Reorganizing for Survival: Building Scenarios

In the “new normal,” how should business leaders ensure that their business is well-equipped to survive and then thrive? Scenario analysis is a handy tool: How are scenarios built and translated into financial projections?

In the “new normal,” how should business leaders ensure that their business is well-equipped to survive and then thrive? Scenario analysis is a handy tool: How are scenarios built and translated into financial projections?

Natasha transitioned to venture capital after a career in banking built in prestigious firms such as JPMorgan and ESM.

PREVIOUSLY AT

The COVID-19 pandemic brought a lot of changes and chaos for everyone, with stay-at-home orders and enforced social distancing. Now that it is obvious we will live in a “new normal” for the foreseeable future, how should business leaders ensure that their business is well-equipped to survive and then thrive in the future? Scenario planning and analysis is a handy tool in these circumstances.

We provide some insights on effective scenario analysis for decision-making, on how to build and implement scenarios, and finally, on the current macroeconomic, epidemiological, and social assumptions that managers can use to build them.

Planning for Recovery

What Is Scenario Planning?

Shell pioneered scenario planning in 1965. The head of economics and planning developed a methodology that the company still uses effectively to this day. The “Futures” program, as it was called, was born from the intuition that understanding the future better could help the company in setting and executing more effective strategies.

According to the Corporate Finance Institute, “Scenario analysis is a process of examining and evaluating possible events that could take place in the future by considering various feasible results or outcomes. In financial modeling, this process is typically used to estimate changes in the value of a business or cash flow, especially when there are potentially favorable and unfavorable events that could impact the company.”

