Unblocking Blockchain: Gaming Is the Tipping Point for Mass Adoption

Experts say gaming will be the first real use case for blockchain, revamping the industry and making games more immersive than ever. How gaming navigates the remaining hurdles will become a case study for other industries considering mass blockchain adoption.

Experts say gaming will be the first real use case for blockchain, revamping the industry and making games more immersive than ever. How gaming navigates the remaining hurdles will become a case study for other industries considering mass blockchain adoption.

Toptal Research

In-depth analysis and industry-leading thought leadership from a panel of Toptal researchers and subject matter experts.

Blockchain was heralded as disruptive tech once it became clear that cryptocurrency wasn’t its only use case. Now, its game-changing applications seem more promised than practiced and many claim it’s overhyped.

Not so with gaming. Experts say the industry is poised for a sea-change; they say gaming will be the first real use case for blockchain. Blockchain could completely restructure the industry, turn the tables on the monopolistic console market, create a multiverse, and make games more immersive and boundary-blurring than ever. How gaming navigates the remaining hurdles will become a case study for other industries considering widespread adoption.

“Way Oversold”?

Yes, according to Wells Fargo CEO Tim Sloan. “Not proven,” according to Ajaypal Banga, CEO of Mastercard, which has the third most blockchain patents in the world. Does skepticism at the top signal trouble for blockchain’s future?

Even bitcoin—which launched “blockchain” into the public lexicon in 2009—is still encountering regulatory issues. Cryptocurrency is often viewed as a gamble after hitting its peak in 2018. Reports of blockchain hacking—once thought oxymoronic and impossible—aren’t soothing hesitations.

