Strategic Financial Leadership: 6 Skills CFOs Need Now

Succeeding as a modern CFO is more demanding than ever before. Here are the skills you need to become a strategic partner who leverages technology and insights to drive growth and plan for the future.

Succeeding as a modern CFO is more demanding than ever before. Here are the skills you need to become a strategic partner who leverages technology and insights to drive growth and plan for the future.

Puneet is a finance expert who has worked for J.P. Morgan Chase & Co. and Pfizer, and holds an MBA from Harvard Business School. He has held CFO positions at public companies, middle-market private-equity-backed companies, and startups.

Expertise

PREVIOUSLY AT

It used to be that a chief financial officer’s primary focus was on the traditional functions of the job: monitoring cash flow and financial activities; serving as a controller and accounting expert; limiting unnecessary spending; and ensuring that financial decisions conformed to standard operating procedures.

These duties are still critical, of course, but they’re increasingly becoming secondary to the strategic roles CFOs are being asked to play. As the pace of business accelerates and technology advances, the modern CFO must take a broader, more forward-thinking and growth-oriented approach to the job.

The consulting firm Accenture captured this transformation in a 2022 survey, finding that typical finance chiefs now spend most of their time spearheading companywide efforts to transform and optimize business operations, with an emphasis on accelerating revenue and profit growth.

It’s a new reality that I’ve seen play out among fast-growing small and medium-size healthcare firms where I’ve held a number of leadership positions. These companies not only expect you to be a functional CFO, delivering on basic accounting responsibilities, they also expect you to be a strategic CFO, working with the leadership team to explore growth opportunities and maximize profitability.

So how do you develop this strategic expertise? Through trial and error, I have learned that the most effective way is to focus on your existing finance capabilities and responsibilities—those functions that are already within your purview as a CFO—and elevate them to deliver the strategic insight your company needs.

In this article, I share six areas where I recommend you focus. The development of the skills I discuss can be applied broadly to growth companies and employed across a wide spectrum—by fractional CFOs working with later-stage startups, by interim CFOs in distressed situations, or even by finance chiefs employed by public companies.

When it comes to expanding and bolstering your existing capabilities, I discuss the easiest areas first. The later ones, especially corporate vision, will probably consume more of your time, but I expect you’ll find that mastering them is well worth it to you and your company. I include examples to show you how I put each of these concepts into action.

