The Commercial Real Estate Market in 2020

Where are we now in the commercial real estate cycle? We analyze current market dynamics, risks, yield expectations, and trends to determine potential well-positioned commercial real estate investments in 2020.

Where are we now in the commercial real estate cycle? We analyze current market dynamics, risks, yield expectations, and trends to determine potential well-positioned commercial real estate investments in 2020.

With 25 years in finance, Martin has raised ~$500 million in capital and managed real asset portfolios from $50 million to $10+ billion.

PREVIOUSLY AT

In the crowded conference room of a major institutional investor in late 2009, an investor asked the owner of a global real estate development company why so much of its good money had been thrown at obviously failing development projects. The answer was: Because we could.

This anecdote raises a number of questions about checks and balances, alignment of interest, but also the understanding (or in this case misinterpretation) of market momentum. We analyze past performance, market dynamics and risks, and target markets/products going forward, yield expectations and interest rates, private real estate debt markets, and technological impacts. We provide some guidance to investors on how to look at potential commercial real estate investments in 2020 and how to avoid common market misperceptions.

The Real Estate Industry 10 Years After the Big Bang – How Did We Do?

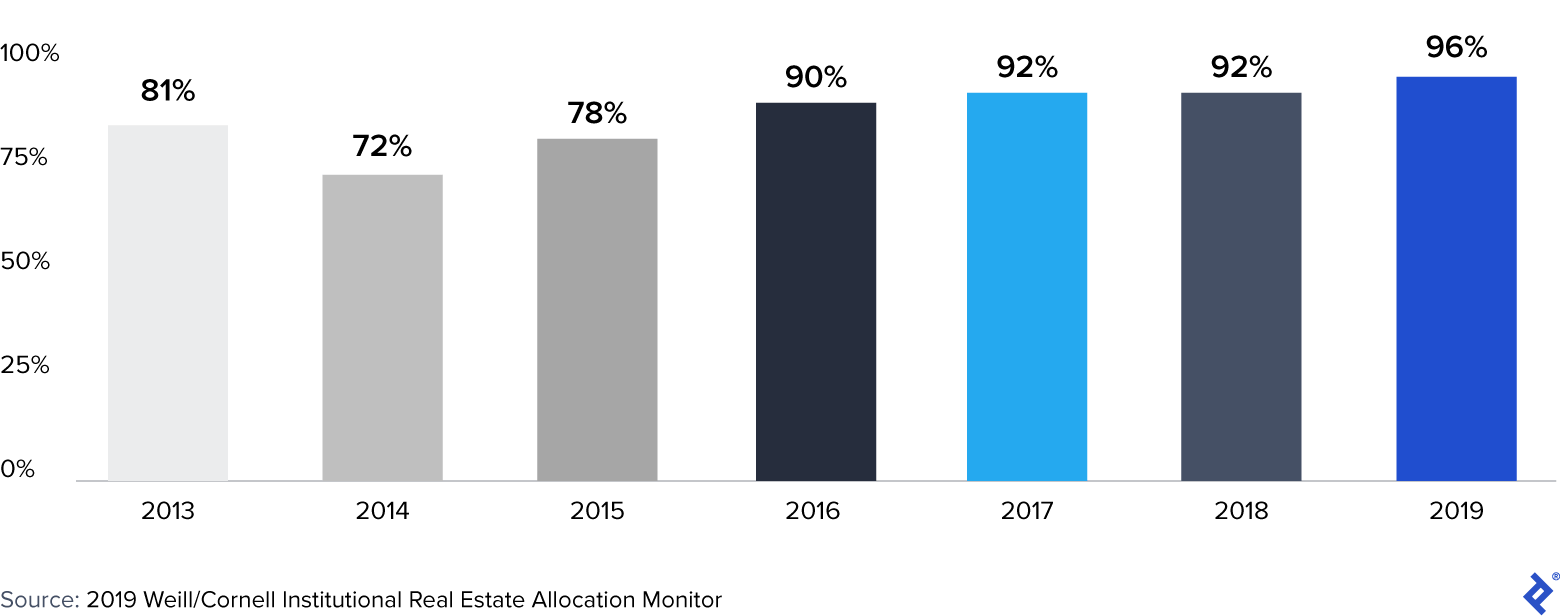

Following the global financial crisis in 2009, most institutional investors significantly reduced their real estate exposure. However, commercial real estate as a distinctive asset class has seen a remarkable resurgence since then with unprecedented allocation levels in institutional investment portfolios, with institutions actively investing in real estate growing from just 72% in 2014 to 96% in 2019.

