Consultant Toolbox: Frameworks for Solving Anything

When something is not right in a business, it can be confusing knowing where to start to fix it. Objective frameworks like issue trees, funnel analysis, and business canvases provide an organized and data-driven way of getting to the root of a problem and give cast-iron evidence toward plotting a route forward.

When something is not right in a business, it can be confusing knowing where to start to fix it. Objective frameworks like issue trees, funnel analysis, and business canvases provide an organized and data-driven way of getting to the root of a problem and give cast-iron evidence toward plotting a route forward.

When something is not right in business, the sincere urgency to try and fix it immediately can result in a haphazard approach. During an unstructured firefight, a hypothesis will be taken that a particular area is definitely not right, and the validity of it won’t be tested beyond just the depth of a hunch. Or, those tasked with fixing things will spread themselves around many areas, resulting in a dilutive, reactive effect.

Making a plan of attack for putting out a fire is neither indecisive nor an exercise in time-wasting. There’s nothing wrong with taking a step back to assess the situation. Here, I will share some methods for business problem solving - beginning with appraising problems, then onto some area-specific tests for digging deeper into the root cause.

Business problems tend to manifest in quantitative ways: e.g., sales have fallen. Yet, their symptoms may be derived from qualitative factors: e.g., culture. While I will focus more on objective reasoning, I will conclude with some thoughts on rectifying the more subjective elements that manifest in the root cause of business problems.

Isolating Problems: Issue Trees

Income Statements

The core skills a finance professional learns early in their career and leans upon throughout the rest of it is the ability to read a financial statement and translate it into “words” for the layman. The supplementary notes to the financial statements are meant to provide such illumination but can oftentimes obfuscate root causes or just further frustrate with jargon.

