Tell a Compelling Story: Pitch Deck Components That Persuade

To persuade investors to fund your startup, your pitch deck must do more than present a solid business case. It must generate an emotional response.

To persuade investors to fund your startup, your pitch deck must do more than present a solid business case. It must generate an emotional response.

Brian is a seasoned finance expert who has held multiple corporate SVP roles and has been a consultant for startups seeking advice on fundraising and valuing their businesses. Having successfully raised seed capital for his own startup, he has a deep understanding of the commercial and operational aspects of starting a business.

Expertise

PREVIOUSLY AT

Developing a compelling pitch deck can be one of the hardest parts of being an entrepreneur. While you ultimately want to raise money, the goal of your initial presentation is simply to persuade potential investors to give you a follow-up meeting. Crafting and sequencing your pitch deck components so they tell an effective story is crucial to building that relationship.

The venture capital industry reached new heights in 2021, committing record amounts of money to startups while seeing unprecedented inflows from investors. But that doesn’t mean it got easier for entrepreneurs to fundraise. The opposite was often true, with market euphoria and competition for capital making it harder for many companies to stand out. Now more than ever, startups need to refine their fundraising efforts.

Since I transitioned from being a corporate finance executive to a consulting role, I’ve helped numerous startups in North America, Europe, and elsewhere develop fundraising strategies. I always tell my clients that there’s an art to creating a pitch deck that makes a compelling business case while also generating an emotional response in potential backers.

Narratively, a pitch deck is similar to a movie trailer in that it introduces the key beats to build interest and excitement without giving away the full story. For a pitch deck, there are 10 distinct beats to include.

- The Problem: Introduce the story by personalizing the problem, creating tension in your audience’s minds.

- The Solution: Offer a glimpse of hope, promising to resolve the problem.

- Product Features: Showcase the main features that make the solution possible, building your potential investors’ confidence in your solution.

- Market: Introduce your setting and characters. Show investors who stands to benefit. Start building a picture of customers in your investors’ minds.

- Competitive Landscape and Potential Risks: Increase the tension again by disclosing the risks and opportunities ahead.

- Revenue and Operating Model: Reassure your investors by demonstrating a persuasive plan for success.

- Traction: Increase potential investors’ confidence in your ability to execute by sharing your record of success.

- Projections: Build excitement by showing where you expect to be in five years.