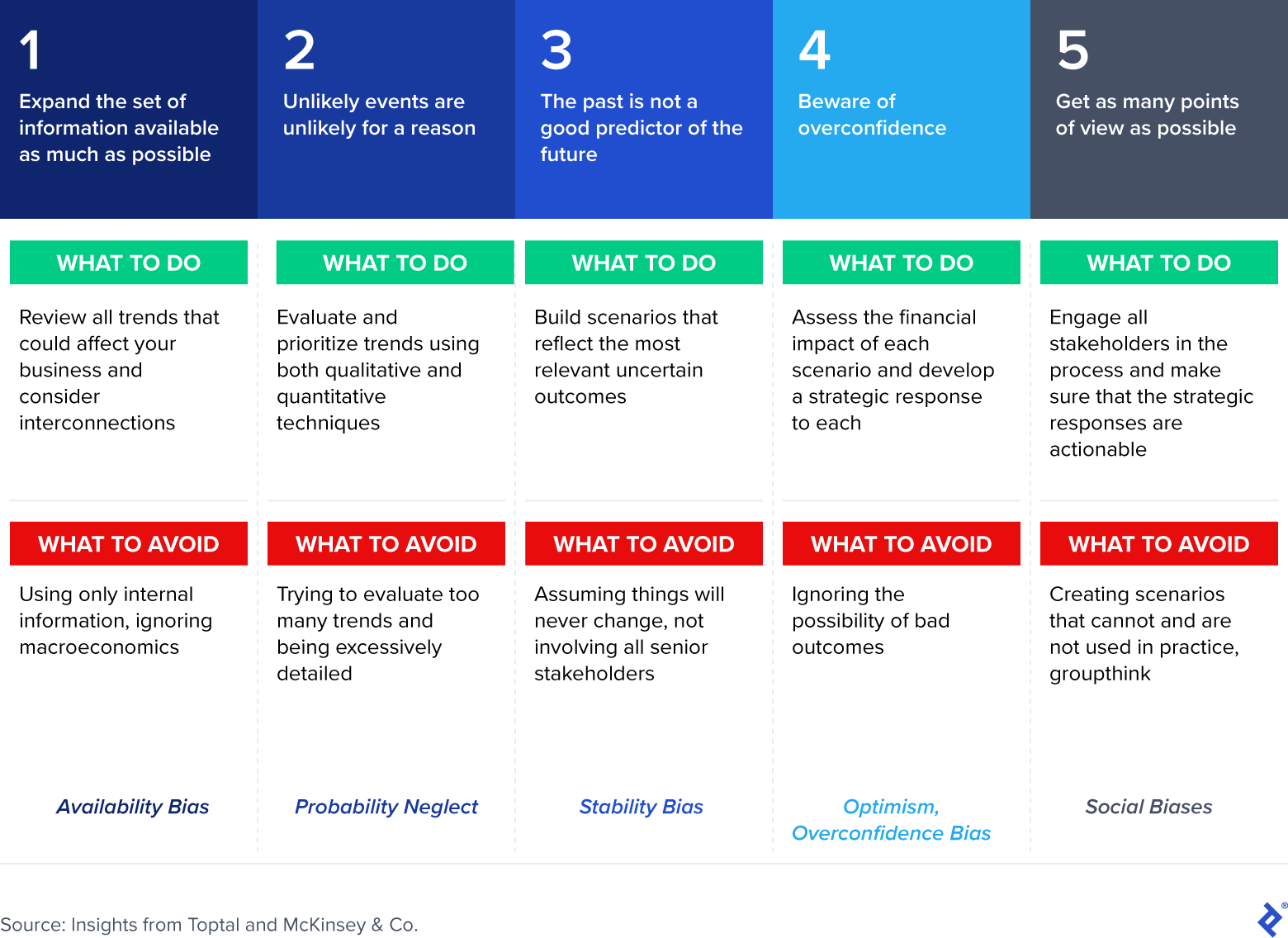

Being able to better prepare for periods of high uncertainty, mainly when that uncertainty is around adverse outcomes, can make the difference in the performance of a company. Companies excel through a better ability to anticipate change and improved ability to learn and respond to it, which is crucial at times of high uncertainty and considerable risk, such as the current pandemic. Previously, the most significant increase in the use of these techniques was immediately after 9/11.

There will typically be three scenarios, although more can be necessary for more complex organizations:

- A base-case scenario describes the expected outcome and is the basis of management’s objectives.

- A worst-case scenario considers what the most severe outcome could be.

- A best-case scenario is the ideal outcome.

What Is the Value of Scenarios and How Are They Used?

Companies can then use the scenarios to create financial projections, which can go out for several years.

Once the financial projections have been calculated, they will form the basis for strategic planning, which will include a differentiated approach for each of the outcomes. The company will then be able to respond better to change, but it additionally has several other positive implications:

- Superior treasury and cash flow management, as management can better anticipate cash needs even when demand outstrips expectation.

- Improved inventory management: reacting quickly to changes.

- Enhanced relations with stakeholders, as management can better explain performance and prepare them for the range of possible outcomes.

The Scenario Building Process Is Complex but Useful

Business analysts start constructing scenarios by first identifying qualitative inputs and then transforming them into qualitative outputs.

The Scenario Building Process

First: Discover Your Variables

The first step is to identify the risks and factors that affect your business. For example, for a restaurant in a pandemic, the variables may include (1) the economic backdrop (e.g., GDP estimates), (2) the epidemiological scenario (as these will have implications for the ability of customers to frequent the restaurant), (3) regulations regarding interactions with the public (will patrons be allowed to consume in, or will the service be take-out only?), and (4) projected consumer spending and sentiment.

For a private equity firm, these assumptions will cover their firm and the portfolio companies. For instance, stay-at-home orders and travel restrictions affect how many of the staff will need to work remotely and how consultants and contractors can be employed in a new, distributed workforce. This list needs to be exhaustive but not exceedingly—going into excessive detail only adds complexity without adding information. At this stage, the purpose of the exercise is to identify what can impact the business and to rank each identified variable by importance.

Second: Understand What Could Go Wrong (or Well)

Second, the potential risks for each of the variables should be estimated. Management needs to dig into each variable, agree on expectations for each, and identify what could present a positive or negative surprise. For example, in the UK, Prime Minister Boris Johnson has announced that he plans to bring the country to as close to normality as possible by the end of July 2020. This “full reopening” could either be anticipated or delayed further, each having a great impact on business strategy. For our hospitality example, this would entail potentially having clients in the busy summer season or not. For PE, this could mean abandoning traditional in-person meetings.

