Is $4.2 Billion Reasonable? How to Evaluate Instacart's Valuation

Grocery delivery startup Instacart has recently been valued at $4.2 billion. In this article, Finance Expert Patrick Gaffney works backwards and uses some basic assumptions to determine if the valuation is reasonable.

With companies opting to stay private for longer, analyzing private companies in this way can help us better understand industries typically shrouded in secrecy and provide clarity on the efficacy of certain business models.

Grocery delivery startup Instacart has recently been valued at $4.2 billion. In this article, Finance Expert Patrick Gaffney works backwards and uses some basic assumptions to determine if the valuation is reasonable.

With companies opting to stay private for longer, analyzing private companies in this way can help us better understand industries typically shrouded in secrecy and provide clarity on the efficacy of certain business models.

Ranked #1 by Institutional Investor for his coverage of EMEA real estate, Patrick specializes in equity research and financial analysis.

Expertise

PREVIOUSLY AT

Executive Summary

Starting from Economics per Order

- A key assumption is that the average Instacart order size is $75. The average weekly spend on groceries in the US is around $100, with 1.5 trips per week, meaning Americans on average spend $67 per grocery trip. Instacart consumers are from wealthier-than-average households that can afford to pay for convenience and spend more on groceries.

- Revenue Channel Roundup. Instacart would yield a total of $6.75 per order in fee revenues from delivery, partners, placements, and markups. This aligns with what reporters have found. A Fortune report said that the company was making $6.96 per order in Atlanta, $4.29 in Chicago and $2.45 in San Francisco, while losing money on each order in New York City and the Bay Area (excluding San Francisco). Below is the breakdown of revenue channels.

- Delivery Fees. Thus, the average delivery fee would be $3.00 (60% through Instacart express, 30% at $3.99, and 10% at $5.99).

- Grocery Store Partner Fees. A Forbes article indicated that over 80% of orders are now being placed with partners, so let's assume that 90% of all orders are with partners. If Instacart makes 3% per order, that would add $2.25 per order. The 3% can be thought of as the cost of grocery stores outsourcing their online ordering and delivery.

- Markups. A Recode article revealed that Instacart was charging 15% higher on Costco items in Manhattan. That may seem high, but I could see at least 20% of orders including a 5% markup; then we would get $75 x 20% x 5%. This means the markup would equate to just $0.75 per order.

- Placement Fees. The company also receives placement or promotional fees from manufacturers. Manufacturers are already doing something similar in physical grocery stores, as they pay for longer shelving and premium placement. But as retail increasingly moves online, customers do not "run across" products as they normally would in a store. So, an Instacart placement might solve the product discovery problem. Let's assume 10% of the products are promoted through this program, and that manufacturers pay a sales incentive of 10%. In this case, $75 x 10% x 10% equals $0.75 per order.

From Economics per Order to Valuation

- Step 1: Calculate Implied Earnings. As of February 2018, Costco, both a partner and a competitor to Instacart, trades at 30x trailing price-to-earnings with a market cap of a bit more than $80 billion. Its enterprise value, which takes into account debt and minority interests, is similar at $80.5 billion. Let's apply 30x to Instacart's market cap. This implies earnings of $420 million a year. If we use a range of multiples, from 20x-40x, earnings would be $630 million at the high end and $315 million at the low end.

- Step 2: Determine Revenue from Earnings. Using a base net margin of 2% (as we did above) and $420 million, the implied revenues would be $21 billion. The below table illustrates several scenarios with varying net margins.

- Step 3: Market Size. Let's say that our revenue estimate represents revenue for 2025, or 8 years in the future, when we want to exit. A Forbes article estimated Instacart's revenue at $2 billion in late 2017. Let's use this $2 billion as our current (2017) base, so revenue of $21 billion would imply a compound annual growth rate (CAGR) of 34% through 2025, while the high end $33.6 billion revenue estimate would equate to a 42% CAGR. For a startup, growth like this is quite high but possible. Amazon's revenues grew at a 43% CAGR from 1998 to 2006.

- Step 4: Sanity Check Transaction Volume. In 2008, surveys showed that 32 million people shopped at grocery stores each day. My high estimate of 280 million orders equates to 767,000 people per day ordering from Instacart instead of shopping on their own. This is just 2.4% of daily shoppers, which makes sense.

