The Power of Optionality, Part 3: Adapting to New Market Landscapes

Optionality has long been regarded as the only approach that gains value from market landscape volatility. Here’s how to map out an optionality-driven approach during even the most extraordinary times.

Optionality has long been regarded as the only approach that gains value from market landscape volatility. Here’s how to map out an optionality-driven approach during even the most extraordinary times.

Data scientist and venture capitalist who has invested in 50 global tech companies. He is the Chief Economist at Toptal.

PREVIOUSLY AT

Read the other installments in this series:

- The Power of Optionality, Part 1: Tech & Talent

- The Power of Optionality, Part 2: Volatility to Opportunity with Distributed Teams

Optionality in business and finance has long been cherished for being the only strategy that gains rather than loses value from market landscape volatility. This asymmetric payoff structure sets optionality apart from more traditional opportunities and is enabled by building proprietary technologies in an agile manner. The global on-demand talent pool opens a nearly limitless new frontier of options to be explored by allowing companies immediate access to the requisite expertise for rapid and flexible validation, prototyping, and scaling.

COVID-19 has confronted companies with an additional and urgent force of volatility and change that has forced many organizations to adopt optionality as an immediate survival strategy. I conclude the series here by relaying the most effective step-by-step process I have witnessed for conceiving the options best available to companies during this extraordinary time.

In the past months, I have spoken with many brilliant entrepreneurs—portfolio companies, clients, and friends—about the risks and opportunities brought about by COVID-19 and how they are responding to them. I have been tremendously inspired by their attitudes, actions, and togetherness in this regard; even those most directly affected have balanced the painful and urgent short-term decisions with creative and methodical adjustments to their lives and companies. I offer the following immediate takeaways, colored by my own experiences working both in black swan events and venture capital:

- This crisis will shrink or destroy certain markets while creating or growing others. These effects are rarely linear in time—certain industries will continue as before but risk decline in the medium to longer term, while some may slow or halt for now but then recover and, in certain cases, see a release of pent-up demand. Those who make difficult decisions early and prioritize adaptability to weather the storm stand to consolidate market landscape share from competitors who do not. “Just as the crisis has revealed differences across workers in their preference to work from home, experience with remote learning, entertainment, and consumption will also shape consumer attitudes toward digital and physical experiences,” according to an article published by Harvard Business School.

Differences in consumer preferences may generate valuable business opportunities. The demand for new digital products, formats, and content will intensify. This will speed up automation and digitization investments and generate new products, services, and business models. Hong Luo and Alberto Galasso for Harvard Business School

-

Customers will have a renewed appreciation for products and services that facilitate online work and business. It is critical to take a problem-driven approach when engaging customers and find ways to truly help them with the problems they’re facing right now. This is not an opportunity to merely pitch our products or services but to offer them for immediate problem-solving.

-

An optionality approach now entails managing short-term cash flow (boring) and long-term exploration (exciting). This is inherent in optionality in finance, business, and life, as every great entrepreneur understands deep down and as we will explore below.

I discuss the dynamics of black swan events in more detail here. As I write in that piece, “We live in an emergency-prone world and can proactively prepare for disruptions to our work, so that adaptability takes the place of knee-jerk reactions—reactions that can backfire and compound situations rather than contain them.” In this piece—the final installment of my three-part series on optionality—I draw upon the aforementioned conversations and experiences to offer a step-by-step means to use the optionality framework to foster valuable opportunities in challenging but important moments such as the current pandemic.

Step 1: Manage Your Burn Rate to Allow Room for Exploration

Since optionality strategies accept higher failure rates in return for disproportionate upsides, they necessitate a strategic component to generate shorter-term, low-risk cash flow, providing the oxygen for big successes. This component, inherent to optionality strategies, is even more critical during a crisis.

