Communicating With Investors: Best Practices for Startups

Investors aren’t patrons—they’re business partners, and startups should treat them as such. Regular updates and the occasional call for advice go a long way toward optimizing the relationship.

Investors aren’t patrons—they’re business partners, and startups should treat them as such. Regular updates and the occasional call for advice go a long way toward optimizing the relationship.

Christopher Holloway

Christopher is an award-winning journalist covering how technology transforms sectors like banking, manufacturing, and healthcare. Based in Latin America, he previously worked at AmericaEconomia, La Tercera, and Netmedia. He is a Senior Writer for Technology at Toptal.

Expertise

Featured Experts

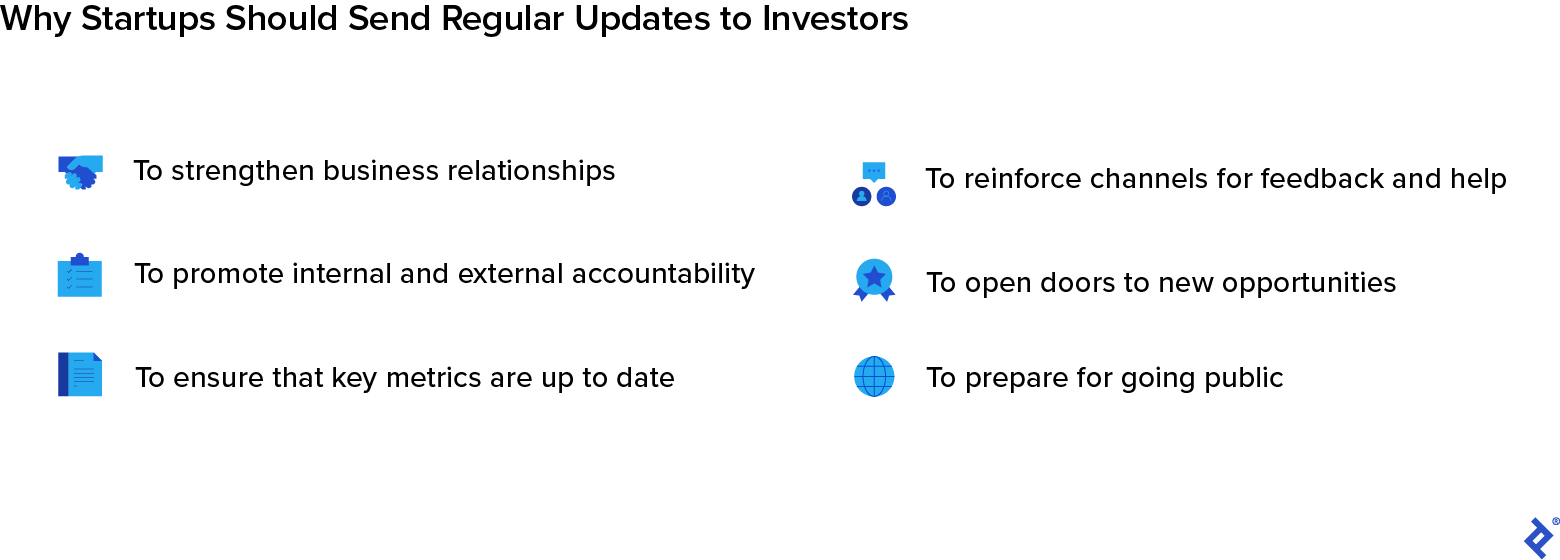

When facing the pressures of funding and growing a new business, startup founders may neglect stakeholder management, but it’s a critical component of success. Learning how and when to communicate with investors can enhance accountability, encourage ongoing feedback, and attract additional investments.

Communication may be difficult to measure, but its effect can be significant. Consider Tesla founder Elon Musk’s 2018 tweet about taking the company private: A message consisting of fewer than 280 characters cost Musk and Tesla $20 million each in fines and a shareholder lawsuit that could amount to billions in damages.

Founders of young startups, however, often take the opposite approach: Instead of oversharing, they undershare. That can be a costly error in its own way. By not engaging regularly and effectively with their investors, founders could lose opportunities to capitalize on the backers’ experience and knowledge.