Third: Build Your Scenarios

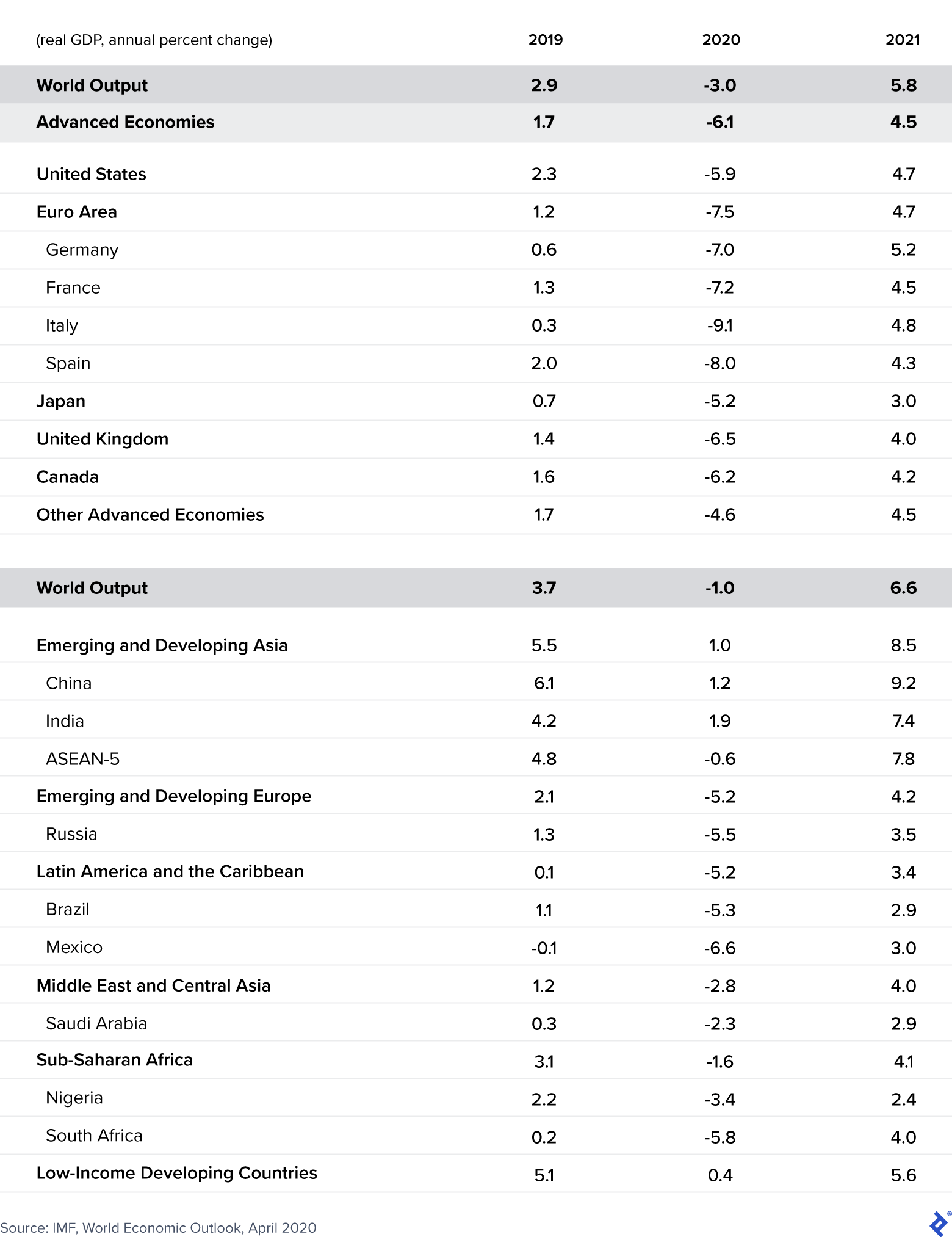

Third, management should then build the required number of scenarios. Starting from the baseline, what is the worst case? What is the best case? What is the time horizon? This step is the first quantitative part of the process, albeit still with external variables. We are not yet looking at the direct impact on the business, but merely trying to quantify the magnitude of the most important external factors to our operations. A good starting point is the macroeconomic projections by the relevant bodies. In the next section, we briefly discuss the IMF Global Economic Outlook for 2020, which covers global GDP forecasts and the risks associated with the pandemic and other factors globally and by country.

