AI Investment Primer: A Practical Guide to Appraising Artificial Intelligence Dealflow (Part II)

In part I of this two-part series, Toptal Finance Expert Carolyn Deng provided an overview of the world of AI aimed at investors, with a focus on understanding what factors make for a great AI company. In this follow-up post, she outlines five practical steps investors should follow when diligencing a potential AI investment.

In part I of this two-part series, Toptal Finance Expert Carolyn Deng provided an overview of the world of AI aimed at investors, with a focus on understanding what factors make for a great AI company. In this follow-up post, she outlines five practical steps investors should follow when diligencing a potential AI investment.

A Wharton MBA and CFA, Carolyn has executed 20+ VC/PE deals, managed a $700M portfolio and is a fundraising, growth and M&A specialist.

Expertise

PREVIOUSLY AT

Executive Summary

Five things one needs to diligence an AI investment:

- Customer desirability (is this business solving a worthwhile customer problem?)

- Commercial viability (will the business make enough money?)

- Technical feasibility (can it actually work, at scale?)

- Common (and hype-prone) misunderstandings related to AI

- Financial and business metrics

Customer desirability diligence:

- To start with, one needs to ask: What problem(s) is the business trying to solve with AI technology?

- an AI business is not desirable, when: (a) it is targeting a problem that not many people care about or can pay for, (b) it is targeting a pain point but too many problems need to be solved to address that pain point, and (c) it is trying to solve too many problems at the same time.

- A tricky issue relates to when a business is trying to solve a mission-critical problem meaning that the solution of the problem has a very low tolerance for error. The potential risks and returns for mission-critical projects, such as self-driving cars or medical applications, are both bigger than non-mission critical ones, making it a tougher issue to handle.

Commercial viability diligence:

- Mature businesses spending money to develop an AI application should have a robust business case to justify the upfront investment.

- For an AI startup, especially if it's pre-revenue, an important question is whether the target addressable market is big enough.

- Another aspect that must be considered is the investment horizon since deeper AI tech takes longer to develop.

Technical feasibility diligence:

- Developing a machine learning algorithm requires access to clean and well-labeled data. One, therefore, needs to know whether they have access to usable data, how they obtained it, and whether they can continue to obtain such data.

- An AI business needs to develop robust, scalable algorithms. To achieve that, there are three must-haves: the large amount of well-labeled data discussed above, the right talent, and the confidence that machine learning is the suitable technology to solve the problem.

- AI businesses must have the ability to acquire extensive computing power. There are therefore two key questions: 1) How much computing power is a typical task required for this business? Is such computing power available today? 2) Can the business afford such computing power?

Common (and hype-prone) misunderstandings related to AI:

- Some companies are really just developing new digital businesses, or rule-based non-machine learning algorithms, but claim they are AI, because of the attention and better valuation AI business gets. During due diligence one should ask for details on the underlying technologies that are being employed, and if the company has not hired a whole team of data scientists and AI engineers one should be dubious.

- Sometimes machine learning mixed with old-fashioned human intervention can work better than just AI.

- There is a big difference between scientific AI prototypes and commercially scalable solutions. Typically a scientific prototype can be developed by one talented data scientist using a quick prototyping software in just a few months. A commercially scalable prototype instead requires significant funding, access to large amounts of data, advanced and scalable algorithms, and access to strong talent.

In a prior post, I went through a basic primer on the field of AI for investors interesting in putting money work in the space. In particular, I discussed a few essential elements that each investor should know in order to make more informed investment decisions:

- What is AI?

- What is special about the current wave of AI?

- What are the four critical components of a successful AI application?

