Imperfect Harmony: An Overview of SoundCloud vs. Spotify

Not many industries have undergone the same level of transformation as the music industry - technology has changed every facet of the industry. File streaming has been nothing short of a revolution. What can be learned from Spotify vs. SoundCloud?

Not many industries have undergone the same level of transformation as the music industry - technology has changed every facet of the industry. File streaming has been nothing short of a revolution. What can be learned from Spotify vs. SoundCloud?

Natasha transitioned to venture capital after a career in banking built in prestigious firms such as JPMorgan and ESM.

PREVIOUSLY AT

Not many industries have undergone the same level of transformation as the music industry. Technology has changed every facet of the industry: from the way the audio is stored and played, the way consumers acquire it, all the way to how artists can market and distribute it. File streaming has been nothing short of a revolution. Lessons from the music business can be applied to many other sectors that are feeling the impact of technology and changing consumer behaviors. We look at two of the companies that have been more innovative in the sector, and what has made them successful (or return to being successful, in the case of SoundCloud). So how should one look at Spotify vs. SoundCloud? Beyond surface similarities, the two businesses are actually quite different.

Spotify’s Recent Successes

Spotify made waves when it went public with a direct listing in 2018. The listing was unusual in many ways. First of all, the company used a new and alternative strategy to make its shares available for public trading: a direct listing, rather than a more traditional underwritten IPO. What does this mean in practice? It means that the company did not enlist an investment bank to sound out the market, secure the interest of institutional and retail investors, and support the price and the trading of the shares after the floatation. Usually, through an IPO, a company sells new shares to raise additional capital. The price of these shares is set by the underwriting investment bank, which determines the range within which investors are willing to buy shares of the company so that the IPO can clear.

Spotify was in a unique position. It was already well-capitalized and did not need to raise additional funds when going public. For the company, the primary objective of the exercise was to allow existing shareholders—mostly venture capital funds and employees—more liquidity than was available to them through the private secondary market. It also aimed to determine a clear, market-driven price for its stock. (Public markets are, through their liquidity and ease of trading, much more efficient at setting “true” prices than private markets, where infrequency of transactions and incentives of buyers and sellers can make each transaction unique.) Spotify did not use an investment bank for this process and thus had to cooperate closely with the SEC. By all standards, the transaction was extremely successful.

Price Evolution of Spotify (Jan 17th 2020)

SoundCloud’s Quest to Survive

While Spotify was treading new ground, one of its closest rivals, SoundCloud, was in a very different position—the company was struggling. SoundCloud arrived very close to needing to shut down. They had to raise emergency funding of $169.5 million (at a $150 million valuation, sharply down from the previous valuation of $640 million that the company had obtained in 2014) from The Raine Group and Temasek, giving the new investors new, preferred shares and cutting the liquidation preferences of the old investors. In the months prior, the company had cut staff by 40% and was in talks for an acquisition by Spotify, which ended up falling apart. Spotify had, at that point, declined to acquire SoundCloud three times.

So why have these two companies had such different histories, even though they operate in the same space and have user bases of similar size? What is behind the impressive turnaround that SoundCloud has undergone since that fateful capital raise?

