Serving Food From the Cloud

The restaurant industry is infamous for its failure rate. The most common reason for failure is location. Cloud kitchens do away with this obstacle, allowing restaurants to operate without having a central hip location.

The restaurant industry is infamous for its failure rate. The most common reason for failure is location. Cloud kitchens do away with this obstacle, allowing restaurants to operate without having a central hip location.

Naveen leverages his extensive fundraising and transaction experience to help entrepreneurs and managers drive value for their businesses.

PREVIOUSLY AT

The restaurant industry is infamous for its failure rate. More than 60% of all restaurants fail in the first year of operation and nearly 80% are closed down by their 5th anniversary. Furthermore, the number of independently owned restaurants in the US fell by 2% from fall 2016 to fall 2017, as the number of independently owned restaurants also declined in New York from 2005 to 2015. While there can be many reasons for failure, the most common one is location.

Cloud kitchens do away with this obstacle, i.e. they allow a restaurant to operate without having a physical presence at a central hip location. A combination of factors such as growth in smartphones, the increase in delivery services, and changes in consumer preferences, have given cloud kitchens a massive boost.

What Is a Cloud Kitchen?

Cloud kitchens are known by various names such as ghost kitchens, shadow kitchens, virtual, or dark kitchens. But the basic idea remains the same: restaurants have an online presence and their food can be ordered through food aggregator apps or through the restaurant’s own app, but the restaurants themselves don’t have dine-in facilities. A few of these restaurants might also provide take-out services to their customers.

One way of looking at these restaurants would be to consider them food manufacturing factories, places where food is manufactured and then shipped to the final consumer: considering cloud kitchens as factories and not restaurants shifts the whole paradigm to one in which the manufacturer is focused on providing quality consistent output at the lowest cost possible without worrying about how or where the product is consumed by the consumer, and thus removing the key constraint posed by their physical location.

Cloud kitchens offer the following advantages over traditional restaurants:

- Low Operational Cost – One of the biggest cost factors for traditional restaurants has always been real estate (~10%). This cost can be reduced by cloud kitchens, as they can operate from non-prime locations, and save on rental expenses posed by the area required to attract dining traffic. Cloud kitchens also manufacture standardized items, which further reduces cost. Staff requirements are also reduced significantly.

- Low Set up and Introduction Cost – Cloud kitchens can be set up, introduce new products and change their menus at a significantly lower cost and can thus experiment swiftly and cheaply. If a product doesn’t perform as expected, it can simply be pulled off the menu without creating much hassle or additional expense.

- Automation – With a focus on limited menus and limited items, product manufacturing can be standardized in cloud kitchens as it would be in manufacturing. Additionally, cloud kitchens are experimenting with robots and machines which can further automate the process.

There are, however, substantial disadvantages to the cloud kitchen model: while being a lower cost and quick turnaround option, cloud kitchens have not been able to generate a similar client flow as established restaurants, for reasons rooted in human psychology. As the final consumer is not in touch with the restaurant and doesn’t have an emotional connection, patronage becomes difficult to establish. Additionally, cloud kitchens have extensive reliance on food delivery aggregators, which leads to concentration risk. Furthermore, occasionally, cloud kitchens have been on the wrong side of working conditions as well as hygiene.

Types of Cloud Kitchens

- Hub and Spoke Model – In the hub and spoke model, a central kitchen prepares the food, and then semi-cooked dishes are shipped to final smaller outlets where they need to be cooked before shipping. It results in cost-savings due to scale and standardization.

- Pod Kitchen – These are small containers that can be placed in any location, such as parking lots. Due to their size and mobile nature, they are easy to set up and operate. They have had their own share of controversies as mentioned earlier.

