Tough Times Don’t Have to Mean Tough Terms: Leveraging Financial and Cap Table Modeling in VC Negotiations

When capital is scarce, VCs may tighten their terms to reduce their risk. Here’s how to think through three of the most common preferred terms to ensure you don’t give away too much of your company.

When capital is scarce, VCs may tighten their terms to reduce their risk. Here’s how to think through three of the most common preferred terms to ensure you don’t give away too much of your company.

Erik is co-founder of a global venture capital fund that has invested in 50 startups—which have raised more than $500 million—and has realized six exits. He serves as Toptal’s Chief Economist.

Expertise

PREVIOUSLY AT

When the global economic forecast is uncertain, fundraising is just the first half of the battle for new startups. The VCs that continue to invest in new companies often demand more aggressive terms to reduce their risk. Term sheets from reputable VCs probably won’t be outright predatory, but during a recession, worst-case scenarios are more likely to occur, and founders will be more likely to pay the price. Careful cap table modeling and financial modeling can help you avoid surrendering more equity than you otherwise need to.

As the co-founder of a global VC firm that has funded more than 50 startups, I have sat across the table from founders like you many times. I can tell you that VCs want you to succeed because that’s how they succeed. But a gloomy economy makes everyone a little more tight-fisted and risk averse, which means you can expect your investment to come with extra conditions you wouldn’t necessarily see in boom times.

Valuation gets a lot of headlines, but preferred terms—the preferred equity that investors receive—are the part of the negotiation that can really lure you into a worse deal than you intended to make. Pricing these terms can be challenging because many of them will only become relevant only under certain circumstances. Dilution protection, for example, kicks in exclusively during a down round, so it can seem like a relatively low-risk concession in a good economy. In a volatile one, however, it can mean the difference between life or death for your company.

The most accurate way to price conditional terms is to run a simulation of potential outcomes in your financial model and calculate the effect of the proposed terms on your cap table, then average those results over many iterations. However, that can require expensive specialized software and significant statistical expertise that you may not have.

A far easier—yet still very reliable—option is to undertake scenario analysis with your cap table and financial modeling. In scenario analysis, you analyze distinct degrees of financial outcomes (typically low, medium, and high) rather than running a dynamic simulation that iterates on hundreds of possible outcomes.

A complete overview of how best to price preferred terms is beyond the scope of this article, but I offer a roadmap for how to approach a few of the most common and consequential terms. I also show you how to value them accurately enough to avoid unintentionally giving away too much of your company.

Position Yourself for Negotiation

Before you sit down at the table, do some homework: Make sure your startup’s finances are in order, be sure that you understand dilution, ensure that your equity is apportioned appropriately, and have your financial model in place.

These steps will prepare you to estimate your company’s valuation and build your cap table so you can model the terms your investors are proposing.

Nail Down Your Valuation

If you’re at the seed stage, valuation is typically a less important part of the negotiation, but you need to make a persuasive case for the numbers you put forth.

This requires some creative thinking. While there are quantitative tools that speak to the financial health of a startup, at this early stage you most likely will not have sufficient cash flow data to arrive at a robust fair-value estimate. Instead, approach this matter as a triangulation exercise, using the following elements:

Financial Model

Even without a lot of historical data, you need a starting point, so perform a traditional discounted cash flow on your financial model with whatever information you have. Then use the standard venture target rate of return—20% to 25%—as the cost of capital to see what present-day valuation it implies. Finally, work backward to determine how much cash flow growth would be required to hit your target valuation. This will reveal the milestones you need to hit in order to develop a clear plan to achieve your target valuation, as well as demonstrate, ideally, a generous return on investment to your investors.

