Strategies for Raising Startup Capital in Small Markets

Raising startup capital in smaller cities is harder than in prominent areas, like Silicon Valley. Strategies for fundraising must be tweaked to account for the different blend of investors on offer.

Raising startup capital in smaller cities is harder than in prominent areas, like Silicon Valley. Strategies for fundraising must be tweaked to account for the different blend of investors on offer.

Brendan has raised more than $700 million and built strategic relationships with numerous Fortune 500 companies to help grow businesses.

Expertise

PREVIOUSLY AT

Startup hotbeds like Silicon Valley, Austin, Boston, and New York City are becoming increasingly differentiated by their “infrastructure” (incubators, accelerators, angel networks, etc.), which supports the creation and growth of new companies. This social infrastructure makes raising early-stage capital in those markets materially easier than in other places.

However, if you don’t live in a startup hotbed but have a promising idea for a business, there are ways to raise the capital you need to get started. Pulling from my own experiences of raising more than $40 million of pre-seed equity, more than $200 million of total equity, $110 million of venture debt, and $365 million of permanent debt to fund privately held companies in the southeast US, here’s a practical guide for raising significant startup capital for early-stage companies in small markets.

If you’d like to skip ahead to the two sources I think are the most valuable, head to the sections on Angel Investors and Strategic Partners.

The Stages of Investment for Young Companies

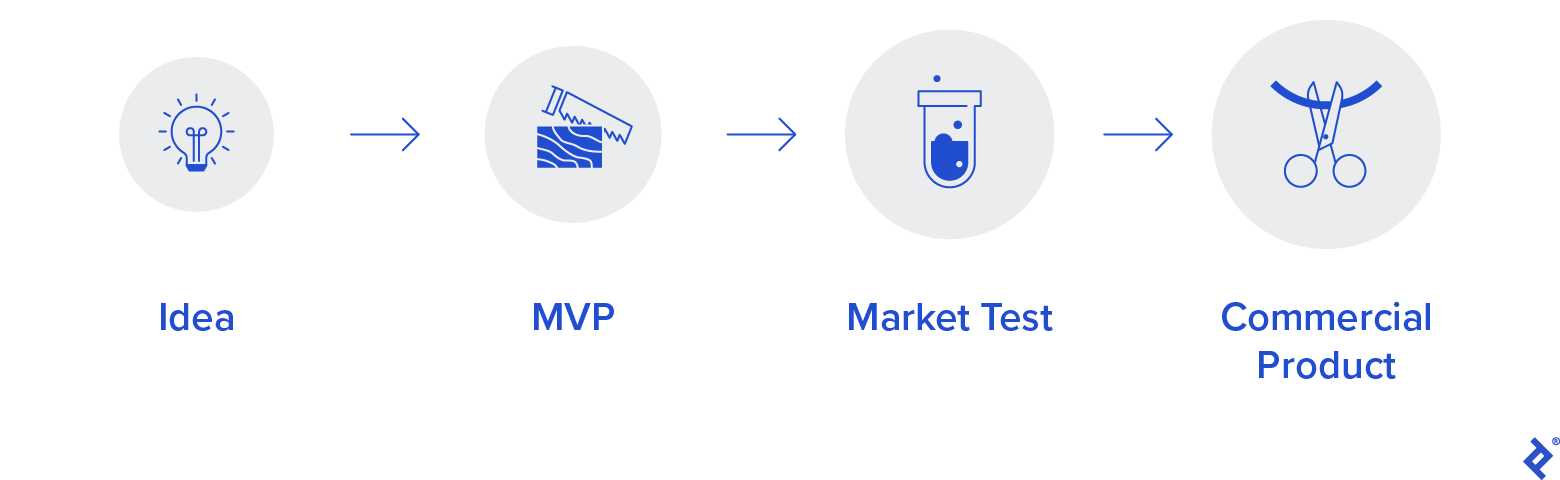

A typical early-stage company evolves through four phases: from the idea to a finished commercial product.

| Phase | Idea | MVP | Market Test | Commercial Product |

| Description | Founder identifies a market need, a differentiated solution to meet the need, and forms a company to pursue the opportunity. | Company develops a minimum viable product (MVP) to test its solution in the market. | Market tests are run to get customer feedback and determine the solution’s feasibility. | MVP version of the product is enhanced based on learnings from the market test. Finally, it launches commercially. |

The idea phase is almost always self-funded, as minimal capital is typically required to conceptualize an idea, write an initial business plan, and form a new legal entity. It rarely makes sense to quit your day job at this stage.

