How Software Will Dominate the Automotive Industry

The rise of autonomous vehicles will cause a tectonic shift in the mobility industry―and incumbents must evolve along with it. Learn how automakers can position themselves to flourish in the new era of mobility.

The rise of autonomous vehicles will cause a tectonic shift in the mobility industry―and incumbents must evolve along with it. Learn how automakers can position themselves to flourish in the new era of mobility.

Toby is a valuation expert with deep financial experience across investment banking, VC investing, and private equity. He founded and sold a VC-backed company, and has also served as an assistant vice president for Barclays Capital. Toby has an MBA from The Wharton School of the University of Pennsylvania.

PREVIOUSLY AT

Once a concept confined to science fiction novels and futuristic movies, autonomous vehicles are now a reality. Tesla, Uber, and Alphabet’s Waymo initially led the way, but traditional automakers have become a driving force in this paradigm shift.

General Motors began the acquisition of self-driving technology startup Cruise Automation in 2016 for $1 billion and bought out another investor’s stake for $2.1 billion in 2022. Hyundai plans to spend $5 billion on US self-driving technology and robotics by 2025, an investment that includes Motional, a mobile technology company that is currently testing robotaxis on public roads in the States. Volkswagen’s vehicle software unit, called Cariad, is earmarking more than $2 billion for a joint effort with China’s Horizon Robotics to create autonomous driving chips for the Chinese market.

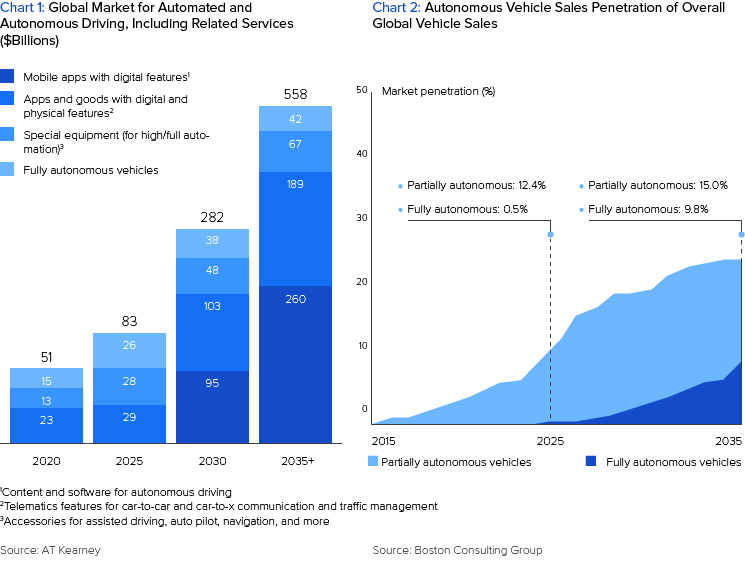

This is just the tip of the iceberg with many OEMs, Tier 1 suppliers, and new emerging technology companies all looking for their chance to secure a spot in the autonomous vehicles (AV) market. Driving all this is a recognition that a profound shift is underway in the automotive industry. As illustrated by Charts 1 and 2 below, AT Kearney estimates that the market value of the connected mobility marketplace will skyrocket to more than $550 billion by 2035, while BCG estimates that autonomous or semi-autonomous vehicle sales penetration could reach 25% by the same year.

In this rapidly evolving market, how can incumbents react? Existing industry players are well aware that autonomous cars will have a tremendous impact on the mobility market. But how will they change consumer behavior, exactly, and at what pace? What strategies will allow the constituents of the automobile value chain to remain relevant in the long term? In this article, we analyze how the auto industry is evolving into a software-first sector as autonomous technology progresses, and what considerations companies can pursue to reposition for the future.

A Radical Shift in Consumer Behavior

As autonomous technology advances, a profound shift in consumer behavior will alter the revenue model and value chain of the industry. While the nature of these changes will be multifaceted, at a high level we can categorize them into two main buckets.

More Time Spent in Vehicles, Without Having to Concentrate on Driving

The first major change relates to the time spent in vehicles. Many people already spend an enormous amount of time in their cars; with the advent of autonomous vehicles, this time is likely to increase. As responsibility for control of the car moves to computers, significant demographics that have historically had limited or no engagement with driving—the elderly, people with disabilities, those who simply dislike driving or don’t feel confident behind the wheel—will no longer be faced with this constraint. Moreover, as the travel experience becomes more pleasant, consumers will be willing to spend greater amounts of time in their vehicles. Some research suggests that AV technology could lead to increases in vehicle miles traveled of up to 20%.

Coupled with increased driving time would be an increased amount of idle time spent in vehicles. The logic is straightforward: As cars evolve into self-driving entities, humans will have more time to do other things while traveling. The pace at which this will occur will depend on advances in technology, but AT Kearney estimates that self-driving technology could free up 1.9 trillion minutes of idle time for passengers by 2030.

The Rise of Mobility-as-a-Service

The other fundamental change in consumer behavior that will be catalyzed by autonomous vehicles is the rise of mobility-as-a-service (or transportation-as-a-service). Loosely defined, mobility-as-a-service (MaaS) refers to a shift away from personally owned vehicles toward the use of mobility solutions on an on-demand basis.

