Looks That Thrill: Inside the Booming Beauty Industry

How has the beauty industry become extremely innovative? How did Glossier and The Ordinary approach (and crack) the problem of enticing consumers, building brand loyalty and creating unique experiences? The lessons are relevant for all DTC companies.

How has the beauty industry become extremely innovative? How did Glossier and The Ordinary approach (and crack) the problem of enticing consumers, building brand loyalty and creating unique experiences? The lessons are relevant for all DTC companies.

Natasha transitioned to venture capital after a career in banking built in prestigious firms such as JPMorgan and ESM.

PREVIOUSLY AT

Nature is beautiful because it looks like Art; and Art can only be called beautiful if we are conscious of it as Art while yet it looks like Nature.

Immanuel Kant, Critique of Judgment

Humans are visual and social creatures. It makes sense thus that, historically, we have been collectively preoccupied with beauty. Someone’s appearance is the first thing we notice about them upon meeting them. The nature of beauty itself has been the focus of Aesthetics, a major field of study in Western Philosophy, and has occupied the brilliant minds of numerous philosophers, from Plato to the aforementioned Kant.

People have been using makeup and cosmetics since ancient times: the Egyptians’ use of dark eyeliner is present in everyone’s mind through their paintings and deities, while most know that Victorian women often fainted not because of their demureness, but because of the wide-spread use of lead-based creams to “improve complexion” together with constricting girdles.

For the most part, these rituals were conducted by women, and were relatively secret: one had to uphold the idea that beauty was natural and effortless, not an artifice.

So how has the beauty industry, as old as the idea of beauty itself, become not only mainstream but also lauded as one of the best sectors in which to launch a company? This is particularly notable in a time in which traditional industries are struggling, and in the extremely challenging times for the retail industry.

In this article, we attempt to answer this question. We start by defining the industry and its main players, both traditional and incumbent, we briefly touch on industry size and trends as well as the anti-cyclical qualities of the beauty sector. Subsequently, we will use companies that exemplify success in this sector, Glossier and Deciem’s The Ordinary, to understand how they approached (and cracked) the problem of enticing consumers, building brand loyalty and creating unique experiences, drawing a few lessons relevant for all direct-to-consumer (DTC) companies.

Beauty Industry Analysis - Market Size and Major Players

The beauty industry is, in fact, quite broad: it includes both services (such as hairdressers, barbers, etc.) as well as products. In the United States alone, the beauty services sector employs over 670,000 people, and its job growth outlook is “faster than average” according to BLS data at a rate of 13% (2016-2026). According to a study, it was worth $532.43 billion in 2017 and is expected to reach a market value of $805.61 billion by 2023.