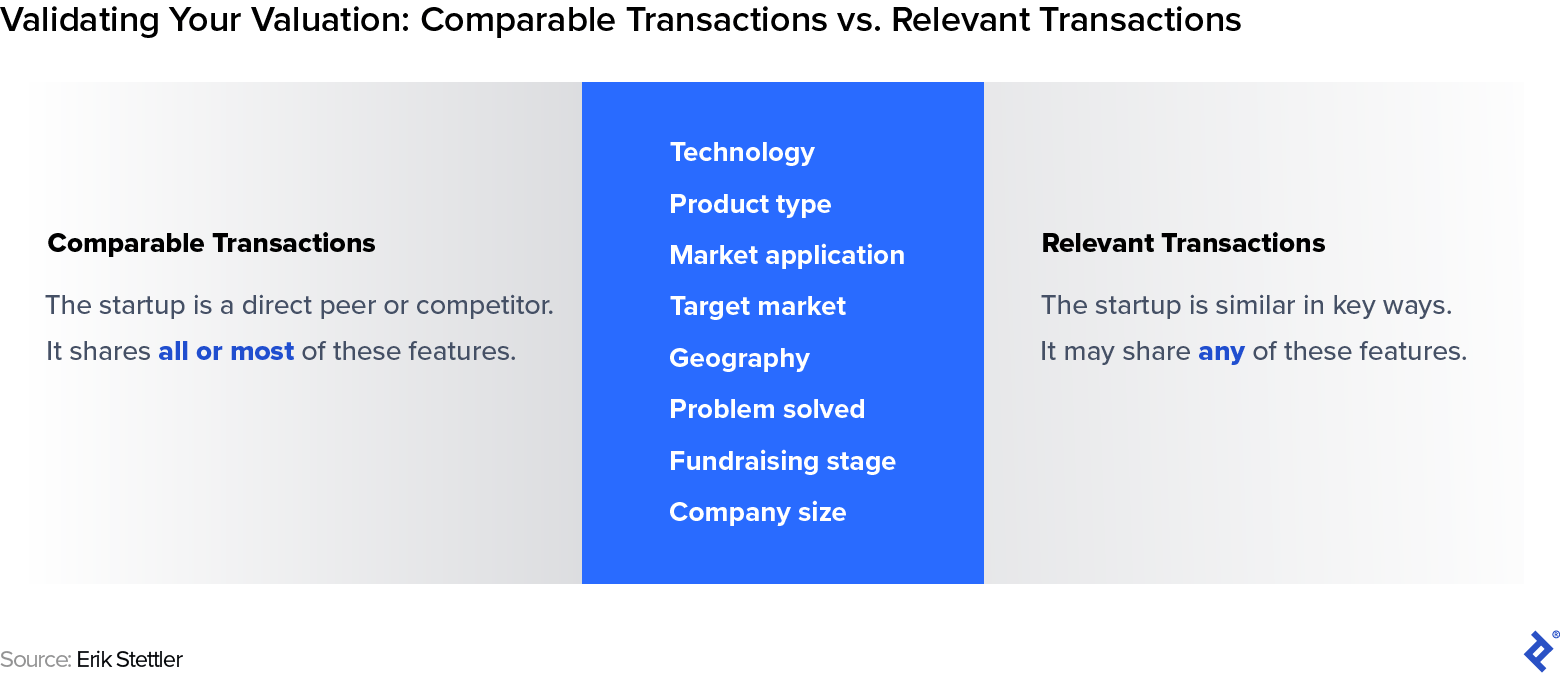

Recent Relevant Transactions and/or Exits

The conventional wisdom is to look at recent comparable transactions to validate your figures, but finding recent similar deals among direct peers or competitors is difficult, even under normal market conditions. Every startup and venture deal is different, and the publicly available information on transactions excludes important elements of the overall deal terms or structure.

However, by expanding your search to recent relevant transactions—those in your general industry or technology area—you can still provide investors with persuasive context to support the multiple on your revenue and other applicable metrics.

Aggregate Market Trends

Pitchbook offers a considerable amount of free data on private market trends in valuation and deal size across funding stages. That data can be skewed by a small number of “mega rounds” at unusually high valuations and can hide a considerable range of outcomes. Even so, in general, showing that the implied valuation from your financial model is in line with other deals will help validate your asking price.

