Successful SaaS Fundraising: Navigating the Evolving Landscape

Investors have been pouring capital into SaaS startups. But that doesn’t mean raising funds is easy. This guide to finding the right financing options can help lead you to the treasure in this tricky terrain.

Investors have been pouring capital into SaaS startups. But that doesn’t mean raising funds is easy. This guide to finding the right financing options can help lead you to the treasure in this tricky terrain.

Julio has more than 25 years of diversified experience as a finance VP for multinational companies in a number of industries. Over the last five years, he has focused primarily on helping owners of early- to mid-stage SaaS and e-commerce startups raise funds to successfully grow their companies. Julio’s experience includes financial planning and modeling, business plan development, company valuation, fundraising, and strategic leadership.

Expertise

PREVIOUSLY AT

Slack, Zoom, DocuSign—these are just a few of the many SaaS companies that are now household names. Slack’s messaging platform, Zoom’s video conferencing system, and DocuSign’s digital signature services have become the glue holding most of the global workforce together during the COVID-19 pandemic. The incredible success of such companies has inspired venture capital (VC) and other investors to put massive amounts of money into SaaS startups in hopes of getting in on the ground floor of the next big thing.

SaaS—software as a service—does not refer to a specific type of software but rather the business model and method of delivery. SaaS companies sell access to software that is centrally hosted in a cloud-based system and accessible via the internet through a monthly or annual subscription. This kind of cloud-based software enables providers to roll out updates and new features quickly, scale up distribution rapidly, and frees customers from the costs of hosting software on their own servers. Subscriptions let customers spread out their costs over a longer period of time, as well as create steady and predictable recurring revenue streams for SaaS companies and their investors.

