Meal Kit Industry Blues: How Can Blue Apron Lift Its Malaise?

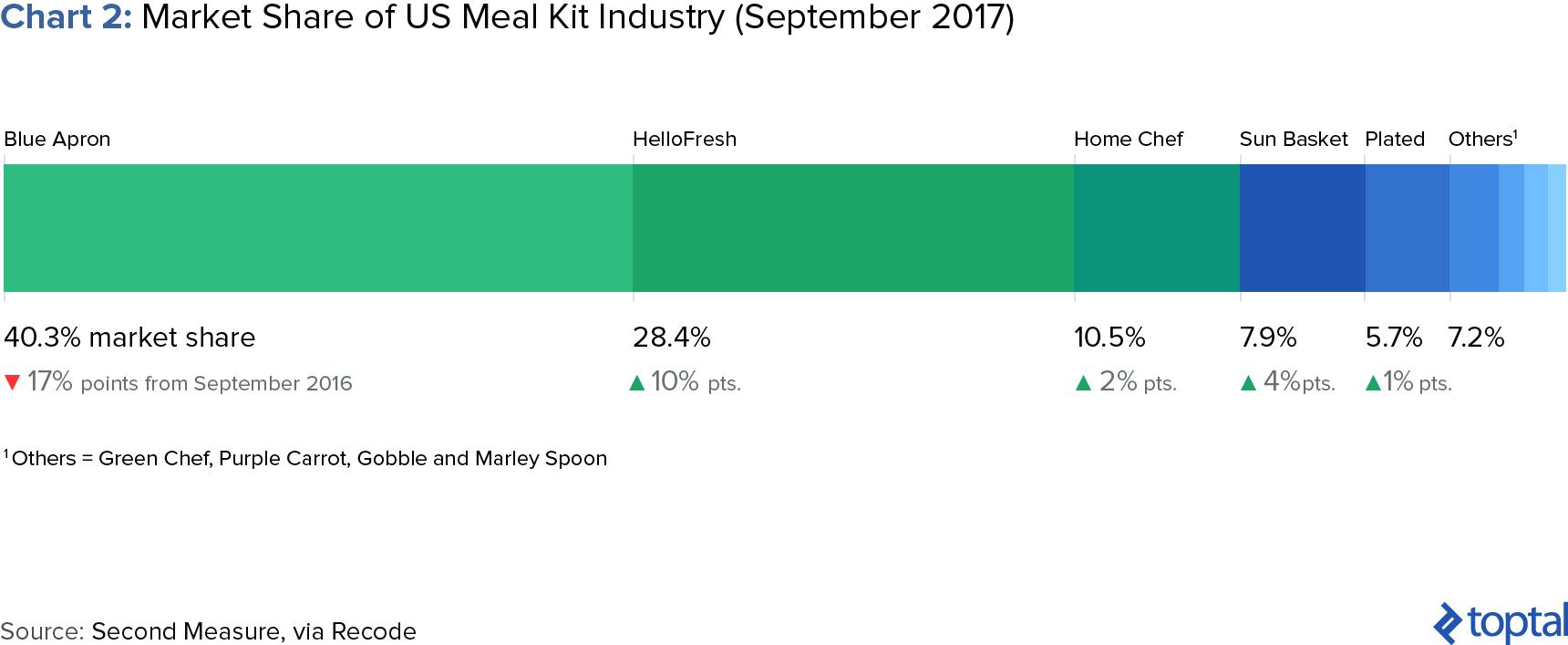

In the past five years, Blue Apron has brought meal kits to the masses and commands a 40% market share in the USA. Yet all is not rosy; its financial losses have continually accelerated and it has ceded 17% of its market share in the past year.

Amazon buying Whole Foods on the eve of its 2017 IPO could have just been bad luck, or prescient signs of what’s to come for Blue Apron. This article looks at ways that the business can get its house in order and win back the Millennial kitchen.

In the past five years, Blue Apron has brought meal kits to the masses and commands a 40% market share in the USA. Yet all is not rosy; its financial losses have continually accelerated and it has ceded 17% of its market share in the past year.

Amazon buying Whole Foods on the eve of its 2017 IPO could have just been bad luck, or prescient signs of what’s to come for Blue Apron. This article looks at ways that the business can get its house in order and win back the Millennial kitchen.

Mike’s an expert in the consumer goods and logistics space. As a PE investor he has sold and invested in a range of businessess

Expertise

PREVIOUSLY AT

Executive Summary

What is the attraction of the meal kit business?