The fundraising challenge really begins once the MVP phase is reached. This is the point where significant capital is required for product development, sales and marketing, patent preparation, etc. to get the venture off the ground. It is also the point when founders reach the crossroads of needing to quit day jobs and commit to the startup full-time. This usually means capital is needed for salaries or stipends.

For many companies, the capital required at the MVP and Market Test phases can be on the order of $500,000 to $1 million, or even more for ideas with significant product development or capex requirements. That’s a lot of money to invest in a company that hasn’t proved it can build a product that customers will pay for.

Let’s talk about where you’re most likely to find such capital.

Fundraising Sources in Smaller Markets

The most commonly mentioned sources of capital for early-stage companies include:

- Self-funding (aka bootstrapping)

- Friends and family

- Incubators/accelerators

- Crowdfunding

- Government contracts or grants

- Business plan contests

- Angel investors

- Strategic partners

Let’s address each of these individually and discuss how practical they are outside the major startup hubs.

Self-funding

Self-funding is great – if you can do it. You don’t lose any of the potential upside through dilution. You don’t give up any control over the company. You don’t delay product development and market entry while you’re trying to raise capital. The major downside to self-funding is that you don’t have other investors who may be helpful strategically, or for future financing rounds.

The corollary to the above paragraph is that self-funding is only great if you can do it “comfortably,” i.e., a total loss of your investment won’t materially impact your lifestyle. Remember, only around 10% of startups succeed. Consider the following real examples of three personal acquaintances who decided to self-fund their own startups.

a) The “Ultra Rich” Entrepreneur

The first person invested and subsequently lost $20 million starting a professional sports team. However, his net worth is +/- $500 million, so the loss (4% of net worth) was aggravating but not catastrophic. Let’s all aspire to get to the point where a $20 million loss is not catastrophic!

b) The “Rich” Entrepreneur

Another friend invested $15 million in an early-stage venture - and also lost it all. His net worth was “only” +/- $20 million when this happened. He’s still working hard to try to maintain the lifestyle his family grew accustomed to at the $20 million net worth level - when he could have retired comfortably years ago.

c) The “Risky” Entrepreneur

The final person invested $100,000 to start a software company that he ultimately sold for millions. The $100,000 was basically everything he had at the time. In hindsight, this looks like a brilliant investment, but listening to him talk about how stressful it was on his entire family to be “all-in” for years as he was growing the business, he would have been better off raising some external capital and giving up some of the upside to take the pressure off.

The bottom line on self-funding – if you have a high net worth and a great business idea that doesn’t require more than 5-10% of your capital, stop reading this article and get going on bringing your product to market. If you’re not among the lucky 1%, then keep reading for some additional insights.

Friends and Family

Professional VC investors will tell you they only invest in businesses if they have confidence and trust in the management team. This maxim is even more important in very early-stage companies, as Murphy’s Law rules and the company’s success often depends on the ability of hardworking, dedicated, smart, resilient, and creative founders to react to new challenges and constantly adapt to achieve success.

If you think you have what it takes, hopefully, your friends and family do too. If they’re willing to invest, make sure you give them a fair economic deal and use counsel to document it, so they sign all the standard disclosures about understanding and accepting the risks associated with the investment. If you’re one of the 90%, and your startup doesn’t make it, the very last thing you’ll want to compound the disappointment is a falling out with your friends and family because they felt deceived.

If you picked your parents well and have all the capital you need, then good luck to you. Some entrepreneurs don’t have this option, while others prefer to keep a clear separation between their professional and personal lives.

Incubators/Accelerators

While not a new concept, the emergence of business incubators/accelerators as a prominent force in the startup community is relatively new. These entities – more prevalent in the major startup hubs – typically provide affordable workspace, mentoring, and networking opportunities to early-stage companies. In a very limited number of cases, they also provide capital to selected companies. Far more frequently, they just provide help with fine-tuning business plans, preparing fundraising presentations, and making connections with potential investors.

Especially for first-time entrepreneurs, or others with limited fundraising experience, this type of assistance can be very valuable. However, the key point is that you’re getting advice, not money. You can’t pay bills with advice. Advice that comes without financial skin in the game can also be an unhelpful distraction that pulls you in different directions.

Crowdfunding

Crowdfunding is a relatively new concept in the US, having been legalized in 2016 via the JOBS Act. There are many crowdfunding platforms out there, each with its own niche specialization.