Napster, the Grandad of Streaming

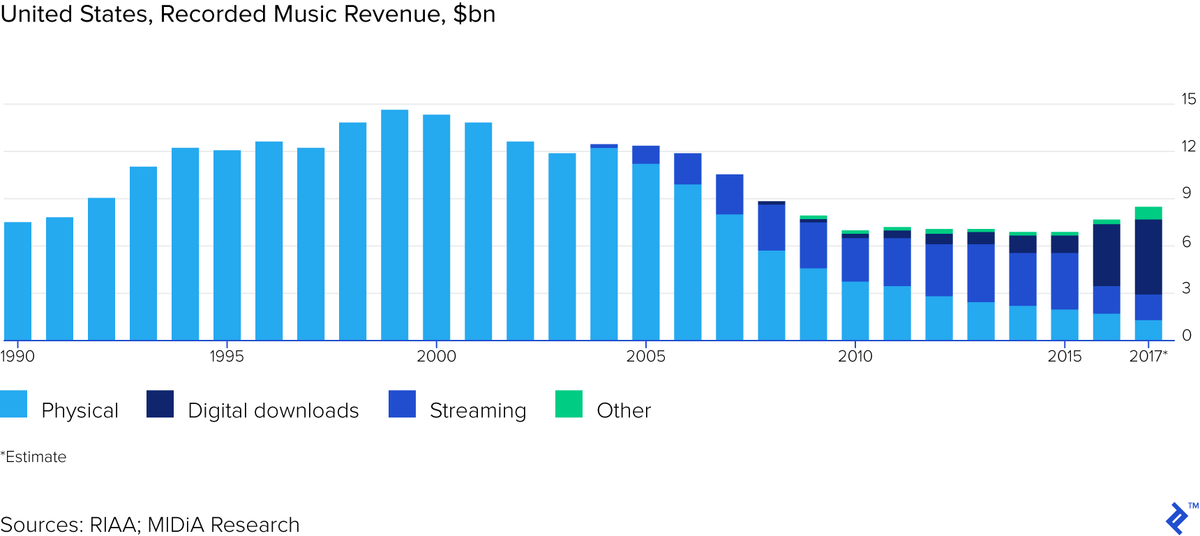

The music industry has undergone incredible changes since the late 90s and the advent of the internet. While all revenues for artists and music labels used to come from record sales, the advent of companies like Napster put pressure on music revenues and disrupted the industry significantly. Napster was a pioneering company. Although it was operational for only two years before getting shut down because of a lawsuit in 2001, it still managed to accrue almost 80 million users.

Napster was a peer-to-peer file-sharing service. It was easy to use and it provided a great user experience. However, it bypassed licensing laws and heavily damaged revenues for the music industry as users were just able to download music files from peers without having to buy an album.

After Napster was shut down, similar services kept proliferating, like LimeWire, until Spotify began operating in 2008, revolutionizing the music industry forever. It was because of Napster that Daniel Ek came up with the idea of Spotify. Basically, he created a product that allowed users to access music files so quickly that it did not require waiting for them to download. It also allowed them to interact with the music they were listening to, creating new playlists and discovering new artists. Ek himself had previously worked for a company that allowed users to download tracks.