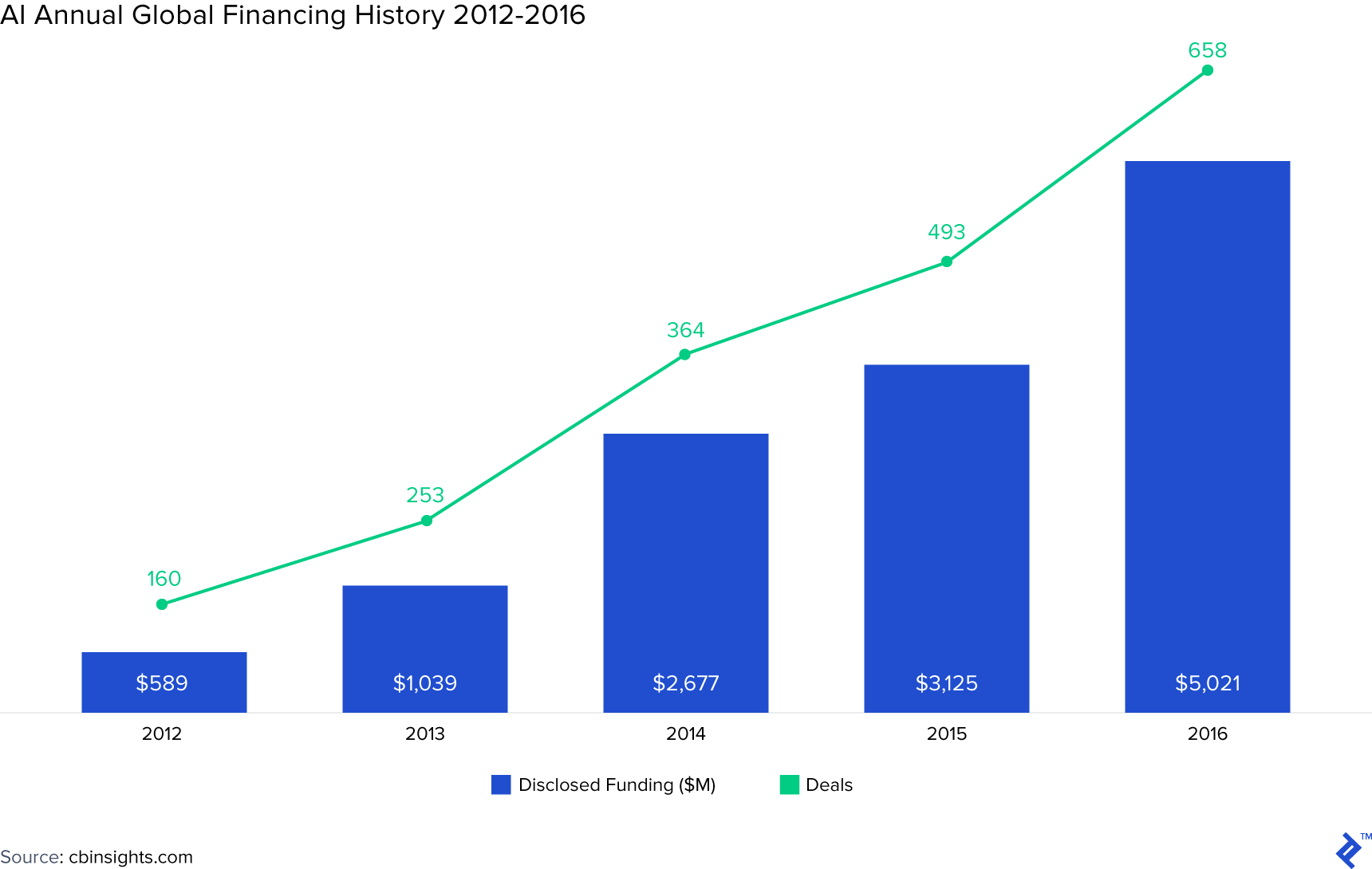

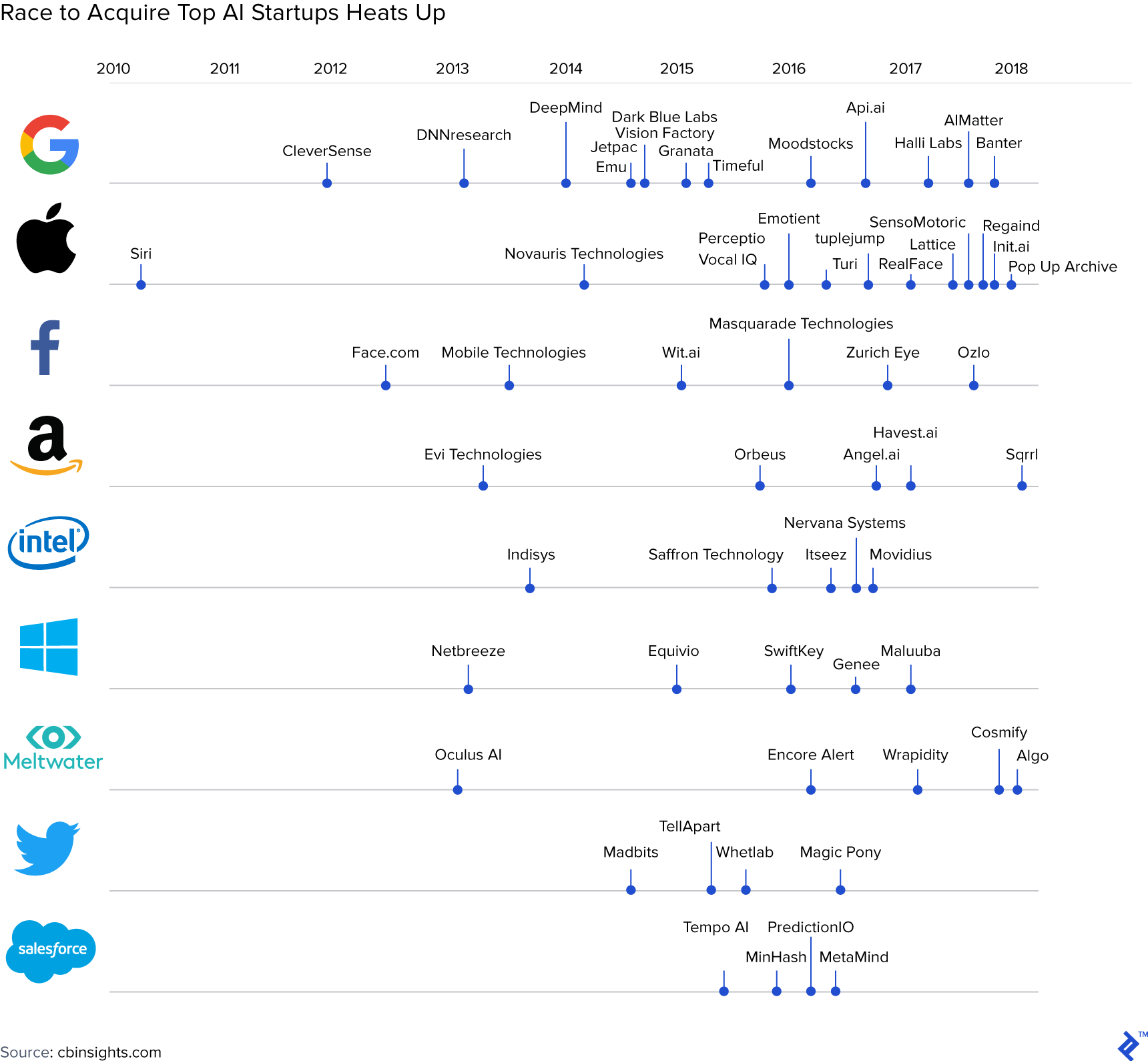

As was discussed, the world has witnessed an explosion of interest in the topic. And unsurprisingly, investment dollars have followed a similar path. According to CB Insights, deals and dollars to AI startups have been rising since 2012, with a huge jump of 60% in invested capital to $5 billion in 2016. Statista estimated that in 2017, global AI startups received $15.2 billion in investment, an exponential 300% increase from 2016. In addition, the big tech companies are snatching up AI startups to get ahead in the AI race.

This follow-up post is intended to be a more practical guide for investors who are evaluating investment prospects in the space. In particular, I will run through the five critical steps to evaluate an AI-related investment:

- Customer desirability (is this business solving a worthwhile customer problem?)

- Commercial viability (will the business make enough money?)

- Technical feasibility (can it actually work, at scale?)

- Common (and hype-prone) misunderstandings related to AI

- Financial and business metrics

Please note: I will use the examples of some well-known publicly traded companies. I do not endorse or discourage readers to invest in these companies.