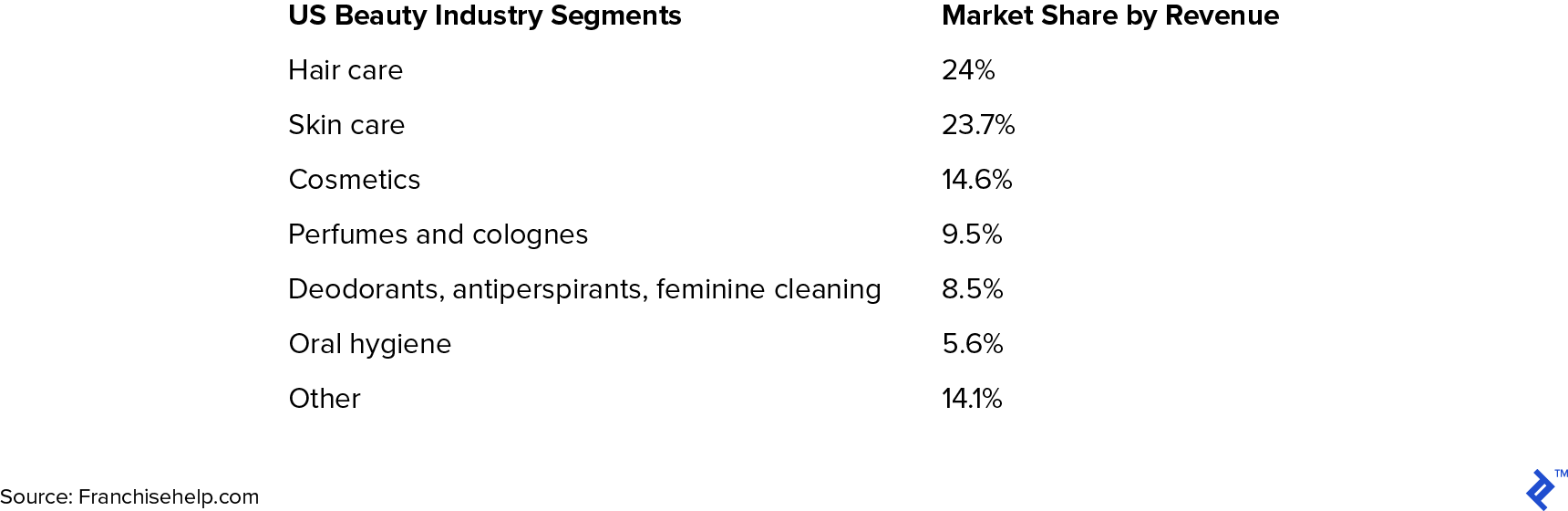

The table below highlights the different segments and their relative weight by revenue.

