IT Integration in Mergers and Acquisitions: Structuring Synergy

Companies are increasingly using M&A as a way to acquire valuable technology. Implementing a strong IT integration strategy from the beginning is the key to ensuring the desired benefits.

Companies are increasingly using M&A as a way to acquire valuable technology. Implementing a strong IT integration strategy from the beginning is the key to ensuring the desired benefits.

John is a finance and technology leader with deep expertise in enterprise architecture and business strategy. With a unique blend of IT and business knowledge, he has successfully developed digital transformation initiatives across diverse industries. John has a master’s degree in mathematics and computer science, and an MBA from The Trinity College and University.

Expertise

Previous Role

Fractional CEO and CTOPREVIOUSLY AT

Technology is the backbone of a modern business, powering everything from day-to-day operations to customer interactions to product development. It’s so vital that more than a third of all mergers and acquisitions (M&A) have the express goal of improving the acquiring company’s technology stack.

During an M&A, IT integration is not just about ensuring that computer systems can communicate with each other or that data is consolidated. I’ve spent my career guiding companies through the intricate pathways of optimizing their enterprise and cloud architecture, and I’ve witnessed firsthand the potential pitfalls and triumphs of technology integrations. My role has been to ensure that M&A technology integrations are seamless and secure, and that they add significant value to the business. Most recently, I helped an acquiring company realize a 20% increase in operational efficiency and a 15% reduction in IT costs within the first year post-integration by managing each aspect of the technology integration.

The most important thing I’ve learned is that companies seeking to acquire or merge with another business must meticulously align their technology strategies with business objectives, which will ensure clear governance and drive digital transformation initiatives across various business units.

This might involve adopting more efficient workflows, gaining new insights from combined data analytics, or launching innovative products and services that were impossible before the merger. Achieving optimal IT integration may include investing in scalable cloud infrastructure, employing flexible and responsive development methodologies, or prioritizing cybersecurity and data privacy. These components have long-term implications for the organization’s resilience, agility, and ability to pursue new opportunities.

Done properly, an IT integration can define the future direction and potential of the company. However, according to Bain and Company, 70% of systems integrations fail at the beginning, not the end, strongly suggesting that it’s essential for acquiring companies to approach the deal with a robust M&A IT integration strategy already in place.

Without such a roadmap, the target company’s unique advantages and innovations could be diluted or wholly lost—especially when the acquiring company is pursuing the M&A for other strategic reasons and fails to recognize the value of leveraging the target’s technology. A haphazard or suboptimal integration could result in inefficiencies, increased costs, and lost competitive advantage. And for companies pursuing a deal for the explicit purpose of acquiring the target company’s technology, a failed integration could spoil the deal altogether.

A Structured Approach to Technology Integration

A successful M&A IT integration enables a merged entity to leverage each organization’s best technologies and practices, potentially transforming its capabilities and market position. Ultimately, the benefits include increased agility, improved efficiency, and the ability to innovate faster than competitors.

To be successful, each area of the IT landscape, from the overarching technology stack to the nuances of data management and network requirements, demands meticulous review and an action plan. Common hurdles in technology integration during an M&A include misalignment of IT strategies, talent management issues, and data security concerns.

Since technology is so essential to a company’s strategy, senior leadership needs to be deeply involved in this process from the very beginning, guiding the merged entity toward long-term prosperity and success. Here are the best practices I recommend:

Build a Cohesive IT Strategy Early

Differing IT strategies and objectives often conflict, leading to merger integration hiccups that can impact the combined organization across a wide variety of functions. For example, I once facilitated a merger in which one organization prioritized cloud solutions while the other utilized on-premises platforms. Without integrating these two approaches, the new organization risked operational disruptions, increased costs due to maintaining two separate IT infrastructures, and potential data silos that could hinder decision-making and efficiency. This could have led to prolonged integration times, reduced employee productivity, and a failure to achieve the desired synergies from the merger, such as cost savings and improved service delivery.

I conducted a comprehensive analysis of both companies’ IT infrastructures and business goals, including evaluating the technical and economic aspects of migrating on-premises systems to the cloud and identifying which cloud services would best meet the combined entity’s needs. This approach ensured critical systems remained reliable and secure during the transition while capitalizing on the scalability and innovation opportunities of cloud solutions.