Step 1: Customer desirability

In my opinion, this step is the most important of the five outlined in this article. To start with, you need to ask yourself - What problem(s) is the business trying to solve with AI technology? For example, self-driving cars can improve mobility experience by making it safer, more convenient, etc. Machine translation makes it easier for humans to communicate with each other. In contrast, an AI business is not desirable, when:

- It is targeting a problem that not many people care about or can pay for.

- It is targeting a pain point but too many problems need to be solved to address that pain point.

- It is trying to solve too many problems at the same time.

Another tricky issue relates to when a business is trying to solve a mission-critical problem. By this, I mean that_ the solution to the problem has a very low tolerance for error_. For example, if an autonomous vehicle AI software’s error is 0.001%, even if that is objectively already a very low error rate, it is still not tolerable. 0.001% means it can have 1 accident every 1000 hours it drives and potentially cause loss of lives. On the contrary, if you get the wrong Amazon or Netflix recommendation even only 1% of the time, no one will die. The potential risks and returns for mission-critical projects, such as self-driving cars or medical applications (e.g. medical diagnosis, surgical robots), are both bigger than non-mission critical ones, making it a tougher issue to handle.

Step 2: Commercial viability

For mature businesses spending money to develop an AI application, they should have a robust business case to justify the upfront investment. For example, IBM CEO Virginia Rometty wants IBM Watson to generate $10 billion in annual revenue before 2024. For an AI startup, especially if it’s pre-revenue, an important question I always ask is: is the market big enough for the type of problems the company is solving? For example, if the company is developing an AI application for a very specific country in a specific industry with a maximum market potential of $1 million per year, would you invest in it?