- 96% of Americans still do their weekly shopping in-person at a supermarket. One such way that startups are tackling the "digitization" of this sector is through meal kits. These are home delivered boxes containing freshly prepared ingredients that the consumer then cooks in their own time.

- For the consumer, they save time on buying ingredients, reduce waste by 62% through having the exact ingredients, and can discover new recipes in a less intimidating way.

- For the startups that sell them, meal kits are a potentially lucrative recurring revenue business, via its subscription-based model. It also provides access to personalized data insights relating to the habits and eating preferences of consumers.

- The meal kit industry is capitalizing upon a trend whereby millennial consumers are spending more money on food, but they want healthy options. 81% of millennials believe that meal kits are healthier than traditional take-out models. In a world where people are working and staying single for longer, meal kits also fit more suitably into these lifestyles.

What's going wrong at Blue Apron?

- After pioneering the industry's growth alongside HelloFresh since 2012, Blue Apron currently has a 40% market share in the US. But it has lost 17% of this share in 2017.

- It IPOed in June 2017, but has lost 70% of its share price value in the proceeding months. Its financial losses have also accelerated, they stand at a $171 million deficit for the first three quarters of 2017, six times greater than the previous year's equivalent.

- With $266 million in the bank and both equity and debt financing options looking constrained, Blue Apron needs a path to profitability within the next year.

How can it improve this?

- Blue Apron needs to increase its prices, it is leaving too much value on the table. Despite selling its meals for less than $10, food critics have said they would pay 3x that amount for the same meal in a restaurant. The benefit of buying portioned ingredients for single shoppers is huge; meal kit businesses save consumers almost half the price of collecting the ingredients themselves.

- Raising prices by $1 will add approximately 5% to Blue Apron's gross margin and removing its blanket same-price policy will remove discrepancies between meat and vegetarian costings.

- Blue Apron needs to find an ally in the form of a grocery chain. This will assist it greatly with reducing its logistical burden and offer a natural environment in which to convert more consumers to online grocery shopping and hence, grocery kits.

- Its revenue per customer has declined to below $230; higher than its acquisition costs of $147 range, but its 72% churn rate renders these economics unprofitable.

- Despite its attractive discounts, Blue Apron has still lost 100,000 customers in the six months to Q3 2017. Reducing discounts should help to arrest this slide, as it will deter low-value customers who ditch and switch after receiving sign-up benefits.

Is Amazon going to change everything (again)?

- Amazon buying Whole Foods and starting its own meal kit pilot may not be the death knell for meal kit startups. It could have the same effect of growing the overall market through increased awareness campaigns, as Starbucks saw when McDonald's entered the cafe market.

- Blue Apron cannot compete with Amazon at scale, instead it must focus on providing quality meals, unbiased with their suggestions and ingredients. It has years of data that it should use to tailor meals better and it must challenge new meal kit consumers to trade up and use Blue Apron: the specialist provider.

Business as Usual for Supermarkets?

An industry generating $650 billion in annual sales with leaders earning profit margins in the 1-3% range would seem to be an ideal candidate for a Silicon Valley startup to disrupt. However, the industry in question, the US grocery industry, has yet to feel any major pain from disruption. As of 2017, 96% of Americans still buy their weekly groceries in shops. Sure, grocers have identified the various irritations of shopping and have offered solutions such as home delivery, pick-up options, self checkout aisles, and store revamps. However these innovations still exist within the traditional brick & mortar model and don’t represent disruptive innovation, say as Uber did for the “taxi” experience.

Online grocery shopping represents the remaining 4% of consumers who have accepted that fresh produce can be delivered to the home without the need to smell or touch it. Nevertheless, a problem still exists; once groceries have been delivered, they still need to be prepared.

Enter Meal Kit Services: Real Grocery Disruption?

Inspired by Sweden’s Linas Matkasse, meal kit companies began to roll out in 2012, most notably by HelloFresh in Europe and Blue Apron in the USA. These meal kit services intended to find a sweet spot between cooking with raw ingredients and picking up a prepared meal. They looked to solve the irritants of grocery shopping while re-igniting the passion of busy people for home cooking, by making it easier. Dinners are delivered on a subscription basis and are expected to take 30 minutes of preparation time at a $9.99-$12.99 cost.

