A Deep Dive Into the Future of Mobility

The paradigm of what a car is and how we use it is changing. Energy innovations, artificial intelligence advances, societal tastes, and environmental concerns are all affecting how we will get around in the future.

The paradigm of what a car is and how we use it is changing. Energy innovations, artificial intelligence advances, societal tastes, and environmental concerns are all affecting how we will get around in the future.

Francesco has more than a decade of experience in finance, consulting, and management at prestigious companies such as Bain and Uber.

Expertise

PREVIOUSLY AT

In recent years, the global auto industry has been experiencing a disruption in worldwide sales. Despite high consumer demand, actual sales numbers dove sharply during the COVID-19 pandemic due to supply chain problems and other factors—then began to recover in 2021. Estimates suggest 2023 sales figures will still come in below 2019’s totals.

Car sales may be in flux, but people are not necessarily less mobile. Enthusiasm for bikes and scooters (especially in dense urban areas) shows that alternative modes are being sought. New trends are emerging, such as micromobility original equipment manufacturers (e.g., e-scooters, e-bikes, etc.) that are pivoting to direct-to-consumer sales instead of B2B. The ubiquitous mobility sharing platforms (e.g., Spin and Lime) are also adapting revenue models to consider new consumer needs by offering daily, monthly, or even yearly rental plans.

There are other underlying reasons contributing to a reduction in the volume of car sales. First, players from different regions and industries—normally outside the traditional automotive set—are gaining ground. The automotive industry has become appealing to a wider pool of investors: tech companies, venture capital funds, and private equity players. New stakeholders are dominating investment volumes in automotive and mobility startups. Moreover, new regions, especially in Asia, are gaining more significance within automotive production.

A growing wave of technology-driven megatrends is redefining mobility. The automotive product is changing, with electronics and software growing in prominence in terms of their value in a vehicle. Such features require skills outside traditional core competencies of automotive engineering. Vehicle software content is estimated to grow at a compound annual rate of 11%, making up to 30% of vehicle value by 2030.

The Trends Transforming the Future of Mobility

The next decade will see a range of innovative headwinds shift the dimensions of mobility toward new horizons. Changing consumer needs are key, with the industry progressively moving from an ownership model toward a Mobility-as-a-Service (MaaS) access model, especially for younger generations. Three pillars have given rise to this change:

- Alternative powertrain options

- Electric vehicle advances

- Popularity of on-demand service access

Social phenomena are influencing the rise of MaaS—increasing urbanization, population growth, and environmental concerns provide favorable conditions. New mobility forms are required to address those factors, which is leading to predictions that our contemporary vehicle-centric system of fossil fuel-powered mobility will gradually be replaced by a consumer-centric one run on electricity.

Mobility is seeing a pronounced growth of investment in new technologies, which are influencing the industry’s transformation. E-hailing (virtually ordering a transportation service), semiconductors, and sensors are the principal areas of focus, all contributing to the development of driving assistance systems and autonomous driving.

Generally, the automotive industry has been an engine of innovation because cars combine multiple technologies: chemical, mechanical, electrical, and digital ones. Cars are productive data centers—and increasingly—parts of larger mobility networks due to leaps in computing power, data generation through sensors and cameras, and cheap data storage. For example, if we look at e-hailing services and real-time data navigation systems (e.g., Waze), they offer both efficient and complementary services to existing urban mobility solutions.

Progress in connectivity, payment technology, and voice and gesture identification allow automakers opportunities to develop innovative cockpits that can provide new kinds of content and enable in-vehicle commerce: e.g., in-vehicle digital wallets that allow the purchase of items directly from the car. In addition, Vehicle-to-Everything (V2X) technology is gaining ground, providing a wider picture of a vehicle’s surroundings than traditional line-of-sight sensors (e.g., cameras, radar, and lidar), which makes it possible to detect connected objects in the proximity.

Modular design will play an important role in the future of mobility due to the changing function of the car. Many automakers are presenting multipurpose concept vehicles that can be utilized to carry people while providing more functionality for other uses, such as item delivery.