I’ve heard the success stories of companies that raised money through crowdfunding, but I have yet to try it myself. I did, however, spend a lot of time looking into it for my last startup, an AI-powered SaaS product that enabled real-time bidding on products and services, initially targeting the golf industry. Ultimately, it was an easy decision not to go the crowdfunding route for a number of reasons, including:

a) Low Success Rate

My research showed that the success rate at raising significant capital was low. If I was trying to raise $50,000, I might have tried it. However, I concluded that my chances of raising the target of $500,000+ were not good.

b) Disclosures

I didn’t like the idea of putting a lot of private information about my business that prospective crowdfunders needed to see out on the internet for customers and competitors to view. In fact, I didn’t really want my customers to know that I needed to raise money, as most customers don’t like to do business with vendors that they perceive to be undercapitalized and may not be there to support the products they sell.

c) Competition

My sense, rightly or wrongly, was that the crowdfunding process is often a case of style over substance. The companies that were successful at crowdfunding had glossy marketing materials and aggressive social media marketing campaigns that did not necessarily correspond to the quality of the investment opportunity. I felt like it would be hard to differentiate my quality investment opportunity from the host of other offerings that had been “dressed up” to look appealing to the relatively inexperienced investors that provide most of the capital on these sites.

Having said that, product crowdfunding (not equity) does have two compelling potential benefits:

- You usually don’t have to give up any equity in exchange for the funding.

- By virtue of raising the money on the platform, you have demonstrated that consumers will pay for your product. This can be a great way to validate your business idea.

I wouldn’t tell you definitively not to try the crowdfunding route, especially if you’ve come up with a sexy consumer product that you may be able to pre-sell. However, I will tell you that it’s clear to me that it’s not the panacea for most early-stage fundraising challenges. I can also tell you that my opinion is shared by several startup company attorneys that I have worked with for years and who have had other clients try unsuccessfully to raise money on various crowdfunding platforms.

Government Contracts or Grants

Government contracts and grants are great – if you can get them. It’s basically free capital that pays for product development and might even stretch to revenue generation. You don’t have to give up any equity, and the government doesn’t typically care if your company is in Silicon Valley or Death Valley. But, in my experience, government funding is very time-consuming to pursue and extremely difficult to obtain.

Having worked at both a NASA contractor and a Fortune 500 defense contractor early in my career, I learned that many government procurements (i.e., the requests for proposals that you respond to in order to win a contract or grant) are “wired” for the companies that have been working with the procuring agency for a long time (often years) in order to get the funds allocated. Thus, the joint probability of a startup company seeing the right procurement request at the time it needs money, submitting a proposal, and getting a contract award in a timely manner is very low at best.

Over the years, I’ve tried several times to bid for government projects that were seemingly directly on point with what my early-stage company did. I’ve yet to win one. I do know three entrepreneurs who have successfully obtained government funding for startups. In each case, they were in the government contracting industry and had a government customer ask them to start a business in order to provide the customer something it needed and couldn’t get from other sources. These situations took years to play out, and in each case, the government ran a procurement to get other bids before issuing the contract to my friends’ companies. You don’t want to be the person who was wasting their time preparing a competing bid.

Business Plan Contests

It’s not uncommon to see universities, angel investor networks, incubators, or other similar organizations run business plan contests. Often, there is a monetary prize for the company whose plan is judged to be the winner.

In my experience, the amount of the prize is typically well under $50,000. The largest award I’ve heard of is $100,000. While these amounts are certainly significant, the fundraising problem we’re trying to solve is typically $500,000 or more. Consequently, I don’t see this path as a viable solution.

However, I should mention that these types of contests have ancillary benefits for first-time entrepreneurs and inexperienced fundraisers in that you typically go through a process that forces you to refine your business plan and practice your pitch skills. This is all beneficial when you go on to raise “real money.”

Angel Investors

If you’ve made it this far into the article, you’ll be happy to know that I saved the best for last, as the two most promising fundraising sources for many startups are about to be discussed.

Over the years, I’ve raised a lot of money from angel investors for early-stage companies located in small markets in the southeast US. By angel investors, I mean individual investors who are not “friends and family.” You may also find “super angels,” who actively seek deals and invest significant amounts of capital into them or bring a group of co-investors into the deal as well.

My personal record is $1 million raised from a single angel investor in a single deal. In a separate deal, I had one investor who put in $25,000, but it was one of 40+ angel investments he had made, and he brought in 5-6 of his regular co-investors with him.

This is an excellent example of how angel investors can add value beyond just their capital. Often, they know other investors who might be interested, or they have insights about your company/product that can be very beneficial. It rarely hurts to have a group of sophisticated, well-heeled investors with a vested interest in your company’s success.

I should also make the point that I differentiate individual angel investors from angel investor syndicates, which generally seem to subscribe to the institutional VC definition of early stage, i.e., “call me back when you have $500,000 of annual revenues.”

Here are some good rules of thumb regarding angel investors:

- They typically invest in things they care about and understand.

- They like to invest alongside their friends.

