The Power of Choice: Bootstrapping vs. Venture Capital

As a founder, how should you fund your startup? Bootstrapping and venture capital both come with advantages and limitations, but this framework can help you compare the two options and make the best decision for your business.

As a founder, how should you fund your startup? Bootstrapping and venture capital both come with advantages and limitations, but this framework can help you compare the two options and make the best decision for your business.

Pala is a seasoned finance professional with expertise in startups and their funding. He has served as CEO of several high-tech startups, and, as a successful IT entrepreneur, he has founded, grown, and exited two ventures.

Expertise

Previous Role

Founder and CEOPREVIOUSLY AT

When entrepreneurs are contemplating how to realize the dreams they have for their concept or product, they most often consider raising an angel or venture funding round to bring these ideas to light. There are in fact thousands of glamorous success stories of startups accelerating growth with fundraising. And then, at the same time, there are 10 times as many fundraising scenarios with unglamorous or failure-related outcomes.

However, there are also thousands of entrepreneurs who have used bootstrapping as a strategy for survival until they got to a sizeable revenue figure, and only then sought funding. Not only could they easily convince the investors of their revenue and business model, based on their strong record of trailing numbers, but they could also command a respectable premium for that proof.

Many factors are important in deciding whether fundraising or bootstrapping is the right choice for you:

- Uniqueness of your product

- Maturity of your market

- Pace of your growth

- Length of the opportunity window

- Types of growth challenges and limitations

Utilizing my experience working with startups and sitting on their boards, I outline in this article how an entrepreneur can think about the choice of bootstrapping versus venture capital, starting with some background and proposing a scorecard for evaluation. I also discuss the advantages and disadvantages of bootstrapping, versus the pros and cons of venture capital funding, to help entrepreneurs thinking about how to get funding for their startup.

Aspirations vs. Reality

A conversation I had with an entrepreneur in Bangalore shed light on a huge reality present in the startup space in emerging markets like India and possibly elsewhere too. For decades, these markets were underserved. After a few unicorns and phenomenal success stories emerged from these markets, the venture capital industry boomed. Suddenly, there was too much money chasing too few good ideas and there was, as a consequence, an overfunding of many companies. Some conscientious entrepreneurs returned the money to the investors, stating that they had no good use of the funds raised because money was not solving the problems they had with their business model. Some continued to go down the path of overspending with no results until they crashed and burned.

In retrospect, many of those overfunded companies could have survived as modest operators in their space, perhaps even with profits good enough to make the founders happy and rich, becoming what we call a “lifestyle business.” But these returns were simply not adequate enough to justify the excessive funding they took on, and they subsequently had to die an expensive death.

Talking to several other entrepreneurs, I have noticed that there is some stigma attached to bootstrapping. The common view that they tend to hold is that, if you’re profitable too soon, you aren’t pushing yourself. Let me explain the thinking: What they believe is that if you’re profitable before taking a sizeable amount of venture capital funding, then you’re making a mistake by not growing the company quickly enough. This isn’t necessarily true. Indeed, this is exactly the trap that has fooled many entrepreneurs into taking more money than was necessary and putting their business in jeopardy.

Trace Cohen at New York Venture Partners cautions: “We want to see your plan to generate $50 million in 5 years – that means you’ve become a player in your industry, you have amazing customers and figured something out. Anything less than that isn’t worth our time.”