Underlying this trend will be two factors. On the one hand, the last decade has already seen a shift in consumer perception of car ownership away from status symbol and toward utility. Car ownership has been waning for several years, likely driven by changing sentiments among younger demographics. Autonomous vehicles notwithstanding, advanced economies are witnessing a secular decline in car ownership figures. Self-driving cars will accelerate this trend.

Augmenting this trend has been the rapid growth of on-demand ride services (e.g., Uber and Lyft) with a total market size in 2021 of $84 billion, growing at 16.3% annually, as well as car-sharing services (e.g., Zipcar). Recognizing the trend, traditional OEMs like Daimler and BMW have already pushed into this space (with car2go and DriveNow). And with the explosive growth of car-hailing applications like Uber, Lyft, and DiDi Chuxing, the lines dividing these services are starting to blur. Once drivers are removed from the picture, Uber and Zipcar will essentially become the same service. The confluence of all these factors will continue to drive the MaaS trend going forward.

A New Value Chain

The result of the above is that a profound shift in the value chain will take place. We are likely to see the industry evolve from an OEM-dominated value chain toward a “technology stack” that in many ways resembles what we have seen occur in the PC industry.

The industry is likely to be divided into three main categories. At the bottom of the stack will be the hardware companies: those producing the vehicles and their components and accessories. Sitting on top of these will be the vehicle software layer, which provides the intelligence that runs the cars, as well as the software enabling connectivity of the vehicles and fleet management functionality. At the top will be the application layer, which will leverage the two lower parts of the stack to provide consumers with services and content related to their transportation needs and experience.

Accompanying this change in the stack will be a shift in where the value lies. Today, the overwhelming majority of the value of a car relates to the hardware―the chassis, the powertrain, interior seating and lighting―but the new paradigm means that differentiation and profits will migrate toward the higher parts of the stack. In a seminal report from 2013, Morgan Stanley Research predicted that software and applications layers will collectively account for 60% of the value of a self-driving car, a figure that remains a commonly accepted industry estimate.

For industry incumbents to stay relevant, they must not only recognize the unfolding shift, but also act accordingly to position themselves in the evolving landscape.

How to Pivot Toward the Future

Faced with the prospect of long-term decline, OEMs that enter new layers of the value chain (software and/or applications) will continue to be relevant in the industry of tomorrow. But how can they do this? Below, we dive into two important considerations to keep in mind.

Who Will Dominate the Software Stacks of the Future?

The key consideration relates to which players will continue to play dominant roles in the software stack. Will it be controlled by OEMs, a collection of partners, and open-source applications? Will the vehicle software be proprietary to a specific hardware chassis or universal to many chassis across brands and companies? As these dynamics play out, the next major race will be around the commercialization of technology and which OEMs play in the sand together or look to capitalize on their investments.

Decisions that are made in the coming months and years will shape how vehicles receive over-the-air updates and other software integrations like third-party apps being allowed to ride alongside proprietary software. It was once believed it would be difficult for OEMs and Tier 1 suppliers to re-invent themselves to attract high-tech talent and be able to operate in a fluid software-based ecosystem. These players have proved skeptics wrong. However, the current challenge is to continue innovation at pace, with an eye to cost-effectiveness and consumer value, while legislators and infrastructure builders run to catch up.

Data volume alone presents a tremendous challenge. Researchers estimate that one self-driving vehicle generates between 3 and 6 terabytes of raw data per hour. Depending on how this information is condensed, queried, and accessed, it could easily exceed the capacity of the fastest 5G networks for cloud storage across millions of vehicles-to-be, according to a 2021 study by Stanford researchers. Beyond capacity issues of networks needed to make mobile data available, the cost of connectivity and storage at this level would be about $1,200 per vehicle per year.

Commercialization

Maintaining the current levels of innovation, staffing, and costs without achieving economies of scale requires a long-term commitment. We are already seeing shifts in players with Argo AI recently shutting its doors and companies like Lyft reducing their workforces. As the pressures continue, companies will need to get creative about rolling out AV advancements through interim driver-assisted models. Ultimately, the industry is betting on consumers wanting driver-assisted vehicles in which they don’t have to actively control the pedals and steering wheels. The next two to three years will see a big push for carmakers to roll this out and either offer subscription models for the software enablement or increase the price of the vehicles.

The commercialization of software will be exciting as OEMs learn how to think like software companies: appealing to the mass market with expensive technology and getting the equation right.

Sourcing the Right Talent

One more critical component for success in the current automotive environment is effective talent sourcing and management. The players that attract the best talent, structure their organizations to maximize innovation, actively plan and manage costs and investments, and commercialize in stages to reduce capital pressure will be the winners in this space. But, as we note in our article about the war for AV talent, competition has been intense and won’t relent. Automakers and OEMs are now competing not only with each other, but also with any industry that needs high-quality engineers, security experts, machine learning specialists, and other tech talent. Mobility players must be strategic in their staffing and hiring strategies in the coming months and years to emerge on top.

Toby Clarence-Smith

Milan, Metropolitan City of Milan, Italy

Member since August 25, 2016

About the author

Toby is a valuation expert with deep financial experience across investment banking, VC investing, and private equity. He founded and sold a VC-backed company, and has also served as an assistant vice president for Barclays Capital. Toby has an MBA from The Wharton School of the University of Pennsylvania.

PREVIOUSLY AT