This trend has been reflected in the steady rise of real estate allocations among major market participants as well as the rise in the relative number of market participants.

Actively Investing in Real Estate, All Institutions

This trend had been driven primarily by an enhanced focus on risk management, strategic asset allocation, and, as a result, diversification efforts in the aftermath of the financial crisis. Significant liquidity injections due to central banks’ QE policies and multiple interest rate cuts fueling increased leverage appetite in real estate helped market performance quite a bit.

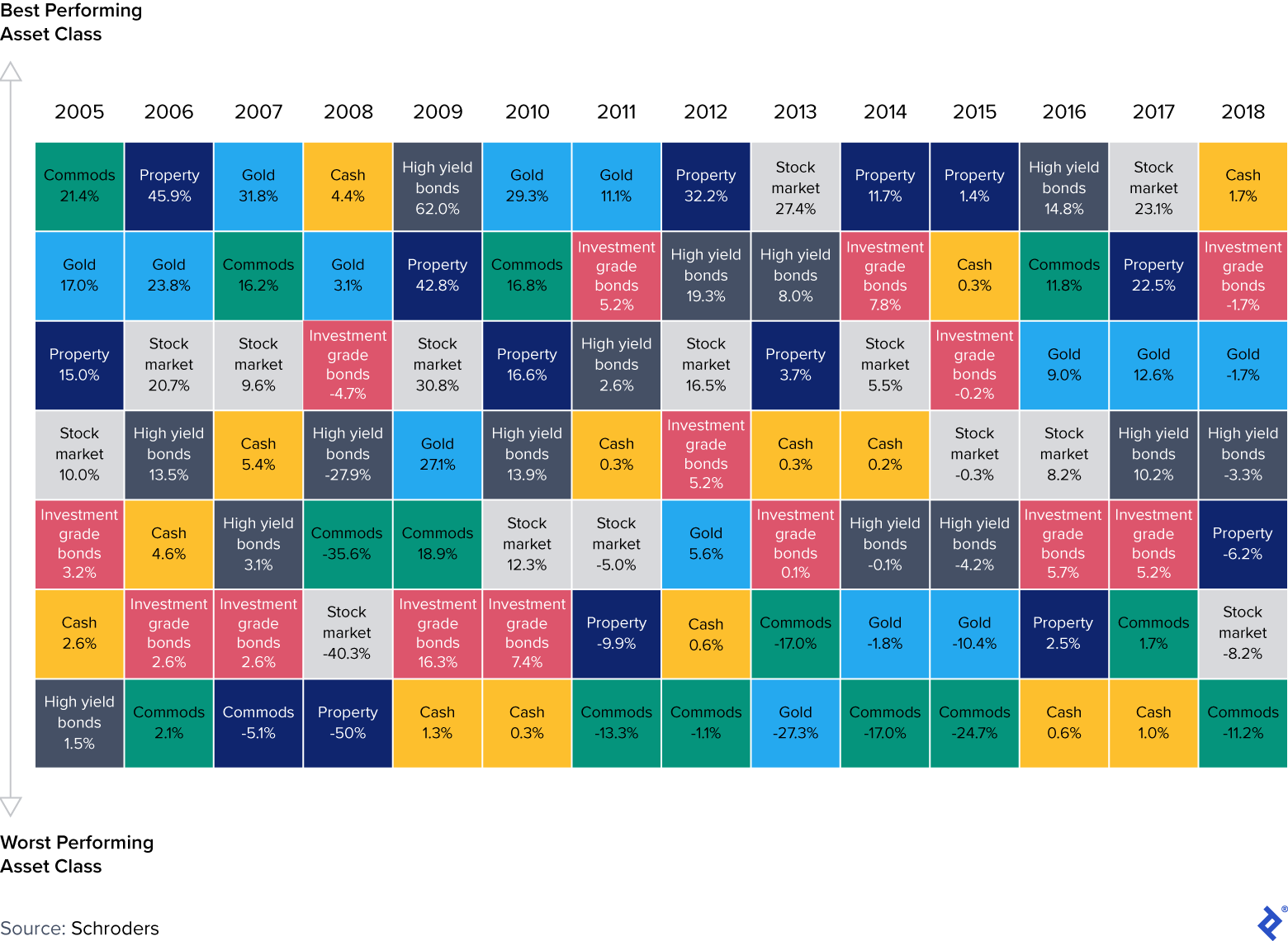

Judging from the relative performance analysis from 2005 through 2018, these factors (QE and interest rate cuts) benefitted real estate in particular since it leads the performance ranking in three out of the nine years between 2010 and 2018, coming in second or third on three other occasions.