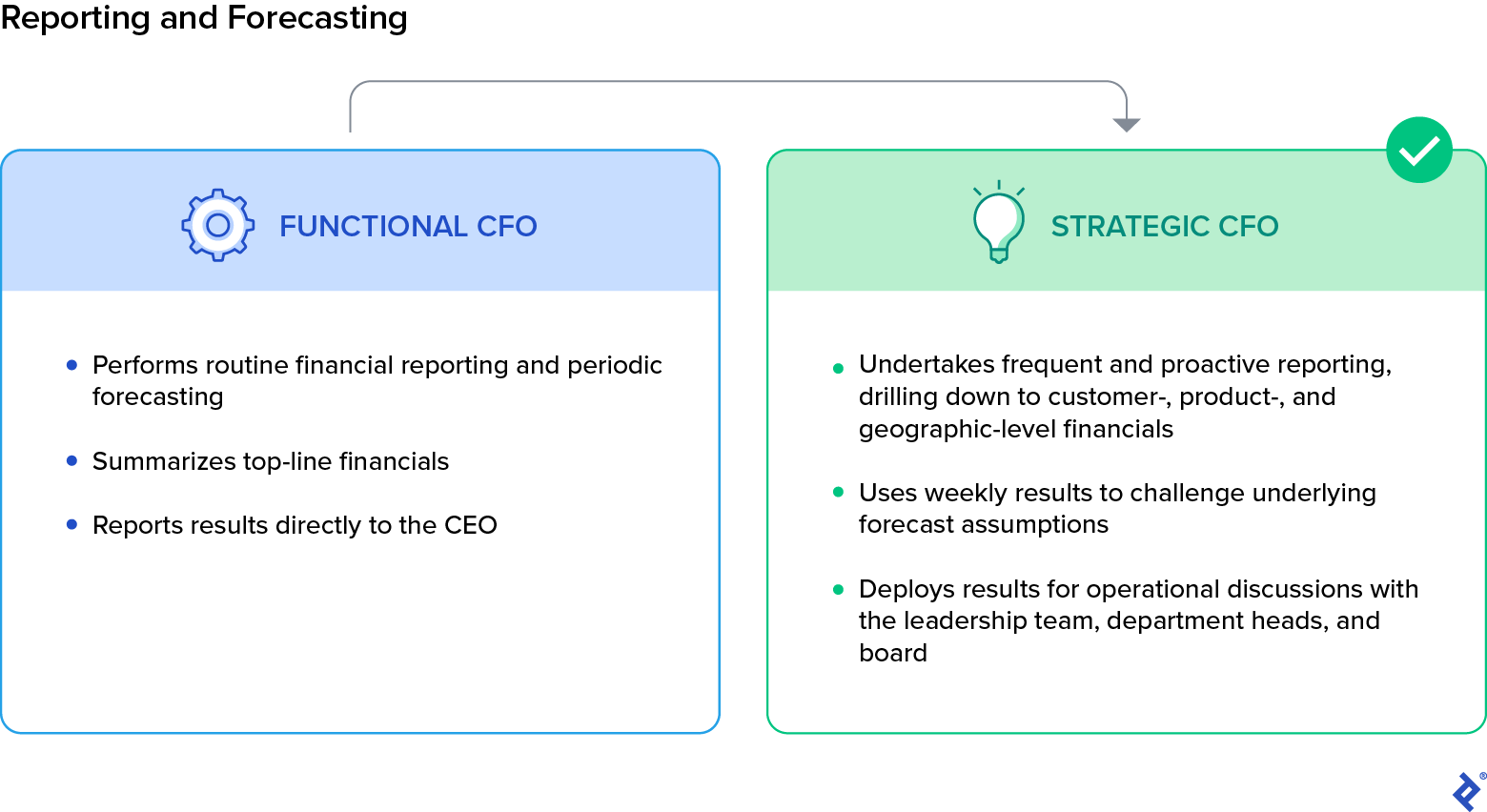

1. Reporting and Forecasting

Reporting and forecasting are table stakes for a finance chief. The proliferation of software as a service (SaaS) and cloud services has made it easier and cheaper to integrate powerful accounting systems across an organization. A functional CFO must ensure that everyone who needs access to these systems has been fully onboarded and is using them, while a strategic leader looks for opportunities to delve deeper into the information to surface actionable insights for the organization.

I can best explain how to develop this area by sharing how I demonstrated to one company that fully onboarding a team is an essential step—even for leadership. I worked for an early-stage healthcare services company where the CEO tracked corporate financials on an Excel worksheet he saved on his desktop and updated at night and on weekends. This practice created obvious problems. First, his shadow financials were often incomplete. Second, his practice caused a disconnect that prevented the finance team from developing a routine of updating information and producing useful and timely insights for the CEO. Without this routine, the CEO was flying blind when it came to sales and profitability decision-making.

When I joined, I helped the company standardize all the accounting, operational, and financial reporting templates, and the chart of accounts. The company and I then agreed on a reporting calendar for when the finance team would give the CEO and board the latest income statement, balance sheet, cash flow statement, and customer- and product-level segmentation. That report also regularly provided information on the performance of individual departments, comparing the figures for each with that department’s budget, forecast, and prior-year numbers.

We didn’t stop with standardizing companywide reporting, however. We leveraged the information to recommend operational changes that would improve areas of financial underperformance. This not only freed up the CEO’s nights and weekends, but also gave us strategic insight into the company’s operations while reducing the management team’s anxiety and stress under the previous fragmented reporting system.

