Thinking of Using a SPAC to Go Public? Here's What to Consider

“I know more people that have a SPAC than have COVID” is a common refrain among finance professionals these days. So what’s driving the spike? Is a SPAC IPO right for your company?

“I know more people that have a SPAC than have COVID” is a common refrain among finance professionals these days. So what’s driving the spike? Is a SPAC IPO right for your company?

Aleksey has significant experience raising equity. As CFO, he completed the reverse merger of SELLAS into a Nasdaq-listed company in 2018.

Expertise

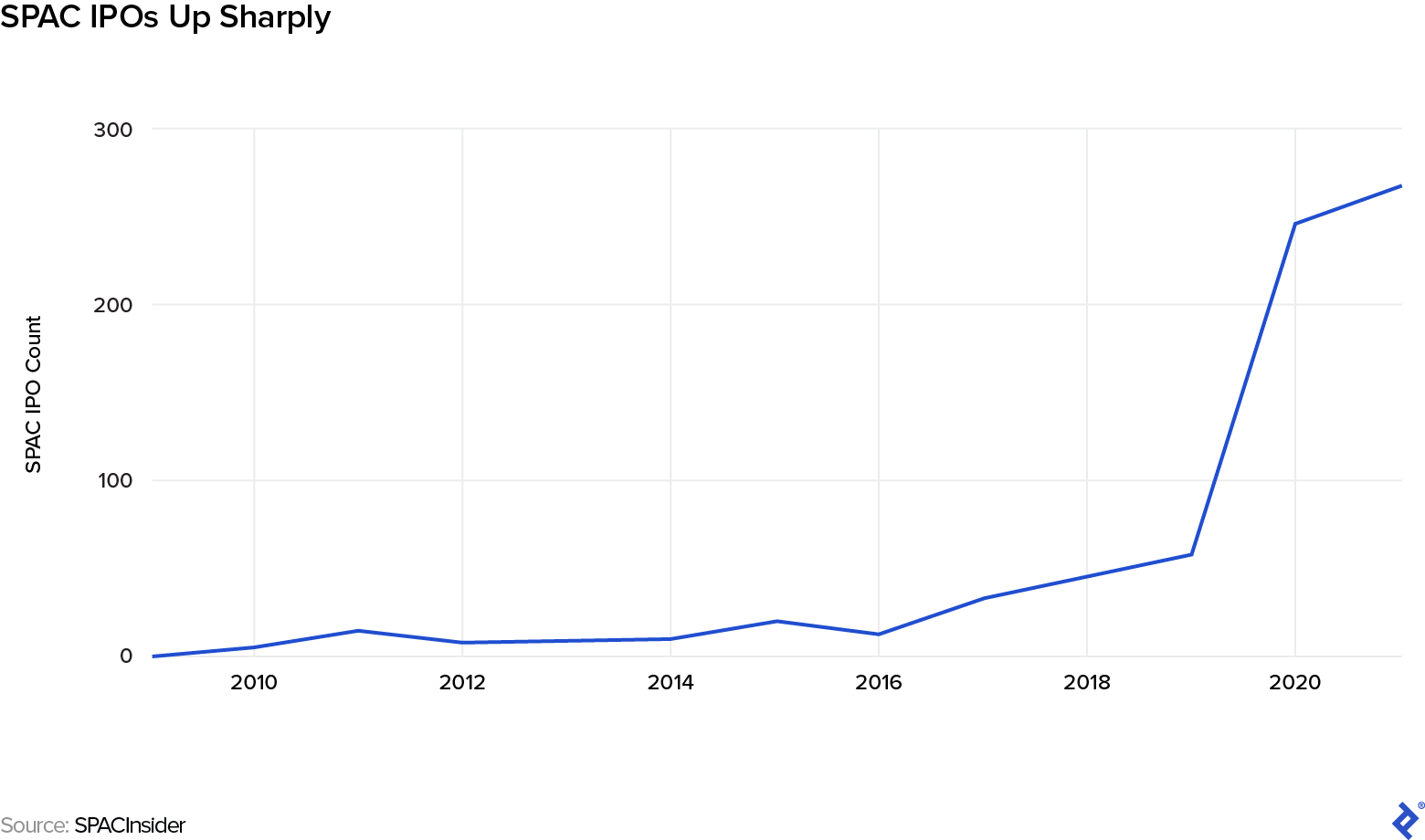

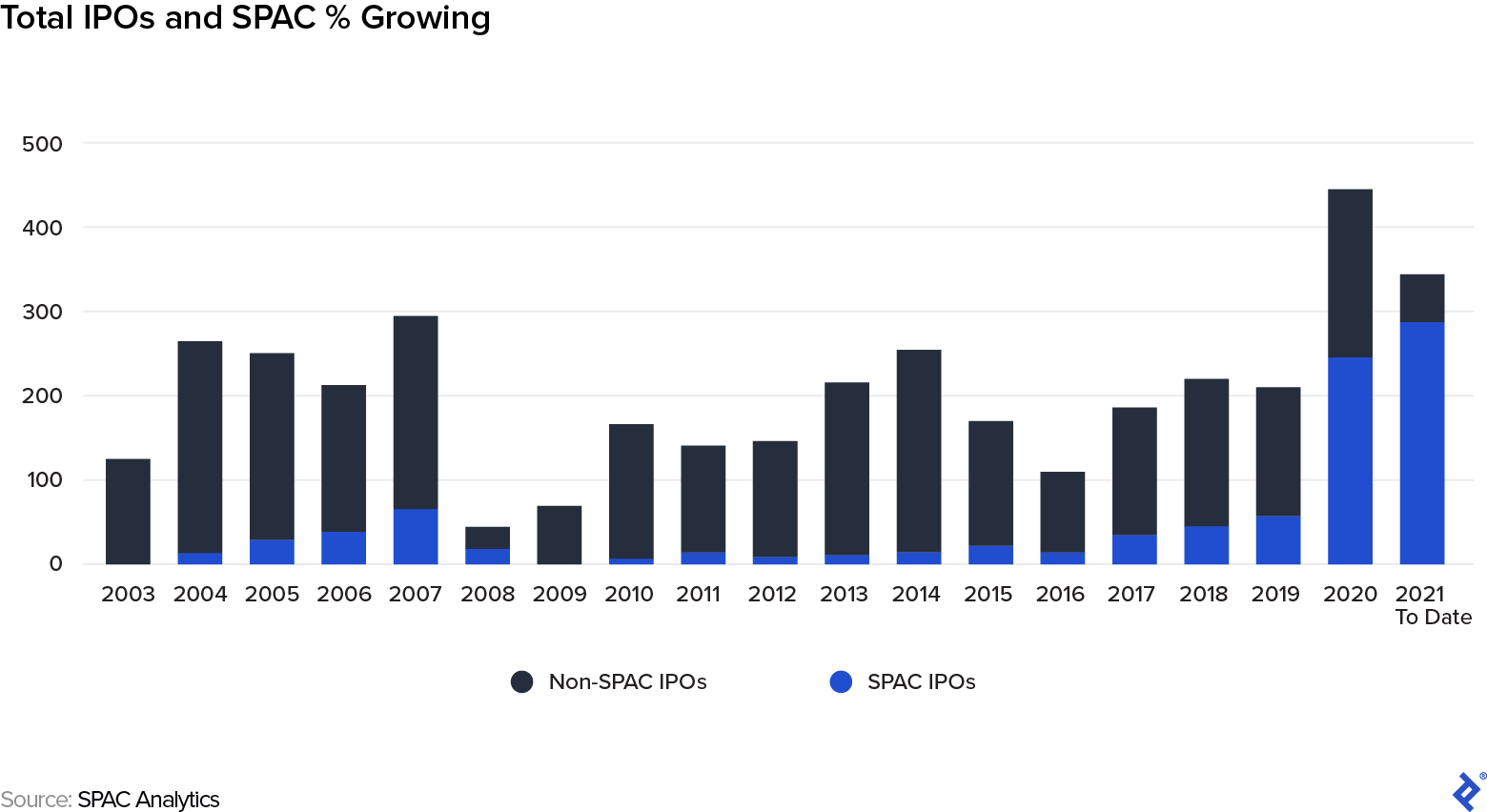

In 2020, 248 special purpose acquisition company (SPAC) IPOs raised $75.3 billion, more funding than in all the previous years since 2010 combined, according to University of Florida professor and IPO expert Jay Ritter.

