Supply Chain Lessons and Opportunities: Learnings From a Crisis

The supply chain crisis caused global players and local businesses alike to rethink logistics networks. Here’s how the world economy can emerge stronger and more resilient.

The supply chain crisis caused global players and local businesses alike to rethink logistics networks. Here’s how the world economy can emerge stronger and more resilient.

Zachary is an expert in financial modeling, fundamental analysis, and valuation. He has completed the sale of a small business, advised on early-stage funding rounds, and acted as interim CFO for startup companies. He holds a master’s degree in economic history from the London School of Economics and Political Science.

Expertise

Previous Role

Investment AnalystPREVIOUSLY AT

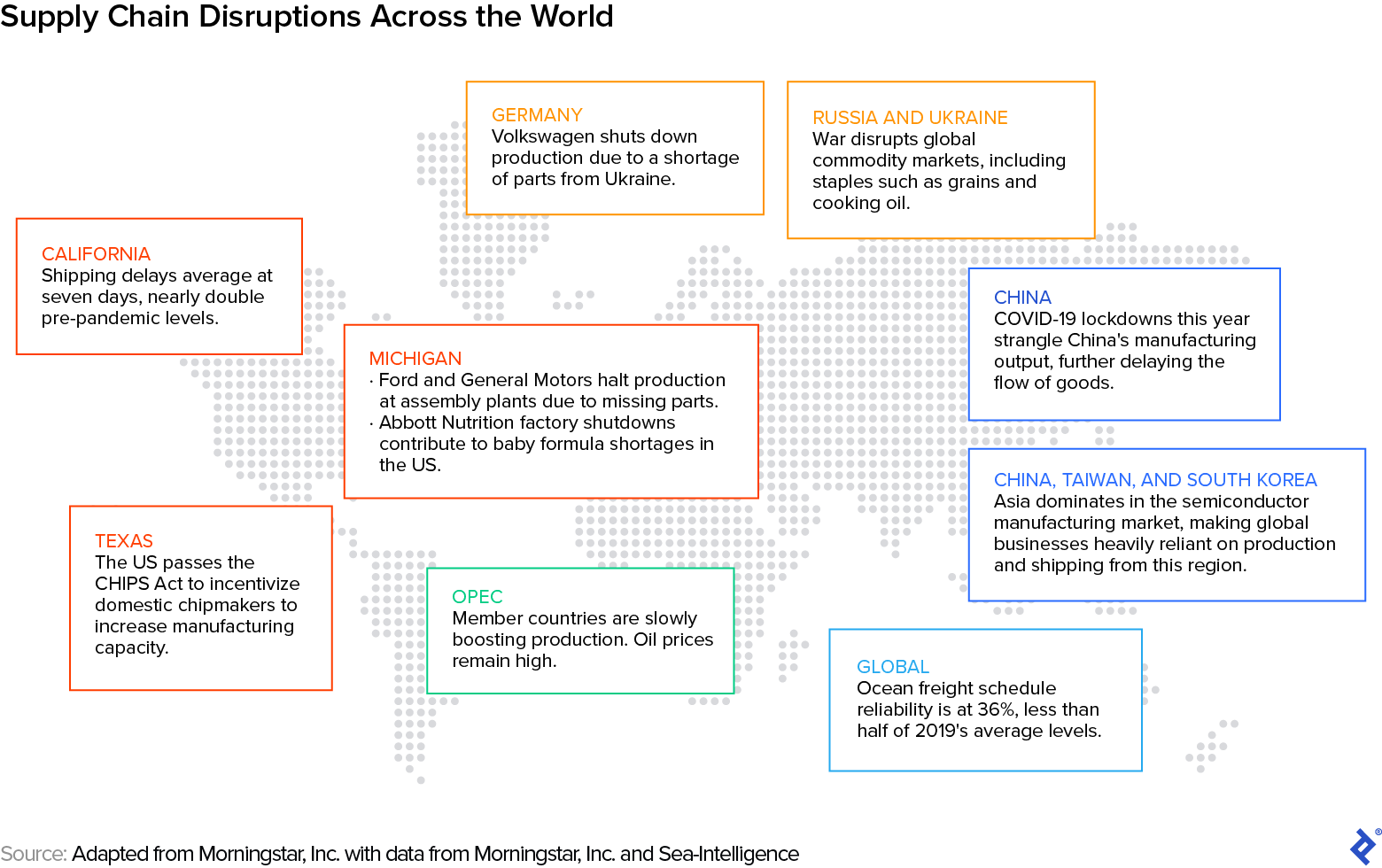

