What Is Sales Forecasting?

Forecasting sales is an activity often performed inaccurately, with growth figures either being anchored around a target of “inflation + x” or an unrealistic round number plucked from thin air. In this tutorial, we explain the process of sales forecasting and how a correct process can help businesses in other areas, beyond just setting top-line targets.

Forecasting sales is an activity often performed inaccurately, with growth figures either being anchored around a target of “inflation + x” or an unrealistic round number plucked from thin air. In this tutorial, we explain the process of sales forecasting and how a correct process can help businesses in other areas, beyond just setting top-line targets.

In its simplest terms, sales forecasting is the process of estimating future sales (revenues). At first, this may sound like both a vague and daunting task, but with some application it can be achieved relatively painlessly. Forecasting sales is neither guesswork nor exact prediction; it is a process of understanding the underlying assumptions and drivers of sales and eventually tracking and managing them.

As we will describe later in the article, there are many models and methods used to forecast sales, both qualitative and quantitative. The good news, though, is that there is usually no need for complex quantitative forecasting models. Although the probability of finding the exact future sales is almost zero, the accuracy of sales forecasting is crucial for projecting out financial statements and empowering smart business decisions.

Some of the most popular sales forecasting methods used are based upon historical data. This can be more realistic for an established company; conversely, a startup must use more creative sources of information.

Sales Forecasting Is Not a Waste of Time

Sales forecasting is important for a company’s success. Some factors that contribute to this are:

-

Strategic decisions and action tools: Sales forecasts can reveal trends or issues and provide necessary guidance in order to capitalize upon them, or indeed rectify them. For instance, a negative deviation of 20% against the sales target could point towards signs of bad management or competitors upping their game. On the other hand, a significant positive upswing will obviously be welcomed, but then suggests that more resources will be required going forward (e.g., recruiting more people). Uncovering potential problems and needs in advance can allow for timely action that will seize upon opportunity.

-

A path forward: A downward deviation from a sales forecast is disappointing, but it can also be a chance to draw a line in the sand. It can help for clear goals to be set and serve to motivate the team through meaningful action plans and milestones.

-

Forecasting financial models: Careful sales forecasting plays an important role within numerous financial modelling exercises:

-

Cash Flows: Sales revenues directly affect cash flow. The accurate estimation of sales can offer insights towards cash movements and thus allow planning for future shortfalls or, indeed, windfalls.

-

Inventory: A good sales forecast accommodates assumptions such as changes in customer habits and macro increases or decreases in demand. This allows for efficient inventory planning and subsequently drives working capital efficiency higher. On a more tangential basis, this then spills over toward better planning of raw material inputs and labor hiring.

-

Factors to Be Aware of When Forecasting Sales

As we mentioned above, sales will almost always deviate from their forecasts. The higher the standard deviation from this prediction, the higher the magnitude of knock-on effects on the business.

Forecasting analysts need to give thought to potential scenarios and/or have a contingency plan in place. Incidents far beyond the control of the business can occur with untold ramifications for its operation. Such examples include unexpected economic factors (e.g., stock market slumps) and legislation or policy changes.

Although sales forecasting is vital, it should never be a lone scapegoat. If predictions fall wildly short, a firm can suffer significant losses and loss of market share. Instead of blaming the forecast, a holistic post-mortem is required to look at how all factors of the business contributed to the disappointment.

Qualitative and quantitative forecasting methods each have idiosyncratic characteristics that one must pay attention to. Within qualitative methodologies, due to their subjective nature, one needs to shape a holistic view and then qualify it further with well-rounded and credible research. On the other hand, quantitative forecasting models can reveal trends, but still could suffer from biases such as the correlation/causality paradigm.

Finally, sales forecasts are critically interconnected to the general strategy of a company and its high-level milestones. Forecasting models are dynamic and therefore need to be continually updated when conditions change.

What Are the Main Sales Forecast Approaches?

There are two main approaches to sales forecasting: “top down” and “bottom up.”

-

Top down: In a top-down approach, we start with the big picture and then work downwards; we define the milestones that need to be achieved in order to reach the target. For instance, if there are 1.8 billion smartphones worldwide and we assume that we want to penetrate 1% of the market, our target number of customers will be 18 million. If done in a rushed and ill-defined way, this can give rise to tenuous situations with unrealistic expectations.

-

Bottom up: In a bottom-up approach, we look at micro assumptions based on the resources that the company holds—an example of one such sales assumption might be how many sales can be made per salesperson, or how many times an advertisement will be converted into a sale. This method allows businesses to look at the efficiency of their current operation and isolate means in which they can tweak factors to increase sales. The more data that the business has from prior performance, the more accurate its forecasts can be in this area.

Which Approach Should We Take?