- Step 5: Combine Orders with Unit Economics. There is not much room for other costs if labor costs remain this high (I assumed 30 minutes per order at $10 an hour). Even as the company reaches scale with 280 million orders and $21 billion in revenue, the company has to maintain strict cost control to reach even a 2% net margin. This is quite tight, leaving just $200 million for non-labor expenses.

The Ruling

- Overall, the valuation is a stretch but seems achievable given the market size and potential revenues. Instacart has already seen success given its $2 billion in revenue and valuation of $4.2 billion. The company is also set to expand into 100 more cities, which should accelerate revenue growth.

- However, the cost of labor is high and only a small percentage of margins are left to support the rest of operations. Labor costs could cost $5 or more per order, and will likely face pressure from higher wages in the economy.

Why is Private Company Valuation Helpful?

- With companies opting to stay private for longer, analyzing them this way can help us better understand industries typically shrouded in secrecy.

- Determining the fairness of this valuation can illuminate how investors view their investments and provide clarity on the efficacy of certain business models.

- This article can teach you how to similarly make estimates and deconstruct the strategy and economics of your competitors.

Introduction

Grocery delivery startup Instacart announced in February 2018 that it had raised $200 million at a valuation of $4.2 billion, up from $3.4 billion last year. Just how realistic is this valuation? How should finance professionals and the general public come to understand this? In this article, we will work backward from the top and use some basic assumptions to determine how reasonable the $4.2 billion valuation is.

For the past 12 years as an equity research analyst, I valued countless public companies to ascertain whether the current market value (stock price) was correct or not. These companies ranged from the real estate industry to the video game sector, including those with businesses in multiple countries, whose business models varied by country. I used multiple valuation methodologies, including DCF, NAV, and multiples, but also built detailed models from the bottom up, examining unit economics.

With companies opting to stay private for longer, analyzing private companies this way can help us better understand industries typically shrouded in secrecy. Determining the fairness of this valuation can illuminate how investors view their investments and provide clarity on the efficacy of certain business models. Beyond these broader insights, this piece can teach you how to similarly make estimates and deconstruct the strategy and economics of your competitors.

What Is Instacart?

Instacart is a private online grocery delivery startup. Customers go to the Instacart website or app and order groceries from stores at which they regularly shop. Instacart then shops for and delivers these groceries to consumers without ever having to leave their houses. Shoppers in Instacart’s network do not work directly for Instacart but are contracted through the app, similar to how Uber’s app matches drivers to customers. The company makes money from delivery fees and from placement fees from companies that are interested in marketing directly to shoppers (either grocery stores or manufacturers).

In this exercise, we will use the announced $4.2 billion figure as a starting point. Then, we will take two approaches to see if this number is justified.

Starting From the Bottom: Economics per Order

Let’s start by evaluating the economics per order. As noted above, there are a number of revenue channels for the company: delivery fees, grocery store partner payments, markups, and placement fees. Below, we’ll conduct some bottom-up analyses of these channels as well as estimated expenses.

A key assumption is the order size since it will help us determine the potential markups or promotional fees. I estimate that the ultimate order size will be $75. The average weekly spend on groceries in the US is around $100, with 1.5 trips per week, meaning Americans on average spend $67 per grocery trip. Instacart consumers are from wealthier-than-average households that can afford to pay for convenience and spend more on groceries. Whole Foods reported on an earnings call in February 2016 that Instacart orders could average as high as $100 at some stores, though I believe it makes sense to assume lower on average.

Delivery Fees

Instacart charges consumers delivery fees for each order. These charges vary, but start at $3.99 for 2-hour delivery and $5.99 for 1-hour delivery, with some purchase requirements. There is also a $149/year Instacart Express option which allows customers unlimited delivery for all purchases over $35. Since the average American visits the grocery store 1.5 times a week, or 78 times a year, this equates to just over $1.90 per delivery for Instacart Express. Given average order size, let’s assume that the majority of orders end up being through Instacart Express. Thus, the average delivery fee would be $3.00 (60% through Instacart express, 30% at $3.99, and 10% at $5.99).