By adopting this unified IT vision early in the process, the company was able to minimize friction and pave the way for post-merger synergies, such as the consolidation of customer databases onto a cloud platform, enabling real-time data analytics and insights. This move significantly improved targeted marketing efforts and personalized customer service, increasing sales and customer satisfaction. Additionally, the unified IT strategy facilitated the streamlining of supply chain management across both entities, resulting in cost reductions and more efficient operations. The strategy required close collaboration between IT teams from both companies, fostering a culture of mutual understanding and shared objectives.

Integrate in Phases

Integrating diverse technology landscapes without a strategy can be chaotic. It’s important to break down the integration process into manageable, sequential parts, and to prioritize critical business areas or systems that will generate the most value from integration.

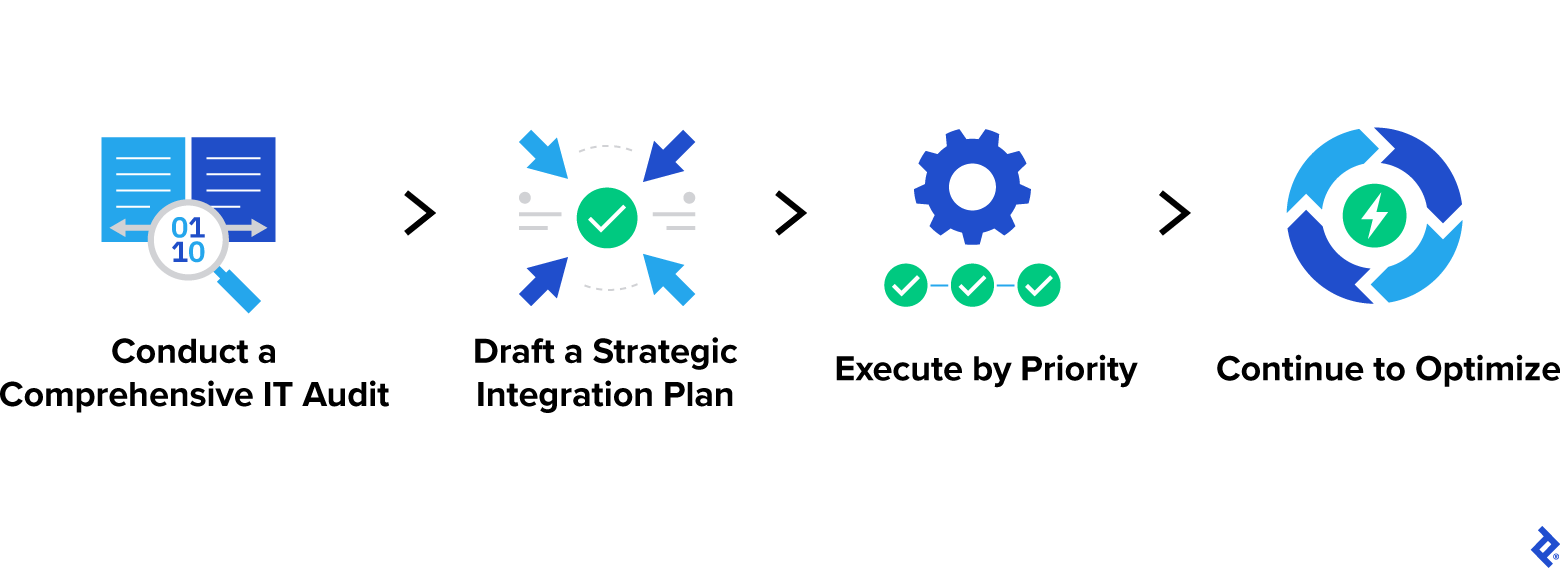

Conduct a Comprehensive IT Audit

Begin with a comprehensive IT audit of both companies that allows stakeholders to understand the depth, capabilities, and potential integration points of both companies’ technology landscapes. The audit should map all hardware, software, data ecosystems, network infrastructures, and security protocols. This will help identify redundancies, gaps, and areas in which either company’s superior technology can be leveraged to enhance the merged entity’s security, cost savings, efficiencies, and overall IT capabilities.

Draft a Strategic Integration Plan

The audit will inform the strategic integration plan by indicating which technologies to keep and which to phase out. This plan should define clear objectives based on the audit outcomes, such as enhancing operational efficiency, reducing costs, or improving customer experience. It should also include a roadmap for technology integration, detailing timelines, resource allocations, and critical milestones. A key goal should be to integrate systems while minimizing disruptions to ongoing operations.