Meal kits’ value proposition to the home chef versus buying in a supermarket is strong:

- Opportunities to learn new recipes and ingredients

- Grocery collection and meal prep is minimized

- Food waste is reduced by 62%

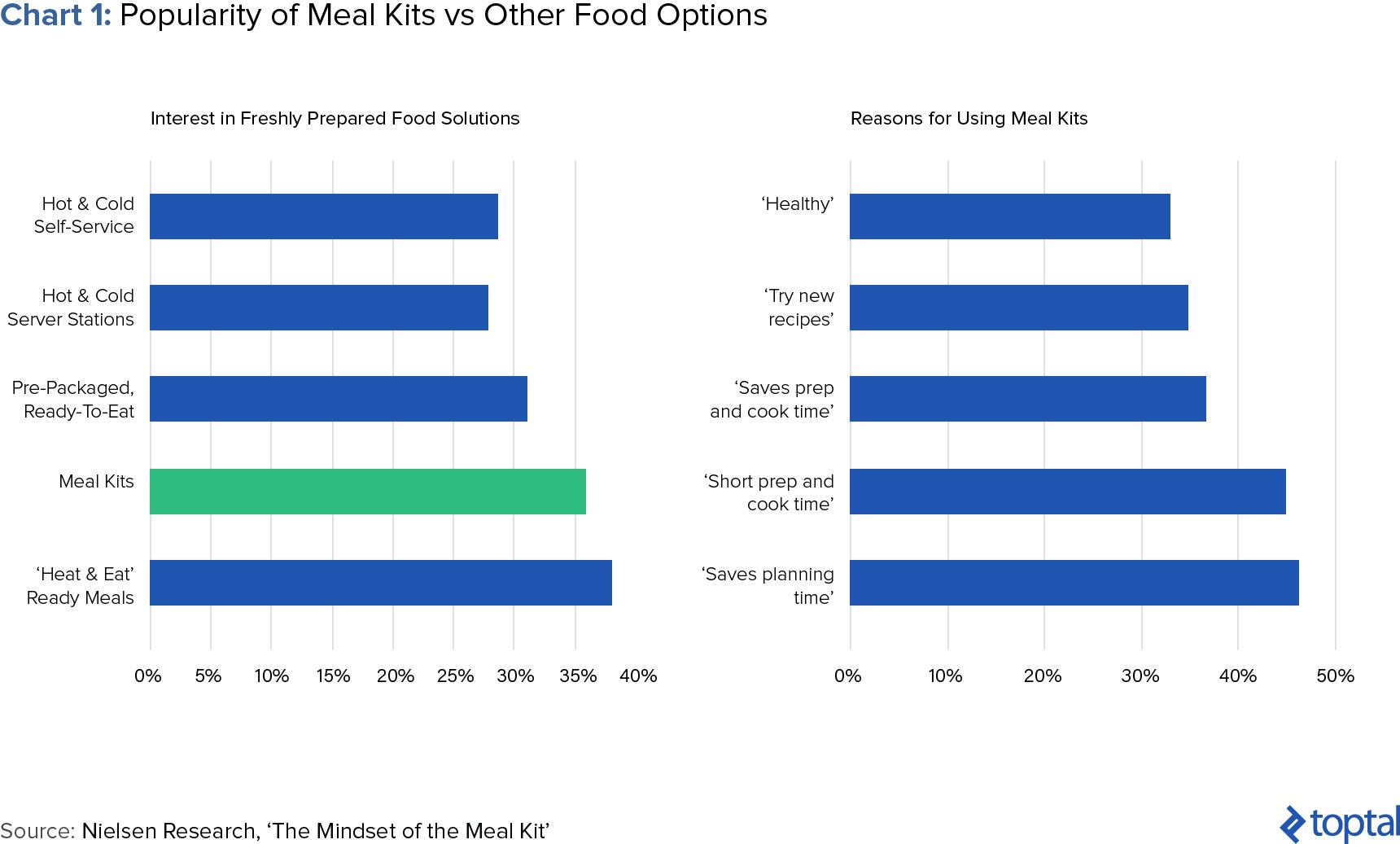

Research from Nielsen corroborates the popularity of home delivery meal kits versus traditional freshly prepared solutions, it also highlighted an even dispersion of reasons for using them:

For meal kit companies, the attraction of the industry is:

- A steady stream of recurring revenue from a subscription-based business model.

- High upselling potential, in terms of potentially serving three daily meals to consumers and selling ancillary products, such as cooking hardware.

- Access to more elegant and organized data streams about eating habits. Supermarkets have been following this path for years through their loyalty programs, but are hampered by their opt-in element and third-party partners muddying the waters.

The Future of Meal Kits Is Bright

Despite the business model being in existence for over five years, the meal kit industry constitutes less than 0.5% of food-at-home sales. Analysts do, however, agree that most of the growth is still to happen; only 3% of consumers have actually tried meal kits, yet 77% of them made repeat purchases, indicating both untapped and loyal potential. This shouldn’t be surprising, as meal kits are an on-trend topic within changing consumer habits:

- 81% of consumers believe meal kits to be healthier than prepared meals or take-out.