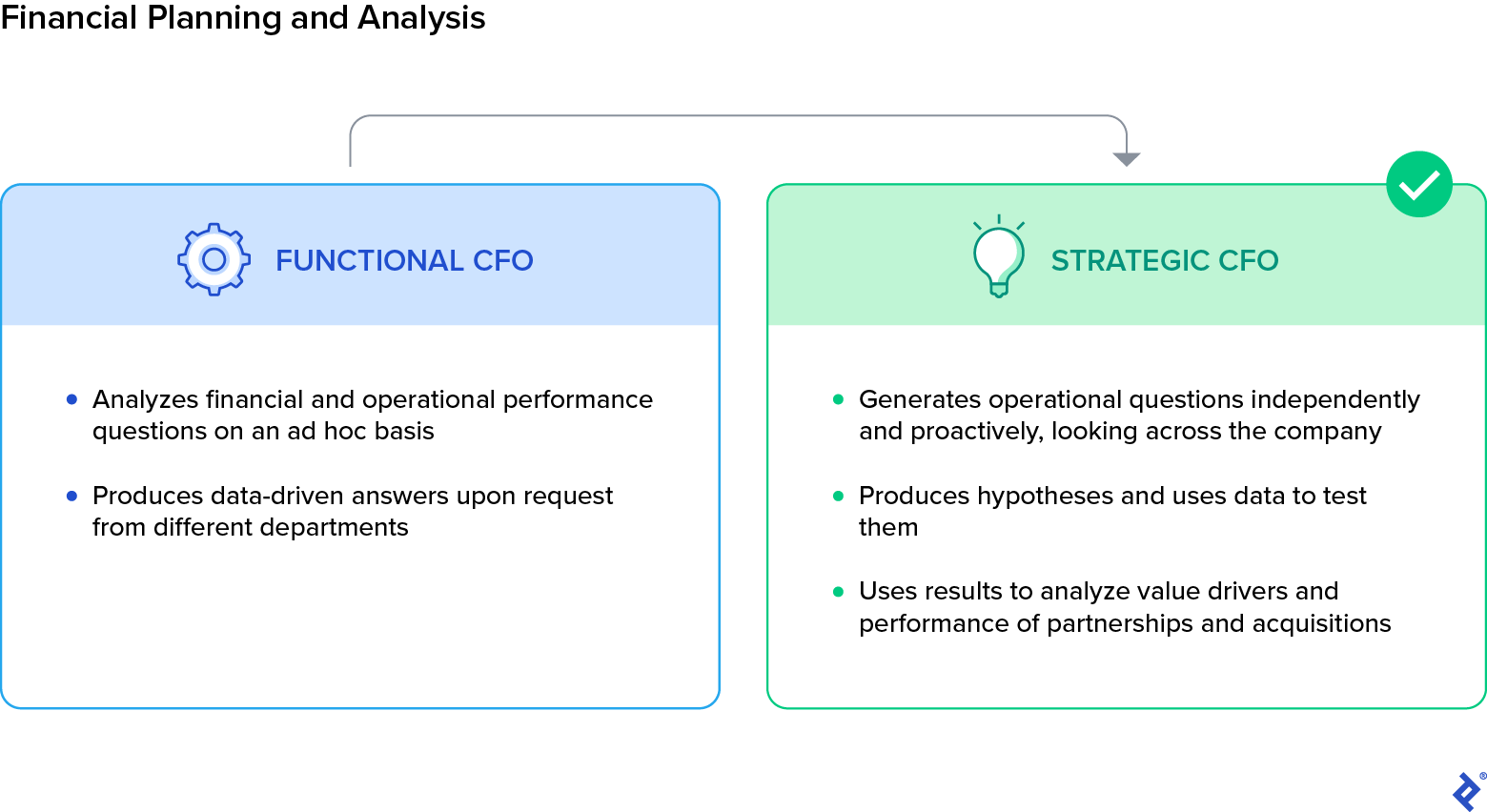

2. Financial Planning and Analysis

The next logical step for a strategic CFO is to look for ways to apply standardized databases and quantitative skills in financial planning and analysis. FP&A is typically used to produce data-driven answers to financial and operational performance questions facing any aspect of the company. Some are routine analyses, such as comparing the current period’s performance to the prior one’s, while others are ad hoc analyses such as calculating the return on investment for a new sales enablement technology platform. A strategic CFO uses the same processes and may address some of the same questions as a functional CFO but takes a more proactive approach.