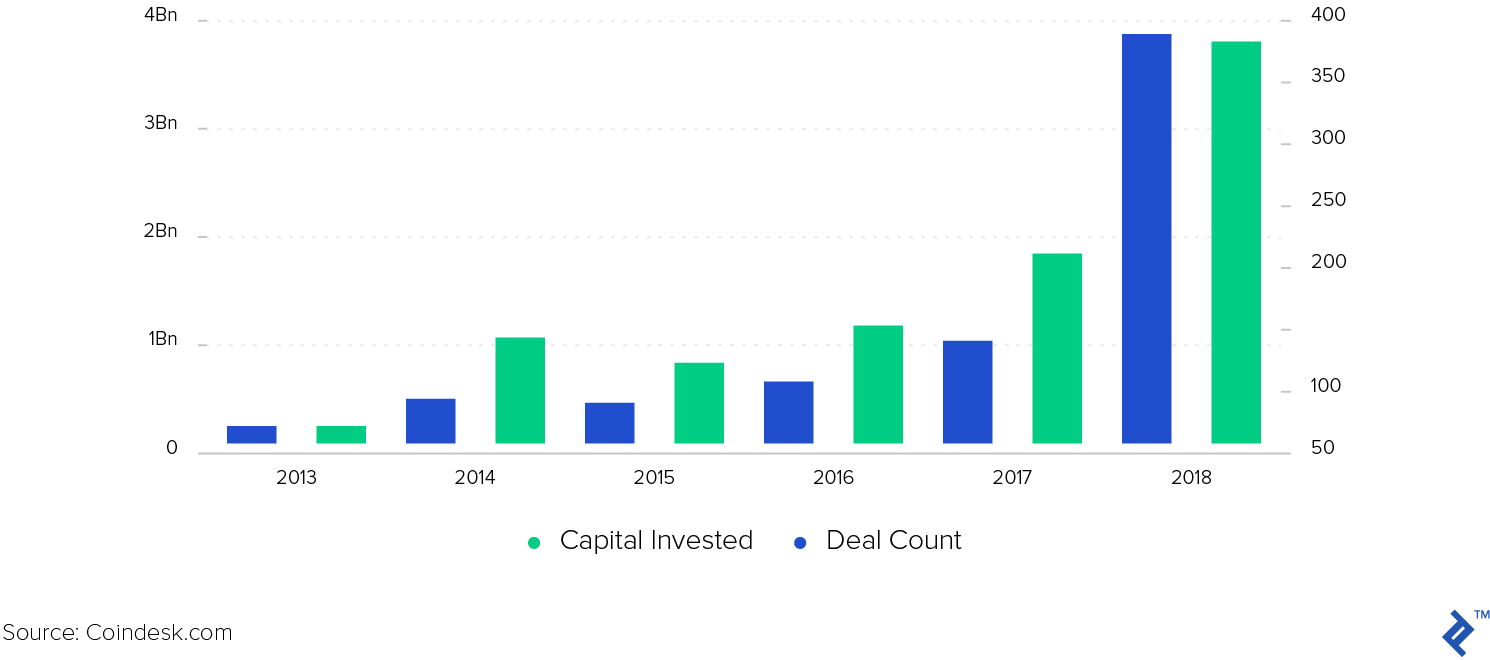

Cryptocurrency is just one of many applications for blockchain, and the potential for other industries hasn’t been ruled out. (We’ve already covered blockchain’s potential to revolutionize data security, enterprise, and energy solutions, for example.) The stream of blockchain investing has only increased—2019 has already seen over $108 million in venture capital investments. Apprehensions could be chalked up to a familiar modern tendency: impatience. It isn’t surprising that blockchain—which promises to rejig some of the most critical infrastructures—is encountering its fair share of hiccups.

Bill Gates describes blockchain as a “technological tour de force.” NASDAQ CEO Bob Greifeld says it’s “the biggest opportunity set we can think of over the next decade.” If the Gates and Greifelds of the world are right, blockchain’s effects will be foundational, immediate, and overwhelmingly positive.

In the case of the gaming industry, blockchain could become the norm for player experience, the transactions of digital items, and the back-end infrastructure of games themselves. How gaming receives blockchain, why, and when, is a signal that other sectors will want to follow with rapt attention.

Liquid Gold

The main use for blockchain within gaming’s realm is, in a word, liquidity.

Blockchain’s application in gaming is in many ways a no-brainer because gamers are already accustomed to tokenization. Some of the earliest games featured applications of virtual currency. Games evolved and fused with the internet: Now, in-game gold and items can be purchased with real-life (fiat) currency. Transactions often occur outside the game itself and to the chagrin of its creators. Blockchain could establish norms and fairness around in-game currency and asset trading and tie them to the real world in sensible ways. This could be particularly useful for the free-to-play model popularized by Fortnite wherein the majority of gaming revenue is generated by in-game purchases (e.g., skins) funded by digital currency.

