Supply Chain Lessons and Opportunities: Learnings From a Crisis

The supply chain crisis caused global players and local businesses alike to rethink logistics networks. Here’s how the world economy can emerge stronger and more resilient.

Zachary Elfman

A Deep Dive Into the Future of Mobility

The paradigm of what a car is and how we use it is changing. Energy innovations, artificial intelligence advances, societal tastes, and environmental concerns are all affecting how we will get around in the future.

Francesco Castellano

Building the Next Big Thing: A Guide to Business Idea Development

Business idea development for new venture concepts is a mixture of art and science. There are playbooks to follow that ensure ideas are validated objectively to ensure financial and opportunity cost risks are minimized.

Brendan Fitzgerald

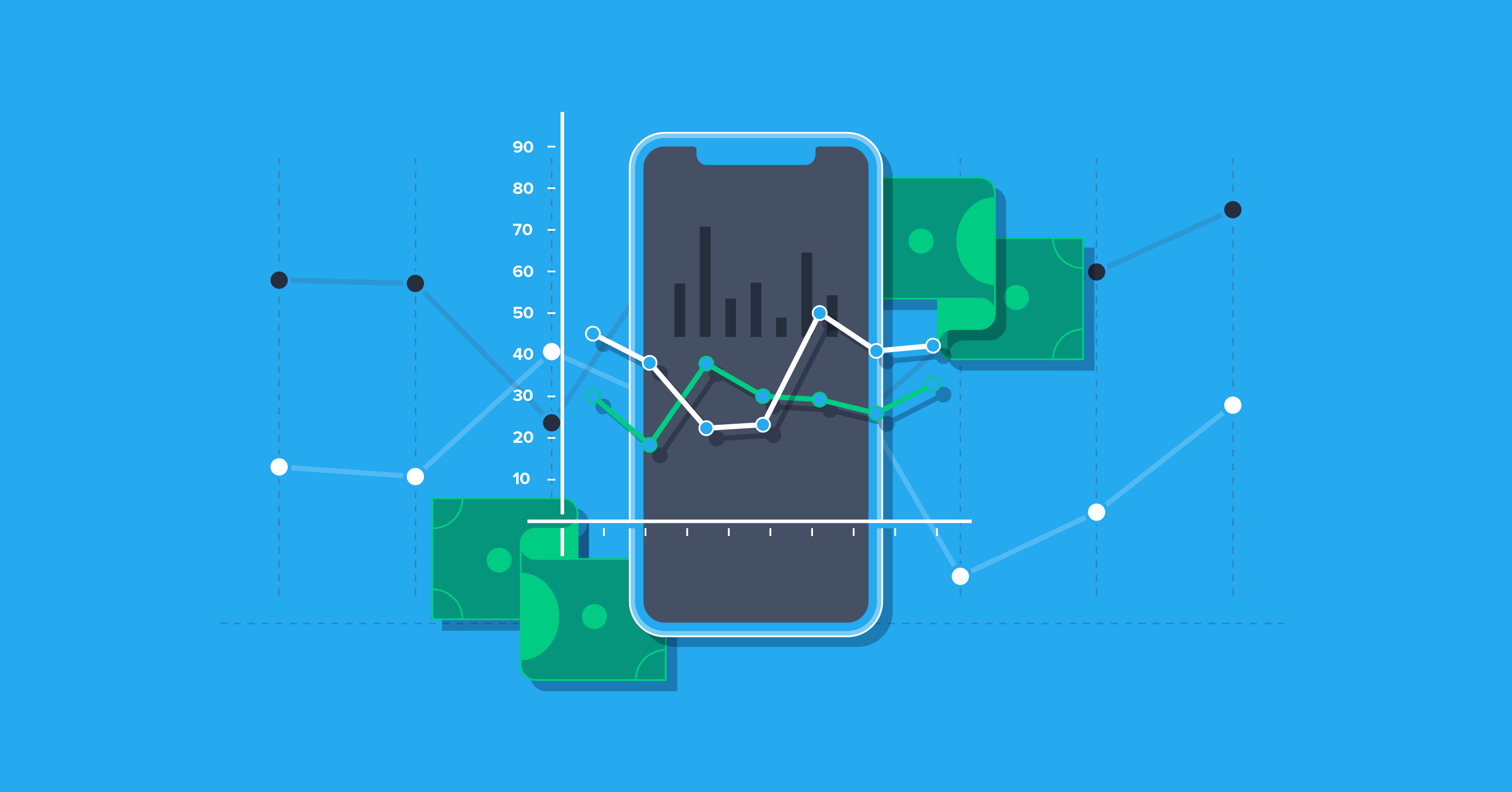

Starting an App Business the Right Way

Building an app-based business can be a daunting project: Within such a competitive space, how can you make your app stand out, attract and retain the right audience, and then monetize it?

