Why Tesla? Evaluating the Electric Craze

Tesla shares are up 60% over the past 12 months—performing relatively well even with the impacts of the coronavirus on the broader stock market (S&P 500 down ~11% over the same period). We dissect the drivers and unpack what the market is building into TSLA’s valuation.

Tesla shares are up 60% over the past 12 months—performing relatively well even with the impacts of the coronavirus on the broader stock market (S&P 500 down ~11% over the same period). We dissect the drivers and unpack what the market is building into TSLA’s valuation.

Zach is a modeling, fundamental analysis, and valuation expert that has managed money for PE and hedge funds. He now runs his own business.

Expertise

PREVIOUSLY AT

Tesla shares are up ~60% over the past 12 months—performing relatively well even with the impacts of the coronavirus on the broader stock market (S&P 500 down ~11% over the same period). The market capitalization and enterprise value have grown even more due to equity issuances and share-based compensation, while a hefty CEO incentive package is about 20% away from being “in the money.” At the peak, Tesla had a fully diluted market cap of nearly $190 billion, greater than all other car manufacturers aside from Toyota.

Trading volumes have surged with more than $55 billion worth of Tesla shares trading hands during some days of the recent frenzy, more than five times greater than the average volume traded of second-place Apple (AAPL), even though Apple is the largest company in the US with a market cap of $1.1 trillion – well over 10 times that of Tesla.

What has changed over the past few months and what is going on? We will take a look at Tesla’s stock growth and try to cut through the deafening noise that has built up around this name.

Sputtering Quarterly Results

Security analysts love numbers. They use numbers to guide their decisions and attempt to avoid irrational persuasions such as media hype, emotions, or even a personal connection to a product.