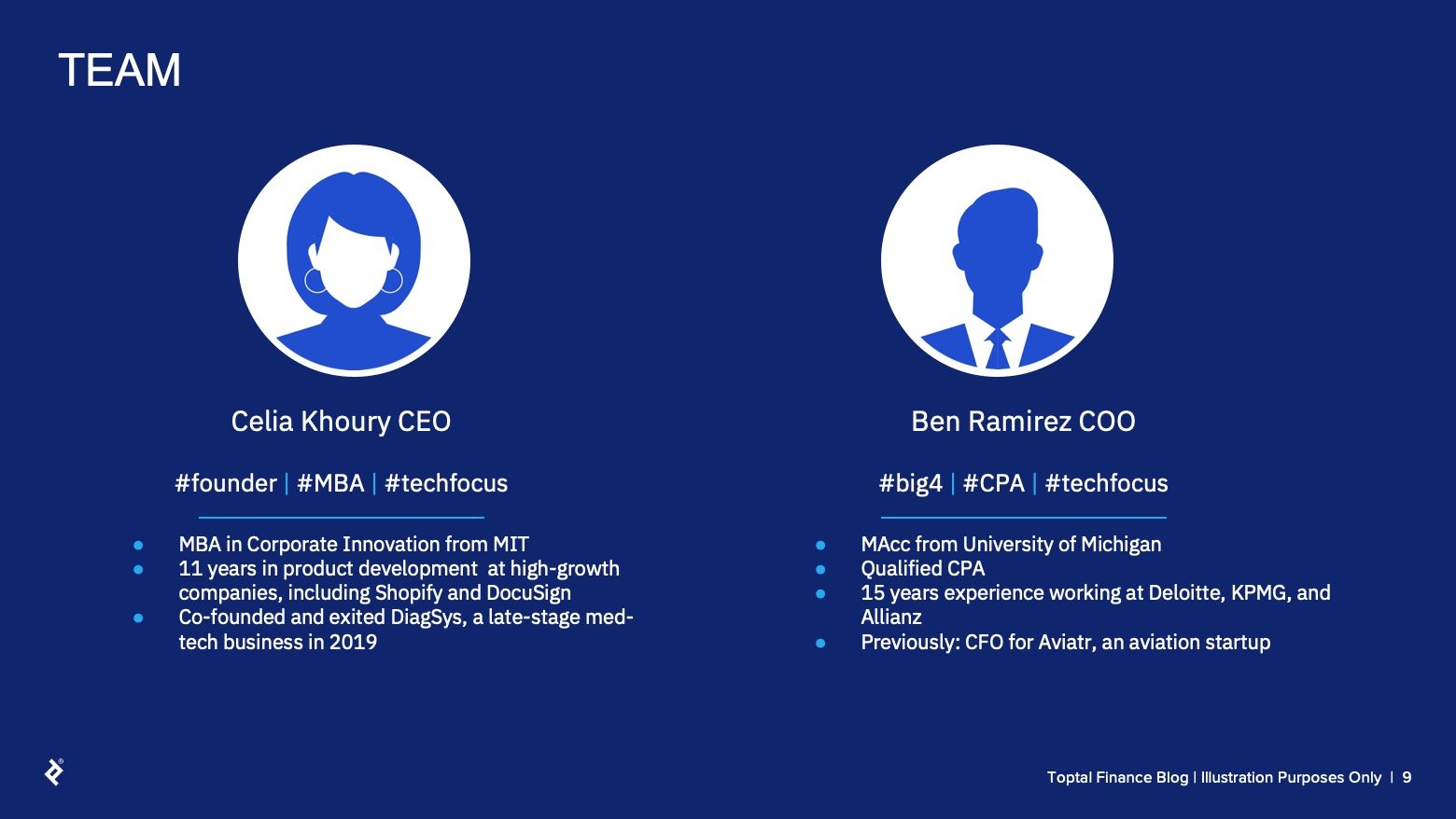

- Team: Introduce your partners. Help investors relate to your company. Show why your lineup is qualified to execute what you’ve promised to do.

- Fundraise: Explain the role you’re asking these investors to play in bringing this product to life, and create urgency by showing why you need them now.

To help illustrate how these concepts play out, individually and together, I’ve created a sample deck for a fictional startup company, OfficeFlex, an online booking platform for remote workers in search of a coworking space. It’s seeking seed funding to ready the product for launch. This simplified deck is for illustration purposes only; depending on the complexity of your business or your fundraising ask, you may need more than one slide per topic. Just try to keep the total under 20.

1. The Problem

Tension is central to any compelling narrative, creating anticipation that evokes an emotional response from the listener. The problem statement introduces that tension.

The problem statement—the description of the issue your product or service will address—needs to be specific, personal, and focused on the biggest pain point (though you can discuss other pain points in your presentation). Be frank about the consequences of the problem going unsolved, which creates empathy for customers and urgency for a solution in your investors’ minds.

OfficeFlex’s founders have identified a core challenge facing remote workers: Despite the proliferation of coworking sites, finding the best fit can be difficult. Remote workers need an easy way to find a coworking space that suits their needs.

2. The Solution

Immediately follow up with the solution—don’t make investors wait for a big reveal. To keep your narrative tight and coherent, it’s essential that this slide addresses the pain points raised in the first slide directly. Otherwise, you simply have a solution looking for a problem.

Crafting a concise solution is tricky for many entrepreneurs because they’re often so close to the product or service that it’s difficult for them to step back and describe it in a clear, objective way. Fight the urge to discuss every aspect of your product. Instead, focus on what makes users most excited.