Grocery Store Partner Fees

Instacart also generates revenue from fees provided by its grocery partners, who they charge a percentage of sales revenue. A Forbes article indicated that over 80% of orders are now being placed with partners, so let’s assume that 90% of all orders are with partners.

If Instacart makes 3% per order, that would add $2.25 per order. The 3% can be thought of as the cost of grocery stores outsourcing their online ordering and delivery. Grocery stores spend a little under 1% on advertising, but I think Instacart in some ways is both advertising and eCommerce for these stores, so 1% would be too low. Another comparison is the current spend on sales, marketing, and eCommerce. Costco, for example, spent 10% on SG&A in 2017, but this is likely the absolute upper limit and an amount too high for a company of Instacart’s size.

Markups

While Instacart typically prices products as they are in stores, there are certain markups. For example, a Recode article revealed that Instacart was charging 15% higher on Costco items in Manhattan. That may seem high, but I could see at least 20% of orders including a 5% markup; then we would get $75 x 20% x 5%. In dollar terms, this means the markup would equate to just $0.75 per order.

Placement Fees

The company also receives placement fees from manufacturers. Let’s say for example that Procter & Gamble (P&G) wants to promote a new type of Crest toothpaste. P&G could serve coupons to Instacart customers or even samples for Instacart customers buying toothpaste, which Instacart would then charge a fee for. Manufacturers are already doing something similar in physical grocery stores, as they pay for longer shelving and premium placement. But as retail increasingly moves online, customers do not “run across” products as they normally would in a store. So, an Instacart placement might solve the product discovery problem. Importantly, this revenue for Instacart is mostly costless.

I will assume that 10% of the products are promoted through this program and that manufacturers pay a sales incentive of 10%. In this case, $75 x 10% x 10% equals $0.75 per order.

Revenue Channel Round-Up

If my assumptions are accurate, Instacart would yield a total of $6.75 per order in fee revenues from delivery, partners, placements, and markups. This aligns with what reporters have found. A Fortune report quoting board materials, said that the company was making $6.96 per order in Atlanta, $4.29 in Chicago, and $2.45 in San Francisco while losing money on each order in New York City and the Bay Area (excluding San Francisco).

How Expenses Fit In

Now let’s examine the expense side of the equation. Labor is going to be the greatest expense. If we assume that it takes 15 minutes to fill each order and another 15 minutes to deliver it, then total labor time is 30 minutes. While a 2014 article said the fastest fulfillment time was 44 minutes, Instacart has improved order fulfillment times significantly since then. With an average labor cost of $10 per hour and our 30-minute estimate, an order would require $5 in labor costs. With a $7 order (close to the Atlanta figure), then there would only be $2 left for all other expenses (marketing, technology, HQ expenses, etc.) and profit.

Determining an Appropriate Net Margin for Instacart

Recent margins for grocery stores have been as low as 0.1% (Supervalu) and as high as 2.8% (Walmart). This may seem low compared to other industries, but it’s mostly because the grocery store business model depends on high volume sales. Intense competition from other grocery stores and discounters also place downward pressure on margins. And, fixed costs are high since well-located stores attract volume but are more expensive.

Therefore, the $2 in remainder needs to cover a great deal. Let’s assume that Instacart has similar margins as grocery stores, or 2.0%. That’s using the full order value as “revenue,” which appears to be what Instacart does currently. That means of a $75 order, it has just a net profit per order of $1.50 and that the company can only spend $0.50 per order on overhead and marketing. That might be difficult as it ramps up but could become more reasonable as it reaches scale. I also expect that order fulfillment time will continue to fall, as the company has already seen. That will give more room for SG&A and profitability. Although at some point, Instacart will reach some limit on order fulfillment.

From Order Economics to Valuation

I will now take these order economics and try to understand how they fit with valuation. We know venture capitalists currently value the company at $4.2 billion. But of course, they want to make money as well, preferably in the next 5-8 years (based on their own investment horizon). Because it is a later-stage investment, they want a fairly good return even if they won’t require as high a cash multiple at exit. A 20% internal rate of return (IRR) would imply 2.5x cash back on exit, while 25% IRR would be 3.0x. Since the company is more mature and already generates revenue (and profits at the gross margin level), this 3.0x seems reasonable. Of course, some venture capitalists would demand more, and some less. This equates to the return demanded by venture capitalists on average over all of their investments in a fund.