Execute by Priority

M&A IT integration activities involve migrating data to a new platform, consolidating IT systems, and/or implementing new technologies across the organization. Prioritize all systems and processes, and begin by integrating the most critical ones first. For example, integrating customer support systems first may provide immediate improvements in customer service, while back-office systems like HR and finance can come next, and then less critical systems last.

Continue to Optimize

Plan for integration to be an ongoing process. It’s essential to continue to monitor and adjust the new IT landscape after integration to ensure the technology remains aligned with business goals and can adapt to future needs. This work may involve having regular performance reviews, updating systems, and adopting new technologies as they emerge.

Implement a Robust Data Management Plan

When each company has its own data management policy, conflicts can arise in various arenas, such as data collection practices, classification standards, retention policies, and access controls. One organization may classify customer contact information as highly confidential, requiring strict access controls, while the other may consider it less sensitive. Such discrepancies can lead to challenges in aligning on a unified approach to data management, potentially compromising data security and compliance with regulations.

Integrating data is another significant challenge. The data must be audited to identify overlaps, cleansed of incomplete or inaccurate elements, and standardized to avoid potential data loss, corruption, and breaches of sensitive information. Such issues can severely impact business operations, lead to legal and regulatory compliance failures, and damage the company’s reputation. During a merger or acquisition, these risks are magnified due to the increased volume of the data being handled and the complexities of integrating disparate IT systems. Formulating a stringent data management plan that encompasses collection, migration, storage, and security protocols can minimize these challenges.

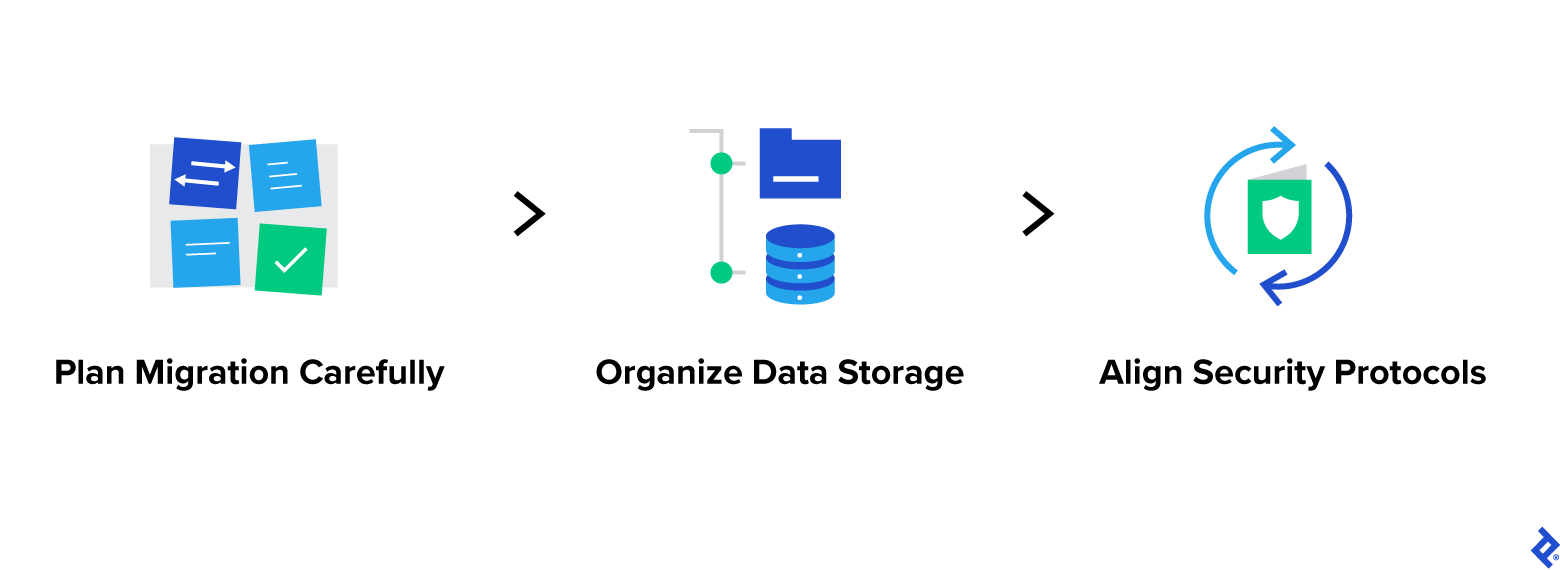

Plan Migration Carefully

Developing a migration plan might involve cataloging and mapping all data assets in detail, standardizing the data, and developing a unified system of governance. The next step is to identify the most critical data for business operations and prioritize accordingly. I often recommend a phased approach to execution, starting with nonsensitive, nonessential data to test the migration process, followed by migrating increasingly critical data once the process has been tested. Implement validation checks before, during, and after migration to ensure no data is lost or altered.