Natasha Ketabchi

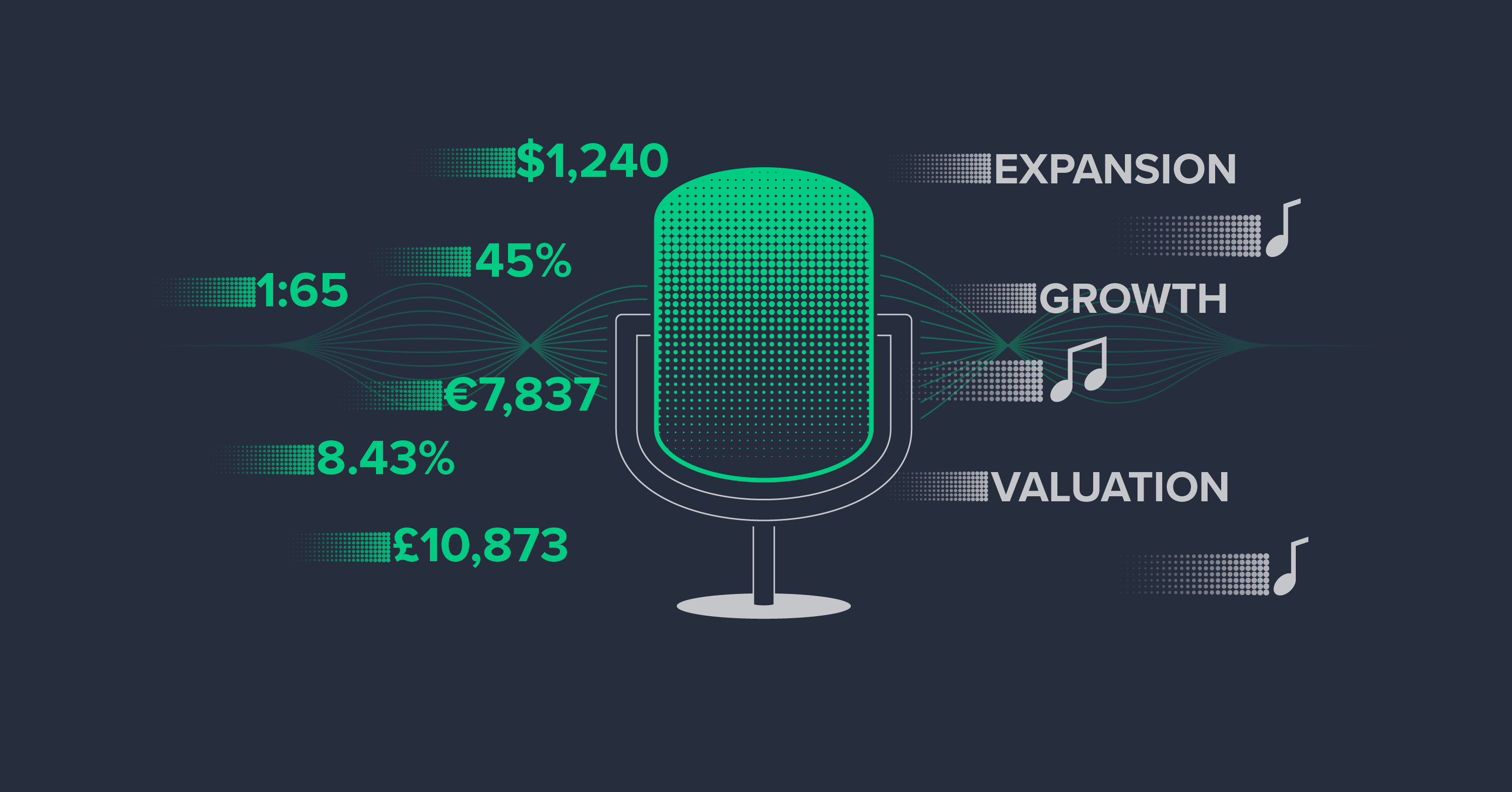

Creating a Narrative from Numbers

The key to a successful business plan is a coherent story built around financial projections and external context.

Ali Al-Suhail

Fatigued by the Subscription Business Model

The subscription business model has existed for generations but has recently surged in popularity. In efforts to replicate the success of the SaaS sector, consumer products startups are increasingly trying to stimulate recurring revenue by offering subscriptions.

Toptal Talent Network Experts

Imperfect Harmony: An Overview of SoundCloud vs. Spotify

Not many industries have undergone the same level of transformation as the music industry - technology has changed every facet of the industry. File streaming has been nothing short of a revolution. What can be learned from Spotify vs. SoundCloud?