Music Industry Revenue Distribution

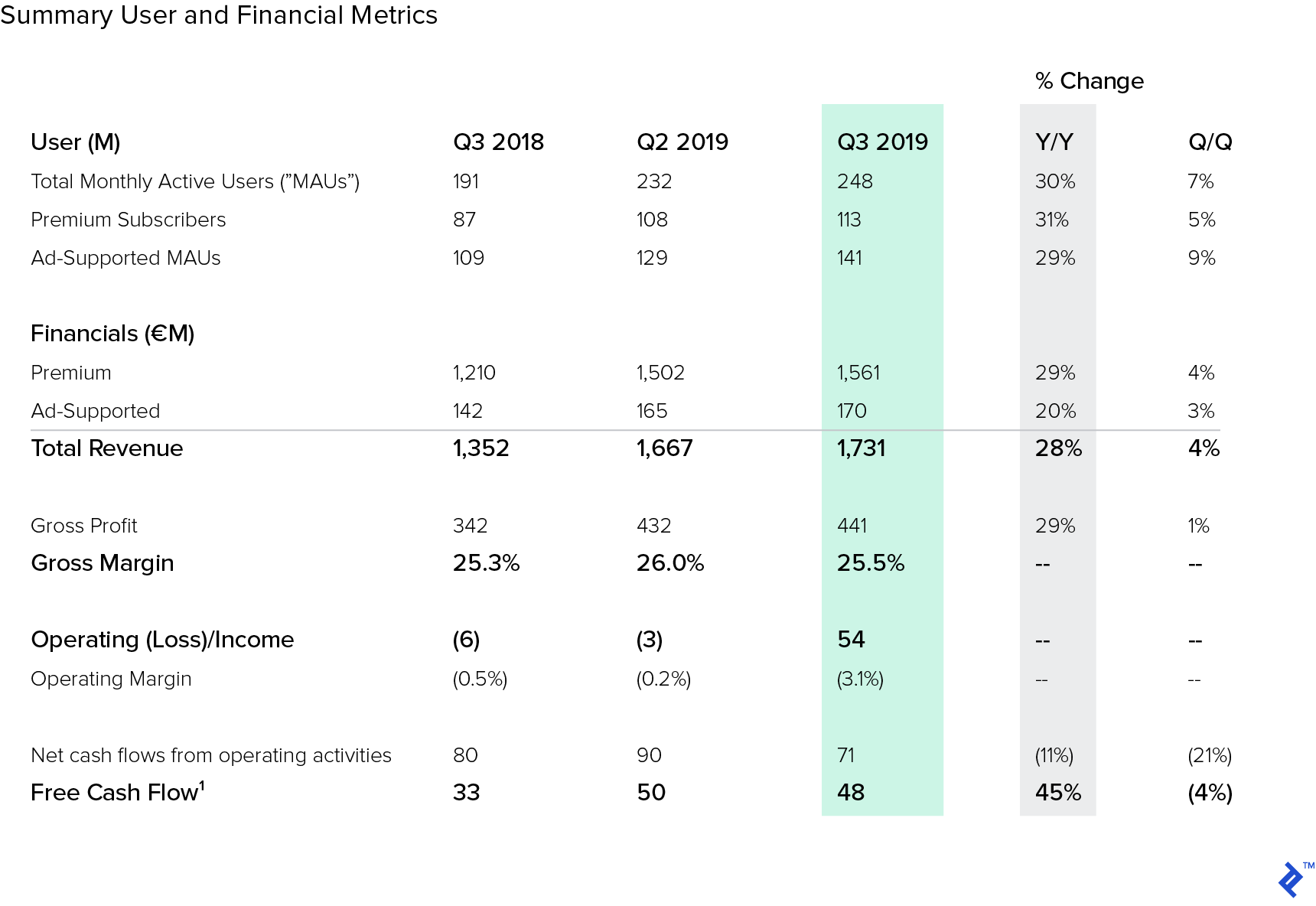

As of Q3 2019, Spotify has more than 248 million Monthly Active Users, and 45.6% of them are premium subscribers. Premium subscribers are the lifeblood of Spotify—they pay to use the company’s product and bring 90.2% of the company’s total revenues. The rest comes from advertisers, an area in which Spotify has not been able to progress as expected. Each premium user is worth €4.67(approximately $5.2). For each dollar of revenue, Spotify pays about $0.75 of royalties to the artist: “Premium Gross Margin was 26.5% in Q3, down seasonally from 27.2% in Q2 and up 40 bps Y/Y. Ad-Supported Gross Margin was 16.0% in Q3, up from 15.8% in Q2 but down 260 bps Y/Y”, for a total of 25.3%.”

Spotify does not pay a fixed royalty fee but instead pays a variable fee between $0.006 to $0.0084 per stream to the holder of music rights. The pricing varies depending on the geography the music is played in and other factors. This is probably the most controversial aspect of Spotify’s business and one that has created a lot of tension with record labels. Spotify needs to negotiate each agreement individually, and then pools all royalty money and divides it among artists based on their share of streaming. Many artists have explicitly complained about the lack of income they receive from the platform, going as far as founding a competing service, TIDAL.

Spotify Financial Results

SoundCloud, on the other hand, has been able to reverse its fortunes after teetering on the brink of bankruptcy in 2017. The company sharply reduced its losses to €32.0 million ($37.6m) in 2018, down from €63.8 million in 2017. SoundCloud has, to date, “amassed the world’s largest and most diverse audio catalog with over 200m tracks.” SoundCloud had 75 million Monthly Active Users in 2019 and around 20 million creatives that were uploading their music to the platform.

Music Streaming Services Compared

SoundCloud has a different business model from Spotify. It allows users to upload music to the platform, thus attracting a very large catalog of original music that may not be available elsewhere. This also creates an additional revenue stream for the company as creatives can pay to upload their music (paid subscriptions allow users to upload more music). Many artists are now able to cultivate a following through the platform, which has sparked a whole new genre, that of the SoundCloud rappers. Compared to Spotify, its revenues are more diversified, with 29.2% of revenues from advertising, compared with <10% at Spotify.