Using this 3.0x means that the exit value of Instacart needs to be $12.6 billion. This helps compensate the VCs for risks and illiquidity and also assures their investors a solid return.

One simple way to put this $12.6 billion valuation into context is to see how comparable companies are currently valued, from which we can gather information about orders, revenue, and market size.

Step 1: Calculate the Implied Earnings

One way to do this is to use a Price/Earnings multiple (P/E), or in this case, the inverse: an Earnings/Price multiple (E/P). The price is set at $12.6 billion, but what are the implied earnings? I’m not referring to current earnings, which are likely negative—instead, we are looking at the VC’s exit, so in say 5 to 8 years, how much can the VCs get through sale or IPO. A good starting point is the valuations of comparable companies.

Unfortunately, some of the most apt comparisons are either not public (Fresh Direct) or are public but do not yet have earnings (Blue Apron, Hello Fresh). In addition, Instacart is a mix of grocery and a service, and their competitors include both grocery stores with their own delivery services and Amazon’s Prime Now service. However, Amazon’s strategy does not emphasize earnings and famously competes in multiple sectors with varied margins. Therefore Costco, which has the closest grocery store model to Instacart, is the best comparison.

As of February 2018, Costco, both a partner and a competitor to Instacart, trades at 30x trailing price-to-earnings with a market cap of a bit more than $80 billion. Its enterprise value, which takes into account debt and minority interests, is similar at $80.5 billion. As an additional point of reference, the S&P 500 is currently trading at 25x multiple, so I am giving a premium to Instacart.

I will use this as a stepping off point, applying 30x to Instacart’s market cap. This implies earnings of $420 million a year. If we use a range of multiples, from 20x-40x, earnings would be $630 million at the high end and $315 million at the low end.