US Beauty Industry Segments by Revenue

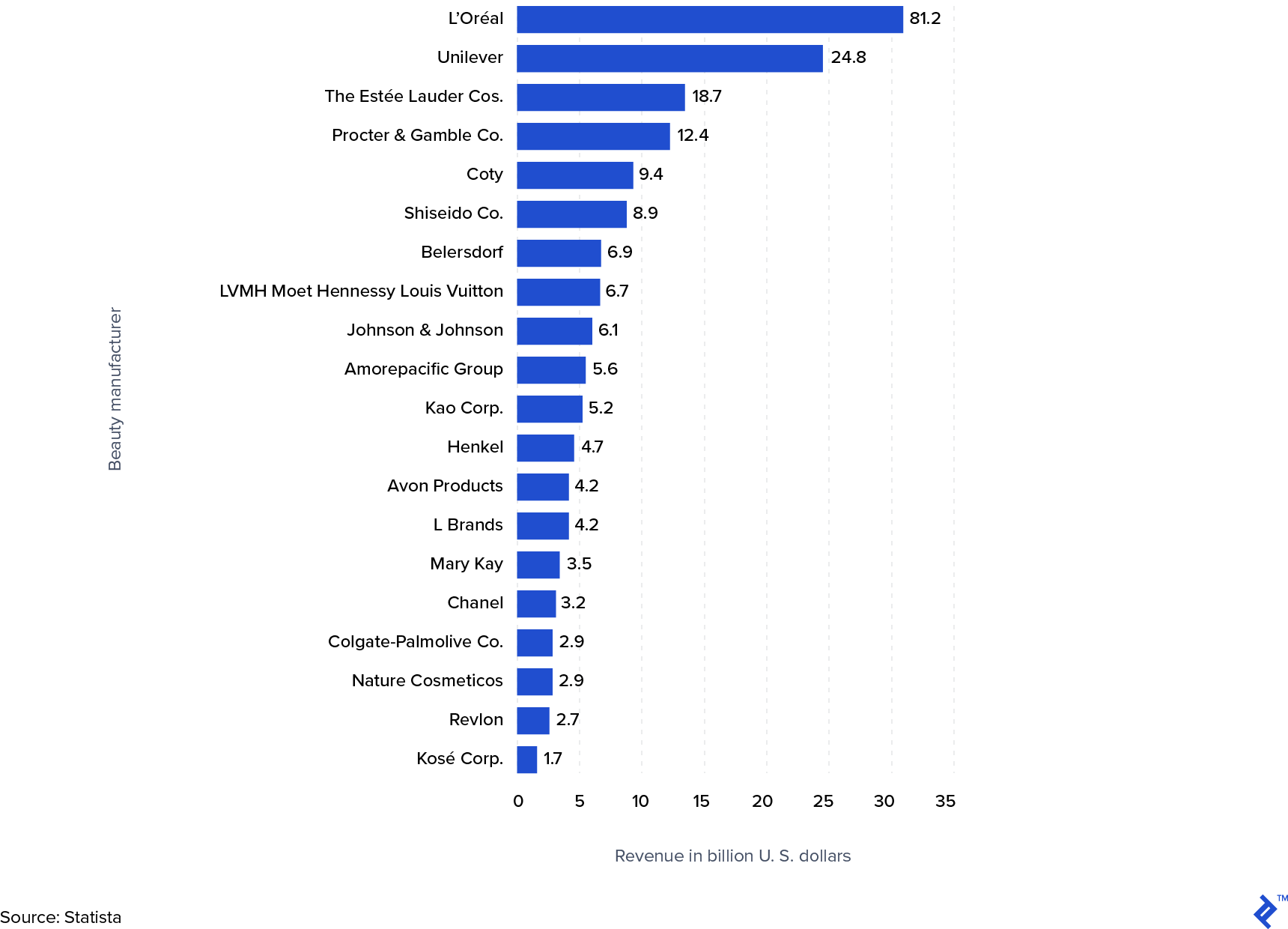

It is still an extremely concentrated industry, with the 20th largest manufacturer in the world still producing only 5.5% of the revenue of the largest one: French giant L’Oréal, which commands an eye-watering 20.2% market share in Western Europe.

Revenue of the Leading 20 Beauty Manufacturers Worldwide in 2018 (US $ Billions)

Traditionally, the industry is divided into a premium and a mass-market segment. The premium segment represents 28% of total sales worldwide, while mass-market accounts for 72%, according to a 2017 study.

Traditional distribution channels focus on bricks and mortar, particularly sales through supermarkets, specialty stores, pharmacies, and salons. Direct sales and eCommerce, however, have become increasingly prominent, with online sales for beauty companies growing at a much faster rate than general internet sales: the category grew at 23.6% in 2017 to reach more than $5 billion in web sales, according to Internet Retailer data. It outpaced the US eCommerce market’s 15.6% growth rate in 2017 and the overall Internet Retailer Top 1000’s 18.5% growth rate. The company was Glossier, which we will cover in more detail later in this article.

For the purposes of this analysis, we will focus on the product side rather than services, and on younger companies (which, not entirely coincidentally, fall in between the premium and mass-market segments) that are utilizing product and other innovation as an engine of growth.

Beauty Industry Trends

The beauty industry is notably anti-cyclical, so much so that a famous economic phenomenon, the lipstick effect, is derived from it. This phenomenon, which is only partly confirmed, alleges that consumers will still purchase luxury items in an economic downturn, privileging however smaller ticket items, such as lipstick. Even if this theory has been criticized by many (notably, The Economist, when it comes to lipstick specifically, many studies have found a statistically significant correlation when it comes to the broader beauty category.

Growth in the beauty industry, however, has boomed in recent years, in a trend that many link to a broader generational trend of attention to physical wellbeing (which we covered in our recent article about the growing plant-based market and Beyond Meat). Millennials are often quoted as being the main drivers behind the meteoric growth of the beauty segment. There have been many articles written on this trend, citing everything from the aging of the millennial demographic to a focus on “self-care” as a coping method against a difficult political and economic climate.

Democratization of Beauty - Bringing High and Low Under One Roof

The harbinger of this trend and the beauty industry growth was the arrival in the USA of specialized French beauty retailer Sephora in 1999, as well as the rise of its US competitor Ulta. These companies found a gap in the market: they created new shopping experiences for consumers, who had an additional choice beyond going to the mall or purchasing beauty products at a pharmacy or supermarket. They importantly stocked products at different price points, from elite brands to store own-labels. In the UK, there were similar concepts being launched at the same time: the local equivalent of Sephora, Space.NK, was founded in 1993 and started expanding their retail footprint in the early 2000s, growing to 69 stores in the UK and Ireland and 31 in the US.