When I joined a pharmaceutical manufacturer as CFO, I found that few of the company’s senior leaders knew which customer, product, or geography generated the highest growth or revenue. This became a problem when the company had to quickly increase profitability. After implementing basic reporting improvements, I conducted a comprehensive profitability analysis of the company’s multiple business and customer segments to begin to answer broader strategic questions.

Using FP&A business intelligence tools like Microsoft Power BI, we pinpointed the sources of the highest growth and the greatest profits and losses. We then broke them down by product category, product SKU, customer, business unit, and geography. But we didn’t just produce a report that sat in colleagues’ inboxes. We looped in cross-functional teams to help us design, develop, and glean insights from the reports, and hosted in-depth conversations with executive leaders of each functional area about commercial and operational changes that would maximize financial performance.

Within a short time, the company had a holistic understanding of which segments contributed profits. Just as important, we had complete alignment among senior leaders that we should focus on the most profitable segments. This strategy allowed us to nearly double the company’s profitability in less than a year.

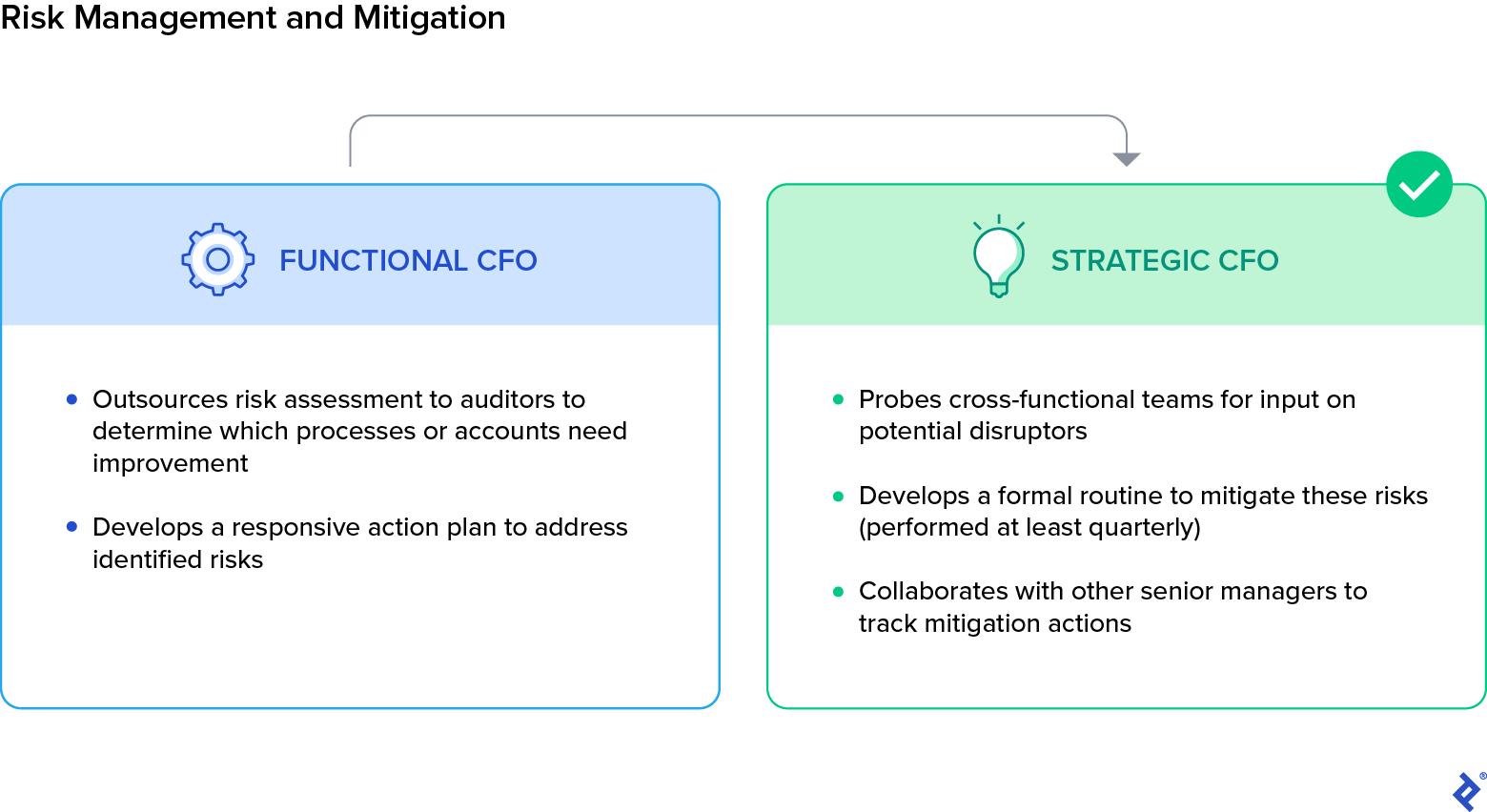

3. Risk Management and Mitigation

If finance leaders thought risk management was just an administrative footnote to financial oversight, then the COVID-19 pandemic and breakdowns in global supply chains upended that misconception. Today, CFOs must take a role in pushing teams across the organization to make risk assessments and regularly address questions of mitigation. At the same time, they need to see risk management through the prism of opportunity, looking for where it creates potential commercial openings.

For example, from 2017 to 2020, I was responsible for a group of companies that imported critical components for medical products to China or assembled them there. The companies enjoyed cross-border, lower-cost arbitrage and consistently expanded gross margins for many years. However, when I joined, I could see operational, regulatory, and macroeconomic risks on the horizon. We engaged senior leaders in thought-provoking quarterly discussions to anticipate possible hazards so we could dedicate resources and take action to mitigate the most pressing material risks. The teams consistently highlighted the possible operational and financial risks of cross-border trade barriers disrupting critical component shipments.

