payroll firms that complied with human resource regulations in their home countries, but it didn’t fully appreciate the complexity of tying together the different software solutions each of the firms used, reflecting a gap in due diligence. The cost of integration ultimately decimated the financial gains of a seemingly solid expansion strategy.

“It happens a lot, especially in the software space,” says Heberlein, who in addition to working with Toptal is founder and managing partner at the business and financial consulting firm STRATYGIKA. “You piece together a Frankenstein and the minute you change the smallest thing everything crashes.”

Even the goal of the acquisition can shift. Augusthy recalls that before he left J&J to found the consultancy VADN Group, J&J acquired a firm to gain access to its supply chain. By the time the integration was underway, the focus had changed to the product the company offered. This is fine, he says, but it’s crucial that the strategy and process, including how the target firm was valued, are updated to reflect that evolution. The measure of success or failure should reflect the reality of the deal.

Principle 2: Don’t Skimp on Due Diligence

M&A strategy is challenging from a conceptual point of view. Due diligence is equally challenging, but from a practical perspective. After a company defines its business goals, it must begin to explore factors like the technology pieces and personnel of a business it’s acquiring, which will lead into the process of building a road map in accordance with what it has discovered. That map will take the deal to the close and provide a checklist for integration.

The elements of this discovery are:

Commercial due diligence. The acquiring company analyzes how well the target fills its market niche and how that market may evolve, with an eye on how this will align with the purchaser’s plans.

Foretelling unprecedented events that impact companies is tough, but commercial due diligence can help you anticipate market shifts and other factors that affect your M&A assessment. Even if you’re buying a company for a single purpose, like its talented software engineers, it’s vital to understand how its products or services are positioned because that influences the deal valuation. Also, your reason for making the acquisition could evolve over the course of the deal, as Augusthy noted J&J’s did when it decided to focus on the product of the company it was acquiring.

Even the smartest companies can err when it comes to commercial due diligence. Both Google and Microsoft made costly mistakes buying smartphone makers in the 2000s, misjudging the influence they would have in the highly competitive market for those products.

Financial due diligence. The acquiring company probes the target’s financial information, including sales, rates of return by product, accounts receivable, and inventory.

M&A can fail when financial due diligence is sloppy. Inadequate financial due diligence was to blame when Bank of America acquired Countrywide in 2008 in the months before the housing market collapsed, sparking the global financial crisis. The banking giant’s failure to fully comprehend the extent of the losses that the mortgage originator was facing would end up costing it more than $40 billion.

Another essential feature of the financial due diligence and pre-close process is valuation of the target company. This is crucial because it helps establish the benchmarks for whether the deal is successful. “If you manage to value the company correctly, the integration part becomes easier,” says Augusthy.

If the company is overvalued, it can also affect other elements of the deal. For instance, it can inflate the retention bonuses that a buyer agrees to pay to keep key employees. Or consider what happened when America Online acquired Time Warner in an ill-fated deal in 2000. The then world’s largest internet service provider was valued at $226 billion. But only months later the dot-com bubble burst and that valuation plummeted to around $20 billion, producing disastrous losses for investors and stakeholders and undermining the merger.

Operational due diligence. The acquirer investigates the business model and operations of the targeted company to determine if it’s a good fit for the buyer.

This is where reality can undermine a great story if you don’t research adequately. For instance, Daimler-Benz AG and Chrysler Corporation planned to create a global behemoth when the two automakers combined in 1998, but then they found that their significantly different cultures could not be meshed. The way executives operated in Germany differed from how they did in Detroit, and their visions for their companies also diverged.

Much of operational due diligence is focused on aligning technologies, says David Crais, a consultant who joined Toptal’s network in 2019. It’s not uncommon, especially in the middle market, for more established firms like banks to buy startups like a fintech firm for its cutting edge product offering. What they often fail to realize is that they need to figure out how to integrate both the new tech and the people who developed and maintain it, he says. “The IT systems integration is huge,” says Crais. “But it’s both the systems and the people together.”