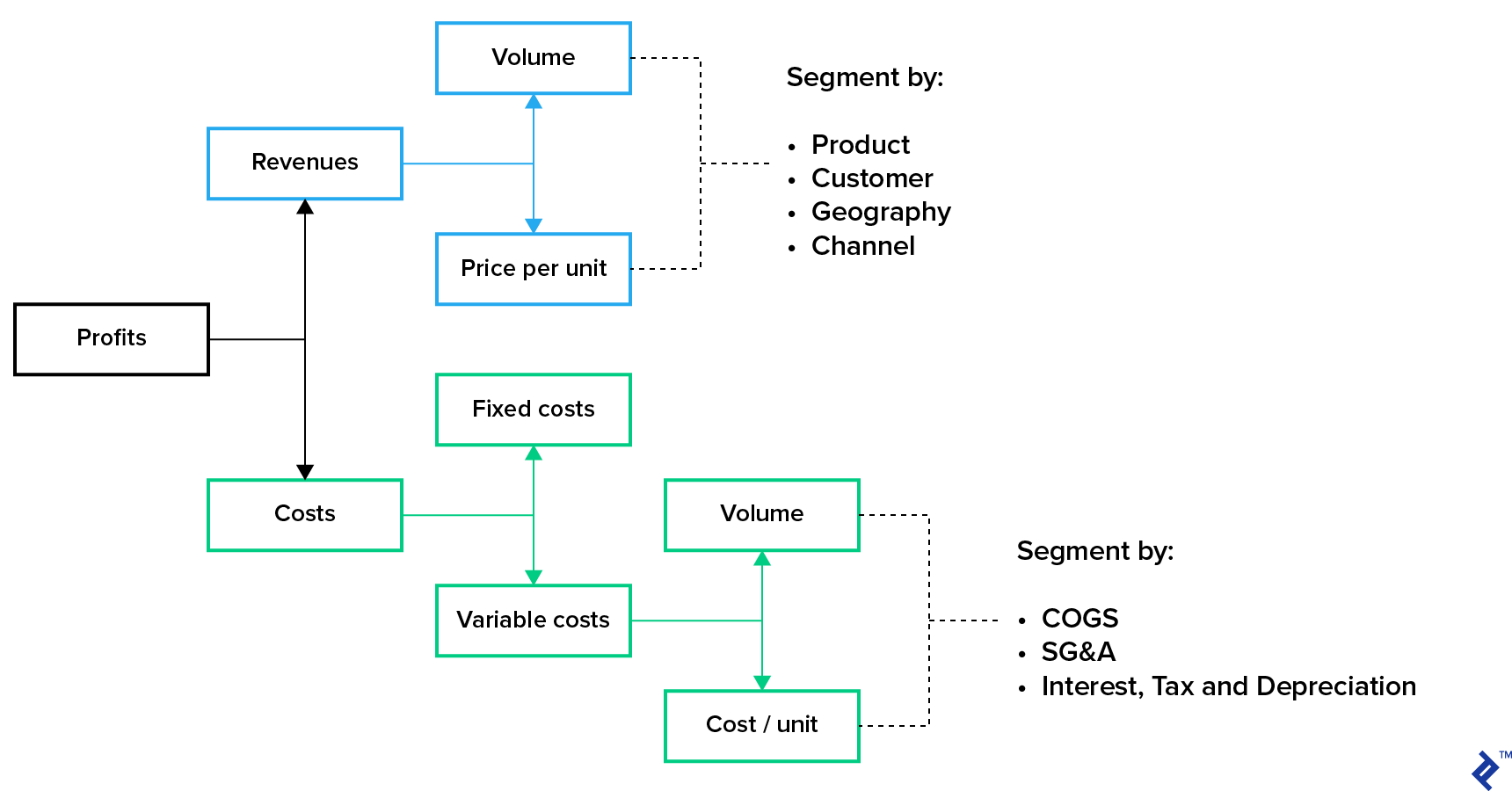

One of the best ways to kick off a firefight is to use an issue tree analysis to pinpoint what has happened financially that has led to the problem at hand. While at first, it may be evident that “sales have fallen,” an issue tree analysis may identify a degree of mutual exclusivity with other factors that may have had a secondary effect on the headline figure.

Issue trees should be built following the MECE business problem solving framework, where everything is captured in a mutually exclusive, collectively exhaustive manner down to the smallest fragments. When applied to an income statement, it can help to break the numbers down and isolate the issue.

Example of a Profitability Issue Tree

Not only does this allow the analyst to pinpoint the root cause of the issue, but it also provides a very clear way of demonstrating it visually.

Isolating which ratio has resulted in underperformance will then turn focus to efforts on rectifying the issue at hand in a more concerted way. For example, if sales have fallen due to price cuts in a specific geography, instead of castigating other regional sales teams, the company can focus efforts in a more proactive way on the problem territory.

Further Work

- Funnel analysis: Mapping out the conversion steps customers go through is a particularly useful exercise and one that should be done on an ongoing basis. Looking back at a period when sales dropped will help to identify the most painful point in the chain where customers dropped out.

-

Cost segmentation. Cost reduction techniques warrant an article on their own, but a good place to start is to categorize all costs in the business into practical buckets. Use a four-tiered system in order of importance:

- Business as usual: Costs required to keep the lights on and operate (e.g., head office rent)

- Unavoidable: Costs that are necessary to be “in the game” (e.g., company registration licenses)

- Secret sauce: What contributes to the differentiation that builds the competitive advantage of the business? (e.g., a star designer, an IP license agreement, etc.)

- Not required: Costs that do not objectively backtrack toward clearly assisting sales (e.g., old software that has replicated functionality in a more modern suite)

- Return on talent. Segmenting and appraising staff by their role within a business line helps to understand whether certain areas are bloated and/or underserved. This can be useful for back-office roles that only serve one function versus being central across the organization. Correctly mapping staff (an issue tree works here too) can lead to correctly adjusting cost accounting measures of apportioning out staff costs to correct business units.