“I know more people that have a SPAC than have COVID’’ is a common refrain among finance professionals these days.

Shaq has a SPAC.

So what’s driving the SPAC spike?

There are three parties in SPAC transactions that are propelling the popularity.

- Retail investors are tired of watching tech IPOs spike more than 40% in their first few days of trading. As small investors, they’re unable to participate in traditional IPOs. SPACs offer retail investors a shot at investing in a fast-growing, young company.

- SPAC sponsors (the management team that sources the deal) get a blank check with unlimited upside and minimal downside if the deal doesn’t materialize (and a deal almost always materializes). Sponsors contribute minimum at-risk capital and often end up holding a 20% or larger stake; this is known as the “promote.” The rationale for the promote is they are the ones putting the deal together.

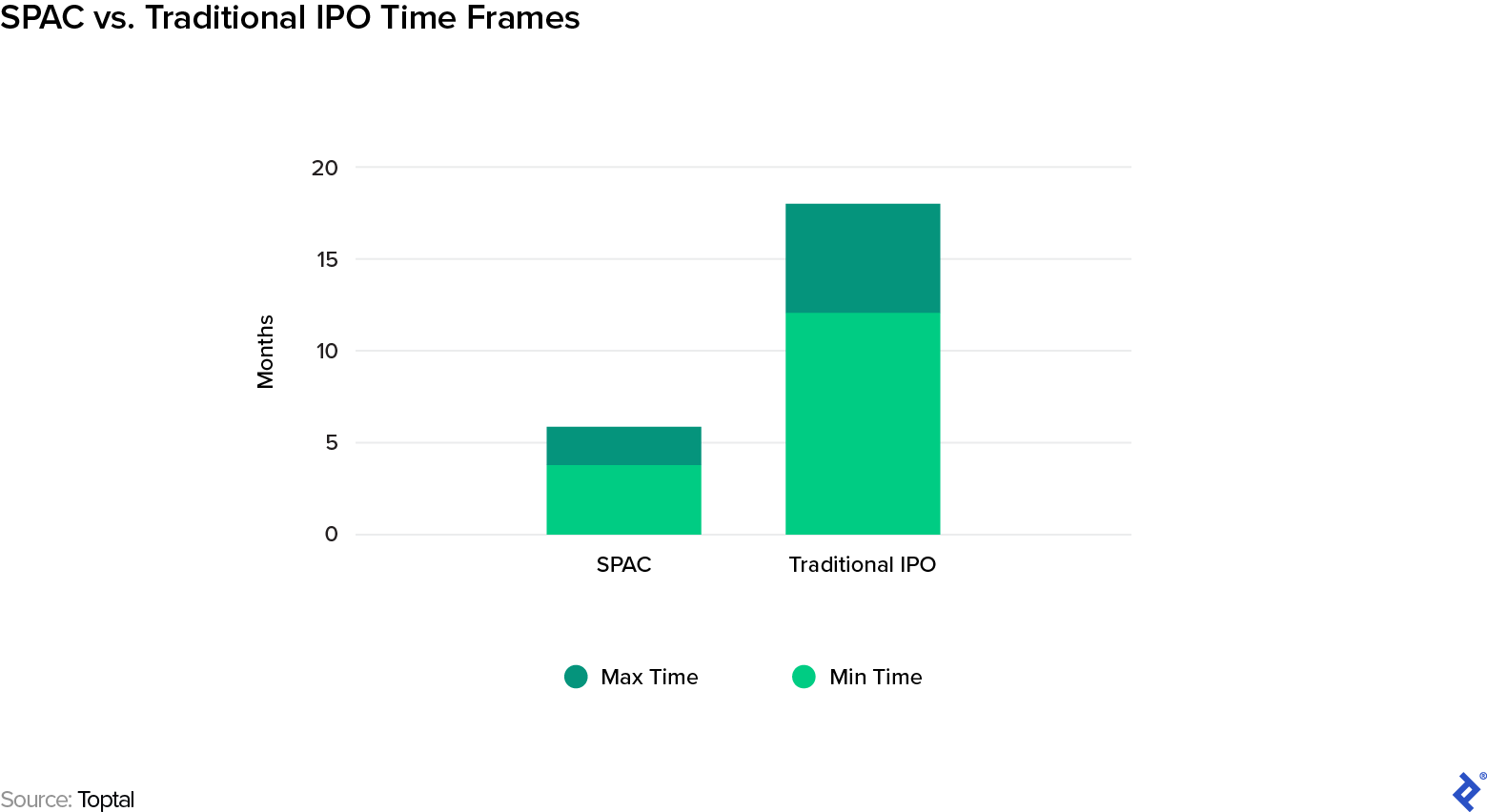

- Private companies get to market faster—in months versus a traditional IPO, which can take more than a year—and unburden themselves of the risk of timing the IPO window. Also, the underwriter fees are slightly lower, as some of the heavy lifting has already been done by the SPAC when it went public.

So, are SPACs a magic bullet for all parties involved? Are there certain companies that are better suited for SPACs? First, let’s do a quick refresh on what a SPAC is and how they work in practice. Then, we’ll move on to an analysis of pros and cons from the point of view of the operating company seeking to go public.

What Are SPACs?

A SPAC is a shell company that pools investor money before it knows how it will deploy it. The SPAC goes public quickly (an a matter of months versus a traditional IPO which can take over a year), as it has no operating history to disclose. Once public, the SPAC looks for a company that wants to go public and they merge—called the de-SPAC-ing transaction. The investors in the SPAC now own a real asset.

Why Privates Are Choosing SPACs