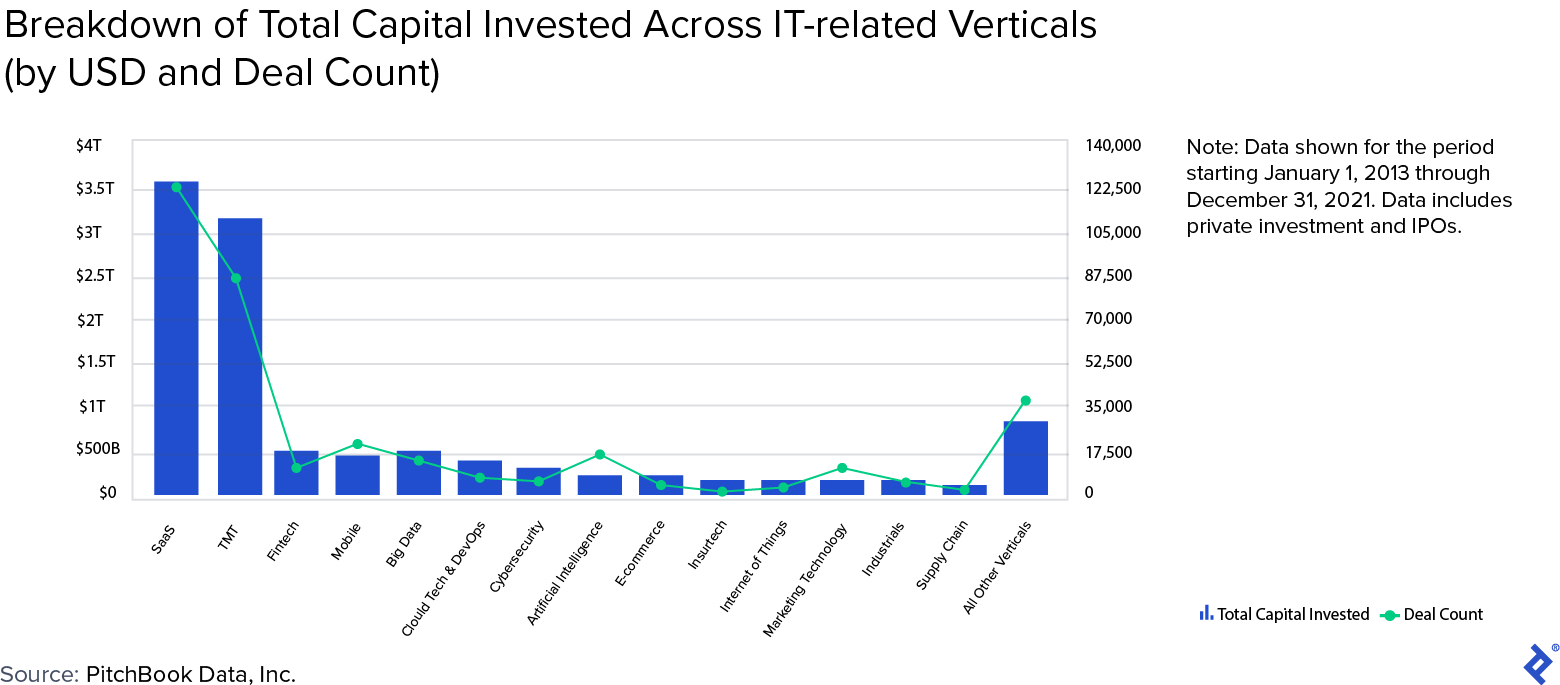

The SaaS business model is not new. Investors have poured US $3.62 trillion into the space since 2013, more than any other category of IT-related company, according to PitchBook Data, Inc. However, this trend has significantly accelerated in recent years, due in large part to the growth of cloud-based computing, and the rapid rise of remote work and education during the COVID-19 pandemic. Globally, end-user spending on public cloud services is expected to exceed US $480 billion in 2022, according to a recent Gartner Forecasts report, up from US $313.9 billion in 2020 and an estimated US $396.2 billion in 2021; SaaS specifically is projected to reach US $171.9 billion in 2022. This presents a tremendous opportunity for founders and early-stage SaaS companies looking to raise funds. However, finding the right investors and securing funding when you need it can be surprisingly difficult.

At least, it’s surprising to many companies that are new to fundraising, I’ve discovered. The importance of experience and expertise in developing and executing a successful fundraising strategy is not to be underestimated. After 25 years at the financial helm of large multinational corporations, I’ve spent the last few years helping owners of early- to mid-stage startups (mostly SaaS and e-commerce businesses) raise funds to grow their companies. I’ve found that many tech companies, understandably, aren’t familiar with the fundraising landscape, which is also evolving rapidly. As a consequence, even SaaS companies, clearly a favorite among investors right now, may make missteps that can cost them valuable time and resources.

Mistakes to Avoid

Chief among these missteps is targeting the wrong type of investor for your company’s stage of development; for example, pursuing VC funding with a questionable minimum viable product (MVP) and no demonstrable marketplace traction. Other potential issues include raising too much or little capital, misallocating limited capital for the wrong purposes, or worst of all, giving away too much equity early on and losing out on value you worked hard to create. The issue of equity dilution is perhaps most pertinent for SaaS startups, where recurring revenue opens the door to alternative financing options, like revenue-based loans, at an earlier stage than for many other businesses.

What I’ve found is that most early-stage companies could use more guidance about how, when, and where to try to raise capital. In this article, I provide a basic map of the fundraising landscape that can help startups and founders better orient themselves. First, I describe the standard rounds of financing and how they should align with a company’s stage of development. Then I lay out the various categories of investors and highlight those that will be most receptive at each stage. My goal is to give you a guide to help you find the right funding for your company, no matter its stage right now.

Targeting the Right Investors at Each Stage in the Fundraising Life Cycle

The amount of available capital is increasing and the investor base is expanding as private equity, hedge funds, and sovereign wealth funds have begun to compete with more traditional venture capital firms to invest in startups, particularly private SaaS companies. The recurring revenue streams and capital-light nature of the SaaS business model make it more appealing for traditional institutional investors.

However, as investor interest in the space has increased since 2010, so has the complexity of the SaaS fundraising landscape. With a broader investor base and more flexibility in terms of financing options, a solid understanding of this environment and a well-thought-out plan for how to approach it are more necessary than ever before.

In recent years, a growing number of early-stage investors (from angels and accelerators to VCs) have adopted a social impact focus, investing in companies that generate positive social and environmental impact alongside a financial return. It’s a common misconception that you have to be saving the world to attract this kind of capital, and it may be worth considering whether your company would fall under a particular impact mandate. In the case of SaaS companies, such a mandate could be as simple as expanding access to underserved demographics or geographies, like a fintech company whose product increases financial inclusion.