Balance Sheets

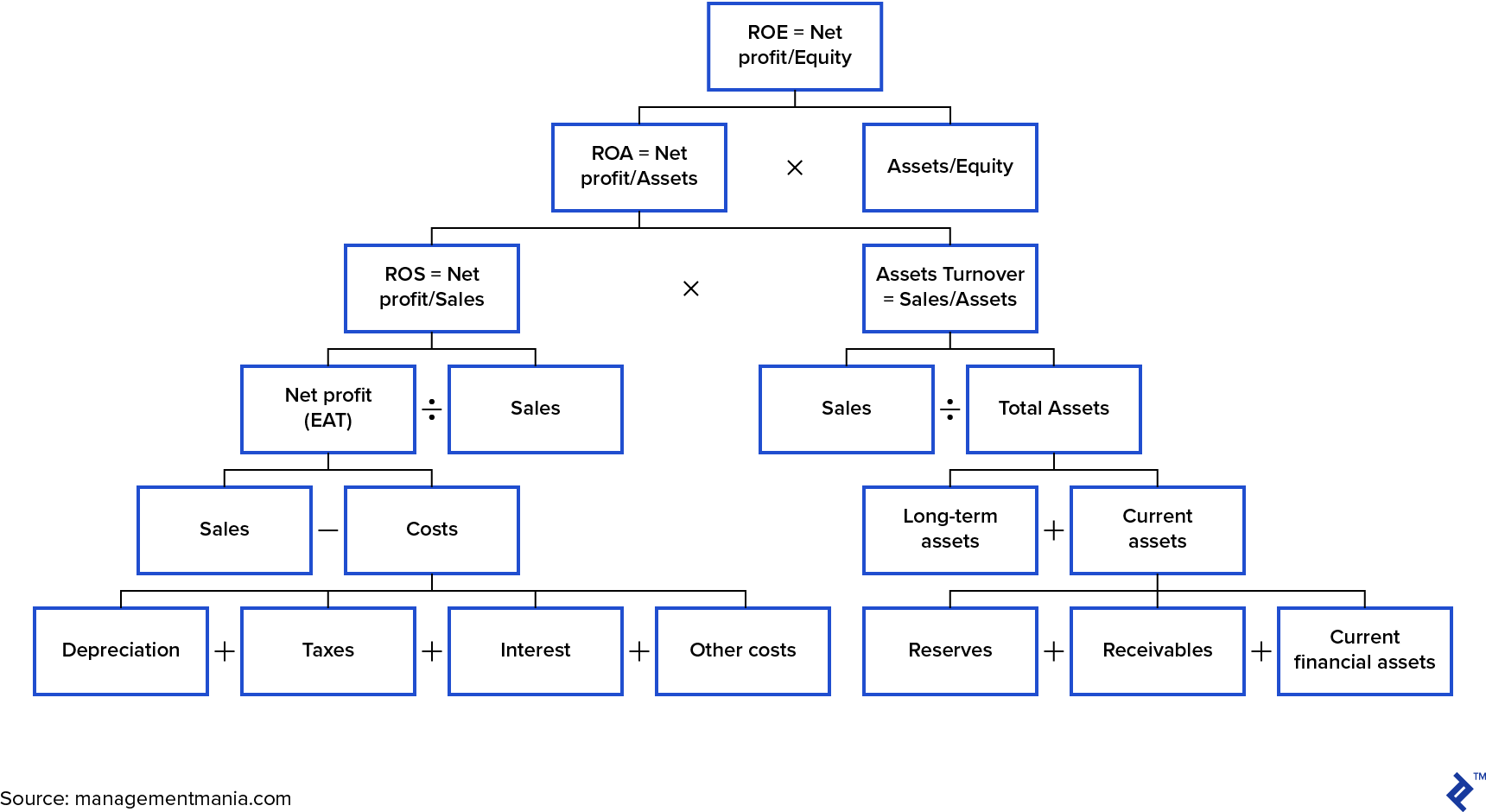

Issue trees can be expanded upon to include balance sheet related components if the problem is related to the broader financial health of the business. Frameworks such as DuPont analysis can combine income statement metrics with those of the company’s leverage to pinpoint the areas implicating issues with return on equity (ROE).