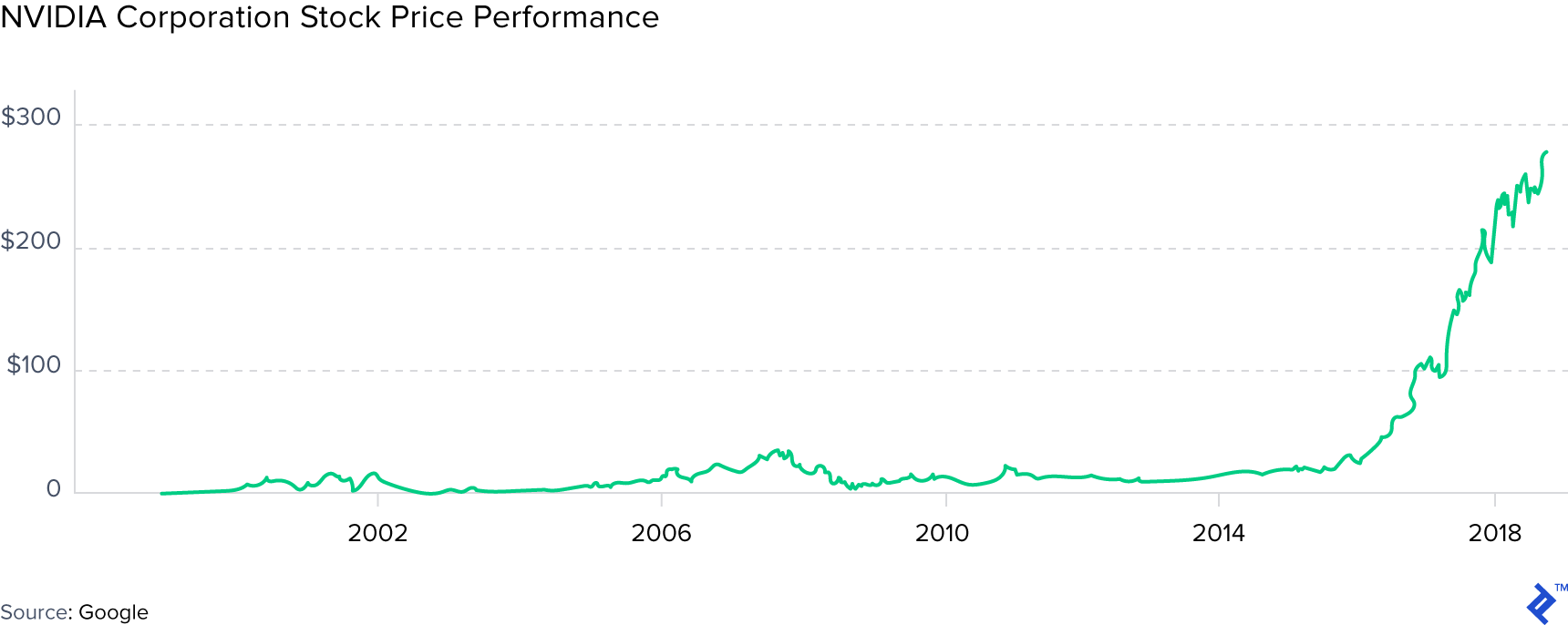

Another aspect you need to consider is the investment horizon. Deeper AI tech takes longer to develop the product. For example, Waymo (Google’s autonomous driving vehicle company) has been testing this technology since 2009 and still hasn’t released a commercial product. Deeper AI tech companies can also take a long time to get the market recognition and subsequent investment returns. Take Nvidia (NASDAQ: NVDA) as an example. Nvidia supplies the most popular chips, GPUs, for computing the neural network algorithms used in many computer vision applications, including self-driving cars. Looking at the stock price chart below, one can clearly notice the famous “S curve” pattern that you see in many innovative businesses. But the timing is significant: if you invested in Nvidia since its IPO in 1999, you wouldn’t have seen the handsome return until after 2016, when deep learning AI became “in fashion”.

Step 3: Technical feasibility

As discussed in my other article, I believe there are four key components to a machine learning (including deep learning) product’s success: well-defined and desirable problems, clean and well-labeled data, robust algorithms, and extensive computing power. The last three determine the technical feasibility of the AI business. Here I will discuss briefly what these components mean and how do one can conduct due diligence as an investor.

First, developing a machine learning algorithm requires access to clean and well-labeled data. This is because, as previously mentioned, these algorithms are built by feeding different statistical models a large quantity of data that are well labeled to establish the necessary predictive relationships. As you research the AI business, you need to know whether they have access to usable data, how they obtained it, and whether they can continue to obtain such data. Or, if they don’t already have the data, what is their plan to collect such data? The trend of democratizing consumer data and initiatives such as open banking will provide a lot of opportunities for new AI applications.

Second, an AI business needs to develop robust, scalable algorithms. To achieve that, there are three must-haves: the large amount of well-labeled data discussed above, the right talent, and the confidence that deep learning is the suitable technology to solve the problem. A key question is therefore: can the business attract the right talent? Top AI talent, especially data scientists and engineers and programmers already experienced with AI, are snatched up by tech giants such as Google, Facebook, Microsoft, and IBM, leaving very few for other corporates and startups. To attract top talent, not only would they need to be prepared to pay hefty salaries (e.g. employees of Google’s DeepMind lab earn on average ~US $345,000 p.a.), they also need a convincing vision. In addition, you need to ask whether deep learning is the most suitable technology to solve the commercial problem. For example, for a robo-advisor application for retail investors’ asset allocations, a rule-based program can be much less costly to develop and easier to implement than a deep learning algorithm. In contrast, a machine learning algorithm with the ability to learn from past mistakes and victories, and that can continue to improve itself, is a better candidate for a hedge fund investing algorithm. Currently, the areas that have achieved the most breakthroughs and that are most suitable for deep learning technologies are natural language processing (e.g. machine translation), computer vision (e.g. facial recognition, driverless cars), and game playing (e.g. AlphaGo, evolutionary investment decision making).

Third, the business needs to have the ability to acquire extensive computing power. As discussed in detail in my prior article, computing power from either cloud computing or one’s own GPU servers is costly. There are two key questions you need to ask for diligence this aspect: 1) How much computing power is a typical task required for this business? Is such computing power available today? This is especially important for applications that require real-time processing but have only limited available space on the actual device to accommodate GPUs and batteries (e.g. drones). 2) Can the business afford such computing power? For example, Kaifu Lee tells an interesting story in his book, Artificial Intelligence, that a deep learning startup that he invested in spent 7 million RMB (~1 million USD) in the first 3 months just to buy deep learning computing servers. He further emphasizes that today, a typical deep learning model training task requires one or multiple computers that have four to eight high capacity GPUs. Many computer vision tasks require hundreds and thousands of GPU clusters and emit 10x more heat than a normal server. Some of the startup teams in these fields had to redesign AC systems or buy huge chunks of ice to cool down the servers.

