All in the Family - A Guide to Family Offices

Family Offices are becoming increasingly popular and prominent in investment circles. Their rise is due to changing economic conditions and the increased flexibility and control that families wish to exert with their capital.

Family Offices are becoming increasingly popular and prominent in investment circles. Their rise is due to changing economic conditions and the increased flexibility and control that families wish to exert with their capital.

Greg has executed over $20 billion of transactions from seed-stage venture investments to large corporate buyouts.

Expertise

PREVIOUSLY AT

“Family Offices.” Along with intermittent fasting, CBD, and Megan Markle, it seems that no one can stop talking about them – at least in the finance world. That being said, the term Family Office implies some level of homogeneity surrounding a group of organizations. In this case, it is a misnomer. Family Offices are as wide and varied – in source, size, structure, and strategy – as the individuals whose money is being managed.

In this article, coincident with the surge in popularity of the theme, I will discuss the reasons for setting up a family office. Through this, I will explain the variety among the different kinds of entities and the numerous aspects of managing interactions with family offices.

What Is a Family Office?

Firstly, what is a “family office”? Even the classification of a firm as a family office would be different depending on who is asked. That being said, the way I think about family offices is: any firm that is investing money directly on behalf of the ultimate principal. As compared to hedge funds, pension funds, endowments, and other institutions, family offices are not pooling third-party capital and then investing. They are operating with a single – or multiple – family’s assets.

Thus, even defining a family office is somewhat challenging. According to the heretofore mentioned description, a son who manages his mother’s $500,000 retirement account by trading equities in an online account would theoretically have a family office. Interestingly, I have come across a family office that was nothing more than the principal and one advisor (although in this case the AUM of over $4 billion was somewhat larger than my example above).

Broadly speaking, most practitioners would use the $100 million net worth threshold as the point in which someone could potentially have a family office. According to a 2018 Credit Suisse report, globally there are ~50,230 individuals who have a net worth greater than $100 million. Many of these individuals manage their net worth within their firms, many pool their assets to create multi-family offices, and many are different branches of the same family. As such, Credit Suisse’s estimates in terms of how many individual family offices exist range widely from 6,500 to 10,500.

With that as a backdrop, there is a saying that “when you know one family office, you know one family office.” Family offices are varied in terms of their:

- Source: Family offices may be solely structured around one principal (“single-family”) or multiple (“multi-family”).

- Size: Ranging from a few hundred millions of dollars under management through to multiple billions.

- Structure: From fully-fledged investment advisors that would rival even the most institutional of firms to just one cited individual advisor.

- Strategy: While wealth preservation on a real basis is generally the main goal, capital appreciation or growth can be just as important depending on the nature of the principals.

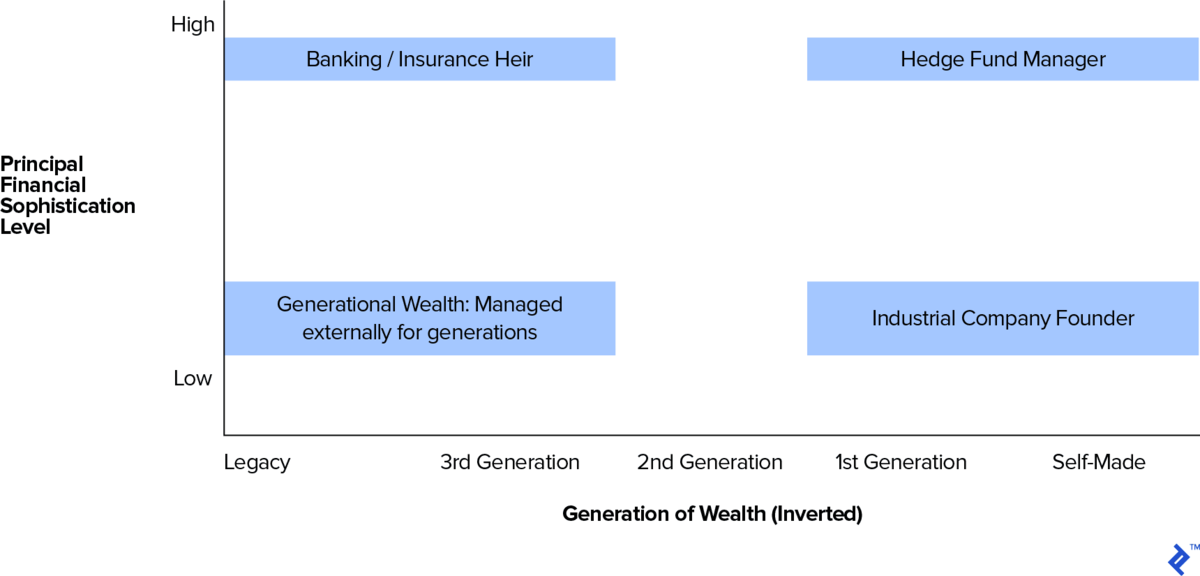

I created this matrix to demonstrate the two paradigms that define the kind of family offices that tend to exist: centered around the history of the family’s capital and the financial sophistication of the principals. Included are some (general) examples of who could be classed into the respective sections.