Fourth: Understand How Each Variable Impacts Your Business

The fourth step is the one that will then translate into the actual forecasts and company-specific impact numbers. At this point, management should involve the relevant internal stakeholders to quantify the impact of each variable in each scenario would be on the business.

It is important to understand that while the assumptions can be applied to many consumer businesses, the importance of each will not be the same, as it will directly relate to impact. Using the previous example of the hospitality industry, a prolonged stay-at-home order could be positive for a delivery-only service and negative for a sit-down restaurant. The objective of this step is to identify how each variable impacts each key financial performance indicator.

Fifth: Financials, Financials, Financials

The fifth and final step is to visualize the impact of each scenario on the business in its entirety, which will usually be done in a financial model. The best practice is to list the scenarios in an individual tab that is then linked to the projections page. A toggle button would then show the effects of each scenario in the main financial page. The inputs for linking to the result will come from step 4.

For instance, the baseline scenario assumes that consumer spending for the second half of 2020 will follow the economic consensus and that after reducing by more than half in the first half of the year, it would recover to 96% of the value of the year prior. Then, if the assumption is that the share of spending to restaurants remains constant (ignoring other restaurant and location-specific variables), revenues for December 2020 should be 96% of what they were at the beginning of the year. In a hypothetical worst-case scenario, both consumer spending and the share spent in restaurants could be lower, meaning that revenues would be 70% of what they were the previous year.