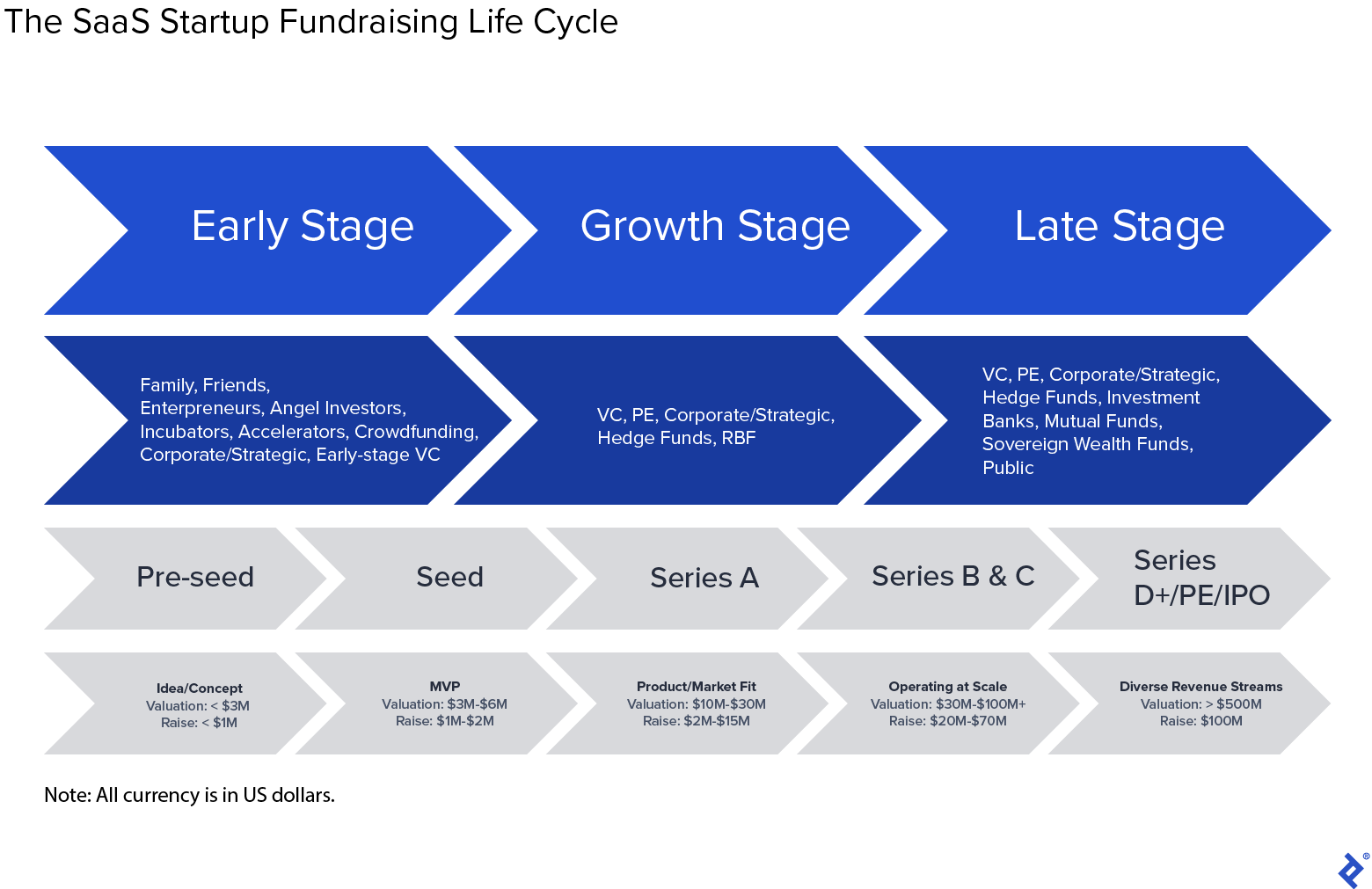

Before you start to formulate any kind of fundraising strategy, you need to have a good sense of what stage of development your company is in. This will help you determine the type(s) of investor(s) you should target and what they will typically want to see from you, as well as the appropriate purpose(s) for raising capital and how much you’ll need to raise. Remember: Fundraising is a process, not a one-time event. You’ll likely go through several rounds of financing before your company becomes the next Zoom—or even just a self-sustaining enterprise. In any given round, your primary objective should be to raise enough capital to get your company to the next stage of growth and secure the next round of funding.