If an investor aggressively pushes for a lower valuation, consider that a red flag. The primary concern of investors should be their return. Framing the price discussion within the larger context of the growth that you’ll achieve with this funding round—and the future valuation it will enable you to reach—can help take some of the pressure off your current valuation. I once had a startup client that was able to demonstrate so convincingly that it could expect ongoing 70% monthly growth that the question of lowering its valuation never came up.

Use a Dynamic Cap Table

Your financial model is central to the valuation discussion. But the true battlefield for the negotiations is your cap table, which is where you track the equity breakdown of your company. Here are three features you must include in your cap table format to model your investors’ proposed terms:

- Every Round of Fundraising: Include any prior seed or pre-seed investments that will convert upon Series A. Include your future rounds as well—something I see founders fail to do all the time. Typically, I assume at least a Series B prior to exit or sufficient profitability, but it’s a good idea to assume a Series C too.

- Investor Payout: Add a line that tallies your investor payout across rounds. This is important because if you offer a certain preferred term to your Series A lead investor, then you can typically expect your Series B lead to demand the same. If you’re not modeling the impact of your terms through the end of fundraising, those concessions can snowball.

- Future Fundraising Needs: As your business grows, so will your expenses—staff salary and options, physical overhead, production costs, and more. Just as you budget for those in your financial model, you’ll need to budget for them in your cap table.

Cap table modeling will also help with the common question of how much money you should attempt to raise in a given round. Fundraising in smaller increments can minimize dilution, since your valuation will presumably increase over time. However, you have to weigh this potential benefit against the risk of having less money in the bank at any given moment, as well as the likelihood that you’ll have less time to focus on fundraising as your business grows.

This question often intertwines with negotiations, as the attractiveness of the terms will affect how much capital you choose to accept. Your modeling may also help you decide that it might be better to walk away entirely and undertake an extension of your prior seed or pre-seed round instead, to buy you more time to grow.

Prepare to Model Preferred Terms

Valuation is just one piece of the puzzle. In times of capital scarcity, investors are likely to consider more aggressive preferred terms in the hopes of reducing their risk (downside protection) or increasing their potential reward (upside optionality).

Here are three of the most common and impactful preferred terms that founders should, in some cases, avoid and, at the very least, model carefully before accepting.