Family-owned firms can also present a challenge. According to Daniel Van Der Vliet, Executive Director of the Smith Family Business Initiative at Cornell SC Johnson College of Business, family businesses offer an appealing mix of stable growth, deep cash reserves, and the ability to move quickly on opportunities. But when employee loyalty revolves around a family identity, or even specific family members, transitions are trickier. “Family businesses can have a very strong culture, which is often a reflection of the family itself,” Van Der Vliet says. “If cared for properly, that can be a great asset, but it can also be a detriment if you try and tinker [with] that too much.”

In addition to traditional diligence, buyers must figure out how long to employ a founder or family member in the transition. This decision is often crucial to a successful integration but can also be where conflicts emerge as changes to the business are made, says Crais.

Failing to fully document negotiations is another common pitfall in the lower-middle market during this discovery process, according to Brandon Pearlman, a software and technology executive who joined Toptal as a consultant in 2019. Pearlman says when he sold his energy information business to a larger player in the industry, there was only high-level documentation of the planned organizational changes, without details on matters like hiring and budgeting. Those omissions later led to disagreements. “It’s too easy to forget or change your mind about important details when you make verbal agreements,” Pearlman says. “Documentation keeps everyone honest.”

Principle 3: Focus on People During Integration

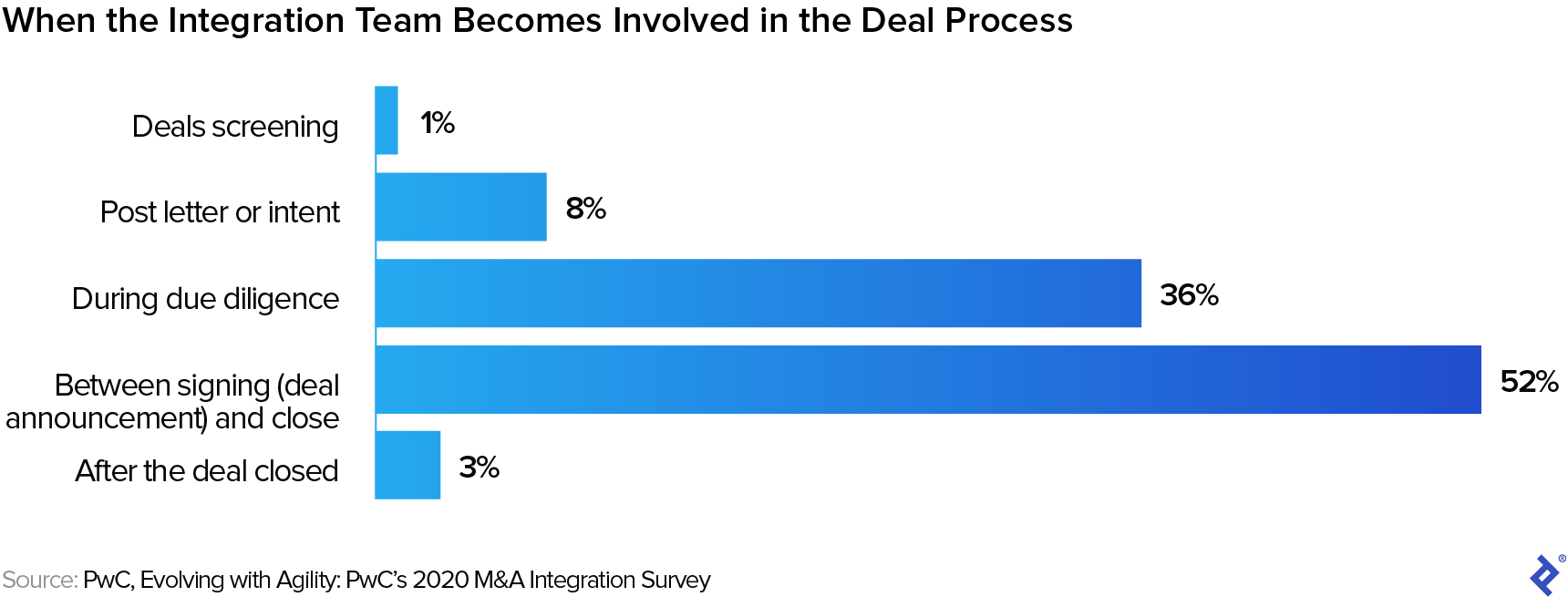

Phase one of M&A is high-level planning: establishing a strategy or investment thesis. Phase two is detailed planning led by due diligence. The final phase is execution, which is often the most challenging because it’s notorious for surprises, making it difficult to plan.

The human touch is especially important at this stage. “Post-merger integration has got to be about the human element,” says Srivastava. “The reason most deals don’t fulfill their promise is they don’t focus on the human element—what is important to people, how to manage change, and how to best incentivize people through a merger and beyond.”

Attending to employees and their concerns can help address what’s known as the culture conundrum, the fact that after deals fail many players involved often blame culture clashes. According to the consulting firm PwC, engaging and retaining talent in an acquisition is critical to capturing deal value. While retention incentives help, an overly process-oriented approach or fixation on financial goals like cost cutting can poison culture, turn off new employees, and spur departures.

Even if you’re working for the acquirer or the private equity firm backing the buyer, as an M&A consultant you also have to guide the employees of the acquired company through the integration. The integration team must understand the company’s management practices, its day-to-day working norms, and how decisions are made in order to help set new performance goals and minimize disruptions.