Considering the trends reshaping the industry, the most interesting ones that will drive innovation over the next decade are likely to be:

- Electrification

- Autonomous driving

- Vehicle-to-Everything

- Mobility-as-a-Service

1. Electrification Is the Growing Power

As automotive technologies evolve, new use cases for electric vehicles (EVs) will arise for them. Currently, electric vehicles constitute a small fraction of total global automotive sales.

The global share of EVs is expected to increase as government regulation ramps up incentives to encourage adoption. Stricter emission and fuel economy targets at national, state, and city levels are expected to continue, especially in Europe and China. In addition, the cost to produce lithium-ion batteries, the most commonly used format, is declining, suggesting future advancement in manufacturing and scaled production of EVs. Incremental steps to reduce EV costs will inevitably assist mass consumer adoption.

Furthermore, mobility industry integration with electricity grids is emerging. There is broader access to charging infrastructure, even if EV charging can create local constraints and stability problems on power networks—while in other cases, electricity companies are attempting to use EV batteries to help stabilize grids, a sign that renewables are becoming more diffused into incumbent networks.

In the short term, automakers are facing challenges of selling enough EVs to comply with rigid fleet emission regulations and fuel economy targets while retaining profitability. The urgency of this is encouraging rapid transformation—automakers are investing in startups to expand knowledge and expertise, and to capitalize on change.

2019 set investment records for electric cars, with automakers committing $225 billion to develop new EV models over the next several years. Specifically, Volkswagen (VW) led the way with an investment of $44 billion, with a goal of abandoning the development of fossil fuel-run vehicles by 2026 and selling 40% EVs by 2030. Another significant investment was made by Ford, which poured $500 million into electric truck startup Rivian. These are just some examples of initial investment—automotive companies have also set aside staggering amounts of money on research, design, development, and readying production.

Startups are currently focused on improving battery technology and building charging infrastructure for public and residential use. BMW and Daimler directed investment into charging infrastructure startup ChargePoint to help build out charging networks aimed at supporting their EVs. Volvo has also invested in FreeWire, a startup that delivers quiet mobile power and fast charging.

The pioneer in the EV field is Tesla, which was once the highest valued automaker in the world with a market capitalization of $1.2 trillion. The company was estimated to be worth $341 billion in early 2023—more than many long-standing OEMs around the world, including General Motors, Ford, Toyota, and VW. This indicates that the market and investors value innovation and the market potential for electric vehicles and related products.

Founded in 2003, Tesla has reached technological leadership by producing a full range of increasingly affordable electric cars. Its vertical and horizontal integrations into solar roofs, home batteries, and wholesale solar power stations with energy storage have augmented its knowledge base, scale efforts, and societal influence.