This proved prescient when a trade war flared up between the US and China in 2018. Because we were prepared through our risk planning, my group of companies was able to minimize supply chain disruptions by leveraging backup component sources in other parts of Asia and Europe. Integrating risk management into the company culture let us not only reduce or neutralize risks, but also limited impact on the bottom line, creating commercial opportunities for our sales and marketing teams to increase market share. We continued reliably delivering products and solutions while our competitors were still coping with disruptions.

4. Digital Transformation

It’s routine for a CFO to ask department heads to do more with less. Finance chiefs can lead the way by doing so themselves, examining ways to automate back-office operations to free employees from repetitive tasks while saving time and money. Automation can also aid the finance department as it deals with the constant cycle of work spiking within tight timetables: monthly closes, urgent analysis requests, and the crunch period around mergers and acquisitions. Being perpetually short of hands and hours inevitably leads to high levels of stress.

I learned how necessary this transition was firsthand. After a reorganization at a global manufacturing firm, my finance team was staffed with just two business analysts. This lean team was responsible for reporting and analyzing financial results for 25 portfolio companies every month within two business days. It simply wasn’t feasible for two people to complete this spreadsheet-based copy-and-paste project within 48 hours. Automation was the only solution.

We invested a small amount into robotic process automation to handle routine reporting processes and restructured the team’s approach, helping the two analysts become experts in business intelligence and visualization programming. Using these technologies, the two were able to complete the reporting tasks in one working day. They used the time they saved to undertake analysis and work with business leaders to complement the reporting with actionable insights.