Asset Class Performances 2005-2018

So that’s the lay of the land to date, where does it take us from here?

Market Dynamics and Risks Going Forward

Equity markets showed a stellar performance in 2019 making it rather difficult for institutional investors to maintain their strong real estate allocations. In addition, signs of market fatigue appear in some corners of the market, driven less by upward pressure on inflation and interest rates but rather by geopolitical risks with potentially negative impacts on economic growth and therefore the demand for the most (correlated) sub-asset classes.

Recently, the coronavirus has put a stop to globalized life as we know it, with ever-growing cities going quiet, hectic street life ending with quarantine, bustling shopping malls emptying, and the ever-increasing tourism industry grinding to a halt. The real estate industry, like airlines, fast-moving consumer goods (FMCG), and others will feel the resulting demand gap. This will probably be cushioned by government and central bank interventions. However, the full extent will only be visible with an industry-typical time lag of 6-12 months as projects get delayed, funding is drying up, or investor focus shifts. So, it’s not over yet.

The current crisis will provide opportunities, like the rearrangement of supply chains (new logistic centers and production facilities), distributed company headquarters (new office buildings used as second headquarters or back-up locations as risk mitigation measures), or additional medical facilities to be prepared for any future crisis. So, stay tuned and let’s re-evaluate the market in early-mid 2021.

Target Markets and Products Going Forward

Throughout the current cycle, tremendous opportunity provided itself in developed markets (e.g., US, UK despite Brexit, Germany, France, Japan, and Australia) driven by the need to create portfolio diversification, but most importantly, by the post-crisis QE and interest policies of central banks in Europe and America. Asia—in particular China and to some extent India and Southeast Asia—saw significant capital inflows as well.

Following strong GDP growth expectations, real estate markets in France, Spain, Germany, Australia, South Korea, and Singapore are expected to remain an investment focus for the foreseeable future. This also applies to Hong Kong, with some caveats surrounding recent events.

Markets in the US, the UK, and other smaller European countries are expected to perform on par with their long-term GDP pattern and as such are expected to see rather cautious investor demand.

The Chinese real estate market is likely to experience a slowdown in investment activity due to GDP growth reaching a plateau unless government-induced investment activity replaces the expected funding gap due to cautioned private capital sentiment.

It is expected that all real estate product types remain attractive, however, individual investor preferences will continue to vary depending on risk appetite, current portfolio structure, regional/home bias, as well as available investment and asset management skill sets.

In general, it is expected that the trend of “too much money chasing the same deal” will continue to result in lower product availability, price increases, and associated cap rate contraction.

The scarcity of construction land is expected to result in increased re-purposing of brownfield sites and refurbishment of pre-used assets, especially in metropolitan areas. Megaprojects in recent years like the NYC Hudson Yard redevelopment support this assumption.

Other Market Trends

- Rising construction cost

- ESG consciousness including:

- Greener, more energy-efficient buildings

- Updated building codes (e.g., enhancements of fire safety and earthquake resistance)

- Housing affordability ensuring social stability

- Resolving issues related to climate change (city relocations due to rising sea levels)

- Enhanced PropTech solutions (smart buildings)

- Real estate as a service (WeWork)

- Infrastructure updates (to accommodate economic growth or renew existing infrastructure)

- Risk for particular asset classes—retail (online shopping), residential (rent control), office (remote work)—needs to be evaluated and modeled into respective rent-roll.