Regardless of which stage you’re in, your business’s trajectory and the funding that will sustain it must be in sync. Taking on too much investment too early or not prioritizing your uses of capital effectively can be as harmful as not raising sufficient funds. Choosing the right investors in the early stages will help set you up for success in future rounds.

Stages of the Fundraising Life Cycle

Different types of investors are willing to provide startup financing at different stages of the fundraising life cycle. Having a good sense of your company’s place on this path, along with what investors will offer and expect in return, will help you to better understand and assess the available options. The following image provides a general overview of the various stages, but remember: In reality, the dividing lines between these broad classifications can be somewhat blurred.

Pre-seed Stage

Pre-seed investments tend to be small amounts that help a company get off the ground and reach a certain base level of operations, turning an idea into a business. At this very early stage, investors are primarily concerned with the creativity, strength, and growth potential of your idea.

Standard valuation: < US $3 million

Typical raise amount: < US $1 million (often US $25,000-$100,000)

Potential investors: Here the investors will likely be family and friends, other entrepreneurs, angel investors, incubators, accelerators, or crowdfunding.

Seed Stage

Seed funding is the first significant investment a company obtains. At a minimum, by this stage, investors will want to see an MVP or prototype, though early evidence of product/market fit and some initial traction in the marketplace will certainly help your case. The more assurances you can provide, the more likely investors are to provide capital for the purposes of supporting further product development and company growth.

Key metrics at this stage include:

- Total Addressable Market (TAM): A proxy for growth potential

- Customer Acquisition Cost (CAC): The cost of acquiring new customers

- Customer Long-term Value (CLTV): The total value of customers throughout their life cycle with the company

The most common, yet critical, error I see companies make early on is misjudging the size of their TAM, which is the “make-or-break” metric at this stage. A major miscalculation will invalidate the reliability of all projections for your company’s future growth and profitability.

Standard valuation: US $3 million-$6 million

Typical raise amount: US $1 million-$2 million

Potential investors: Investment will generally come from larger angel investors, early-stage VCs, or corporate/strategic investors—or in the form of revenue-based loans.

Series A

Series A rounds typically occur when a company has attained positive recurring revenue and is looking for investment to fund further expansion. Financing can be used to support the optimization of processes and technology, make key hires to strengthen the management team, and position the organization to ensure continued growth. Series A rounds are often led by an anchor investor that will then draw in additional investors. By this stage of growth, investors will require the presentation of all relevant business metrics.

Standard valuation: US $10 million-$30 million

Typical raise amount: US $2 million-$15 million

Potential investors: Investment will be provided primarily by venture capital, private equity, corporate/strategic investors, or in the form of revenue-based loans.

Series B & C

Investors will consider providing Series B & C funding when a company has generated significant traction in the marketplace and all its fundamental KPIs look encouraging. By the time you reach this stage, you’ll have made it through several successful rounds of financing and have a good idea of how to proceed.

Now that your company can provide more metrics, the analysis will become much more quantitative in nature. In addition to the types of investors that are active in earlier rounds, larger secondary market players are likely to get in the game. They’ll be looking to invest significant sums of money into companies that have the potential to become market leaders or continue to develop at a global scale, like independent metals marketplace Reibus or Alchemy, which provides software solutions for blockchain and Web3 developers. Historically, a company would usually end its external equity funding with Series C. However, as more companies stay private longer, some go on to Series D, E, and beyond before considering an IPO or private equity buyout.

Series B

The primary purpose of financing at this stage is to take businesses from the development stage to the next level. At this point, companies should have a substantial user base and funding will be used to scale up to meet higher demand.