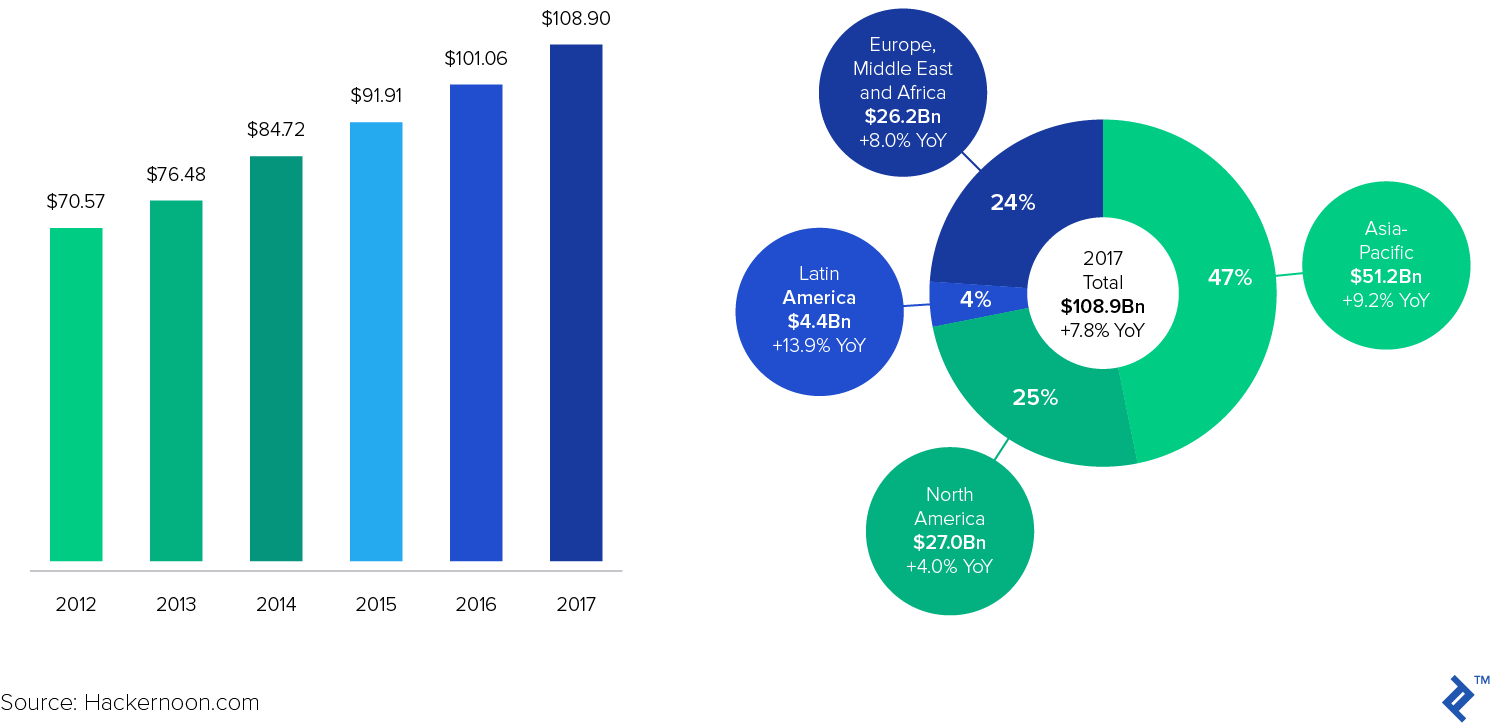

The success of Epic Games’ Fortnite could be a premonition of blockchain’s success with gaming. Fortnite earned $2.4 billion in 2018, making it the highest-grossing game in history. Free-to-play games in general made up 80% of all global gaming revenue in 2018; on consoles, free-to-play titles grossed 458% more in 2018 than in 2017.

A second use concerns structure. So far, blockchain games have been simple in scope, falling into one of two main categories: decentralized or hybridized. In the first model, the game is run completely from a blockchain, meaning that the developer cannot alter the game in any way without the say-so of the community. In a hybridized model, the game itself still runs from a central server but its assets are traded via a decentralized marketplace. In either scenario, blockchain takes in-game assets and makes them as ownable as possible, creating legitimacy and permanent value.

As the gaming industry pivots its focus to in-game assets, blockchain could potentially solve a number of related problems: eliminating fraudulent items, creating scarcity, and incentivizing more purchases by making items transferable across games (more on that below). According to a survey by Worldwide Asset eXchange (WAX), a blockchain platform focused on virtual items, 62% of gamers would be more likely to invest in digital assets if they were transferable between games; 84% of developers would create in-game items for the same reasons. Epic Games’ CEO Tim Sweeney hasn’t publicly ruled out blockchain or cryptocurrency—application at the level of Fortnite might be enough to tip gaming toward mass blockchain adoption.

Blockchain offers a number of other solutions to the gaming industry:

- Granting immutable ownership of in-game items, solving item theft due to hacking and the sale of fake in-game assets.

- Tying assets to players instead of games, thereby protecting time/money investments players have made, irrespective of developer decisions.

- Protecting players from undesirable actions on the part of creators; players can take the wheel, extending game longevity and encouraging user content. (Virtual reality game Decentraland is a promising example.)

- Restoring trust between game developers and distributors by recording sales on a blockchain.

- Creating a decentralized distribution network for games.

- Creating more realistic economic systems within games.

- Shifting the definition of a successful game away from revenue and toward in-game currency value, thereby refocusing game development efforts to benefit players.

- Incentivizing players by offering dividends and granting them a vote in development processes.

- Fixing the high-cost, low-revenue problems of cloud gaming initiatives (like Sony’s PS Now) by distributing the server over a blockchain network.

- Encouraging game development competition outside of the monopolistic console and game-publishing industries.

According to Josh Chapman, managing partner of Konvoy Ventures, a venture firm dedicated only to esports and video gaming, “Gaming does not need blockchain; blockchain needs gaming. Blockchain will only see mass adoption and mass application once it provides significant value to the video gaming ecosystem.”

As Chapman points out, most other industries are about 40 years behind where gaming has been. “You have 2.6 billion people that play video games and thousands of studios that all have digital assets and digital IP. Within video gaming, tokenization is a 40-year-old concept. The founders of Blockchain Capital had great success trading digital assets in Second Life (a massively-multiplayer game—more on that below). They then used that experience to identify value in a brand new digital currency, Bitcoin, and invested heavily into it.”