Liquidation Preference

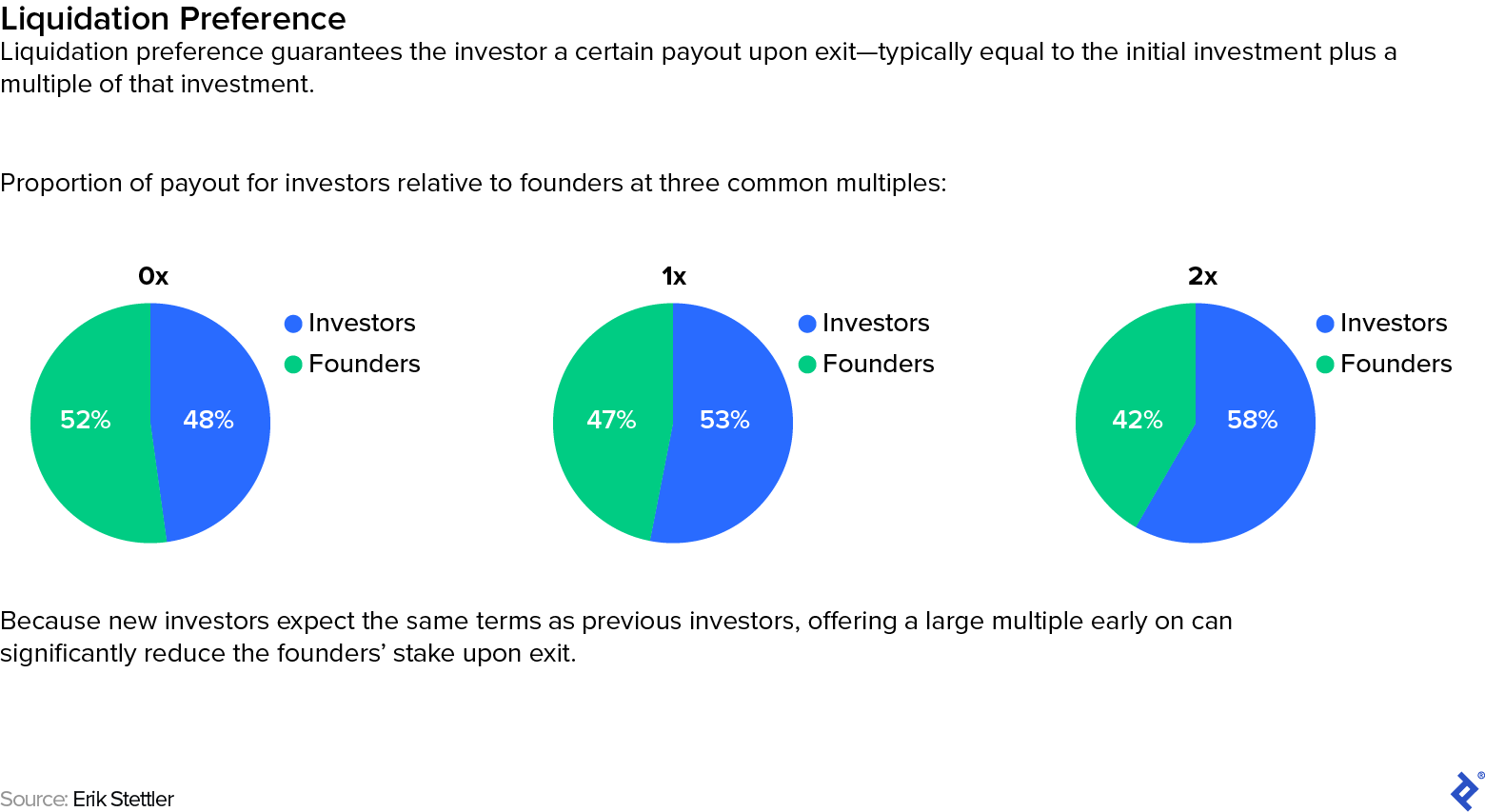

In the event of liquidity or dissolution, liquidation preference grants the investor an agreed-upon amount—usually the return of their capital (1x), plus a potential guaranteed multiple (>1x)—before you receive anything. The rest of the pie is allocated proportionally based on percent ownership.

To see the impact of your investors’ proposed liquidation preference, add a line to the cap table that shows the amount that will be due upfront to your investors (and those from expected future rounds) before you receive your share. The results may demonstrate a substantial reduction in the payout that you and your team members can expect.

You can use this information in the negotiation to make the case that if the investors expect to derisk their return in this way, they should accept a higher valuation. It’s a matter of principle: Risk and reward go hand in hand in investing, and contractually reducing the former should then raise the size of the latter.