Organize Data Storage

A data storage plan should detail how and where data will be stored, considering data access speeds, cost, and compliance with data sovereignty laws. The plan might specify using cloud storage for scalability and flexibility alongside secure on-premises solutions for sensitive or mission-critical data. The plan should also outline backup and disaster recovery procedures to ensure data availability and continuity.

Align Security Protocols

This type of planning also involves standardizing security measures across the merged entity, including encryption, access controls, and monitoring systems. It may require upgrading legacy systems to meet current security standards and implementing uniform security policies such as regular password changes and multifactor authentication. Regular security audits and employee training on data-handling best practices are also crucial components of the plan.

Prioritize Cultural Integration Throughout

Different corporate cultures and IT practices can strain the integration process. Consider a merger between a fast-paced tech startup known for its agile development practices, casual work environment, and open-door policy and a well-established corporation with a formal hierarchy, structured development cycles, and traditional IT operations. The startup’s culture encourages rapid innovation and embraces risk, while the corporation prioritizes stability, process, and risk mitigation.

In the new entity, the clash of cultures and IT methodologies could manifest as resistance to change from both sides. For instance, the startup’s employees might feel the corporation’s measured approval processes for new software deployments stifles innovation. Conversely, the corporation’s employees might view the startup’s rapid development and deployment practices as reckless, potentially compromising quality and security.

This clash can lower productivity, morale, and talent retention. Projects might be delayed as teams struggle to find common ground. The ultimate risk is a lack of employee buy-in that undermines the synergistic potential of the merger. But there are strategies to prevent or solve these issues.