Anyone can Google coworking spaces to find one nearby, but OfficeFlex adds value by helping users identify the ones that best meet their needs and facilitating easy booking.

3. Product Features

Demonstrating the product features is the central point of the pitch—after all, this is the key that will unlock the solution you’ve just presented. Your goal here is to focus on why your product stands out and how it addresses the root problem you established. Think of it as a property listing that homes in on the most special features of a house.

Investors also want to know how difficult it will be for competitors to replicate your solution. This is your “competitive moat,” the sustainable advantage you have in the marketplace. Make sure you highlight this. At the same time, use restraint and avoid technical and jargon-heavy descriptions of how the product works. Be optimistic but grounding because excessive enthusiasm can backfire and make investors suspicious.

OfficeFlex works through a patent-pending recommendation engine that not only matches users to their ideal workspace but generates user insights that can be monetized.

4. Market

Now that you’ve set the scene for your story and hooked your listeners, it’s time to show who this product is going to help. Investors want to know that a lot of people experience the problem you’re going to solve, which demonstrates a strong potential for revenue growth.

This slide is where you’ll define the market size. You should be prepared to describe your customer segments so investors can understand your strategy. Business-to-business companies typically segment according to employee headcounts, technology used, or location, while business-to-consumer companies focus on individual traits like age, life stage, or household income.

While OfficeFlex’s founders hope to expand nationwide, they are focusing their launch in three US metros with substantial remote worker populations: New York, San Francisco, and Charlotte, NC. Of the total addressable market (TAM) of 12 million remote workers in the US, 750,000 of them live in those three cities and make up the serviceable addressable market (SAM). Approximately 1 in 7 remote US workers uses a coworking space, meaning the serviceable obtainable market (SOM) is about 107,000 people.

5. Competitive Landscape and Potential Risks

Next, you must build investor confidence in your ability to deliver on your promises. An effective way to do that is to raise the tension again—so you can relieve it later, of course.