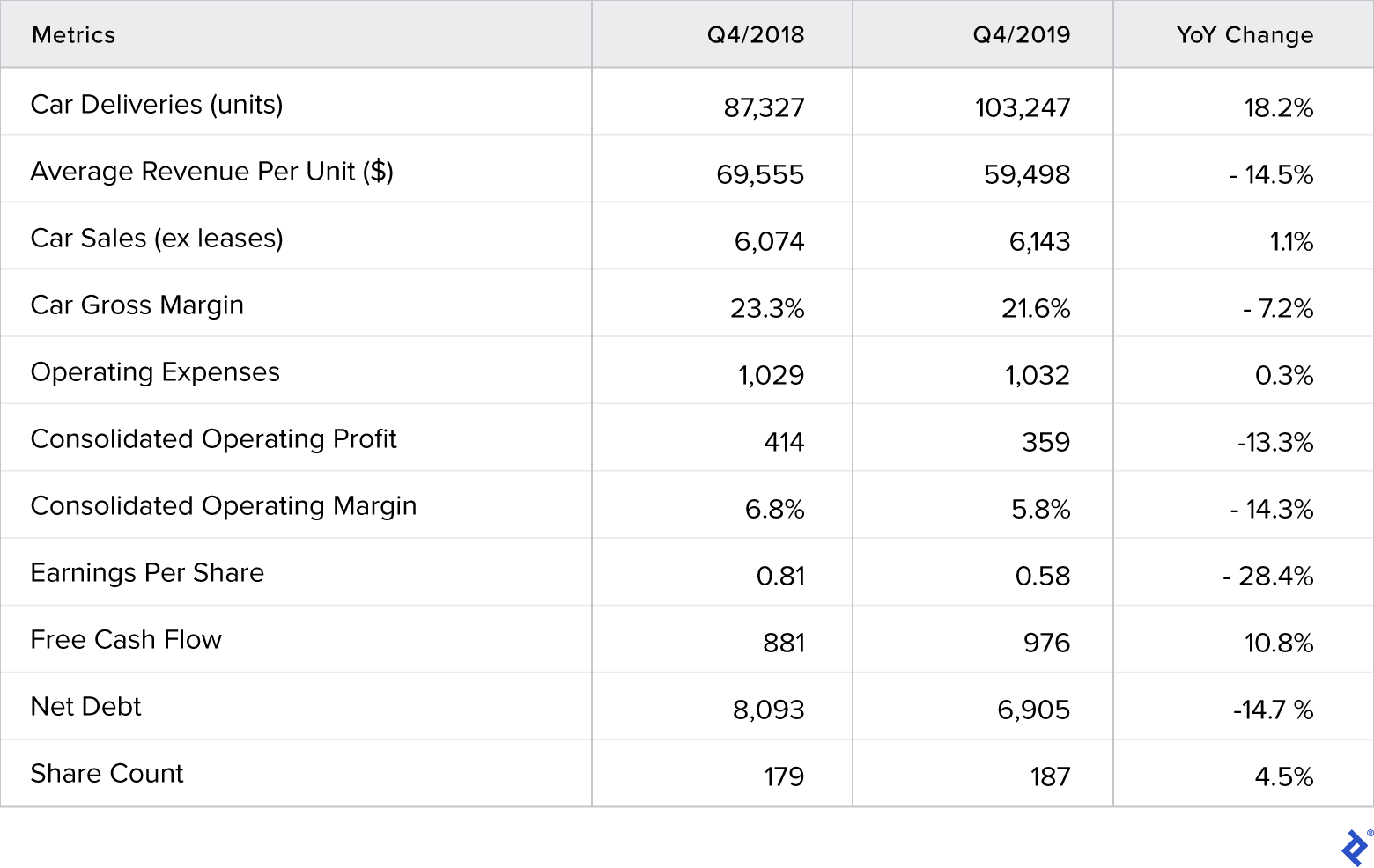

An overview of the numbers that Tesla posted recently, however, don’t appear particularly inspiring at first glance:

Many explanations have been given for why Tesla’s numbers came out as they did, such as a much larger sales mix of lower-priced, lower-margin cars (the Model 3). However, analysts must look through the explanations and let the numbers speak for themselves.

Are these figures an improvement on the prior year period? Marginally, yes. Sure, the reduction in net debt puts the company on a stronger financial footing. Perhaps we can attribute the stock’s rise to increased confidence in positive free cash flow generation. But are these the numbers that warrant Tesla’s valuation multiple being applied to revenues (as opposed to profits) because of breakneck growth? Frankly, no.

Simply looking at the figures, it is difficult to see how Tesla is going to produce meaningfully increased profits with its revenue per unit declining so substantially. On the other hand, it is encouraging to see that operating expenses have remained constrained, but the declining gross margins are worrying.

Another Approach to Explain the Turbo Run

So let’s take a different approach. Since Tesla fans claim the company is more than a mere car manufacturer—and indeed, all right-minded securities analysts would agree that it must be far more than a car manufacturer to justify Tesla’s valuation today—let’s look at what else the company is doing, examining the company’s main businesses: automobile manufacturing, autonomous vehicle technology, and the company’s solar/battery divisions. It is worth pointing out that, if Tesla were being valued in line with auto manufacturers at a P/E ratio of about 3.5x and the Q4/2019 earnings were annualized, shares would be trading at under $10, a significantly lower price than its current ~$430.

Wall Street has been trying to explain the current share price by comparing Tesla to Apple, which in a way makes sense as they both primarily sell premium-quality physical products, but some sell-siders have also come out with comparisons to Google, Microsoft, or Netflix, which trade at much loftier multiples. But to the rationally-minded, this amounts to the proverbial apples being compared to oranges.

Tesla is not a software company, nor is it distributing content. It is a car manufacturer, albeit with advanced technology implemented in the vehicles, but at least in its present incarnation, it still must sell physical cars in order to deliver its technology to customers. And car manufacturing does not have the same scalable economics that Google, Microsoft, or Netflix can boast.

Is Autonomous Driving the Answer?

But let’s go down this rabbit hole. Tesla does have proprietary technology that is undoubtedly valuable, just as other car manufacturers do. Could it be that the autonomous vehicle technology is where all of the value lies? That explanation does not hold water, as Tesla’s self-driving technology – as far as anyone can tell – is likely at a similar stage of development compared to competitors Google, GM, Uber, and others. These competitors are spending large sums on developing their technologies, with Uber spending $20 million per month as recently as last year.

And to put things in perspective, Uber’s self-driving car unit was valued at $7.25 billion in an investment last year by SoftBank, Toyota, and the Japanese automaker Denso. However, this pales in comparison to Tesla’s enterprise value of ~$87 billion.

But maybe it is the potential of autonomous technology that has rocketed shares into the stratosphere. Promises by the company, primarily from CEO Elon Musk, have rarely been kept, and autonomous driving has been particularly treacherous to customers since the add-on feature costs many thousands of dollars and still does not exist. Back in 2015, Musk declared that full autonomy was “a much easier problem than people think it is” and predicted it would take about two years. In early 2016, Musk predicted that people would be able to “summon” their cars from thousands of miles away “in ~two years.” In October 2016, Musk predicted that Tesla vehicles would be able to drive coast to coast without human hands on the steering wheel by the end of 2017. Needless to say, none of this has yet happened.

Then more recently, in a February 2019 interview, Musk said, “I think we will be feature-complete full self-driving this year, meaning the car will be able to find you in a parking lot, pick you up, take you all the way to your destination without an intervention — this year. I would say that I am certain of that. That is not a question mark.”

But can Musk’s predictions be trusted given his shaky history?

Backing Into Valuation - How Many Cars Does the Market Expect Tesla to Get on the Road?