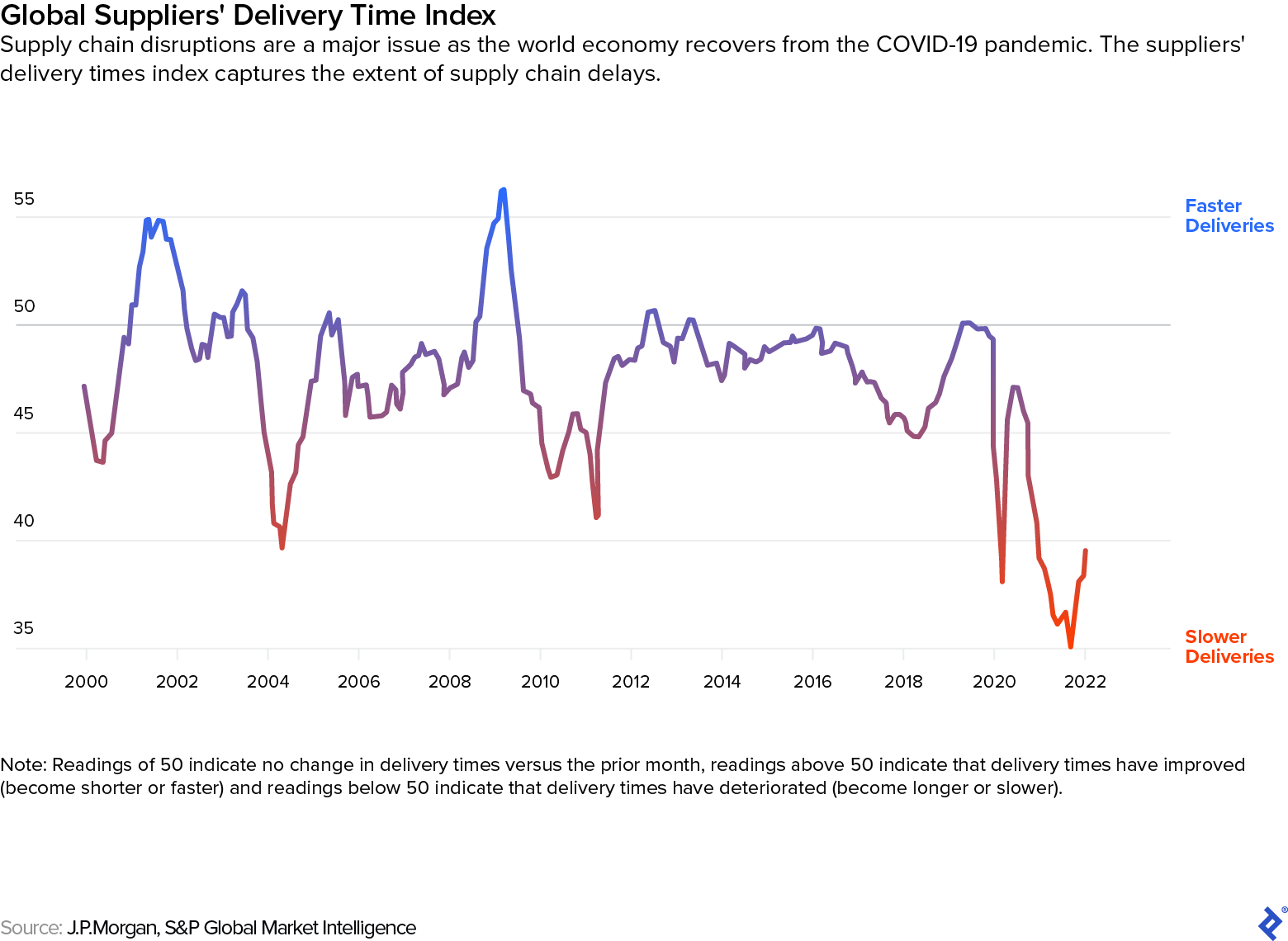

For the last few years, breakdowns in the global supply chain have been front and center in world news. Cascading product shortages have affected everyone from major industries to individual consumers facing the now-familiar sight of empty store shelves. The short-term effects of supply chain disruption have severely impacted all manner of businesses worldwide. But I firmly believe the world economy is likely to emerge from this period stronger than before.

As an experienced finance professional with a master’s degree in economic history, I’ve watched this crisis unfold from the frontlines and also have considered it from a historical perspective, and I’m convinced that it will mark a significant turning point in the way we do—and think about—business.