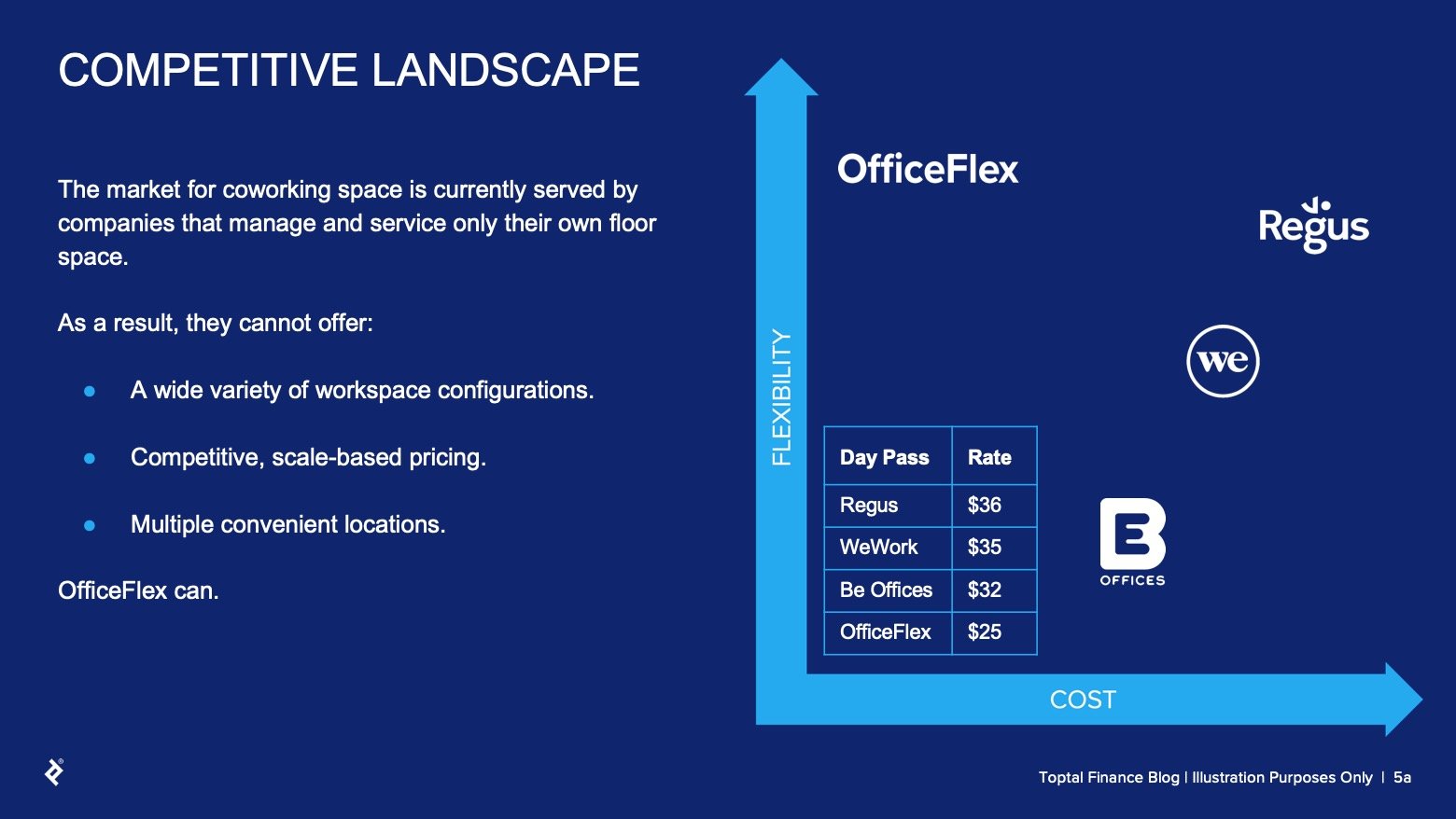

Knowing your competition is as important as knowing your product and your customer. Presenting a robust competitive analysis shows that you know where you stand in your industry and how you plan to outmaneuver existing players.

The most popular visual display of competitive analysis, particularly for tech firms, is known as the Gartner Magic Quadrant, which classifies competitors on a grid under four categories: leaders, visionaries, challengers, and niche players. However, it’s not the only option. OfficeFlex’s founders have chosen to display their competition across two axes that capture what their customers value most.

A counterintuitive but effective addition to your competitive analysis is a slide that openly acknowledges the challenges you face. Eric Lagier, Founding Partner of byFounders, has dubbed this frank risk assessment the “ugly slide.” This analysis is meant to offer insight into what keeps you up at night while demonstrating that you’re not naive, and that you’re taking the venture capitalist’s time and money seriously.

I strongly recommend that founders include an ugly slide alongside their competitive evaluation, as OfficeFlex has done here. In it, the founders both acknowledge their chief risks and demonstrate how they’re prepared to confront them.