Anyone working one job for immediate and low-risk cash flow while pursuing a project with higher risk but tremendous potential upside—from aspiring artists to engineers working on a new app that they dream of taking global—is following this strategy without necessarily realizing it. They structure their life around hours dedicated to their next creation each day, which can prove to be a flop, a phenomenon, or anywhere in between—there’s a high degree of uncertainty. All of their other work is in service of this deeper value creation. They know that even if the current project flops, there will always be the next one, and then the next one. They only need to get it right once. Companies making bold bets on new products will likewise often have a services arm or other business unit that covers R&D and other related expenses, thus providing the requisite low-risk cash flow. In business, we call the ongoing consumption of cash in pursuit of greatness the “burn rate.” In optionality, we call it “the bleed.”

It is critical that your strategy clearly distinguishes between the aspects of the business that address the burn rate and those that aim toward the bold bets. The more interesting (psychologically and monetarily) the low-risk cash flow component the better of course, but it’s critical to be clear about why this aspect of the business strategy exists. Conflating the cash flow and bold bet arms of your strategy leads to a lack of focus and misses the opportunity for true optionality with unlimited upside. Many of the most brilliant aspiring artists and entrepreneurs I know have turned down various interesting opportunities for full-time employment (a few, admittedly, when I tried to recruit them for a portfolio company)—they explained their logic as “I don’t want to risk confusing that with what I’m really working toward.”

Managing the Expense Side

During crises, it is critical that innovative companies manage their burn rate both in terms of cost structure and shorter-term, lower-risk income streams. Here are my key recommendations when reviewing your cost structure during these times:

-

Decouple growth from direct marketing spend (Google AdWords, Facebook, etc.). While an effective part of a larger marketing landscape strategy, it is dangerous to overly rely on marketing spend to drive growth, even during good times. This crisis is an opportunity to force yourself and your team to adopt product and SEO-driven growth strategies that allow for organic growth without increasing marketing spend.

-

Just as this is an opportunity to fundamentally review your growth drivers, it is also the moment to instill more flexibility into your cost structures as regards talent, vendors, and other key contributors. This involves carefully reviewing your hiring plan and other key assumptions and considering more flexible alternatives. The assumption that on-demand talent, for example, is more expensive than its full-time equivalent (FTE) is often based on simplistically comparing hourly rates. This analysis tends to prove untrue when adjusting for important factors including the following:

-

Cost of benefits. This can increase the hourly expense of FTEs by as much as 1.4x, whereas freelancers tend to provide their own or receive them through the platform they interface with.

-

Cost of demands on company overhead. Freelancers tend to arrive with and use their own resources, ranging from laptops to software licenses.

-

Cost of paid unproductive time. On average, people tend to be productive just over 12 hours of a 40-hour traditional workweek.

-

Cost of recruiting, onboarding, ongoing training.

-

Flexibility and cost of termination.

-

-

The imperative to work without a physical office and business-related travel is an opportunity to assess how much of both you truly need in the first place.

-

Depending on your assessment of how this situation affects your current product (explored below), distinguish between expenses for maintenance vs. new features.

Managing the Income Side

Do not limit yourself to cost-cutting. Even during a crisis (and in many cases because of it), there are additional income streams available.

On the company level, shorter-term opportunities for cash flow might include launching a content subscription or consulting offering that deploys your expertise to help clients with a particular challenge brought on by COVID-19. This also translates to the opportunity to learn more about current and potential customers.

One of my portfolio companies, for example, realized that many stakeholders within their industry now recognize the need for digital strategies—they are launching a subscription service to leverage their expertise on the matter. Even though these stakeholders are not their original target customers, my portfolio company understands their point of view and believes that engaging them in this way will inform the development of their core product as well. The hotels offering their rooms as personal offices, restaurants and grocery stores entering eCommerce, and fitness companies creating virtual workout offerings are just the beginning of what we will see in this regard as the world continues to adapt and innovate.

On the individual level, if you face the possible need to let key people go, consider instead temporarily moving them to part-time and help them explore options for freelance work to make up the difference. I have witnessed startups do this successfully during their own crisis moments. It allows teams to stay together until circumstances change (closing a funding round, achieving product-market fit, achieving cash flow break-even, etc.).