For older businesses that have more dividend-centric shareholder bases (e.g., banks) - who aren’t solely looking at a topline metric expansion (e.g., VCs) - relative income returns to equity capitalization are paramount. While a business may be profitable, if it’s being funded by a disproportionately larger equity base, it may not be financially efficient relative to the opportunity cost.

DuPont Analysis Issue Tree

ROE is essential in an industry such as banking, which has in recent years been stuck at low levels. While on the face of it, a profitable bank may appear sound, using a DuPont issue tree to assess the interconnectivity of the income statement and balance sheet will uncover that while profits may have risen if equity has been recapitalized upward, it won’t lead to higher relative returns on equity.

In the face of lower interest rates, we have seen banks retrench from certain areas in order to increase their profitability with a view to enhancing their ROEs.

By again using a MECE mentality to list all factors, what a DuPont issue tree result shows is an almost complete financial picture of the company in a far more digestible manner than streams of spreadsheets and financial statements.

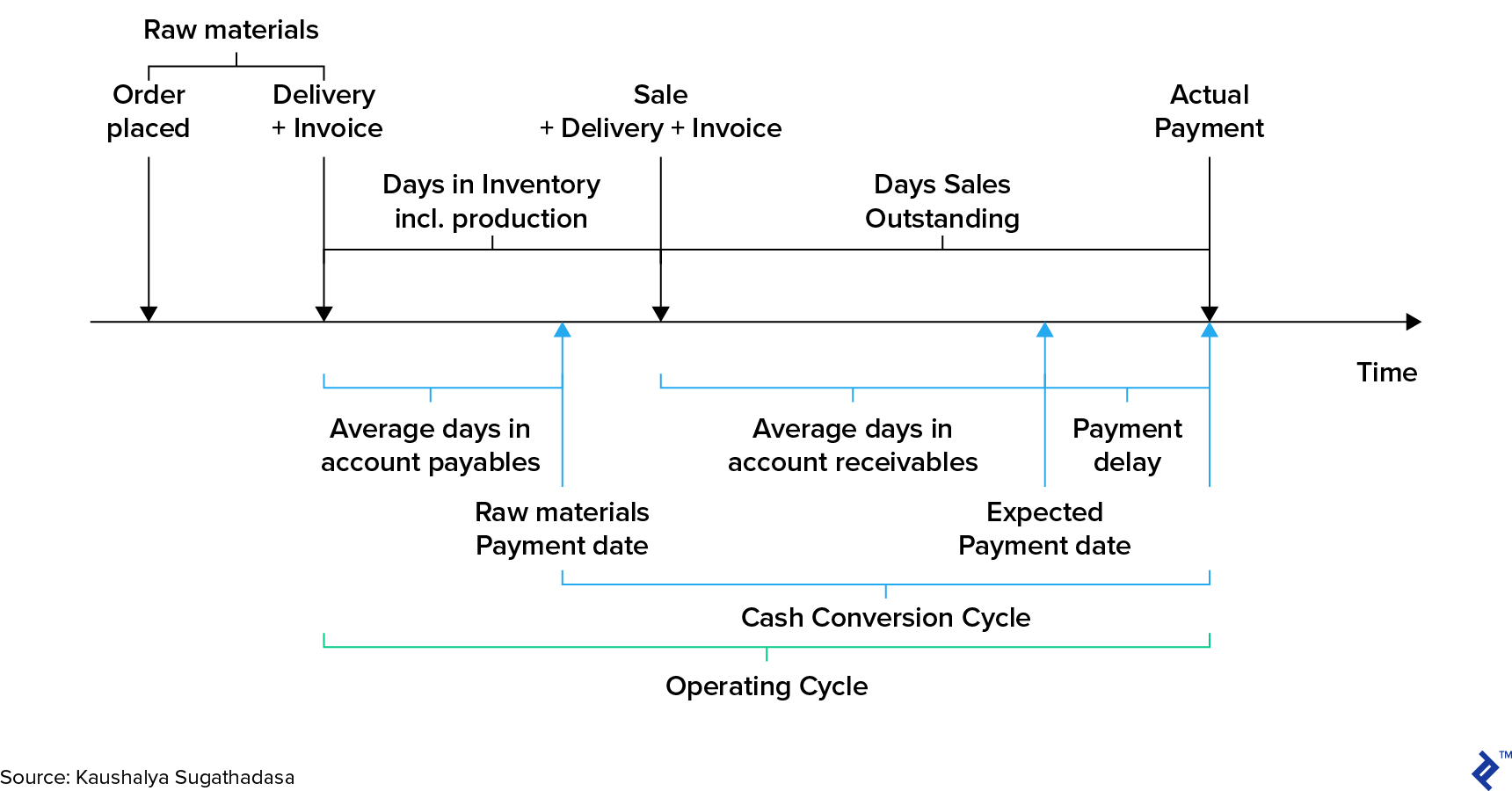

Liquidity: Cash Conversion Cycle

The cash conversion cycle is a metric regularly calculated by potential lenders and investors of a business. It assesses how quickly a firm can convert its operating activities into realized cash. The longer the cycle, the less liquid the business is in, and this, if left unchecked, can escalate and bring about serious implications. For example:

- Over time, creditors may extend less leeway or put more onerous terms on payables/short-term loans.

- Chasing sales too aggressively can result in too many receivables being extended to customers.

- Inventory build-ups result in fire sales that affect margins.

The formula for calculating the cash conversion cycle is as follows:

Cash conversion cycle = days inventory outstanding + days sales outstanding - days payable outstanding

Days inventory outstanding = average inventory in period / cost of goods sold * 365

Days sales outstanding = average accounts receivable in period / revenue * 365

Days payable outstanding = average accounts payable in period / cost of goods sold * 365