Despite the past disappointments, let’s give Tesla the benefit of the doubt and assume that autonomous driving technology will be rapidly introduced into Tesla vehicles and allow the company an edge over the competition, and in turn, give the company the ability to retain its lofty automotive gross margins.

The non-car units are troubled (e.g., some Tesla customers who ordered the Solar Roof have no idea when they’ll get it) and lossmaking. Because there is likely technology of significant value in them we would not ascribe a negative value, however, we can assume these are worth a negligible amount today; and even if positive, the value would amount to a rounding error when looking at the EV of the company as a whole at around $90 billion. So that leaves the car manufacturing operations.

As equity markets are discounted predictors of future cash flows to shareholders, let’s peer into the future to see what Tesla would need to look like in order to justify its current share price of about $430. We will make the following (charitable) assumptions in order to back into the valuation:

- Time horizon of five years, as the electric vehicle landscape is changing rapidly and visibility is poor even that far out. As we are using a P/E multiple “yardstick” and being generous, no discount rate is applied.

- Gross margin profile in the automotive segment in line with Q4/19

- Operating expenses increasing at 5% per year

- No increase in gross debt or the company’s effective interest rate of 5.5%, CapEx is funded by cash on hand and internally generated cash flows

- Income tax rate of 20%

- P/E ratio in line with Apple of about 20x

- No further equity issuances beyond the conversions of the convertible bonds and first two milestones of the CEO incentive package

Using the above assumptions, Tesla would have to produce 1.1 million cars per year in order to justify the current share price, or 2.6x the Q4/19 run-rate of 413,000. That implies a 21% production growth CAGR, which is better than the company did in Q4 (18%) but below the 46% growth rate that the company has guided to for 2020.

Given that the IEA predicts that the BEV (battery electric vehicle) market will expand nearly 6x to 41 million units by 2024, the Tesla growth story appears achievable in this light. So maybe the market craze can be pinned down to the great possibilities that are in store for the company.

As China is now Tesla’s first manufacturing facility outside of its home base in the US, the novel coronavirus is having an effect on the supply and demand picture there. The extent is difficult to determine, as auto sales in China are down 80% with the economy in full crisis mode, but Tesla sales of nearly 4,000 units in February capturing a third of this much weakened electric vehicle market appear promising. On the supply side, the Shanghai factory was shut down for a few weeks, but deliveries resumed in mid-February, so the effect is not likely very large. Globally, the short-term effect on demand is going to be brutal, however, Tesla seems to have had more problems on the supply side than on the demand side so once the pandemic is resolved, it would be fair to assume that demand will catch up over the medium term.

The company expects to rapidly expand, and as we have examined, it must in order to justify its current share price. However, incremental growth requires the construction of new factories, rather than merely selling more subscriptions (as in the case with Netflix, for example). Fortunately, the balance sheet is now in better shape. With value nearly impossible to find in the US capital markets, many investors have been left searching for growth wherever they can find it, and Tesla found itself with a story to tell so it could arguably be added to the FAANG group of high-flying growth companies. But will Tesla be able to execute? There are many reasons to believe that the company’s historical record on execution leaves plenty of reasons for doubt.

Musk is one of the most ambitious men alive today and he has built Tesla into a company that produces hundreds of thousands of electric cars that have gained ready market acceptance. He has led the development of numerous innovative endeavors including the first private company to return a spacecraft from low-Earth orbit, started an innovative tunneling company, and captured the mainstream imagination with relatively affordable and attractive electric cars.

However, there have been a great number of unfulfilled promises, and the repeated misfires of the autonomous vehicles outlined above are not the end of it. Let’s not forget the “funding secured” fiasco. And is the management team to be believed credible after issuing equity only weeks after promising it was not needed? There has also been a concerning amount of turnover of the top brass excluding Musk.

A Comp Package Tied to Market Cap

Analysts of a company should always understand the executive compensation, and the incentive package that the board granted this CEO come living legend is potentially the largest pay package ever granted at more than $50 billion over 10 years. Refreshingly, it grants zero cash compensation so the CEO payments are entirely tied to company performance. However, the bulk of the package is tied to the company’s market capitalization, rather than price per share, leaving Mr. Musk with as much incentive to increase the share count as increase the share price. Could this be why Tesla has issued so many convertible bonds and so much equity?