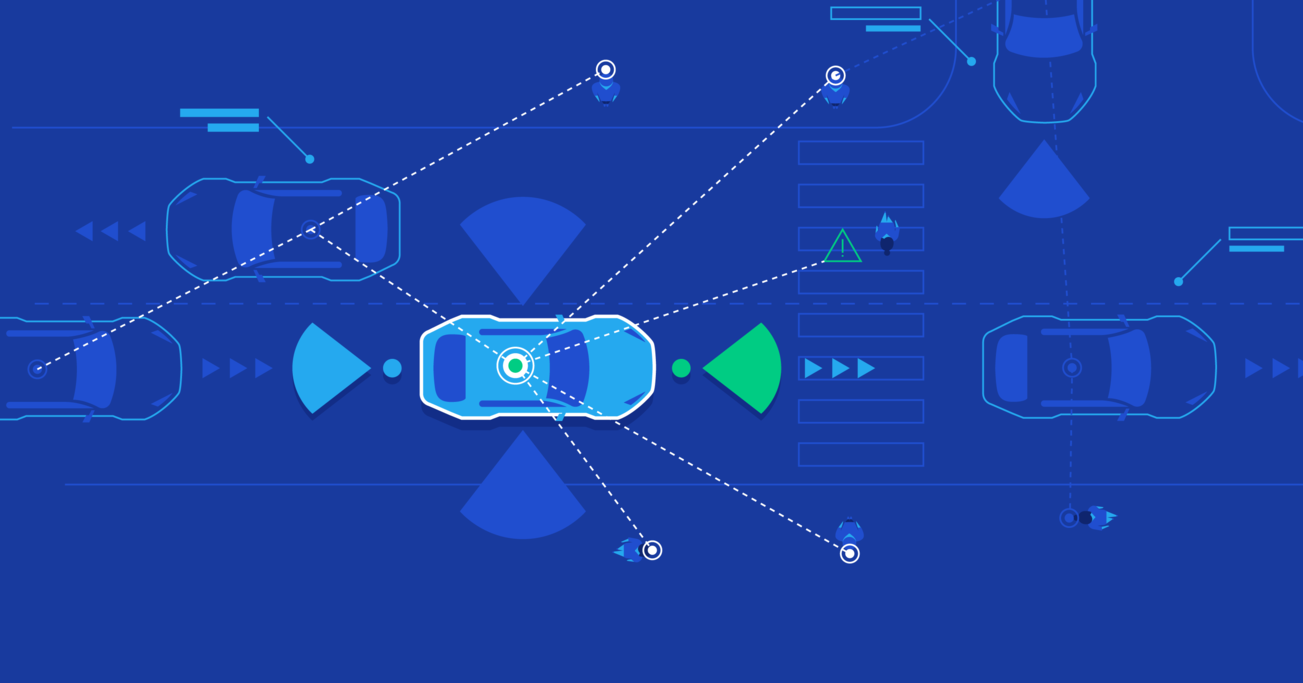

2. Autonomous Driving Will Reshape How We Move

The progressive evolution of automotive technology promises greater safety benefits through Automated Driving Systems (ADS) that, in the future of mobility, could make fully driverless cars a reality.

Self-driving vehicles will progressively integrate six levels of driver assistance technology advancements over the coming years. The six levels range from Level 0, which requires human drivers to do all driving tasks, to Level 5, where vehicle ADS performs in every situation. The intermediate levels (NHTSA) still require human drivers to monitor the environment and perform some tasks.

- Level 0 - No Automation: Zero autonomy, driver performs all tasks.

- Level 1 - Driver Assistance: Vehicle is controlled by driver, some driving assistance features may be included in vehicle design.

- Level 2 - Partial Automation: Vehicle has combined automated functions, like acceleration and steering, but driver must remain engaged with the driving task and monitor the environment at all times.

- Level 3 - Conditional Automation: Driver is a necessity but is not required to monitor the environment. The driver must be ready to take control of the vehicle at all times.

- Level 4 - High Automation: Vehicle is capable of performing all driving functions under certain conditions. The driver may have the option to control the vehicle.

- Level 5 - Full Automation: Vehicle is capable of performing all driving functions under all conditions. The driver may have the option to control the vehicle.

Autonomous driving offers significant benefits such as increased safety, time savings, mobility for nondrivers, decreased environmental harm, and reduced transportation costs. With regard to personal safety, already a number of current vehicles use a combination of hardware (sensors, cameras, and radar) and software to help vehicles identify certain risks and avoid crashes.

Autonomous Vehicle (AV) technology adoption will be evolutionary, and predictions for the roll out of cars with Level 4 autonomy continue to shift. In the meantime, improvements in sensor technology and machine vision software are enabling semi-autonomous driving. Advanced Driver Assistance System (ADAS) includes new capabilities such as adaptive cruise control, automatic braking, and traffic and lane departure warnings, which enhance driver capabilities and assist in case of distraction or tiredness.

On the hardware side, improvements have been made in automotive sensors that help vehicles detect and manage surroundings—a significant feature for driver assistance technology. Each sensor offers different strengths: Cameras recognize colors and fonts, radars detect distance and speed, and lidar creates highly accurate 3D renderings of surroundings. However, these sensors also have some constraints and cannot be used in isolation given the detection accuracy needed for semi-autonomous and fully autonomous vehicles.

According to a market research report by Next Move Strategy Consulting, the Global Advanced Driver Assistance System market size was $20.7 billion in 2021 and anticipated to grow to nearly $75 billion by 2030, with a compound annual growth rate (CAGR) of 14.2%.

