What Designing Formula 1 Cars Can Teach You About Corporate Strategy

Whether you need to fix a roadblock or test a new idea, these insights from a former Formula 1 engineer can help speed your success.

Whether you need to fix a roadblock or test a new idea, these insights from a former Formula 1 engineer can help speed your success.

Isaac is a management consultant, CEO, and CTO with deep expertise in electrical and automotive engineering currently focusing on AI, blockchain, and crypto projects. Applying the management methods he learned as a Formula 1 engineer for Alpine, he now helps tech startups and SMBs optimize their growth and innovation strategies and increase revenue.

Expertise

Previous Role

CEOPREVIOUSLY AT

I’ve been working as a corporate strategy consultant with entrepreneurs and small businesses for more than a decade, helping them solve problems as they seek to grow. But before that, I trained as an engineer, working in research and design for the Renault Formula 1 racing team (now Alpine F1 Team), then in technology projects for Airbus. When you’re designing race cars and airplanes, there’s no room for error—precision is essential. However, when I moved into consulting, I noticed that scientific precision was frequently in short supply, often resulting in wasted time and money.

In a typical consultant-client relationship, the client will notice a problem, identify the culprit, and then call a consultant to help fix it. The consultant will then focus on that area of underperformance, collecting data, developing hypotheses, building solutions, and analyzing the results. However, the client doesn’t always know what the problem actually is—and it may not be what they had assumed. For example, the client may be concerned about low sales, and assume the problem is that they’re targeting the wrong customers. But in fact the problem may be that the product itself is flawed, or that it’s not being positioned properly.

Even when the consultant recognizes that there may be other factors in play, the traditional methods of discovery, analysis, and solution building often require a substantial investment of time, effort, and money before anyone knows whether the solution is hitting the mark.

Executing on growth and innovation as part of corporate strategy often starts with problem analysis and the problem-solving frameworks used in product management and design thinking. Knowing how to break down large problems into smaller questions helps clarify roadblocks and speed the development of solutions. While there are a number of business problem-solving methodologies available to facilitate that process, I have never found one that gets to the true heart of the matter as quickly as I’d like.

I knew from my years as a Formula 1 and aerospace engineer that there had to be a more efficient way to identify problems and test solutions without compromising thoroughness. Using my knowledge and experience, I developed a two-part process to identify root causes and test solutions. It involves some extra research in the beginning, but ultimately allows me to arrive at solutions much more efficiently. I call it competitive management methodology, and here I show you how it works.

Part 1: Identify the Root Cause of Current Problems

When challenges arise in a business—for example, underperforming sales—managers and consultants will often ask big questions: What’s not working in our current go-to-market strategy? Could we sell more by changing the price? Would adding more features to the product help? What other customer groups could we target?

These are good questions to ask, but they’re not precise enough to reveal the problem. Furthermore, they often reflect the biases or hunches of those in charge, rather than the actual root cause.

The F1 mindset means that you need to turn over every stone in search of trouble spots, without making assumptions about where the cause might lie. The competitive management methodology begins with a 360-degree survey of the company’s performance. This allows me to see where different domains intersect to contribute to the problem, and ultimately helps me provide more holistic solutions. These are the eight domains I examine:

- Purpose

- Clients

- Market

- Suppliers and Partners

- Talent and Team

- Organization and Processes

- Financial Analysis

- Competitive Values

For each category, I use a questionnaire asking stakeholders a series of simple questions to determine how thoroughly they have structured and optimized these areas and how well each is performing. These questions are the same for every company I assist.

To ensure unbiased results, I speak to stakeholders all across the company about every domain—not just the area they’re responsible for. For each of the eight domains, I note whether the question is relevant to the business I’m working with at the time, assign points to rank how much improvement is needed, then convert those points into a percentage value. Here is an example of the financial analysis portion of the questionnaire:

Financial Analysis | Relevant | Points | % Value |

Have you performed a profitability analysis for each product or service? |

0 = no

1 = yes

|

x/13 | x% |

What is the total profitability of your business? |

0 = no

1 = yes

|

x/8 | x% |

Do you have a budget, and do you review it as often as your business requires? |

0 = no

1 = yes

|

x/13 | x% |

Do you perform cash flow analyses, and do you review them periodically? |

0 = no

1 = yes

|

x/13 | x% |

Do you automatically set aside a portion of your income to increase your margin or to fund reserves and cover anticipated losses? |