At least from the Industrial Revolution onward, accelerating in tandem with the expansion of global trade, businesses at all scales have been ruthlessly optimizing for efficiency. The quest to streamline operations has intensified over the last few decades, with businesses on a search-and-destroy mission to cut any identifiable waste or redundancies in their processes.

Although these optimizations generated meaningful cost savings over many years, the systems built on them have proved to be fragile and subject to catastrophic failure under stress. Disruptions caused by the trade war between America and China that began in 2018, the COVID-19 pandemic in 2020, and the war between Russia and Ukraine in 2022 have delivered major shocks to the global economy that caught business leaders blindsided and unprepared.

This is exactly where essayist and risk analyst Nassim Taleb’s concept of antifragility—the ability of a system to gain strength and resilience as a consequence of stress or injury—comes into play. The natural reaction of local, regional, and global supply networks will likely be to increase their robustness in preparation for inevitable future crises. These adaptations will involve unavoidable costs, but the need for change also presents opportunities for companies to rethink their existing ways of doing business and build stronger enterprises that will be better prepared for an increasingly uncertain future. While many businesses are still struggling with immediate supply chain issues, it would be shortsighted to let the crisis pass without focusing on long-term solutions. Taking the time to step back, critically assess existing operations, and make substantial investments in improving them now will almost certainly pay dividends down the line.

In this article I’ll discuss the ways that companies of all sizes are already innovating to build more durable supply chains as well as what more they can do. Once-in-a-generation reforms and adaptations are being made. What emerges is not going to be the same as before; it will be better.

Rethinking Regional Distribution: A Case Study

In 2020, I was hired to advise a London-based online wine retailer through the early stages of the COVID-19 pandemic. Demand had risen to a level that was unmanageable for my client. The local wine shops that didn’t close during this period had to find creative ways to drive business. They began to offer conveniences like same-day home delivery, with some shopkeepers even riding their bikes to deliver to customers’ homes. This fantastic supply chain adaptation wasn’t a feasible solution for my client who shipped a large volume of product via an online store.

The root of the problem my client faced was the location of their storage facility. Their wine was housed in an e-commerce specialist third-party logistics center near Wales, around 200 miles from London. This facility had served the retailer perfectly well as part of normal day-to-day operations before COVID-19, when rapid order service wasn’t as important. But now, due to a shortage of staff (to pick and pack the wines) and a location far outside the city, the facility was unable to process orders quickly enough to facilitate same-day shipping, so the company was effectively unable to compete with the smaller local operators that could.

We searched for and secured a wine-specialist warehouse located closer to London that could partner directly with a courier service. If orders came in before noon, the warehouse manager would pick and pack the order, generate the shipping labels, and have them ready for the courier at the loading bay. This gave the company the upper hand in competing with the brick-and-mortar retail shops, enabling it to offer convenient same-day shipping for a far more extensive selection of wines.

Although this example may seem relatively simple and small-scale, it illustrates the types of changes that are taking place in businesses of all sizes across the globe. From multinational enterprises to small businesses, organizations are rethinking and redesigning their distribution networks to be stronger and more resilient.

Restoring Balance: A Reversal of Recent Trends

The supply chain crisis has made several things clear. The near-singular focus on optimizing for efficiency above all else has created vulnerabilities in supply and distribution networks. Practices like single-source offshoring and just-in-time (JIT) manufacturing enabled companies to increase profitability by minimizing the costs of production and inventory storage. But, as we’ve now seen, the networks that these practices created are unable to withstand even small disruptions along their lengthy supply chains.

Several optimization strategies that businesses have used assume—and depend on—certain preconditions. For example, JIT manufacturing requires that deliveries from sources higher in the supply chain will always be on time. Lowest cost sole-sourcing assumes that the lowest cost source will always have sufficient supply along with the capacity to deliver those supplies quickly. Neither of these assumptions have held during the current supply chain crisis. As a result, businesses using these optimization strategies have suffered severe shortfalls in production and income.

As the global supply chain slowly recovers, returning to business as usual—and its underlying assumption of frictionless delivery of unlimited low-cost supply—would only lead to more frequent and severe problems down the line. New supply chain disruptions from political instability, climate change, and other global catastrophes are inevitable, and businesses that invest for the long term will be in a far better position than those that refuse to look beyond next quarter. Two major opportunities present themselves.