The Rise of the Indie Brand - Focus on Ingredients and Quality

The second significant trend was the rise of new and unknown brands focusing on ingredients and quality, originally coming from Korea, but now also from Japan or other countries. Korean skincare exploded in the West when Sephora started carrying a Korean brand, Dr. Jart+ in 2011. The Korean skincare industry is heavily promoted by the South Korean government, which has made Dr. Jart+, together with K-Pop, one of its flagship cultural exports (and with amazing success). What is particularly noteworthy about K-beauty, for the purposes of this article, is the focus on dermatological ingredients, the unbundling of products into different (and thus customizable) steps, and the proliferation of smaller, indie brands.

Rise of Social Media - Instagram Influencers Paint a Pretty Picture

Finally, another significant change that propelled the beauty industry forward has been the rise of social media, in particular of image-based social network Instagram. Obviously, a visual medium is optimal for a beauty brand: it fully allows it to explore the visual potential of its products. Not only, but Instagram has enabled brands to cultivate a stronger image, interact with consumers in a more direct way, as well as creating an entirely new marketing category, that of influencers, which, in turn, have at times turned into fully-fledged entrepreneurs. Kylie Jenner, probably one of the most famous women in the world right now, was just this year crowned the world’s youngest self-made billionaire, thanks to her immensely successful makeup line.

We have thus identified some of the key success factors for established and upcoming beauty brands: a focus on consumer and experience, price-points that are potentially below those of premium brand but a focus on dermatological results and credentials, and finally, a strong digital presence and direct-to-consumer marketing. This leads us into the next section of our piece, a small case study.

Glossier and The Ordinary

Many smaller and newer brands have emerged in recent years, eroding the market dominance of the large beauty companies. Glossier and Deciem’s The Ordinary are, however, probably the most interesting of the incumbents, because of their deep understanding and intelligent use of the success factors outlined above, albeit in extremely different ways.

Glossier, on the one hand, is obsessively focused on customer experience and, as a digital-native company, has strongly utilized social media as a growth engine. The Ordinary, on the other hand, has built a huge brand and received an investment from Estée Lauder by being obsessively focused on product innovation, scientific rigor in product development, and a very low price point. It also has a strong social media presence, however, whether that has always been a success factor is highly debatable, as explained below. We refer to The Ordinary, rather than the parent company Deciem, as it accounts for 70% of its sales.

Glossier

Glossier is arguably the most successful of the new crop of beauty companies, so much so that it became a unicorn after its latest round of funding in March 2019. How has the company achieved this feat? Glossier started originally as Into the Gloss, a beauty blog that profiled celebrities and customers in intimate pieces about skincare and makeup habits. The first four products were launched in 2014, reaching $100 million in revenue in 2018.

We have identified the following as keys to success for this innovative Direct-to-consumer (DTC) brand:

- Digital presence and marketing: Emily Weiss, the founder, is considered by many to be an extraordinary entrepreneur, and has translated the ethos of her blog into a successful (and growing) product line. What Glossier is best known for is its use of social media to build a very strong and instantly recognizable brand. Glossier pink, the color at the base of the company’s branding and color scheme, has become universally recognized by beauty customers, so much so that the hashtag #glossierpink has been used over 22,000 times on Instagram. In fact, Emily Weiss famously treats all of her customers as influencers and content creators for the brand. She was able to leverage the engaged community that followed the blog and turn that into a committed and loyal customer base.

- Product innovation: Glossier approaches product innovation in a very similar vein: they regularly consult with customers on the way they use the company’s products, on their wishes, and even have a dedicated slack channel with the 100 best customers, which is used effectively as a highly engaged focus group.

- Channels and distribution: Again, the approach that Glossier uses is extremely consistent, and based entirely on customer experience. The following quote from Emily Weiss illustrates this best: when asked in an online Q&A whether she was planning on partnering with retailers for the distribution of Glossier, she replied “Great question! One of the things we strongly believe, as a customer-centric company, is that we can’t form the meaningful relationships that we value with our customers if we sell through other distribution channels. Being able to communicate and engage with our customers across various channels, and ensuring that we are delivering the true Glossier customer experience, is challenging if we go through other channels. I love discovering beauty products at all sorts of retail environments–for us, it’s not about what retailers are doing wrong, but more so ensuring we are able to deliver the Glossier customer experience that we’re proud of.”

- Pricing strategy: Finally, even in its pricing, Glossier is consistent in its inclusivity: the products are positioned between mass-market and premium, thus being an affordable luxury for its young customer base.