SoundCloud Financial Results

Business Model Differences

How do Spotify and SoundCloud differ, despite both being music streaming businesses? They are, in essence, very different, and SoundCloud struggled when it was trying to copy what Spotify was doing. In fact, most of the problems that SoundCloud had were a direct result of trying to copy Spotify. Nowadays, the companies can be compared by using an analogy in another creative field: Netflix is to Spotify what YouTube is to SoundCloud. What is meant by this is that, like Netflix used to, Spotify relies on external content producers and on convincing them to use its platform to reach consumers. Netflix, notably, has moved away from this strategy by producing more and more original content and increasingly incurring the ire of the film industry. SoundCloud, like YouTube, on the other hand, is a place for content producers to directly reach their audiences and is the most efficient tool they have in growing them.

Spotify: Strengths and Weaknesses

Spotify is effectively a content aggregator. It allows users to access a finite collection of content, music, and podcasts and to interact with this content by creating and sharing playlists and discovering new articles. It also holds a lot of data on how, where, and when its users consume music.

Spotify’s greatest strength is undoubtedly the quality of its product and the relentless focus on it. The founders had a very clear vision of what this product should be like, and they relentlessly pursued it.

Starting with the idea that Napster had revolutionized the way people consumed music, Ek and Lorentzon set out to build a tool that sat between the extremes of Napster (unlimited, free music, but illegal) and iTunes (unbundled music available for purchase, legally). They set out to create a “frictionless” music consumption experience that allowed users to listen to music instantaneously, without owning the tracks, thus encouraging exploration, but entirely legally.

Ek is famously obsessed with the quality of the experience that users have, and bets that people would be willing to pay for an improved experience when compared to illegal streaming. One key concept that he championed is the fact that the human brain perceives anything that happens in under 250 milliseconds as instant. He thus used this number as a key performance metric for Spotify’s music player.

