Strategies to Recession-proof Your Business

Some industries like healthcare and utilities are naturally recession-proof. However, if you operate in more cyclical sectors, there is a range of initiatives that you can implement to make your business more resilient to economic shocks.

Some industries like healthcare and utilities are naturally recession-proof. However, if you operate in more cyclical sectors, there is a range of initiatives that you can implement to make your business more resilient to economic shocks.

Listen to the audio version of this article

Some businesses are fortunate enough to be in industries that perform resiliently during recessions. However, for those on the outside, peering into the window of this exclusive club, all is not lost.

As discussed in The 6 Most Recession-Proof Industries, what defines a recession-proof industry is not what it sells. The key theme that bonds recession-proof industries together is that they capitalize upon some form of an inherent behavior need of consumers: necessity or quality. The tangible product or service offered is a derivative of this, and as such, there are steps that any business can take in order to build recession-proof characteristics.

Speaking of behaviors, specific ones are the very things that slowly build up to become avalanches that form recessions.

Recessions Build Off Narratives

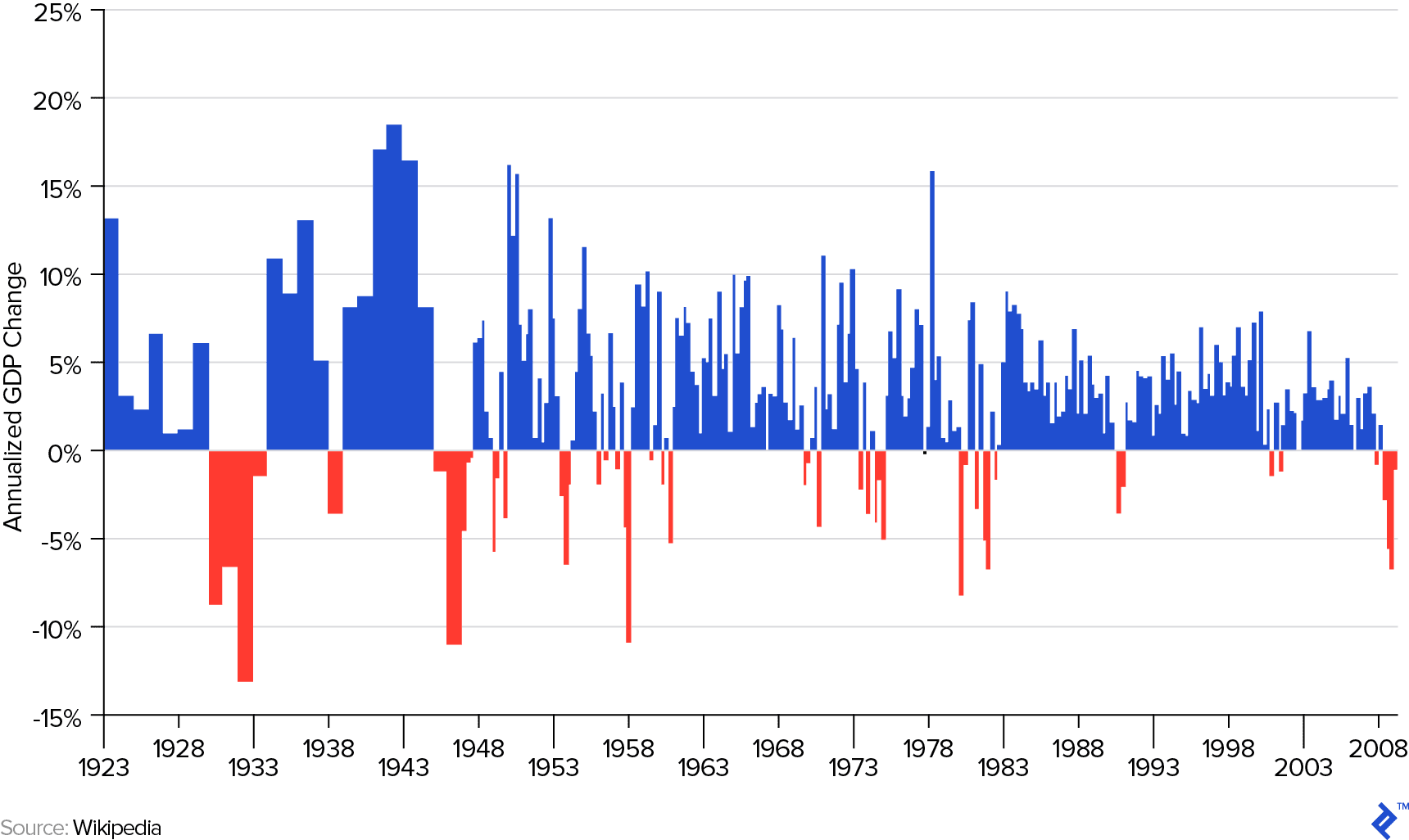

Recessions are defined as periods of severe economic contraction when business activity rapidly drops and GDP subsequently falls. In some economies, a recession is technically triggered when GDP contracts for two consecutive quarters. In the US, a recession is declared more subjectively, by a panel at the National Bureau for Economic Research. The following chart shows all of the recessions experienced by the US in modern times.

As can be seen, the US has experienced a number of recessions with varying degrees of severity. The Great Depression from 1929 to 1933 carved 26.7% off the US GDP, while the recession following the Dotcom bubble burst lasted only eight months at a cost of just 0.3%.