On one hand, you have to be the sherpa, helping a company that’s being acquired understand where it’s going, Srivastava says. On the other, you need to be able to communicate in financial terms to owners like private equity firms to get them to support steps to ensure a good integration.

Another lesson for the middle and lower-middle market is to simplify the operational integration when the acquisition is aimed at scaling and growing. Many smaller companies will often insist on retaining back-office systems that they developed, or some other aspect of their operations that’s particular to them. But they should instead focus on the reason they’ve been acquired. “Unless it’s your competitive advantage, nobody is buying you because of how well you pay invoices,” says Srivastava.

It’s Up to Leadership to Bring It Home

Success in M&A can be quantified using metrics like revenue growth, profit margins, market share, productivity, or geographic footprint. But the key to success can be elusive, even after you develop a plan built on principles. Often that’s because successful integration relies heavily upon the buyer’s leadership and communication, which can help smooth over some of the conflicts caused by cultures combining.

Mary Zellmer-Bruhn, Chair of the Work and Organizations Department at the University of Minnesota’s Carlson School of Management, says workers in the acquiring company may try to draw a distinction between themselves and their new colleagues. It’s up to leaders to encourage integration by mixing old and new employees within departments or units.

“Years ago I was working with General Mills and they had acquired Pillsbury. Ten years later General Mills [employees] still referred to them as ‘Pillsbury legacy people,’” says Zellmer-Bruhn, whose work focuses on teamwork in organizations. If integration doesn’t work, she explains, leaders should emphasize the value of these “outsider” identities, so new employees are seen as positive and intentional additions with distinct skill sets.

The narrative that leaders present to employees is critical because successful middle-market M&A almost always comes down to people merging with people, says Morné Wiggins, who joined Toptal as a consultant in 2019 and specializes in enterprise transformation. “Sometimes we get lost in the playbook thing,” he says. “But it has to be done by people.”

Understanding the basics

What is a middle-market M&A?

Middle-market mergers and acquisitions occur between midsize companies, often with revenues between $5 million and $1 billion. When successful, such transactions can help companies attain vital technology, customers, personnel, or financial resources.

Why is operational due diligence important?

Operational due diligence ensures post-merger integration success by making sure that the technology and culture of both companies are compatible.

What percentage of M&As fail?

Harvard Business Review estimates that the M&A process fails 70-90% of the time.