Yield Expectations

Real estate yield expectations for 2020 onward continue to remain attractive at:

- Around 6% annually (incl. 4% income yield) for China

- About 5% (incl. 4% income yield) for Europe, with a further slowdown of the capital appreciation portion

- 5.5% (incl. 4% rental yield) for US markets, with growth expected to pick up following the 2020 presidential election

Private Commercial Real Estate Debt Markets

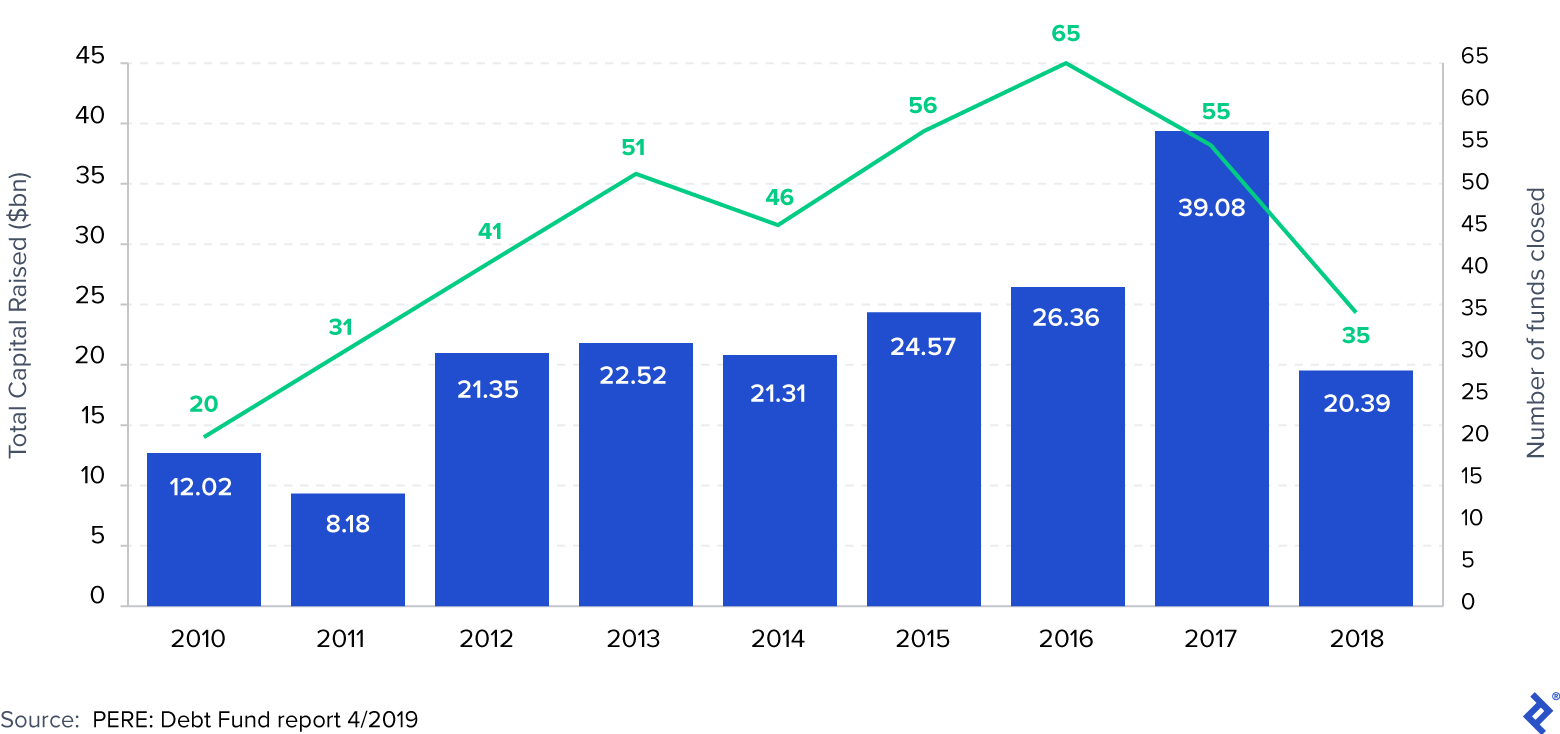

Commercial real estate markets for debt have experienced significant structural changes during the current cycle, the most prominent being the emergence of nontraditional lenders as well as a whirlwind of fundraising for debt funds.

Steep Descent: Total capital raised for debt funds fell sharply last year after a record-breaking 2017

Initially thought of as gap fillers for reduced lending activity of commercial banks in the aftermath of the 2009 financial crisis, debt funds nowadays provide an interesting income-generating investment opportunity for institutional investors. Given the underlying collateral as well as continued prudency with respect to loan-to-value (LTV) ratios applied, the downside risk for investors tends to be significantly lower than in the case of equity investments via fund vehicles or direct investments. In some cases, it allows an internal risk/return diversification for investors in particular assets by providing funding along the entire capital structure.