- Millennials (meal kits’ most popular demographic) spend $6,638 a year on food. In theory, they could comfortably afford to pay for 52 weeks of a Blue Apron Subscription (~$1,560 per annum)

- People are staying single for longer. Meal kits fit this demographic as they eschew the one-size fits all approach of supermarket food packaging.

Can Blue Apron Maintain Its Leadership Position?

This article focuses on Blue Apron, which went public in June 2017 and is the US market leader for meal kits. In my opinion, though, this leadership position is looking vulnerable and I do not believe that the company will maintain it. In the past year, the company has lost 17% of its market share and has had a tough time post-IPO. HelloFresh, on the other hand, has fared better since its own November debut.

Blue Apron Needs a Path to Cash Flow and Profitability

Buried on page 17 of Blue Apron’s S-1 SEC filing, it admitted that they “have a history of losses, and […] may be unable to achieve or sustain profitability.” This is a common refrain from startups that are building out new markets at scale, but usually by the time they IPO, losses will have plateaued. Blue Apron on the other hand, has seen its losses accelerate post IPO. Up to Q3 2017, it had a net loss of $171 million, 6x greater than the $29 million deficit recorded in the same period of 2016.

As Amazon has shown, profitability doesn’t have to be a necessity for public companies, so long as the stock shows growth potential. Blue Apron though has lost 70% of its share price value since IPO. The combined issue that I see from lack of profitability and growth potential is that the company’s cash position will face rising stress. It raised $278.5 million (net of fees) from the IPO, which was less than it originally budgeted for, after its price fell from an initial range of $15-17 to $10 per share.

Pre-IPO, Blue Apron had $62 million in cash reserves vs. $70 million in cash operating losses over the prior 6 months. The IPO raised enough cash to sustain at least another 12 months of similar losses, with another $75 million also available through a revolving credit line. In total it has $125 million on a 2019 maturity revolver balance, at a 3.39% weighted average interest.

Continued operating cash flow losses and any increases in interest rates will make it difficult for Blue Apron to find more financing and service its debt. The stock performance shows that for now, it’s probably tapped out in the equity markets, so unless a benevolent/opportunistic lender can provide more debt lines, it will need to find rapid means of increasing cash flows from operating activities.