As the descriptions above show, the top-down approach may result in subjective, overly-optimistic predictions, but it is useful for swiftly establishing clear milestones that can become organization-wide benchmarks. Forecasts derived using the more granular, bottom-up approach will typically end up being more conservative by comparison, yet more accurate due to their emphasis on internal capabilities. For sales forecasting purposes, as is the case with financial modeling in general, the bottom-up approach can give a more structured, realistic perspective, which can be complemented from a strategic perspective with some top-down analysis.

What Are the Main Methods for Sales Forecasting?

As previously mentioned, there are two principal methods of sales forecasting: quantitative sales forecasting and qualitative sales forecasting.

Quantitative Sales Forecasting

Quantitative sales forecasting pertains to the gathering and analysis of numerical data, such as consumer spending and economic trends. There are many quantitative models and their forms vary significantly. In their simplest form, they appear as linear models and look like the following:

Y = a0 + a1X1 + … + anXn

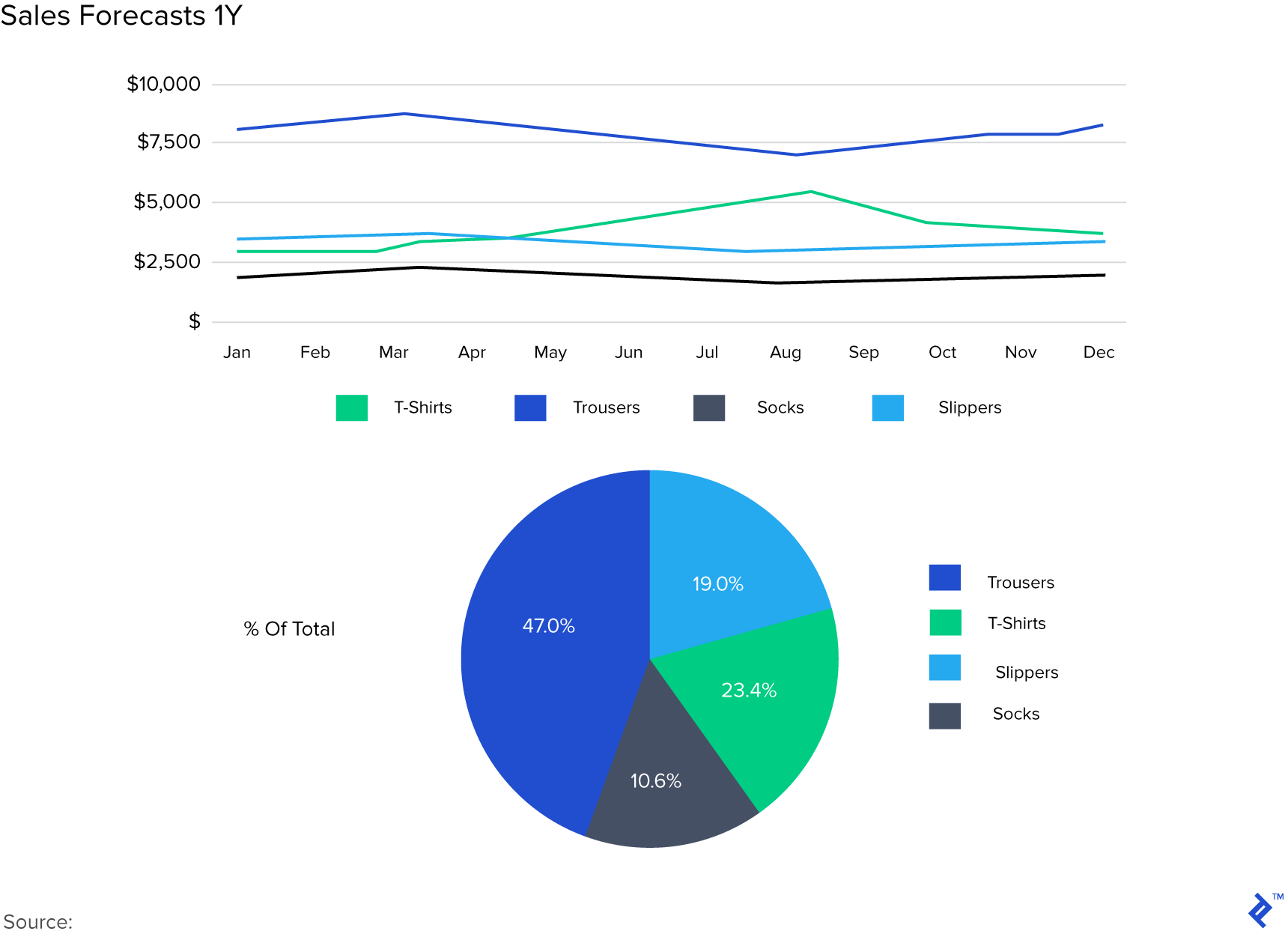

These formulas can quickly become more complicated when testing, trends, and seasonal effects enter the picture. While quantitative methods might not be very appropriate for a new business that has no track record, they can be very useful for established ones. Take an example of a mid-sized clothing company; a quantitative model could enable it to discover seasonal trends and other cyclical effects. This would offer them more accurate sales forecasting and, consequently, prudent inventory planning.