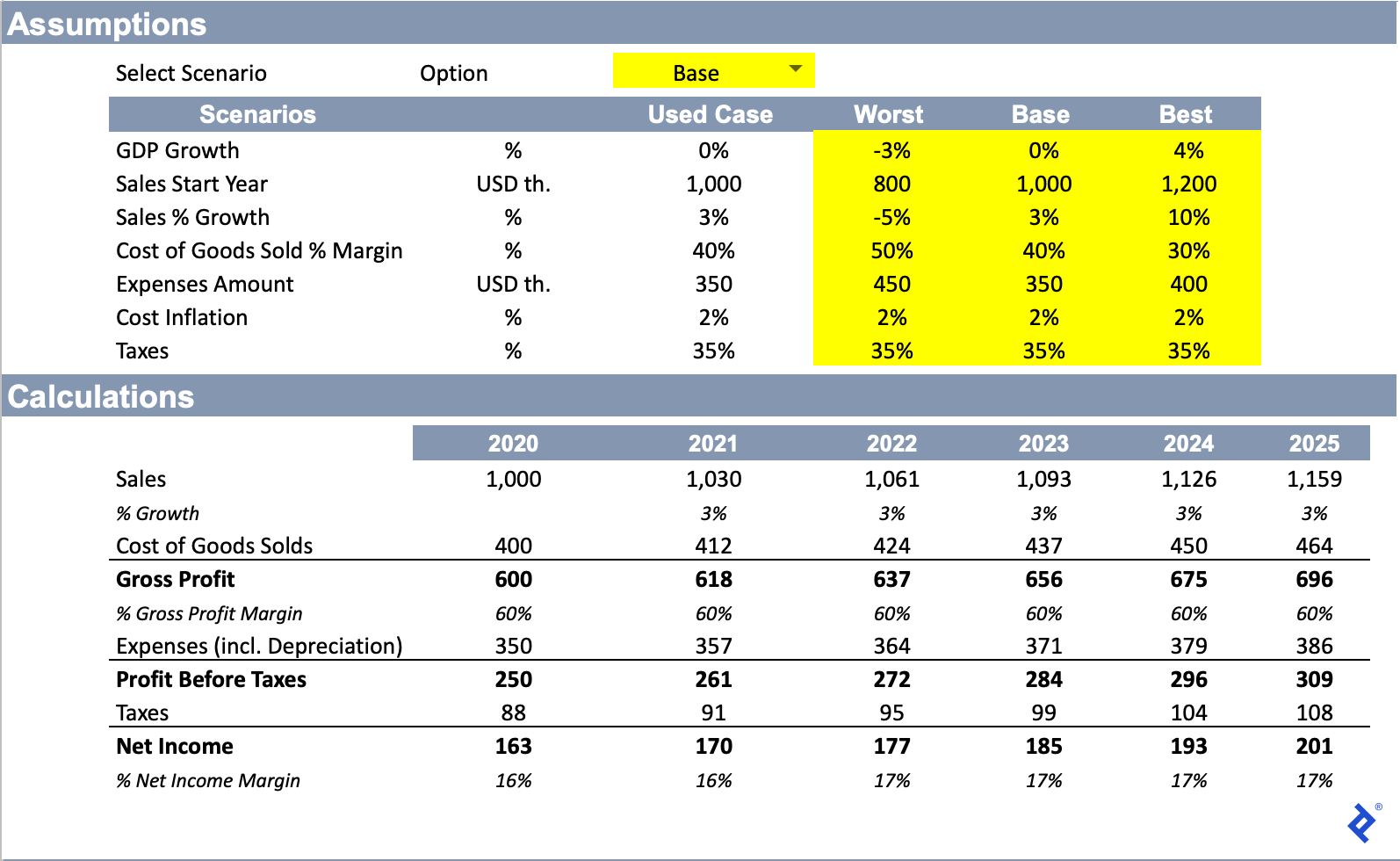

A Simple Model Can Help Visualize How Assumptions Impact Financials

We provide here a very simple financial model that can be used for strategic scenario planning. At the top, we list the variables and show how each one of them behaves in each scenario. The base scenario is one of nearly flat growth over an extended period of time, which could be consistent with a stagnating economy.