Natasha Ketabchi

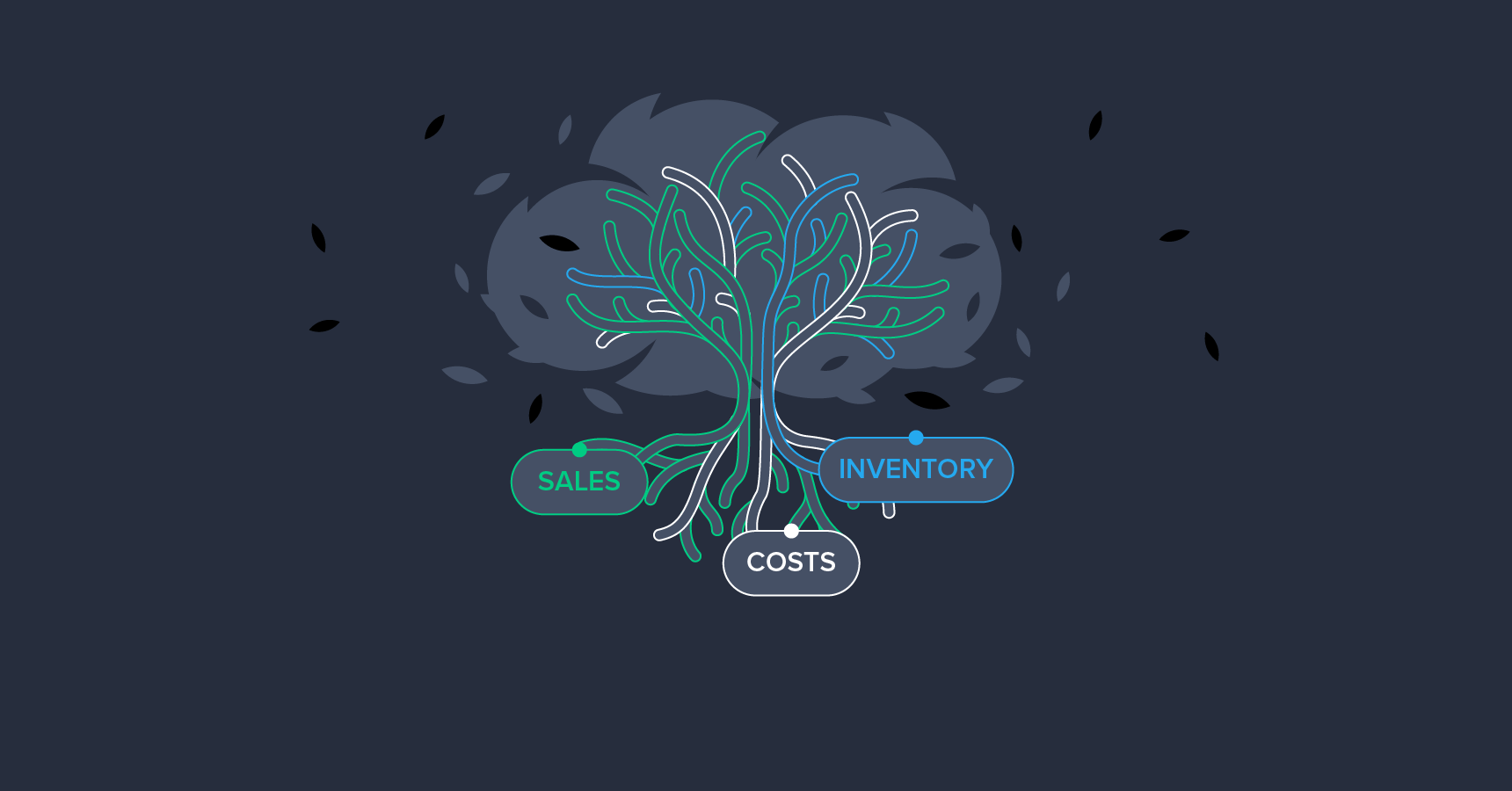

Consultant Toolbox: Frameworks for Solving Anything

When something is not right in a business, it can be confusing knowing where to start to fix it. Objective frameworks like issue trees, funnel analysis, and business canvases provide an organized and data-driven way of getting to the root of a problem and give cast-iron evidence toward plotting a route forward.

Toptal Talent Network Experts

Serving Food From the Cloud

The restaurant industry is infamous for its failure rate. The most common reason for failure is location. Cloud kitchens do away with this obstacle, allowing restaurants to operate without having a central hip location.

Naveen Sharda

World-class articles, delivered weekly.

Toptal Finance Experts

- Blockchain Consultants

- Business Management Consultants

- Business Plan Consultants

- Business Process Optimization Consultants

- Certified Public Accountants (CPA)

- Economic Development Consultants

- Equity Research Analysts

- Excel Experts

- Financial Benchmarking Consultants

- Financial Forecasting Experts

- Financial Modeling Consultants

- Financial Writers

- Fintech Consultants

- FP&A Consultants

- Fractional CFOs

- Fundraising Consultants

- FX Consultants

- Growth Strategy Consultants

- Integrated Business Planning Consultants

- Interim CFOs

- Investment Managers

- Investment Thesis Consultants

- Investor Relations Consultants

- M&A Consultants

- Market Sizing Experts

- Pitch Deck Consultants

- Private Equity Consultants

- Procurement Consultants

- Profitability Analysis Experts

- Real Estate Experts

- Restructuring Consultants

- Risk Management Consultants

- Small Business Consultants

- Supply Chain Management Consultants

- Valuation Specialists

- Venture Capital Consultants

- Virtual CFOs

- Xero Experts

- View More Freelance Finance Experts

Join the Toptal® community.