6. Revenue and Operating Model

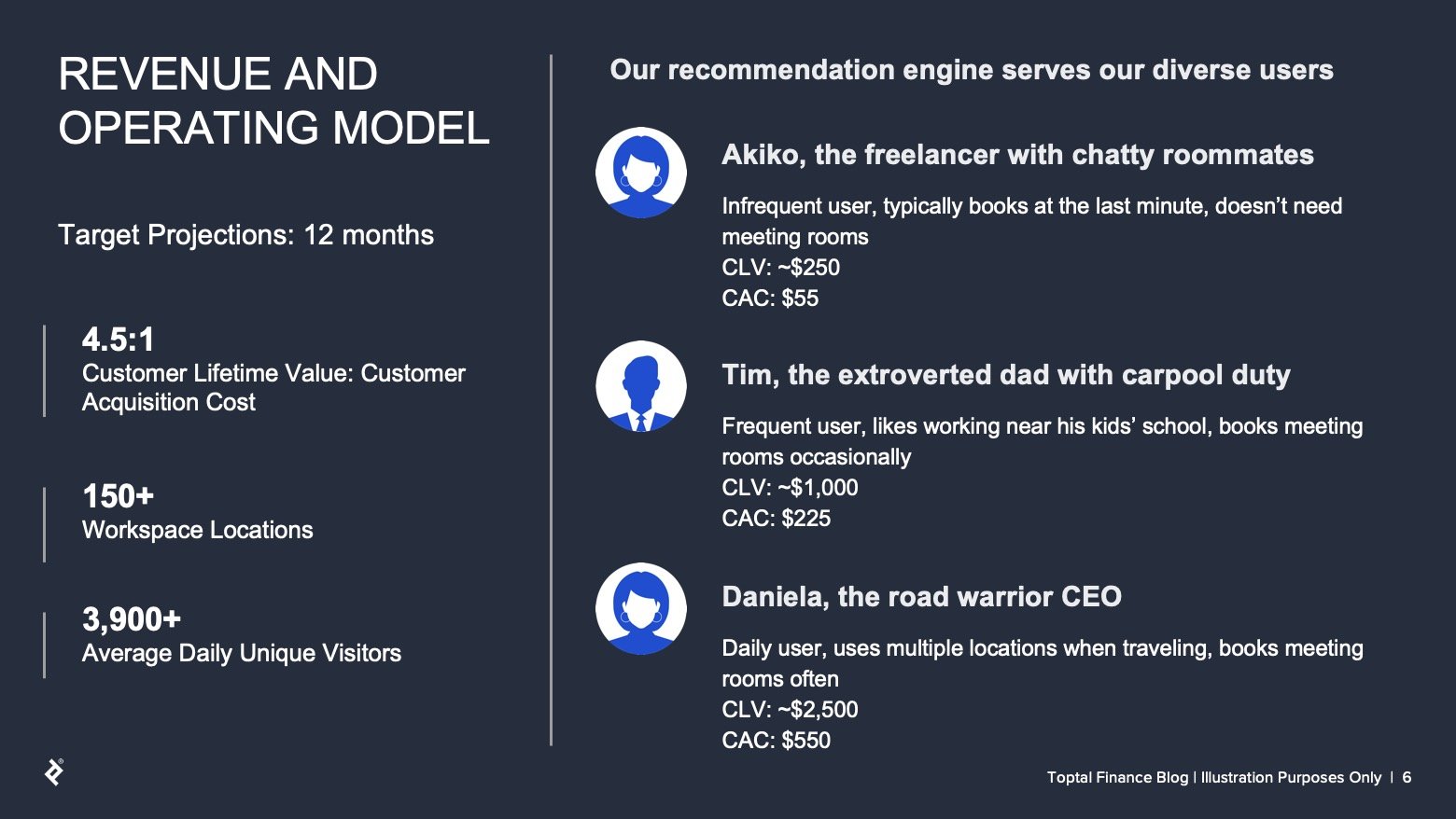

Now that you’ve demonstrated that you understand the territory ahead, it’s time to show how you’re going to execute. Your revenue and operating models should provide a detailed view of your business plan, and respond to the tension created in the previous section.

This may be the most important part of your pitch deck because revenue is a singular focus for venture capitalists. However, it can also be the most treacherous part, because market research may be the only way for early-stage and pre-revenue companies to determine the optimal business model—and reality may pan out quite differently. Fortunately, seasoned VCs understand this.

You’ll want to be prepared to share estimates for gross revenue, margin, and profits, as well as your price points, and be ready to explain how you arrived at them. You’ll also want to share details of your marketing plan and your unit economics, even if you’re still optimizing them.

This is a lot to pack into a single slide, so you may choose to divide your material into two slides or convey some of this information verbally. OfficeFlex has already mentioned its price points in the competition slide and has opted to highlight its operating model here. The customer personas help investors feel more connected to OfficeFlex’s users.