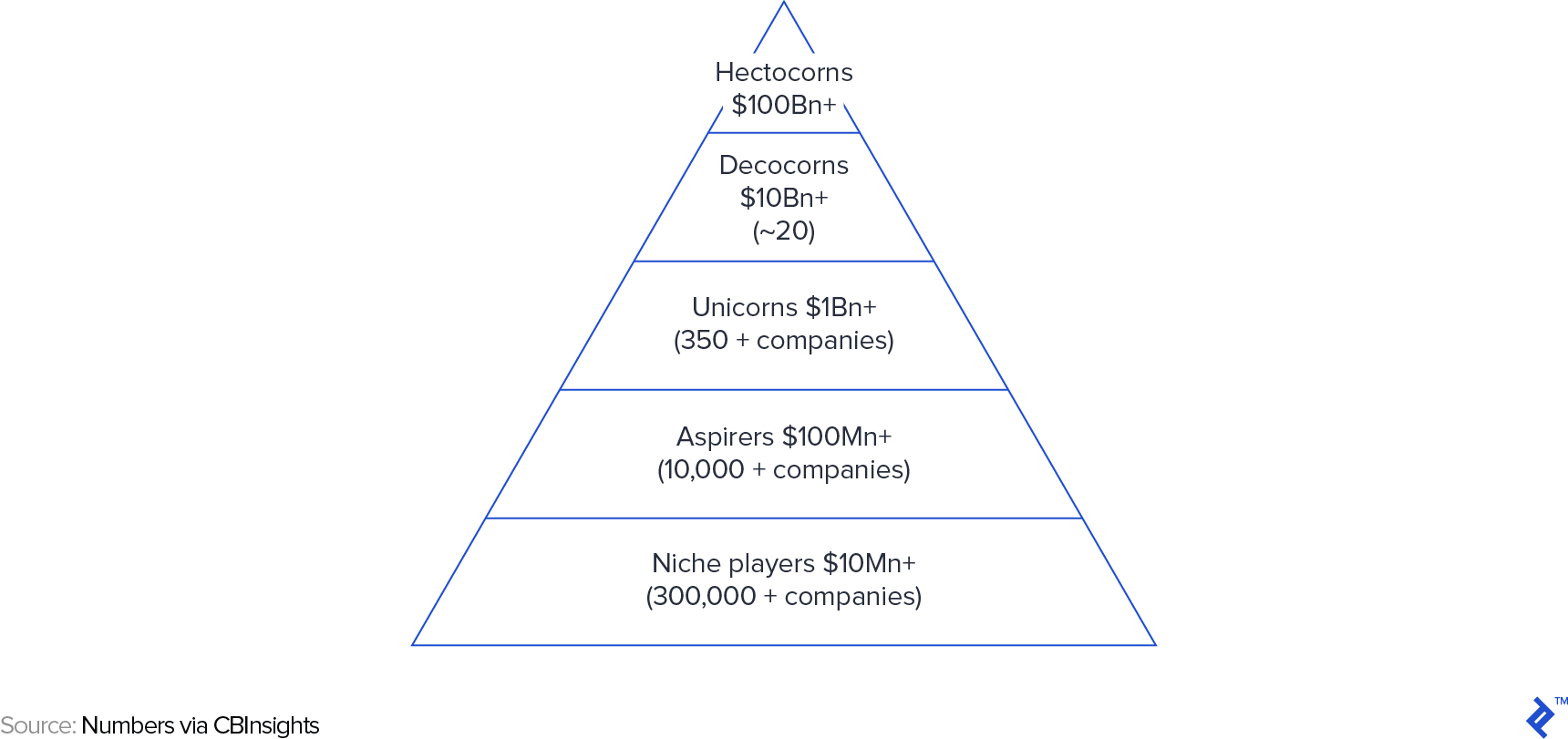

While different venture funds may have different criteria, the quote above gives us a good idea on what VCs expect out of a startup. Look at this data on the revenue size achieved by startups globally, to get a grasp on reality.

Let’s face it. Not every idea is a potential candidate to become a unicorn, or even to get to the $100+ million space. A very useful frame of reference for the type of market and number of clients you need to achieve to climb the pyramid is contained in Christoph Janz’s brilliant analysis on how to build a $100 million business. However, this will not be possible for everyone, and there is no shame in that. You can be a successful entrepreneur, running a roaring business, serving a niche market, addressing a $100 million market, generating $10 million in revenue and working toward a north star of $30 million. You may not be the perfect candidate that venture funds are looking to invest in, but you can run a very successful and rewarding company with happy employees. As a matter of fact, I know and have worked with dozens of similar sized companies in the market research and consumer insights space.