Multi-sourcing: Reshoring, Nearshoring, and China +N

On a basic, pragmatic level, the global supply chain has suffered because of widely reported problems with container trade imbalance as well as insufficient port and ship staffing during the pandemic. The logical reaction to these problems, which primarily affect long-distance shipping, is to look for alternative sources of supply. After years of moving manufacturing and production to countries that offer lower labor costs, businesses have done an about-face and are now making efforts to diversify their supply chains and move production closer to home. According to a survey in the management consulting firm Kearney’s 2021 Reshoring Index report, 78% of CEOs have already reshored or are considering doing so.

Three common approaches that fall under the general umbrella of “multi-sourcing” are reshoring, nearshoring, and China +N. Reshoring involves the revival of domestic industry by moving manufacturing and production back to a company’s home country. Nearshoring shortens lengthy supply chains by using production facilities located in a company’s region but not in their home country. And China +N (or +1) acknowledges China’s primacy in inexpensive industrial production across various sectors, but nevertheless attempts to secure alternative suppliers as a safeguard. In contrast to nearshoring and reshoring, China +N focuses on diversification of supply without necessarily reducing shipping path length.

These approaches can be politically fraught when they involve the mass transfer of capital and labor across international borders. But putting this concern aside, the underlying strategy involves a temporal tradeoff between near-term results and long-term viability. Moving production closer to home generally involves paying higher wages. This increases the overall cost of production, squeezing margins and detracting from near-term profitability. However, the current crisis has reminded the business world of a fundamental point: Higher profit margins don’t mean much if you’re unable to conduct business altogether.

As my case study suggests, small and midsize businesses can apply similar approaches on local and regional scales. The local equivalent of reshoring is investing in production or resource gathering activities further up the supply chain. Nearshoring and China +N can be analogized at the local and regional levels by diversifying suppliers, even if this requires increased spending for higher-cost supplies.

Transitioning From Just-in-time to Just-in-case Manufacturing

The impact of failures in production and/or transportation can cascade through the entire supply chain when any part of the supply network relies on a fragile delivery strategy. These effects, however, can be avoided by using a smarter inventory strategy.

Just-in-time refers to the practice of holding minimal inventory of component parts, instead relying on suppliers to deliver the necessary inputs “just in time” to be seamlessly incorporated into the manufacturing process. JIT was developed by Toyota in the 1970s to optimize supply-chain and manufacturing efficiency, though its roots lie in assembly line innovations by Ford and others earlier in the 20th century. Leveraging the containerization revolution, JIT took the world by storm in subsequent decades, transforming industries as wide-ranging as microchips and grocery stores.

While JIT significantly improved efficiency by decreasing the cost of production, it’s inherently sensitive to supply-chain backups. Without the warehousing of resources and components that JIT discarded, any upstream problems can stall production. And retail store shelves can be rapidly emptied when JIT deliveries are even temporarily disrupted.

In response to these problems, the pendulum has begun to swing back in the other direction, with more companies adopting the just-in-case (JIC) approach to manufacturing. As its name implies, JIC recognizes the possibility of supply chain disruptions and attempts to mitigate such difficulties by maintaining a certain level of inventory on-site. JIC is retrogressive in some respects, more of a shift backward to the way inventories were managed before the adoption of JIT strategies. It can lead to increased costs because it involves stockpiling critical components or resources that require additional warehouse space and staffing. But where a pure JIT factory is simply forced to cease operations if a delivery doesn’t come through, a JIC facility has effectively self-insured against such failures. Production can continue until warehoused resources are depleted—which hopefully doesn’t happen before regular supply is restored. Because too much stockpiling can be wasteful—particularly for resources that have limited life spans—finding the right balance is crucial.

A number of management teams that I’ve spoken to recently are now holding three to six months worth of inventory even for noncritical components, while their pre-crisis inventory levels could typically be measured in days. More specific to the wine industry, glass bottle supplies have been completely exhausted in Europe. Glass manufacturers and distributors are giving their larger clients preferred allocations—a trend that’s increasingly evident in other industries as well. And, just as consumers were once hoarding toilet paper, large industrial wineries are stockpiling enough glass bottles to last them an entire year. This has left many smaller wineries without the means to bottle last year’s harvest, and many are struggling to find new options. While some are switching to alternatives such as Bag-in-Box type packaging, others are simply aging their wines longer. Adaptations like these are an interesting experiment and may well prove to be a better strategy than simply doing things as they have always been done.

Balancing resilience against cost efficiency both in warehouse sizing and resource accumulation can start with an exercise in decision analysis based on the business operator’s level of risk aversion, and Bayesian probability assessments of the likelihood of various types of supply disruption. While analytical methods can provide useful input, finding the right balance between efficiency and risk mitigation can’t be reduced to algorithms and formulas - it is something that business leaders must consider and decide for themselves.