Standard valuation: US $30 million-$60 million

Typical raise amount: > US $20 million (average ~ US $33 million)

Potential investors: Investment may come from venture capital, corporate/strategic investors, private equity, investment banks, hedge funds, and more.

Series C

Businesses that make it to Series C are already quite successful and will generally be looking for additional financing to scale for exponential growth: funding expansion into new geographies, developing new products, and growing vertically or horizontally.

Standard valuation: > US $100 million

Typical raise amount: US $30 million-$70 million (average ~US $50 milion)

Potential investors: Investors may include venture capital, private equity, investment banks, hedge funds, corporate/strategic investors, and sovereign wealth funds, among others.

Finding the Right Investor

All investors are not created equal. The various investor types presented so far differ in three main respects: when they participate, what they can offer, and what they want in return. Rather than viewing each round of funding as a separate event, it’s important for startups to have an overarching strategy. Over the course of your company’s fundraising life cycle, each round will build upon those that came before it. That’s true not only in terms of capital raised, but also in terms of the guidance you receive, the relationships you establish, and perhaps most importantly, the equity dilution you may face.

Angel Investors

This is a broad category that refers to individuals who make relatively small investments in early-stage businesses. A group of such investors may invest together in a particular project, forming what is referred to as an angel syndicate. These investors are often professionals who have made money through their own successful startups or who have expertise in the same field as your business—in which case they may be able to provide you with valuable advice in addition to capital. However, angel investors can also be wealthy individuals who simply want to invest in startups and do not have relevant experience or business acumen.

Among other things, angel investors will be interested in evaluating the size of your company’s market opportunity, the feasibility of your business plan, the strength of your team, and the likelihood that you will be able to secure subsequent rounds of financing. Angel investment can come in the form of equity, a convertible note, or a simple agreement for future equity (SAFE). Some great resources for finding angel investors are AngelList, F6S, Investor List, Gust, and Indiegogo.

Incubators and Accelerators

While these terms refer to similar programs and are often used interchangeably, there are several key distinctions between an incubator and an accelerator.

First, the similarities: Both aim to help entrepreneurs and startups achieve success, and both may sometimes (confusingly) be provided under the same corporate umbrella. Perhaps most importantly, participation in either type of program can increase your chances of attracting major VC investment at a later stage.

But there are also significant differences between the two. Incubator programs are designed to nurture early-stage startups and founders over an extended period of time (anywhere from six months to several years) and help them turn promising ideas or concepts into something with product/market fit. Incubators provide resources that often include shared office space and access to consultation with experts across a range of business areas, as well as networking and partnership opportunities. They typically do not provide capital and therefore don’t require a cut of equity, instead charging a nominal fee for participation. Incubators may make sense for very-early-stage companies and first-time or solo founders. They may be independent companies or sponsored by VC firms, corporations, government entities, or angel investors. Idealab and Station F are two notable incubators.

Typically run by private funds, accelerators are programs with a set time frame (usually three to six months) that are designed to provide proven, viable startups with the capital and guidance necessary to rapidly accelerate their growth. Accelerators are looking for startups with a validated MVP and a strong founding team who may not have enough capital to establish the marketplace traction necessary to secure a seed round. They provide mentorship and capital, as well as connections to investors and potential business partners. Acceptance rates are very low, and accelerators generally take a cut of equity in exchange for placement in the program (often 4%-15%). Major accelerators include YCombinator, Techstars, 500 Global, and AngelPad.

Venture Capital

VCs represent multiple limited-partner investors and invest much larger amounts than the other classes we’ve covered. VCs generally look for companies with proof of product/market fit that have generated some initial traction in their target markets. Most VCs have a specific niche or area of focus, whether an industry, a stage of company development, or a particular geography. When considering prospective investors, realistically assess how well your company aligns with the focus of a given VC to help you quickly narrow your search and enable you to focus on the most viable targets.

Given the high risk of investing in early-stage companies, VC investors will need to be convinced that there is significant upside potential (> 25%) before they make investments. Securing investment from a VC is not an easy task, but the rewards can be substantial. Some great resources for finding VCs with a focus on SaaS are PitchBook, Crunchbase, CB Insights, and The Midas List from Forbes.