The Ordinary

The Ordinary, much like Glossier, was born from the vision of an extraordinary founder, Brandon Truaxe. He was (he has unfortunately passed in tragic circumstances) a believer in the necessity for transparency and innovation in the beauty industry, and sought to do so by launching a skin-care line (amongst other products in the range of the parent company, Deciem) that is projected to reach $300 million in sales in 2019. He did so through an extremely radical product idea: The Ordinary sells products based on single active ingredients at extremely low prices, which can then be mixed and matched by consumers for their specific needs. This creates an affordable and extremely personalized experience.

The keys to success we’ve identified for The Ordinary are the following:

- Digital presence and marketing: The Ordinary strongly utilized social media to build a brand connection and engage with their customers, as well as very clearly and strongly building a brand. They were initially renowned for responding to each individual message and comment. The brand was built on scientific rigor and a minimalistic aesthetic. Deciem and The Ordinary are however also a cautionary tale for the dangers of social media: Brandon Truaxe’s personal issues and conflicts with investors were prominently featured on the company’s Instagram for a long period, which created intense (and at times morbid) interest in the company, and not necessarily in a positive way.

- Product innovation: This is undoubtedly the main reason for The Ordinary’s extraordinary success (a success such that many products were on endless waiting lists and were effectively being sold on the black market). The brand tagline goes “Clinical formulations with integrity,” and summarizes the approach. The focus of the company is selling effective ingredients and formulations, that can then be integrated by the consumer. The focus is on product, and product only, with very limited spending on packaging and marketing. The belief here was that if the product is valid, that in itself is sufficient marketing. The following quote from the founder describes what he thought this to mean: “Brand loyalty in the beauty industry is near zero because the products don’t work or they over-promise,” says Truaxe. “What we’re doing differently is simply not promising what is not there.” This extreme focus on effectiveness is also the result of extreme control of each phase of product development: everything is done in-house.

- Channels and distribution: Deciem never spent on advertising outside of its social media pages. The product is sold online, through flagship stores, and through a retailer network.

- Pricing strategy: This is where The Ordinary absolutely stands out. The brand was built on selling products at extremely low prices, with most products sold for less than $10, a sharp contrast to more complex formulations with similar active ingredients and significantly higher mark-ups. Most products, in fact simply carry the name of the active ingredient and the strength, such as Niacinamide or Hyaluronic Acid. Truaxe broke down the cost of a product that retails for $5.80 as follows: “Our Vitamin C Powder is the best example. There are about 20 cents of vitamin C in it, and about 5 to 6 cents of other ingredients, and then the tube is about 20 cents and the box is about 10 cents. I mean, the product costs less than a dollar.”

Conclusion

The innovators in the beauty industry, and Glossier and The Ordinary in particular, can give very precise guidelines into what makes a consumer brand a success: knowing the strength of the company, whether it is consumer experience or product, building a simple and clear brand based on the company’s ethos, and extreme control over all aspects that define the focus in order to ensure constant quality. These are invaluable lessons for any entrepreneur.

If you are interested in a customized industry deep dive, you can work with Toptal’s market research specialists and Toptal’s consulting team.

Further Reading on the Toptal Blog:

Understanding the basics

What is included in the beauty industry?

The beauty industry is quite broad: it includes both services as well as products. In the United States, the beauty services sector employs over 670,000 people. It is an extremely concentrated industry, with the 20th largest manufacturer in the world still producing only 5.5% of the revenue L’Oréal.

When did the beauty industry start?

Humans are visual creatures. People have been using makeup and cosmetics since ancient times: the Egyptians’ used dark eyeliner while Victorian women often fainted not because of their demureness, but because of the wide-spread use of lead-based creams to “improve complexion” together with constricting girdles.

How large is the skincare market?

The beauty industry includes both services as well as products such as cosmetics and skincare. According to a study, the industry was worth $532.43 billion in 2017, and is expected to reach a market value of $805.61 billion by 2023,

About the author

Natasha transitioned to venture capital after a career in banking built in prestigious firms such as JPMorgan and ESM.

PREVIOUSLY AT