- Commissary (Aggregator) Kitchens - These are the kitchens that are owned by a 3rd party. Many restaurants will use them on a shared basis, from kitchen space to fridge space. Travis Kalanick has invested in City Storage Systems, which transforms old warehouses into kitchens. A comparison can be drawn with shared working spaces where different companies share the same utilities and rent out office space from a service provider. These kitchens can be fully stacked or just having a shell kitchen. These are also termed kitchen as a service (KaaS).

- Outsourced Model – As the name suggests, here all the operations, food preparation and customer-facing operations are outsourced. The chef just provides the final touch before sending out the product for delivery. This is not a popular model.

- Independent Kitchen – Standalone kitchens with no offline presence. They can deliver the product themselves, through a food aggregator, or through both.

Brief History and Market Size of Cloud Kitchen

Cloud kitchens are not a new concept: pizza delivery restaurants have been around for decades, and, specifically, pizza prepared for take-out came to be in the 1950s.

The current concept of the cloud kitchen initially emerged in India. In 2003, Rebel Foods, backed by Sequoia, started its first business, Faasos, which sells Kebabs. Today, Rebel Foods has over 9 brands and recently raised $125 million and is valued at $525 million.

Rebel Foods Brands

Market Size

With improvements in technology, changes in lifestyle preferences, and upgrades of the value chain, cloud kitchens are set to take off.

In the report “Is the Kitchen Dead?” UBS estimates that the online food delivery market will grow ten times in the next ten years, from $35 billion currently to $365 billion by 2030. UBS mentions that “In a world of increasingly time-starved and asset-light consumers, online food delivery is part of a mega-trend, combining the on-demand and sharing economies.” UBS predicts that there could be a scenario that most meals currently cooked at home are instead ordered online and delivered from either restaurants or central kitchens.

Food Delivery Scenarios

UBS predicts that, additionally, food preparation may follow the same trajectory as clothes manufacturing. “A century ago, many families in now-developed markets produced their own clothes. It was in some ways another household chore. The cost of purchasing pre-made clothes from merchants was prohibitively expensive for most, and the skills to produce clothing existed at home. Industrialization increased production capacity, and costs fell. Supply chains were established and mass consumption followed.” This obviously based on the assumption that “The cost of ordering a cooked meal from a restaurant can reach as low as a home cooked meal and can become lower if time is factored in.”