Step 4: Common (and hype-prone) misunderstandings related to AI

- Some companies are really just developing new digital businesses (e.g. process automation for banks), or rule-based non-machine learning algorithms, but claim they are AI, because of the attention and better valuation AI business gets. In your due diligence, you can try to find out these disguises by asking them questions such as what underlying technologies they are employing? If they have not hired a whole team of data scientists and AI engineers since they claim they use “AI”, whether through contracting to other tech companies or in-house, then it can be a red flag.

- Sometimes machine learning + human intervention can work better than just AI. For example, recently, the Chinese translation technology company, iFlytek, broke a controversy when their supposedly simultaneous machine translation device was discovered to be merely listening and copying a human simultaneous translator’s voice. iFlytek later explained that real-time translation is not currently possible at the speed and accuracy required. They think the combination of human and machine intelligence brings the best solution for results.

- Lastly, my main lesson learned from my startup experience (also a cautionary tale for aspiring entrepreneurs and investors) is that there is a big difference between scientific AI prototypes and commercially scalable solutions. Typically a scientific prototype can be developed by one talented data scientist using a quick prototyping software (e.g. MatLab), in just a few months using, by way of example, 1000 to 10,000 data points. A commercially scalable prototype, as discussed earlier, requires: 1) funds to hire AI specialists (data scientists, architects, software engineers, product managers), 2) training datasets with tens of millions of data points, 3) computer program (in e.g. Python, C++, etc), 4) funds to buy deep learning computer servers or cloud computing solutions on Amazon AWS, Google Cloud, Microsoft Azure, etc.