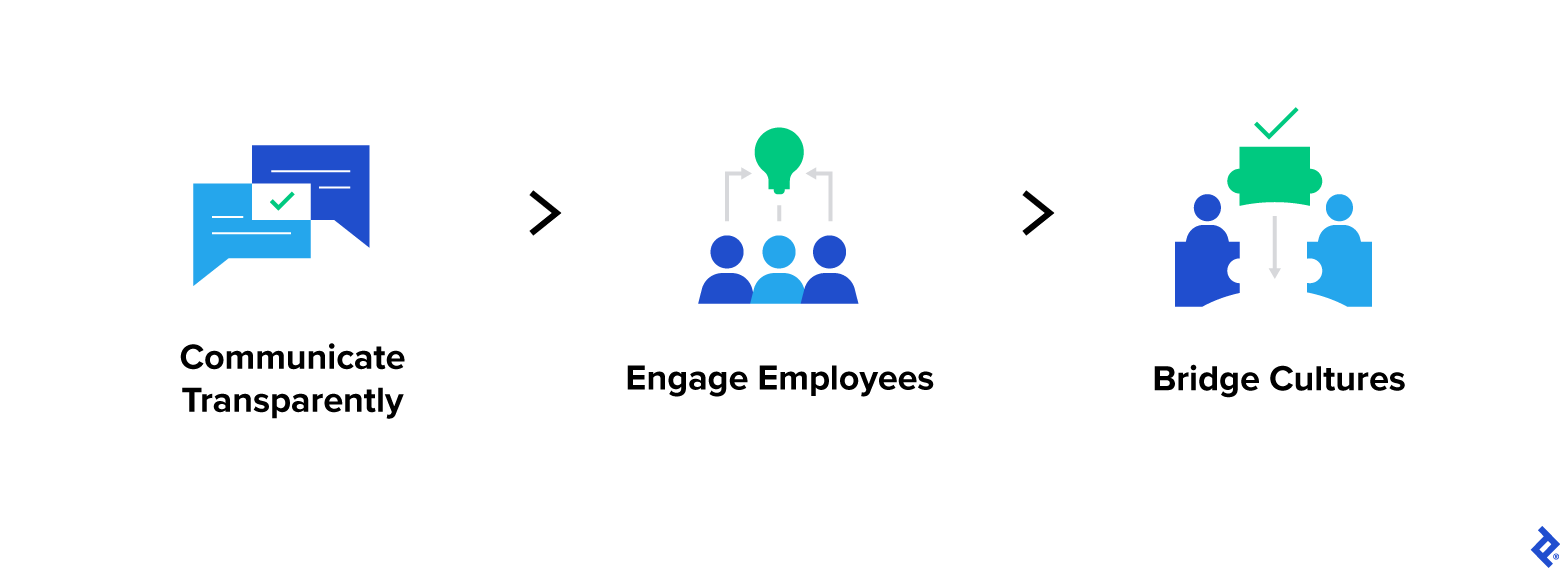

Communicate Transparently

In order to align everyone toward a common goal, it’s essential to openly discuss the differences in culture and practices between the entities, acknowledge the strengths of each, and set clear expectations for the merged organization. Regular town hall meetings, Q&A sessions with leadership, and transparent updates on integration progress all contribute to creating a shared sense of ownership of the process.

Engage Employees

Leveraging employees’ in-the-trenches expertise during the integration process lets them provide input on how to blend the best aspects of both cultures. This can happen in a variety of ways, including creating cross-functional teams to work on integration projects, circulating regular feedback surveys, and hosting forums at which employees can voice concerns and suggestions.

Bridge Cultures

When teams from both entities are going to be working together, it’s helpful to create opportunities for them to understand each other. These efforts could include joint team-building activities, cross-training sessions, and mentorship programs pairing employees from differing corporate backgrounds. For example, a “shadowing” program in which employees from the startup spend a day shadowing their counterparts in the corporation (and vice versa) can help team members understand the work practices and challenges of others.

A thriving cultural integration lays the foundation for a collaborative and innovative environment. When employees feel heard and see actionable steps being taken to blend cultures, their engagement and loyalty to the company increase, reducing turnover. As employees from different backgrounds begin to understand and appreciate each other’s methodologies and practices, I’ve found that they can develop new, hybrid approaches that leverage the strengths of both cultures. This improves workflow efficiencies and drives innovation, ultimately benefiting the merged entity’s market competitiveness and growth.

Continue to Optimize Your Tech Stack

Technology should be an enabler, not just a functional necessity. A successful technology integration is about far more than maintaining basic operations—it’s about keeping systems running, data safely stored, and processes flowing. It’s a strategic asset that drives business growth, innovation, and competitive advantage. Periodic post-merger tech audits can help spot scalable solutions, reducing operating costs and ensuring they bolster the new entity’s growth trajectory.

M&A IT Integration: The Foundation for Long-term Prosperity

Technology integration during an M&A isn’t merely an IT project, it’s a strategic imperative. I have found that with a careful approach, businesses can ensure a smooth transition and position themselves for increased success in the post-merger world.

Ultimately, the approach I’ve outlined here maximizes the value derived from the merger, provided the technology integration adds to the strength and efficiency of the merged company rather than becoming a chaotic stumbling block that undermines the premise of the deal. A successful M&A IT integration fundamentally shapes the newly combined organization’s ability to achieve its strategic goals, adapt to market changes, and maintain a competitive edge. It involves meticulous planning, execution, and optimization to ensure that technology catalyzes business growth and transformation.

Further Reading on the Toptal Blog:

- Selling a Business for Maximum Value in a Challenging M&A Market

- M&A Negotiation Tactics and Strategies: Tips From a Pro

- Valuation Drivers to Consider During the M&A Sale Process

- Refining Your Middle-market Merger Strategy: From Acquisition to Integration

- Selling Your Business? Stop Leaving Money on the Table

Understanding the basics

What is an M&A IT integration strategy?

An M&A IT integration strategy outlines the process for combining the technological capabilities of the two companies involved. It should include a full technology audit, a meticulous plan of execution, careful data management, a thoughtful meshing of cultures, and a commitment to post-merger optimization.

Why do you need an M&A IT integration plan?

An M&A IT integration plan is an essential tool to ensure that the acquiring company realizes the most value it can from the target company’s technology stack. Otherwise, some potential synergies could be overlooked or lost.

Why is technology important for M&A integration?

Technology powers virtually every aspect of a company’s operations. Whether or not the purpose of an M&A deal is specifically to acquire the target company’s technology, a smart approach to integrating the two tech stacks can deliver significant improvements to a wide range of functions.

Carrollton, TX, United States

Member since March 2, 2023

About the author

John is a finance and technology leader with deep expertise in enterprise architecture and business strategy. With a unique blend of IT and business knowledge, he has successfully developed digital transformation initiatives across diverse industries. John has a master’s degree in mathematics and computer science, and an MBA from The Trinity College and University.

Expertise

Previous Role

Fractional CEO and CTOPREVIOUSLY AT