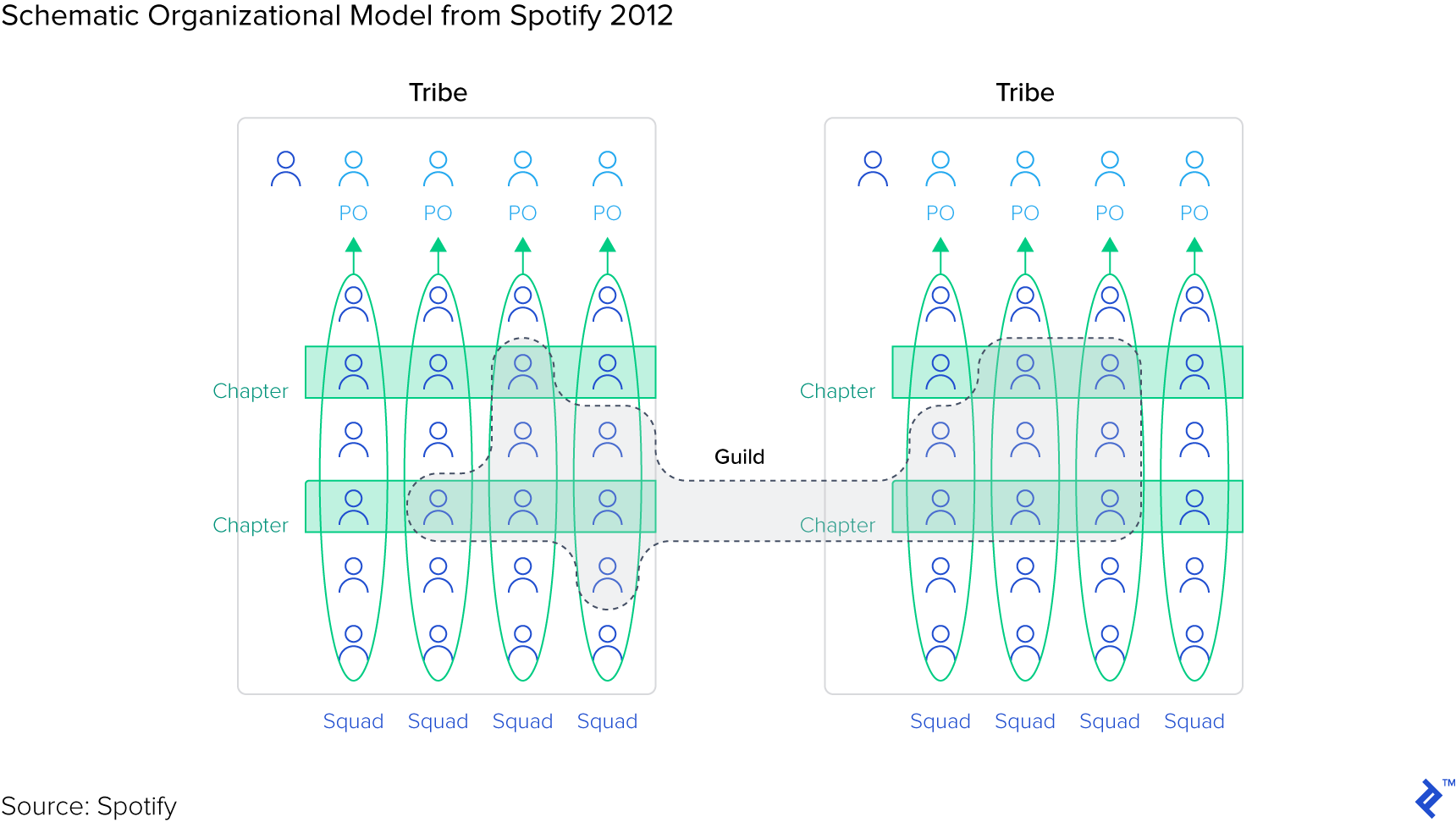

Product culture is so integral to Spotify that their paper on product development and agile team design and communication has become a must-read for any tech entrepreneur. The model predicates creating a collaborative, agile (both in name and in practice) organization that allows for continuous improvements, easy releases, and rapid change. Staff are also given a sense of ownership and encouraged to associate in groups that operate like mini-startups within the company.

Spotify Team Structure

On the other hand, Spotify’s greatest weakness is the fraught relationship with the producers of the content that it provides. Many artists have a difficult relationship with the streaming company, with Taylor Swift going as far as not releasing any of her music on the platform for a long time. Many observers are noting how Spotify has effectively taken the first steps toward becoming a record label itself—through an initiative geared toward artists that do not currently have a record label.

SoundCloud: Strengths and Weaknesses

SoundCloud, in our example, is effectively more like YouTube. It allows musicians to upload their own music and get it in front of an audience of music fans. In a way, it almost acts like a content creation tool, rather than a pure streaming service.

A lot of the problems that SoundCloud suffered from derived from poor product design and a lack of focus on its strength. Not only was SoundCloud being sued for copyright violations, but it also had issues retaining its community of creators, a complicated pricing structure, and it allowed the system to be gamed with reposts and multiple versions of the same song on the platform.

After the emergency recapitalization in 2017, the founders of SoundCloud have stepped back from their executive roles at the company and have been replaced by a CEO and COO coming from Vimeo, which has achieved its objective of returning the company to the path to profitability by reducing losses and increasing revenues. Kerry Trainor, the new CEO, appears to have done just that by focusing on the company’s greatest asset: the content creators. SoundCloud now has a simplified pricing structure and a much greater focus on creatives by putting editing tools at their disposal and letting them use the platform as a distribution channel for their music.

Conclusion

Despite both being music platforms, Spotify and SoundCloud are very different. While the former has become the world’s leading music streaming platform through an obsessive focus on product and customer experience, the latter has built an impressive turnaround on the strength of its community of artists and music superfans. Spotify is a product-first company, and SoundCloud is a content-first one. So what can one expect from the Spotify vs. SoundCloud battle? Time will tell which of the two strategies will win in an increasingly crowded and complex market such as music, increasingly eyed by giants such as Apple and Amazon.

Understanding the basics

Does Spotify own SoundCloud?

SoundCloud came very close to needing to shut down and had to raise emergency funding. In the months prior, the company had cut staff by 40% and was in talks for an acquisition by Spotify, which ended up falling apart. Spotify had, at that point, declined to acquire SoundCloud three times.

What's the difference between Spotify and SoundCloud?

SoundCloud has a different business model from Spotify. It allows users to upload music to the platform, thus attracting a very large catalog of original music that may not be available elsewhere. Spotify, on the other hand, allows streaming of labels’ catalogs.

Is SoundCloud losing money?

SoundCloud came close to having to shut down operations and running out of money. The company raised emergency funding, replaced the founders with new management, and has since been able to significantly increase revenues and reduce losses. It is, however, still loss-making.

About the author

Natasha transitioned to venture capital after a career in banking built in prestigious firms such as JPMorgan and ESM.

PREVIOUSLY AT