Google Apps Script Tutorial for Mastering Macros

Google Apps Script may appear familiar to those with knowledge of Microsoft’s Visual Basic for Applications (VBA) language. However, Google’s coding offers more integrations and the ability to harness workflows seamlessly across spreadsheets, documents, and presentations.

Stefan Thelin

Paying It Forward: Understanding Leveraged Buyouts

Fully leveraged buyouts are among the most mythical and highly touted transactions on Wall Street. Yet, their success is predicated on successful comprehension of a business’s potential and the ability to negotiate the right terms for a deal.

Martin Kemeny

Python and Finance: Power Up Your Spreadsheets

The Python language has the functionality to consign many a VBA-filled spreadsheet, held together with sticky tape, to the recycle bin. Its ease of use and suitability for iterative development lends well to finance-based workflows. We delve into this and provides a brief tutorial.

Stefan Thelin

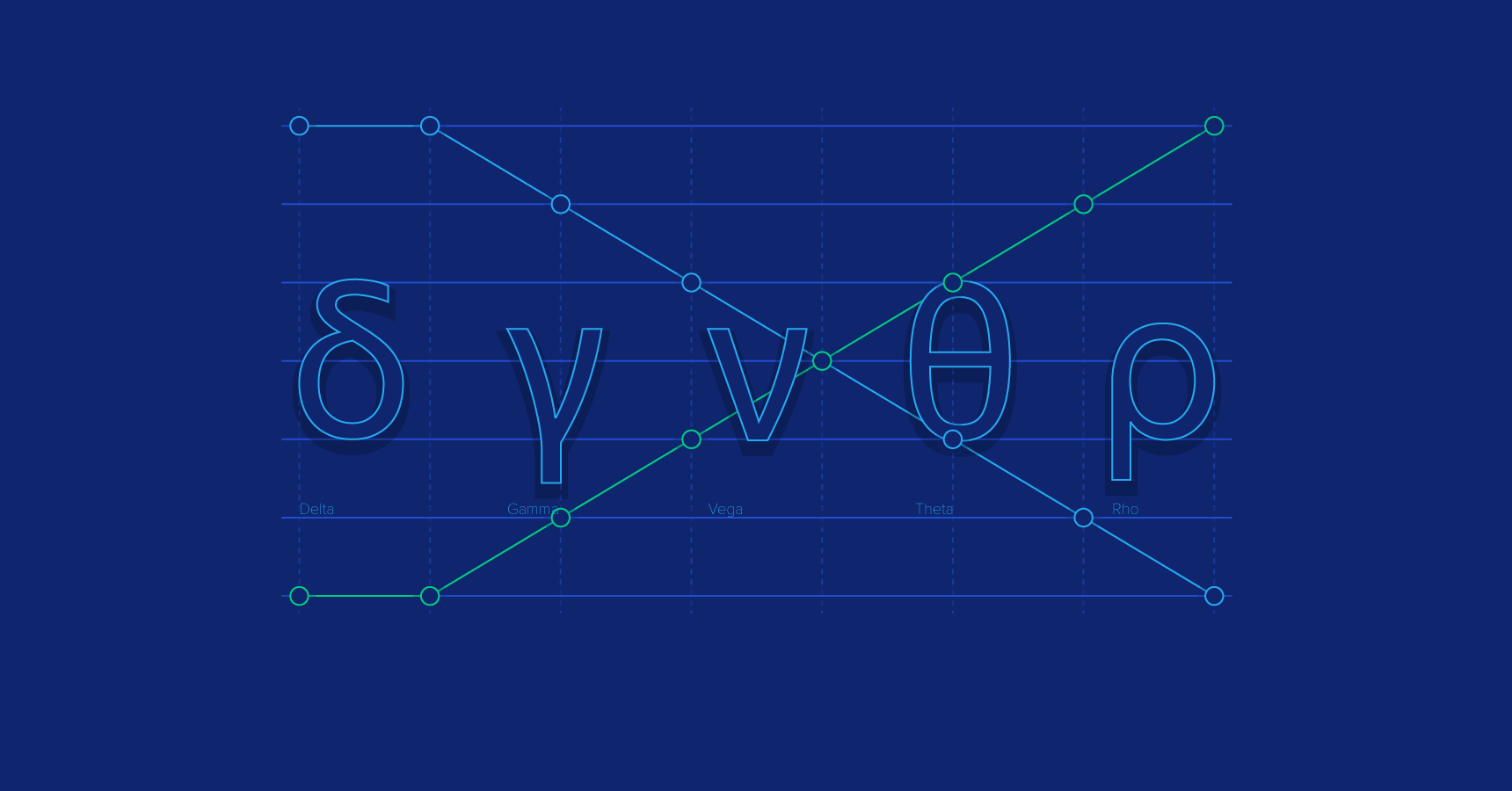

Getting to the Greeks: The Comprehensive Guide to Option Pricing

Stock options are widely used in public and private markets, both as malleable trading tools and for employee compensation. Yet many do not understand the components behind how they are priced. This guide discusses what drives the behavior of call and put options and how they can be deployed within portfolio management.

Nathan Krishnan S

Exploring Excel’s Get & Transform Functionality

Hidden in Excel and Power BI is a powerful data analysis pack named Get & Transform (previously known as Power Query). It is an ETL pack for cleaning and sorting raw data from a range of input sources, such as CSV and text files. This tutorial demonstrates how to–quite literally– get and transform data in Excel, in ways that can help the data analyst save time and uncover more insight.

Ellen Su

Justifying Investments With the Capital Budgeting Process

For a business manager, choosing what to invest in should not be an exercise of instinct. With capital budgeting methods, managers can appraise various projects simultaneously, with the end result indicating which one will have the highest impact on company value.

David Bradshaw

Real Estate Valuation Using Regression Analysis – A Tutorial

Traditional approaches to valuing real estate can lean towards the qualitative side, relying more on intuition over sound rationale. Linear regression analysis, however, can offer a robust model for using past transactions in an area, to provide better guidance on property valuations.

Daniel Barr, CFA, CAIA

Forecaster’s Toolbox: How to Perform Monte Carlo Simulations

One of the most important and challenging aspects of forecasting is handling the uncertainty inherent in examining the future. Every CEO, CFO, board member, investor, or investment committee member brings their own experience and approach to financial projections and uncertainty, influenced by different incentives. Oftentimes, comparing actual outcomes against projections underscores the need to explicitly recognize uncertainty.

Monte Carlo simulations are an extremely effective tool for handling risks and probabilities, used for everything from constructing DCF valuations, valuing call options in M&A, and discussing risks with lenders to seeking financing and guiding the allocation of VC funding for startups. This article provides a step-by-step tutorial on using Monte Carlo simulations in practice.