For businesses, a recession event is particularly ominous due to the effect it has on ongoing operations:

- Revenue: As sentiment turns to “risk-off,” sales drop off and some customers ultimately disappear.

- Costs: A fully operational business cannot turn quickly and shed capacity without extreme pain, either from a human capital or machinery perspective.

- Operations: Supply chains can be irrevocably disrupted by restructurings or bankruptcies of their stakeholders.

- Capital: Financial health can enter uncertain risky periods as equity markets close for new issuance and debt costs rise from credit lines disappearing, interest rate spikes, or penalties from covenant breaches.

What Causes a Recession?

Because a recession is a period of depressed consumer confidence–which culminates in lower spending and business activity–there is an array of leading indicators that can suggest an imminent recession. High interest rates, falling house prices, and a bear market on public indices are popular metrics that are leaned upon.

What comes to define a recession during a post-mortem is that there is usually an underlying narrative that builds up around the time that then falls apart. Times are usually good, and activity around a certain economic area keeps escalating to ever higher levels. Commentators start wondering if we are in a bubble and when it will burst. The tinderbox then catches fire in a miniscule way, which then spreads rapidly. For example, if we look at the three most recent US recessions, they all had a bubble bursting:

- 2007-09: Real estate prices pushed to all-time highs, fueled by subprime mortgage and asset-backed security bubbles. Eventually, defaults caught up with Lehman Brothers’ liquidity position causing a contagious collapse.

- 2001: The Dotcom bubble bursting and various corporate scandals severely dented investor confidence, after which followed the 9/11 attacks.

- 1990-91: Following restrictive monetary policies introduced to calm a real estate bubble, an oil price shock caused by Iraq’s invasion of Kuwait sent the economy into a spiral.