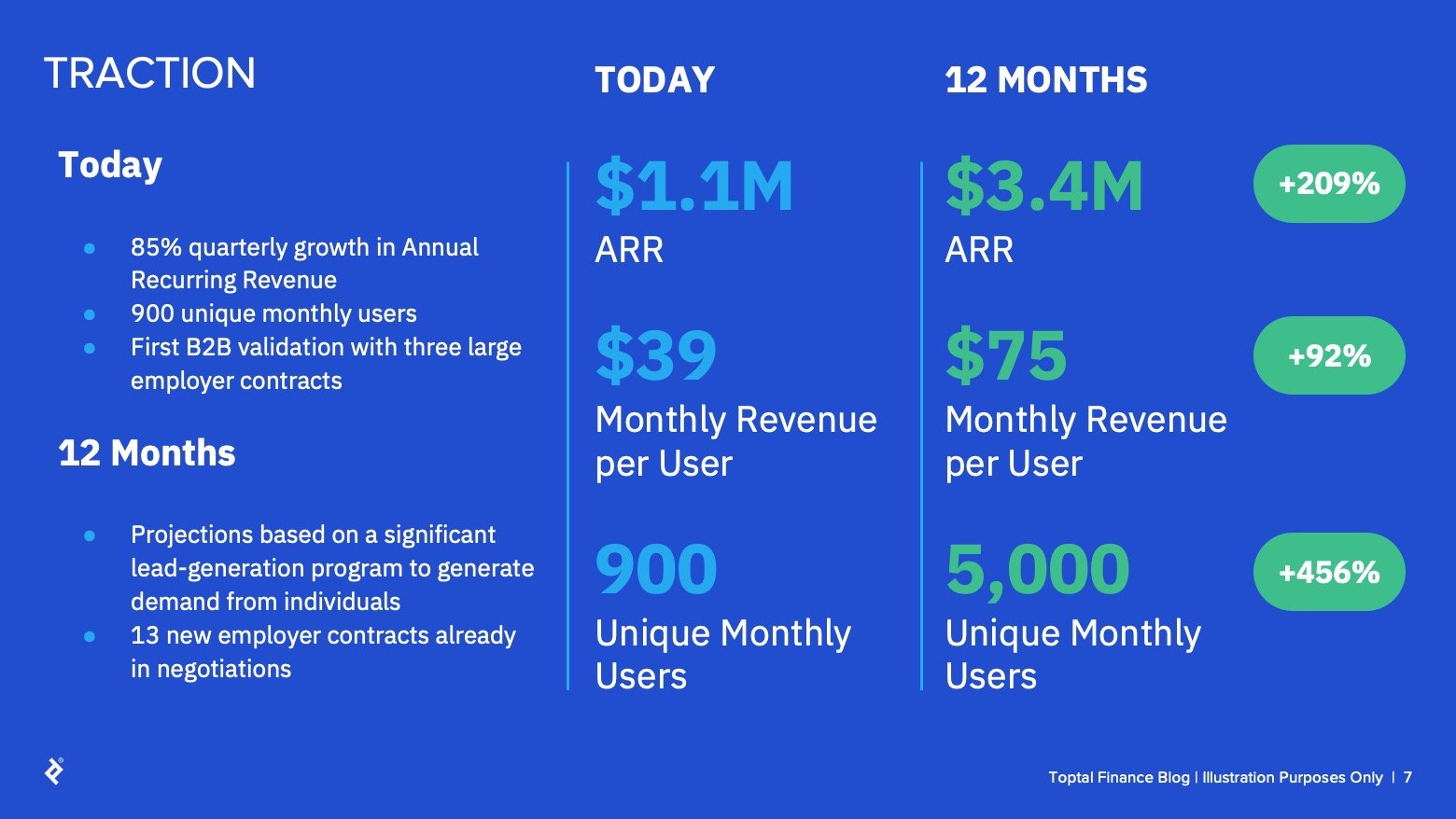

7. Traction

There may be no better way to persuade investors to believe in you than to demonstrate a record of success. Use this section to show what you’ve accomplished already and where you’re headed in areas like:

- Revenue

- Customers, including deals inked or monthly active user stats

- Team, including consultants and advisors hired

- Operating capacity, including sales offices opened or retail space secured

Another approach is to show the product milestones reached, which can segue into a roadmap outlining plans for additional features and enhancements.