Dilution Protection

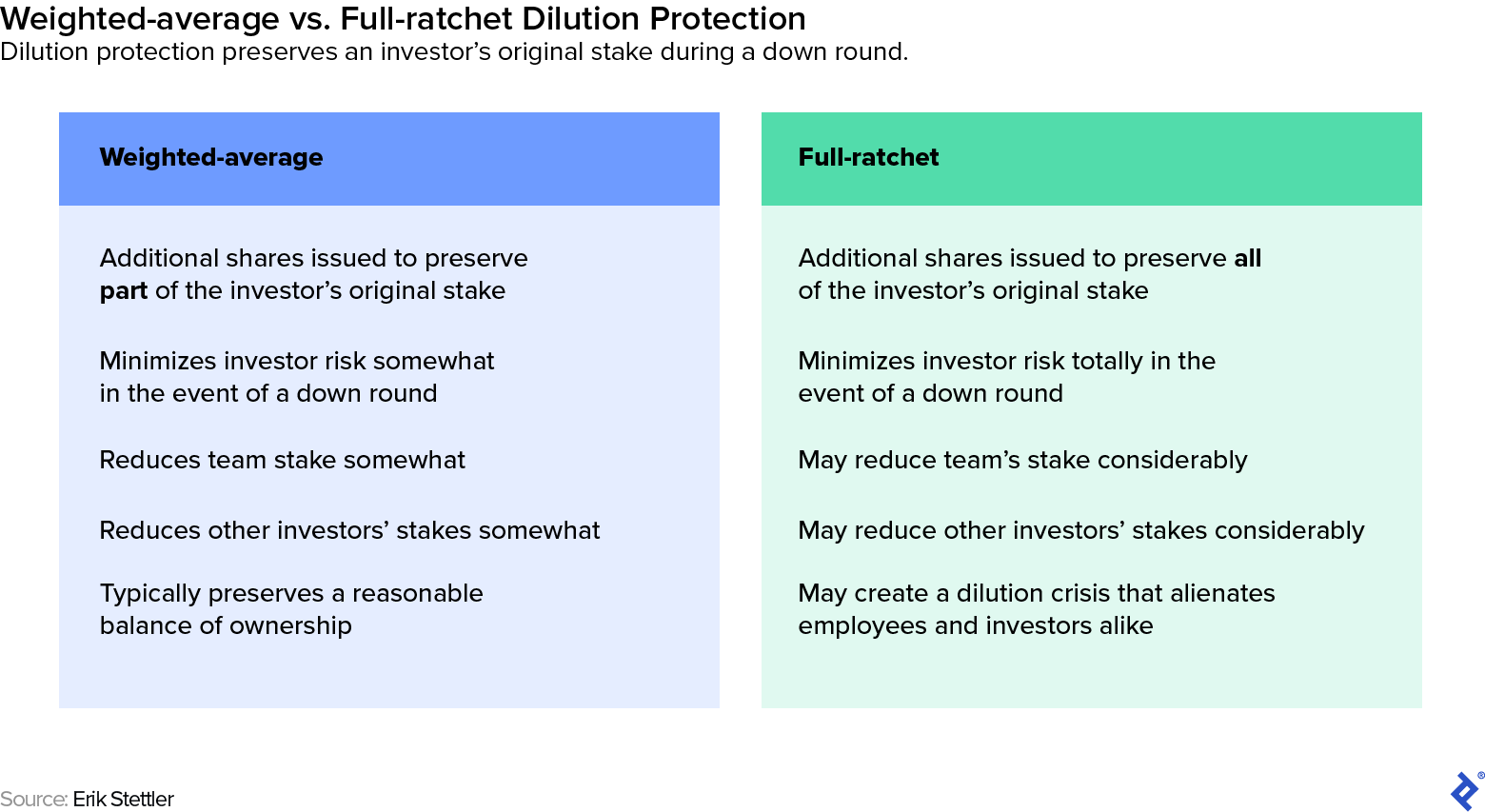

In the event of a down round, dilution protection clauses require a startup to generate additional shares for the investor in order to maintain the investor’s relative stake. Weighted-average dilution protection, which only guarantees a certain percentage of the original stake, is a tolerable ask. Full-ratchet dilution protection, which preserves the investor’s entire stake, is a highly aggressive request, as it essentially demands all the potential reward without exposing the investor to the corresponding risk.

Aggressive dilution protection raises your risk as well, as it can trigger a dilution death spiral that can ultimately kill your chances of surviving a down round. When your company becomes too diluted, that can eat up so many of the shares reserved for your team and future investors that it becomes difficult to retain and hire the best talent, as well as continue fundraising.

Pushing back against full-ratchet dilution protection requires a delicate touch. I find the best way to do it is to take a Socratic approach and ask your investors enough questions about the potential downsides of their proposal that they eventually come around to your position of their own accord.

First, show your investors your cap table modeling and explain the impact that that level of dilution will have on employee morale and investor appeal. Ask them how they think it’s possible for you to grow the company under such conditions without the additional capital a higher valuation would provide. In this way, you can show them how the expected dollar value of their final holdings can increase if they give a little on the percentage today.

Full-ratchet dilution protection can be so damaging to a startup that I generally advise doing everything possible to avoid it—including walking away from the deal—unless your business will not survive without that investor. Even then, it’s worth trying to push back.