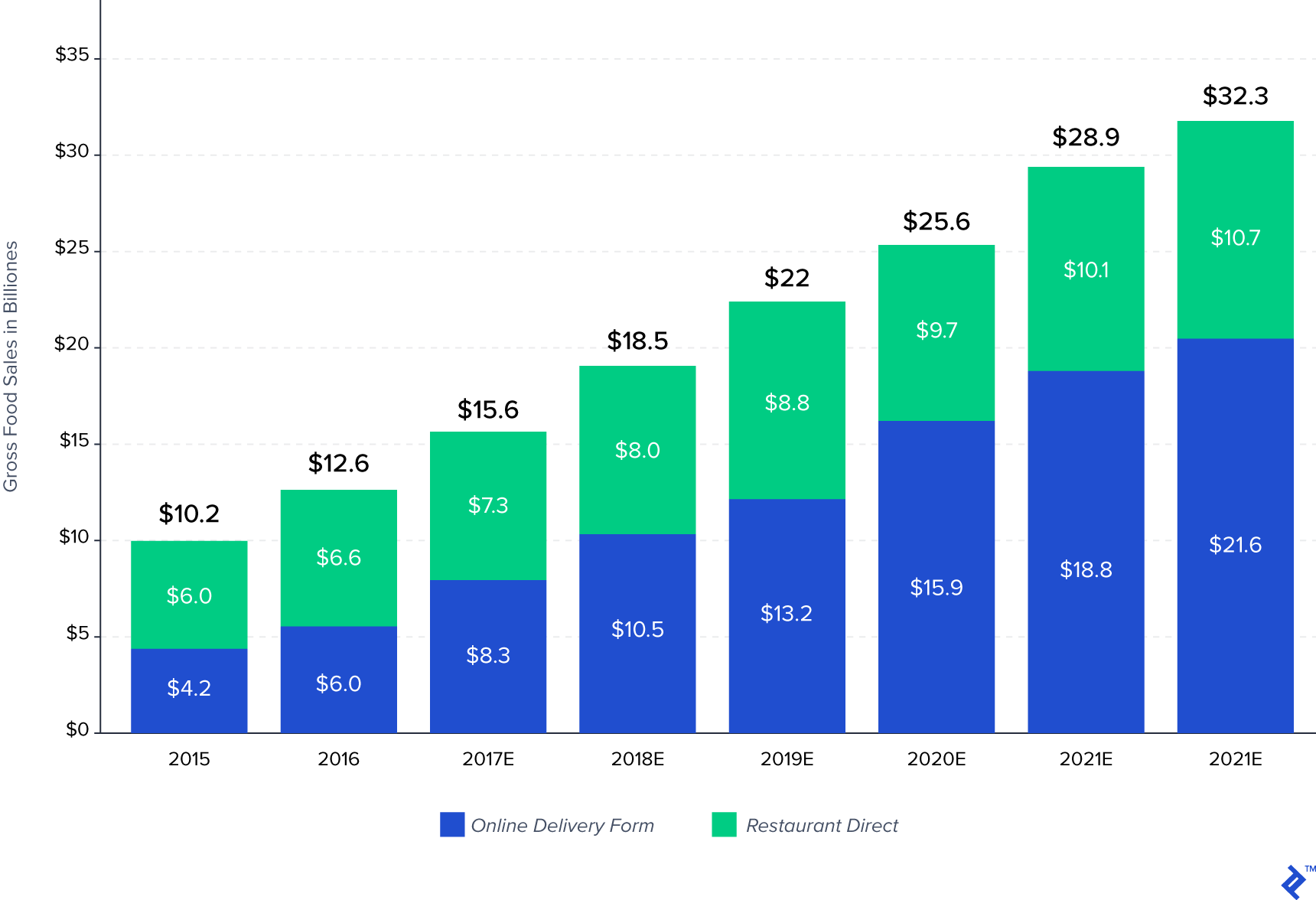

As per Morgan Stanley, 40% of total restaurant sales—$220 billion—could be up for grabs for delivery by 2020, compared with current sales of around $30 billion. Online food delivery could grow by a 16% annually compounded rate over the next 5 years.

Food Delivery Growth

Based on various other reports, the current market size is estimated to be in the range of ~$30–40 billion and is estimated to grow at double-digit growth in developed markets. In developing markets such as India, online food delivery has been growing at a rate of 100% annually.

Kitchen Infrastructure Providers

Next, we’ll discuss the three major players in the cloud kitchen value chain: kitchen infrastructure providers, cloud kitchens themselves, and food aggregators.

These are the companies providing kitchen infrastructure to restaurants. As mentioned earlier, these are commissary kitchens. They house multiple restaurants under one roof, where workers share everything from kitchen space to walk-in fridges to utensils and pickup counters. A restaurant can be started quickly without incurring the capital expenditure required in traditional businesses when it utilizes a commissary kitchen. This enables the business to move quickly without incurring significant upfront costs. Kitchen United, which has raised funding from Google Ventures, describes itself as a provider of “Turnkey solutions for off-premise restaurant expansion.” Travis Kalanick has invested $150 million in City Storage Systems (CSS) which provides distributed kitchen services through its subsidiary Cloud Kitchens. Pilotworks had also raised significant capital from VC investors before shutting down. Uber Eats and Deliveroo have also started with their cloud kitchen services. In India, unicorns such as Zomato and Swiggy have launched kitchen infrastructure services.

Aggregator Apps

The most important role in the advent of cloud kitchens has been played by food aggregators. With services like UberEats, DoorDash, PostMates, Deliveroo, Eat24, Amazon Restaurants, Swiggy, etc., food has become available through just a few clicks. These services charge between 15% and 35% to restaurants as commission. Ideally, restaurants don’t mind the commission due to the order volumes generated by these services.