Reinforcing Positives: New and Emerging Opportunities

The practices we’ve discussed so far illustrate reversals and reevaluations of past strategies. We’ll now turn to continuations and/or accelerations of past trends that present new opportunities to rebuild after the supply chain crisis.

Mergers and Acquisitions

On the global scale, financial damage inflicted on various carriers and freight forwarders during the crisis has created opportunities for some of the biggest and wealthiest players to profit from the misfortunes of their competitors. Maersk and other big carriers are considering not just acquiring their competition, but extending their reach through various phases of logistics, transport, and freight forwarding to provide end-to-end solutions for their customers and secure greater control of the entire supply chain. After all, the more control a business has, the more able it is to mitigate damage to the chain when unforeseen events disrupt specific links.

On the regional and local scale, smaller businesses can achieve similar results by establishing stronger partnerships with suppliers and logistics firms, or if they’re fortunate enough to have the resources—by acquiring competitors, suppliers, and/or distributors. Alternatively, this crisis may also give certain smaller businesses an opportunity to make a profitable exit during a time of consolidation.

Technological Solutions

Companies and whole industries have been trying to solve, or at least mitigate, the problems of the supply chain crisis through the use of technology. This is one of several factors that will help increase the robustness of the global supply chain as we emerge from the crisis period.

Key technologies include:

- Industrial Internet of Things: Although the benefits of industrial IoT are well documented, the costs have historically discouraged some businesses from deploying this transformative technology for logistics management, smart stock keeping, and improved floor productivity. Investment in industrial IoT will not only increase supply chain resilience over the long term, but will also help mitigate costs associated with just-in-case warehousing.

- Improved AI Logistics Planning: The combination of deep learning and advanced operations research algorithms can lead to increased transport efficiency and lower costs in the long term. The state of the art is advancing in this field, and I expect these systems to offer continued efficiency improvements in the near future.

- Supply-chain-as-a-service: Giants like Amazon are increasingly enabling other enterprises to use their networks to acquire supplies and distribute products. Walmart, for example, recently locked in Home Depot as a client for its GoLocal delivery service. For small businesses, especially, partnering with a noncompetitor who has an effective distribution network can provide substantial cost savings.

The Bottom Line: Optimize for the Long Term

With investors, shareholders, and capital markets all encouraging businesses to focus on next quarter instead of next year or five years down the line, self-insurance through foresight—with its consequent reduction in near-term profits—can be difficult. But after the disruption and loss of the last three years, the evidence is hard to ignore: supply chain systems and strategies need to change. Perhaps the silver lining is that now it will be easier to convince stakeholders of the benefits of taking such considerations seriously.

The current crisis offers important supply chain lessons and a chance for new initiatives to revamp old business methods, systems, and relationships. Companies that choose to respond to the crisis by making only the most minimal changes are wasting the opportunity to emerge from this period with a stronger, more competitive, and ultimately more resilient enterprise.

Further Reading on the Toptal Blog:

- Learning to Learn: 5 Tips to Master Any Product Management Domain

- Healing Broken Supply Chains: Manufacturing Outside China

- Supply Chain Optimization Using Python and Mathematical Modeling

- Industry Analysis and Porter’s 5 Forces: A Deeper Look at Buyer Power

- Mission Statements: How Effectively Used Intangible Assets Create Corporate Value

- Going Global: A Financial Guide for International Expansion

Understanding the basics

What caused the current supply chain crisis?

While many factors contributed to the current supply chain crisis, the underlying cause was the fragility of global logistics networks created by years of businesses optimizing for efficiency at the expense of resilience. Disruptions caused by the COVID-19 pandemic, together with an increase in consumer demand during the pandemic and other geopolitical dynamics, brought the situation to a head.

How do you fix supply chain issues?

It will take time to resolve the many issues plaguing global supply chains. However, the overarching solution should involve a rebalancing of objectives—emphasizing the need for strength and resilience in addition to efficiency.

What are the benefits of supply chain preparedness?

Building more robust and resilient supply chains will leave businesses better prepared to deal with inevitable future disruptions.

Vigo, Spain

Member since January 6, 2017

About the author

Zachary is an expert in financial modeling, fundamental analysis, and valuation. He has completed the sale of a small business, advised on early-stage funding rounds, and acted as interim CFO for startup companies. He holds a master’s degree in economic history from the London School of Economics and Political Science.

Expertise

Previous Role

Investment AnalystPREVIOUSLY AT