Pulling off a startup is already a great feat considering the odds for success. Getting to the top three rungs of the pyramid, however, is very unlikely. Many VCs will still compel you to get there and will say “Go big or go home.” If you believe that you are able to build a successful startup in the $10 – $100 million bracket, but not necessarily with the potential to climb up the pyramid, you might actually do yourself a favor by bootstrapping. This will reduce outside pressures on spending and rapid growth, therefore largely improving your chances of survival.

A Scorecard Method for Deciding Whether to Bootstrap

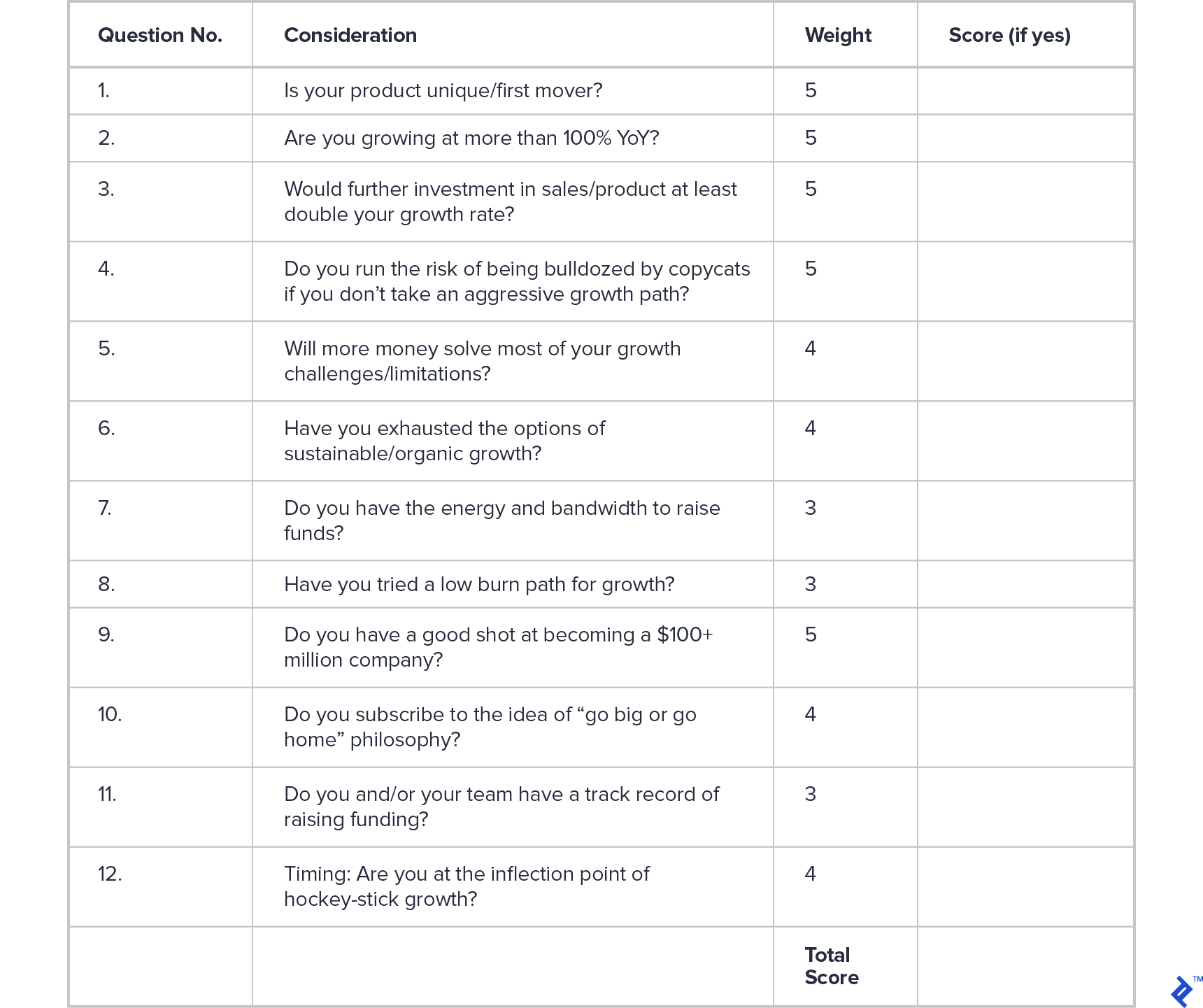

Although the revenue potential of your startup is a key indicator of whether you are a good candidate for venture funding, it isn’t the only criterion that can help entrepreneurs decide between bootstrapping and fundraising. If you’re reading this blog, you have probably read around the topic extensively, but perhaps have received conflicting reports.

I see scorecards as simple instruments to move from analysis paralysis to actionable insights.

With so much information to process, it’s only helpful if we can deploy that knowledge and a framework to help us in making a good decision. What we are trying to achieve here is a thought framework that will help you identify a few key characteristics of your business, of your funding needs, in addition to the personality and skills of the founders, that can help you assess whether you would be a good candidate for venture capital. In a way, it is not dissimilar to the checklist that VCs utilize to assess whether companies are a good fit for them. Here is an example from Point Nine.

Obviously, as part of this exercise, you should also have thought of what your company’s short, medium, and long-term objectives are, what your go-to-market strategy is, and, most importantly, about what resources you need in order to achieve these objectives. Here is some useful advice from Fred Wilson on how much money to raise (if that is the appropriate path for you).

So, let us break this down into a scorecard that will point you in the right direction.

Bootstrapping vs. Equity Funding: A Scorecard

Interpreting the Results

If your score, as calculated through the scorecard, is below 30, you should seriously consider bootstrapping. If your score is above 40, you’re probably a good candidate for fundraising. If you’re between 30 and 40, you’re in a zone that requires more consideration of the pros and cons of both options before choosing.