Improved reputation. In the 1980s, SPACs had a shady reputation known for scamming investors. Since then, SPACs have adopted some investor protection measures, like allowing investors to back out if they don’t approve of the merger. The increase in investor protection, combined with more VCs frustrated with the traditional IPO process, led to some serious names becoming SPAC sponsors. In October 2019, Virgin Galactic led the way when it merged with VC Chamath Palihapitiya’s SPAC. This was the first time that a company that Wall Street considered legitimate went public via SPAC. Since then many success stories have followed, among them DraftKings, which IPO-ed via SPAC and has returned 776% as of March 2021.

Increased market volatility. The markets have been volatile. The CBOE Volatility Index (VIX) reached a 10-year high in May 2020. The IPO window appears wide open and then slams shut quickly. This volatility is not kind to the traditional IPO process, which can take more than a year.

Retail investors interested in high-growth companies. One significant drawback of a SPAC for investors is the significant ownership the sponsor takes from the deal. This may reach double digits. Why would investors accept this? Because SPACs give retail investors a chance to invest in “hot” IPOs with high growth and exciting possibilities. Traditional IPOs and direct listings are not available to the general public. In 2020, the mean first-day return of IPOs was 41.6%, according to the University of Florida’s Ritter.

How a SPAC Works in Practice

SPACs are typically formed by sponsors. A sponsor can be a private equity or hedge fund manager, or a team of successful operating executives. The sponsor may have a target in mind, but they cannot legally have term sheets or definitive agreements executed with that target.

Once the SPAC IPO is priced and funded, unlike a traditional public offering, the company does not get the cash. The proceeds are placed into a trust account that pays a nominal interest rate.