Seizing on these learnings, our corporate development teams took a similar approach: They automated their monthly outreach, allowing them to contact 10 times the number of prospective acquisition targets and thus cultivate a larger partner pipeline.

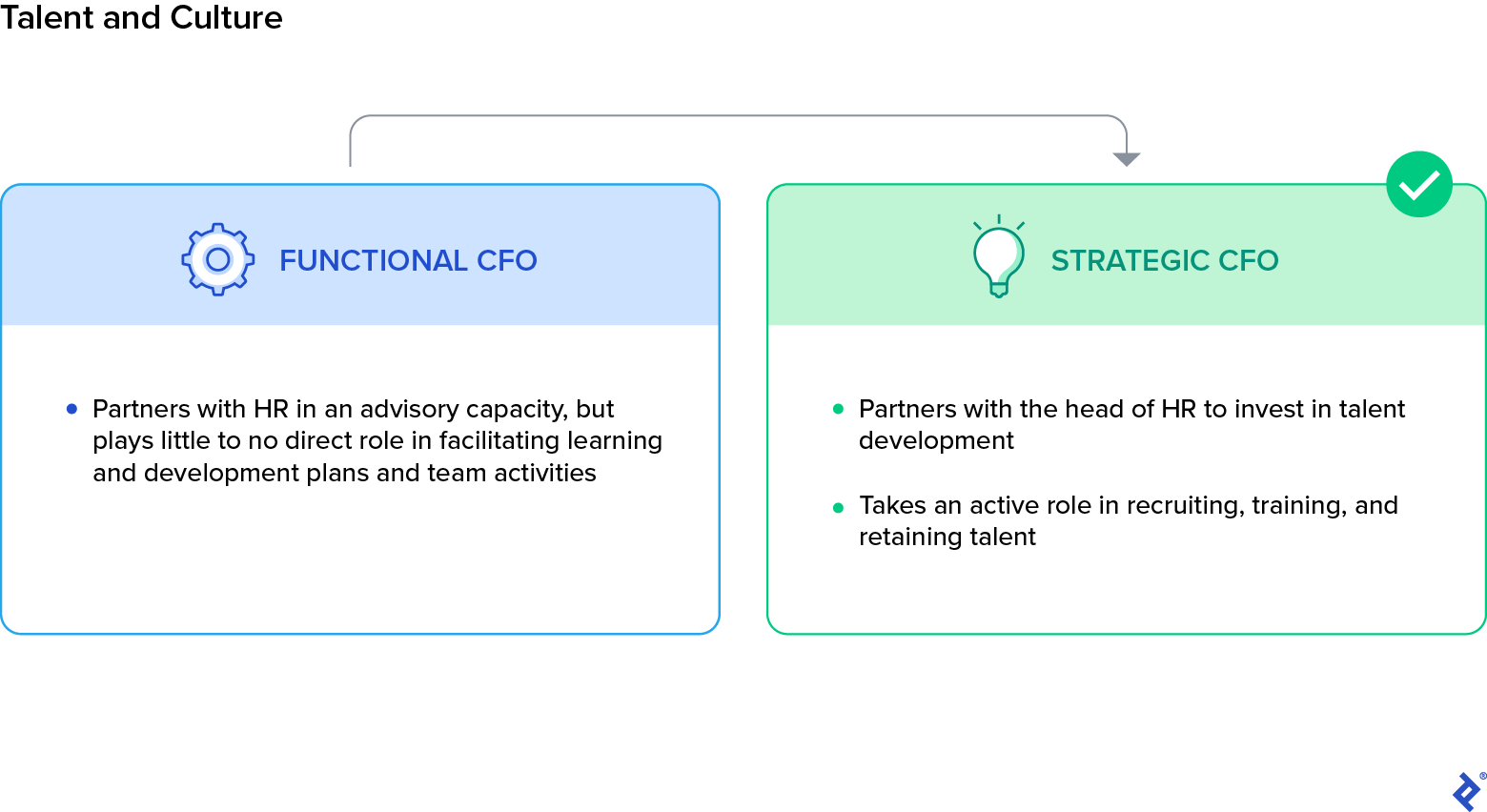

5. Talent and Culture

One valuable way a CFO can take a more strategic role is by becoming more directly involved in recruiting and cultivating talent. Instead of just advising HR on staffing requirements, a strategic CFO will partner with HR to create opportunities to bring high-performing financial talent into the organization.