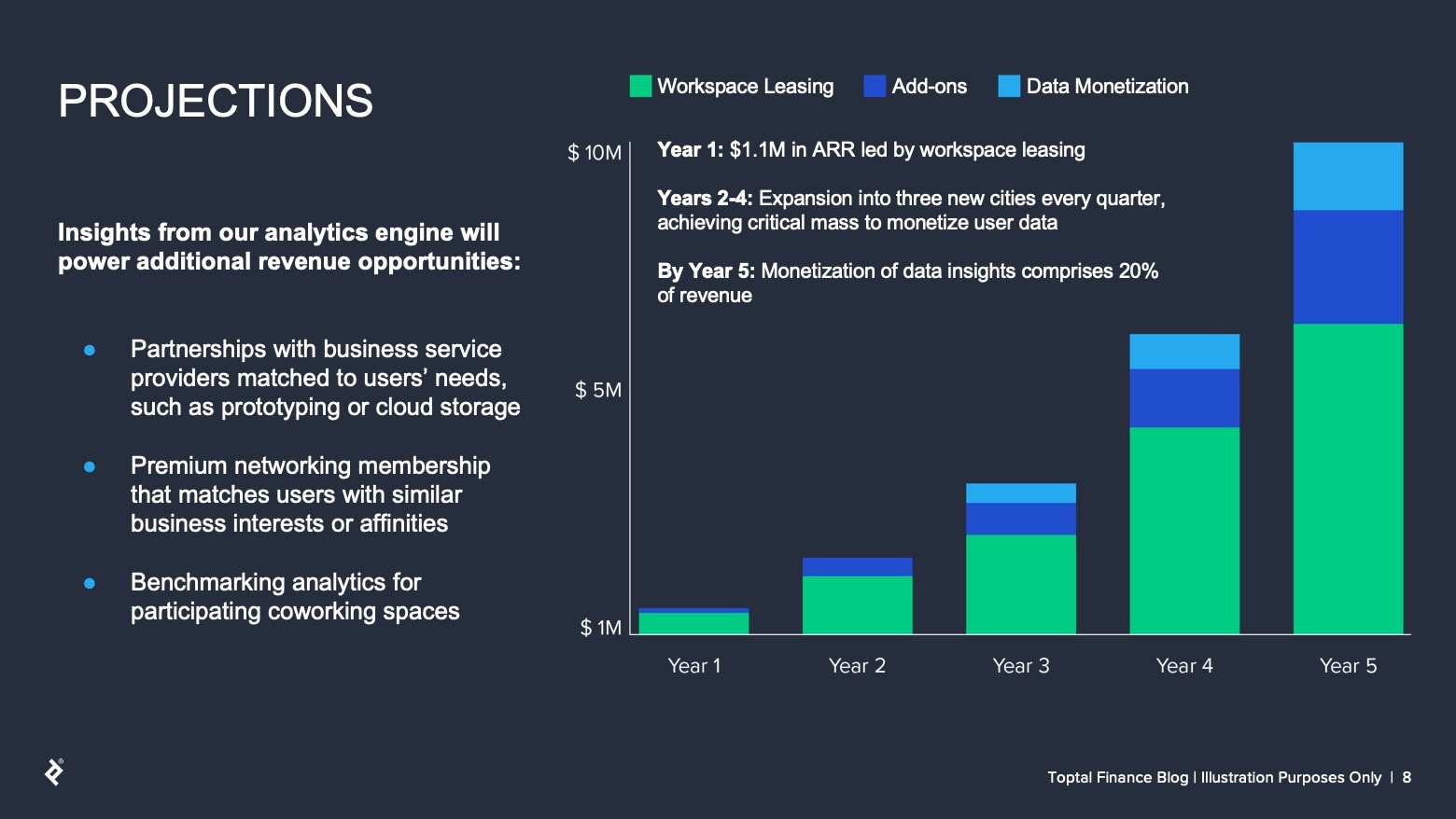

8. Projections

This is your opportunity to convince potential backers that this venture will be worth the effort.