Step 2: Map Out Your Options

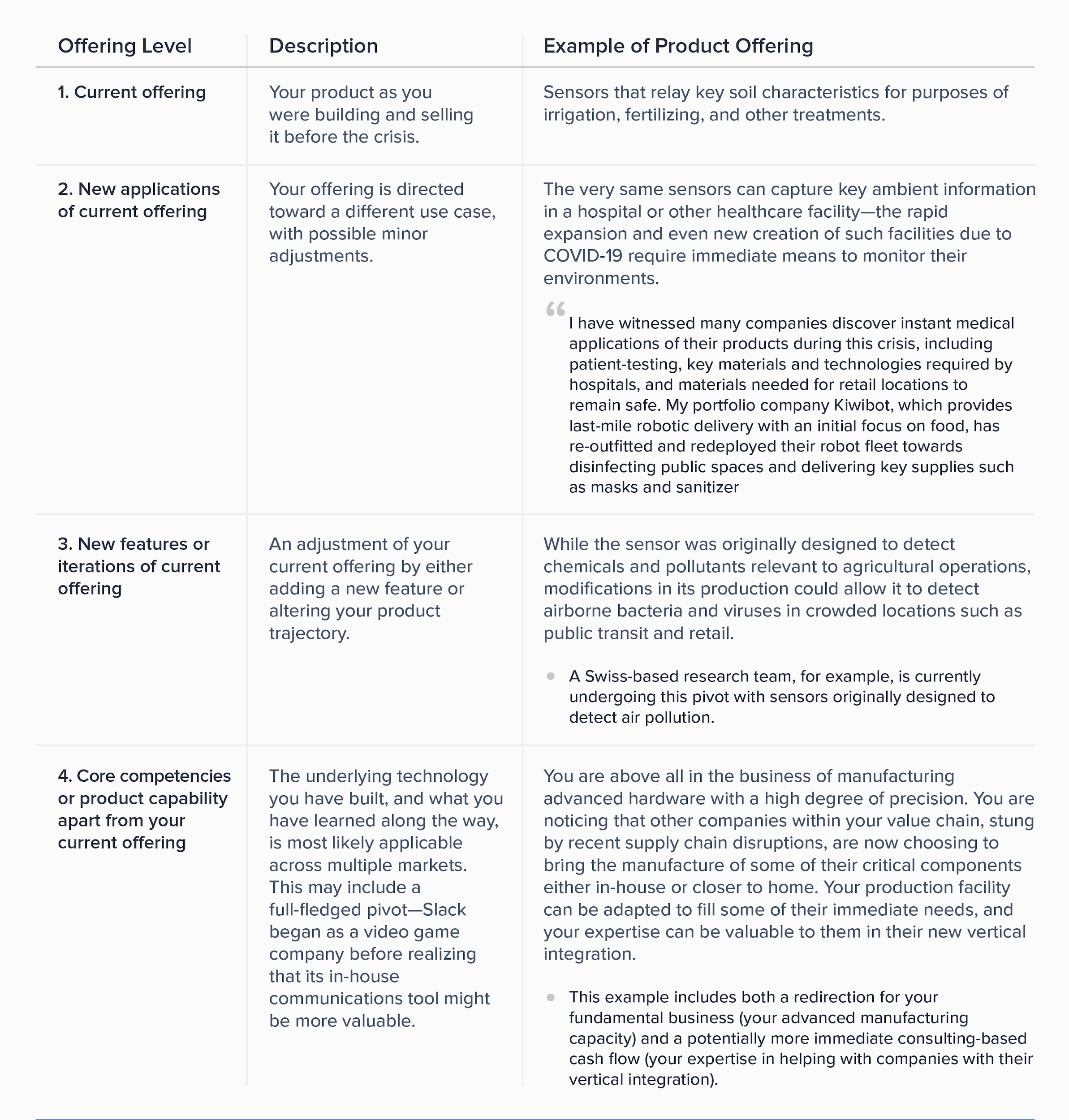

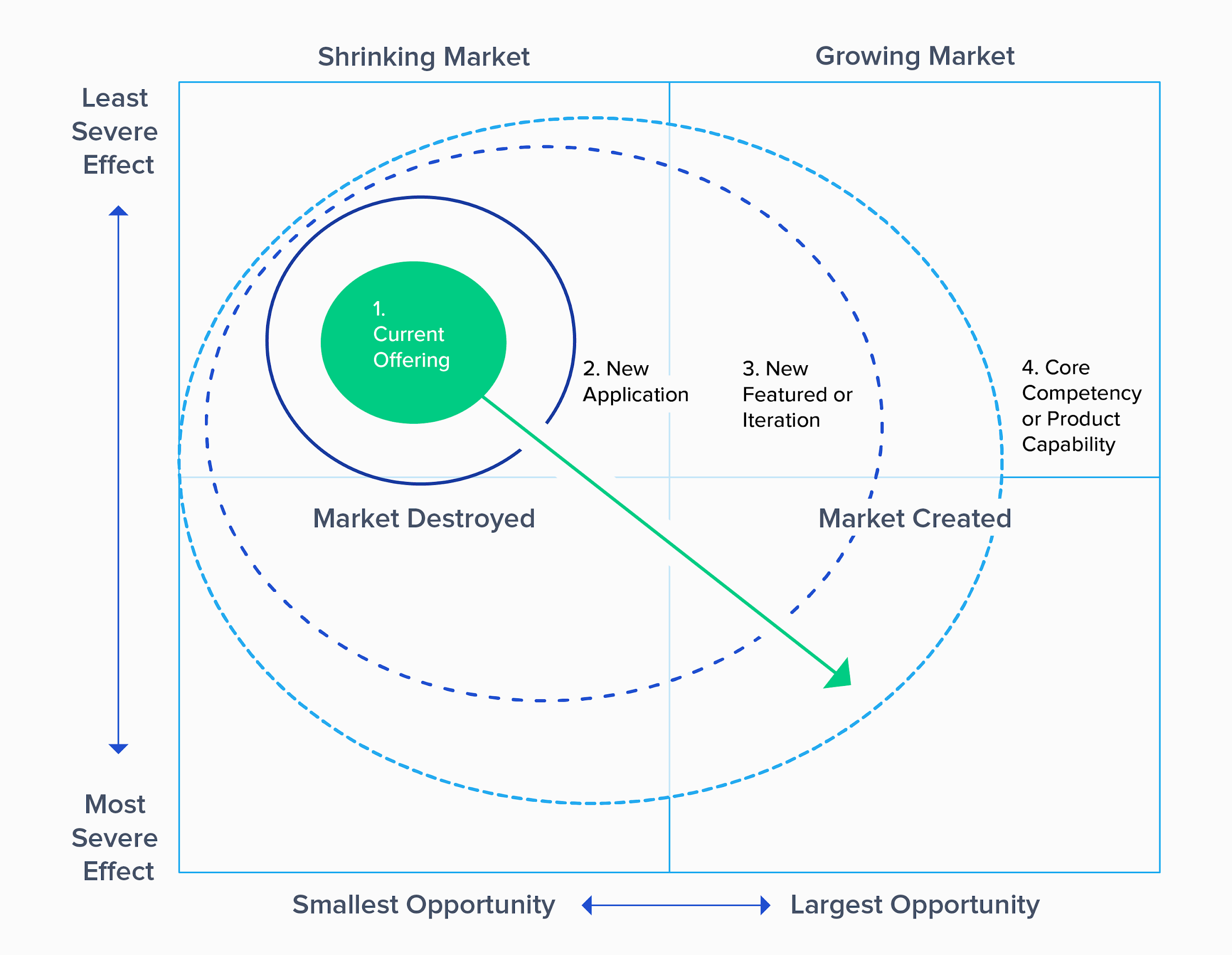

Once the short-term burn rate is managed, confronting the new market landscape realities becomes paramount. The first step is to take a broader look at what you are positioned to offer the world beyond your current product and its applications. The following shows the four steps to realizing this goal, through the hypothetical example of a company that produces sensors for agricultural applications, such as humidity, temperature, and chemical concentrations in the air.