Next, the sponsor begins to identify, screen, and negotiate with prospective acquisition targets. Thus begins the de-SPAC-ing process—the merger between the private operating company and the publicly traded SPAC. Once the letter of intent and merger documents are signed, the combined company may close the M&A and put the cash in the trust account. Often, however, deals are accompanied by private investment in public equity financing (PIPE). So if the SPAC initially raised $300 million but found a target that seeks $700 million in capital, the sponsor may raise that additional $400 million via a PIPE from institutional investors, usually at a discounted price.

Once the target is announced, the SPAC shareholders vote on the acquisition. Those who approve the transaction stay on and ultimately participate as shareholders in the combined company. This assumes that the critical mass of “yes” votes is secured to consummate the deal. Those investors who dissent receive their cash back. If some SPAC investors “walk away” from the M&A, PIPE financing may close the gap in the capital sought by the private company.

In this process, there are three parties’ interests to navigate: the company going public, investors in the SPAC, and the sponsors of the SPAC. We will focus the discussion from the perspective of the company going public.

IPO vs. SPAC From the Perspective of the Company Going Public

| Traditional IPO | SPAC IPO | |

|---|---|---|

| Pros | Publicity and credibility | Faster path to becoming public |

| Fundraising | Lower execution risk | |

| Strategic partnership with sponsor | ||

| Lower banking fees | ||

| Cons | Lengthy process | Due diligence risk |

| Execution risk | Lack of readiness for public scrutiny | |

| Higher banking fees | May be considered lower quality | |

| Dilution from the sponsor’s promote (~20%) |

Advantages of SPACs

Faster

A SPAC transaction is a merger; it can be a reverse merger, a merger of equals, or SPAC owners can dominate the cap table post transaction. Yet, because the SPAC was prepared, filed, and managed for the purposes of executing a merger, it is likely faster (and cheaper) than a traditional IPO for the acquired company. The typical IPO process can take one to two years from start to finish, while a SPAC merger only takes three to four months.

Lower Banking Fees

Because the funding is already raised (and funded in the trust account), the banking fees may be somewhat lower than a traditional IPO’s 7%. The underwriting discount for a SPAC IPO is about 5.5%, with 2% paid at the time of the IPO and the remaining 3.5% paid at the time of the de-SPAC transaction (i.e., target business acquisition).

Lower Dependence on Market Conditions (IPO Window)

With a SPAC, the capital formation transaction is decoupled from the exchange listing exercise. The funding is already raised and sitting in a trust account. Assuming the management of the private target, together with the sponsor, can sell the story to investors and convince them to vote to approve the merger, the transaction can be done even during an economic crisis or bear market.

Strategic Partnership From Sponsor Leadership

Even after the merger, the sponsor does not disappear. They tend to stay involved either as consultants, advisers, board members, or in some other nonexecutive capacity. This link can be helpful to the management of the private company (especially if such a team is young and/or does not have a lengthy track record running and/or funding a public company), and can be a valuable resource in continuous governance and follow-on financing efforts.

Shell With Cash

Cash is an extremely valuable asset for M&A transactions involving private companies seeking access to public markets. SPAC solves for that quickly.

Clean

From the diligence perspective, SPAC is the cleanest “no hair” shell one can hope for. Of course, one still has to perform due diligence on its capital structure, charter, and rules of governance, but it is highly unlikely that a SPAC would come with significant contingent or litigation-tied liabilities. Its history is short and they are truly non-operating shells, hence diligence of the entities is fairly simplified.

SPAC Disadvantages

Poor Returns Once Public

An analysis of the 30 most recent SPACs found that so far, their average return is -0.2%, according to data from SPAC Analytics. An analysis of IPO data from the University of Florida’s Ritter shows that from 2015 through 2020 the mean initial return (measure from the offer price to the first close) for traditional IPOs was 41.6% versus 0.7% for SPACs. For founders, this could be a positive, indicating that there was minimal capital left on the table. However, the management team will need to navigate lofty investor expectations going forward, as retail investors may believe they got in early on a “hot” IPO.