Graphically, the diagram below shows how the cash conversion cycle fits into the operating cycle of a company.

Cash Conversion Cycle Within the Operating Cycle of a Business

Continual monitoring of the cash conversion cycle will allow managers to be more on the front foot about changes happening to their liquidity positions. If a certain tolerance of acceptable days is extended to each part, once triggered, a review can occur in the specific area.

Once identified, further analysis can uncover the root cause, such as:

- Accounts receivables aging report: To dig into arrears of potential problem customers and specific trends over time. This should, in turn, lead to a review of the collections process.

- Lender stress test: Most corporates have a Rolodex of banks and suppliers that extend credit, which can be drawn upon to provide immediate liquidity. A stress test of these (e.g., drawing them all down at once) can test for whether external credit views of the business have changed.

- Inventory turnover ratio (COGS/Average inventory): This helps to determine how quickly inventory is “turned” in terms of being sold off. Compiling this analysis for individual SKUs and geographies can help work toward whether a specific product has an issue.

- Liquidity horizon: By taking all assets and liabilities of the business and netting off their tenors (or expected time to liquidate), an analyst can determine the financial life horizon of an entity. Such an exercise is vital in financial services but also quite pertinent for businesses that operate with short-term liabilities and long-term assets. If it’s noticed that a company is operating with a very short horizon, it may become obvious that the stress is spilling over into the income statement through decreased sales margins and lower-quality units of production.

Starting a Turnaround: Business Canvas Exercises

After moving on from the financials, a business model canvas exercise allows for a deeper understanding of the commercial fabric of the business and how attuned the operation is to consumer needs. This is where a more qualitative insight comes into play. While the profitability tree may show that sales volume has dropped in a certain geography, it will not be particularly evident as to why this is happening. A canvas exercise will help to dig into the operational aspects of this issue.