Given the combination of specialized pricing, debt management, and real estate skills required, institutional investors and family offices mostly seek debt exposure through fund vehicles and/or dedicated mandates for specialized asset managers (e.g., fund sidecars).

Interest Rates and Loan-to-value (LTV) Ratios

Interest rates for commercial real estate remain competitive in most developed markets. The main drivers, as in the recent past, are rock-bottom central bank rates. Whereas the 10-year fed rate hovers firmly in the 1.5-1.75% range, the Euro zone’s base rate remains firmly in negative territory (currently at -0.50%) with little change on the horizon for the latter.

The abundance of debt providers (traditional and nontraditional, like insurers or debt funds) puts additional pressure in lenders’ margins, with the caveat that price differentiation for heightened economic and political risk in particular markets remains intact. Accordingly, the lender margin landscape in Europe currently stands at 100bps (France/Germany), 175bps (Italy), 170bps (UK). This results in rather attractive and returns-enhancing financing rates.

However, with valuations already sky-high in some European sub-markets, realistic valuations and due diligence procedures are key in preventing deals from turning out to be overextended as the cycle turns.

Despite increased lender competition, underwriting remains prudent, with LTV ratios (60-70%) and debt covenant remaining stable.

Lender margins in the US reflect the more cautious GDP growth expectations and are around 150-200bps. With a base rate of 1.5-1.75%, this results in average financing rates around the 3-3.75% mark, with similar LTV expectation as in Europe.

Construction Costs

Driven by both market demand but also the sheer amount of liquidity available for all sorts of real estate investments, global construction markets are red-hot.

According to the most recent construction cost survey published by Turner & Townsend, one of the major global property consultancies, 35 markets are considered to be warm/hot/overheating, with 23 more heating up and just five cooling down. Construction price increases are primarily observable in North America, with tech industry-driven construction in the San Francisco market leading the pack with a 6% year-over-year (y/y) price hike between 2019 and 2020, followed by Vancouver (+5%) and Indianapolis (+4%). Amsterdam (+9% y/y) and Frankfurt (+4% y/y) saw the largest cost increases in Europe.

Going forward, San Francisco and Houston in North America, Amsterdam, Frankfurt, and Paris in Europe, Shanghai in China, Riyadh and Muscat in the Middle East, Dar es Salaam in Tanzania, as well as Brisbane and Perth in Australia are considered to have the biggest potential for increased construction cost.

Investable Market Expansion

During the current cycle, the investable commercial real estate market expanded significantly. This has been primarily driven by brick-and-mortar requirements of the tech industry in the form of warehouses and data centers. Another major driver in both the real estate and infrastructure markets was the market entry of institutional investors in previously fragmented industries with single-lot sizes insufficient to absorb meaningful capital. Examples include student housing, hospitals, and retirement homes. Some of these were not even part of the investable universe in some markets but have been made available due to deregulation and the need to professionalize government functions.

Given the budgetary challenges faced by quite a few developed and most importantly emerging markets, this trend is expected to grow. The constant and relatively stable income stream from some of these asset categories enhances the portfolio attractiveness, especially for income yield-focused investors such as pension funds.

However, keeping in mind the old rule of thumb: “The more specialized an asset, the less liquid it is,” special attention should be paid to potential alternative uses, marketability, and contractual downside protection.