Honesty, openness, and timely conversation must be central to every good relationship, and this one is no exception. Investors generally aren’t looking for anything more elaborate than routine updates coupled with periodic conversations about future plans, so leaders don’t need to be professional communicators to do it effectively.

And the benefits are numerous: Regular contact with investors helps young startups enhance their networks, strengthen their businesses, and prepare for the challenges of growth. We interviewed three Toptal investor relations consultants and distilled their best advice into simple guidelines that can help you establish and maintain this connection.

Make Time to Connect

Why don’t young companies communicate more effectively with their investors? One reason is time, says Brendan Fitzgerald, a serial entrepreneur in Toptal’s freelance network with more than 25 years of experience. He has worked with hundreds of investors, frequently taking a role as the point person on investor relations.

The chief reason founders don’t prioritize communication is because they think their time would be more profitably spent on other pressing tasks, he says.

But nurturing that relationship is a critical task, Fitzgerald says. “You don’t want them to think that you only call when you need more money.” A useful way to always keep backers in the loop is through periodic reports. Most investors are happy with a concise monthly or quarterly performance report about how the company is doing. And it doesn’t take as much time as founders might fear—once you’ve put the first report together, he says, the subsequent ones generally shouldn’t take more than half an hour to prepare.

Establish a Rhythm

The most common mistake that founders of young businesses make is thinking that investors are doing them a favor, according to Toptal expert Greg Barasia, who has executed more than $20 billion in transactions from seed-stage venture investments to large corporate buyouts. That thought makes them afraid that they are being annoying by sending investors frequent information about the company or asking for guidance.

However, Barasia says, these investors aren’t patrons, but business partners. “They want to see how their investment is doing, and many are willing to offer any help they can. It’s not that you’re bugging them; it’s actually putting them in a position where they know what’s happening with their money,” he says.