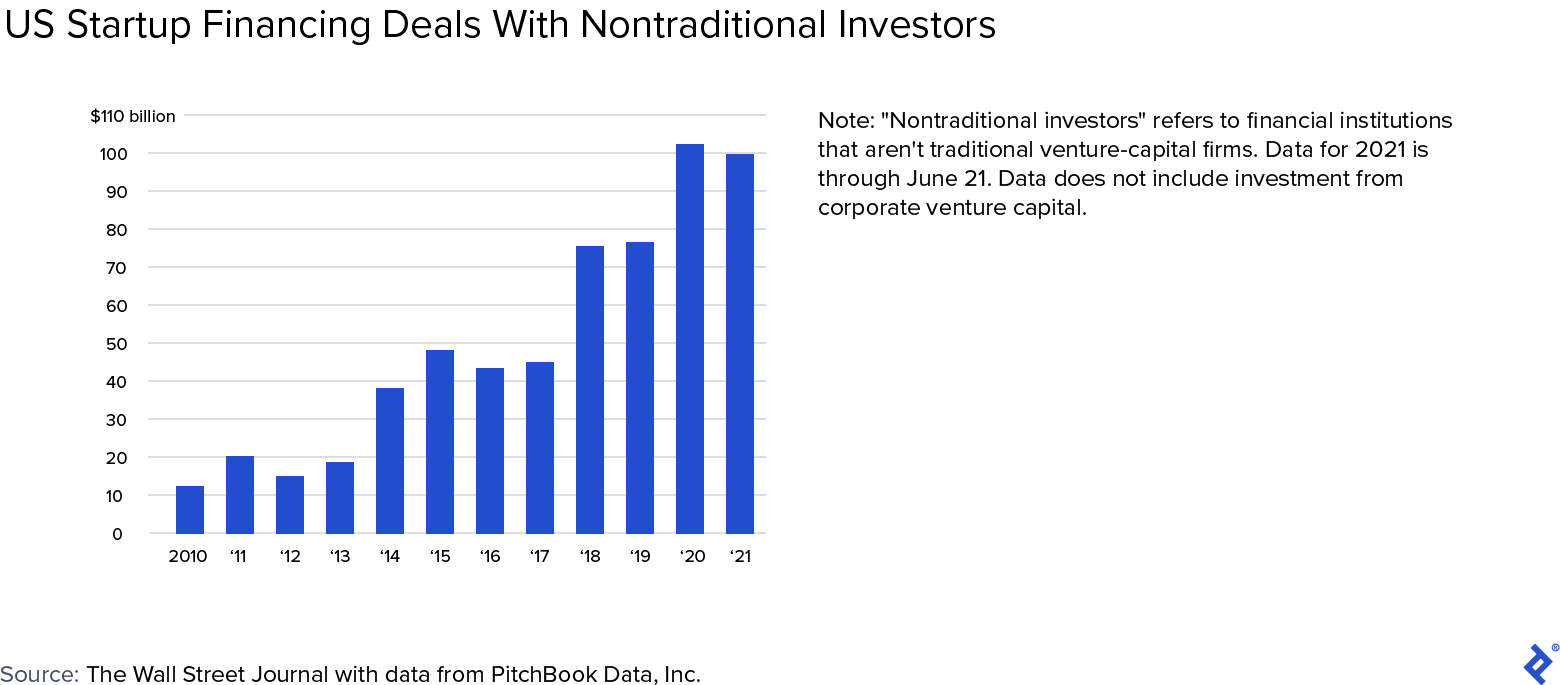

Nontraditional VC Investors

Startups, and SaaS companies in particular, are drawing increasing attention from nontraditional VC investors, including private equity, hedge funds, mutual funds, and sovereign wealth funds. These investor classes have pushed valuations higher and even begun to crowd out VCs in later-stage fundraising rounds. They’re often willing to deploy larger sums of capital more rapidly than traditional VC firms and are generally less price sensitive given their lower return thresholds.

It’s worth mentioning these types of investors because their entrance has significantly reshaped the fundraising landscape. However, they often don’t start to participate until later-stage rounds (Series B+) and are primarily interested in companies that have already established themselves as top names in their spaces, like Stripe or Canva. If one of these power players is interested in leading your next round, it likely won’t come as a surprise.