Step 5: Financial and business metrics

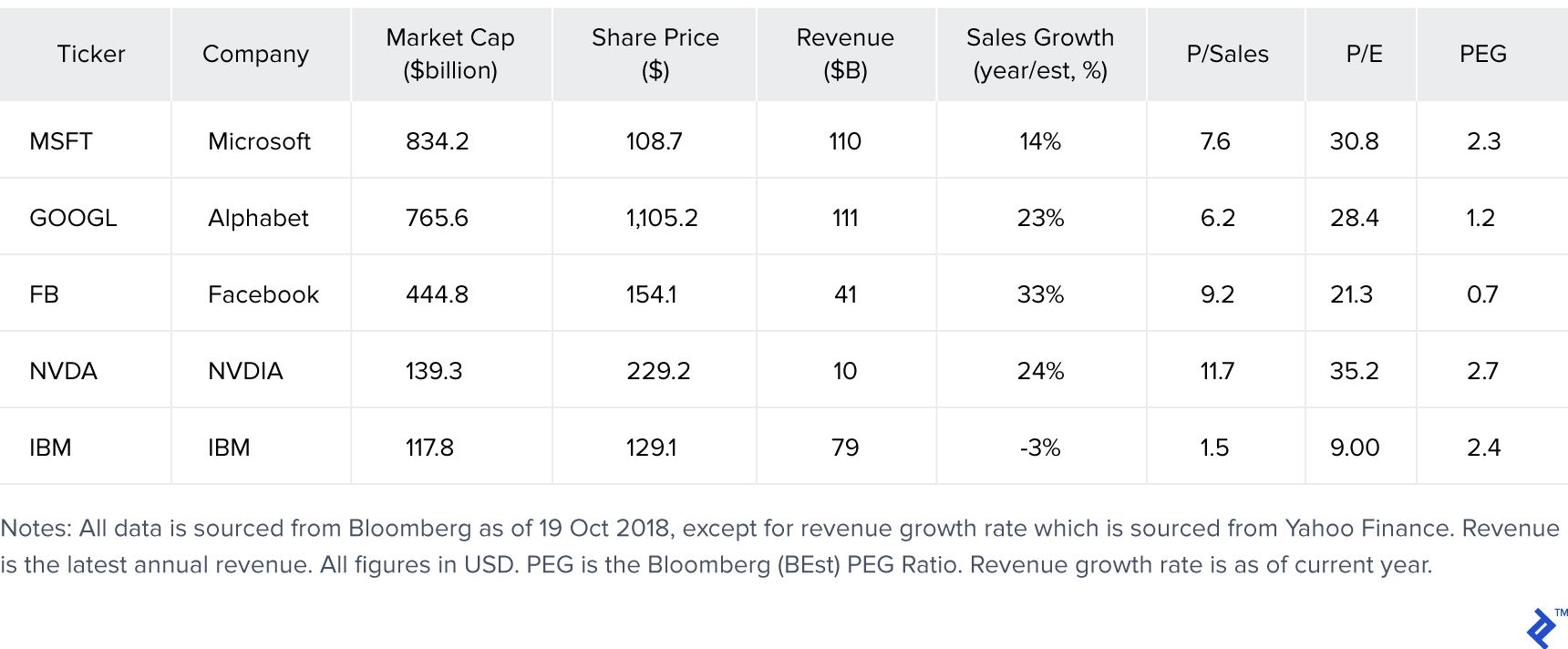

Finally, you should diligence the AI business’ financial statistics and its non-financial business perspectives, and evaluate it as how you would do for any other tech companies. See the example analysis as illustrated in the table below.

The traditional financial and non-financial metrics to value the business include revenue, net income/cash flows, revenue growth rate, ratios (P/E, P/S, etc), macroeconomics, competitors, regulation, etc. Tech companies also have their own unique characteristics. One example is that the growth rate can be more important than profitability. For early-stage tech startups, user statistics such as active users and bookings are more important than revenues or cash flows. The valuations can be higher due to the demand for such investments. For example, the P/E ratio for Nvidia (NVDA) is at ~30x P/E, while McDonald’s (MCD) is trading at ~20x.

There are many investment books about how to value a company so I am not going to delve into that in too much detail here. If it’s a public company, you can get these details from public filings such as financial reports, or from market data providers such as Google Finance or Bloomberg. If it’s a private company, you can contact the company management to get the necessary details.

Conclusion

In summary, in my opinion, I think the most desirable attributes for an AI investment in the short to medium term (and therefore what makes a good AI investment), are: 1) solving a well-defined desirable problem and 2) non-mission-critical (no one will die if it fails). These cases include the areas of smart customer service such as chatbots (not purely rule-based), medical imaging diagnosis, facial recognition, machine translation, AI financial advisors, computer gaming, etc. Of course, for the long term, the high risk/high reward mission-critical problems (e.g. driverless cars) are the prizes many have their eyes on. Once you determine they have a desirable problem to solve, you can analyze their commercial viability, technical feasibility, financial statistics, and business metrics.

You also need to think about the specific AI verticals you want to invest in. Different AI verticals have different urgency of customer demand and technology readiness, and therefore different investment returns and risks. You can invest in hardware vs. software vs. platform vs. service, and in different industries such as financials, education, healthcare, industrials. In a subsequent article, I will discuss how you can start investing in AI including the most promising verticals and technologies, investment style (passive vs. active), and geographies (US vs. China vs. rest of the world).

Understanding the basics

What companies are involved in AI?

Many of the giant tech companies are involved in AI: Google (Alphabet), Microsoft, Amazon, Apple, IBM, Facebook, etc. Each firm is developing different AI-based applications. For example, Google’s self-driving (Waymo) involves computer vision. IBM’s Watson is very strong in natural language processing.

What is Google’s DeepMind?

DeepMind is a subsidiary of Alphabet (Google’s parent company) which was acquired by Google in 2014. It was a leading neural network technology startup founded in 2010 by Demis Hassabis, Shane Legg and Mustafa Suleyman. DeepMind made the headlines after its program AlphaGo defeated Go player Lee Sedol in 2016.

What is an AI platform?

An AI platform is a hardware architecture or software framework business that other businesses can use to develop new AI applications on. Top AI platforms include Microsoft Azure, TensorFlow, Infosys Nia, etc. Using these platforms can often expedite the development and save money, therefore “democratizing AI”.

Carolyn Deng, CFA

Singapore, Singapore

Member since July 20, 2017

About the author

A Wharton MBA and CFA, Carolyn has executed 20+ VC/PE deals, managed a $700M portfolio and is a fundraising, growth and M&A specialist.

Expertise

PREVIOUSLY AT