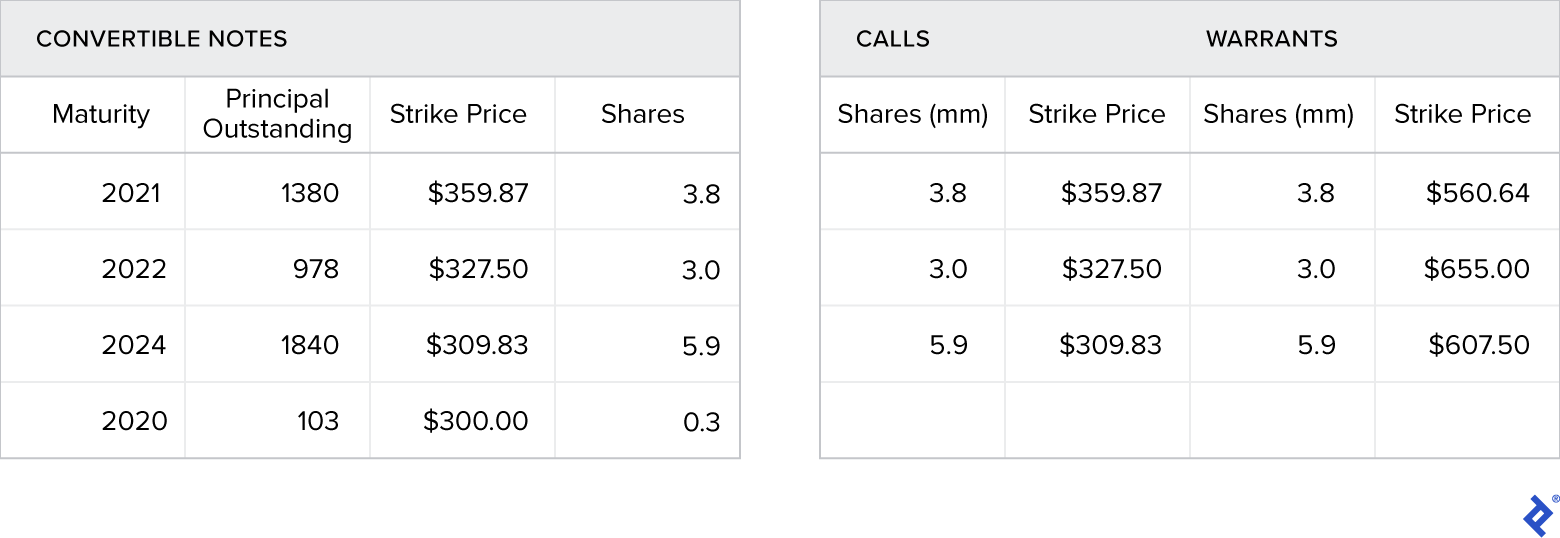

Indeed, the company’s cap table is worth a closer look. If shares continue to trade where they are, the company will automatically delever significantly due to the large amount of convertible bonds outstanding – indeed, Tesla issues make up 5% of the US convert market. Some commentators have opined that a contributing factor to extreme volatility in the Tesla share price is due to high levels of short interest, which is, in part, a side effect of so many convertible bonds outstanding and convertible arbitrage funds selling shares short. With all of the converts now in the money, the equity will dilute upon maturity. However, this is complicated by the fact that the company bought call options to offset the dilution and funded these calls by selling warrants at higher strike prices. As the stock price was trading in ranges where the warrants strikes sit, we believe that delta hedging was adding to the volumes traded and could also have been adding to the volatility.

In any case, the dilution of the equity would be an estimated 13.1 million shares (on a base of ~187 million shares) if the warrants are in the money, in exchange for $4.3 billion in debt, meaning Tesla effectively sold equity at approximately $329 per share (plus some extra expenses for issuance costs and the premium paid for the call options that were closer to the money than the warrants). The 13.1 million share dilution would increase the company’s market cap by ~$8.5 billion if shares are trading at $655 (the highest warrant strike level), while there would not be any dilution if shares continue to trade at current levels.

So What’s It All Worth?

While we have given a lot of benefits to a lot of doubts, we have still struggled to justify the current share price, which assumes that the stars will align in the company’s favor. The conclusion is that Tesla’s shares are not for the analytically minded. Buyers of Tesla shares over the past month must have been motivated by other factors: momentum, FOMO, and the promise of continued technological innovation. It may just be a coincidence, but time will tell if what used to be termed hedge fund hotels might now be Robin Hood Motels.

So what does this all amount to? Looking back at the historical performance, one can definitely find room for skepticism, but there seems to be a new generation of investors coming on the scene that has a more optimistic outlook. Some would call it a moonshot. And should we be so surprised that the founder of SpaceX is attempting to shoot the moon?

Understanding the basics

Who are Tesla’s competitors?

In the electric market, Tesla’s competitors include Google, GM, and Uber.

Are Tesla cars fully electric?

Tesla builds all-electric vehicles.

Zachary Elfman

Vigo, Spain

Member since January 6, 2017

About the author

Zach is a modeling, fundamental analysis, and valuation expert that has managed money for PE and hedge funds. He now runs his own business.

Expertise

PREVIOUSLY AT