Creating a canvas for the entire business will help to provide an eagle-eye view of the current operation. Most companies only ever touch on this kind of overview when writing their initial business plan. Aside from then potentially never reviewing it again, a verbose business plan may struggle to come to life in the eyes of the reader. A canvas exercise is both regularly reviewed and very expressive to conceptualize when read.

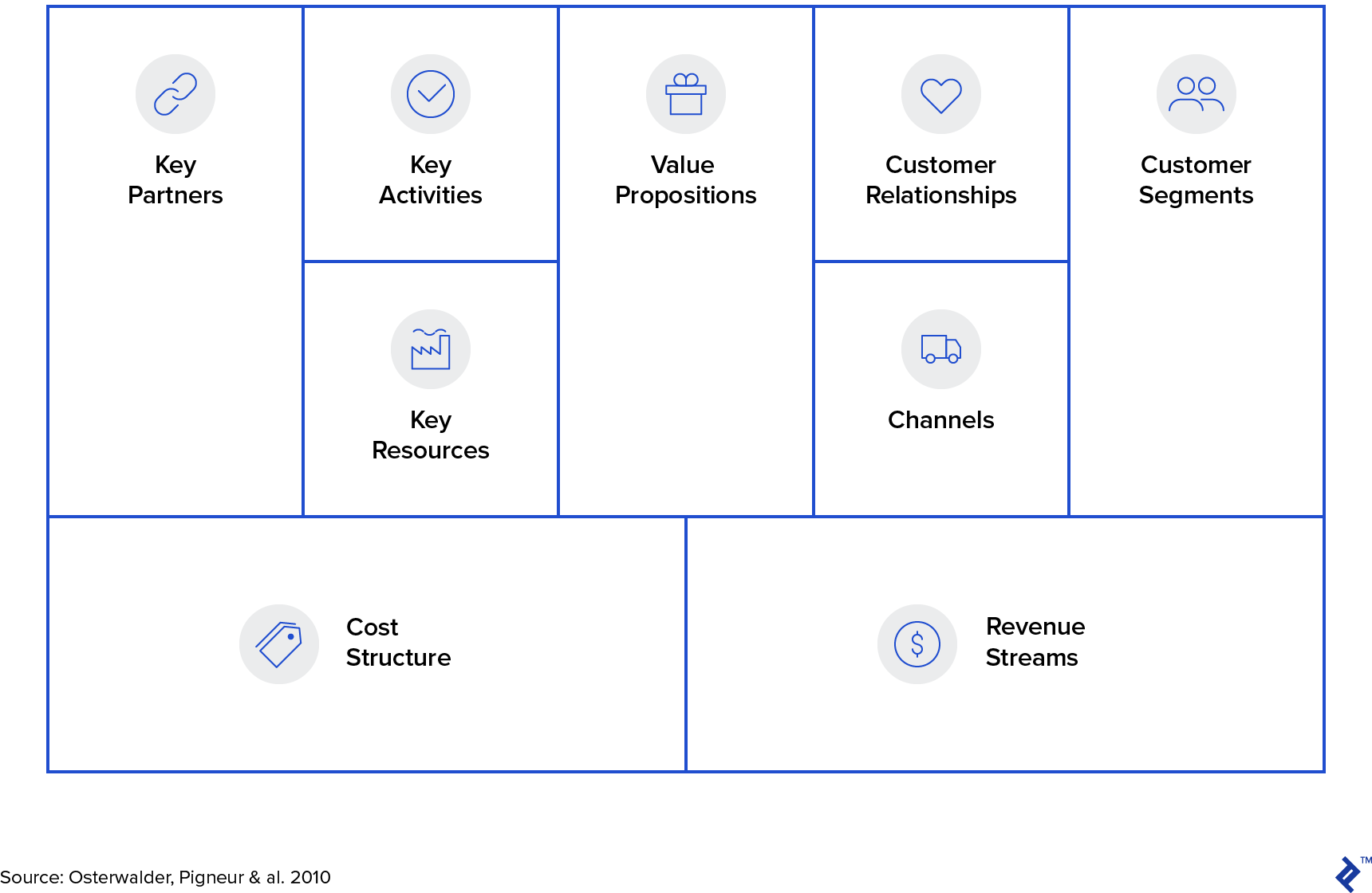

The Business Model Canvas

In terms of what these boxes mean, below are brief explanations and examples.