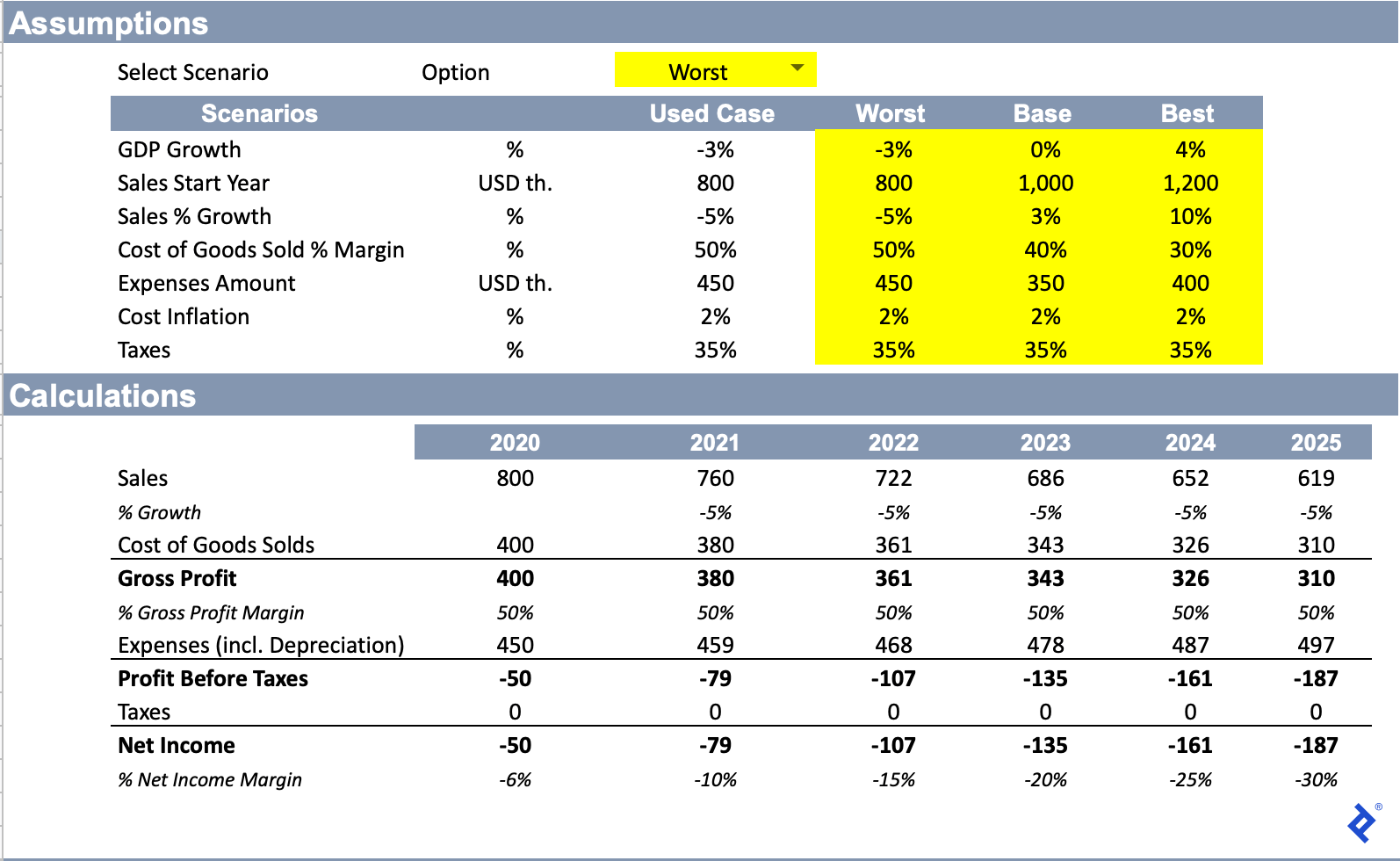

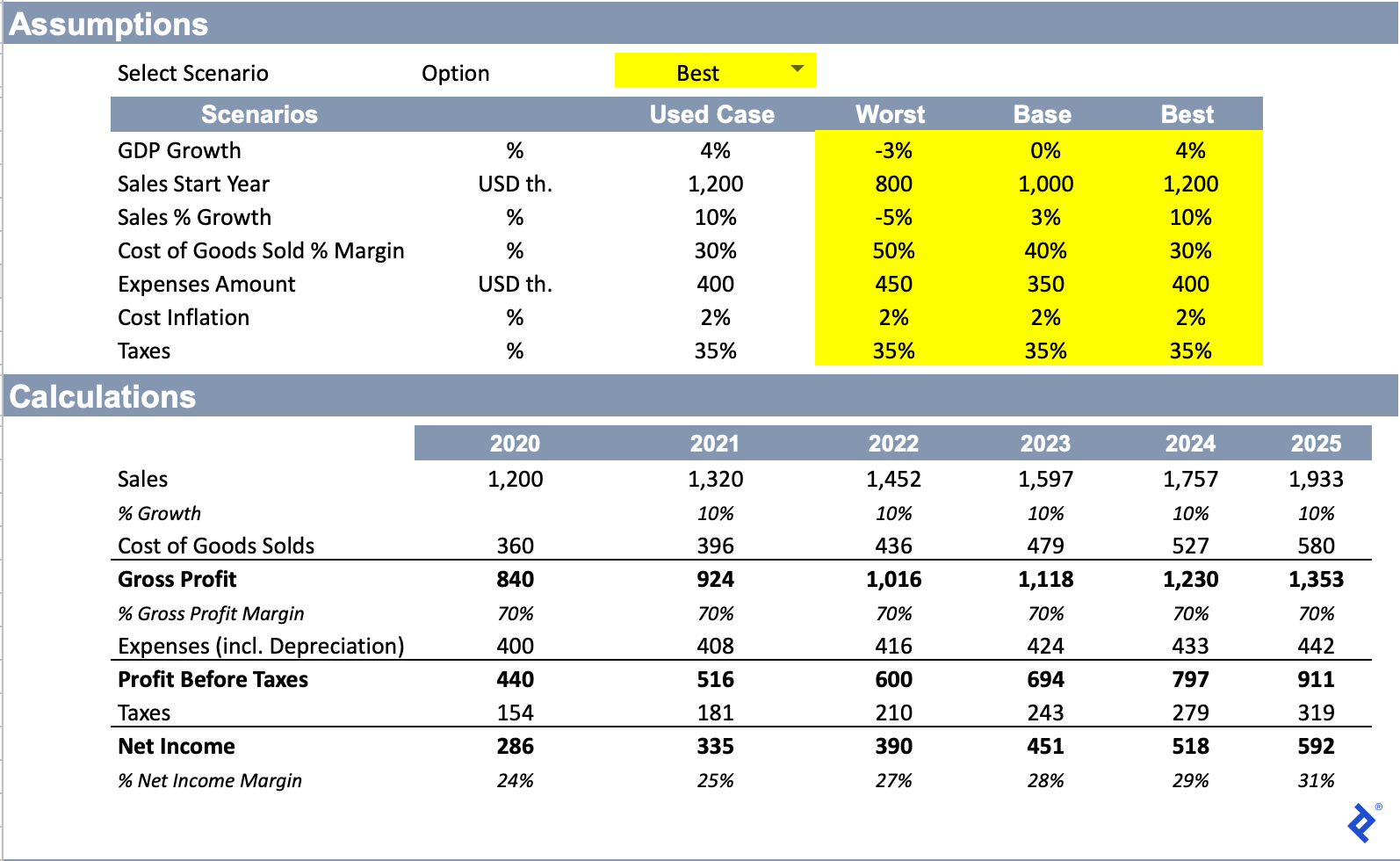

The worst-case scenario is one in which the business is affected by adverse macroeconomic conditions and suffers a decline in sales. Finally, the best-case scenario shows an economic rebound. For simplicity, we have kept figures constant over time.

Base-case Scenario

Worst-case Scenario

Best-case Scenario

Through looking at the three outcomes, it becomes clear how much each assumption can affect net income. Considering future business scenarios can help managers understand and anticipate changes in performance and their drivers.

What Do the World’s Best Economists Think the Main Scenarios Are?

The IMF has called the COVID-19 crisis “The Great Lockdown: Worst Economic Downturn Since the Great Depression.” They have built their scenarios, but being economists, they have calculated the risks only to the downside, based on their estimate that this is where the majority of the risks lie. Their baseline scenario assumes that the pandemic will fade in the second half of 2020 and that shutdown measures will reflect this. They then built three alternative scenarios based on the duration of the pandemic: 50% longer but mostly over in 2020, a second milder outbreak in 2021, and a combination of the two. Additionally, “All three scenarios contain four common elements: the direct impact of measures to contain the spread of the virus; tightening in financial conditions; discretionary policy measures to support incomes and ease financial conditions; and scarring resulting from the economic dislocation that policy measures are unable to fully offset.”

Latest World Economic Outlook Growth Projections

A Word of Caution to Conclude