Revenue-based Financing (RBF)

RBF is similar to traditional debt financing, except that instead of charging regular interest payments across a set time horizon, investors provide capital in exchange for a fixed percentage of your company’s future revenues until a predetermined payback amount has been reached. Revenue-based loans offer earlier-stage companies the ability to use future revenue as collateral in place of pledged assets, as well as greater flexibility to align the timing of payments with the receipt of income. While it’s technically a form of investment, rather than a type of investor, revenue-based financing is a particularly good fit for SaaS companies given the regular recurring revenue inherent in the business model. The symbiotic relationship has practically created its own industry, with a host of RBF lenders cropping up over the last 10 years to keep up with the rapid proliferation of the SaaS business model. Leading RBF providers include Lighter Capital, Flow Capital, and SaaS Capital.

These lenders use a multiple of revenue (e.g., 2.2x payback) to determine a total loan amount, inclusive of their return. The borrower is then required to pay the lender a certain percentage of its monthly revenues (e.g., 7%) until the loan has been paid back in full.

This type of loan can work well for companies that aren’t eligible for or interested in venture debt and that wouldn’t yet qualify for a traditional bank loan. With RBF, there’s no loss of equity, and revenue-based lenders are unlikely to demand board seats or direct participation in the governance or operations of a company. This makes it an attractive option for founders that would prefer to avoid the loss of ownership and control that accompanies traditional equity financing. It may be particularly appealing if you’re in need of fast financing, as the process typically only takes between four and eight weeks.

Bear in mind that this type of loan can be quite expensive and that you’ll need to calculate your cost of capital, taking the cash flow impact of your monthly payments into consideration. Ultimately, you’ll need to weigh the cost of RBF against the cost of giving away equity in your company. While RBF may appear more expensive in the short term, when you consider the opportunity cost of foregone equity in the long term, it may be the better option.

The SaaS Fundraising Bottom Line

As I’ve seen time and again, raising capital can be a slow and frustrating process in the early stages, even for red-hot SaaS companies. Taking the time to understand the startup fundraising landscape and formulate an effective strategy before starting down this path will help you make the right choices. Establishing strong and mutually beneficial investor partnerships early on can put you in a much stronger position for later rounds of funding, ensuring that your company will continue to grow and that you will retain much of your hard-earned stake in it.

Further Reading on the Toptal Blog:

- Startup Financing for Founders: Your Companion Checklist

- Strategies for Raising Startup Capital in Small Markets

- Raising Venture Capital in Down Markets: A Guide to Early-stage Funding

- Aligned for Success: A Guide to What Investors Look for in a Startup

- Why More Entrepreneurs are Choosing To Build Search Funds over Startups

Understanding the basics

What is a SaaS startup?

SaaS, or software as a service, is a business model in which a company leases centrally hosted software to customers through a monthly or annual subscription. It describes not a business area but a method of delivery: Any company that sells access to software through a central, cloud-based system is a SaaS business.

What are three important aspects of SaaS?

Three key aspects of the SaaS business model are affordability, adaptability, and scalability. Subscription payments create predictable revenue streams for SaaS companies and let customers spread out their costs. Centrally hosted, cloud-based software lets providers rapidly roll out updates and scale up distribution.

How do most startups get funding?

Investment can come in the form of debt or equity. It might begin on a small scale with family and friends, but it will evolve as your company progresses through different stages of development, meaning you might get private-equity or corporate investors down the road.

What do startup investors look for?

In the early stages, investors will be concerned with the strength of your idea and the size of the addressable market. Further along, you’ll need to demonstrate product/market fit and establish some traction in the marketplace.

Julio C. Ortiz

Miami, FL, United States

Member since February 18, 2021

About the author

Julio has more than 25 years of diversified experience as a finance VP for multinational companies in a number of industries. Over the last five years, he has focused primarily on helping owners of early- to mid-stage SaaS and e-commerce startups raise funds to successfully grow their companies. Julio’s experience includes financial planning and modeling, business plan development, company valuation, fundraising, and strategic leadership.

Expertise

PREVIOUSLY AT