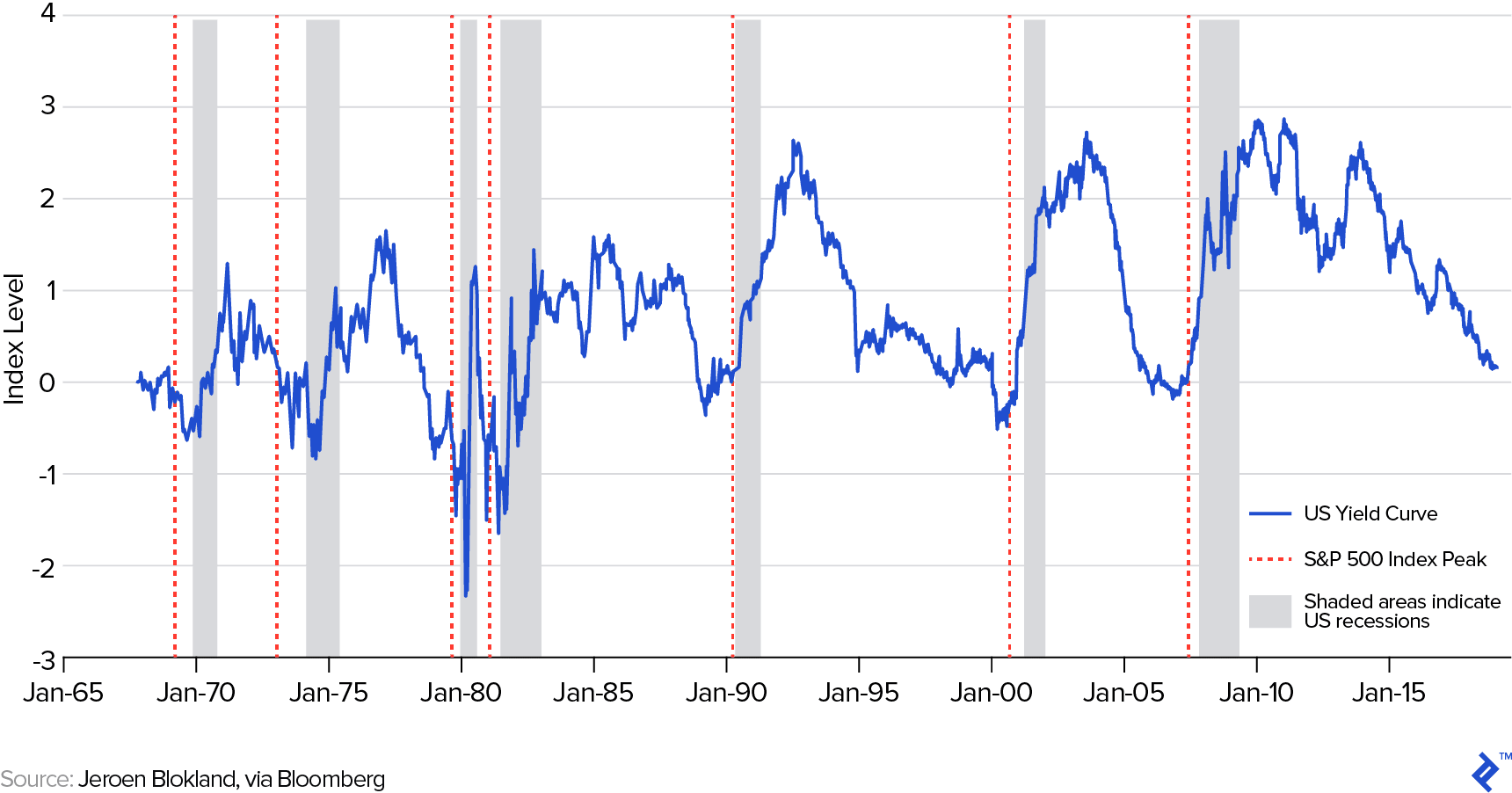

One such indicator that many lean on for clues of recessions is when the yield curve inverts, which means shorter-term borrowing is cheaper than longer-term. While not perfect, you can see that the directional shifts largely correspond with the S&P 500’s peak price, which then brings a recession.

How To Make Your Business Recession-Proof?

Aiming to make your business recession-proof is a more pragmatic approach than trying to make your business defensive. Being defensive results in a compromise of lower performance in boom times, for the security of resilience during the busts. By recession-proof I am referring more to the idea of making your business shock-resistant, giving it flexibility and nimbleness to not fall off a cliff and be prepared to thrive on the ensuing upturn.

Horizontal Integration

A horizontally integrated business can build a diversified portfolio of offerings, which can act as a sponge to recession shocks. If we think back to the consumer goods companies mentioned in the Recession-Proof Industries article, they offer products that touch every part of the house, which gives them more of a shock absorber.

Vertical integration is specifically useful for firms that want to build a cost, or quality advantage, through tightly controlling their production chain. The disadvantage of such an approach is that in doing so in a specific area, they are putting their eggs into one distinct basket.

When we see businesses make abstract investments in different areas, or acquiring companies in another field, it is an example of them broadening their horizons and developing more of a portfolio approach to spreading their risks. There must be a valid rationale for the investment though and with clear synergies to the core business (i.e., not a wave pool startup).