- Like friends and family, you have to be really careful to make sure they understand the risks and are prepared to lose their entire investment.

So how do you find angel investors who might be interested in your deal? The simple answer is you have to network like crazy!

Here’s an example. In my last startup, the SaaS company targeting the golf industry, I raised $1.2 million from 25+ angels to fund the development of the MVP and do a market test. But I talked to well over 200 individuals and angel investor groups trying to raise the money. I ended up with three major groups of investors:

- My own golf buddies from the local area

- My business partner from a prior successful startup and his golf buddies

- Members of a golf club in Chicago, one of whom was the brother-in-law of one of my local buddies

They obviously all had golf in common, so they could understand the benefits of the company’s product. Everyone knew at least several other investors in the deal, including someone who knew me personally and could vouch for me. Finally, for all of them, this wasn’t “their first rodeo,” they had invested in other startups and knew the risks they were taking. When they saw the subscription agreement with five pages of risk factors, they weren’t scared away.

At the risk of stating the obvious, to attract angel investors, you also need to have a compelling investment opportunity and it has to be presented properly. Stay tuned for my next article on how to get both of those parts right.

Strategic Partners

I’ve also raised a lot of money over the years for very early-stage companies from strategic investors. To be clear, I’m talking about operating companies, not the corporate venture funds that are a major part of the VC landscape today. The good news about dealing with strategic investors is they often:

- Don’t care where you’re geographically located.

- View numbers like $500,000 as rounding errors.

- Can create significant additional value for your company beyond just the cash they invest.

The only thing I don’t like about sourcing capital from strategics is that it often takes longer than you want, as big companies often fear making bad decisions so much that they go overboard on due diligence. It’s hard to have patience when you’re worried about making payroll, but the wait is often worth it.

The keys to attracting strategic investors are:

- Having a product idea that’s compelling and synergistic to them

- Getting to the right person in the organization to pitch your idea

- Structuring the deal so it generates operating revenue for them, not just a return on their equity investment

I’ve never had a corporate investor write a check as just a passive investor. However, I have raised a lot of money from large corporations when, for example, I:

- Licensed their technology, then asked the licensor to invest cash to “buy up” the royalty percentage.

- Granted exclusive manufacturing rights to a Fortune 500 company that had a lot of excess manufacturing capacity.

- Sold the first 10,000 units of our (to-be-designed-and-built) product to a Fortune 500 company that wanted to get a leg up on its competitors.

- Committed to make our unique financial product offerings available through an industry leader’s ubiquitous distribution channel.

In each case, the strategic investor not only had potential upside from its equity ownership, it also had very tangible upside potential in terms of operating revenues. From my perspective, I was more than happy if the investor made money on the operating side because it meant that my company was also doing well. Not to mention, you can be assured that within 30 seconds of meeting any other prospective investor, I managed to slip into the conversation that one of our current customers/partners was (large and well-known) XYZ, Inc., which liked our product so much that it also invested in our company. This implied credibility can be really beneficial for an early-stage, unknown startup.

Get Your Business Plan Right and Stay Focused

Raising money for startup companies in small markets is very hard, but it is possible. If you have identified a great opportunity and have a well-thought-out business plan and a smart fundraising strategy, one of the strategies summarized in this article may well work for you.

| Source | Pros | Cons |

| Self-funding | No dilution Avoid fundraising time and effort | Only viable if you have significant resources Lose potential benefits of having other investors |

| Friends and family | Can come together quickly | Relationships can suffer if the investment doesn't work out |

| Incubators/ Accelerators | Mentoring Investor introductions | Too much advice and assistance can be distracting Rarely have capital on offer |

| Crowdfunding | Validation of market demand and product-market fit No dilution | Public disclosures Tough to raise significant capital |

| Government contracts or grants | No dilution | Time-consuming to bid Low probability of success |

| Business plan contests | No dilution (if you win) Advice and assistance | Rarely enough capital on offer |

| Angel investors | Can provide significant funding and advice | Takes networking effort to raise significant capital |

| Strategic partners | Can provide significant funding and advice Can leverage a known brand to enhance credibility | Big companies tend to move slowly and do a lot of due diligence |

Understanding the basics

What are the sources of startup capital?

There are eight main sources of capital for startups: 1) Self-funding (aka bootstrapping) 2) Friends and family 3) Incubators/accelerators 4) Crowdfunding 5) Government contracts or grants 6) Business plan contests 7) Angel investors 8) Strategic partners

Brendan Fitzgerald

Indialantic, FL, United States

Member since February 14, 2020

About the author

Brendan has raised more than $700 million and built strategic relationships with numerous Fortune 500 companies to help grow businesses.

Expertise

PREVIOUSLY AT