0 = no

1 = yes

|

x/13 | x% |

Are your personal accounts separate from your business accounts? |

0 = no

1 = yes

|

x/3 | x% |

Total point value |

x/63 | ||

Number of relevant questions |

x/6 | ||

Total percentage value |

x%/100% | ||

After assigning percentage values for each question, I add up the answers to arrive at a total percentage between 1% and 100%, with 1% indicating a highly refined, high-performing area that needs little intervention, and 100% indicating a severe lack of development in that area requiring extensive intervention. Finally, I map the results of all domains to a spiderweb chart to identify the top three areas in greatest need of improvement and with the highest potential for impact on the company overall.

While the answers may confirm the client’s suspicions, they can also reveal undiscovered problems that may be contributing to the end problem the client is seeing. Only after I’ve identified the primary three areas of concern do I deploy more traditional problem identification techniques such as the Five Whys. Here is what my process looks like in action.

Case Study: Identifying the Real Problem

I once consulted for a major digital marketing agency that was having difficulty with its workflows and objective-setting processes. After I ran the founders through my questionnaire, I discovered that while their processes did need optimizing, the following were their most pressing problems:

- The founders’ responsibilities were not clearly laid out, which led to areas of overlap or neglect.

- The team was not flexible enough.

- There were bottlenecks.

- Team costs were excessive or not optimized throughout the whole team structure.

- The agency’s operating margin was declining.

So the core question shifted from “How can we improve our workflows and objective-setting processes to save money?” to “How can we optimize our team structure to improve performance?”

However, not every part of a team works the same way, so the next step was to get even more granular: How could we optimize for staff to improve their performance? For managers? For department heads? For C-suite leaders?

In this case it was crucial to classify each role according to aspects such as strategic know-how, frequency that know-how is required, cost, and even target revenue per type of employee. For instance, the chief marketing officer would possess one of the most critical parts of the company’s know-how: the ability to design a digital marketing strategy for every new customer e-learning product. This role would be required on every new and existing project, and the company would do well to invest in keeping such a key professional on staff.

The chief financial officer, on the other hand, could be a highly qualified fractional professional. This expert would jump on board for a short period of time to analyze finances, set the overall controller process, identify key indicators to track, and even help develop a business plan projection. They could then hand the reins to a full-time, permanent financial controller to oversee the day-to-day finances.

Finally, the person in charge of implementing and tracking marketing campaigns on social media, following the company’s designed strategy, could be a long-term contract employee, since that role does not demand high strategic know-how, but rather is primarily responsible for executing the final strategy and managing the data.

Once the work of classifying roles was complete, I was able to develop a hypothetical solution. It included:

- Drawing up a founders’ agreement outlining the responsibilities of each founder.

- Designating key strategic long-term and/or permanent roles to keep in-house.

- Identifying strategic short-term or periodic projects and tasks and contracting out for those services as needed to expert freelancers or top agencies.

- Determining whether it makes sense from a financial and company culture perspective to outsource any departments, such as a call center or the marketing analytics team.

- Making sure that the result prioritizes the right goals: flexibility, high performance, and cost efficiency. Keep the company culture for the core team—and recognize that the optimal return on investment may not necessarily mean hiring the cheapest labor.

With this hypothesis in place, it was time to test.

Part 2: Embrace Minimum Viable Testing of Corporate Strategies

In corporate strategy, too often clients want to commit to a solution right away. But the process will be faster, cheaper, and more effective if you start smaller.

F1 teams deploy a rigorously scientific approach, improving vehicle performance incrementally, primarily through using computer simulations and aerodynamic data produced by testing car models in wind tunnels. What I learned is that the teams that test their hypotheses most often and the most efficiently—by prioritizing the most impactful tests—are the ones that produce an advantage. When implementing this insight in other fields, the challenge is to develop a framework that enables you to test more, test better, and test as cheaply as possible. The way to do that in corporate strategy is through the minimum viable test (MVT) methodology.