- Key partners: Outside stakeholders that assist the business model (e.g., having an exclusivity agreement with a local best-in-class logistics provider)

- Key activities: What are the most important things done by the business that allow its business model to work? (e.g., having a streamlined product development team that gets new releases out quickly)

- Key resources: The most valuable assets (financial, human, physical, and intellectual property) required for the business to excel (e.g., a key patent)

- Value propositions: This must explain succinctly why customers go to the business, what value they get from it, and what problem is solved.

- Customer relationships: How do customers interact with the business - is it a self-serve, long-term relationship or one that is merely transactional?

- Channels: How do customers want to reach the business and how are they currently being served?

- Customer segments: Who does the business deliver value to, which segment is the most important?

- Cost structure: What are the most prominent costs in the business and how much does it cost to deliver the key resources and activities?

- Revenue streams: How does the business make money from customers - is it on a recurring basis or one-off transactions?

Once complete, this exercise should help to uncover some red flags, depending on which box will determine how serious they are. For example, if a business struggles to settle on its key value proposition, then it will be quite evident why financials have underperformed and that a more profound turnaround effort is required. Yet, if it’s uncovered that customers desire a heavy touch approach to onboarding and support, and the business is currently offering a self-service model, the focus can quickly switch toward tweaking the plan.

Whenever I work on a project, irrespective of whether it’s forward-facing or a firefight, a canvas is the first thing I do. It helps to focus on the unique advantages that a business has and how it is capitalizing upon them in the market.

Product Market Fit: Jobs to Be Done

When addressing sales issues, the default approach can tend to be adjusting the seller’s manner of conducting sales. It is a rather binary assumption that spending more on marketing, adding more salespeople, or tweaking a website will help sales in a linear (or exponential) fashion. While all of these tactics are indeed valid approaches, they are enacted under the paradigm of appeasing the seller’s needs and having a slightly arrogant attitude toward assuming that customers will want what is being delivered to them.

What can go unnoticed here is what the consumer actually wants and how the product/service serves their needs. Jobs To Be Done (JTBD) is a concept developed by Clayton Christensen at Harvard Business School, centered around a mentality of serving the needs customers are trying to fulfill from using a product or service. He says that “we hire products to do jobs for us.” While this may sound vague at first, the genesis of his idea - which came from studying commuters using McDonald’s drive-thru to buy milkshakes - explains it vividly.

The JTBD theory states that customers have three “jobs” they are trying to get done: functional, emotional, and consumption-led.

- Functional: Reaching a fixed outcome that is measured by speed and accuracy

- Emotional: How a customer wants to feel and be perceived by others while doing the job

- Consumption: Jobs that must be done to enable a solution elsewhere

The last two are usually derivatives of functional jobs, which is the key job to be done. A visible way to see whether a company espouses JTBD thinking is when their products are named and targeted at outcomes people want to achieve. For example, LinkedIn Premium is not just one generic product but a number of tiered services aimed at users, whether they are job hunting or hunting for talent to fill other jobs.

Below are some tips for instilling a JTBD mentality in business.

Remove Bias from Surveys and Customer Outreach

When I was in graduate school, whenever group work involved testing a hypothesis for a business idea, groups would create surveys for their classmates, usually with the explicit goal of validating what they wanted to hear. Questions would go along the lines of:

“How would you feel about purchasing an internet-of-things connected teapot?”

Aside from the sample bias of sending a survey to a homogeneous stratum of classmates (i.e., similar psychographics), using such leading questions can corrupt a survey and fail to understand what needs the customer wants to fulfill. Questions like this return to the original point about companies trying to fit their round peg solution into a square hole. Remember when the iPhone came out? No one knew they wanted an iPhone before then, as they didn’t exist, so a leading question about their desires for one would have left consumers flummoxed.