European automotive giants are leading the way in ADAS developments, aided by advanced manufacturing resources and governmental assistance, such as through the European New Car Assessment Programme safety standards, which encourage the integration of the technology.

Some automakers are prioritizing advanced driver assistance rather than full autonomy. For example, Toyota’s goal of developing a vehicle that is “incapable of causing a crash” suggests a future that is not necessarily driverless. Nonetheless, other automakers still want to achieve full autonomy, and the market value is projected to reach roughly $80 billion by 2025. Another interesting trend is the more immediate business application of autonomous driving for item delivery, as acknowledged by Alphabet Inc.’s Waymo division. Other industry players are also participating in the race for autonomy, most notably processor maker NVIDIA, which is commercializing its technologies into driving areas.

Investors remain confident in companies developing the fully autonomous driving stack. As we noted in our article on software in the automotive industry, General Motors began the acquisition self-driving technology startup Cruise Automation in 2016 for $1 billion and bought out another investor’s stake for $2.1 billion in 2022. Hyundai plans to spend $5 billion in US self-driving technology and robotics by 2025, an investment that includes Motional, a mobile technology company that is currently testing robotaxis on US public roads. Volkswagen’s software unit, Cariad, is earmarking more than $2 billion for a joint effort with Horizon Robotics to create autonomous driving chips for the Chinese market.

Two of the biggest and most well-known players in autonomous driving are Cruise and Waymo, a subsidiary of Alphabet that is building a public ride-hailing service.

3. Vehicle-to-Everything Will Simplify Lives

V2X refers to Vehicle-to-Vehicle (V2V) and Vehicle-to-Infrastructure (V2I) communication: wireless technology that enables data exchange between vehicles and their surroundings. Specifically, V2X technology can solve the issue of sensors that can’t detect objects outside the line of sight by enabling cars to wirelessly communicate with connected devices on other cars, pedestrians, and roadway infrastructure. When devices are connected to the same wireless network, V2X enables cars to detect the movement of objects outside the field of vision, ensuring safety beyond the traditional line-of-sight sensors. By sharing data, such as position and speed, to surrounding vehicles and infrastructure, V2X communication systems enhance driver awareness of potential risks.

V2X technology can enhance traffic efficiency by providing warnings for upcoming traffic congestion, alternative routing, and reduced CO2 emissions through adaptive cruise control. Such technology will help mitigate traffic and minimize fuel costs for individual vehicles. The V2V communication segment, with its focus on safety measures, is predicted to have the largest share of the automotive V2X market. The Cadillac CTS and Mercedes Benz E-Class vehicles are already on the road and equipped with V2V technology.

Adoption of V2X is still in its early stages; few corporations and startups are working on the technology, and even fewer are testing it. However, automotive V2X is projected to grow at a CAGR of 17.61% from 2017 to 2024 to reach a market size of $84.62 billion by 2024 from $27.19 billion in 2017.

The main drivers of market growth in V2X are increasing concerns about transportation pollution and the growing trend toward safe, connected vehicles. Along with a variety of hardware and service providers, OEMs are working to develop their own V2X protocols, data, measures, and processes as part of their own ADS or ADAS platforms.

4. Mobility-as-a-Service Is Redefining the Navigation of Cities

MaaS is principally driven by alternative powertrains, EVs, and on-demand business models. Shifts are encouraging the replacement of the current vehicle-centric system of mobility with a more efficient consumer-centric one. Originally focusing on ride hailing and subsequently on car sharing, MaaS has recently expanded into bikes and scooters (areas often referred to as micromobility) due to a surge in investor interest and rapid consumer adoption. The light vehicles used in micromobility provide short-distance transport solutions for urban dwellers.

MaaS enables users to book various transportation services from apps, choosing e-bikes, e-scooters, taxis, or public transportation services in various combinations throughout their journey. MaaS has emerged as a viable alternative to personal vehicle ownership, and in many cases, it facilitates mobility across cities with subpar public transportation options.