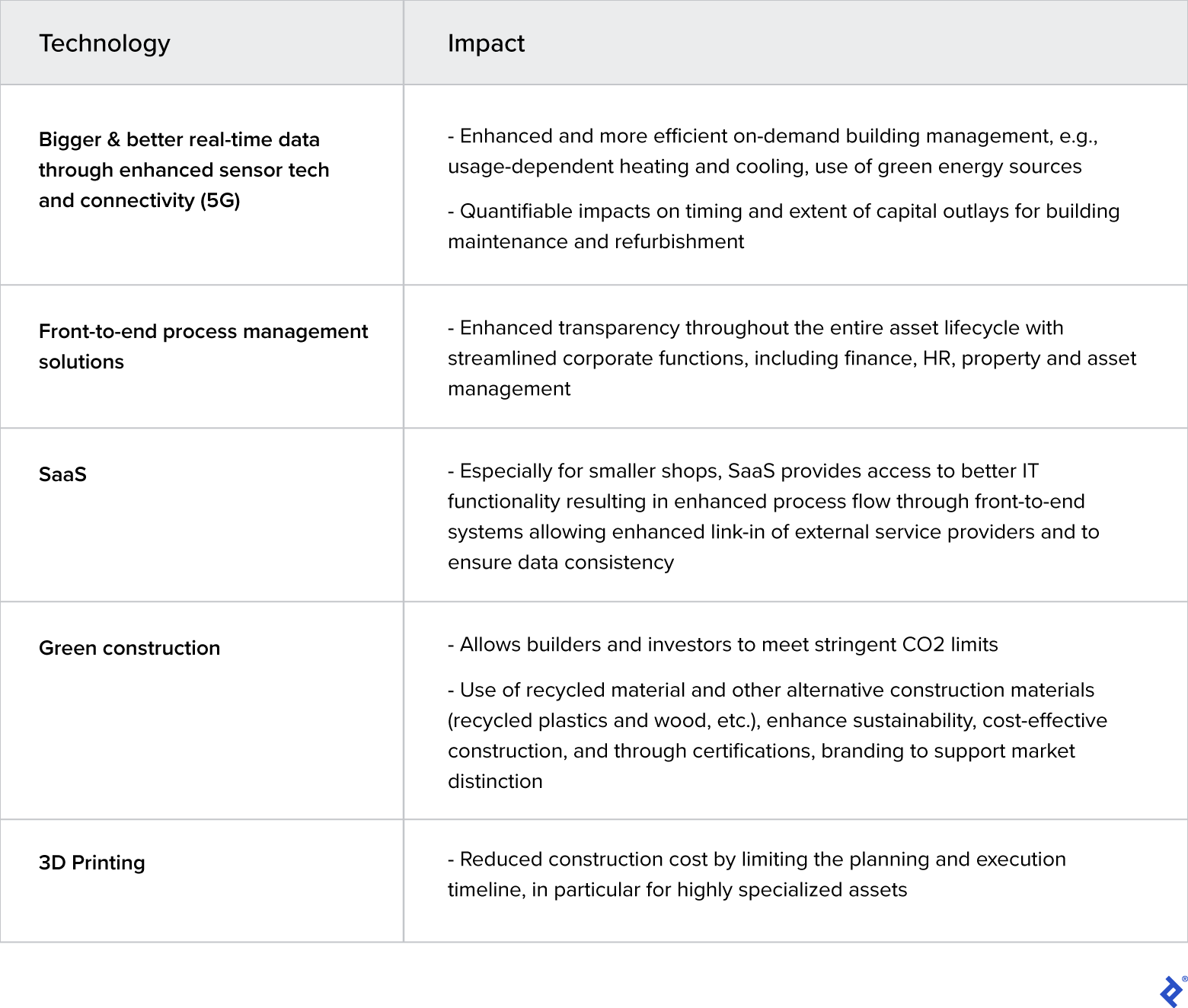

Digitization and Technology Impact

Recent developments in the real estate space are characterized by broad-based technology-driven innovations commonly referred to as PropTech. With total VC PropTech investments of $16bn in 2019 alone, digitization—and PropTech in particular—will have a profound impact on the real estate industry going forward.