1. It Has Underpriced Its Product

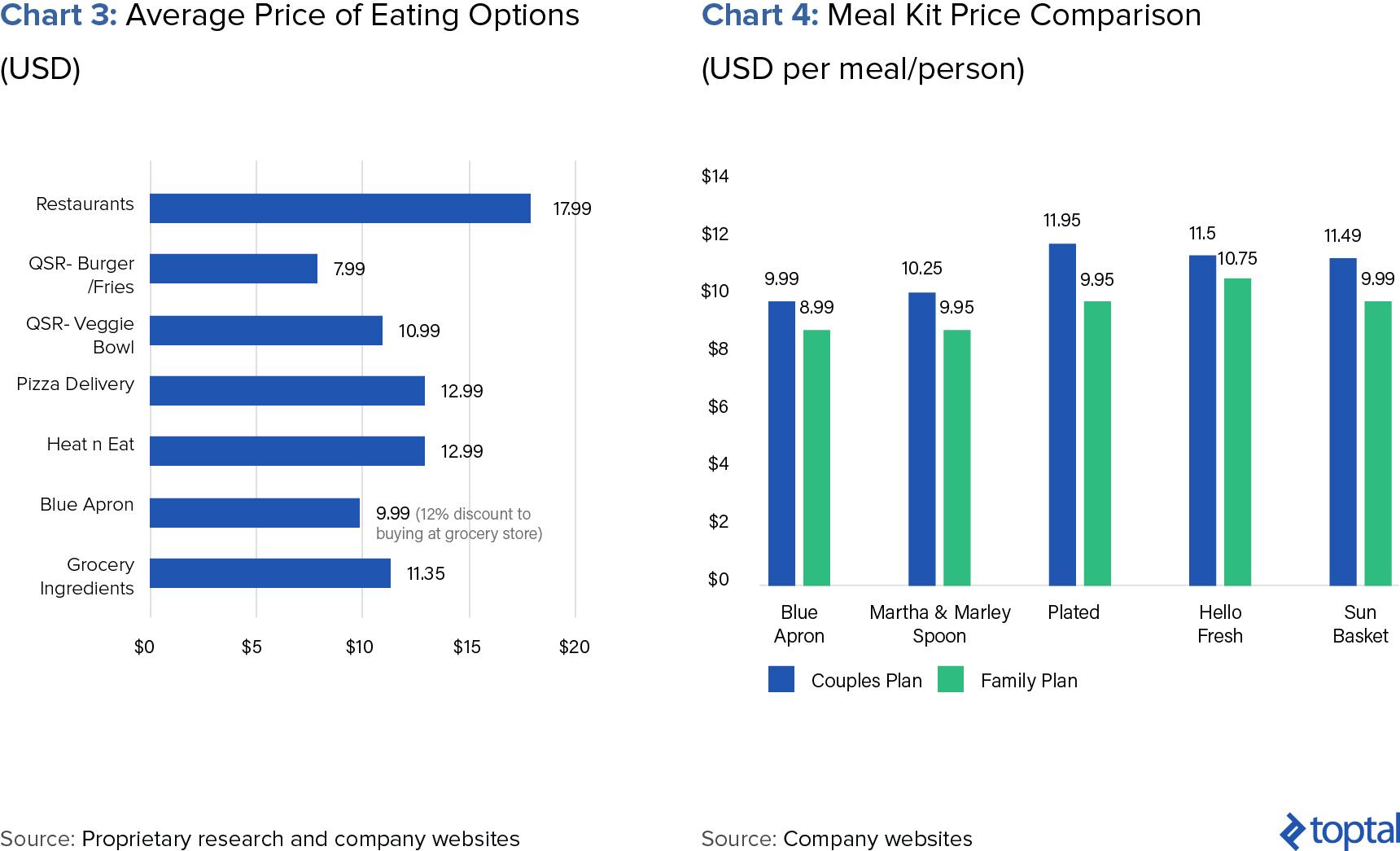

Meal kit companies, especially Blue Apron, underprice their products relative to their raw ingredients. A Forbes Guest Chef was quoted as saying “I’d pay $30 for this meal at a restaurant” after making a $9.99 Blue Apron Meal. Time Money found that the equivalent groceries of a meal kit cost 12% more in shops and their overall prices are attractive comparable to other freshly prepared eating options:

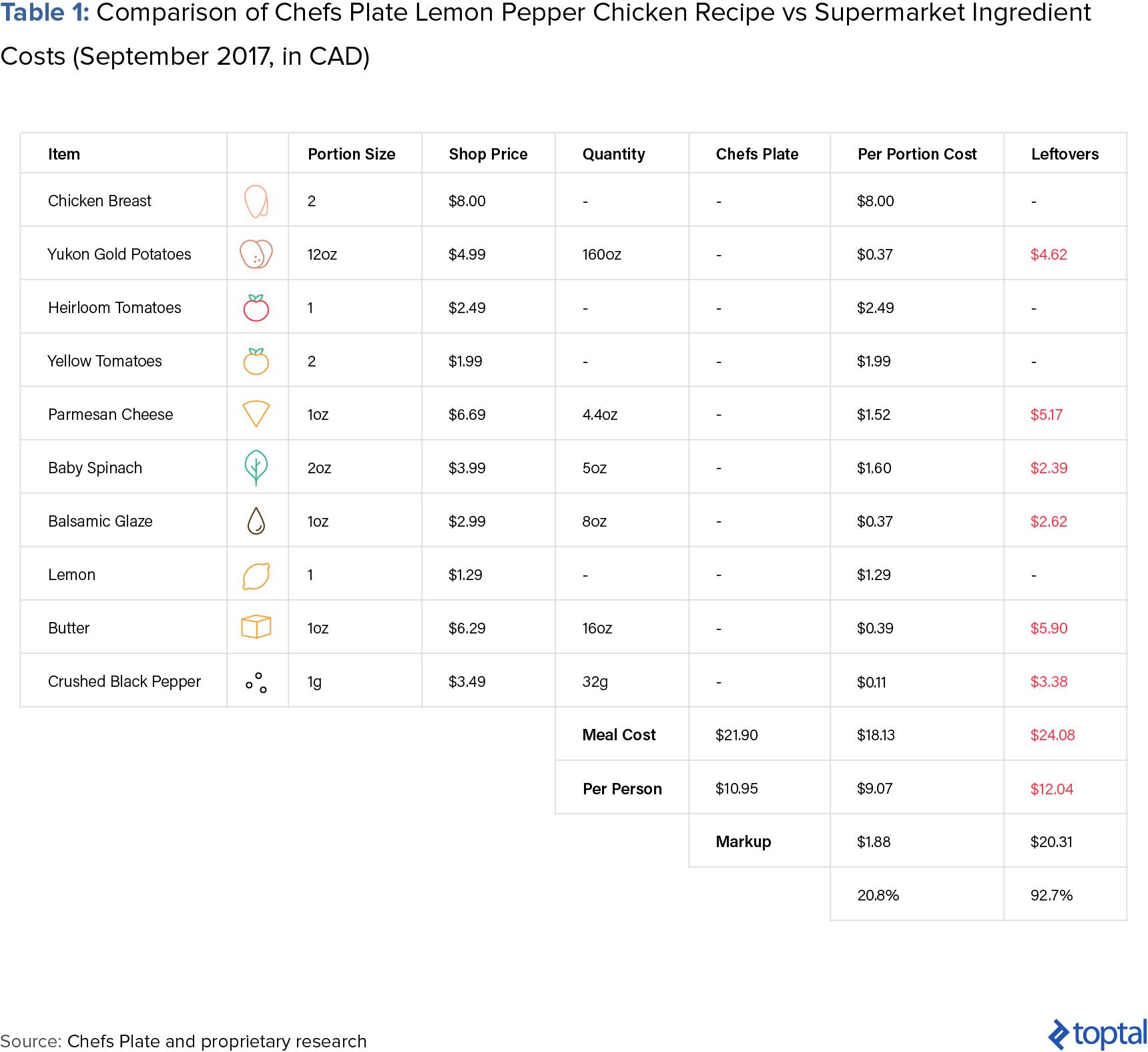

Taking the cost of ingredients further, I conducted my own experiments using Chefs Plate, a Canadian startup, similar to Blue Apron. In September 2017, I went to supermarkets in Toronto and purchased ingredients for three of its CAD 21.90 “Couples Meals” to see how much they would cost to replicate under the constraints of package quantities. The average cost to assemble the ingredients of these meals was CAD 33.41, a 52% premium over Chefs Plate pricing. A comparison of one of these meals is shown below:

Granted, the sample size was small and Chefs Plate is still making a nice markup, and it probably has access to wholesale prices. But, the point that I wanted to highlight from this was the utility provided to consumers in terms of reducing their deadweight loss from leftover ingredients. They are giving single cooks the economies of scale that families can enjoy, and for that, I believe that the meal kit industry is leaving money on the proverbial kitchen table.

I can see why prices are low—the players are looking to build market share and convert new customers. But, in the long term, this is not sustainable, or even necessary. In Nielsen’s research, consumers never indicated that a cheaper price was a driving factor to try meal kits, it was all about the convenience and health factors.

Blue Apron should conduct deeper pricing research and possibly raise its prices to $12.99 per meal. Every $1.00 increase in price will add approximately 5% gross margin to its performance. At Q3 2017 these margins had fallen to 21.9%, which had deteriorated 10% over the quarter. Here are my steps to how they could implement this:

- Grandfather the $9.99 price point for existing subscribers

- Use tiered, rather than flat pricing for vegetarian, chicken, and beef options. Consumers are well trained to pay more for steak than salad.

- Reduce meal sizes to reduce losses from leftovers. Include a dessert option to satisfy larger appetites.

- Decouple protein from sides and offer an a la carte option, where consumers are less likely to have price discovery.

- Offer discounts on ancillary products, such as wine and kitchen gadgets.

- Pre-mix sauces to further reduce the customer preparation burden

2. It Became Too Obsessed with Building Its Own Distribution Network

Blue Apron has grown within its own proprietary supply chain and distribution network. It sells online and customers are shipped packages from distribution centers. Keeping everything in-house affords Blue Apron certain quality control and data advantages. But it is also an achilles heel; its Q3 earnings disappointed, and it pointed the blame towards a new fulfillment center in New Jersey. Continuous training of 5,000 staff members doesn’t help either.

Blue Apron missed an opportunity to partner up with existing brick and mortar grocers. The cruel irony of Amazon buying Whole Foods right before its IPO highlighted some of the advantages of mixed distribution models. Moves by Publix and Krogers to start their own meal subscription businesses could be a “fatal bullet” to their tech equivalents. If Blue Apron had already made such moves, it could have given itself a better head start through the following:

- Better skills transfer and knowledge of distribution. Would an experienced partner, such as Wal-Mart, with over 60 years of logistical knowledge, help growing pains?

- 96% of consumers still do their grocery shopping in brick-and-mortar shops. A partnership with a chain of these shops would provide untold educational and customer conversion opportunities.