MaaS platforms are arguably a more effective use of transport, given that personal vehicles are unused for 95% of the day. Shared mobility also allows users to avoid costs associated with ownership like insurance, tax, maintenance, and parking while still taking riders from point A to point B. Generally, the field of MaaS is broad, with four macro-themes at play:

- Software for personal use (e.g., Zipcar)

- Public transportation improvements (e.g., Citymapper)

- Shared mobility services (e.g., BlaBlaCar)

- Commercial use (e.g., CargoX)

The shift to smart mobility has started, but to effectively achieve a societal shift, the adoption of a new way of thinking and widespread MaaS platform integrations is required. Users should be able to plan and pay for journeys by train, bus, taxi, etc., using a single application or pay for an “all-in” subscription at a fixed price. Applications need to strive to manage all client transportation needs.

MaaS interfaces are moving toward deeper integration with transport network tools and journey planners to assist with real-time planning and in-app services like payment, bookings, and ticketing. Startups and automakers have also started to offer subscription services as an alternative to buying or leasing vehicles. While leases lack owners up to a few years at a time, such subscriptions allow users to rotate cars throughout the term.

In order to overcome profitably issues faced by sharing platforms, new efficiency-driven fleet management platforms are sprouting up. The pandemic has highlighted difficulties related to operations and fleet management, which has led to increased focus on driving down costs through efficiency. In the US, Superpedestrian is one example.

Some of the most relevant players dealing with shared mobility and MaaS services are the ubiquitous Uber, Lyft, Bird, Share Now, and Cabify. In addition, several interesting startups have recently emerged, including Zoox, Via, UbiGo, and SkedGo.

As vehicle cost increases, companies are looking at many commercialization models that will appeal to a wide consumer base. For example, vehicles in the future could be fully loaded with software and hardware features that can be purchased for specific periods of time, even for a single ride. This flexibility not only allows consumers on-demand access to state-of-the-art technology and features, but also reduces complexity during manufacturing by reducing the number of different production configurations and traditional “trim packages.” A setup of this kind also opens the door for royalty business models in which multiple providers could offer services and products through common platforms in which an ecosystem of partners find creative ways to boost income and make technology accessible.

Huge Disruption Brings Huge Opportunities

Companies and organizations should consider how to grow properly across multiple markets and segments, and how their supporting operating models are structured. A new combination of cross-sectoral capabilities is required to build reliable solutions to move people and goods. Increased collaboration among players acting in different sectors will become essential for fostering innovation.

From a private sector perspective, change will not be driven by one company or industry. Instead, it will require unprecedented collaboration in order to develop precise and integrated mobility solutions, especially among tech giants, which have the financial capabilities to support research and innovation in these industries.

From a public sector point of view, cooperation between public and private, represented by big high-tech companies, must be encouraged as much as possible. In particular, governments should support the development of the four emergent trends highlighted in this article, with consideration toward how to drive investment into areas that can be harnessed for national gain.

The disruption is likely to be huge, and it will bring both great opportunities and risks.

Understanding the basics

What is the mobility market?

Mobility is the industry of transporting people and goods. In recent times, mobility has expanded in scope and complexity beyond binary paradigms of getting from point A to point B. This is due to advances in multimodal transport (e.g., changing vehicles mid-journey) and applications of software (e.g., autonomous driving).

What is needed for autonomous driving?

Level 5 full automation requires advances in existing software and hardware. Innovation patterns in machine vision and Advanced Driver Assistance System (ADAS) software suggest breakthroughs in the mid-2020s, while on the hardware side, sensors to detect surroundings require further capability improvements.

What is Mobility-as-a-Service (MaaS)?

MaaS enables users to book various transportation services from apps, choosing e-bikes, e-scooters, taxis, or public transportation in various combinations throughout a journey. MaaS emerged as a viable alternative to personal vehicle ownership as it facilitates mobility across cities with subpar public transport.

Milan, Italy

Member since January 4, 2017

About the author

Francesco has more than a decade of experience in finance, consulting, and management at prestigious companies such as Bain and Uber.

Expertise

PREVIOUSLY AT