Pitchbook data indicates a 280% rise in blockchain investments from 2017 to 2018 and investments in blockchain gaming is at an all-time high. In 2019, transaction blockchain Ripple combined forces with blockchain gaming company Forte to create a $100 million project aimed at fusing blockchain and gaming. Last year, Mangrove Capital (of Skype and Wix fame) put $5 million into esports/blockchain platform DreamTeam. In the same year, a blockchain called Tron invested $100 million towards its own blockchain gaming fund, Tron Arcade. The gaming sector is projected to hit $143 billion in revenue globally by 2020.

Chapman’s “blockchain needs gaming” statement rings even truer when examining the customer acquisition strategies of the blockchain companies investing in gaming. “They’re not investing $100 million, they’re granting it, for free, to game studios. It is effectively a customer acquisition strategy by Ripple & Tron.”

The shakeout from blockchain gaming investments probably won’t look dissimilar from other classic tech rivalries. This time, the game isn’t digital storage, it’s digital asset transferability. As a corollary to Chapman’s hypothesis, once blockchain finds a way to add real value within the video gaming ecosystem, it will remain a key part of the technical fabric of this accelerating industry.

Enter the Multiverse

For Jonathan Sterling, a Toptal Java Developer who specializes in fintech and cryptocurrency solutions, another possible outcome is “more like a Second Life experience,” referring to the popular online virtual world. Players create avatars to virtually represent themselves and interact with places, objects, and other players. Digital assets and worlds are created by players within Second Life, and the game features a proprietary virtual currency that’s tradeable for real-world money; as of 2015, its economy was worth $500 million dollars. Second Life’s ties with blockchain are unmistakable—in 2018, one of the original co-creators of Second Life secured a $35 million Series D, helmed by a blockchain investment firm called Galaxy Digital Ventures.

Actually, Second Life refers to its users as “residents” and the creators don’t call it a game. “It becomes, for a lot of people, maybe even your primary existence,” says Sterling. Add blockchain to the equation, and “maybe it took up 30% of your life, and now it can take up 40% because you can cross-tie the assets—your assets in the game can be traded for real life stuff and vice versa . . . what is the game and what is real life?”

Just as blockchain could encourage blurred lines between real and digital, it could also smudge boundaries between game worlds themselves—what’s known as interoperability. Through blockchain, items could be transferable between different games and game universes, resulting in a digital multiverse. “I could buy a cool Mario Kart skin and then bring that skin over to Counter-Strike and put it on whichever in-game asset I prefer,” says Chapman. Game world fluidity would require unprecedented cooperation between studios; if successful, the universe of network gaming could be completely redrawn.

A Changing Landscape

As in other use cases, blockchain gaming is rife with potential drawbacks. Sterling hypothesizes that the impetus for implementation might simply be “regulatory arbitrage”—there are tax and legal implications for selling in-game currency outside of the game. “Why doesn’t Blizzard sell gold?” he points out, referencing the company responsible for World of Warcraft and Starcraft.

Sterling is admittedly skeptical about blockchain’s idealistic tint; he’s written for Toptal previously on the subject. For him, blockchain also helps devalue the gaming experience. “If you play a game for hundreds of hours every week, then you get some great item, right? If you can just go sell that for $5 on some network, it devalues the entire game for legitimate players. If you’re using Blockchain and allowing the good to be traded on a secondary market, it’s enabling that problem even more. The game producers are jumping on that bandwagon when really they should be against it for the long term health of their game.”

In his early career, Sterling spent time working for Jagex, creators of RuneScape, the world’s largest free-to-play, massively multiplayer online role-playing game. He witnessed a kind of in-game pyramid scheme: networks of accounts within the game funneling in-game “gold” to a single, central account which then sold that gold for real money outside of the game. “You’ve also started to see game studios start to embrace this model where they are the official resellers of gold just because they realized that they couldn’t stop it. It cheapens the gaming experience, but at the same time they know it’s going to happen anyway and they might as well get in on it and make some money.”

One similar worry is that blockchain would make success in games like Fortnite a matter of money. But blockchain itself could solve that very problem. If player accounts were on a blockchain, how they attain items would also be verifiable. Developers could then restrict the use of certain items based on achievement, meaning that players still must invest play time to use it.