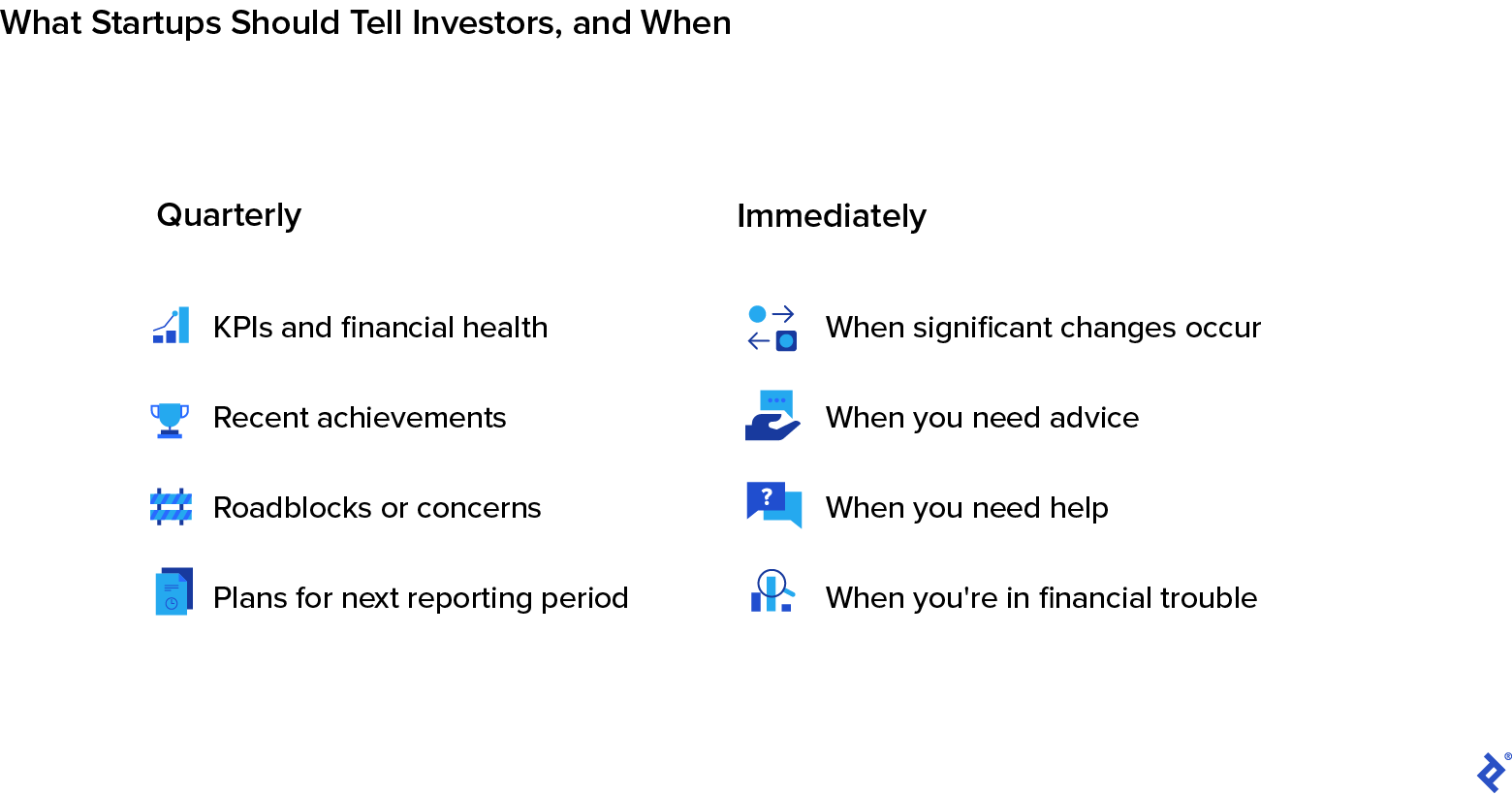

The US Securities and Exchange Commission (SEC) requires that public companies file an annual report (Form 10-K) and quarterly reports (Form 10-Q) containing detailed financial and operating information, including income, cash flow, net sales, growth, and obligations. Although startups may not be required to follow SEC disclosure guidelines, these rules can serve as a helpful general template for leaders to develop their own information-sharing framework.

Young businesses don’t necessarily need to follow these forms precisely, but they serve as a handy starting point. A secondary benefit is that, if the company ever goes public, being in the habit of gathering and presenting this information to investors will simplify the transition to presenting it to stockholders.

But disclosing certain events shouldn’t wait until the next report. Again, SEC rules are a useful guide: Public companies are obliged to disclose changes such as the appointment of new directors or new leadership, as well as the acquisition or disposition of assets, among other significant events. “If you launch a major new version of your product, if you acquired your competitor, or if you received an acquisition offer yourself and want advice, you should consult your investors,” says Erik Stettler, Chief Economist of Toptal and a former venture capitalist.

Keep It Concise

Founders may be tempted to send their investors elaborate presentations and reports with all the information they can gather. They shouldn’t. “Investors in the tech world are not known for their attention span,” Stettler says. “They’re looking for particular facts and pieces of information when they get an update. First and foremost, are you financially OK? Do you need to raise additional capital? What’s your most urgent problem?”

The report should always include your primary KPIs, like growth, active user numbers, transaction volumes, and customer retention. It’s also good to include milestones like securing a big deal or reaching a business goal.

There are other questions that should be addressed, too, according to Barasia. “What have you done since we’ve last spoken? What’s the overall status of the business? What are the new updates? What are you trying to do in the near future? That’s the information an investor needs from a young business,” he says. This report should not be more than two pages.

Keeping the status reports short and consistent will make it easier for investors to compare different periods, understand the startup’s evolution, and respond with better insights. That, in turn, strengthens accountability and collaboration.

Even if investors don’t read every report, the discipline of building the reports means up-to-date answers to common questions are often readily available, which can save everyone a lot of time. “If [your investors] call or have an issue or question, you say ‘Hey! Let me resend last month’s status.’ You already did the job,” Fitzgerald says.

Ask for Help If You Need It

Founders understandably want to project an image of strength and reliability, and may feel that asking for advice can undermine that purpose. They may be afraid to seek help from their investors because that could imply they aren’t prepared to lead or fulfill their promises. However, investors typically want to help founders succeed, and they’re usually happy to take those calls, Stettler says.