For instance, I once helped recruit a very talented executive to a small healthcare device manufacturing company that my firm owned, even though I knew we were going to sell it within the next year. We asked this person to join as the vice president of finance, stabilize the company, and successfully complete the sale—even though we didn’t have a specific role lined up for him afterward. This would have been a hard sell had we not approached this candidate with transparency, honesty, and a commitment to retaining him in a senior role.

A year after the sale, we delivered on the commitment and he became CFO of our largest portfolio business. Three years later, he was promoted to be the holding company finance chief, overseeing all portfolio companies.

As CFO, taking an active role in developing a high-potential finance leader meant I was contributing to the company’s long-term strategy by helping to secure an employee who could steer the company in a post-sale future. While all of this transpired in the finance department, others in different functional areas noticed and adopted similar approaches to recruiting and cultivating high-potential talent in sales, marketing, operations, and technology.

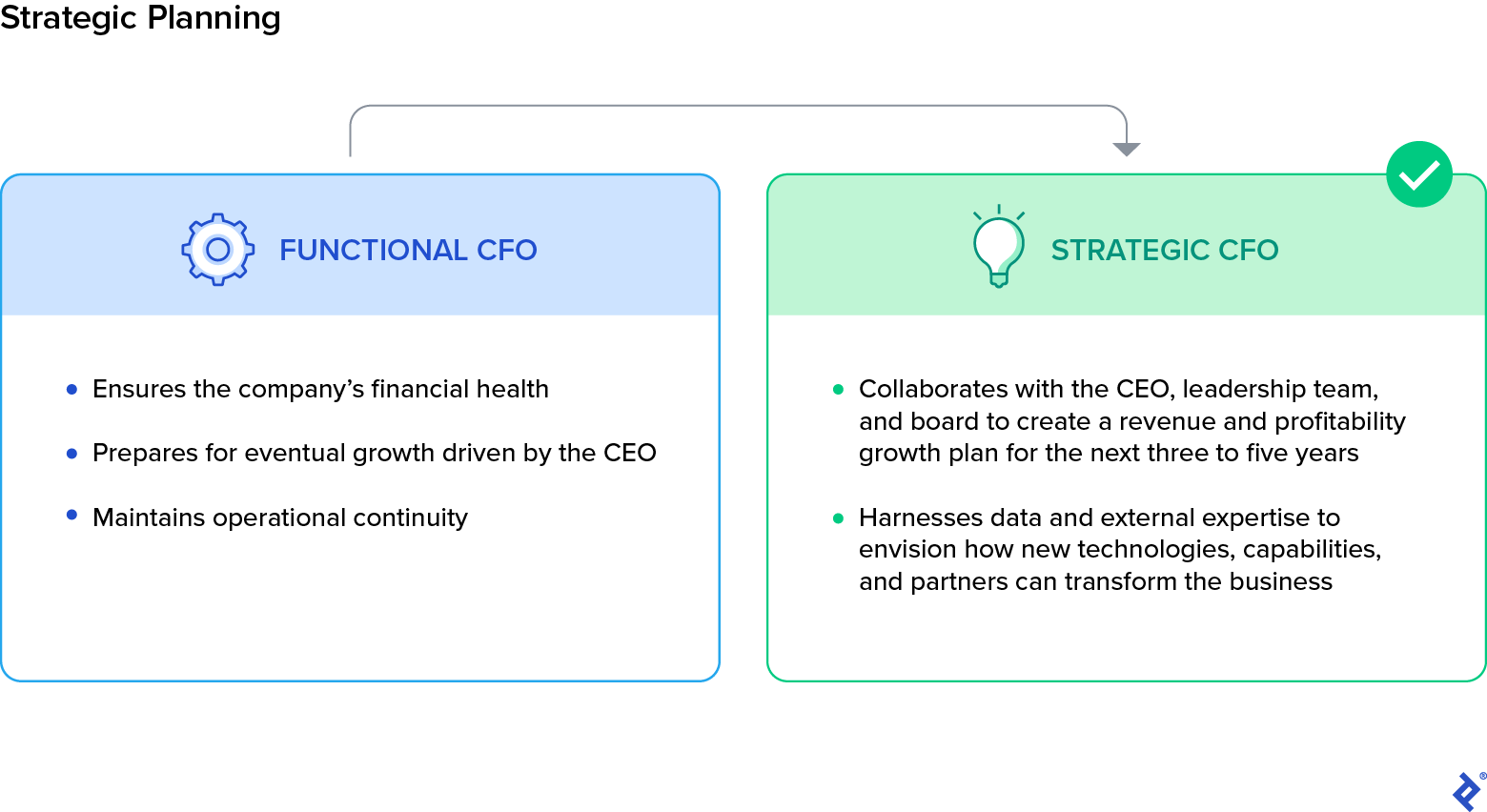

6. Strategic Planning

Companies value the hard data and empirical mindset that a finance chief lends to strategic planning. The CFO can use this as an opportunity to contribute to the transformation of a company’s commercial goals or capabilities, for instance, by championing acquisitions or introducing partnerships to extend competitive advantages.

I had the opportunity to put this into action while working with an emerging markets cardiovascular diagnostic company that made heart monitors. The company had aggregated terabytes of heart rhythm data through the thousands of devices it had sold. This data was a unique asset, but the company didn’t use the information for any commercial purposes. As CFO, I considered any large source of unique data as a potential opportunity in a world where SaaS business models can be commercialized quickly.