Screen Loading

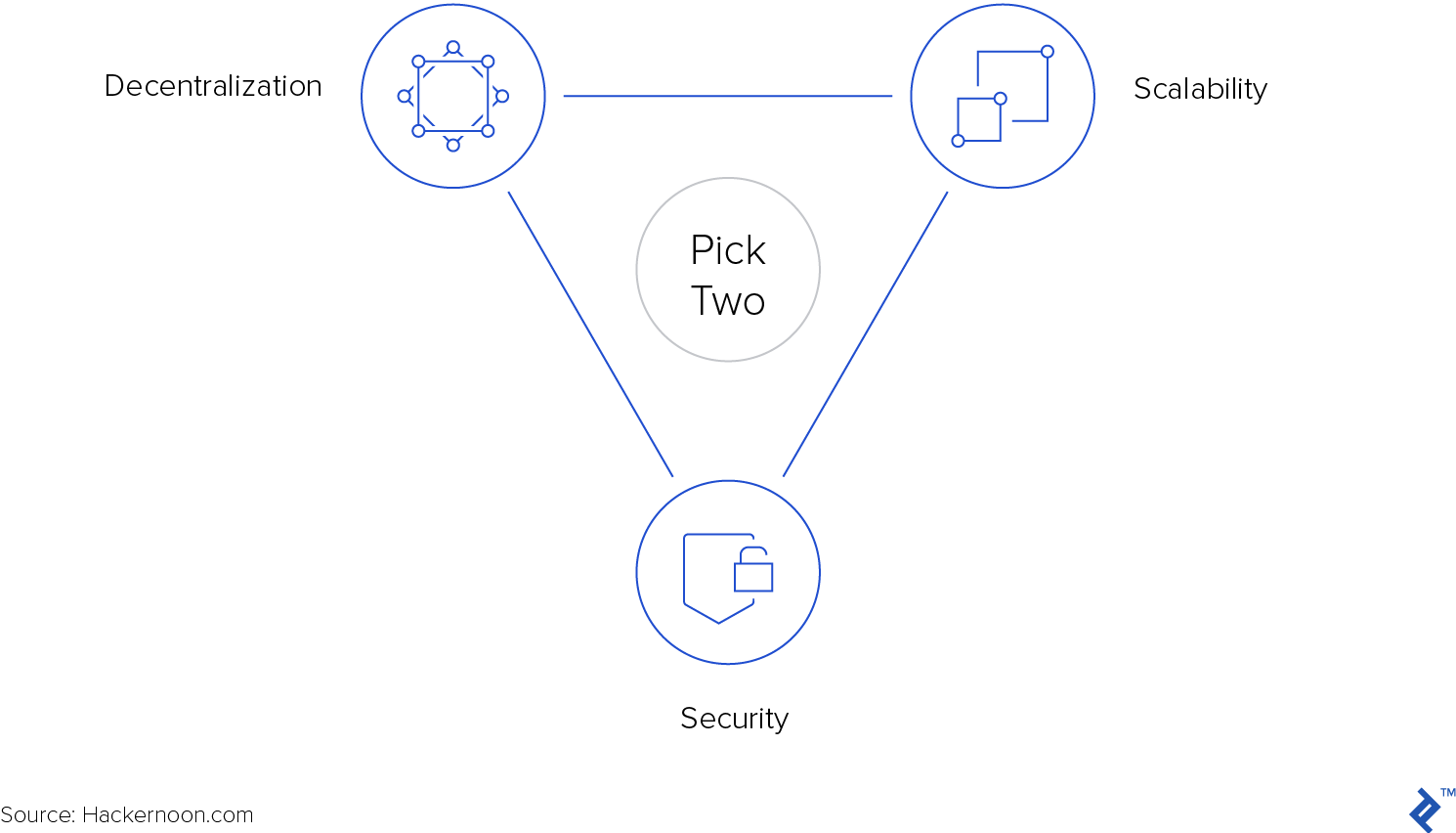

With so many shareholders standing to make a killing, why is mass blockchain adoption still pending for the gaming industry? One reason is simply time: blockchain has yet to reach a critical mass in the industry. The main problem boils down to what’s known as the blockchain trilemma. Like the familiar project management quandary—cheap, good, or fast: pick two—blockchain struggles to balance decentralization, scalability, and security.