Step 2: Determine Revenue from Earnings

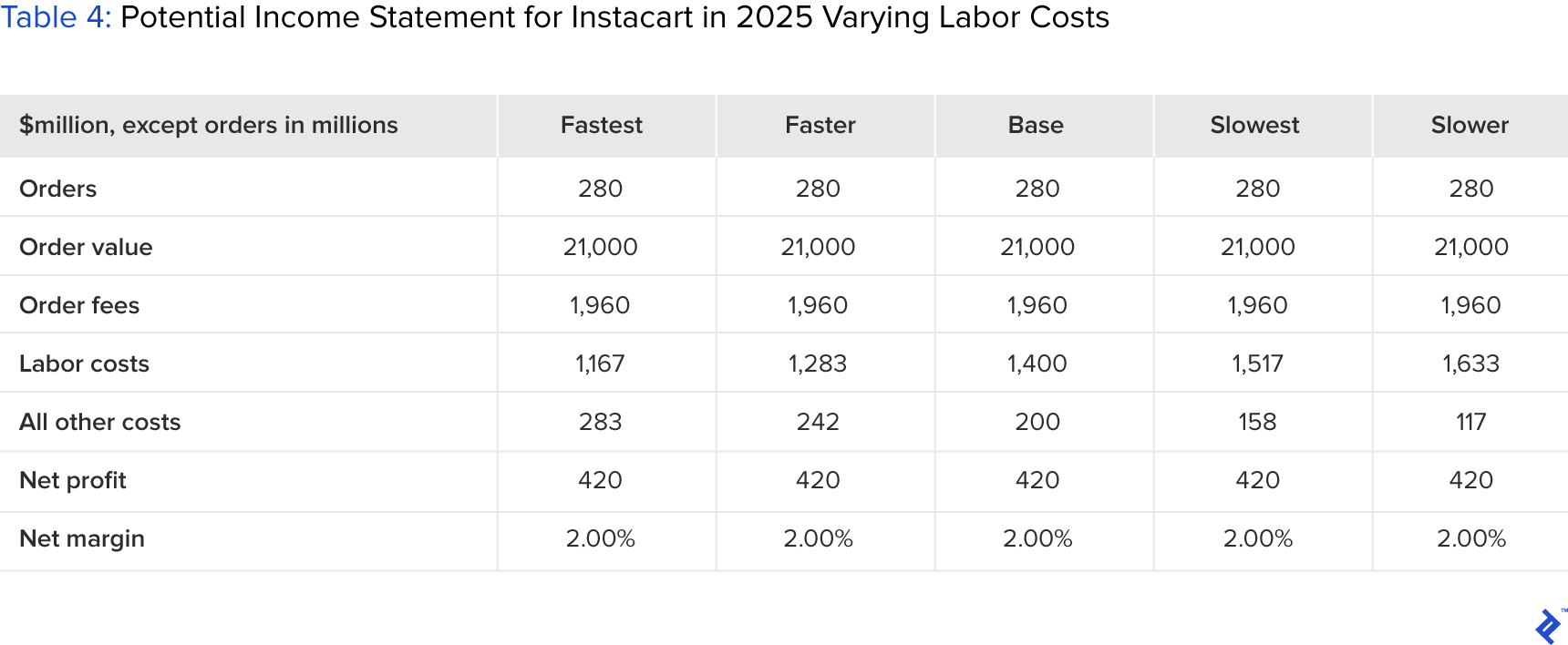

Now that I have an earnings estimate, I want to understand what this means for revenues. Using a base net margin of 2% (as we did above) and $420 million, the implied revenues would be $21 billion. The table below illustrates several scenarios with varying net margins.

Step 3: Market Size and Instacart’s Place in the Market

Many times, I have seen people use simple growth assumptions but don’t ensure that the resulting figure is reasonable. For instance, if I took a startup that has been growing 100% over the past three years and then assumed that this rate continues for the next 10 years, the resulting revenue figure may be completely unreasonable.

Let’s say that our revenue estimate represents revenue for 2025, or 8 years in the future, when we want to exit. A Forbes article estimated Instacart’s revenue at $2 billion in late 2017. Let’s use this $2 billion as our current (2017) base, so revenue of $21 billion would imply a compound annual growth rate (CAGR) of 34% through 2025, while the high-end $33.6 billion revenue estimate would equate to a 42% CAGR. For a startup, growth like this is quite high but possible. Amazon’s revenues (which were mostly sales of books) grew at a 43% CAGR from 1998 to 2006.

While the growth figures look quite difficult, they are small in comparison to the overall grocery market. For example, Costco had total revenues of almost $130 billion in the year ended Sept. 3, 2017, while Kroger had $119 billion for the twelve months ended September 2017, while Albertson’s (which owns Safeway) boasted revenues of $60 billion in 2017. However, that $21 billion would be more than WholeFoods had in 2017 ($16 billion) or Supervalu ($12.5 billion for year ended Feb. 25, 2017)

And our estimate of $21 billion is a small part of the potential market for online ordering. A recent study by Nielsen and the Food Marketing Institute forecast that online grocery sales will reach $100 billion by 2025. Currently, Nielsen estimates that they are 2% to 4.3% of total grocery sales or $13-28 billion. Instacart’s $2 billion in current revenues are just 7-16% of the total online grocery ordering market now. Our base case of $21 billion represents just a 21% market share, which seems possible. Basically, Instacart has a tailwind because growth is expected to be so high (22% CAGR through 2025 using the midpoint for estimates of current online sales ($20 billion).

Step 4: Sanity Check Transaction Volume

Looking at the total transaction volume rather than value, if we assume that each order at Instacart is $75 (as we did above), $21 billion in revenue equates to 280 million orders a year. On the higher end, $33.6 billion in revenue would equate to 448 million orders.

In 2008, surveys showed that 32 million people shopped at grocery stores a day. My high estimate of 280 million orders equates to 767,000 people ordering from Instacart a day instead of shopping on their own. This is just 2.4% of daily shoppers, which makes sense.

Step 5: Combine Orders with Unit Economics

Now let’s combine the unit economics with the valuation metrics above to see what the potential income statement looks like. In the table below, I show what the potential order fees and expenses are using the 280 million order figure along with a net margin of 2%. One thing this shows is that there is not much room for other costs if labor costs remain this high (I assumed 30 minutes per order at $10 an hour). It leaves little room for marketing or overhead.

Even as the company reaches scale with 280 million orders and $21 billion in revenue, the company has to maintain strict cost control to reach even a 2% net margin (using orders as revenues). This is quite tight, leaving just $200 million for non-labor expenses.