Qualitative Sales Forecasting

Qualitative sales forecasting is based upon expert and/or personal opinion. This method is particularly suitable when there is a lack of historical data. There are four main categories of qualitative forecasting:

-

Jury of executive opinion: This method gathers opinion from a group of company executives and then compiles them to form a consensus. It is quick, easy, and based upon informed opinion. However, not all executives are equally experts in sales and, subsequently, their opinions might not carry equal weight within commercial realities.

-

Delphi technique: Similar to the previous method, this technique averages opinion from a firm’s executives, but in addition, augments it with counsel from external experts. Although it can lead to more rounded results, it is more time intensive and typically more expensive.

-

Sales force composite: This technique gathers opinions from the sales force, which can lead to well-informed and inexpensive sources of sales forecasts. However, the sales force may not have access to the strategic insights that managers have. Perverse incentives may also come into play, where, for example, the sales force forecasts lower-than-expected sales in order to make benchmarks easier to hit.

-

Survey of buyer intentions: This method focuses on the demand-side and the intention of the consumer to buy a product or service. By focusing on the final client, the forecasts can be relatively accurate because some layers of information can be found through reliable public data (e.g., economic indicators of the US Census Bureau)

A firm should use a hybrid of these methods in order to achieve holistic forecasts based upon robust assumptions, placing more or less weight on a technique depending on its applicability to the business. For example, a company with a relatively inexperienced sales force may not want to value the results of a sales force composite projection too highly. Given the nuance involved in deciding upon the correct approaches and weighting, a rational approach can ensure that a business will arrive at accurate forecasts. In deciding the mix of methods required for a forecast, the input of an expert can provide valuable perspective and knowhow.

Building Your Own Sales Forecasts

The math to calculate net sales is simple. We just multiply the forecasted units to be sold with the expected price and we reach the sales forecast. We then perform a similar process for direct costs. After subtracting these (COGS) from sales, we reach the net sales.

Moving away from absolute numbers, if we divide the net sales by gross sales, we can see the expected gross margin. We should do this for every month of the first year and then for every quarter for the following two.

Start with the Costs

A business has more control over its expenses compared to its revenues. Therefore, expenses presents an easier place to start at from a forecasting perspective. We can create categories of costs and then analyze each category granularly to help us find more accurate waypoints. For instance, if marketing is a significant driver of sales, instead of being placed as a single number under a generic category of overhead, we can segment it further (e.g., Google Ads, social media ads, etc.) for greater accuracy.

Develop and Check Sales Assumptions

We should include the costs in the sales forecast assumptions tab. It is critical that these are reviewed every month and, if necessary, that the sales are also revised accordingly. As is the case with financial modeling, these assumptions must be flexible and easily changeable. High quality and relevant (cited) sources are also critical. For example, data from app stores can help sales forecasting for a new mobile app while credible tech blogs can also provide anecdotal evidence that can be applied into assumptions. The key final factor for developing appropriate assumptions is having relevant previous experience developing sales forecasts. If a company does not have the expertise required, it is better to hire specialist talent, even if for a short period. Below is an example of sales and cost assumptions built out for a forecast:

Forecasting Sales for Two Scenarios

Sales forecasts should include a conservative scenario and an aggressive/optimistic one. The latter is the ideal outcome that can keep the company motivated and also serve as an illustration of its true potential to investors. This is the “think big” factor. The former is the scenario that keeps the company prepared for disappointing outcomes. Furthermore, it is better to break down sales into prices and units, which allows for deeper understanding of their respective dynamics. In addition, estimating intervals and probabilities can lead to more accurate projections.

Complementing the Data with Ratios and Graphs

Ratios can reveal key information while also serving as tests to confirm whether the sales forecasting is sound and if the numbers tie up. For instance, a direct cost to revenue ratio that is too low (and subsequently, a gross margin ratio that is too high) could be an indication of overly-optimistic projections. Another useful ratio is the employees-per-client ratio. This ratio offers insight regarding future sales and how they can evolve based on recruiting decisions. Finally, graphs can help visualize trends and the progress of the sales, rendering the numbers more comprehensible.

And Finally, Beware of Templates

It can be easy to just search for a template and try to shoehorn your business’ requirements into what has already been created. This approach could actually be to your detriment, as each business has its own needs and no one is the same.

I would encourage you to try building your own template from scratch using the learnings from this article. Starting the process from a blank spreadsheet will help you to understand how all facets of your business tie together and ensure that your forecast is exactly tailored to your business’ specific needs.