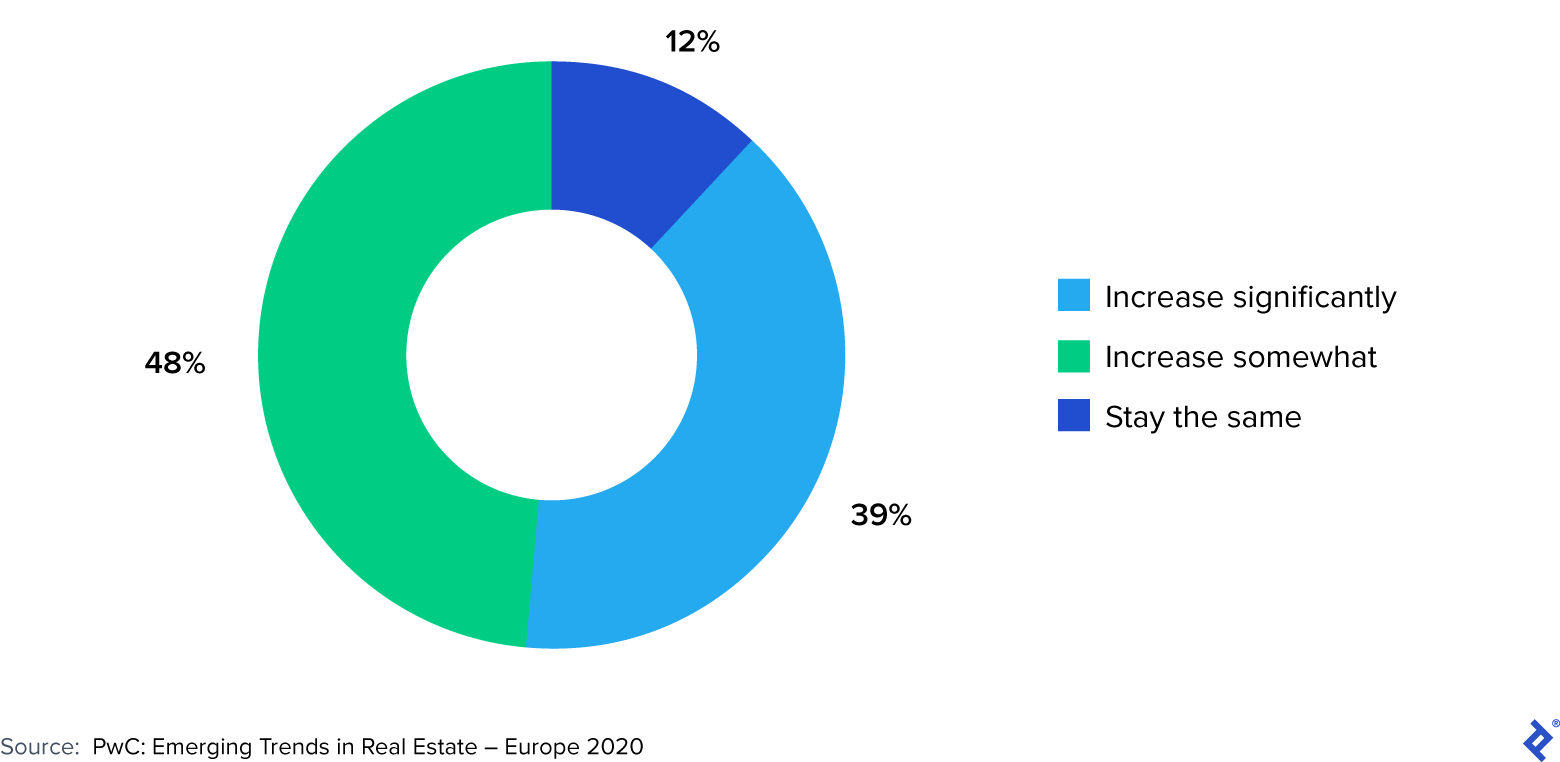

Accordingly, 87% of market participants in Europe expect increased PropTech spending over the next 3-5 years according to PwC’s 2020 Emerging Trends in Real Estate.

PropTech Investment/Usage in the Next 3-5 Years

Major Trends Impacting the Commercial Real Estate Industry

Over the past 10 years, the commercial real estate industry has moved to main street in terms of market appeal and, to the most part, met investors diversification and yield enhancement expectations with respect to overall portfolio performance.

However, with already sky-high prices and significant geopolitical and macroeconomic challenges ahead, the next 10 years will provide significant challenges. Hence, quite a few market participants should look at their in-house capabilities needed to manage portfolios and assets in rather stormy waters.

Given the prolonged period of “institutional confidence-building” since 2009, it may take a violent market fallout to see who has learned their lesson, or to quote Warren Buffett: “Only when the tide goes out do you discover who’s been swimming naked.”

• • •

Additional Real Estate Reading on the Toptal Finance Blog:

Understanding the basics

How big is the commercial real estate industry?

The commercial real estate industry in the United States is $1.2 trillion, according to IBIS.

What are the major risks to the commercial real estate industry?

Climate change, US-China trade conflict, Iran conflict, coronavirus outbreak, Libya conflict.

What are the major trends impacting the commercial real estate industry?

1) Bigger and better real-time data through enhanced sensor tech and connectivity; 2) Front-to-end process management solutions; 3) SaaS; 4) Green construction; 5) 3D printing

About the author

With 25 years in finance, Martin has raised ~$500 million in capital and managed real asset portfolios from $50 million to $10+ billion.

PREVIOUSLY AT