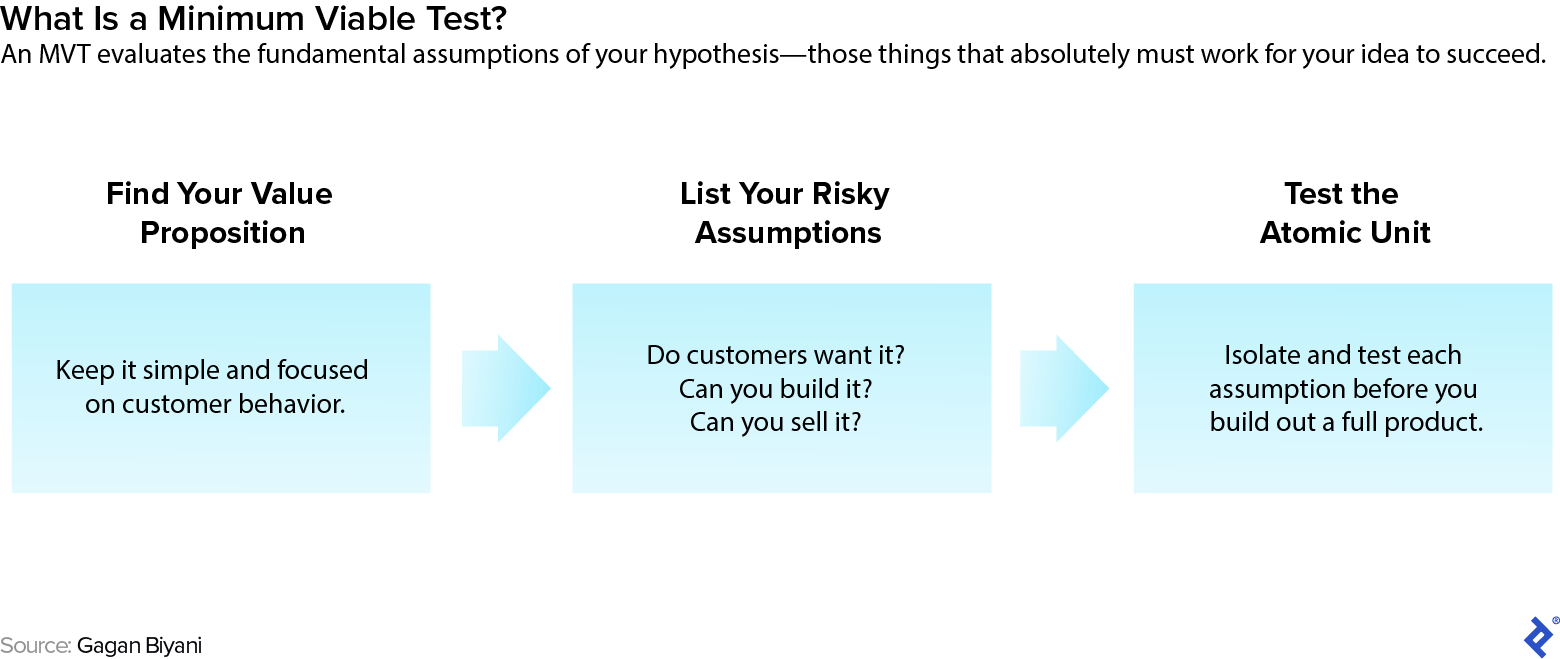

Most entrepreneurs are familiar with the concept of a minimum viable product (MVP). An MVT is a related process that breaks down a business idea or feature into a series of small, hypothetical tests conducted even before the beta version is attempted. Popularized by serial entrepreneur Gagan Biyani, the methodology requires you to come up with a list of fundamental assumptions about your idea—the assumptions that absolutely must be correct in order to succeed—and then devise what are known as “atomic unit tests” to evaluate each of these core assumptions individually on a very small scale.

For example, if your idea is a digital toothbrush subscription service, one of your atomic unit tests might be to send out a survey to determine whether people are interested in buying toothbrushes online in the first place.

Competitive management methodology includes one key aspect that derives from the F1 mindset: First focus on finding out which options don’t work and can be discarded, rather than aiming to find out which options can potentially work. In other words: Don’t worry so much about looking for the needle in the haystack at first—just go for the hay, so you can discard it quickly.

Not every test needs to be conducted in the real world; by asking a thoughtfully worded question that isolates one core assumption at a time, you can use simple inductive and deductive thinking to discard many bad ideas quickly. Sometimes the answers are very obvious, and that’s OK. The more granular and well-worded the questions are, the easier it will be to shortlist your ideas and narrow them down to find the optimal answer. Here’s how I did this for the digital marketing company.