I challenged the team to use that data as the basis of an analytics service while protecting patient confidentiality. After months of development with local software partners, the team unveiled a new service to hospitals to provide real-time monitoring, analysis, and alerts if the software detected abnormal rhythms in a patient. The service deepened customer relationships and added a highly profitable revenue stream.

With greater visibility and deeper insights about the company, the strategic CFO develops a point of view about what products, capabilities, and M&A opportunities can create transformative value for their company. Yet it’s important to keep in mind that what truly elevates your contribution to a growth company comes down to leadership.

The demand on firms to meet targets is immense, especially as macroeconomic pressures rise and venture capital, private equity, and public market expectations for financial performance continue to climb. Companies need leadership, and leaders must deliver growth. The strategic CFO is uniquely empowered in this respect. When the modern CFO rises above their functional responsibilities and provides valuable strategic insights, they can help their company transform and grow for the future.

Further Reading on the Toptal Blog:

Understanding the basics

What makes a CFO successful?

A successful modern CFO typically spends the majority of their time spearheading companywide efforts to transform and optimize business operations, with an emphasis on accelerating revenue and profit growth.

How can a CFO help a company grow?

A CFO can help a company grow by optimizing financial operations and managing risk, as well as by identifying untapped opportunities and generating insights that drive strategic business decisions.

What should the goals of a CFO be?

Modern CFOs oversee routine reporting and forecasting, financial planning and analysis, risk management and mitigation, digital transformations that amplify finance processes, recruitment and development plans that finance talent, and strategic planning to ensure a company’s future growth.

New York, NY, United States

Member since March 8, 2017

About the author

Puneet is a finance expert who has worked for J.P. Morgan Chase & Co. and Pfizer, and holds an MBA from Harvard Business School. He has held CFO positions at public companies, middle-market private-equity-backed companies, and startups.

Expertise

PREVIOUSLY AT