Stefan Thelin

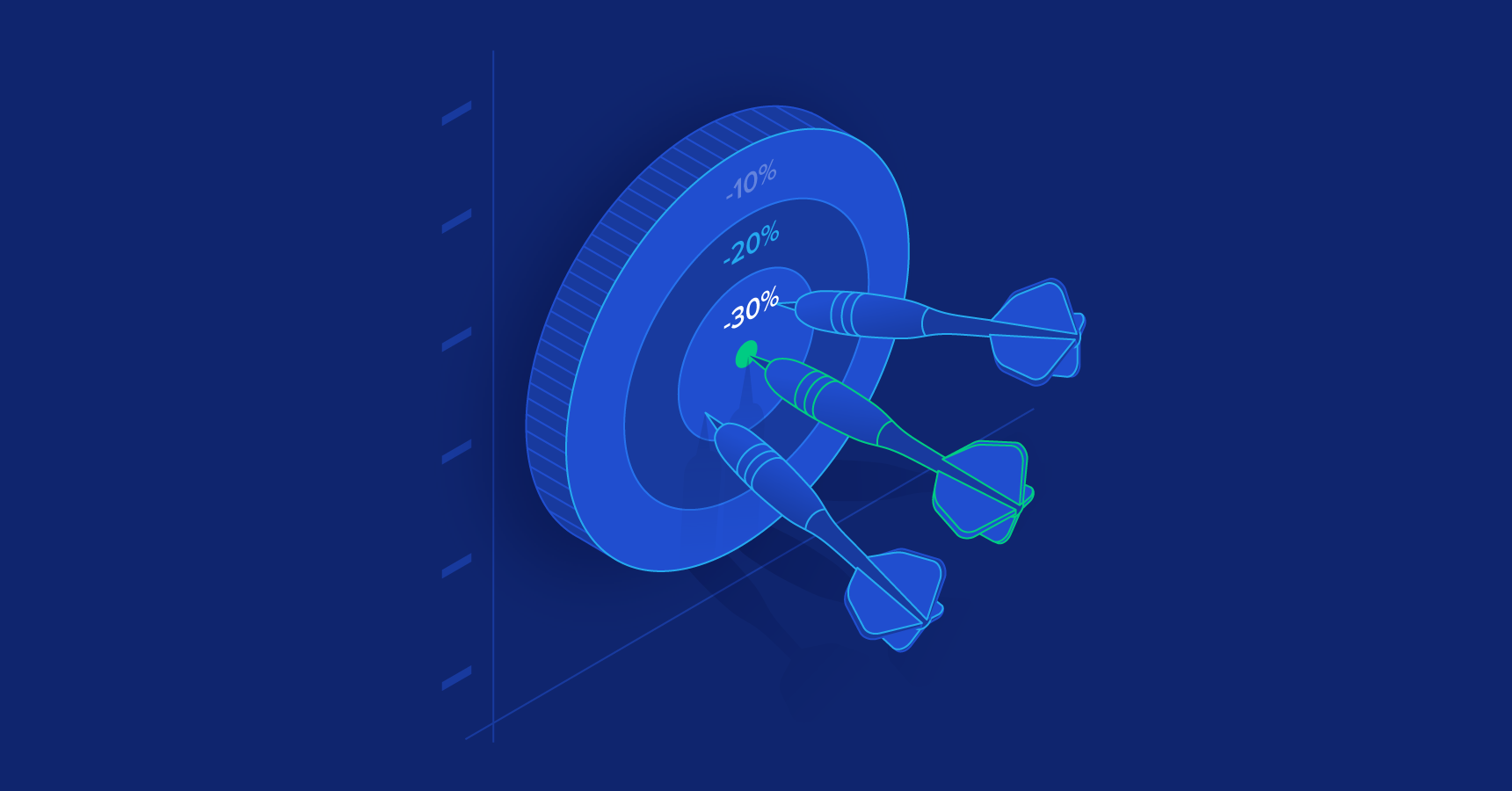

Estimating WACC for Private Company Valuation: A Tutorial

The discount rate is a critical input in any discounted cash flow valuation analysis. How does an analyst estimate a reasonable discount rate for a private company that has no publicly traded debt or equity?

This article focuses on best practices for estimation of the WACC in the context of a private company valuation. The discussion begins with an overview of the WACC, background on the components of the WACC, methods to estimate the WACC components for private companies, and an example of how to apply this framework to estimate a privately-held building materials company.

David Turney

World-class articles, delivered weekly.

Toptal Finance Experts

- Blockchain Consultants

- Business Management Consultants

- Business Plan Consultants

- Business Process Optimization Consultants

- Certified Public Accountants (CPA)

- Economic Development Consultants

- Equity Research Analysts

- Excel Experts

- Financial Benchmarking Consultants

- Financial Forecasting Experts

- Financial Modeling Consultants

- Financial Writers

- Fintech Consultants

- FP&A Consultants

- Fractional CFOs

- Fundraising Consultants

- FX Consultants

- Growth Strategy Consultants

- Integrated Business Planning Consultants

- Interim CFOs

- Investment Managers

- Investment Thesis Consultants

- Investor Relations Consultants

- M&A Consultants

- Market Sizing Experts

- Pitch Deck Consultants

- Private Equity Consultants

- Procurement Consultants

- Profitability Analysis Experts

- Real Estate Experts

- Restructuring Consultants

- Risk Management Consultants

- Small Business Consultants

- Supply Chain Management Consultants

- Valuation Specialists

- Venture Capital Consultants

- Virtual CFOs

- Xero Experts

- View More Freelance Finance Experts

Join the Toptal® community.