Bootstrapping Considerations

When bootstrapping, entrepreneurs are not just having skin in the game, but are also sticking their necks out. They act instinctively to save the company and themselves at all costs. They tweak their business model, pivot their product, and do whatever it takes to make their venture successful and turn their company profitable. Maybe, some decisions for survival in bootstrap mode might hurt their growth rate, but delayed growth is most definitely preferable to a premature death, for both the entrepreneurs and their employees.

As we saw in the market value pyramid of startups, the probability of success and survival is vastly higher at the bottom of the pyramid, i.e., the $10 – $100 million space. Ironically, this is the space that is less desirable for VC, a fact that is apparent when looking at the mathematics of venture funds, and the fact that funds are becoming larger and larger and need larger deals.

Again, it is worth repeating that if your honest opinion is that you and your startup are more likely to stay in this part of the pyramid, you’ll be doing yourself a favor by bootstrapping.

Control and Time Allocation

Bootstrapping gives you complete control of your company and direction. You can experiment, fail fast, repeat. There isn’t anyone questioning you except yourself. You won’t need to work on business plans and spreadsheets each time to convince the board about your hunch. You can spend that time on making your hunch work. With bootstrapping, you have your entire focus on the product and its success. Your key resources aren’t loaded with too much administrative overhead. The fundraising process, furthermore, can take away a considerable amount of founders’ bandwidth, possibly 10 to 20 man months of effort per round of fundraising.

Equity and Dilution

Bootstrapping allows you to preserve your valuable equity until a point where you are ready to command an attractive price for it by having a demonstrable commercial traction and track record. As the conventional wisdom goes, it is easy to raise money when you don’t need it.

Also, bootstrapping might be the forced choice for you if the founders and team do not have enough background or experience in fundraising and/or the market. Last but not least, it comes down to the market. When markets are tough, even deserving companies can find it an uphill battle to raise money. Bootstrapping is a smart choice to sail through the tough times on your own dime, with anticipation to explore fundraising later on, when the market is conducive to doing so.