Instead, a more useful question would be:

“When you prepare hot beverages, what do you do during the boiling period?”

Answers to this question would provide more insight into the job being done by the drinker and, thus, how the provider could serve them.

Job Statements

Writing down job statements for the jobs customers are doing helps to really simplify what it is they are doing and why. Statements are constructed using three parts: a verb, an object, and a contextual modifier. Here are some varied examples for products/services that have been tailored toward specific jobs consumers want done:

| Example | Verb | Object | Contextual Modifier |

| Amazon Lockers | Pickup | My internet shopping | At my own time, near home |

| Oatmeal Sachets | Prepare | My breakfast | Conveniently and quickly at work |

| Airport Valets | Enter | The airport terminal | With minimal luggage effort |

Once complete, job statements can be a powerful and concise way of remembering what it is customers are doing and how a business can strive toward making the contextual modifier as seamless as possible for them.

Outcome Expectations

Further to compiling job statements, work toward understanding the outcome expectations for both your customers and your business for the desired and undesired outcomes of the provision. Understanding the needs and avoidances of both parties serves to uncover friction that may appear during a service. For example, a taxi rider wants to get to a destination as soon as possible, while a driver will not want to break speed laws. Marrying these two frictions together can assist with uncovering stumbling points in service delivery and reaching the most optimal compromise.

Find Customer Workarounds

Look at data clues and customer patterns for how they are purchasing and using the service. If they are doing specific workarounds (e.g., ordering a product on specific days, using an app more than a browser, etc.), consider why this is happening and how that is fulfilling their needs more than how you initially intended.

Firefights Are Inevitable, so at Least Be Prepared

The more a business plans its activities using objective metrics, the less time it has to spend finding the causes of problems when they occur. Referring back to the introduction, when I mentioned qualitative issues, in a roundabout way, they can be the main reason why problems begin to occur quantitatively. Oftentimes, when budgets are set, they are done in a siloed manner, which can ignore debilitating competitive friction between teams, or the butterfly effect of one team’s goals negatively affecting another’s.

A balanced scorecard is a simple but effective way to appraise business performance on an ongoing basis and monitor the key metrics that contribute to holistic success. Such a method also accounts for the qualitative issues that can eventually spill over into finances. Goals and quantitative measures are collected along four key lines:

- Learning and Growth: Can we continue to improve and create value?

- Business Processes: What must we excel at?

- Customer Perspectives: How do customers see us?

- Financial Data: How do we look to shareholders?

Each focuses on the aspects that matter to the core stakeholders of a business: investors, employees, customers, and non-human assets. Applying quantitative goals and prescribing how they will be measured ensures that periodically, they can be reviewed and then measures put in place to rectify underperformance. While firefights are almost always inevitable in business, having a firehose on hand and with water in the tank ensures that a response can be immediate and effective.

Further Reading on the Toptal Blog:

- The Undeniable Importance of a Business Plan

- The Rules of Motivation: A Story About Correcting Failed Sales Incentive Schemes

- Working Capital Optimization: Practical Tips From a Pro

- Do Economic Moats Still Matter?

- Forecaster’s Toolbox: How to Perform Monte Carlo Simulations

- C Corp, S Corp, LLC? Finding the Best Fit for Your New Business

Understanding the basics

Why is a business model canvas important?

A business model canvas provides an eagle-eye view of the current operation and allows for a deeper understanding of the commercial fabric of the business and how attuned the operation is to consumer needs. There is a significant amount of qualitative insight required.

What is a problem tree analysis?

Problem trees list all of the factors that contribute to a final figure. For example, business profitability is affected by revenue and costs, so a problem tree will fork out toward those two factors.

About the author

Alex is a trained treasurer and CFA charterholder who has managed investments ranging from $3bn of bond assets to $15m Latin American micro-VC funds.