What Is Behind the Recent Rise in Family Offices?

Why have these investment organizations become so prevalent recently? In large part, it’s due to the increasing returns to capital as compared to labor, which have created large multi-generational-type fortunes. Across numerous industries, concentrations of returns are generating significant financial wealth.

However, the second factor is just as important, if not more. Wealthy individuals and families have discovered that they can operate at a significantly lower cost than the traditional vehicles accessible to them, while maintaining strong performance. In the recent past, wealthy individuals would be funneled into institutional investment funds which would often charge significant management fees (in some cases the “2 and 20” model). On the other hand, the recently released UBS Global Family Office Report 2019 shows that the 360 family offices surveyed paid an average of 117 bps (1.17%) in total costs, including all operational, administrative, and performance-related costs.

Also, often times a wealthy individual or family generates wealth by having domain expertise in a specific industry. This expertise can extend to operating experience, valuable relationships, or general thought leadership. By specifically maintaining a family office, the principal can continue to exercise some level of control over their investments and also have a role in helping to create value once investments are made.

Finally, family offices are often operating on a much different timeline than traditional institutional funds. Rather than a seven to 10-year horizon when looking to exit, family offices are looking across generations (many family offices say they are targeting third-generation, or 100-year wealth). As a result, holding periods can be much longer, especially if an asset is generating cash flow that is being remitted to the principal and their family.

The Process of Interfacing with Family Offices

With that backdrop, thinking about the best way to interface with a family office becomes a bit easier. The first takeaway should be obvious. Just as there is no uniformity to family offices, there will be no uniform way to deal with each family office. Each relationship will be predicated and influenced by the individual firm. That being said, there are some general benefits and considerations that should be measured.

One major benefit of working with a family office is the ability for the firm to bring more than financial capital to an investment. When thinking through investment partners, we often think about the “three forms of capital”: intellectual capital, relationship capital, and financial capital. In many cases financial capital is the most fungible of all. If the principal of a family office has extensive industry experience and relationships that are relevant, that can be a huge positive to a firm seeking investment partners.

Additionally, family offices can often operate with much more speed and flexibility than traditional investment firms. Unlike institutional funds, many family offices do not have a formal mandate or even an investment committee. The general goals come down to the determination of the principals, and as such, investments can be made much more quickly and unique structures can be deployed.

Similar to structure on the entry, family offices can be very flexible on the exit of their investments. As mentioned above, they are often longer-term holders, which can be a valuable asset to have in a capital structure. Furthermore, family offices are often natural buyers as companies scale and grow, especially to a family office whose principal has deep domain expertise.

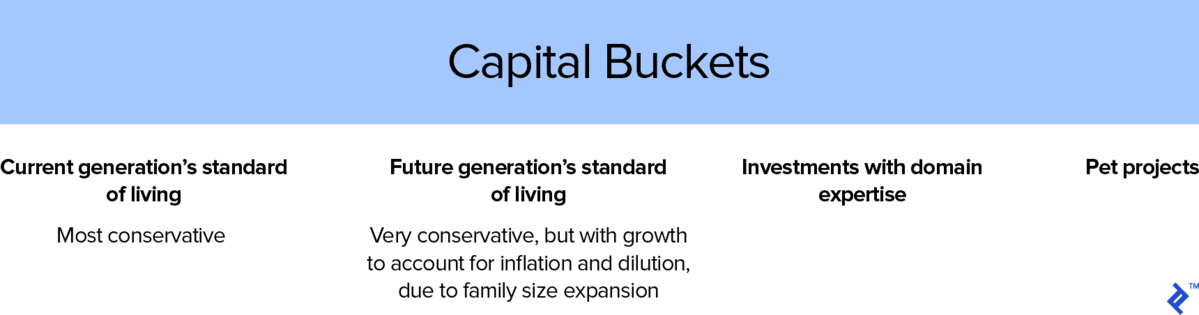

Finally, family offices often make investments on metrics other than those that are purely financial. Whether it is a pet project in which they want to invest (e.g., a winery or golf course) or based on a relationship, family offices often make investments looking at overall utility to the principal, rather than pure IRR. This aspect is obviously a double-edged sword and can lead family offices to immediately rejecting very attractive opportunities. However, when approaching a family office it is always best to frame the opportunity in terms of their passions. Try to visualize the investment within the types of capital buckets that will exist in their minds.