With this expanded list in hand, it is now time to take a new look at the changes affecting your current and adjacent markets. These market transformations can be spurred both by macro effects (clients seeking a lower cost or more flexible offering) and technological factors (clients seeking a better means to virtually run their businesses or to transact online).

Again, there are four general effects this crisis can have on a given market landscape: reduction, growth, destruction, or creation. These four concepts interrelate—overall effects of a recession aside, a dip in one market tends to coincide with growth in another, and one market’s destruction coincides with another’s creation. More simply, most situations create both winners and losers.

I recommend mapping out all markets currently and potentially relevant to your business across these four areas. This is a form of scenario analysis—especially for growing and new markets. It involves not merely what you believe could happen but what you believe you can make happen. Adopt a problem-driven approach. What problems for organizations will result from COVID-19 that you can help solve?

Do your best to rank these market landscapes in terms of size of opportunity. This is not necessarily the largest market in absolute terms, and should take into account:

- How likely the decision-makers are to work with you (as a company, not just via your current product offering, as we will discuss below).

- The competitive dynamics—is there a clear dominant player that can capture most of the market, and/or do you believe many other companies are well-placed to serve this market as well?

- Speed of growth—the faster and more abrupt the growth in the market landscape, the easier to capture share.

The next step is to overlay against this map your ability to serve these markets based on your newly explored levels of product and expertise. Taken together, these exercises yield the following graphic:

You can whiteboard a version of this with your team with a virtual whiteboard platform. You now see the map of opportunities available to you, and it’s time to begin converting them into real options. The closer your current product is to larger, growing opportunities or new markets, the better. If it is currently lagging behind the large opportunities, however, then you will need to begin moving through the successive rings until you find one of the appealing markets within your orbit.

Don’t Go It Alone

Collaboration is critical for both the conception and validation of these new ideas. Many entrepreneurs I know have begun organizing unofficial advisory boards to allow rapid and open exchange of ideas and mentoring across markets, disciplines, and geographies. As I discuss here, ecosystem-driven businesses (those that empower their business to identify and test new opportunities while fostering networks of strategic partners) are far better at weathering crises. The companies I am witnessing respond the most proactively to COVID-19 involve as many team members as possible, regardless of formal title, in their in-depth discussions on strategic maneuvering.

You likewise have immediate access—through on-demand talent platforms like Toptal—to experts who can offer unique perspectives from other disciplines, cultures, and experiences. A fresh perspective is responsible for a significant portion of the largest breakthroughs in business and technology. These experts are only a Zoom call away.

Conclusion

The effects of COVID-19 are severe but varied, and open the door to new opportunities as they close the door to others. By managing your burn rate, mapping out challenges and opportunities offered by this new reality, and adopting an agile, options-driven strategy, you will find your new footing and help the world to find it as well. We live in a world of nearly infinite possibility due to the technologies and global talent pool available to us. Selecting which options to cultivate can sometimes prove the greatest challenge. We can do anything but we can’t do everything, and there is always the next compelling opportunity that competes for our attention and resources. This moment of crisis can allow for extraordinary clarity of purpose in the options you pursue as the needs of the world are suddenly laid more bare.

React swiftly and decisively where necessary, but do not limit yourself to merely reacting. Those who take a proactive and adaptive approach to help others will be tomorrow’s leading companies. You have tremendous value to give the world at this moment and have a world of expertise and potential strategic partners at your fingertips to help you see it through.

Erik Stettler

New York, NY, United States

Member since November 21, 2017

About the author

Data scientist and venture capitalist who has invested in 50 global tech companies. He is the Chief Economist at Toptal.

PREVIOUSLY AT