- Lowering the customers’ “leap of faith” to meal kits. A basic and cheaper version could be offered in supermarkets, with happy converts then moving to more elaborate online menus.

- Lower fulfilment costs from in-store pick-up and distribution. Having a brick-and-mortar partner would help the margins of Blue Apron and reduce the cost and package wastage from a pure shipment model. This tweet sums this up perfectly:

here it is. here's Farm Egg pic.twitter.com/vEGQp1U3T5

— Brian Lee (@BrianLeeWow) August 31, 2016

To me, it’s a no-brainer that Blue Apron should move quickly to find a grocery chain to partner with for, at minimum, a small pilot program. I would also imagine that there would be many benefits for a grocer to go down this route, instead of starting their own program:

- Access to Blue Apron’s sophisticated online ordering software

- The cache of adding a new brand, exclusive to them, to their shelves

- Customer data sharing opportunities between two disparate entities—the “millennials” of Blue Apron and the “suburbans” of the grocery store

3. It Has Ineffective Marketing

It is fair to say that since IPOing, Blue Apron has endured a rough time from public investors. Moving from the top-line “growth at all costs” focus of private venture capital to the bottom-line quarterly earnings call of the public markets has not gone smoothly. In line with its earnings pains, Blue Apron needs to rethink its marketing strategy and look beyond just pure customer acquisition, it must build sustainable lifetime value.