Meal Delivery - Monthly Sales Growth

However, it may become problematic if an uneconomical commission is required by such apps or a restaurant is solely dependent on one app.

Investment Trends

Traditionally, VCs have not been attracted to the restaurant business, as it is considered a non-scalable model and one in which the expansion can be driven by cash flows generated from business. However, with cloud kitchens, this has changed. Sweet Green, which can be considered the first unicorn in this space, processes 50% of its orders through an app or online platform. India-based Rebel Foods, Faasos’ parent company, is valued at $525 million.

Initially, investors have been focused more on food aggregators due to the scalability of operations. However, the focus has been shifting towards service provides as well as towards cloud kitchen operators. As the aggregator market faces intense competition, we can expect more investment in the first two stages of the value chain.

While in food aggregators, it has been a winner take all approach, for service providers and cloud kitchens we can expect a sustainable growth model.

Emerging Trends

Vertical Consolidation: Existing players are expanding and trying to become full-stack players. An example of this is UberEats entering into cloud kitchen space with the acquisition of Ando. This enables the players to closely control the ecosystem and remain in the dominant position. This might also allow them to follow the “Walled Garden” approach.

Automation: Keatz, a Berlin-based cloud kitchen company that has raised ~$14 million in funding wants to automate the kitchen to the extent where appliances are connected to the internet and are operated by robots. This is said to help in less food waste and a lower need for manpower in the long run.

Recipe Improvement: Startups are also focused on improving recipes for the food. Startups such as Dig Inn are working on recipes where the food is not shipped in the traditional form but with slight changes making it suitable for consumption during transit. UberEats has been working with restaurants to create delivery only menus.

Data-Driven: In order to become efficient, cloud kitchens have to utilize data more efficiently. They have data about time of order, ticket size, location, and which ingredients are used for a specific order. This data provides valuable information about how a food business can continue optimizing its operations. Each data point helps an organization make better decisions.

Will Cloud Kitchens Replace Restaurants?

Traditionally, restaurants have to depend on repeat business for continuing the operations. However, consumer loyalty has not been generated for food aggregators, and restaurants are generally not able to interact with the customer directly. For repeat business, a restaurant has to focus on ambiance, hospitality, service, and food quality. Cloud kitchens do away with the first two requirements. Guests will come back if you have timely delivery and your food tastes good. While restaurants closely guard food quality, delivery is still done by third parties. As mentioned by Jonathan Maze, executive editor of the Restaurant Business magazine, delivery is booming. Many people love it, but it is still a tiny percentage of industry sales. There remains a significant headspace for cloud kitchens to grow. With advances in automation, reduction in costs, and standardization, this business model will become more viable. If you are interested in customized market research reports like this, work with Toptal’s market research specialists.

Understanding the basics

What is a cloud kitchen?

Cloud kitchens are known by various names such as ghost or dark kitchens. But the basic idea remains the same: restaurants have an online presence and their food can be ordered through food aggregator apps or through the restaurant’s own app, but the restaurants themselves don’t have dine-in facilities.

Why do most restaurants fail?

The restaurant industry is infamous for its failure rate. More than 60% of all restaurants fail in the first year of operation, and nearly 80% are closed down by their 5th anniversary. While there can be many reasons for failure, the most common one is location.

How does a cloud kitchen work?

Cloud kitchens can be considered food manufacturing factories, places where food is manufactured and then shipped to the final consumer: the manufacturer is focused on providing quality consistent output at the lowest cost possible without worrying about how or where the product is consumed by the consumer.

Naveen Sharda

London, United Kingdom

Member since March 26, 2019

About the author

Naveen leverages his extensive fundraising and transaction experience to help entrepreneurs and managers drive value for their businesses.

PREVIOUSLY AT