Scenario planning and building is a useful tool for management, as it helps organizations navigate complex and unexpected situations. It can help any organization to reorganize itself in a time of crisis or be best prepared to benefit from an unexpectedly rosy turn of events. Asking the right questions and understanding where the risks lie will ensure preparation, but involving stakeholders and understanding each scenario’s quantitative repercussions accurately will be the true differentiators for success. In these circumstances, this will often ensure survival.

The Dos and Don’ts of Scenario Planning

Understanding the basics

What is scenario planning in business?

Scenario planning is a corporate process that starts with listing possible future events and evaluating their probability and the impact of the associated outcomes. These can then be used to build financial models that can be used to estimate the impact on the business of positive or negative events in the future.

How do you use scenario planning?

Companies will typically build three scenarios: 1) Base-case: describes the expected outcome; 2) Worst-case: considers what the most severe outcome could be; 3) Best-case: the ideal outcome. The scenarios to create financial projections and inform strategic decisions.

Why is scenario planning important?

Being able to better prepare for periods of high uncertainty can make the difference in a company’s performance. Companies excel through an improved ability to anticipate change and also to learn and respond to it, which is crucial at times of high uncertainty and considerable risk.

About the author

Natasha transitioned to venture capital after a career in banking built in prestigious firms such as JPMorgan and ESM.

PREVIOUSLY AT