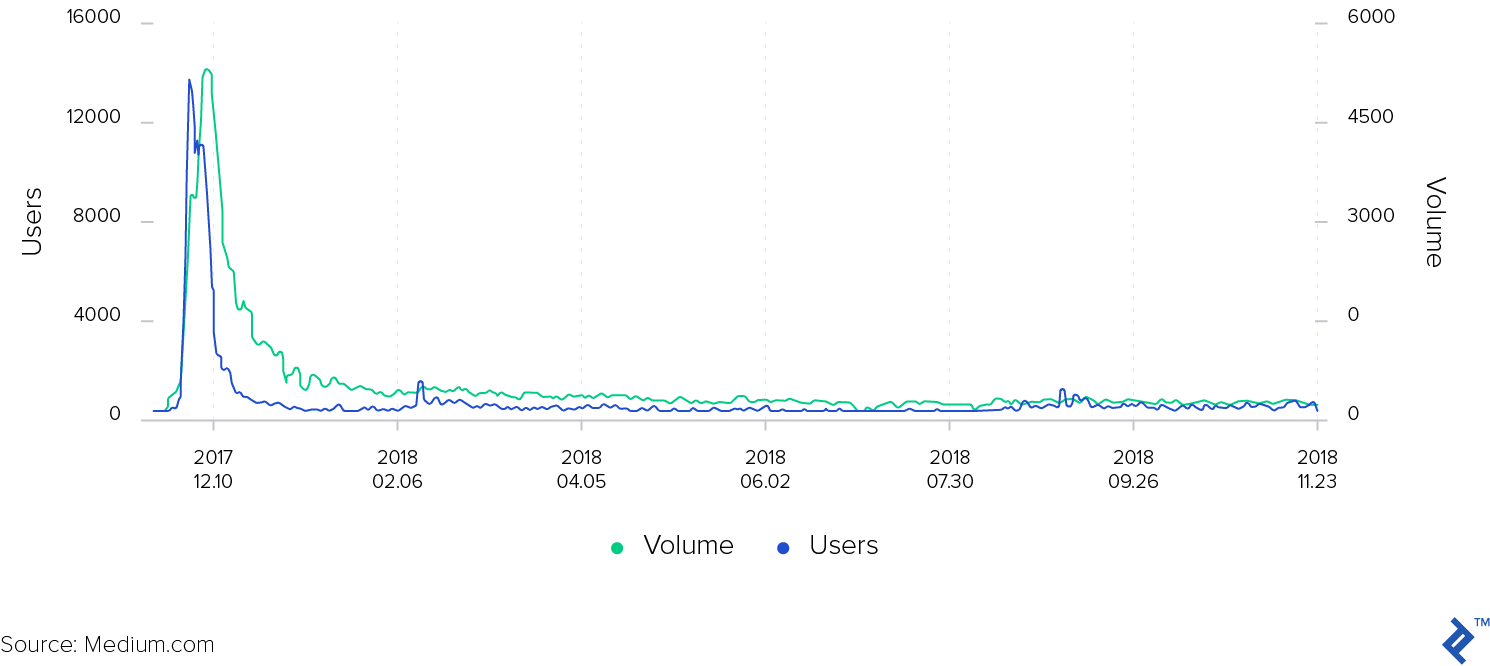

Scalability issues are most prominent. Using the online tool DappRadar to view traffic for DApps—decentralized apps including blockchain games—reveals a striking lack of players.

Here gaming encounters another issue which plagues other blockchain applications: speed. Blockchain networks are notoriously slow, as experienced in the heyday of Bitcoin and Ethereum, and transactions often crawl. When a blockchain game called CryptoKitties launched in 2017, it congested the Ethereum blockchain to the point of crisis, necessitating a dedicated emergency task force.

Infrastructural issues abound as well. Currently, players of blockchain games must create private keys for each game they choose to play; if lost, their accounts are irretrievable by design. In many cases, players must pay a per-transaction cost, as in the case of CryptoKitties, deterring many players due to cost.

For users of mega-popular games, expediency is an expectation. Mainstream gaming is where blockchain adoption could finally tip the scales, but most blockchain-game offerings don’t even approximate high-profile games. There’s a lack of developer activity to boot.

A Fork in the Chain?

Early trilemma solutions seem like first drafts. One proposed remedy involves spending less computational power on each transaction but creates an unacceptable security risk to the blockchain. The Ethereum blockchain is experimenting with new ways of load reduction, including partitioning the network into “shards” rather than using one main network for every transaction.