Case Study: Discovering and Implementing the Right Test

While many consultants would have simply rolled out the new structure companywide for a trial period or would have picked a team and project based on intuition and hunches, I wanted to test it on a carefully selected single team and project. In order to determine the characteristics that the team/project combination should have in order to test the hypotheses, I first applied MVT methodology to the test design itself:

- Should we pilot the new structure with a team of new hires who were less familiar with the company but had never been exposed to the problematic processes, or should we use a team of people who had already been there for a while?

- Should the new structure involve people from all levels of the hierarchy, i.e., line workers to C and founder levels, or just one layer of personnel, such as middle managers?

- Would it be better to test an existing project to check improvements in key indicators, or a new project to ensure that it did not incorporate any of the old bad habits?

By breaking down our assumptions about the ideal test and challenging them one by one, I quickly realized that if we didn’t test the new structure on a completely new team and project, we would never know how much of the result was due to the new structure and how much was due to residual practices or biases from the old way of doing things. In other words, by not implementing the test properly, we would end up wasting time and money trying to isolate those factors further. Similarly, we realized that because we could never completely isolate the activities of just one layer of the hierarchy, we would need to test the structure on everyone from line workers to leadership.

These thought experiments led us to roll out the new structure for a totally new team working on a short-term special project—the launch of an e-learning offering. This gave us real-world results that we could extrapolate more confidently to the full team structure, and also limited the impact of the change on the company’s revenue and operations while I fine-tuned it.

Considering that part of the test involved determining the right mix of permanent staffers and contract workers, we elected to start with in-house staff, including the person designing the marketing strategy (for this small company, it was the CEO), the director of HR, highly specialized support staff, and the copywriting staff. While arguably copywriters could have been outsourced, we found that bringing them on full time made more sense because the need for their skills was long term and their work was tightly linked to the company’s strategy.

On the other hand, we were able to outsource a number of roles in customer support, video production, and marketing analytics. This mix made it much easier for the team to scale and contract as needs shifted throughout the launch cycle—for example, transitioning from a heavily sales-oriented support team at the beginning to technical and learning support once people began using the e-learning course.

Once data indicators showed consistently improved profitability, operations, and customer and employee experience, we adapted, scaled, and implemented the new structure companywide.

The Competitive Management Methodology in Corporate Strategy

The competitive management methodology is a blend of scientific approach, tight deadlines, and substantial budget optimization. In order to succeed, you need to understand your weaknesses and rigorously challenge each assumption—with an eye toward filtering out what doesn’t work first—before implementing a new improvement.

Even when there isn’t a problem that needs to be corrected, startup and small business leaders can use this approach to evaluate any new strategy option—a price change, a new product launch or feature, the targeting of a new customer group, or an entirely new business idea. You should ask yourself: What is the simplest, quickest, and least expensive way that I can test this and still achieve a result that is representative enough to indicate which option is more likely to work?

By taking the time on the front end to seek out the root cause of problems and testing your hypothesis as much as you can, you will arrive at your solution and refine your corporate strategy more efficiently and effectively.

Further Reading on the Toptal Blog:

- 5 Key Tips for Smarter Sales and Operations Planning Implementation

- Better Digital Banking Through Data Analytics

- Cash Flow Optimization: How Small and Medium Businesses Can Unlock Value and Manage Risk

- The KPI Cure: How Healthcare Data Analytics Can Improve Medical Center Finances

- Strategic Financial Leadership: 6 Skills CFOs Need Now

Understanding the basics

What is corporate strategy?

Corporate strategy is the roadmap a company uses to achieve its objectives, typically with the goal of increasing value or profits.

What are the four levels of corporate strategy?

The four levels or elements of corporate strategy generally include visioning, setting objectives, allocating resources, and prioritizing or determining trade-offs.

What are the five elements of corporate strategy?

The five elements of corporate strategy, or the strategy diamond, is a model developed by Hambrick and Fredrickson that includes: arenas (markets, categories, and needs); vehicles (methods); differentiators (unique features); staging (processes and timeline); and economic logic (business model).

Bogotá - Bogota, Colombia

Member since August 10, 2022

About the author

Isaac is a management consultant, CEO, and CTO with deep expertise in electrical and automotive engineering currently focusing on AI, blockchain, and crypto projects. Applying the management methods he learned as a Formula 1 engineer for Alpine, he now helps tech startups and SMBs optimize their growth and innovation strategies and increase revenue.

Expertise

Previous Role

CEOPREVIOUSLY AT