In the market research industry, which was traditionally a less appealing space for venture capitalists, I have witnessed companies like Surveymonkey and Qualtrics who bootstrapped and grew organically but sharply into billion-dollar-plus valuations. They did not need venture capital injections to get to this point. There are many successful unicorns that shied away from venture capital and chose to bootstrap until they got to a large scale. Mailchimp, Shopify, Wayfair, Mojang, Atlassian, and Shutterstock are some great examples of bootstrapped success.

Surveymonkey is a particularly great example of bootstrapping done right: It had great branding and kept a low profile, a good business model, and sticky customer retention for SMEs. This has served them very well, and the owners were able to sell their shares to a private equity group in 2009.

Fundraising Considerations

So, when is fundraising the better choice? If you have a unique, highly scalable product with a short success window and the potential to be a $100 million company in the short run, clearly an injection of capital would solve the majority of your growth challenges. Therefore, it would make sense to fundraise.

Oftentimes, though, the answer is not this straightforward in real life. Every entrepreneur is likely to be biased about their product’s uniqueness, scalability, and potential. Money may appear to solve all of their growth problems. This can wrongly skew their decision-making process towards fundraising.

A product may not be unique, but instead, a terrific fast follower, challenging the incumbent and with the promise of taking on the market more aggressively. This can also be a great candidate for fundraising despite the fact that it is not unique. Alibaba, Flipcart, and Ola are good examples of fast followers that created a geographic niche for themselves by using funding to establish themselves very quickly.

Funding can be considered for a few other benefits too:

- Fundraising can add value when the investors bring valuable network, client access, or industry expertise.

- Strategic funding is a good option to get funded by your potential clients and prospective acquirers, such as Lyft getting an investment from General Motors.

- External funding is seen as an endorsement that helps to attract better talent and clients. Funded companies are viewed more favorably by clients and employees, as it is perceived as a proof of the startup’s potential and financial capability, particularly if the funder has a good reputation—take as an example Y-Combinator companies.

Revenue Potential Is the Key Variable

Revenue potential emerges as a key indicator to determine whether your startup needs to raise money to grow fast. If the potential is high and you’re an early player, you need to be cautious and make sure that the space will most definitely attract other competitors due to the opportunity. Speed will be of the essence and raising external money will be the fuel to this fire.

Higher revenue potential is a more acceptable compromise for ceding equity to investors, as with valuations predominantly based off revenue multiples, it will ensure that down the line, there is still money on the table for the founders from their ownership percentages

Revenue potential also becomes apparent once the product is proven and there is a clear path toward scalability. At this point, it is ripe for funding to accelerate growth because the capital intensive initiatives required to do this—such as marketing, sales, support, and expansion—can be daunting or impossible for the business to fund through its own reserves.

Conclusion

There are numerous success stories from Silicon Valley about how venture funding catapulted startups into stardom on a fast trajectory. Whatsapp, Groupon, Snapchat, Alibaba, and Zynga are some of the examples of spectacular success with venture funding. Whatsapp is a great example of the perfect venture case: a consumer product that was simple to use, that had built-in virality, and that just needed to reach as many users as quickly as possible to be here to stay. If you have decided, after applying the scorecard, of course, that venture capital is the way to go for you, this checklist is a good resource, alongside contracting experts to assist you with the process.

Talking to entrepreneurs who have tried and succeeded (or failed) in both approaches will be a valuable exercise to help collect your thoughts. I personally consider this to be an enriching experience on many levels. Getting some professional help from experts in this space and strengthening your advisory board with members who have the right experience can also help you make informed, confident choices about your business and choosing bootstrapping or venture capital to fund it.

Further Reading on the Toptal Blog:

Columbus, United States

Member since March 20, 2018

About the author

Pala is a seasoned finance professional with expertise in startups and their funding. He has served as CEO of several high-tech startups, and, as a successful IT entrepreneur, he has founded, grown, and exited two ventures.

Expertise

Previous Role

Founder and CEOPREVIOUSLY AT