The Challenges of Dealing with Family Offices

Working with a family office can bring some unique challenges. Firstly, depending on the level of sophistication of the family office, there may be a lack of organization. In my experience, family offices are generally leaner in terms of staff, and given the potentially changing demands of the principal, sometimes it seems as though they are running in many different directions at once.

Similarly, family office principals may have a variety of different interests and may lose interest in your opportunity, specifically if it is what we refer to as a “cocktail party” investment. A “cocktail party” investment is the type of investment that a principal makes specifically to discuss with friends at social gatherings. Many direct early-stage venture capital investments made by individuals with little knowledge in the relevant industry are made in this nature. While it is not necessarily a bad thing to accept an investment of this sort, it is important that the principal truly understands the opportunity and the business plan. If not, having a tough-to-manage investor may not be worth the amount of investment, especially at early stages. This account from Fabrice Grinda, who founded the European auction site Aucland in the late 1990s, provides a fascinating insight into his experiences of raising money from a venture fund linked to the large LVMH family conglomerate.

Finally, in negotiation theory, there is an acronym that is often used, BATNA: Best Alternative To a Negotiated Agreement. BATNA can be used as a general metric to determine the relative leverage of two parties in a negotiation. Most family offices have a very high BATNA, which means that if the deal does not go through, or the investment is not made, it will not impact their lives in any meaningful way (if at all). As a result, family offices are known for dragging out the investment process to create as much optionality as possible. Also, given that you are dealing with individuals who are naturally used to getting their way, it can be very difficult to arrange favorable terms.

What Does the Future Hold for Family Offices?

In all, the family office space remains a dynamic and ambiguous corner of the capital markets. The one thing that most agree on is that the corner is growing quickly. As income inequality and the rapid increase in returns to capital – as compared to labor – continue to grow, these types of firms should continue to accelerate in number.

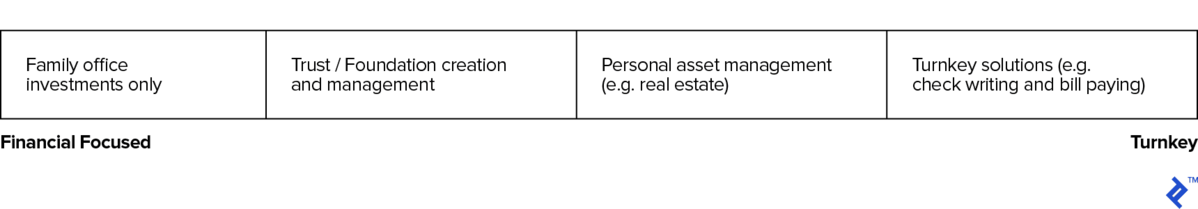

Furthermore, service providers are now spending more time thinking through the best way to service these unique clients. Investment banks are competing to offer the most turnkey solutions in hopes of having these families work with them. Historically, family office relationships were based on long-standing familial relationships. However, increasingly being able to provide all of the wants and needs of the family office principals and operating staff is essential. These services can bundle everything from M&A advisory, personal or transaction financing to bespoke concierge services – such as art valuation and educational programs for rising generations.

As service providers become more attuned to the needs of these firms, it will increasingly make more sense for these family office firms to form. As more firms form, more service providers will offer increasingly efficient services to them. All in all, a virtuous cycle will lead to a drastic rise in family offices.

As such, it is incumbent upon anyone who is soliciting capital to think seriously about approaching family offices. While this prospect will have to be much more nuanced than the “spray-and-pray” attitude generally adopted by many seeking funds, it can be very fruitful in the long run.

Understanding the basics

What does a family office do?

Family offices are investment funds that manage the financial assets of a family. They operate in a similar manner to standard investment funds but with more flexibility towards the needs of their sole principal.

How much money do you need to start a family office?

It is widely assumed that once an individual family has a net worth of over $100 million, forming a family office should start becoming a consideration.

How many family offices are there in the world?

Credit Suisse estimates that between 6,500 and 10,500 family offices exist globally.

Greg Barasia, CFA

New York, NY, United States

Member since September 16, 2019

About the author

Greg has executed over $20 billion of transactions from seed-stage venture investments to large corporate buyouts.

Expertise

PREVIOUSLY AT