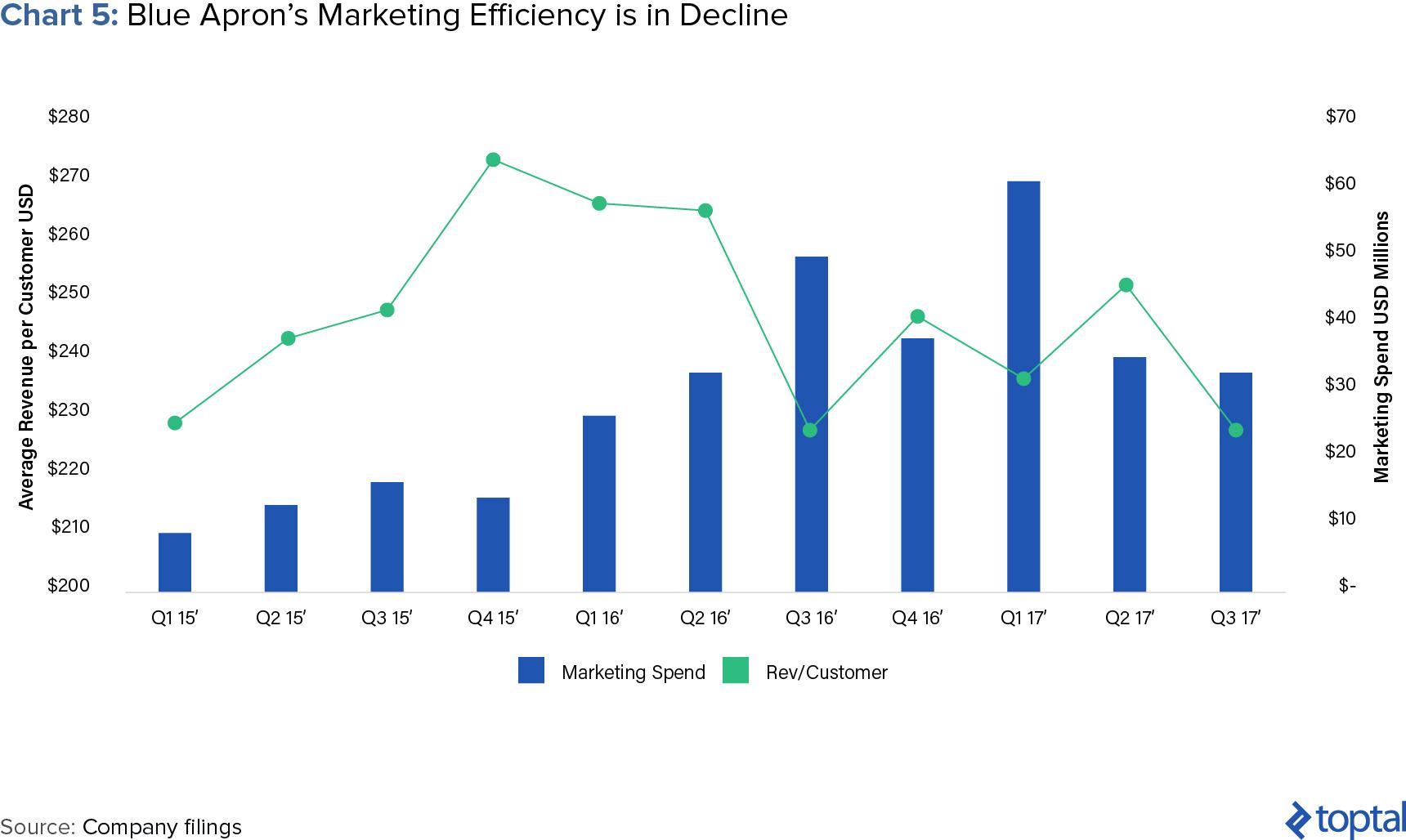

In the six months to September 2017, Blue Apron lost over 100,000 customers and, while this has coincided with marketing being pared back, it is following a continuous downward trend; revenue per customer has been in decline for over a year now. This displays characteristics of poor customer quality—customers are signing up for their free opening offers and then churning once they’re over.

Blue Apron’s promotional offerings are richer than the rest of the industry. Most meal kit companies provide a 50% first-time discount; however, Blue Apron gives the first three meals away for free. In Q1 2017, 72% of customers were churning before they were 6 months old and the cost of acquiring new customers was $147. Daniel McCarthy noted in his analysis that to break even on these numbers, Blue Apron would need to generate $565 of net revenue from new customers, which, as you can see in Chart 4, is not happening at all.

The unit economics are not working for Blue Apron because its promotional tactics are both expensive and present a psychological price-cliff to customers, who churn once their generous free offers end. A move away from the three-for-free meal model to a one-off discount would help to reduce this cliff and let Blue Apron concentrate on quality customers instead of churn-y bargain hunters. It should allocate more of its marketing budget towards educating the 97% of consumers that have never tried a meal kit about the value that they can bring.

Could Amazon’s Purchase of Whole Foods Be an Opportunity?

After McDonalds launched its McCafe concept nationwide in 2009, Starbucks CEO Howard Schultz commented that it would “create unprecedented awareness for the coffee category overall and has actually had a positive result on Starbucks’ business.” Since then, Starbucks has seen its share price climb over 1,000%. McDonald’s decision allowed Starbucks to piggyback on its marketing efforts and tempt new customers to trade-up once they had learned about coffee. As per then Starbucks CMO Terry Davenport:

But we never had hundreds of millions of dollars to do that education. The fact that there are people spending money and having that conversation, we think it will benefit the entire category, and we’ll get our fair share. If people get into the category, get comfortable and want to trade up to a premium, higher-quality version, we’re in a great position to capture some of those.

Enter Amazon in 2017, fresh from its Whole Foods acquisition, the successful launch of Amazon Fresh, and 80 million hungry Prime users. It currently is selling meal kits, but only on a limited basis in Seattle; pricing is around the $10 per meal mark, but online testing by CNBC ranked Blue Apron as the superior offering.

Blue Apron unfortunately cannot outcompete Amazon, nor is it as established as Starbucks was in 2009. However, neither Amazon nor Whole Foods are known for meal selection, curation, or suggestion, but Blue Apron is. It needs to excel in this and challenge newly converted meal kit aficionados to use it as their long-term provider. With no hidden cross-selling intentions or restrictions to just use Whole Foods produce, Blue Apron can present the transparent and specialized alternative.

To increase switching costs, Blue Apron must stabilize its customer base. Part of that can be achieved by focusing on the core client it serves instead of chasing growth vanity metrics from coupon-hoarding switchers. It also has an advantage in terms of the data it holds about people’s eating habits. It should use this to better adapt to tastes and continually refine menus that it suggests to customers.

The inverse of all of this, of course, is that Blue Apron could just be the McDonald’s to Amazon’s Starbucks. It has spent years pioneering the market, its investors have effectively subsidized a public awareness-building exercise, and now others are coming in to seize the market.

Disclosure: The views expressed in the article are purely those of the author. The author has not received and will not receive direct or indirect compensation in exchange for expressing specific recommendations or views in this report. Research should not be used or relied upon as investment advice.

The author has no investments or business relationships with any of the companies mentioned in this article.

Understanding the basics

What is a meal kit?

A meal kit is a subscription service that delivers prepared ingredient components of a meal to a consumer, alongside a recipe. The consumer then cooks the final meal in their own time.

Michael Yarmo

Toronto, ON, Canada

Member since May 16, 2017

About the author

Mike’s an expert in the consumer goods and logistics space. As a PE investor he has sold and invested in a range of businessess

Expertise

PREVIOUSLY AT