Scalable and Flexible Units of Production

One of the many gripes with WeWork’s now failed IPO prospectus was its lackadaisical attitude towards its fortunes during recessions. The business felt that it would perform better in a recession due to clients desiring more flexible tenancy arrangements during the turbulent times. In isolation, this is indeed a valid argument, but what WeWork failed to address was the other side of its model: its own leasing arrangements with office providers. Offering short-term office arrangements while being tied into long-term lease arrangements on the underlying building is actually a very risky strategy that could backfire during a recession. WeWork would be hamstrung in its ability to contract its factors of production quickly.

A recession-proof business can quickly and painlessly contract or expand its methods of production. This ranges from its fixed asset capital to its actual human resources. Going back to the point about horizontal integration, that is why controlling your whole production chain can be a dangerous prospect.

Companies should ensure that their methods of production have a degree of flexibility and malleability, either to be deployed into other activities or be subcontracted elsewhere. The standard trope for dealing with human capital (i.e., staff) during a recession is to question how easy it is to retrench workforces quickly. A far more optimistic outlook that I espouse is to ensure that staff are cross-functional and can wear many hats, allowing management to seamlessly shift strategies on a dime when required.

Create Inelastic Demand

If your business legitimately provides a life necessity or a renowned luxury, then you will be in the fortunate position of having inelastic demand characteristics. For others, the key phrase to focus on is building loyalty. On a very basic level, this can be continually measured via NPS scores and actively responding to feedback. On a more functional level, look at loyalty schemes and rewards for continual service. The frequent flyer programs introduced by airlines almost half a century ago have bred rabid loyalty and gamification effects from their customers that have been a success for the airlines.

Try to create ways that customer experience naturally improves the more the service is used. Algorithmic suggestions on streaming services, one-click checkouts, and special offers timed for predicted paydays are all ways that companies create data moats by using trends to enhance their existing customers’ ease of service.

Don’t Be Stuck in the Middle

One of Michael Porter’s core tenets of competitive strategy is that a firm cannot be everything to everyone and must focus on leading either through cost leadership or quality differentiation. Having a clear north star towards one of these sides will ensure that a business stays on the right path and will retain loyalty during recessions.

This is particularly important for startups that try to be everything to everyone; instead, find your beachhead and become a master at it. Despite the high street facing an almost continual existential crisis of shop closures and consolidation, we are seeing discount retailers and bespoke offerings thrive because they focus clearly on one goal: value (cost leadership) or quality (differentiation).

Keep Cash for a Rainy Day

Having a range of sources of financial capital on hand gives businesses an advantage during recessions. It can ensure that runways are long enough to handle any drop in activity, but more importantly, it provides optionality. During a recession, assets become cheaper (and distressed), and labor supplies rise, which provides more options to find standout candidates.

Keeping cash on hand is a great way to use a recession to prepare for its aftermath and ensure that opportunities are capitalized upon. During the recession of 2007-2009, Amazon went on a spending spree and bought 12 companies, despite the period being very much a period of protective consolidations. Some of these names, like Zappos and Audible, were particularly prominent brands, which have gone on to become significant parts of Amazon’s offering.

Patience Pays Off

Public companies have a harder time making themselves recession-proof than their private counterparts. The pressure to meet quarterly targets and make shareholder distributions can make the task of preparing for an unknown event (that might not even happen) hard to stomach for managers.

One of the very reasons family businesses are so resilient and long-lasting is because they are often far more long-term in their thinking due to their inter-generational timeframe. According to EY, US family firms with revenues between $100 million and $3 billion are less likely to fail during economic downturns compared to their peers.

What will be interesting to see going forward is whether the increased trend of younger companies staying private longer will have an influence on recession-proof characteristics. While the private investors that fund hyper-growth startups are not benevolent altruists, their investing timescale stretches far longer than the next quarter.

Understanding the basics

How often do recessions occur?

In developed economies, large recessions tend to occur at intervals of one decade.

About the author

Alex is a CFA charterholder that has managed investments ranging from $15 million Latin American micro-VC funds to $3 billion bond assets.