Super Pro-rata Rights

Standard pro-rata rights allow the investor to participate in subsequent rounds, up to the point of maintaining their initial ownership stake. This term can most often arise during the seed round, as many seed investors look to follow on with more capital as the stars begin rising. I typically recommend that founders preemptively offer pro-rata rights to investors, as the opportunity to follow on is part of what makes early-stage investing viable.

During tight markets, however, investors sometimes request super pro-rata rights, which give them the right to invest enough to increase their percent stake in subsequent rounds.

While pro-rata rights are fair, super pro-rata rights are not, as they lock in a share of the potential upside disproportionate to the size of the investor’s commitment in the current round. They are essentially the opposite side of the coin from full-ratchet dilution protection. If you are familiar with options pricing, you can model this as a call option where the strike price is your expected Series A valuation and the volatility inputs come from the scenario analysis you performed with your financial model and their respective probabilities.

I don’t recommend granting super pro-rata rights under any circumstances, as that can hinder your ability to bring on additional investors in future rounds. Investors in later-stage companies typically have a minimum percentage that they’re willing to accept, and if super pro-rata rights allocate too much to your earlier investors, you can find yourself in a situation where you have too little space left in the round to close your funding gap. If an investor wants more exposure to your company, they should increase their current investment amount instead.

If, however, you really can’t afford to walk away from a deal that demands super pro-rata rights, then you need to persuade the investor to give a bit more on current valuation in return for this ability to capture additional upside.

Read the Contract and Get a Lawyer

I cannot emphasize enough how necessary it is to hire a lawyer who specializes in venture agreements when you’re reviewing an investor contract. This is one area where you don’t want to skimp.

Preferred terms are constantly evolving, and no matter how precisely we attempt to model or summarize them, the only source of truth is the legal contract. While you can negotiate the business and financial essence of the terms, do not sign anything without first showing the documentation to a lawyer to ensure that it accurately reflects what you’ve agreed upon.

Sloppy and ambiguous language can be just as dangerous as a deliberate “gotcha” clause. For example, any metrics-based payout plan opens the door to havoc, even in the rare cases when the metrics are perfectly defined. Ambiguity nearly always favors the larger and better-funded party (in this case, the investor), since they can fund and withstand a dispute for longer. Hiring a highly qualified venture attorney will help you avoid this outcome.

Remember the Human Factor

I’ve focused on how your cap table and financial model can help you grasp certain key terms in order to understand the true worth of what you’re offering and make sure you receive sufficient consideration in return. The negotiations themselves, however, are a profoundly human exercise.

Knowing the profile and point of view of the investors will help you infer how much relative value they’ll place on certain terms. Investors who are newer to VC, such as family offices and investors with more traditional private equity backgrounds in emerging ecosystems, will often focus more on downside protection, while Silicon Valley investors frequently pay more attention to upside optionality. Corporate venture capital may be more interested in strategic terms than economic ones. Understanding their priorities will help you tailor your approach.

Finally, remember that just as the terms you accept will set a precedent for future rounds, the negotiation is only the beginning of your relationship with a particular investor. Your behavior during negotiations will tell the investor what kind of partner you will be—and vice versa. The moment you sign the final agreement, you’ll all be on the same team, and soon enough you’ll be preparing together for the next round.

Further Reading on the Toptal Blog:

Understanding the basics

What is a cap table in VC?

A capitalization table is a way to visualize the allocation of a company’s equity over time. It allows startups to track the breakdown of common stock, preferred stock, convertible notes, and other forms of equity capital across all shareholders.

What is cap table modeling?

Startup founders use their cap tables to model their funding rounds and investor terms to make sure they’re raising the right amount of money and that they aren’t giving away too much equity.

Do investors see your cap table?

Yes, investors review a startup’s cap table after a successful pitch, typically during the diligence phase.

Erik Stettler

New York, NY, United States

Member since November 21, 2017

About the author

Erik is co-founder of a global venture capital fund that has invested in 50 startups—which have raised more than $500 million—and has realized six exits. He serves as Toptal’s Chief Economist.

Expertise

PREVIOUSLY AT