Many founders are surprised to learn that investors are far more interested in how solid the business assumptions are than in raw revenue and profit projections. That’s because projections typically have very little data behind them, while business assumptions are common conjectures and easily understood.

The goal of preparing a detailed forecast is to clearly demonstrate these assumptions and stress-test them to understand how they impact performance. Explain why you believe the inputs chosen are credible. This justification is the difference between guessing and estimating, and will demonstrate that you understand what needs to happen to create a profitable business.

Aside from the target annual recurring revenue figure for Year 1, OfficeFlex’s projections don’t touch on finances at all. Instead, they look at the most influential inputs: geographic expansion, product growth, and data acquisition.

9. Team

Every business relationship is founded on people, and investors want confidence that the group involved in your venture has the skills and experience to bring the project to fruition. This is why it’s much easier for successful founders to raise capital. If you don’t have a successful exit in your past, consider showcasing the following in your deck:

- Time commitment of the founders

- Years of industry experience of the core team

- Business and managerial background of the core team

- Technical skills of the core team

This is your last opportunity to build investors’ confidence in you and your product before you arrive at the funding ask.

10. Fundraise

At this point, you explain the role an investor will play in building your product. At minimum, you’ll need to detail how much funding you need, what exactly you need it for, and what impact the investment will have on the value of the business. Be sure to describe the use of funds in the context of your planned milestones, such as your break-even point, some meaningful traction in growth, or the development of your product.

If you wish, you may also detail the valuation guidance and/or equity that you’re offering. Investment advisors can add a great deal of value here for founders who haven’t been through a pitch before.

OfficeFlex is asking for $500,000 to add more team members, develop the minimum viable product (MVP) into a more fully featured app, and improve its market research in order to better position itself for success at launch. By comparing this request to other rounds, it creates a subtle sense of scarcity, compelling investors to get on board.

The Afterword

There’s no such thing as a universal pitch deck template that works for every startup, but there are important narrative beats that can help you capture the essence of your company’s unique story, persuading investors to help you see it through to the end.

Ironically, most venture capitalists hate pitch decks because they become so repetitive. Remember that your audience is being bombarded with a growing number of these presentations, so don’t be afraid to show some creativity and panache to make yours memorable. At the same time, make sure you’re armed with all the data and insights you’ll need to answer the questions your presentation will generate.

Venture capital commitments are some of the most human of investment decisions, tapping into emotion and gut feelings as much as financial analysis. Unlike bond allocations or portfolio weightings or hedges, each funding choice represents a belief that a particular company and a particular team has the vision and wherewithal to grow rapidly, defy the odds, and provide incredible value to its backers. To earn this conviction requires a great story–and a compelling way to tell it.

Further Reading on the Toptal Blog:

Understanding the basics

What should a pitch deck include?

A pitch deck should be no longer than 20 slides, and it should define the problem being addressed by the new service or product, describe the market for it, introduce the team, and explain how the fundraising will advance the business.

What are the components of a pitch?

Your pitch deck should include 10 elements: the problem, your solution, key product features, market fit, competitive landscape, revenue and operating models, your traction, your projections, your team, and your funding request.

What do investors look for in a pitch?

Investors look for a concise, comprehensive pitch deck that tells a compelling story and makes a clear ask. They expect a professional design and tone, as well as answers to common questions.

Brian Nichol

London, United Kingdom

Member since May 20, 2020

About the author

Brian is a seasoned finance expert who has held multiple corporate SVP roles and has been a consultant for startups seeking advice on fundraising and valuing their businesses. Having successfully raised seed capital for his own startup, he has a deep understanding of the commercial and operational aspects of starting a business.

Expertise

PREVIOUSLY AT