Lack of Readiness for Compliance and Regulatory Requirements

Once a company is public, it has to operate as such, in compliance with regulatory requirements. This includes publishing of financial reports and disclosures periodically, conducting shareholder meetings, or working within strict governance and financial controls frameworks imposed by the securities laws and enforced by the SEC and exchanges (e.g., Nasdaq). Furthermore, unlike an IPO, in which management teams have the luxury of doing trial runs and making mistakes while the company is preparing for the IPO, managers don’t have that luxury. Mistakes can be costly and have long-lasting ramifications. Sponsors should start prepping early, operating as a public company while it’s still private.

Companies often utilize consultants at this stage to provide administrative resources, infrastructure, and discipline to meet these requirements.

Fees and Dilution for SPAC Investors

An often overlooked item is the sponsor’s promote. This is a stake of the target company that the sponsors get and it can be as high as 20%. Let’s say a $100 million SPAC invests $100 million into a target company. In the transaction, the SPAC sponsor gets $20 million worth of additional shares. Who pays that? Technically, the target pays it but, depending on the valuation, the retail investor is really the one who ends up paying it. The target company is aware of the promote before they close the deal, so they know the additional percentage they will be giving up. Therefore, the private company must negotiate for a higher valuation to capture the value diluted by the promote.

The sponsors benefit if the stock price performs well after the merger transaction and have limited exposure if the stock does not. This misalignment of interest may create interesting negotiation dynamics around valuation and compensation structures in the de-SPAC-ing transaction.

Additionally, sponsors’ underwriters may charge as much as 5% to raise capital for the SPAC, but the terms of the deal are as such that only a portion of that fee is paid in cash at the IPO closing (e.g., 2%); the balance of the fee is either deferred and becomes payable upon the de-SPAC-ing transaction closing. So the optics may appear compelling (e.g., 2% underwriter fee on $250,000 in legal drafting/printing/filing fees is a steal!) but more fees become due and payable once the transaction is complete.

The Spike in SPACs Will Create a Lot of Demand for Privates

SPACs normally have two years to find a merger target. As they approach the expiration of their terms, the pressure on the sponsor to de-SPAC grows. Seeking extensions is expensive, as that involves paying legal and other advisers to organize and conduct shareholder meetings. Further, sponsors normally give up some economics every time they seek an extension. Not acting and returning cash to investors is laden with meaningful reputation risk and likely makes it more difficult to raise capital going forward.

I expect that in the next 12-18 months, as a result of a huge wave of SPAC IPOs in 2020, the growing pressure on sponsors to consummate deals will likely create a compelling environment for private companies to negotiate deals. While the enormous supply of SPACs creates favorable supply/demand balance for private companies, if the 430 US SPACs looking for acquisitions begin to run out of reasonable targets, the trend will encounter tension. According to an analysis by INSEAD professor Ivana Naumovska in the Harvard Business Review, more than 300 of those SPACs need to find assets to merge with in 2021 or they will need to be liquidated. For reference, there were 450 total IPOs in 2020—the highest number in at least 17 years.

Whether a private company decides to SPAC, direct list, or do a traditional IPO, it is reassuring to have an experienced CFO or IPO consultant on board, as they don’t receive fees based on the size of the deal, a piece of the equity, or an underwriter’s fee. Their goal is simply to create the best outcome for their client.

Understanding the basics

What does SPAC mean?

A SPAC is a special purpose acquisition company.

How does a SPAC work?

A sponsor raises money to create a shell company. That shell company goes public quickly as there is little to disclose. Then, the shell company, known as a SPAC, looks for assets to acquire. Once acquired, the sponsor usually receives about 20% of the company for a nominal fee.

What is a SPAC vs. IPO?

A SPAC IPO occurs when a private company merges with an already-public shell company. This method is much faster than a traditional IPO, in which a company must file documents with the SEC on its own.

New York, NY, United States

Member since November 15, 2016

About the author

Aleksey has significant experience raising equity. As CFO, he completed the reverse merger of SELLAS into a Nasdaq-listed company in 2018.