Some companies are adapting blockchain theory to create new forms of distributed ledgers. The cryptocurrency Nano uses a “block-lattice architecture” and gives each account its own blockchain. With Nano, users utilize their own computational power to drive speedy transactions.

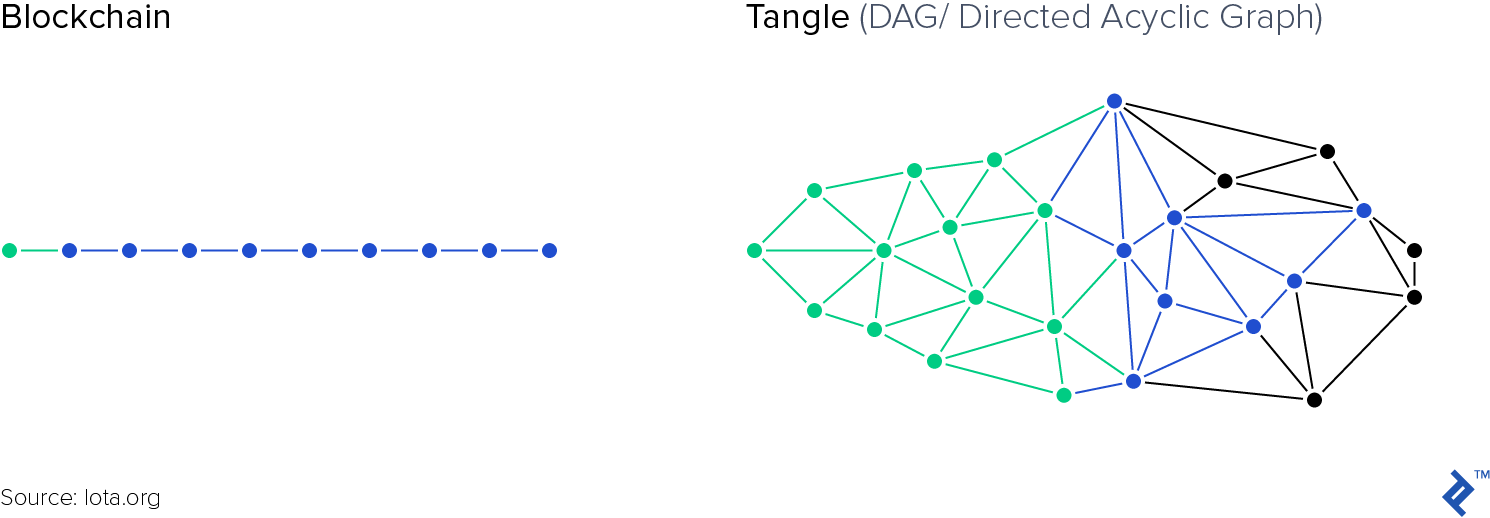

The permissionless distributed ledger IOTA offers another way to achieve blockchain-like results without actually using a blockchain: Its system is called the Tangle. Through a pay-it-forward system, each transaction requires validation of two previous transactions on the system; that transaction is then validated by a subsequent transaction, and so on. The catch is that IOTA is necessarily centralized, though it plans to become decentralized in the future.

It’s possible that the future of blockchain isn’t a blockchain at all. Future adopters might look back on blockchain as a failed experiment with valuable lessons for more nuanced and effective distributed ledgers. Whatever the case, it’s clear that blockchain, or a blockchain-like system, won’t reach a tipping point in gaming without first balancing its trilemma. How the gaming industry accomplishes this could set an example for other industries hoping to do the same.

Continue, Save, Retry?

For Chapman, blockchain belongs behind the scenes; he predicts that its current age of hype is necessarily short-lived. “I think in the future of blockchain, consumers will never know they’re even using it. This is similar to how I, as a consumer, don’t know that there are five intermediaries when I send a wire transfer. I’ve never heard a consumer say that they wished they had more transparency into the back end of their digital assets. Therefore, the very thing that you’re trying to solve is not a consumer problem, which is usually the start of a failed enterprise. If blockchain is used as a back-end-infrastructure efficiency tool, that the users never know about, that I think is the future.”

Gaming is a proving ground for the future of blockchain. Gaming is a learning tool, not just for blockchain but for other applications too. The game Sim City has even been credited with inspiring a generation of city planners. With blockchain, real money is at stake, but it’s still wrapped inside a game: the perfect place to test blockchain’s first mass adoption.