In some ways, it is easier to see the company reaching their revenue figures (just 20% of the market for online ordering) than it is for them to keep costs this low. Of course, if it can control labor costs more than we expect, then there is more room for expenses (and profits) further down the income statement.

The Ruling

Overall, the Valuation Seems Reasonable

Overall, the valuation seems possible given expectations for the growth of online ordering. Instacart has already seen much success given its $2 billion in revenue and valuation of $4.2 billion. This valuation is higher than that of Blue Apron (market cap of $648 million) and Fresh Direct ($2.63 billion). The company is also set to expand into 100 more cities, which should accelerate revenue growth. It helps that the market is quite large, with U.S. grocery spending totaling $600 billion, and that venture capitalists have been excited to invest in Blue Apron and Fresh Direct. We have also seen significant investments from Amazon in both brick-and-mortar stores (Whole Foods) and in delivery.

However, it seems like reaching the earnings necessary could be difficult, even assuming quite a low margin. I was surprised by how significant the cost of labor is to earnings and how little money is left to support the rest of operations. Labor costs could cost $5 or more per order and will likely face pressure from higher wages in the economy. Since the financial crisis, companies like Instacart have been able to depend on a large number of people that have are unemployed or underemployed, but as the labor market improves, they may have to focus on internal efficiencies more. I am, however, including a few caveats below:

Caveats for My Analysis

- I made simple exit multiple and P/E assumptions. VCs may demand more than 3x cash-on-cash returns given the risky nature of the business. At the same time, the P/E multiple of 30x may not be appropriate for a growing startup. Investors would review a range of multiples to understand how earnings would need to change. However, it’s important to start somewhere and it provides a goal for the company to reach in order to go public.

- Labor costs are a real concern and will ultimately determine margins. Currently, as customer orders grow, so do labor costs. However, this could change if this company moves to supplying customers in more efficient ways or there is some advantage to scale.

- I have assumed low revenue from promotional and partner fees. These could grow quickly if manufacturers lose other effective ways to market to customers and/or Instacart is very effective in introducing or upselling products.

- Sales and marketing costs are likely high right now, and I didn’t address them. Most customers are new and receive free orders or discounts. This becomes an issue If these new customers do not convert to regular customers. Blue Apron is an example of a company that has suffered from this difficulty.

- The landscape for on-demand services is challenging and could force the Instacart business model to change. I believe Instacart could build competitive firewalls by understanding both customer and partner needs, and it’s already mapping out grocery stores in order to more quickly fulfill orders. However, the landscape is evolving and the company may face threats that are as yet unknown. It needs to continuously keep an eye on these and the changing environment.

Parting Thoughts

From this evaluation, I was pleasantly surprised to find that Instacart’s valuation seemed achievable, especially in light of the inflated valuations and malaise that Blue Apron and the meal-kit industry have recently experienced. The above analysis did, however, reveal that Instacart might struggle to maintain margins due to high labor costs, an issue the company understands well and is trying to address.

Overall, by taking a few numbers and applying common sense assumptions, we can learn about the efficacy of the underlying business model, the drivers of profitability, and where the pressure points exist. Finance professionals and business owners alike can benefit from this exercise, whether the company is raising another round of funding or looking to conduct analyses of its competitors.

Disclosure: The views expressed in the article are purely those of the author. The author has not received and will not receive direct or indirect compensation in exchange for expressing specific recommendations or views in this report. Research should not be used or relied upon as investment advice.

The author has no investments or business relationships with any of the companies mentioned in this article.

Understanding the basics

What is Instacart?

Instacart is an online grocery delivery startup. Customers order groceries from stores at which they regularly shop. Instacart then shops for and delivers these groceries to consumers. Shoppers in Instacart’s network are contracted through the app. The company makes money from delivery fees and placement fees.

What does the price-to-earnings ratio tell me?

The price-to-earnings ratio is a ratio of a company’s market price to its earnings, which allows a venture to be compared with others. A high P/E suggests that the company might be overvalued, whereas a low P/E can indicate that it is undervalued. It is a metric often used by investors to compare companies.

Patrick Gaffney

Washington, DC, United States

Member since October 30, 2017

About the author

Ranked #1 by Institutional Investor for his coverage of EMEA real estate, Patrick specializes in equity research and financial analysis.

Expertise

PREVIOUSLY AT