“As a founder, you should expect your investors to add value,” he says. “They shouldn’t be making your life more difficult by getting too involved, but they should be available for counsel and for whatever doors they can open for the company. It does not make you look weak to ask for help.”

Barasia agrees. He’s one of the first investors in an AI-powered event management platform whose leaders send a monthly update with crucial information to all their investors. By doing so, he says, they’ve signaled that they’re receptive to dialogue and guidance without ceding control. “This company is now raising funding for about $3 million. The founder has been very proactive about soliciting advice and perspective from the investors. Ultimately, he controls the decision because of the way ownership is structured, but we [the investors] can speak with him directly and weigh in on the decision.”

Communicate Bad News Promptly

The founders of early-stage startups can feel nervous about disclosing that they’re going through a crisis, but it’s unlikely to surprise investors. Historically, around 20% of new companies fail in the first year, and 50% meet their end during the first five years. Good investors know this, so the complete absence of bad news may raise suspicions.

Just as seasoned investors are no strangers to failure, founders need to be prepared for the possibility, too, Barasia says. “I expect young businesses to be proactive about communicating the challenges they’re facing ahead of time.”

“The only time I’ve ever truly become angry with a startup happened after they didn’t communicate anything for a very long time,” Stettler says. “When they finally made contact, it was to tell me they had one month left of runway and needed to figure something out quickly.” His anger stemmed not from the crisis but from the fact that the startup waited until the last minute to tell him about it. By then, he says, it’s often too late to do anything.

It’s also critical that your investors hear bad news from you first. “You don’t want investors finding out that your company is doing badly on social media,” Fitzgerald says. “You have to keep communication constant, and the corollary to that is you always have to be accessible, within reason. If your investors have comments, questions, or concerns, they must be able to call you.”

Paint a Complete Picture

It’s tempting to share only the best possible version of the future to persuade people to help you make that future happen, but communicating with integrity is essential to maintaining trust with investors.

This means more than just not lying. “I think entrepreneurs are very optimistic by nature,” Barasia says, but founders need to be careful not to let optimism turn into exaggeration. “I get it: You started a business and have all these ideas, but you need to be very clear about the facts. Sometimes a startup CEO will send an email to everyone, making it seem like the company has advanced in talks around a new partnership, but it was actually just a preliminary conversation,” he says. Overstatements like that are a deal breaker for him.

Fitzgerald adds that you shouldn’t oversell your capabilities. “The worst thing you can do when you take money is not being honest about what you can accomplish, setting the bar unrealistically high,” he says. “If you told an investor that your company could reach Point C in 10 months, but you didn’t come anywhere near Point C, you’ve lost credibility. Investors put their money in people they can trust. All your communication should try to reinforce that trust.”

Setting realistic goals and communicating regularly and with integrity can build a network of investors for future projects, Fitzgerald notes. He has developed a circle of investors who have supported a number of his startups—some of which failed. But because of the positive relationship they had with him, they continued to invest in his subsequent endeavors. “Some lost money in a company, but then invested in a subsequent startup that was successful. For entrepreneurs, having this network of investors who trust you is critical,” he says. Stettler agrees. “I have invested more than once in the same founder because failing is a natural part of this journey.”

Communicate for Success

When people engage with one another, when communication is clear and the possible outcomes are well-defined, they can face even the worst scenario with minimal conflict and potentially set the stage for future success. “The best way to face [bad news] is doing it in a timely manner, explaining the key lessons that [you’re] going to apply next time,” Stettler says.

Communicating with investors doesn’t need to be difficult, but it must be intentional. Good communication nurtures the kind of partnership that begins with your first pitch deck and lasts well beyond your investors’ exit.

Further Reading on the Toptal Blog:

Understanding the basics

How do you effectively communicate with investors?

Investors aren’t looking for an elaborate communications campaign. Sending concise, regular progress reports and seeking advice or assistance can help a startup solidify its relationship with investors.

Why is it important to communicate with investors?

Investors are business partners, not patrons. Establishing a healthy cadence of communication helps startups keep their investors in the loop and allows them to take advantage of their investors’ experience and knowledge.

How do you build relationships with investors?

Communication is crucial to building a good relationship between founders and investors. Sending regular updates nurtures the partnership and signals that founders are receptive to feedback and insight.